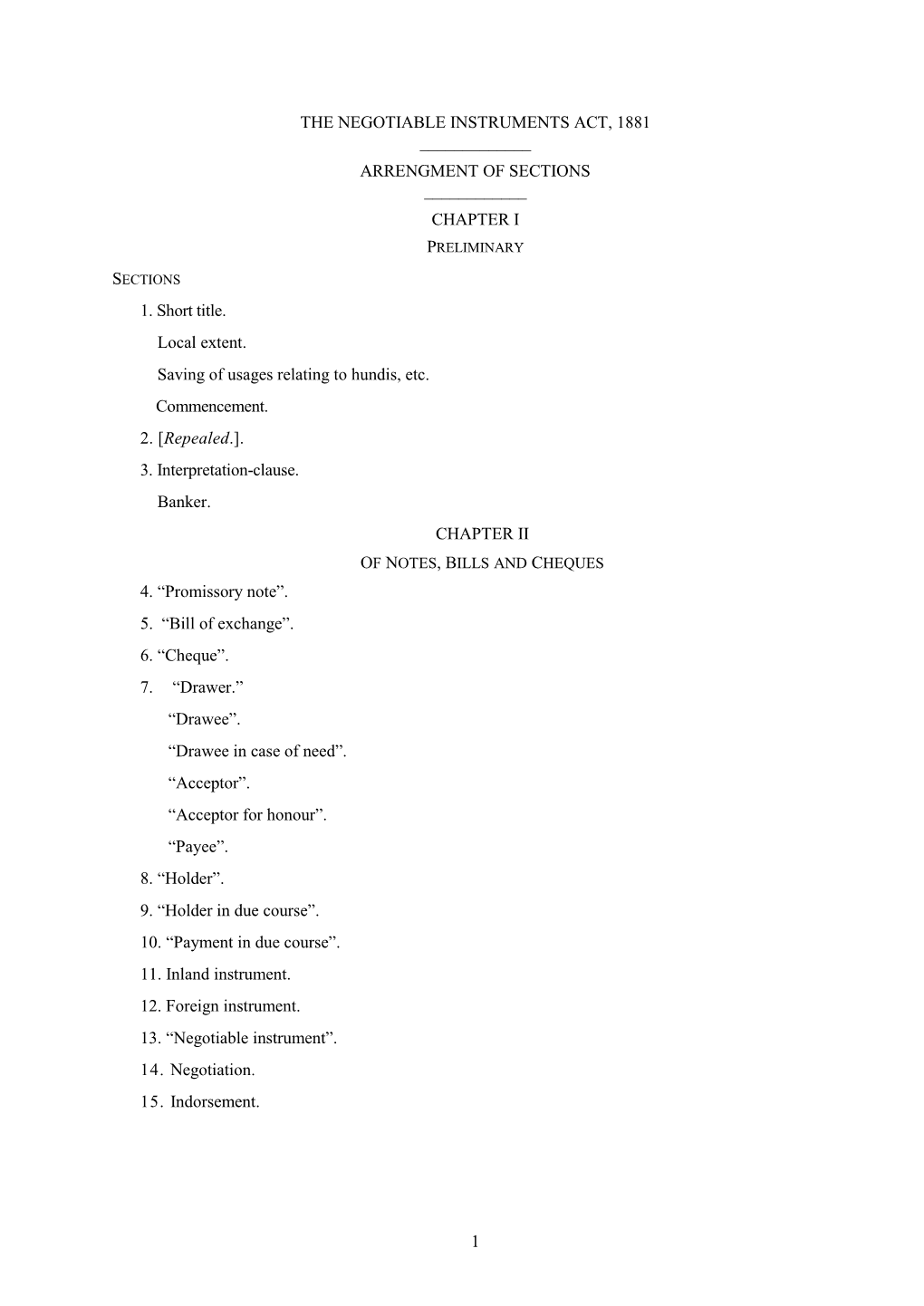

1 the Negotiable Instruments Act, 1881

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHAPTER NEGOTIABLEINSTRUMENTS ACT, 1881 Introduction: • Businessmen Have a Common Practice of Making Use of Certain Documents

