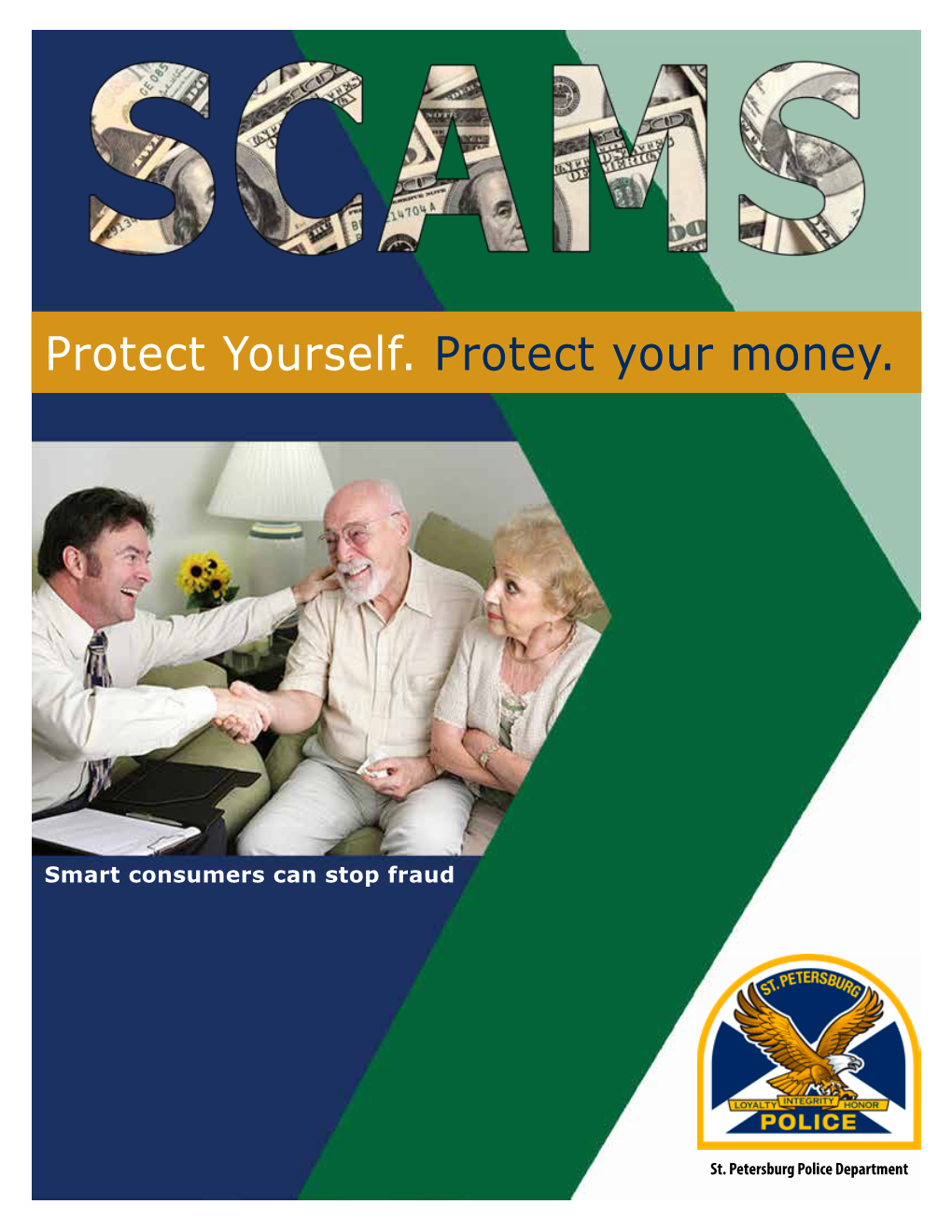

Senior Scams Brochure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

History and Nature of Ponzi Schemes Page 1 of 3

History and Nature of Ponzi Schemes Page 1 of 3 SAN JOSÉ STATE UNIVERSITY ECONOMICS DEPARTMENT Thayer Watkins History and Nature of Ponzi Schemes In August of 1919 Charles Ponzi in Boston received from an acquaintance in Italy an International Postal Reply Coupon. These coupons had been created to handle small international transactions. The recipients of such coupons could exchange them in at their local post office for stamps. Ponzi noticed that the coupon he had received from Italy had been purchased in Spain and found that the reason for this was that the price in Spain was exceptionally low. In fact, the cost of the International Postal Reply Coupon in Spain, given the current exchange rate between the Spanish peseta and the dollar, was only one sixth the value of the U.S. postage stamps it could be traded for in the U.S. This seemed to be an extraordinary opportunity for arbitage. Ponzi envisioned a massive money making scheme in which dollars funds would be converted into Spanish pesetas to use to purchase International Postal Reply Coupons which would be sent to the U.S. to be redeemed in U.S. postage stamps which could then be sold for dollars. To Ponzi this seemed the opening to fast, unlimited profits. The problem with the scheme was that if anyone began to exploit the discrepancies in the prices of International Postal Reply Coupons in different countries the discrepancies would be corrected and the profit opportunity would disappear. Ponzi founded a company to expoit the profit opportunity in International Postal Reply Coupons. -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of NEW YORK ------X SECURITIES INVESTOR PROTECTION : CORPORATION, : Plaintiff, : : ‒ Against ‒ : : Adv

