Yum China (9987

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Store Location Selection Via Mining Search Query Logs of Baidu Maps

Store Location Selection via Mining Search Query Logs of Baidu Maps ∗ Mengwen Xuxy, Tianyi Wangx, Zhengwei Wux, Jingbo Zhoux,Jian Liy, Haishan Wux xBaidu Research, Big Data Lab, yIIIS, Tsinghua University {xumengwen,wangtianyi02,wuzhengwei,zhoujingbo,wuhaishan}@baidu.com [email protected] ABSTRACT Choosing a good location when opening a new store is crucial for the future success of a business. Traditional methods in- clude offline manual survey, which is very time consuming, and analytic models based on census data, which are un- able to adapt to the dynamic market. The rapid increase of the availability of big data from various types of mobile de- vices, such as online query data and offline positioning data, provides us with the possibility to develop automatic and (a) Detecting the spatial dis- (b) Estimating service dis- accurate data-driven prediction models for business store tribution of customer de- tance of existing stores and placement. In this paper, we propose a Demand Distribu- mand from query data from detecting the demand-supply tion Driven Store Placement (D3SP) framework for business Baidu Maps. gap. store placement by mining search query data from Baidu Maps. D3SP first detects the spatial-temporal distributions of customer demands on different business services via query data from Baidu Maps, the largest online map search engine in China, and detects the gaps between demand and sup- ply. Then we determine candidate locations via clustering such gaps. In the final stage, we solve the location opti- mization problem by predicting and ranking the number of customers. We not only deploy supervised regression mod- els to predict the number of customers, but also learn to (c) Determing potential (d) Optimizing the place- placement locations by clus- ment positions by maximiz- rank models to directly rank the locations. -

From the Ground up the First Fifty Years of Mccain Foods

CHAPTER TITLE i From the Ground up the FirSt FiFty yearS oF mcCain FoodS daniel StoFFman In collaboratI on wI th t ony van l eersum ii FROM THE GROUND UP CHAPTER TITLE iii ContentS Produced on the occasion of its 50th anniversary Copyright © McCain Foods Limited 2007 Foreword by Wallace McCain / x by All rights reserved. No part of this book, including images, illustrations, photographs, mcCain FoodS limited logos, text, etc. may be reproduced, modified, copied or transmitted in any form or used BCE Place for commercial purposes without the prior written permission of McCain Foods Limited, Preface by Janice Wismer / xii 181 Bay Street, Suite 3600 or, in the case of reprographic copying, a license from Access Copyright, the Canadian Toronto, Ontario, Canada Copyright Licensing Agency, One Yonge Street, Suite 1900, Toronto, Ontario, M6B 3A9. M5J 2T3 Chapter One the beGinninG / 1 www.mccain.com 416-955-1700 LIBRARY AND ARCHIVES CANADA CATALOGUING IN PUBLICATION Stoffman, Daniel Chapter Two CroSSinG the atlantiC / 39 From the ground up : the first fifty years of McCain Foods / Daniel Stoffman For copies of this book, please contact: in collaboration with Tony van Leersum. McCain Foods Limited, Chapter Three aCroSS the Channel / 69 Director, Communications, Includes index. at [email protected] ISBN: 978-0-9783720-0-2 Chapter Four down under / 103 or at the address above 1. McCain Foods Limited – History. 2. McCain, Wallace, 1930– . 3. McCain, H. Harrison, 1927–2004. I. Van Leersum, Tony, 1935– . II. McCain Foods Limited Chapter Five the home Front / 125 This book was printed on paper containing III. -