CHAPTER NEGOTIABLE INSTRUMENTS ACT, 1881 CHAPTER AT A GLANCE Introduction: • Businessmen have a common practice of making use of certain documents for making payments. • Such documents are known as negotiable instruments. • The law relating to negotiable instruments is contained in the Negotiable Instruments Act, 1881. • The Act recognizes only three types of instruments: (a) Promissory notes (b) Bills of exchange (c) Cheques • Accepting payments through them is risky as it involves deferred payments. • It is the law of commercial world. • It was enacted to facilitate the activities in trade and commerce. • Its main purpose was to present an orderly and authoritative statement of the leading rules of law relating to negotiable instrument. • It refers to an act to define and amend the law relating to promissory notes, bills of exchange and cheques. • Act applies to whole of India and all persons resident in India. • Its provisions are not applicable to Hundis and other native instruments. Negotiable Instruments: • It is an “instrument which is transferable, by delivery, like cash, and is also capable of being sued upon by the person holding for time being. • As per the Section 13(1) of the Act, “A negotiable instrument means a promissory note, bills of exchange, or cheque payable either to order or to bearer.” • Conditions of Negotiability: (i) It should be freely transferable. (ii) Defective title of transferor does affects the title of person taking it for value and in good faith. (iii) Transferee can sue upon the instrument in his own name. • Negotiability Involves two Elements: (i) Transferability free from equities. (ii) Transferability by delivery or endorsement. -

History and Economics of Suretyship Willis D

Cornell Law Review Volume 12 Article 2 Issue 2 Febraury 1927 History and Economics of Suretyship Willis D. Morgan Follow this and additional works at: http://scholarship.law.cornell.edu/clr Part of the Law Commons Recommended Citation Willis D. Morgan, History and Economics of Suretyship , 12 Cornell L. Rev. 153 (1927) Available at: http://scholarship.law.cornell.edu/clr/vol12/iss2/2 This Article is brought to you for free and open access by the Journals at Scholarship@Cornell Law: A Digital Repository. It has been accepted for inclusion in Cornell Law Review by an authorized administrator of Scholarship@Cornell Law: A Digital Repository. For more information, please contact [email protected]. The History and Economics of Suretyship* By WILLIS D. MORGANt EARLY HISTORY OF THE CONTRACT OF SURETYSHIP The contract of suretyship antedates the Christian era by more than 2500 years.' The Library of Sargon I, king of Accad and Sumer (circa 275o B. C.) contains a tablet which records the making of such a contract. This contract, although made nearly 4700 years ago, contains features which are strikingly modern. A farmer, who resided in the suburbs of Accad, had been drafted into the military service of the king. He entered into a contract with a second farmer by the terms of which the latter agreed to cultivate the soldier's farm for the period of his absence. He also agreed to fertilize the land properly and to maintain the property and return it to the owner upon the expiration of the lease, in as good condition generally as when received by him. -

Promissory Note Comparison Guide

Promissory Note Comparison Guide © LEGALZOOM.COM, INC. 2009 Borrowing from or lending money to a friend or colleague is a sensitive situation. A lender wants to be sure money is returned on a timely basis. A borrower wants enough time to repay the amounts and some flexibility on interest rates. If you lend money to a family member or borrow money from your neighbor, you may find it useful (and comforting) to keep a record of the exchange and set out a schedule for repayment. By writing down specific terms, you are creating a “promissory note” to be evidence of the debt. A promissory note is not the same as an IOU. An IOU tells the world money is owed, but does not provide details about when and how it will be repaid. A promissory note gives the details of both the debt and the repayment plan, including any deadlines or interest payment requirements. Like most agreements, promissory notes can be tailored to meet your needs. There are, however, certain essential elements of a promissory note. Be careful if you’re signing (or offering) a promissory note that doesn’t meet the following requirements. Writing . Promissory notes must be in writing. There is no such thing as a “verbal” promissory note. Someone may promise to repay you, but it will be difficult to prove, and you may not be able to get it enforced in court without a written record. For Money . A promissory note is valid only if it is a promise to pay money. A promise to give property (or both property and money) is not a promissory note. -

