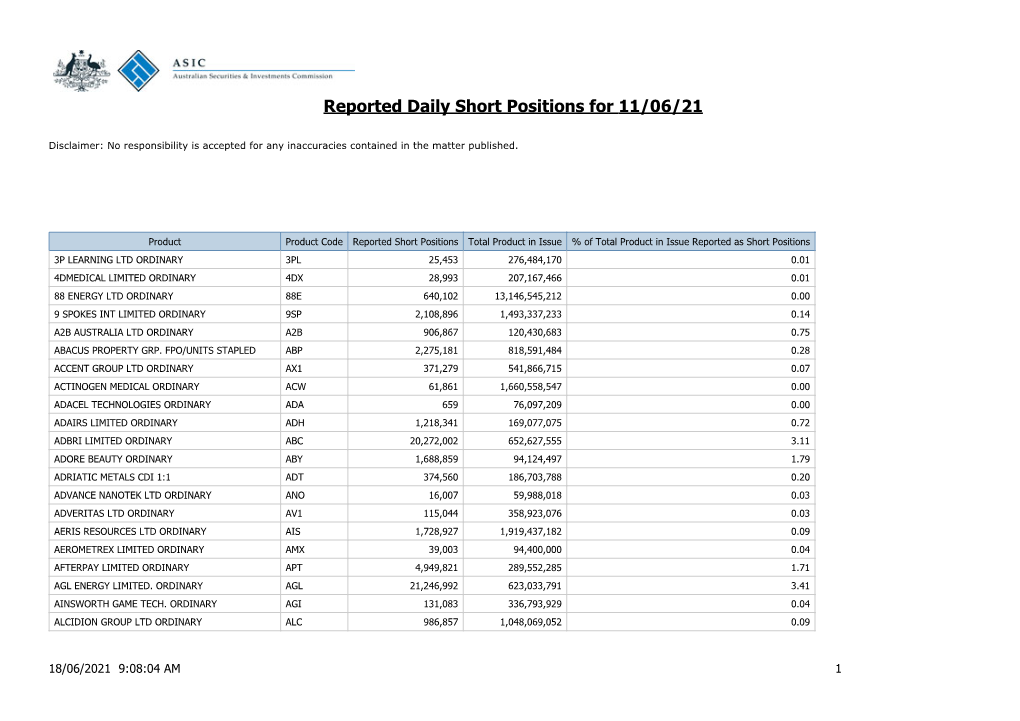

Reported Daily Short Positions for 11/06/21

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021

1H21 INVESTOR MATERIALS 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. CONTENTS 1H21 RESULTS PRESENTATION 3 ABOUT BOQ 30 1H21 RESULTS 34 PORTFOLIO QUALITY 38 CAPITAL, FUNDING & LIQUIDITY 45 DIVISIONAL RESULTS 52 ECONOMIC ASSUMPTIONS 56 Bank of Queensland Limited 2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. AGENDA INTRODUCTION Cherie Bell, General Manager Investor Relations RESULTS OVERVIEW George Frazis, Managing Director and CEO FINANCIAL DETAIL AND PORTFOLIO QUALITY Ewen Stafford, Chief Financial Officer and Chief Operating Officer SUMMARY & OUTLOOK George Frazis, Managing Director and CEO Q&A George Frazis, Managing Director and CEO Ewen Stafford, Chief Financial Officer and Chief Operating Officer Bank of Queensland Limited 2021 Half Year Results Presentation 4 RESULTS OVERVIEW GEORGE FRAZIS MANAGING DIRECTOR AND CEO 1H21 OVERVIEW 1. Statutory profit growth of 66%, cash net profit up 9%, and EPS growth of 3%1, reflecting strong growth whilst managing margin, costs and lower impairments 2. Good business momentum, with strong housing loan growth of 1.6x system and improved NIM to 1.95% 3. Delivering on the strategic transformation, over the last three halves, with go live of the first phase of the retail digital banking platform, and acquisition of ME Bank announced 4. Asset quality remains sound, reflected by loan impairment expense to GLAs reducing to 10bps and arrears reducing over the half. Prudent provision levels maintained 5. Capital strength to support business growth and transformation investment with CET1 of 10.03% 6. -

