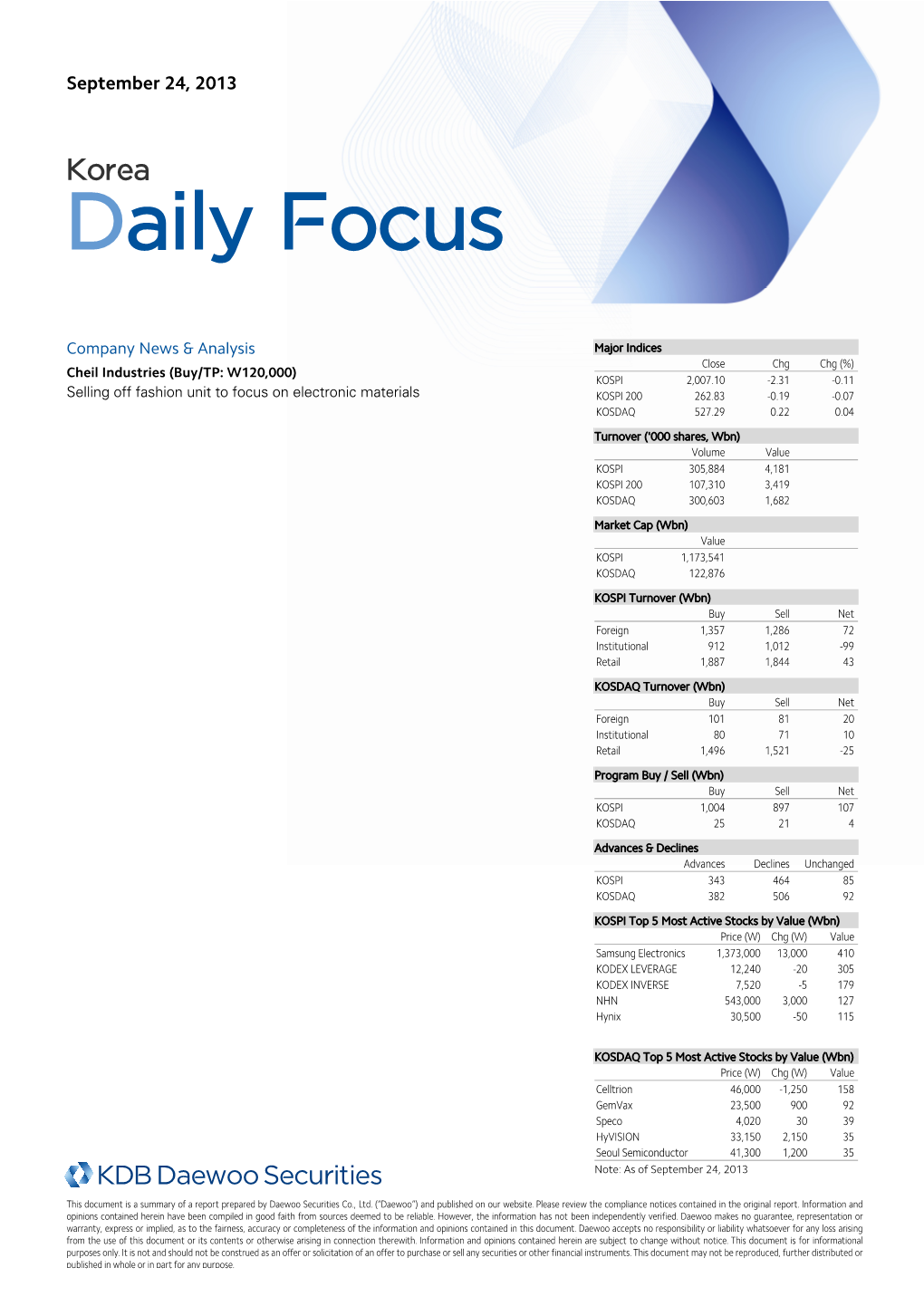

September 24, 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

November 11, 2015

November 11, 2015 KOREA Company News & Analysis Major Indices Close Chg Chg (%) Wonik IPS (030530/Buy/TP: W16,000) KOSPI 1,997.27 0.68 0.03 Implications of the spin-off KOSPI 200 245.86 0.00 0.00 KOSDAQ 667.21 10.51 1.60 CJ E&M (130960/Buy/TP: W110,000) Ready for the next big leap Turnover ('000 shares, Wbn) Volume Value Interpark (108790/Buy/TP: W30,000) KOSPI 282,596 3,796 Mobile and tour growth story remains intact KOSPI 200 63,222 2,712 KOSDAQ 628,336 3,430 Kangwon Land (035250/Buy/TP: W54,000) Market Cap (Wbn) 3Q report reaffirms golden goose status Value KOSPI 1,266,258 Korea Gas (036460/Hold) Downgrade rating KOSDAQ 190,795 Wait until uncertainties are cleared KOSPI Turnover (Wbn) Buy Sell Net Sector News & Analysis Foreign 904 1,128 -224 Institutional 726 720 6 Healthcare (Overweight) Retail 2,067 1,931 136 Healthcare Weekly Briefing KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 218 171 48 Institutional 115 144 -30 Retail 3,090 3,114 -24 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 729 841 -112 KOSDAQ 56 44 12 Advances & Declines Advances Declines Unchanged KOSPI 511 296 68 KOSDAQ 746 297 64 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Hanmi Pharm 818,000 34,000 303 Samsung Electronics 1,333,000 12,000 187 KODEX LEVERAGE 10,095 -20 170 Hanmi Science 164,000 -4,000 158 KODEX INVERSE 8,185 5 124 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Celltrion 79,900 4,100 155 New Pride 15,800 -200 119 NATURECELL 7,680 -320 117 Digital-Tech 2,400 280 97 Kolon Life Science 210,600 11,100 87 Note: As of November 11, 2015 This document is a summary of a report prepared by Daewoo Securities Co., Ltd. -

Cheil Industries Stronger Is the Unconventional Challenges

year in review in year unconventional challenges and our responses What makes Cheil Industries stronger is the unconventional challenges. We continued to move forward when competitors were at a standstill, and worked on making the company better while others were solely focused on external growth. Cheil Industries looks to push boundaries and seeks challenges and innovation even in times of great uncertainty. This Corporate Report is a record of what Cheil Industries has done in the past, and how we have responded to crisis by taking full advantage of opportunities and boldly adopting changes. It is also a commitment to growth in the future, so that Cheil Industries can join with all of our stakeholders in becoming a stronger, better company. 