Yum China Launches Pizza Hut Book Donation and Exchange Program Across China

Yum China Launches Pizza Hut Book Donation and Exchange Program across China 2 May, 2018 SHANGHAI, May 1, 2018 /PRNewswire/ -- Yum China Holdings, Inc. (the "Company" or "Yum China") (NYSE: YUMC) today launched the Pizza Hut Book Donation and Exchange Program at Pizza Hut restaurants across China. To mark World Book Day, Yum China also celebrated the grand opening of the "Pizza Hut Book Donation and Exchange Sub-Center" in Shenzhen. Joey Wat, CEO of Yum China commented, "By pioneering innovative CSR programs like this, we aim to make a positive difference to the lives of our customers and the communities in which we operate. Using our strong brand and scale, Yum China is in a privileged position to support government initiatives to encourage reading in the long term." Jeff Kuai, General Manager of Pizza Hut, said, "As a leading casual dining restaurant brand in China, Pizza Hut is well-positioned to help integrate reading into people's daily lives. We hope Pizza Hut's new book exchange center will ignite people's love for reading and learning, and provide a place for the community to connect and engage." In collaboration with the Shenzhen Book Donation and Exchange Center, Yum China initiated a pilot program in November 2017 to promote and advocate the importance of reading through the establishment of a community reading center – the Shenzhen Pizza Hut Book Donation and Exchange Sub-Center. This center, located in the Shenzhen Pizza Hut Oriental Garden Restaurant, currently has over 2,000 books and offers services similar to a library, including book exchange and sharing services. -

Yum China Holdings, Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents As filed with the Securities and Exchange Commission on February 27, 2018 Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM S-3 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 Yum China Holdings, Inc. (Exact name of registrant as specified in its charter) Delaware 81-2421743 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 7100 Corporate Drive Yum China Building Plano, Texas 75024 20 Tian Yao Qiao Road United States of America Shanghai 200030 People’s Republic of China (469) 980-2898 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) Shella Ng Chief Legal Officer and Corporate Secretary Yum China Holdings, Inc. 7100 Corporate Drive Plano, Texas 75024 (469) 980-2898 (Name, address, including zip code, and telephone number, including area code, of agent for service) With copies to: Lindsey A. Smith Sidley Austin LLP One South Dearborn Street Chicago, Illinois 60603 (312) 853-7000 Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective. If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐ If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒ If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. -

Haidilao International Holding Ltd Version 1 | Bloomberg: 6862 HK Equity | Reuters: 6862.HK Refer to Important Disclosures at the End of This Report

China / Hong Kong Company Guide Haidilao International Holding Ltd Version 1 | Bloomberg: 6862 HK Equity | Reuters: 6862.HK Refer to important disclosures at the end of this report DBS Group Research . Equity 1 Aug 2019 HOLD (Initiating Coverage) Priced in a blue sky Last Traded Price ( 31 Jul 2019):HK$30.50 (HSI : 27,778) • One of China’s leading and fastest growing hotpot player Price Target 12-mth:HK$28.70 (5.9% downside) with strong servicing reputation on going above and Analyst beyond for its customers Alison FOK+852 36684170, [email protected] Mavis HUI+852 36684188, [email protected] • Expect near-term positives priced in, now trading at 46x Alice HUI CFA+852 36684182, [email protected] FY20F PE; we expect downside risk on FY20F earnings on margin dilution as a result of fast expansion Price Relative • Initiate coverage with HOLD and TP of HK$28.7 One of the fastest-growing hotpot restaurant chains in China with inflated valuations. Haidilao is one of the fastest-growing and leading hotpot cuisine restaurant chains in China. We forecast the group to achieve an earnings CAGR of 34.5% in 2019-21F, on the back of a sales turnover CAGR of 36% supported by its ambitious store- expansion strategy, positive SSSG and above-industry table turnover ratio. We estimate the group’s net store openings at +210/+200/+195 in FY19-21, with stronger focus on tier 2 cities. Contrary to peers, Haidilao presents itself as a premium service provider rather than sale Forecasts and Valuation FY Dec (HK$m) 2018A 2019F 2020F 2021F of products, supported by attractive employee profit-sharing and Turnover 16,969 26,225 36,628 48,362 incentive schemes. -

