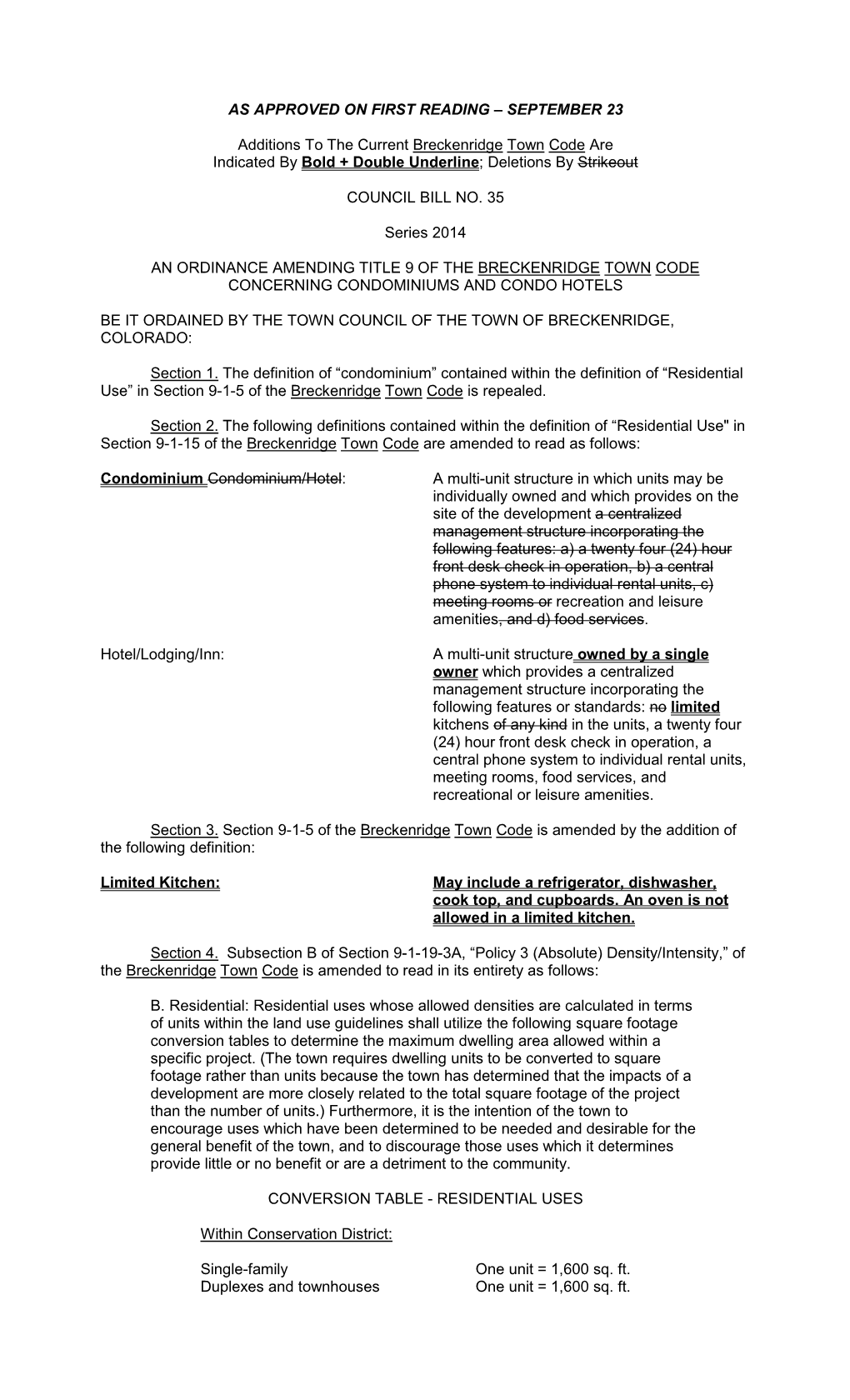

SEPTEMBER 23 Additions to the Current

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investing in a Mexican Condo Hotel