03 Cheil Industries Corporate Report 2011 year in review in year we are original strong no future creative without a past Cheil Industries’ 57 year history has built a company of immense experience. The company has always upheld a strong set of values, resulting in today’s growth and success. This is an introduction to the history of Cheil Industries – a history which also serves as the basis for the core values that will shape our future. 04 05 Cheil Industries Corporate Report 2011 1954 Cheil Woolen Fabrics Industries founded ns I 1956 Commenced plant operations and manufactured Korea’s first combed yarn Beg year in review in year 1961 Launched Korea’s first textile exports (1954~1968) 1965 Became the first Korean business to secure a license to use the WOOL trademark A Journey 1969 Became the -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

Corporate Hierarchies, Genres of Management, and Shifting Control in South Korea’S Corporate World

Ranks & Files: Corporate Hierarchies, Genres of Management, and Shifting Control in South Korea’s Corporate World by Michael Morgan Prentice A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy (Anthropology) in The University of Michigan 2017 Doctoral Committee: Associate Professor Matthew Hull, Chair Associate Professor Juhn Young Ahn Professor Gerald F. Davis Associate Professor Michael Paul Lempert Professor Barbra A. Meek Professor Erik A. Mueggler Michael Morgan Prentice [email protected] ORCID: 0000-0003-2981-7850 © Michael Morgan Prentice 2017 Acknowledgments A doctoral program is inexorably linked to the document – this one – that summarizes the education, research, and development of a student and their ideas over the course of many years. The single authorship of such documents is often an aftereffect only once a text is completed. Indeed, while I have written all the words on these pages and am responsible for them, the influences behind the words extend to many people and places over the course of many years whose myriad contributions must be mentioned. This dissertation project has been generously funded at various stages. Prefield work research and coursework were funded through summer and academic year FLAS Grants from the University of Michigan, a Korea Foundation pre-doctoral fellowship, and a SeAH-Haiam Arts & Sciences summer fellowship. Research in South Korea was aided by a Korea Foundation Language Grant, a Fulbright-IIE Research grant, a Wenner-Gren Dissertation Fieldwork Grant, and a Rackham Centennial Award. The dissertation writing stage was supported by the Rackham Humanities fellowship, a Social Sciences Research Council Korean Studies Dissertation Workshop, and the Core University Program for Korean Studies through the Ministry of Education of the Republic of Korea and Korean Studies Promotion Service of the Academy of Korean Studies (AKS-2016-OLU-2240001). -