Three Colomns-ML Based on DOHMH New York City Restaurant Inspection Results

Three colomns-ML Based on DOHMH New York City Restaurant Inspection Results DBA CUISINE DESCRIPTION DUNKIN Donuts ALL ABOUT INDIAN FOOD Indian CHARLIES SPORTS BAR Bottled Beverages MIMMO Italian SUENOS AMERICANO BAR Spanish RESTAURANT ANN & TONY'S RESTAURANT Italian GREEN BEAN CAFE Coffee/Tea PORTO BELLO PIZZERIA & Pizza RESTAURANT GUESTHOUSE RESTAURANT Eastern European CALEXICO CARNE ASADA Mexican JOHNNY UTAHS American RUMOURS American FORDHAM RESTAURANT American HONG KONG CAFE CHINESE Chinese RESTAURANT ASTORIA SEAFOOD & GRILL Seafood SUP CRAB SEAFOOD RESTAURANT Chinese SWEETCATCH POKE Hawaiian SWEETCATCH POKE Hawaiian Page 1 of 488 09/29/2021 Three colomns-ML Based on DOHMH New York City Restaurant Inspection Results INSPECTION DATE 11/18/2019 09/15/2021 11/24/2018 03/12/2020 01/03/2020 02/19/2019 01/16/2020 07/06/2017 04/24/2018 04/19/2018 06/20/2018 12/12/2019 09/10/2019 05/14/2018 08/19/2019 08/27/2019 06/24/2019 06/24/2019 Page 2 of 488 09/29/2021 Three colomns-ML Based on DOHMH New York City Restaurant Inspection Results KAHLO Mexican 52ND SUSHI Japanese EL COFRE RESTAURANT Latin American CARVEL Frozen Desserts CHOPSTICKS Chinese CATRIA MODERN ITALIAN Italian CATRIA MODERN ITALIAN Italian TAGLIARE PIZZA DELTA TERMINAL American OVERLOOK American BILLIARD COMPANY American BOCADITO BISTRO Eastern European FINN'S BAGELS Coffee/Tea FINN'S BAGELS Coffee/Tea CHUAN TIAN XIA Chinese LA POSADA MEXICAN FOOD Mexican CHINA STAR QUEENS CHINESE Chinese RESTAURANT AC HOTEL NEW YORK DOWNTOWN American NEWTOWN Middle Eastern NO.1 CALLE 191 PESCADERIA -

Yum China Launches Family Care Program for Restaurant Management Team

Yum China Launches Family Care Program for Restaurant Management Team 5 February, 2020 SHANGHAI, Feb. 5, 2020 /PRNewswire/ -- Yum China Holdings, Inc. (the "Company" or "Yum China") (NYSE: YUMC) today announced the launch of a family care program, by establishing the "Restaurant Management Team (RMT) Family Care Fund". The program is designed to provide additional health protection for family members of restaurant management employees. The new scheme will start in July 2020 and cover an estimated 86,000 parents, spouses and children of more than 31,000 RMT employees. On top of the existing commercial insurance, RMT members will be entitled to additional coverage for critical illness for their parents as well as additional accident coverage for their children and spouse. The scheme also offers express medical treatment for their parents in selected hospitals. "In 2018, Yum China launched the Restaurant General Manager (RGM) Family Care Program, which was greatly appreciated by our RGMs and their families. Since then we have been exploring ways to offer a similar program for RMT members who are sometimes required to take on the extreme burden of caring for their families when faced with unfortunate events. The establishment of this plan further reinforces our commitment to being a supportive and caring employer," said Joey Wat, CEO of Yum China. RMT members can participate in the scheme on a voluntary basis with only a small contribution to the fund every year. The bulk of the remaining cost will be borne by the Company. This scheme goes beyond others in the market by increasing the age cap to 75 years for employees' parents and 22 years for their children. -

Yum! Brands, Inc. (NYS: YUM)