10-04818-smb Doc 37 Filed 06/02/15 Entered 06/02/15 15:40:26 Main Document Pg 1 of 86 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------X SECURITIES INVESTOR PROTECTION : CORPORATION, : Plaintiff, : : ‒ against ‒ : : Adv. Pro. No. 08-01789 (SMB) BERNARD L. MADOFF INVESTMENT : SIPA LIQUIDATION SECURITIES LLC, : (Substantively Consolidated) Defendant. : ---------------------------------------------------------------X In re: : : BERNARD L. MADOFF, : : Debtor. : ---------------------------------------------------------------X MEMORANDUM DECISION REGARDING OMNIBUS MOTIONS TO DISMISS A P P E A R A N C E S: BAKER & HOSTETLER LLP 45 Rockefeller Plaza New York, NY 10111 David J. Sheehan, Esq. Nicholas J. Cremona, Esq. Keith R. Murphy, Esq. Amy E. Vanderwal, Esq. Anat Maytal, Esq. Of Counsel WINDELS MARX LANE & MITTENDORF, LLP 156 West 56th Street New York, NY 10019 Howard L. Simon, Esq. Kim M. Longo, Esq. Of Counsel Attorneys for Plaintiff, Irving H. Picard, Trustee for the Liquidation of Bernard L. Madoff Investment Securities LLC 10-04818-smb Doc 37 Filed 06/02/15 Entered 06/02/15 15:40:26 Main Document Pg 2 of 86 SECURITIES INVESTOR PROTECTION CORPORATION 805 Fifteenth Street, N.W., Suite 800 Washington, DC 20005 Josephine Wang, Esq. Kevin H. Bell, Esq. Lauren T. Attard, Esq. Of Counsel Attorneys for the Securities Investor Protection Corporation Attorneys for Defendants (See Appendix) STUART M. BERNSTEIN United States Bankruptcy Judge: Defendants in 233 adversary proceedings identified in an appendix to this opinion have moved pursuant to Rules 12(b)(1), (2) and (6) of the Federal Rules of Civil Procedure to dismiss complaints filed by Irving H. Picard (“Trustee”), as trustee for the substantively consolidated liquidation of Bernard L. -

