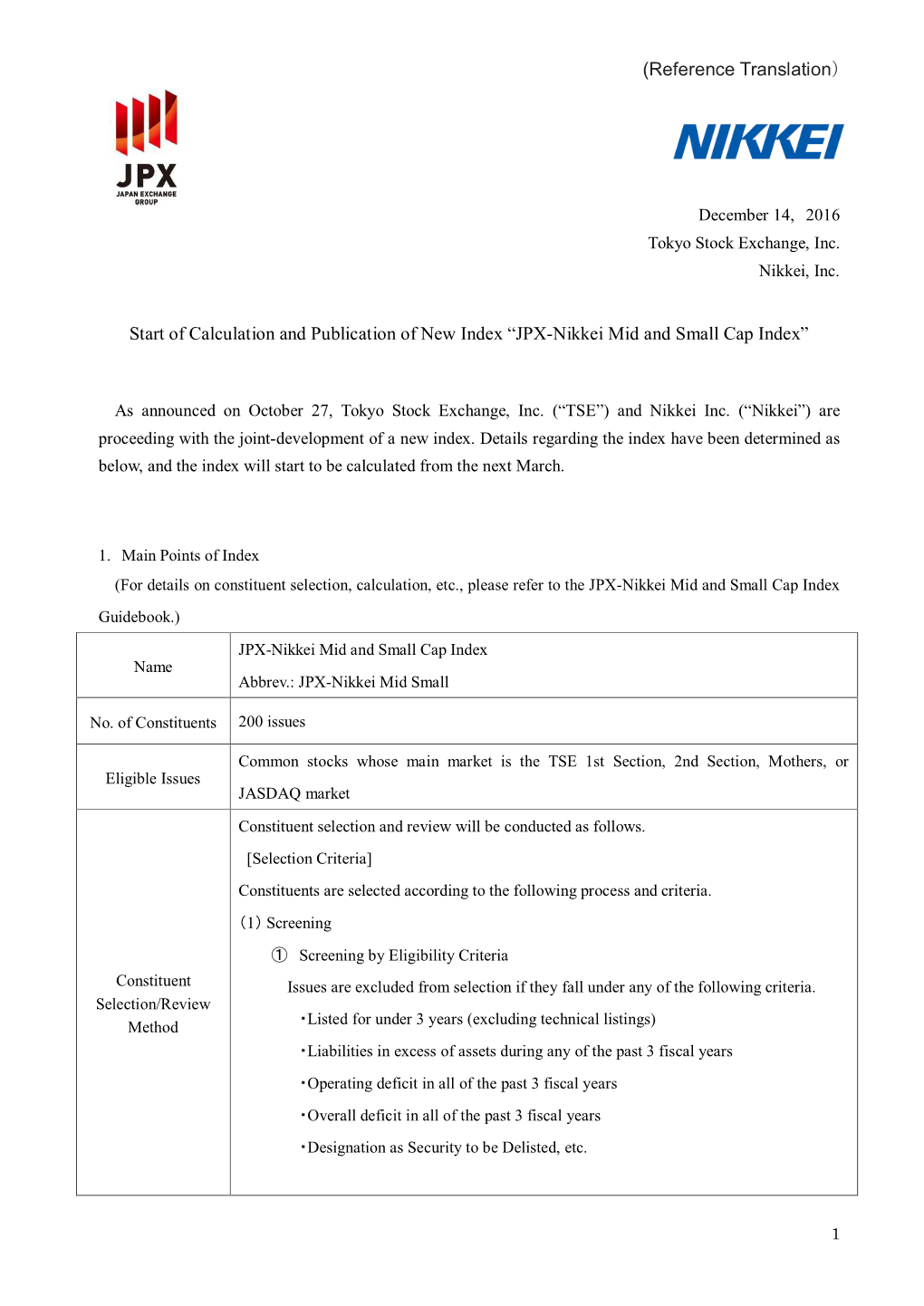

Of Calculation and Publication of New Index “JPX-Nikkei Mid and Small Cap Index”

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Electronics System Coordinator