Yum! Brands, Inc. (NYS: YUM) General Company Information Principal Office Website 1441 Gardiner Lane Louisville, KY 40213www.yum.com USA Phone Primary NAICS 502 874-8300 722211 : Limited-Service Restaurants Fax Closing Stock Price 502 874-8790 71.48 (as of 09/09/2013) Auditor Incorporated KPMG LLP 1997 , NC, United States Number of Employees Mergent Dividend Achiever 523,000 (Year End Average Staff as ofNo 12/29/2012) Country Number of Shareholders United States 65,133 (as of 02/12/2013) Exchange and Ticker Annual Meeting NYS : YUM In May Primary SIC 5812 : Eating places Business Summary Yum! Brands is a service restaurant company. Through the three concepts of KFC, Pizza Hut and Taco Bell, Co. develops, operates, franchises and licenses a worldwide system of restaurants which prepare, package and sell a menu of food items. Co.'s business consists of six operating segments: YUM Restaurants China, which includes mainland China; YUM Restaurants International, which includes the remainder of Co.'s international operations; the U.S., which consists of Taco Bell U.S., KFC U.S., and Pizza Hut U.S.; and YUM Restaurants India, which includes India, Bangladesh, Mauritius, Nepal and Sri Lanka. As of Dec 29 2012, Co. had about 39,000 units in more than 125 countries and territories. Company Details Pricing Summary Time Period: 1 week Yesterday 5 Days 30 Days Close 71.48 69.84 74.4 Volume 3,323,516.002,633,502.00N/A 52 Week High/Low : 74.82 - 62.08 % Price Change (100 Days) : 5.51 200-Day Moving Avg. -

Vincom Retail Joint Stock Company 1Q2019 Financial Results

Vincom Retail Joint Stock Company 1Q2019 Financial Results 23 April 2019 Disclaimer IMPORTANT: The information contained herein is preliminary and subject to change without notice, its accuracy is not guaranteed, has not been independently verified and may not contain all material information concerning Vincom Retail Joint Stock Company (the “Company”) and its subsidiaries (the “Group”). You should not rely upon it or use it to form the basis for any investment decision or commitment whatsoever. None of the Company, its shareholders, or any of their respective affiliates, directors, officers, employees, agents, advisers or any other person makes any representation or warranty (express or implied) or accepts any responsibility or liability for the accuracy or completeness of this presentation or any or all of the information in this presentation or otherwise made available. It is not the intention to provide, and you may not rely on these materials as providing, a complete or comprehensive analysis of the financial or trading position or prospects of the Group. No part of this presentation shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. Further, nothing in this presentation should be construed as constituting legal, business, tax or financial advice. You should conduct such independent investigations and analysis of the Group as you deem necessary or appropriate in order to make an independent determination of the suitability, merits and consequences of investment in the Company. This presentation contains “forward-looking statements”. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond the Company’s control and all of which are based on management’s current beliefs and expectations about future events. -

Yum China Reports First Quarter 2020 Results

Yum China Reports First Quarter 2020 Results 28 April, 2020 Total Revenues down 24%. System Sales down 20% and Same Store Sales down 15% in constant currency Opened 179 new stores and Reported $97 million Operating Profit despite Unprecedented COVID-19 Impact SHANGHAI, April 28, 2020 /PRNewswire/ -- Yum China Holdings, Inc. (the "Company" or "Yum China") (NYSE: YUMC) today reported unaudited results for the first quarter ended March 31, 2020. Impact of COVID-19 Outbreak and Mitigation Efforts As the COVID-19 outbreak progressed, Yum China further heightened its focus on safeguarding the health and safety of its employees and customers. The Company implemented stringent health measures at its restaurants and workplaces, and provided extended healthcare and other support to employees. First quarter operations were significantly affected by the outbreak. Working closely with local health authorities to safeguard the public, the Company began temporary store closures in late January where appropriate. Approximately 35% of stores were closed by mid-February at the peak of the outbreak, with significant regional differences. As of the date of this release, approximately 99% of stores in China are either partially or fully open. For restaurants that remained open, same-store sales declined due to shortened operating hours and reduced traffic, with a significant portion of stores providing only delivery and takeaway services. Our results were strong for the first three weeks of January, but then the outbreak led to subsequent same-store sales declines of 40-50% compared to the comparable Chinese New Year holiday period in 2019. As the first quarter progressed, sales performance recovered gradually, with same-store sales down approximately 20% in late March. -