Investing in a Mexican Condo Hotel Mexico Condo Hotels The Advantage of Professional, International Promotion The developer of a high-quality, luxury resort-style complex once pointed out the importance of promotion for people renting out their property; you could have the most beautiful unit an amazing development for a super rental price, but if no one knows about it, it could sit there empty. This points to one of the key advantages to buying a condo for sale in a hotel or resort setting (generally called a condo-hotel); professional hotel service providers will often be contracted not only to provide the best service to vacationers, but also to promote the condos as a part of the hotel as a whole to these same international vacationers. This fact points to a distinct advantage in buying in a condo-hotel as a real estate investment. Experienced and successful hotel service providers will already have established networks to bring vacationers directly to the rental units. For this reason, it is also important to enquire about this point. If it is a resale, a buyer can enquire about occupancy rates; with a new development, if the rental service is through an established provider, the occupancy history of the provider can also be enquired. In other cases, simply evaluating the rental strategy can be helpful. In most cases, having a professional rental strategy is advantageous for those who do not have experience in managing a rental properties; this is especially true for those who are buying to enjoy a vacation property with the benefit of getting a worry-free income from it. -

Name Tax Paid BED & BREAKFASTS

GALVESTON PARK BOARD OF TRUSTEES Hotel Occupancy Tax (HOT) - May 2016 Name Tax Paid BED & BREAKFASTS BNB - Ave O B&B $ 790.85 BNB - Coastal Dreams B & B $ 798.37 BNB - Coppersmith Inn B & B $ 933.60 BNB - Lasker Inn B & B $ 831.60 BNB - Lost Bayou Guesthouse B & B $ 797.53 BNB - The Villa B & B $ 420.03 BED & BREAKFASTS BNB - Victorian B & B $ 373.50 $ 4,945.48 HOTELS/FULL SERVICE HFS - Courtyard Galveston Island $ 25,091.62 HFS - Gaido's Seaside Inn $ 18,723.25 HFS - Hilton Galveston Island $ 110,932.56 HFS - Holiday Inn Resort $ 62,017.27 HFS - Hotel Galvez $ 89,509.85 HFS - Inn at the Waterpark $ 17,593.37 HFS - Moody Gardens Hotel $ 132,079.50 HFS - San Luis Resort $ 115,621.29 HFS - The Victorian Condo Hotel $ 10,569.03 HFS - Tremont House $ 38,789.01 HOTELS/FULL SERVICE $ 620,926.75 HOTELS/LIMITED SERVICE HLS - America's Best Value Inn 12,731.31 HLS - Baymont Inn & Suites 20,860.24 HLS - Beachcomber Inn 15,298.63 HLS - Beachtree Motel 1,619.42 HLS - Best Western Hotel 14,536.93 HLS - Candlewood Suites 11,550.74 HLS - Comfort Inn & Suites 17,958.06 HLS - Comfort Suites 8,340.30 HLS - Commodore on the Beach 14,944.05 HLS - Country Inn & Suites 13,079.89 HLS - Days Inn & Suites 12,661.96 HLS - Four Points by Sheraton 24,714.59 HLS - Hampton Inn & Suites 19,183.84 GALVESTON PARK BOARD OF TRUSTEES Hotel Occupancy Tax (HOT) - May 2016 Name Tax Paid HLS - Harbor House 12,439.28 HLS - Holiday Inn Express 18,739.12 HLS - Howard Johnson Express 4,439.02 HLS - Knights Inn 3,037.27 HLS - La Quinta East 21,459.96 HLS - La Quinta West 19,611.64 HLS - Mariner Motel 3,120.36 HLS - Motel 6 I-45 12,150.47 HLS - Motel 6 - Seawall 5,170.00 HLS - Ocean Inn, LLC 1,328.67 HLS - Pearl Inn 3,477.35 HLS - Quality Inn & Suites 22,219.66 HLS - Red Roof Inn 18,603.26 HLS - Rodeway Inn 5,899.07 HLS - Rosenberg Motel 626.80 HLS - Sandpiper RV Resort 357.33 HLS - Scottish Inn 4,009.10 HLS - Springhill Suites 15,260.84 HLS - Super 8 Motel 9,945.00 HLS - Surf Motel & Apts. -

Keeping the Inn-Mates from Running the Hotel – Short and Long Term Concerns in Mixed-Use Developments Containing a Hotel March