Electronics System Coordinator RYOSAN CO., LTD. CORPORATE PROFILE 2020 Since its founding, Ryosan has conducted corporate activities based on the strong conviction that “a corporation is a public institution.” This phrase means that corporations are founded in order to benefit society in both the present and the future. Corporations are allowed to exist only if they are needed by society. In other words, corporations lose their meaning when they are no longer needed by society. Ryosan will continue its corporate activities with this strong conviction and firm resolution. “A corporation is a public institution.” Ryosan keeps this phrase firmly in its heart as the Company moves forward into the future. Ryosan History ~1960 1970 1980 1990 2000 2010~ 1953 1974 1981 1996 2000 2012 Ryosan Denki Co., Ltd. is established Hong Kong Ryosan Limited is The company name is changed to Ryosan Technologies USA Inc. The head office is moved to the current Ryosan Europe GmbH is established. in Kanda-Suehirocho, Chiyoda-ku, established. Ryosan Co., Ltd. is established. Head Office Building. Tokyo. Consolidated net sales exceed 300 2014 1976 1982 1997 billion yen. Ryosan India Pvt. Ltd. is established. 1957 Singapore Ryosan Private Limited Consolidated net sales exceed Zhong Ling International Trading The Company is reorganized as is established. 100 billion yen. (Shanghai) Co.,Ltd. is established. 2001 2016 a stock company as Korea Ryosan Corporation and Ryosan Engineering Headquarters obtain Ryosan Denki Co., Ltd. 1979 1983 1999 (Thailand) Co.,Ltd. are established. ISO9001 certification. Ryotai Corporation is established. Stock is listed on the Second Section Kawasaki Comprehensive Business 1963 of the Tokyo Stock Exchange. -

UNIVERGE Application Partner Program

INTRODUCTION OF SOLUTION Special Issue on IT/Network Integrated Solution “UNIVERGE” UNIVERGE Application Partner Program Introduction gram and the Sales Part- ner Program. t the start of The Application Part- A UNIVERGE, we ner Program is a program examined our business that recruits companies strengths and weak- who contribute in dis- nesses. The analysis playing a wide variety of showed that the key as- UNIVERGE solutions pect is to develop coop- through combining their erative businesses which products with the enhance both our and our UNIVERGE products. partners’ strengths. Ac- The Sales Partner Pro- knowledging such a goal, we have launched the gram, on the other hand, is a program for the sales UNIVERGE Partner Program through which we of UNIVERGE solutions and supports our aim not only to expand our cooperative businesses, UNIVERGE sales partners which primarily con- but also to provide our partners with new busi- sist of our authorized resellers. ness opportunities through the interaction among This article mainly explains the Application Part- our partners. ner Program. Two Types of UNIVERGE Partner (1) Program Activities Programs The main activities in UNIVERGE Application Partner Program are as follows. wo types of activities in the UNIVERGE Part Tner Program are the Application Partner Pro- 1) API (Application Programming Interface) Disclosure To establish interoperability between partners’ API Description products and our UNIVERGE products, APIs are disclosed to our partners. We also provide other Softphone We can provide a variety of applications by connecting SIP telephony and PC- types of integration interfaces at the request of based applications. our application partners. -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

Manager's Comment Performance Total Return

UPDATE 30 November 2017 Manager’s Comment Investment Objective: To achieve capital growth through a focused BTEM’s NAV was essentially unchanged over the month with portfolio of investments, particularly in companies whose share prices local currency gains - driven mostly by discount narrowing - stand at a discount to estimated underlying net asset value. being offset by adverse FX moves (a strengthening Pound). We now have over 20% of NAV in Japanese holdings and these were a key source of performance over the month. Tokyo Broadcasting System, Digital Garage, Toshiba Plant, and the Japan Special Situations Basket all performed strongly. Performance Total Return Outside of Japan, GP Investments, Cosan Limited (which was until now an undisclosed position), JPEL Private Equity, and This investment management report relates to performance figures to Third Point Offshore Investors contributed to returns; Exor, 30 November 2017. Investor AB, Adler, Symphony, and Swire Pacific were detractors. Month Financial Yr* Calendar Yr to date to date We wrote last month on Tokyo Broadcasting System (TBS) and our public campaign to encourage the company to reduce its stock portfolio. TBS’ BTEM NAV1 0.0% 3.5% 12.6% share price rose +20% over November on the back of publicity surrounding our actions and strong operating profit growth (+38% for H1-17) in the MSCI ACWI Ex US3 -1.1% 1.8% 14.1% underlying operating business. Despite the share price increase, non-core assets (listed equities, investment properties, and net cash) more than cover 1 the market cap with the high quality operating business being implicitly MSCI ACWI Ex US Value -1.4% 1.0% 10.0% assigned a negative value by the market. -