Alton H. Blackington Photograph Collection Finding

Special Collections and University Archives : University Libraries Alton H. Blackington Photograph Collection 1898-1943 15 boxes (4 linear ft.) Call no.: PH 061 Collection overview A native of Rockland, Maine, Alton H. "Blackie" Blackington (1893-1963) was a writer, photojournalist, and radio personality associated with New England "lore and legend." After returning from naval service in the First World War, Blackington joined the staff of the Boston Herald, covering a range of current events, but becoming well known for his human interest features on New England people and customs. He was successful enough by the mid-1920s to establish his own photo service, and although his work remained centered on New England and was based in Boston, he photographed and handled images from across the country. Capitalizing on the trove of New England stories he accumulated as a photojournalist, Blackington became a popular lecturer and from 1933-1953, a radio and later television host on the NBC network, Yankee Yarns, which yielded the books Yankee Yarns (1954) and More Yankee Yarns (1956). This collection of glass plate negatives was purchased by Robb Sagendorf of Yankee Publishing around the time of Blackington's death. Reflecting Blackington's photojournalistic interests, the collection covers a terrain stretching from news of public officials and civic events to local personalities, but the heart of the collection is the dozens of images of typically eccentric New England characters and human interest stories. Most of the images were taken by Blackington on 4x5" dry plate negatives, however many of the later images are made on flexible acetate stock and the collection includes several images by other (unidentified) photographers distributed by the Blackington News Service. -

FINANCIAL CRIME DIGEST July 2020

FINANCIAL CRIME DIGEST July 2020 Diligent analysis. Powering business.™ aperio-intelligence.com FINANCIAL CRIME DIGEST | JULY 2020 ISSN: 2632-8364 About Us Founded in 2014, Aperio Intelligence is a specialist, independent corporate intelligence frm, headquartered in London. Collectively our team has decades of experience in undertaking complex investigations and intelligence analysis. We speak over twenty languages in- house, including all major European languages, as well as Russian, Arabic, Farsi, Mandarin and Cantonese. We have completed more than 3,000 assignments over the last three years, involving some 150 territories. Our client base includes a broad range of leading international fnancial institutions, law frms and multinationals. Our role is to help identify and understand fnancial crime, contacts, cultivated over decades, who support us regularly integrity and reputational risks, which can arise from a lack in undertaking local enquiries on a confdential and discreet of knowledge of counterparties or local jurisdictions, basis. As a specialist provider of corporate intelligence, we enabling our clients to make better informed decisions. source information and undertake research to the highest legal and ethical standards. Our independence means we Our due diligence practice helps clients comply with anti- avoid potential conficts of interest that can affect larger bribery and corruption, anti-money laundering and other organisations. relevant fnancial crime legislation, such as sanctions compliance, or the evaluation of tax evasion or sanctions We work on a “Client First” basis, founded on a strong risks. Our services support the on-boarding, periodic or commitment to quality control, confdentiality and respect retrospective review of clients or third parties. for time constraints. -

Branding in Ponzi Investment Schemes by Yaron Sher Thesis Bachelors of Honours in Strategic Brand Communication Vega School Of

BRANDING IN PONZI INVESTMENT SCHEMES BY YARON SHER THESIS SUBMITTED IN THE FUFILLMENT OF THE REQUIREMENTS OF THE DEGREE BACHELORS OF HONOURS IN STRATEGIC BRAND COMMUNICATION AT THE VEGA SCHOOL OF BRAND LEADERSHIP JOHANNESBURG SUPERVISOR: NICOLE MASON DATE: 23/10/2015 Acknowledgements First and foremost, I wish to express my thanks to Nicole Mason, my research supervisor, for providing me with all the necessary assistance in completing this research paper. I would also like to give thanks to Jenna Echakowitz and Alison Cordeiro for their assistance in the construction of my research activation and presentation. I take this opportunity to express gratitude to all faculty members at Vega School of Brand Leadership Johannesburg for their help and support. I would like thank my family especially my parents Dafna and Manfred Sher for their love and encouragement. I am also grateful to my girlfriend Cayli Smith who provided me with the necessary support throughout this particular period. I also like to place on record, my sense of gratitude to one and all, who directly or indirectly, have helped me in this producing this research study. Page 2 of 60 Abstract The subject field that involves illegal investment schemes such as the Ponzi scheme is an issue that creates a significant negative issues in today’s society. The issue results in forcing financial investors to question their relationship and trust with certain individuals who manage their investments. This issue also forces investors, as well as society, to question the ethics of people, especially those involved in investments who operate their brand within the financial sector. -