Keeping the Inn-Mates from Running the Hotel – Short and Long Term Concerns in Mixed-Use Developments Containing a Hotel March, 2012 I. Introduction The 1990s and early 2000s were a boom time for real estate and hotel condominiums in mixed-use projects were no exception. During those boom times, the development of mixed, multi-use projects which included hotel or residential condominium components and regular hotel components took off. Developers realized that by selling off the hotel and/or residential units, they could “have their cake and eat it too”. Although hotel or residential condominium units were sold without the requirement that the purchasers of the units put the units back into a rental program, in fact, the vast majority of buyers did exactly that. Accordingly, developers of hotels which were in a combined development containing condominiums were able to recoup a large portion of the cost of the project while still maintaining the ability to manage the hotel and derive the income from the hotel operations. Similarly, by including a residential condominium component in a hotel building, the developer could lower its per-room cost of the hotel component which it continued to own and operate. And indeed, without adding the residential component to the deal, including a hotel in a mixed use development could not be economically justified, as the cost of the required elements (separate elevators, lobby and back of house) added expense without offsetting revenue. This was especially true because the sales prices of the residential units in a “high-end” brand hotel building were much higher than in a “traditional” residential condominium. -

2004 Visitor Plant Inventory

2004 VISITOR PLANT INVENTORY March 2005 Research and Economic Analysis Division This report has been catalogued as follows: Hawai‘i. Dept. of Business, Economic Development and Tourism. Research and Economic Analysis Division. Visitor plant inventory. Honolulu: 2000– Annual. Continues report published by the Hawai’iVisitors and Convention Bureau 1. Hotels-Hawai‘i. 2. Resorts-Hawai‘i. TX911.2.H29.2004 TABLE OF CONTENTS PREFACE .........................................................................................................................................1 OVERVIEW.......................................................................................................................................2 METHODS AND PROCEDURES ....................................................................................................5 VISITOR PLANT INVENTORY AVAILABLE UNITS – 1965 TO 2004 ..............................................8 SUMMARY BY ISLAND AND TYPE ...............................................................................................10 CLASS OF UNITS...........................................................................................................................21 2004 VISITOR PLANT INVENTORY – LIST OF PROPERTIES ....................................................27 TIMESHARE PROPERTIES BY ISLAND AND AREA ...................................................................56 LIST OF NON-RESPONDENTS ....................................................................................................59 PLANNED ADDITIONS -

Goin Going Condo? What This Means for the Hospitality Financial Professional

THE JOURNAL OF HOSPITALITY FINANCIAL AND TECHNOLOGY PROFESSIONALS Volume 21, Number 3 April/May 2006 Inside: Financial Challenges to Condo-hotels; Off-the-shelf Software for Financial Reporting; Computer-based Training; Key Managerial Accounting Skills; Kiosk Markets; Feature Profile — Cihan Cobanoglu, Ph.D., CHTP WWW.hftp.org • WWW.HITEC.org C o n t e n t s THE JOURNAL OF hospitality FINANCIAL AND TECHNOLOGY PROFESSIONALS Volume 21, Number 3 A P R I L / M A Y • 2 0 0 6 FEATURES 13 GOING CONDO? HFTP®, HITEC® and ONHTEC® are registered service marks of Hospitality Arlene Ramirez, MBA, reviews the challenges involved for a financial professional when work- Financial and Technology Professionals. ing at a condo-hotel property. ProLinks and GUESTROOM 2010 are service marks of Hospitality Financial and NLIMITED ESOurcES FOR THE IMITED SERVICE USINESS Technology Professionals. 16 U R L - B Franklin John P. Sikich, CPA, CHAE and Arlene Ramirez, MBA give tips on how to use eco- nomical, off-the-shelf software for financial reporting and tracking. Submissions and Inquiries Individuals interested in submitting an article 20 DOES ON-ScrEEN LEARNING EQUAL ON-TArgET RESULTS? for publication should contact the editor. The Celeste Mozeik and Brian L. Miller, Ed.D., provide a survey report on the use of computer- Bottomline is a peer review journal. All ma- terials submitted for publication are reviewed based training in the hospitality industry. by members of the editorial review board or recognized experts in the field. 23 KEY MANAGERIAL AccOUNTING SKILLS Ray Schmidgall, Ph.D., CPA, CHAE and James Damitio report on the importance of 24 mana- The Bottomline (ISSN 0279-1889), the jour- nal of Hospitality Financial and Technology gerial skills, as rated by hotel financial executives. -