Read the Report

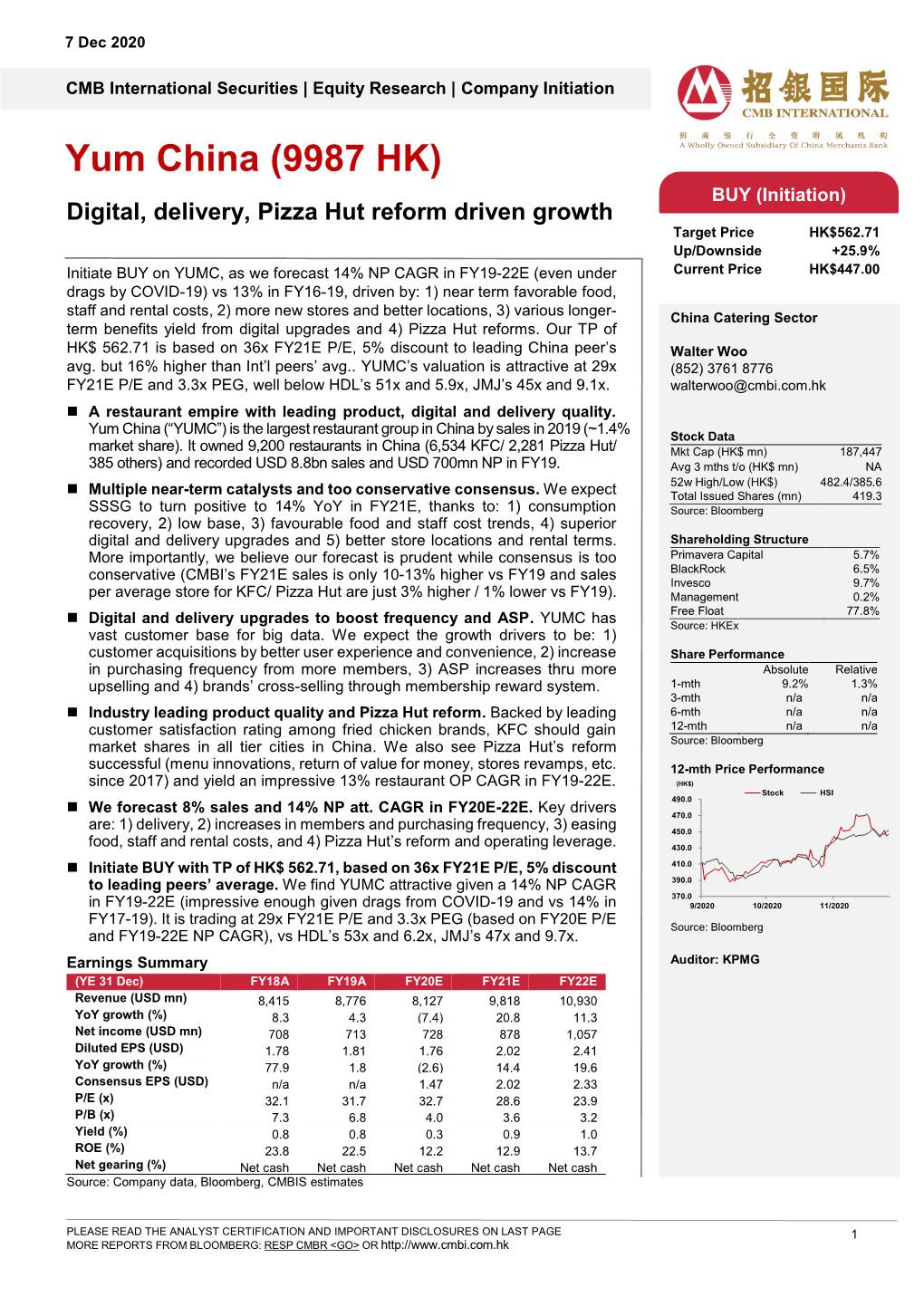

7 Dec 2020 CMB International Securities | Equity Research | Company Initiation Yum China (9987 HK) BUY (Initiation) Digital, delivery, Pizza Hut reform driven growth Target Price HK$562.71 Up/Downside +25.9% Initiate BUY on YUMC, as we forecast 14% NP CAGR in FY19-22E (even under Current Price HK$447.00 drags by COVID-19) vs 13% in FY16-19, driven by: 1) near term favorable food, staff and rental costs, 2) more new stores and better locations, 3) various longer- China Catering Sector term benefits yield from digital upgrades and 4) Pizza Hut reforms. Our TP of HK$ 562.71 is based on 36x FY21E P/E, 5% discount to leading China peer’s Walter Woo avg. but 16% higher than Int’l peers’ avg.. YUMC’s valuation is attractive at 29x (852) 3761 8776 FY21E P/E and 3.3x PEG, well below HDL’s 51x and 5.9x, JMJ’s 45x and 9.1x. [email protected] A restaurant empire with leading product, digital and delivery quality. Yum China (“YUMC”) is the largest restaurant group in China by sales in 2019 (~1.4% Stock Data market share). It owned 9,200 restaurants in China (6,534 KFC/ 2,281 Pizza Hut/ Mkt Cap (HK$ mn) 187,447 385 others) and recorded USD 8.8bn sales and USD 700mn NP in FY19. Avg 3 mths t/o (HK$ mn) NA 52w High/Low (HK$) 482.4/385.6 Multiple near-term catalysts and too conservative consensus. We expect Total Issued Shares (mn) 419.3 SSSG to turn positive to 14% YoY in FY21E, thanks to: 1) consumption Source: Bloomberg recovery, 2) low base, 3) favourable food and staff cost trends, 4) superior digital and delivery upgrades and 5) better store locations and rental terms. -