Dirty, Rotten Scoundrels

South Jersey.com Page 1 of 3 August 10, 2009 Brought to you by: Post Free Classified Ad | Search the Classifieds | Add Your Free Event | Add Your Business Listing | Subscribe to SouthJersey.com Newsletter SEARCH site web Sponsors Dirty, Rotten Scoundrels South Jersey's Top Chef …From the pages of South Jersey Magazine… South Jersey's Top Talent South Jersey has its own Bernie Madoffs, conning South Jersey's Best area residents out of their hard-earned money for Dining investments that are too good to be true. Employment Many people knew Glyn Richards. He was a friend, South Jersey Yellow Pages a fellow parent, a business partner and much more. Real Estate He was also a conman operating a lucrative Ponzi Down and Dirty (Blogs) scheme that bilked South Jersey residents out of nearly $6 million. Galas, Fundraisers and more Community Corner What seems so obvious now—the lies behind the Haddon Heights’ man astonishing claims, promising a 44-percent return in four months on an initial $25,000 investment— Auto wasn’t so obvious back then. Richards was a recognized member of the community, Beauty & Fashion even sponsoring the local little league. “He’s someone I would have been friends with,” Entertainment says one victim we’ll call Ray, a 41-year-old resident of Voorhees who asked that his identity remain anonymous (as did the other victims interviewed for this article). “He was Movie Showtimes a great guy, to be honest with you. It seemed like he would give you the shirt off his Health & Fitness back, but when it came to it, he didn’t have a shirt to give.” Jersey Shore Article continues below Legal Guide South Jersey Sports advertisement South Jersey People South Jersey Features Instead, he wore prison detention clothes on July 1 when he was sentenced to 30 years Business & Finance in jail after pleading guilty to charges of mail fraud and money laundering. -

Catfishing”: a Comparative Analysis of U.S

“CATFISHING”: A COMPARATIVE ANALYSIS OF U.S. V. CANADIAN CATFISHING LAWS & THEIR LIMITATIONS Antonella Santi* I. INTRODUCTION ................................................................................... 75 II. BACKGROUND .................................................................................... 78 A. Catfishing– what is it? ...................................................................... 78 B. Harms of Catfishing .......................................................................... 78 C. Why do Perpetrators Catfish? ........................................................... 81 1. Loneliness ................................................................................ 81 2. Dissatisfaction with Physical Appearance ............................... 81 3. Sexuality and Gender Identity .................................................. 82 D. The Victim: Who Succumbs to Catfishing Schemes? ...................... 82 E. Society’s Contribution to Catfishing ................................................. 83 III. U.S. ANTI-CATFISHING LAWS ........................................................ 85 A. Federal Law ...................................................................................... 85 1. The Federal Identity Theft and Assumption Deterrence Act of 1998 ............................................................................................... 85 2. The Interstate Communications Act ......................................... 85 3. The Federal Interstate Stalking Punishment and Prevention Act ...................................................................................................... -