2019 Visitor Plant Inventory Report Is Posted on the HTA Website

2019 VISITOR PLANT INVENTORY Tourism Research TABLE OF CONTENTS Executive Summary ................................................................................................................................................................ 1 Overview of Methodology .................................................................................................................................................... 2 Visitor Plant Inventory & Individually Advertised Units in Hawai‘i Reports ........................................... 2 Data Collection ................................................................................................................................................................ 2 Terminology for Vacation Rental Units ................................................................................................................ 2 When to Use VPI vs. Individually Advertised Units data .............................................................................. 2 Visitor Plant Inventory .......................................................................................................................................................... 3 State of Hawai‘i .................................................................................................................................................................... 3 Inventory by Island ............................................................................................................................................................ 5 Island -

Will Resume and List of Projects

William T. Tanaka, Jr. 1225 Ikena Circle Honolulu, Hawaii 96821 (808) 216-4560, email: [email protected] For over 35 years Will Tanaka has been involved with the development, conversion, sales and management of mixed use resort projects including hotels, condo-hotel and timeshare projects, in Hawaii and abroad. He is the Hawaii based owner of Aloha Hospitality Consulting LLC (AHC) and American Pacific Hotels LLC (APH), and the managing general partner of Island Colony Partners. Will’s advisory projects include the Trump Waikiki, The Ritz Carton Residences Waikiki Beach, The Ritz Carlton Residences Kapalua, and redevelopment of the King’s Village site. Prior to forming AHC he had held senior executive positions with Aqua Hotels & Resorts, Marc Hotels & Resorts, Shell Vacations, and Koar Real Estate Investment & Development. From 1995 to 2000 Mr. Tanaka Chaired the Oahu Chapter of the Hawaii Lodging & Tourism Association, the Hawaii affiliate of the American Hotel & Lodging Association. He has also served as executive committee member of the Hawaii American Resort Development Association (ARDA). He is a recognized authority in condo hotels having participated as an expert panelist and speaker at several condo hotel symposiums in Hawaii and on the mainland. William T. Tanaka, Jr. RESUME SUMMARY 2000 to Aloha Hospitality Consulting, LLC Present Owner/Managing Member – Hospitality advisory and development services specializing in the acquisition, development or conversion, and management of mixed use and resort projects. 2011 to American Pacific Hotels Present Managing Member – formed to become the general partner of Island Colony Partners and manager of Skyline at Island Colony Hotel. 2006 to Tanlin LLC Present Managing Member – formed to acquire and manage rental units in Island Colony. -

Accommodations Certified by the Destination's Health and Safety Program

ACCOMMODATIONS CERTIFIED BY THE DESTINATION'S HEALTH AND SAFETY PROGRAM METRO REGION # Hotel Name Category 1 352 GH Guest House 2 AC Hotel San Juan Hotel 3 Acacia Seaside Inn Hotel 4 Aloft SJ Hotel Best Western Condado Palms Inn Hotel 5 & Suites 6 Casa Blanca Hotel Hotel 7 Casa Isabel Bed and Breakfast B&B 8 Casa Los Cummins Guest House 9 Casa Sol Bed and Breakfast B&B 10 Ciqala Luxury Home Suites Hotel 11 Comfort Inn San Juan Hotel 12 Conturce Hostel Hostel 13 Coral by the Sea Hotel 14 Coral Princess Inn Hotel Courtyard by Marriott - Isla Verde Hotel 15 Courtyard by Marriott Miramar, Hotel 16 San Juan 17 Doubletree By Hilton San Juan Hotel 18 Dream Hotel - Miramar 19 Dream Hotel - Rio Piedras Hotel 20 El San Juan Hotel Hotel Embassy Suites Hotel & Casino - Hotel 21 San Juan 22 Four Points Sheraton Caguas Hotel 23 Holiday Inn Express San Juan Hotel 24 Hosteria del Mar Guest House 25 Hotel Condado Vanderbilt Hotel Hotel Milano / San Juan Property Hotel 26 Group 27 Hotel Miramar Hotel 28 Hotel Villa del Sol Hotel 29 Hotel Villa Herencia Hotel 30 Hyatt House Hotel Hyatt Place Bayamón Hotel & Hotel 31 Tropical Casino 32 La Concha Resort Hotel 33 La Terraza de San Juan Guest House 34 Nomada Urban Beach Hostel Hostel 35 O:LV Fifty Five Hotel 36 Olive Boutique Hotel Hotel 37 San Juan Airport Hotel Hotel San Juan Marriott Resort & Hotel 38 Stellaris Casino San Juan Water and Beach Club Hotel 39 Hotel San Juan Water and Beach Club Hotel 40 Hotel 41 Sandy Beach Hotel Hotel 42 Sheraton Old San Juan Hotel 43 Sheraton PR San Juan Hotel 44 The Condado -