The State of the Deal and Deloitte Queensland Index

The State of the Deal and Deloitte Queensland Index March 2021 – Queensland Index Exceeds $100 billion THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion Contents Executive Summary 1 Then & Now – Investment Landscape 3 Then & Now – Deloitte Queensland Index 4 Queensland Economic Update 7 The Deloitte Queensland Index Q1 2021 8 Contacts 11 Sources 12 ii THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion Executive Summary Following the significant rebound in the second half of 2020, companies in the Deloitte Queensland Index exceeded $100 billion at 31 March 2021, the highest month end market capitalisation on record for the State. Deloitte Queensland Index S&P/ASX All Ordinaries Companies in the Deloitte return in Q1 2021 return in Q1 2021 Queensland Index 3.5% 2.4% 169 at 31 March 2021 10.6% in Q4 2020 14.0% in Q4 2020 173 at 31 December 2020 90 companies increased Market capitalisation as at Mar-21 market capitalisation (53%) 66 companies decreased market $101.6b capitalisation (39%) 12 no movement (7%) $97.2b as at Dec-20 $18.5b as at Sep-02 5 delistings 1 listing (1%) Announced QLD M&A Disclosed value of announced transactions in Q1 2021 QLD M&A transactions in Q1 2021 64 $1.9b 92 in Q4 2020 $3.3b in Q4 2020 1 THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion The Deloitte Queensland Index increased by 3.5% in Q1 2021 Queensland M&A more broadly remains strong with with total market capitalisation increasing to $101.6b at 64 transactions announced in Q1 2021 including: Mar-21, the highest month end value on record for the State. -

Lynas Corporation Limited

Lynas Corporation Limited Stock Exchange Listing ASX: LYC Company profile Lynas Corporation owns the richest known deposit of Rare Earths, also known as Lanthanides, in the world at Mount Weld, near Laverton in Western Australia. This deposit underpins Lynas’ strategy to create a reliable, fully integrated source of Rare Earths supply from the mine through to customers in the global Rare Earths industry. Lynas has received all environmental approvals and commenced construction of a Concentration Plant at Mount Weld and an Advanced Materials Plant to process the Mount Weld concentrate through to final Rare Earths oxides in the Gebeng Industrial Estate, Kuantan, Pahang, Malaysia. The Company plans to become the benchmark for security of supply and a world leader in quality and environmental responsibility to an international customer base. ‘Rare Earths” is the term given to fifteen metallic elements known as the lanthanide series, plus yttrium. They play a key role in green environmental products, from energy efficient compact fluorescent light bulbs (CFLs) to hybrid cars, automotive catalytic converters and wind turbine generators. They are also essential in the development and manufacturing of many modern technological products, from hard disc drives to flat panel displays, iPods and magnetic resonance imaging (MRI) scans. Click here to access the company's 2009 Annual Report (PDF 2.4MB) Recent Developments Recent developments include: • Capital raising of approximately $450 million fully funded to phase, through a 1-for-1 non-renounceable -

19 October 2020 the Manager ASX Market Announcements

19 October 2020 The Manager ASX Market Announcements Office Australian Securities Exchange Dear Manager SEEK Limited – Notice of 2020 Annual General Meeting and Proxy Form In accordance with the Listing Rules, attached are the following SEEK Limited (SEEK) documents for release to the market: • Notice of 2020 Annual General Meeting (AGM); and • Sample Proxy Form To ensure the safety of its people and its shareholders, SEEK will be holding its 2020 AGM as a virtual rather than physical meeting. The SEEK virtual AGM will be held on Thursday 19 November 2020 at 3.00pm (AEDT). Yours faithfully, Lynne Jensen Company Secretary This announcement was authorised for release by the Company Secretary. For further information please contact: Investors & Analysts Media Steven Moran Daniel Ellis SEEK Limited SEEK Limited (03) 8517 4484 Phone: 0400 587 232 SEEK Limited Level 6, 541 St Kilda Road, Melbourne, Victoria, 3004 | Tel: +613 8517 4100 | Fax: +613 9510 7244 | ABN 46 080 075 314 SEEK LIMITED NOTICE OF 2020 ANNUAL GENERAL MEETING Thursday 19 November 2020 at 3.00pm (AEDT) SEEK Notice of Annual General Meeting 1 INVITATION TO ANNUAL GENERAL MEETING 19 October 2020 Dear Shareholder, On behalf of the SEEK Board, I would like to invite you to our 2020 Annual General Meeting (AGM) to be held on Thursday 19 November 2020 at 3.00pm (AEDT). The challenges brought about by the COVID-19 pandemic have required us to make numerous changes to the way we operate, including to the way we will hold our AGM. To ensure the safety of our people and our shareholders, we will be holding our 2020 AGM as a virtual rather than physical meeting. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