(Ponzi's Scheme) That Enabled Him to Get Very Rich. He

then early 1920s, Charles Ponzi created a scheme (Ponzi's scheme) that enabled him to get very rich. He promised investors unreasonably high rates of return, and used the money of new investors to pay the ear- Ilier investors and himself. Inevitably, the scheme collapsed because people stopped investing. Ponzi's name became forever linked to the thousands of Ponzi schemes in which an enormous number of investors have been cheated out of millions, if not billions, of dollars. Creditors and investors are increasingly forcing the perpetra- tors of the fraud and the entities the perpetrator owns and controls into bankruptcy court. When the individual perpetrator of the scheme and the entities which he owns and controls are forced into bankruptcy, creditors and investors sometime ask the judge to combine all of the separate cases into one. If the judge grants the request, there are major impacts on the bankruptcy trustee's ability to recover money. Before asking the bankruptcy judge to combine the cases, creditors should carefully consider whether they really want what they ask for. 58· THE FEDERAL LAWYER· JANUARy/FEBRUARY 2013 The Original Ponzi Scheme relinquished all investment authority to Madoff. Madoff collected Charles Ponzi was born in Italy in 1882, and died in Rio de Janeiro funds from investors, claiming to invest their funds in a "split-strike in 1949. In 1903, he arrived in Boston. It is believed that Ponzi had as conversion strategy" for producing consistently high rates of return little as $2.50 in cash when he arrived in the United States. on investments. -

The SEON Online Fraud Dictionary - 2021 Edition

EBOOK The SEON Online Fraud Dictionary - 2021 Edition SEON Technologies Ltd. [email protected] seon.io +44 20 8089 2900 1 The SEON Online Fraud Dictionary - 2021 Edition The SEON Online Fraud Dictionary - 2021 Edition All the analysts agree: online fraud is going to increase in the upcoming years. And at SEON, our job is both to fight it, and to help companies prepare against attacks. This is why we wanted to compile a list of all the useful terms you might need to understand, prevent, and combat fraud. The vocabulary of online security and cybercrime evolves fast, and it’s important to keep up with the latest terms. But it’s also important to know the basics if this is your first entry into the world of cybercrime. We’ve compiled a list of both in this dictionary. 2 The SEON Online Fraud Dictionary - 2021 Edition 2FA Stands for 2-factor authentication. When a user wants to access a website or app, they need to provide a single piece of authentication (SFA) in the form of a password. Adding another method is called 2-factor authentication, and it improves security. You will also hear the name multi-factor authentication. Authentication factors can include facial scans, ID cards, SMS confirmations, security tokens, or biometric fingerprints, amongst others. According to Google, 2FA helps reduce 66% of targeted attacks, and 99% of bulk phishing attacks. 3D Secure A security protocol designed for online credit and debit card transactions. It is designed as an additional password validated by the issuer, which helps transfer liability to the customer in case of fraud. -

Copyrighted Material

1 The Many Faces of Evil Online Human wickedness is sometimes the product of a sort of conscious leeringly evil intent… But more usually it is the product of a semi‐deliberate inattention, in a swooning relationship to time. Iris Murdoch1 1.1 Introduction In May 2008, hackers bombarded the website of the Epilepsy Foundation of America with hundreds of pictures and links. The site provides advice, news on scientific research and contacts for people who suffer from epilepsy. People who suffer from epileptic seizures have to manage their condition carefully and need regular checkups and medical advice. Epilepsy patients often take precautionary mea- sures to deal with situations where they may be incapacitated and unable to act. Some patients suffer from what is called “photosensitive epilepsy,” which means that flickering and flashing images may trigger epileptic seizures. The hackers who attacked the Landover site exploited a security flaw and inserted links to pages with rapidly flashing images. These images were perceived inadvertently by epilepsy patients who were looking for medical information on the website and triggered severe migraines and near‐seizure reactions in some site visitors. “They were out to create seizures,” said Ken Lowenberg, senior director of web and print publishing for the COPYRIGHTED MATERIAL 1 Iris Murdoch, The Black Prince, Harmondsworth: Penguin, 1973, p. 189. Evil Online, First Edition. Dean Cocking and Jeroen van den Hoven. © 2018 John Wiley & Sons Ltd. Published 2018 by John Wiley & Sons Ltd. 0003386160.indd 1 3/6/2018 6:46:20 AM 2 The Many Faces of Evil Online foundation.2 The hackers did not seem to be interested in money or in control over the victim’s computer; they just wanted to create this impact on vulnerable people. -