Acanto Boutique Hotel Alhambra All Riviera

ACANTO BOUTIQUE HOTEL ALHAMBRA ALL RIVIERA RESORT AQUALUNA AVENTURA MEXICANA BANYAN TREE MAYAKOBA BLUE BAY GRAND ESMERALDA Blue Parrot 5th Avenue CARMEN INN Casa Ticul Boutique Hotel by Koox Luxury Collection CATALONIA PLAYA MAROMA COCOC RIO COHIBA COSTA DEL MAR DESEO HOTEL EL TUKAN HOTEL FAIRMONT MAYAKOBA HACIENDA PARADISE HACIENDA TRES RIOS HOTEL EUROSTARS HACIENDA VISTA REAL HOLIDAY INN EXPRESS RIVIERA MAYA HOTEL BASICO ILUSION BOUTIQUE IN FASHION HOTEL BOUTIQUE HOTEL KIN BE PLAYA DEL CARMEN LA TORTUGA LAS GOLONDRINAS LUNATA MAGIC BLUE BOUTIQUE MAGIC EXPRESS MAHEKAL BEACH MANDARIN ORIENTAL MAROMA RESORT & SPA BY ORIENT EXPRESS MIMI DEL MAR MOSQUITO BEACH MOSQUITO BLUE NINA PLAYA DEL CARMEN ALLEGRO PLAYACAR OCCIDENTAL GRAND XCARET (GRAND FLAMENCO XCARET) PASEO DEL SOL PELICANO INN PLAYA DEL CARMEN PIER PLAYA DEL KARMA Playa Palms Beach Hotel PLAYACAR PALACE PORTO PLAYA POSADA MARIPOSA PUEBLITO ESCONDIDO QUINTA PALMERA QUINTO SOL REAL PLAYA DEL CARMEN REEF PLAYACAR RIU LUPITA RIU PALACE MEXICO RIU PALACE RIVIERA MAYA RIU PLAYACAR RIU TEQUILA RIU YUCATAN RIVIERA CARIBE MAYA RIVIERA DEL SOL ROYAL HACIENDAS ROYAL HIDEAWAY PLAYACAR ROYAL INN SANDOS CARACOL Sandos Playacar Beach Resort - All Inclusive SECRETS CAPRI RIVIERA CANCUN SUNSET FISHERMEN TROPICAL CASA BLANCA VILLA AMANECER VILLAS SACBE VIVA WYNDHAM AZTECA VIVA WYNDHAM MAYA Aldea Thai Studio + Private Pool AZUL FIVES HOTEL BY KARISMA BANANA PLAYA DEL CARMEN EL PATIO HOTEL AND SUITES CONDO XAMAN HA PLAYACAR EL DORADO MAROMA A BEACHFRONT RESORT BY KARISMA EL CIELO HOTEL FUSION PLAYA DEL CARMEN GRAND COCO BAY PANAMA JACK PORTO REAL GRAND FLAMENCO XCARET (GRAND XCARET) GRAND RIVIERA PRINCESS HOLIDAY INN PLAYA CAR HOSTEL RIO PLAYA DEL CARMEN HOTEL EL PUNTO IBEROSTAR GRAN PARAISO IBEROSTAR PARAISO BEACH IBEROSTAR P. -