JMAD Media Ownership Report

JMAD New Zealand Media Ownership Report 2014 Published: 2014 December 5 Author: Merja Myllylahti This New Zealand Ownership Report 2014 is the fourth published by AUT’s Centre for Journalism, Media and Democracy (JMAD). The report finds that the New Zealand media market has failed to produce new, innovative media outlets, and that all the efforts to establish non-profit outlets have proved unsustainable. The report confirms the general findings of previous reports that New Zealand media space has remained highly commercial. It also confirms the financialisation of media ownership in the form of banks and fund managers. The report also observes that in 2014 convergence between New Zealand mass media and the communications sector generally was in full swing. Companies, such as Spark (former Telecom NZ), started to compete head-to-head with the traditional broadcasters on the online on-demand video and television markets. The American online video subscription service Netflix is entering the NZ market in March 2015. Additionally, the report notes evidence of uncomfortable alliances between citizen media, politicians, PR companies and legacy media. As Nicky Hager’s Dirty Politics book revealed, the National Party and PR practitioners used the Whale Oil blog to drive their own agendas. Also, events related to Maori TV, TVNZ and Scoop raise questions about political interference in media affairs. It is now evident that the boundaries between mainstream media, bloggers, public relations practitioners and politicians are blurring. Key events and trends concerning New Zealand media Financialisation of mass media ownership confirmed Substantial changes in Fairfax, APN and MediaWorks ownership Competition heats up in online television and video markets Turbulence at Maori TV Blurred lines among politicians, bloggers, journalists and PR practitioners The JMAD New Zealand media ownership reports are available here: http://www.aut.ac.nz/study- at-aut/study-areas/communications/media-networks/journalism,-media-and-democracy-research- centre/journalists-and-projects 1 1. -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

16 August 2021 Company Announcements Office Australian

16 August 2021 Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 2021 FULL YEAR RESULTS – ANNUAL REPORT Seven West Media Limited (ASX: SWM) attaches the Annual Report for the year ended 26 June 2021. This release has been authorised to be given to ASX by the Board of Seven West Media Limited. For further information, please contact: Investors/Analysts Media Alan Stuart Rob Sharpe T: +61 2 8777 7211 T: +61 437 928 884 E: [email protected] E: [email protected] Seven West Media Limited / 50 Hasler Road, Osborne Park WA 6017 Australia / PO Box 7077, Alexandria NSW 2015 Australia T +61 2 8777 7777 / ABN 91 053 480 845 Repositioned for growth. Annual Report 2021 Big Brother Contents Our Strategy Who We Are 2 Our Strategic Priorities and Performance Dashboard 4 Executive Letters Letter from the Chairman 6 Letter from the Managing Director and Chief Executive Officer 8 Review of Operations Group Performance – Key Highlights and Summary of Financial Performance 11 Seven Network 17 The West 20 Corporate Social Responsibility Risk, Environment, People and Social Responsibility 22 Seven in the Community 28 Governance Board of Directors 33 Corporate Governance Statement 36 Directors’ Report 47 Remuneration Report 52 Auditor’s Independence Declaration 73 Financial Statements Financial Statements 74 Directors’ Declaration 132 Independent Auditor’s Report 133 Investor Information 138 Shareholder Information 139 Company Information 141 1 Section 1: Our Strategy Seven West Media Limited Annual Report 2021 Who We Are Transforming to lead Seven West Media is being transformed to drive long-term success. -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

FTSE World Asia Pacific

2 FTSE Russell Publications 19 August 2021 FTSE World Asia Pacific Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.04 NEW Asustek Computer Inc 0.1 TAIWAN Cheil Worldwide 0.02 KOREA ZEALAND ASX 0.12 AUSTRALIA Cheng Shin Rubber Industry 0.03 TAIWAN AAC Technologies Holdings 0.05 HONG KONG Atlas Arteria 0.05 AUSTRALIA Chiba Bank 0.04 JAPAN ABC-Mart 0.02 JAPAN AU Optronics 0.08 TAIWAN Chicony Electronics 0.02 TAIWAN Accton Technology 0.07 TAIWAN Auckland International Airport 0.06 NEW China Airlines 0.02 TAIWAN Acer 0.03 TAIWAN ZEALAND China Development Financial Holdings 0.07 TAIWAN Acom 0.02 JAPAN Aurizon Holdings 0.05 AUSTRALIA China Life Insurance 0.02 TAIWAN Activia Properties 0.03 JAPAN Ausnet Services 0.03 AUSTRALIA China Motor 0.01 TAIWAN ADBRI 0.01 AUSTRALIA Australia & New Zealand Banking Group 0.64 AUSTRALIA China Steel 0.19 TAIWAN Advance Residence Investment 0.05 JAPAN Axiata Group Bhd 0.04 MALAYSIA China Travel International Investment <0.005 HONG KONG ADVANCED INFO SERVICE 0.06 THAILAND Azbil Corp. 0.06 JAPAN Hong Kong Advantech 0.05 TAIWAN B.Grimm Power 0.01 THAILAND Chow Tai Fook Jewellery Group 0.04 HONG KONG Advantest Corp 0.19 JAPAN Bandai Namco Holdings 0.14 JAPAN Chubu Elec Power 0.09 JAPAN Aeon 0.2 JAPAN Bangkok Bank (F) 0.02 THAILAND Chugai Seiyaku 0.27 JAPAN AEON Financial Service 0.01 JAPAN Bangkok Bank PCL (NVDR) 0.01 THAILAND Chugoku Bank 0.01 JAPAN Aeon Mall 0.02 JAPAN Bangkok Dusit Medical Services PCL 0.07 THAILAND Chugoku Electric Power 0.03 JAPAN Afterpay Touch Group 0.21 AUSTRALIA Bangkok Expressway and Metro 0.02 THAILAND Chunghwa Telecom 0.17 TAIWAN AGC 0.08 JAPAN Bangkok Life Assurance PCL 0.01 THAILAND CIMB Group Holdings 0.08 MALAYSIA AGL Energy 0.04 AUSTRALIA Bank of East Asia 0.03 HONG KONG CIMIC Group 0.01 AUSTRALIA AIA Group Ltd. -