Japan Under Construction: Corruption, Politics, and Public Works

Preferred Citation: Woodall, Brian. Japan under Construction: Corruption, Politics, and Public Works. Berkeley, Calif: University of California Press, c1996 1996. http://ark.cdlib.org/ark:/13030/ft5489n9zf/ Japan Under Construction Corruption, Politics, and Public Works Brian Woodall UNIVERSITY OF CALIFORNIA PRESS Berkeley · Los Angeles · Oxford © 1996 The Regents of the University of California To Joyce, Leslie, and Melissa Preferred Citation: Woodall, Brian. Japan under Construction: Corruption, Politics, and Public Works. Berkeley, Calif: University of California Press, c1996 1996. http://ark.cdlib.org/ark:/13030/ft5489n9zf/ To Joyce, Leslie, and Melissa ― ix ― Acknowledgments In researching this book, I have drawn extensively on Japanese-language materials: newspaper reports, periodicals, industry association publications, and government documents. In addition, I conducted over one hundred open-ended interviews, primarily in 1987–1988 and in 1993–1994. Almost all of these interviews were conducted in Japanese, each lasting about an hour. I spoke with construction contractors, industry association officials, elected politicians and their aides, political party officials, government bureaucrats, newspaper reporters, and academics. Because of the highly sensitive, and sometimes sub rosa, nature of the subject matter, I cannot identify these individuals by name. For their willingness to answer sometimes naive questions and to assist in other ways, however, I owe a deep debt of gratitude. At the time I undertook this study, sensible people warned me about the quagmire that lay ahead. They alerted me to the difficulties of handling the shadowy actors engaged in the complex and secretive process of rigging bids on public works projects. Others warned me about dealings with the government bureaucrats and legislators who also animate the policymaking stage in this heretofore strictly "domestic" domain. -

Code Issue Size 1 1301 KYOKUYO CO.,LTD. Topixsmall TOPIX1000

TOPIX New Index Series (As end of October , 2012) (sort by Local Code) As of October 5, 2012 Code Issue TOPIX New Index Series Size 1 1301 KYOKUYO CO.,LTD. TOPIXSmall TOPIX1000 小型 2 1332 Nippon Suisan Kaisha,Ltd. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 3 1334 Maruha Nichiro Holdings,Inc. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 4 1352 HOHSUI CORPORATION TOPIXSmall 小型 5 1377 SAKATA SEED CORPORATION TOPIXSmall TOPIX1000 小型 6 1379 HOKUTO CORPORATION TOPIXSmall TOPIX1000 小型 7 1414 SHO-BOND Holdings Co.,Ltd. TOPIXSmall TOPIX1000 小型 8 1417 MIRAIT Holdings Corporation TOPIXSmall TOPIX1000 小型 9 1514 Sumiseki Holdings,Inc. TOPIXSmall 小型 10 1515 Nittetsu Mining Co.,Ltd. TOPIXSmall TOPIX1000 小型 11 1518 MITSUI MATSUSHIMA CO.,LTD. TOPIXSmall TOPIX1000 小型 12 1605 INPEX CORPORATION TOPIX Large70 TOPIX 100 TOPIX 500 TOPIX1000 大型 13 1606 Japan Drilling Co.,Ltd. TOPIXSmall 小型 14 1661 Kanto Natural Gas Development Co.,Ltd. TOPIXSmall TOPIX1000 小型 15 1662 Japan Petroleum Exploration Co.,Ltd. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 16 1712 Daiseki Eco.Solution Co.,Ltd. TOPIXSmall 小型 17 1719 HAZAMA CORPORATION TOPIXSmall TOPIX1000 小型 18 1720 TOKYU CONSTRUCTION CO., LTD. TOPIXSmall 小型 19 1721 COMSYS Holdings Corporation TOPIX Mid400 TOPIX 500 TOPIX1000 中型 20 1722 MISAWA HOMES CO.,LTD. TOPIXSmall TOPIX1000 小型 21 1762 TAKAMATSU CONSTRUCTION GROUP CO.,LTD. TOPIXSmall 小型 22 1766 TOKEN CORPORATION TOPIXSmall TOPIX1000 小型 23 1780 YAMAURA CORPORATION TOPIXSmall 小型 24 1801 TAISEI CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 25 1802 OBAYASHI CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 26 1803 SHIMIZU CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 27 1805 TOBISHIMA CORPORATION TOPIXSmall TOPIX1000 小型 28 1808 HASEKO Corporation TOPIX Mid400 TOPIX 500 TOPIX1000 中型 29 1810 MATSUI CONSTRUCTION CO.,LTD. -