Yum Yum! Free

FREE YUM YUM! PDF Yusuke Yonezu | 24 pages | 01 Apr 2014 | Minedition | 9789888240586 | English | Hong Kong, United States Menu | Yum Yum Donuts Brands, Inc. Prior toYum! Based in Yum Yum!, Kentucky, it is one of the world's largest fast food restaurant companies in terms of system units. In nations and territories worldwide, they operate 43, restaurants, including 2, Yum Yum! are company-owned and 40, that are franchised. The company's history traces back towhen PepsiCo entered into the restaurant business by acquiring Pizza Hut. A year Yum Yum!, PepsiCo purchased Taco Bell. InHot 'n Now was acquired via Taco Bell, [4] but the company would later be sold in Brands ", Tricon Global was spun off in late InKFC started test restaurants in Austin, Texas, called "Wing Works", a chicken wing line sold with one of a few flavored sauces. KFC also hired a consultant to develop a breakfast menu. The acquisition was finalized on May 8,and the name change became effective on May 22, [17] On June 6,Yum! InYum! An East Dawning test cafeteria-style Yum Yum! was opened in Shanghai Yum Yum! After initially failing, Yum! In JanuaryYum! For the decade leading up to the company's announcement, Yum Yum! growth had relied on international expansion. With little Yum Yum! outside North America, the two chains no longer fit in the company's long-term growth plans. Both of those chains also suffered from poor sales, and had fewer locations compared to Yum Yum! other chains in the Yum! Brands portfolio. In SeptemberYum! In MayYum! The Ministry approved the deal in Novemberaccording to Little Sheep representatives.