Abstract: the Purpose of This Paper Is to Investigate

THE ECONOMIC COST OF NUCLEAR THREATS: A NORTH KOREA CASE STUDY. Abstract: The purpose of this paper is to investigate how public announcements of a nation’s nuclear programme development influence neighbouring countries’ stock markets. The countries examined in this case study are North and South Korea. To test this relationship I conducted an event study using MacKinlay’s market model. Six announcement days were studied comprising out of three nuclear tests and three missile and satellite related tests. The findings of this research are in contrast to prior research. Empirical researches on the economic effects of terrorism suggest that acts of terrorism create large impacts on economic activity. The results of our event study show that the announcements caused both negative and positive reactions on the market. Author: Ryan McKee Student number: 6181066 Supervisor: Shivesh Changoer Date: 8th of Jan, 2014 ETCS: 12 INTRODUCTION Stock prices represent investor’s expectations about the future. News announcements effect these expectations on a day to day basis. Terrorist attacks, military invasions, nuclear threats or any other ambivalent events can alter investor’s expectations and so allow the prices of stocks and bonds to deviate from their fundamental value. Once such events have taken place investors often defer from the market in search of safer, more secure financial investments which can lead to panic and chaos on the markets (Chen and Siems, 2004). Such chaos can also be caused by threats from other neighbouring countries. A perfect example of this is the relationship between North and South Korea. Ever since the division of North and South Korea on September 8, 1945 the two bordering nations have had a strenuous relationship, ultimately leading to the Korean war of 1950-1953. -

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

Voting Disclosure

Notices: LGPS Central Limited is committed to disclosing its voting record on a vote-by-vote basis, including where practicable the provision of a rationale for votes cast against management. The data presented here relate to voting decisions for securities held in portfolios held within the company’s Authorised Contractual Scheme (ACS). Meeting Company Name Meeting Type Voting Action Agenda Item Numbers Voting Explanation 20/01/2021 Guotai Junan International Holdings Limited Special All For 04/02/2021 Lenovo Group Limited Special All For 04/03/2021 MMG Ltd. Special Against 1 Apparent failure to link pay and appropriate performance 05/03/2021 CSPC Pharmaceutical Group Ltd. Special Against 11.1 Concerns related to board gender diversity 12 Concerns related to shareholder rights 29/03/2021 China Resources Beer (Holdings) Co. Ltd. Special Against 2 Concerns related to board gender diversity 28/01/2021 Kobe Bussan Co., Ltd. Annual All For 28/01/2021 Park24 Co., Ltd. Annual Against 1.6,1.7 Concerns about overall board structure 19/02/2021 Kansai Mirai Financial Group, Inc. Special All For 20/02/2021 OSG Corp. (6136) Annual Against 2.1 Concerns related to approach to board diversity 25/02/2021 Kewpie Corp. Annual All For 26/02/2021 Hitachi Capital Corp. Special Against 1 Concerns to protect shareholder value 26/02/2021 Mitsubishi HC Capital, Inc. Special All For 09/03/2021 Nippon Building Fund, Inc. Special All For 18/03/2021 Toshiba Corp. Special Against 1 SH: For shareholder resolution, against management recommendation / Shareholder proposal promotes transparency 19/03/2021 Kubota Corp. -

1H13 Business Report

1H13 Business Report I. Corporate Overview □ Affiliates As of end-1H 2013, Samsung Group had a total of 77 domestic affiliates. Compared to end-2012, two new affiliates (Jung-ahm Wind Power, and Sungkyunkwan University Dormitory) were added and six (SECRON, SEHF Korea, SB LiMotive, GES, Idea Company Prog, Top Cloud Corporation) were excluded. Among Samsung Group’s 77 affiliates, 17 including Samsung Electronics are listed, and 60 are unlisted. (As of June 30, 2013) No. of affiliates Name of affiliates Samsung C&T, Cheil Industries, Samsung Electronics, Samsung SDI, Samsung Techwin, Samsung Life Insurance, SEMCO, Samsung Heavy Industries, Listed 17 Samsung Card, Hotel Shilla, Samsung Fire & Marine Insurance, Samsung Securities, S1, Samsung Fine Chemicals, Samsung Engineering, Cheil Worldwide, Credu, Samsung Everland, Samsung Petrochemical, Samsung SDS, Samsung General Chemicals, Samsung Total Petrochemicals, Samsung Lions, SERI, STECO, Samsung Thales, SEMES, Living Plaza, Samsung Corning Precision Materials, Samsung SNS, Samsung Electronics Service, Samsung Electronics Logitech, Hantok Chemicals, Global Tech, CVnet Corporation, Care Camp, Allat Corp., SECUI.com, Wealthia.com, Open Tide Korea, Samsung Futures, 365Homecare, Samsung Venture Investment Corporation, Samsung Asset Management, Saengbo, Samsung Claim Unlisted 60 Adjustment Service, Anycar Service, World Cyber Games, SD Flex, Gemi Plus Distribution, Samsung Bluewings, HTSS, RAY, Songdo Land Mark City, S- Core, S1 CRM, Open Hands, S-EnPol, Samsung Medison, Samsung Biologics, Miracom Inc., Samsung Life Service, SMP, STM, SSLM, SU Materials, Colombo Korea, Samsung Display, Samsung Bioepis, Nuri Solution, Samsung Corning Advanced Glass , Natural 9, Daejung Offshore Wind Power, SERICEO, Samsung Real Estate, Jung-ahm Wind Power, Sungkyunkwan University Dormitory Total 77 ☞ Refer to 『□ Affiliates』 in 『III. -