Provista, Our Company's Supply Chain Partner, Offers You Personal

The best savings on the best products — only for you at Best Buy.® Provista, our company’s supply chain partner, offers you personal discounts on more than 150,000 brand-name products in addition to a complete in-store selection. Enjoy huge savings on products like: • HD displays • Tablets • Video games • Laptops • Printers • Appliances Get started by signing up. You’ll need: Steps to create an account: 1) Your company 1) Visit bbfb.com/psf/provista Member ID 2) Click on the right 2) The Best Buy Registration side of the screen code: PROVISTA1 3) Complete the form as directed 4) Click at the bottom of the page 5) Enjoy the website! Need assistance with your member ID or have other questions? Call Provista at 888-538-4662 © 2015 Provista Empower your business with a powerful product line. Appliances Denon (Boston Acoustics) Fūl Philips Dynex Anaheim Griffin Technology Gefen Pioneer Electronics Elmo Aroma iHome (Hotel Golla Plantronics Fuji Avanti Technologies) Harman Multimedia RCA GoPro Bissell Insignia HP Roku Labs HP Black & Decker Ion Audio Incase Russound Insignia Bosch Klipsch Init Samsung JVC Broan LG Electronics Insignia Sennheiser Kingston Bunn Logitech Kensington Sharp Kodak Char-Broil Monster Cable Klipsch Shure Lenmar Conair Numark Lenovo Sirius Lexar Cuisinart Panasonic Logitech Sony Lite-On Danby Peavey Electronics Macally Toshiba Logitech DeLonghi Peerless Industries Microsoft Universal Electronics Lowepro Dirt Devil Philips NLU Products ViewSonic Microsoft Dyson Pioneer Electronics Peerless Industries XM Nikon Electrolux -

ACXW Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value ETF (AVDV) May 28, 2021 Avantis International Small Cap Value ETF - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.4% Australia — 8.0% Adairs Ltd. 64,691 233,414 Adbri Ltd. 444,216 1,141,164 Aeris Resources Ltd.(1) 238,800 31,179 Alkane Resources Ltd.(1)(2) 152,741 103,278 Alliance Aviation Services Ltd.(1) 50,306 171,065 Asaleo Care Ltd. 212,115 229,790 Aurelia Metals Ltd. 716,008 245,064 Austal Ltd. 283,491 520,718 Australian Finance Group Ltd. 186,297 400,567 Australian Pharmaceutical Industries Ltd. 419,111 373,258 Bank of Queensland Ltd. 555,800 3,869,929 Beach Energy Ltd. 2,204,143 2,167,414 Bendigo & Adelaide Bank Ltd. 252,445 2,042,517 Boral Ltd.(1) 116,988 619,401 Calix Ltd.(1) 39,671 84,060 Cedar Woods Properties Ltd. 8,294 45,011 Champion Iron Ltd.(1) 492,380 2,502,893 Collins Foods Ltd. 16,697 160,894 Coronado Global Resources, Inc.(1) 453,537 242,887 CSR Ltd. 651,143 2,799,491 Dacian Gold Ltd.(1) 129,467 28,363 Deterra Royalties Ltd. 179,435 579,460 Eclipx Group Ltd.(1) 432,641 710,525 Emeco Holdings Ltd.(1) 476,645 332,757 EML Payments Ltd.(1) 327,130 862,970 Galaxy Resources Ltd.(1) 3,318 9,808 Genworth Mortgage Insurance Australia Ltd.(1) 442,504 945,096 Gold Road Resources Ltd. 660,222 763,347 GrainCorp Ltd., A Shares 347,275 1,343,019 Grange Resources Ltd. -