2006 US Lodging Report

REAL ESTATE, HOSPITALITY, AND CONSTRUCTION !@# The 2006 U.S. Lodging Report Introduction Overall US Estimates Dear Colleague, We are pleased to present the 2006 edition of the Ernst & Young LLP U.S. Lodging Report. Our United States Lodging Report offers our assessment of the direction of the U.S. lodging industry, including our thoughts on key lodging industry trends and segment performance, as well as our detailed outlook for major metropolitan markets. Additional copies of this report are available through our local offices or on our Web site http://www.ey.com/us/realestate. I would like to thank the Hospitality Services professionals who contributed significant time and effort in preparing the 2006 U.S. Lodging Report, including Troy Jones and Rebecca Goldberg. Ernst & Young’s Hospitality Services professionals provide developers, lenders, owners, and operators with an array of advisory services each year. Please feel free to contact me or any of the professionals mentioned at the end of this report if we may be of service. Sincerely, Michael Fishbin National Director Hospitality Services Ernst & Young LLP Transaction Advisory Services Contents REGIONS AND MARKETS: TOP 10 THOUGHTS . 2 ATLANTA . 38 INDUSTRY OVERVIEW . 12 BOSTON . 46 SPOTLIGHT SEGMENTS: CHICAGO . 54 LUXURY . 24 DALLAS . 62 UPPER UPSCALE . 26 FORT LAUDERDALE . 70 UPSCALE . 28 HAWAII . 78 MIDSCALE WITH FOOD AND BEVERAGE . 30 LAS VEGAS . 86 MIDSCALE WITHOUT FOOD AND BEVERAGE . .32 LOS ANGELES. 94 ECONOMY . 34 MANHATTAN . 104 MIAMI . .114 NEW ORLEANS . .122 ORLANDO . 130 PHOENIX . 138 SAN DIEGO . 146 SAN FRANCISCO . 154 WASHINGTON, D.C. 162 T HE 2006 U.S. LODGING REPORT top 10 thoughts 3 TOP 10 THOUGHTS Capital Market Activity – Asset Class of Choice, Appetite for Hotels Remains High Favorable lodging industry fundamentals, a low interest rate environment, and attractive pricing among the publicly traded lodging stocks combined to create another exceptional year for the capital markets. -

Agency Guideline Revisions Note: Truist Specific Overlays Are Underlined

Agency Guideline Revisions Note: Truist specific overlays are underlined. Impacted Revised Guidelines Topic Impacted Products Current Guidelines Document Effective for NEW Loan Applications ON OR AFTER December 7, 2020 Condominium Correspondent Standard Agency / Ineligible Projects / List of Ineligible Project Characteristics Agency / Ineligible Projects / List of Ineligible Project Characteristics Requirements Section 1.06 Agency (non- Condominium AUS & DU) Non-AUS Non-AUS and PUD Approval Agency Plus Mortgage loans that are secured by units in certain condo projects are not eligible if those projects Mortgage loans that are secured by units in certain condo projects are not eligible if those projects Requirements (DU) have characteristics that make the project ineligible. Such characteristics are described in the table have characteristics that make the project ineligible. Such characteristics are described in the table HomeReady® below, with additional details provided in the sections that follow. All eligible projects must be created below, with additional details provided in the sections that follow. All eligible projects must be created (non-AUS & and remain in full compliance with state law and all other applicable laws and regulations of the and remain in full compliance with state law and all other applicable laws and regulations of the DU) jurisdiction in which the project is located. jurisdiction in which the project is located. Texas Section 50(a)(6) Note: If a lender determines that a project does not meet all project eligibility requirements but Note: If a lender determines that a project does not meet all project eligibility requirements but Mortgages believes that the project has merit and warrants additional consideration, the lender may request an believes that the project has merit and warrants additional consideration, the lender may request an (non-AUS & exception. -

Hotel-Condos: a Broken Promise? by Morris Newman

Becker Public Relations July 1, 2008 Page 1 of 6 Hotel-Condos: A Broken Promise? By Morris Newman Summertime in Las Vegas might be more scorching this year than usual due to the heat from a growing number of condo hotel lawsuits. A group of 40 investors who bought condo-hotel units — privately owned homes inside hotels that revert to hotel rooms when the owners are away — are suing the developers of Signature, a hotel and condominium complex developed by a partnership of MGM Mirage and Aventura, Fla.-based Turnberry Associates. The owners claim their units aren't generating the revenue promised by salesmen. The basic facts are similar for a group of 12 buyers in Palm Beach County, Fla., who bought condo units at The Resort at Singer Island, developed by WCI Communities, based in Bonita Springs, Fla. They paid $400,000 to $2 million apiece for their units. Again, the expected rental income from the condo hotel never quite materialized. Some buyers, in fact, found themselves owing money to the very people who had sold them the condo units and who had promised, in essence, to be their business partners. In both the Las Vegas and Palm Beach County cases, plaintiffs' lawyers are taking a similar tack: They are charging hotel owners for allegedly violating state and federal securities laws. If that is true, the lawyers argue, their clients were sold their units illegally, entitling the condo owners to undo the sales and get their money back, plus damages. “The securities law in Florida is a ‘blue-sky’ law that is very broad and remedial,” says Adam T.