Korea Morning Focus

July 11, 2019 Korea Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Jin Air (272450/Trading Buy/TP: W21,000) KOSPI 2,058.78 6.75 0.33 Waiting for restrictions to be lifted KOSPI 200 268.75 1.03 0.38 KOSDAQ 666.90 9.10 1.38 Turnover ('000 shares, Wbn) Volume Value KOSPI 350,018 3,939 KOSPI 200 66,267 2,805 KOSDAQ 761,789 3,861 Market Cap (Wbn) Value KOSPI 1,372,819 KOSDAQ 228,677 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,298 1,095 203 Institutional 854 1,043 -188 Retail 1,760 1,762 -1 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 458 389 69 Institutional 203 165 38 Retail 3,182 3,271 -89 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 997 1,009 -13 KOSDAQ 433 350 84 Advances & Declines Advances Declines Unchanged KOSPI 537 286 72 KOSDAQ 956 258 74 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 45,550 450 420 Hynix 72,900 3,100 315 KODEX Kosdaq150 8,385 115 187 Leverage KODEX Leverage 11,920 105 174 KODEX KOSDAQ150 8,350 -70 173 INVERSE KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 44,800 2,800 247 Ilji Tech 4,270 500 116 Dongjin Semichem 12,800 -850 110 DUAL 2,215 510 108 Seoam Machinery 7,130 370 90 Industry Note: As of July 10, 2019 This document is a summary of a report prepared by Mirae Asset Daewoo Co., Ltd. -

Korea Chaebols

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by K-Developedia(KDI School) Repository Emerging Market Spotlight November 2010 The Chaebols in South Korea: Spearheading Economic Growth South Korea has witnessed an incredible transformation in the Fast Facts three decades spanning from the Chaebols are large multinational family-controlled 1960s to 1990s, evolving from an conglomerates in South Korea, which have enjoyed strong impoverished country to a governmental support. developed high-income economy today. Often referred to as the The word Chaebol literally means “business association”. “Miracle of the Han River”, this President Park Chung Hee (1961-1979) widely propagated remarkable turnaround was and publicized the chaebol model of state-corporate achieved through an aggressive, alliance. outward-oriented strategy, focusing on developing large-scale The Chaebols have invested heavily in the export-oriented industrial conglomerates or manufacturing sector. chaebols. Some well-recognized South Korean conglomerates boasting global brand names are Samsung, Hyundai and Today, the chaebols have become LG. multinational powerhouses with a global footprint. And with this, The chaebol model of state-corporate alliance is based on South Korea boasts of an economy the Japanese Zaibatsu system, which encouraged economic that ranks 15th globally in nominal development through large business conglomerates from 1968 until the end of the World War II. terms and 13th in terms of Purchasing Power Parity (PPP). Paradigm shift in the South Korean economy The first half of the 20th century was a tumultuous, war-ravaged period for the country, punctuated by a 35-year Japanese colonization of the country, which ended with Japan’s defeat in World War II. -

Corporate Sustainable Management and Capital Market: Evidence from Data on Korean Firms

August 2016;1(1):56-66 http://dx.doi.org/10.20522/APJBR.2016.1.1.56 Corporate Sustainable Management and Capital Market: Evidence from Data on Korean Firms Young Sik Kim School of Management, Kyung Hee University Ki Bum Park* Department of music education, Chuncheon National University of Education Abstract This paper analyzes the impact of CSR on the capital market in Korea. Using listed firm data, we found that the creation of a sustainability report that indirectly measures the level of CSR can bring the stock rate of return difference of the capital markets representative market index. First, when a firm that publishes a sustainability report was compared in terms of its market rate of return, it showed a return increase of about 2%. We found that higher returns were gained through the competitive advantage of related business when the firm was actively involved in social responsibility. Second, subdivided by industry, firms belonging to the capital goods industry were found to reach a rate of return higher than that of industry. These firms were noticeable in that they were mainly industries that caused environmental pollution. Third, in an additional analysis, foreign investors were given the sustainability report of financial businesses, which was interpreted as a result of industrial properties. A sustainability report is a comprehensive report on the economic, environmental, and social activities of a firm. Firms must learn that they can gain trust through publishing trustworthy reports while achieving the lasting power of growth from the stakeholders. Keywords Sustainability report, CSR, Capital market, GRI, Stock return 1) 1.