Bank of Queensland Submission to RBA: EFTPOS and Visa Debit

Bank of Queensland Submission to RBA EFTPOS and Visa Debit Consultation Document April 2005 Contents 1. Executive Summary 2. EFTPOS Interchange Fees 2.1 The Case for Zero EFTPOS Interchange Fees 2.2 RBA’s Draft EFTPOS Interchange Fee Standard 2.3 Potential Impact of the Reforms on Product Pricing 3. Visa Debit Reforms 3.1 The ‘Honour All Cards’ Rule 3.2 Visa Debit – Transparency 4. EFTPOS Access 5. Conclusion 1. Executive Summary It is a matter of history that the differing reform processes adopted for credit card interchange and for EFTPOS interchange has resulted in the implementation of these reforms becoming “out of step”. All the benefits from the disconnect between these reforms have fallen on the side of the retailers. In designating the EFTPOS system, we believed that the Reserve Bank would move to redress this situation and place the EFTPOS reforms back on track, as such we embraced designation as a positive development. Clearly, the self-regulatory industry EFTPOS reforms were aimed at achieving concurrent interchange fee reform between EFTPOS and Credit Cards but were required to follow an onerous and uncertain regulatory approval process. The uncertainty of the process was highlighted by the Australian Competition Tribunal (ACT) decision in 2004 to overturn the successful Authorisation Application determination made by the Australian Competition and Consumer Commission (ACCC) in relation to Zero EFTPOS Interchange Fees. For the record, Bank of Queensland supports the views expressed by the Reserve Bank1 in the Consultation Document in relation to the ACT findings. Throughout the whole Payments System reform process, the financial services industry has been characterised as being generally opposed to reform, when clearly this has not been the case. -

Specialist Australian Small Companies Quarterly Investment Option Update

Specialist Australian Small Companies Quarterly Investment Option Update 31 December 2020 Aim and Strategy Sector Allocation % To provide a total return (income and capital growth) Consumer Discretionary 21.97 after costs and before tax, above the performance Materials 17.24 benchmark, the S&P/ASX Small Ordinaries Industrials 14.87 Accumulation Index, on a rolling three-year basis. The Health Care 9.90 portfolio invests in small companies listed on the Information Technology 8.64 Australian Securities Exchange (ASX). For this Financials 6.06 portfolio small companies are considered to be those Communication Services 5.61 outside the top 100 listed companies (by market Consumer Staples 5.50 value). Up to 20% of the portfolio may be invested in Real Estate 5.37 unlisted companies that the investment manager Cash 2.80 believes are likely to be listed in the next 12 months, or Energy 2.05 in companies between the top 50 and 100 listed on the ASX. Top Holdings % City Chic Collective Ltd 2.49 Investment Option Performance Lynas Rare Earths Ltd 2.43 To view the latest investment performances for each Eagers Automotive Ltd 2.07 product, please visit www.amp.com.au/performance Integral Diagnostics Ltd 2.04 Marley Spoon AG 1.89 Investment Option Overview Technology One Ltd 1.85 Investment category Australian Shares Pilbara Minerals Ltd 1.84 Suggested minimum investment Seven Group Holdings Ltd 1.83 7 years timeframe Ingenia Communities Group 1.78 Relative risk rating Very High Auckland International Airport 1.75 Investment style Active Manager style Multi-manager Asset Allocation Benchmark (%) Australian Shares 100 Cash 0 Actual Allocation % International Shares 11.61 Australian Shares 82.23 Listed Property and Infrastructure 3.36 Cash 2.80 Fund Performance The Fund posted a very strong positive absolute return and outperformed its benchmark over the December quarter.