A Short History of Tontines

Columbia Law School Scholarship Archive Faculty Scholarship Faculty Publications 2010 A Short History of Tontines Kent McKeever Columbia Law School, [email protected] Follow this and additional works at: https://scholarship.law.columbia.edu/faculty_scholarship Part of the Banking and Finance Law Commons, Business Organizations Law Commons, Law and Economics Commons, and the Legal History Commons Recommended Citation Kent McKeever, A Short History of Tontines, 15 FORDHAM J. CORP. & FIN. L. 491 (2010). Available at: https://scholarship.law.columbia.edu/faculty_scholarship/2213 This Essay is brought to you for free and open access by the Faculty Publications at Scholarship Archive. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of Scholarship Archive. For more information, please contact [email protected]. Fordham Journal of Corporate & Financial Law Volume 15, Number 2 2009 Article 5 A Short History of Tontines Kent McKeever∗ ∗ Copyright c 2009 by the authors. Fordham Journal of Corporate & Financial Law is produced by The Berkeley Electronic Press (bepress). http://ir.lawnet.fordham.edu/jcfl A SHORT HISTORY OF TONTINES Kent McKeever' ". [T]he tontine is perhaps the most discredited ' 2 financial instrument in history. A tontine is an investment scheme through which shareholders derive some form of profit or benefit while they are living, but the value of each share devolves to the other participants and not the shareholder's heirs on the death of each shareholder. The tontine is usually brought to an end through a dissolution and distribution of assets to the living shareholders when the number of shareholders reaches an agreed small number.3 If people know about tontines at all, they tend to visualize the most extreme form - a joint investment whose heritable ownership ends up with the last living shareholder. -

2015 Buyer's Guide

Janmagazine_Layout 1 12/29/14 11:56 AM Page 1 Communications & new media Jan. 2015 II Vol. 29 No. 1 2015 BUYER’S GUIDE PRODUCTS & SERVICES IN MORE THAN 50 CATEGORIES FOR THE PR INDUSTRY BROADCAST MONITORING, SPEECH TRAINING, VIDEO, PRESS RELEASE DISTRIBUTION, CLIPPING SERVICES, COPYWRITING, PRINT SERVICES, TV PRODUCTION, RADIO, MEDIA MONITORING, MEDIA TOURS, NEWSWIRES, WEBCASTS, SOCIAL MEDIA, SATELLITE SERVICES, PSA’S & MORE! SPECIAL FEATURE: CRISIS COMMUNICATIONS Why no company is immune to a data breach Shareholder activism goes mainstream Top crisis blunders of 2014 Crisis training for campus sexual assault Crisis preparation in the digital age January 2015 | www.odwyerpr.com Nuance matters over formula in a crisis Profiles of crisis communications PR firms Janmagazine_Layout 1 12/29/14 11:56 AM Page 2 Janmagazine_Layout 1 12/29/14 11:56 AM Page 3 Janmagazine_Layout 1 12/29/14 11:56 AM Page 4 Vol. 29, No. 1 January 2015 EDITORIAL CRISIS PREPARATION IN PR, journalism jobs are stressful. THE DIGITAL AGE Favorable outcomes in today’s TRUSTEE OBJECTS TO SALE OF 6 28 crises come to those who prepare. BULLDOG ASSETS A bankruptcy trustee has objected to CIA PUBLIC AFFAIRS LEAKED Bulldog Reporter’s plans to sell assets.8 FALSE INFORMATION A Senate Intelligence Committee PR “FAILS” OF 2014 30 report reveals shocking details. Bill Cosby, the NFL, and GM top O’Dwyer’s PR “fails” of the year. THE LOST ART OF PAUSING 10 10 IN TIMES OF CRISIS Silence, reflection accompanies 2014, THE YEAR IN REVIEW 32 preparation in times of crisis. Jack O’Dwyer recounts the top PR stories of the year.