Case 1:15-Cv-01310-RJJ-RSK ECF No. 34, Pageid

Case 1:15-cv-01310-RJJ-RSK ECF No. 34, PageID.<pageID> Filed 08/16/16 Page 1 of 10 UNITED STATES DISTRICT COURT WESTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION STEVEN L. MARVIN, Case No. 1:15-cv-1310 Plaintiff, Hon. Robert J. Jonker v. CAPITAL ONE, Defendant. / REPORT AND RECOMMENDATION Pro se plaintiff filed a complaint against defendant Capital One Bank (USA), N.A. (named in the complaint as “Capital One”). This matter is now before the Court on Capital One’s motion to dismiss (docket no. 6). I. Background This case involves a dispute arising out of plaintiff’s use of a Capital One credit card ending in the number 7624. Compl.(docket no. 1, PageID.16); Letter (Nov. 4, 2015) (docket no. 1-1, PageID.21). Plaintiff apparently incurred a credit card debt in the amount of $5,754.24. Plaintiff’s Fax (Sept. 30, 2015) (docket no. 1-1, PageID.43). Rather than pay the credit card debt with a check or money order, plaintiff issued defendant “two separate promissory notes.” Compl. at PageID.2. After sending the first note, Capital One required plaintiff to send a second note along with his social security number, date of birth, and other specific data for submission to its fulfillment center for processing. Id. Sometime prior to September 30, 2105, plaintiff sent a second “promissory note” in the amount of $5,000.00, “with my wet signature on it along with my thumb print in red ink with Case 1:15-cv-01310-RJJ-RSK ECF No. 34, PageID.<pageID> Filed 08/16/16 Page 2 of 10 numerous legal citations quoted on the face of the promissory note.” Plaintiff’s Fax at PageID.43. -

Deed of Trust and Promissory Note

Sacramento County Public Law Library & Civil Self Help Center 609 9th St. Sacramento, CA 95814 saclaw.org (916) 874-6012 >> Home >> Law 101 DEED OF TRUST AND PROMISSORY NOTE Real Property as Security for a Loan This Guide includes instructions and sample forms in a format that the Sacramento County Recorder’s Office will accept. The Guide and related forms may be downloaded from: saclaw.org/deed-of-trust. BACKGROUND Related Step-by-Step Guides A deed of trust, also called a trust deed, is the functional • Completing and Recording equivalent of a mortgage. It does not transfer the ownership Deeds of real property, as the typical deed does. Like a mortgage, a • Petition to Release trust deed makes a piece of real property security (collateral) Mechanics’ Lien for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to Find all this information on our pay off the loan. website at saclaw.org. Note: A trust deed is not used to transfer property to a living trust (use a Grant Deed for that). Other than the terminology, trust deeds and living trusts have nothing in common. A living trust is used to avoid probate, not to provide security for a loan. See the Law 101 page on Wills, Trusts, and Estate Planning on our website at saclaw.org/law-101/plan-estate/ for more information on that topic. A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. -

Download Espinal.Information.Pdf

UNITED STATES DISTRICT COURT DISTRICT OF NEW JERSEY UNITED STATES OF AMERICA Hon. Crim. No. 20- v. 18 U.S.C. S 1349 18 U.S.C. S 2 EDWARD ESPINAL 1s U.s.C. SS 78j(b) and 78ff 17 C.F.R. S 24O.10b-5 INFORMATION The defendant having waived in open court prosecution by Indictment, the United States Attorney for the District of New Jersey charges: COUNT ONE (Conspiracy to Commit Bank Fraud) 1. At all times relevant to this Information: a. Cash Flow Partners, LLC ("Cash Flou/'), was a business- consulting firm with offices in New Jersey and New York. b. Edward Espinal ('ESPINAL") was the founder and Chief Executive Officer ("CEO") of Cash Flow. As the CEO of Cash Flow, ESPINAL controlled Cash Flow's operations. Cash Flow employees reported to ESPINAL, and ESPINAL directed their activities. ESPINAL owned Cash Flow from on or about January 5,2016, when the company was registered, through on or about April 9,2018, when ESPINAL transferred ownership of Cash Flow to his wife. c. The "Payroll Company' was a New Jersey corporation that provided payroll processing services and reports to its client companies. d. Victim Bank 1 was a federally insured financial institution, as that term is defined in Title 18, United States Code, Section 20. e. victim Investors 1 and 2 invested money with ESPINAL and Cash Flow. The Bank Fraud ConsPiracv 2. From in or around March 2016 through in or around December 2olg, in Bergen County, in the District of New Jersey, and elsewhere, defendant EDWARD ESPINAL knowingly and intentionally conspired and agreed with others to execute and attempted to execute a scheme and artifice to defraud financial institutions, as defined. -

Negotiable Instruments

St. John's Law Review Volume 26 Number 1 Volume 26, December 1951, Number Article 3 1 Negotiable Instruments Edward D. Re Follow this and additional works at: https://scholarship.law.stjohns.edu/lawreview This Symposium is brought to you for free and open access by the Journals at St. John's Law Scholarship Repository. It has been accepted for inclusion in St. John's Law Review by an authorized editor of St. John's Law Scholarship Repository. For more information, please contact [email protected]. NEGOTIABLE INSTRUMENTS EDWARD D. RE - I. INTRODUCTION T HE uniformity envisioned by the draftsmen of the original Negotiable Instruments Law over half a century ago, has, to a large extent, vanished from the American legal scene. Indeed, its passing began even before it had reached ma- turity, for the Law, itself, was never adopted in identical form in all the states. Furthermore, such of its substance, as was uniformly accepted, has been subject to more than fifty years of amendment, modification, and divergent inter- pretation in the various jurisdictions.1 In addition, it has become increasingly obvious that the statute, as originally drafted and presently in force, contains certain basic defects which render substantial revision both necessary and desirable. 2 The proposed Commercial Code, in the article on "Commercial Paper," is designed to achieve t Professor of Law, St. John's University School of Law. 'An example is the construction placed on Section 62 of the Uniform Negotiable Instruments Law. See Wells Fargo Bank and Union Trust Co. v. Bank of Italy, 214 Cal. -

Promissory Note

Promissory Note – Installment Payments with Interest Borrower: ________________________________ Lender: ________________________________ Borrower promises to pay to Lender the amount of $ ___________ on ________________ [date payment is due] at ________________________________ [address where payments are to be sent] at the rate of __________ % per year from the date this note was signed until the date it is due. 2. Borrower agrees that this note will be paid in installments, which include principal and interest, of not less than $ ___________ per month, due on the first day of each month, until the principal and interest are paid in full. 3. If any installment payment due under this note is not received by Lender within __days of its due date, the entire amount of unpaid principal will become immediately due and payable at the option of Lender without prior notice to Borrower. 4. If Lender prevails in a lawsuit to collect on this note, Borrower agrees to pay Lender's attorney fees in an amount the court finds to be just and reasonable. The term Borrower refers to one or more borrowers. If there is more than one borrower, they agree to be jointly and severally liable. The term Lender refers to any person who legally holds this note, including a buyer in due course. Borrower's signature: ________________________________ Date: ________________________________ Print name: ________________________________ Location: ________________________________ [city or county where signed] Address: ____________________ ____________________ Certificate -

Bill of Exchange, Promissory Note and Cheque

342 Chapter 28 Bill of exchange, Promissory Note and Cheque 1. General Romania is not part of the Geneva Convention of June 7, 1930 for a unitary law of the bills of exchange and promissory notes and did not ratify the Geneva Convention of March 19, 1931 regarding cheque, although having signed the latter. However, the applicable legislation, adopted for the most part in 1934, follows exactly the rules established by the two conventions. 2. Main Regulations The main legal regulations applicable in the field are: Law No. 58/1934 on the bill of exchange and promissory note, with subsequent amendments and supplements (“Law No. 58/1934”); Law No. 59/1934 on cheque, with subsequent amendments and supplements (“Law No. 59/1934”); Framework-norms No. 6/1994 of the National Bank of Romania (“NBR”) regarding the trading of bills of exchange and of promissory notes by banking companies and other credit companies, based on Law No. 58/1934 on the bill of exchange and promissory note, with subsequent amendments and supplements (“Norms No. 6/1994”); NBR framework-norms no 7/1994 regarding trading of cheques by the banking companies and other credit companies, based on Law No. 59/1934 on cheques, with subsequent amendments and supplements (“Norms No. 7/1994”); NBR technical norms No. 4/2008 on cheques (“Norms No. 4/2008”); NBR technical norms No. 5/2008 regarding the bill of exchange and the promissory note (“Norms No. 5/2008”); Regulation No. 10/1994 regarding multilateral compensation of the inter-banking payments without paper cash, with subsequent amendments and supplements (“Regulation No. -

JAPAN Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT JAPAN Executive Summary Banking The Japanese central bank is the Bank of Japan (BOJ). Bank supervision is performed by the Financial Services Agency (FSA). Japan does apply some central bank reporting requirements. These are managed by the Ministry of Finance (MOF) through the BOJ, according to the rules set out in the Foreign Exchange and Foreign Trade Law and relevant regulations. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Japan. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Japan. Japan has four large city banks and a decreasing number of regional banks (64), which are divided into first and second tiers generally according to size and assets. There is a significant foreign banking presence in Japan: 56 foreign banks have established 77 branches in Japan. Payments Japan’s four main interbank payment clearing systems are BOJ-NET, FXYCS, Zengin and the BCCS. In addition, there are seven Japanese banks that are Settlement Members of CLS Bank. The most important cashless payment instruments in Japan are electronic credit transfers in terms of value and, in terms of volume, electronic-money and payment cards. Checks are primarily used for business-to-business transactions, while direct debits are widely used among individuals and businesses to make regular payments. Though the Japanese have been slower to adopt credit and debit cards, their usage, particularly of credit cards, is increasing rapidly. Liquidity Management Japanese-based companies have access to a variety of short-term funding alternatives. -

ORIGIN of the NEGOTIABLE PROMISSORY NOTE Jacob J

1956] THE ORIGIN OF THE NEGOTIABLE PROMISSORY NOTE Jacob J. Rabinowitzt The origin of the negotiable promissory note has been widely dis- cussed by legal historians. Brunner, who has devoted a number of articles to the subject,1 maintains that the principles underlying the negotiable promissory note are traceable to Germanic law and that the main elements of the negotiability clause are discernible in Lombard documents of the eighth, ninth and tenth centuries.' Under the Ger- manic law of procedure, Brunner asserts, the emphasis was upon the validity or invalidity of the defendant's defense and not upon the validity of the plaintiff's claim. In other words, it was incumbent upon the defendant to show why he was not liable to the plaintiff. There- fore, he says, when the promise ran to the person in whose hands the instrument would appear, the defendant had no valid defense against the holder of the instrument who was not required to show how the defendant became liable to him.3 It seems, however, that Brunner's so-called "principle of the Ger- manic law of procedure," which supposedly lays stress upon the validity of the defendant's defense-a most peculiar principle indeed-is but a product of his own imagination. He cites no evidence whatsoever for this principle, except the facts which he seeks to explain by it. Further- more, Brunner would apparently have us believe that the spirit of the Germanic law of procedure, having asserted itself through the Lom- t Professor of Law, The Hebrew University, Jerusalem. Member of the New York Bar. -

Negotiable Instruments Act, 1881

Subject: Principles of Insurance and Banking Course Code: FM-306 Author: Dr. S.S. Kundu Lesson: 1 Vetter: Dr. B.S. Bodla NEGOTIABLE INSTRUMENTS ACT, 1881 STRUCTURE 1.0 Objectives 1.1 Introduction 1.2 Meaning of Negotiable Instruments 1.3 Characteristics of a negotiable instrument 1.4 Presumptions as to negotiable instrument 1.5 Types of negotiable Instrument 1.5.1 Promissory notes 1.5.2 Bill of exchange 1.5.3 Cheques 1.5.4 Hundis 1.6 Parties to negotiable instruments 1.6.1 Parties to Bill of Exchange 1.6.2 Parties to a Promissory Note 1.6.3 Parties to a Cheque 1.7 Negotiation 1.7.1 Modes of negotiation 1.8 Assignment 1.8.1 Negotiation and Assignment Distinguished 1.8.2 Importance of delivery in negotiation 1.9 Endorsement 1.10 Instruments without Consideration 1.11 Holder in Due Course 1.12 Dishonour of a Negotiable instrument 1.13 Noting and protesting 1.14 Summary 1.15 Keywords 1.16 Self Assessment Questions 1.17 References/Suggested readings 1.0 OBJECTIVES After reading this lesson, you should be able to- • Understand meaning, essential characteristics and types of negotiable instruments; • Describe the meaning and marketing of cheques, crossing of cheques and cancellation of crossing of a cheque; • Explain capacity and liability parties to a negotiable instruments; and • Understand various provisions of negotiable instrument Act, 1881 regarding negotiation, assignment, endorsement, acceptance, etc. of negotiable instruments. 1.1 INTRODUCTION The Negotiable Instruments Act was enacted, in India, in 1881. Prior to its enactment, the provision of the English Negotiable Instrument Act were applicable in India, and the present Act is also based on the English Act with certain modifications.