ACZH Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value Fund May 28, 2021 Avantis International Small Cap Value Fund - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 98.5% Australia — 8.0% Adairs Ltd. 10,087 36,395 Adbri Ltd. 41,613 106,901 Aeris Resources Ltd.(1) 194,638 25,413 Alkane Resources Ltd.(1)(2) 23,444 15,852 Alliance Aviation Services Ltd.(1) 9,551 32,478 Asaleo Care Ltd. 55,544 60,172 Aurelia Metals Ltd. 117,534 40,228 Austal Ltd. 40,665 74,694 Australian Finance Group Ltd. 27,184 58,450 Australian Pharmaceutical Industries Ltd. 57,039 50,799 Bank of Queensland Ltd. 50,470 351,413 Beach Energy Ltd. 256,312 252,041 Bega Cheese Ltd. 10,686 47,626 Bendigo & Adelaide Bank Ltd. 28,090 227,274 Boral Ltd.(1) 23,590 124,899 Brickworks Ltd. 3,303 53,477 Byron Energy Ltd.(1) 7,834 635 Calix Ltd.(1) 13,271 28,120 Champion Iron Ltd.(1) 59,052 300,176 Class Ltd. 1,392 1,856 Coronado Global Resources, Inc.(1) 116,275 62,270 CSR Ltd. 61,819 265,781 Dacian Gold Ltd.(1) 57,096 12,508 Eclipx Group Ltd.(1) 40,478 66,477 Emeco Holdings Ltd.(1) 64,744 45,199 EML Payments Ltd.(1) 32,108 84,701 Fleetwood Ltd. 1,403 2,649 Galaxy Resources Ltd.(1) 50,126 148,165 Genworth Mortgage Insurance Australia Ltd.(1) 23,355 49,881 Gold Road Resources Ltd. 119,473 138,134 GrainCorp Ltd., A Shares 46,105 178,302 Grange Resources Ltd. -

Empower Your Business with a Powerful Product Line

Empower your business w ith a powerful product line. Appliances Denon (Boston Acoustics) Fu! Philips Dynex Anaheim Griffin Technology Gefen Pioneer Electronics Elmo iHome (Hotel Golla Plantronics Fuji Aroma Avanti Technologies) Harman Multimedia RCA Go Pro Insignia HP RokuLabs HP Bissell Black & Decker Ion Audio In case Russound Insignia Klipsch !nit Samsung JVC Bosch Broan LG Electronics Insignia Sennheiser Kingston Bunn Logitech Kensington Sharp Kodak Char-Broil Monster Cable Klipsch Shure Len mar Conair Numark Lenovo Sirius Lexar Panasonic Logitech Sony Lite-On Cuisinart Danby Peavey Electronics Macally Toshiba Logitech Peerless Industries Microsoft Universal Electronics Lowepro De Longhi Dirt Devil Philips NLU Products ViewSonic Microsoft Dyson Pioneer Electronics Peerless Industries XM Nikon Electrolux Polk Audio Plantronics Olympus Eureka Rocketfish Primax Electronics Displays Panasonic Euro-Pro Russound RCA Acer America Pen tax Frigidaire Samsung Rocketfish AOC Pinnacle SDI Technologies (iHome) Samsonite PNY GE ASUS GE Profile Sennheiser Samsung Dell Pure Digital Haier Sharp Sennheiser HP Samsung Hamilton Beach Skullcandy SIIG Lenovo San disk HoMedics So nos Sony LG Sanyo Fisher Sony Speck Sony Honeywell NEC Hoover Yamaha StarTech.com Panasonic Sunpak Yamaha Pro Audio STM Bags Targus Hotpoint Samsung Inglis Swiss Gear Sharp Toshiba Targus Vivi tar iRobot Cables Sony Keurig Cables To Go Timbuk2 Toshiba KitchenAid Belkin Toshiba View Sonic Interactive Velocity Micro Electronics Krups Dynex Whiteboards Wacom Lasko Monster Cable E-Readers -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD.