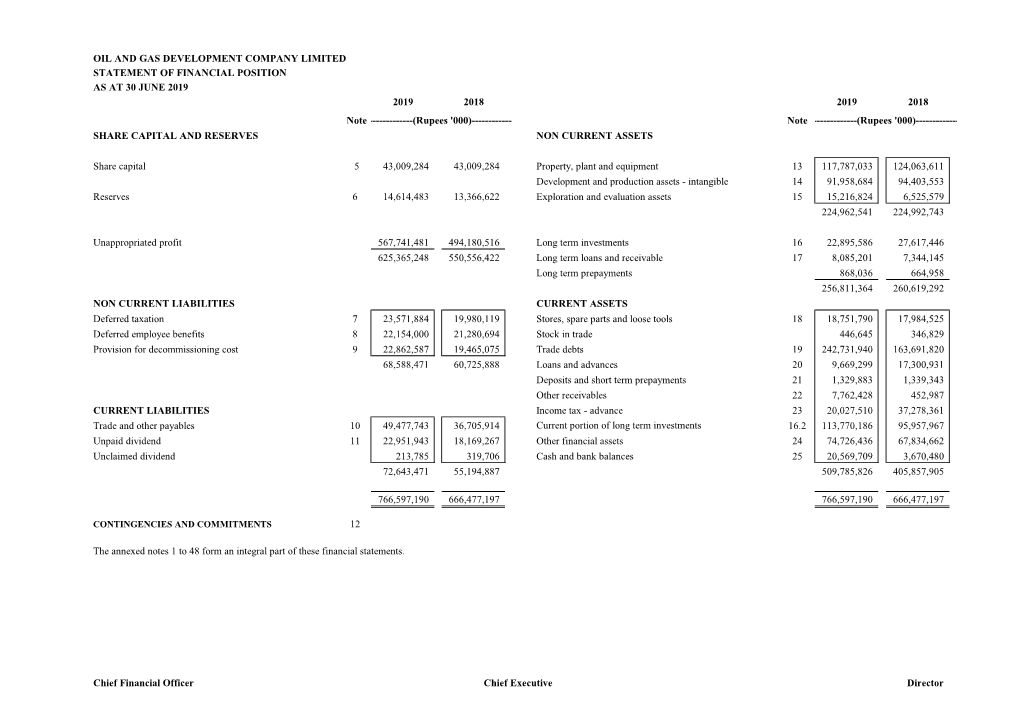

Oil and Gas Development Company Limited Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Islamist Politics in South Asia After the Arab Spring: Parties and Their Proxies Working With—And Against—The State

RETHINKING POLITICAL ISLAM SERIES August 2015 Islamist politics in South Asia after the Arab Spring: Parties and their proxies working with—and against—the state WORKING PAPER Matthew J. Nelson, SOAS, University of London SUMMARY: Mainstream Islamist parties in Pakistan such as the Jama’at-e Islami and the Jamiat-e-Ulema-e-Islam have demonstrated a tendency to combine the gradualism of Brotherhood-style electoral politics with dawa (missionary) activities and, at times, support for proxy militancy. As a result, Pakistani Islamists wield significant ideological influence in Pakistan, even as their electoral success remains limited. About this Series: The Rethinking Political Islam series is an innovative effort to understand how the developments following the Arab uprisings have shaped—and in some cases altered—the strategies, agendas, and self-conceptions of Islamist movements throughout the Muslim world. The project engages scholars of political Islam through in-depth research and dialogue to provide a systematic, cross-country comparison of the trajectory of political Islam in 12 key countries: Egypt, Tunisia, Morocco, Kuwait, Saudi Arabia, Yemen, Syria, Jordan, Libya, Pakistan, as well as Malaysia and Indonesia. This is accomplished through three stages: A working paper for each country, produced by an author who has conducted on-the-ground research and engaged with the relevant Islamist actors. A reaction essay in which authors reflect on and respond to the other country cases. A final draft incorporating the insights gleaned from the months of dialogue and discussion. The Brookings Institution is a nonprofit organization devoted to independent research and policy solutions. Its mission is to conduct high-quality, independent research and, based on that research, to provide innovative, practical recommendations for policymakers and the public. -

Other Notifications, Orders, Etc

PART III] THE GAZETTE OF PAKISTAN, EXTRA., MAY 27, 2019 1021(1) ISLAMABAD, MONDAY, MAY 27, 2019 PART III Other Notifications, Orders, etc. GOVERNMENT OF PAKISTAN CABINET SECRETARIAT (Cabinet Division) NOTIFICATION Islamabad, the 14th May, 2019 No. 1/1/2018-Award-I.—The President of the Islamic Republic of Pakistan has been pleased to confer Pakistan Civil Awards on the following Pakistani and Foreign nationals dignitaries during the investiture ceremony held on 23rd March, 2019:— 1021(1-24) Price : Rs. 6.00 [825(2018)/Ex. Gaz.] 1021(2) THE GAZETTE OF PAKISTAN, EXTRA., MAY 27, 2019 [PART III S.No. Name and Address Field I NISHAN-I-IMTIAZ 1. Mr. Shoaib Sultan Khan, Public Service Chairman, Chairman/Board of Directors, Rural Support Programmes Network (RSPN), 8-Aga Khan Road, F-6/4, Islamabad. Domicile: Khyber Pakhtunkhwa 2. Mr. Sadruddin Hashwani, Public Service Chairman, Hashoo Group & Company, Hashoo House, House No. 1, Street No. 62, Sector F-6/3, Islamabad. Domicile: Sindh II. HILAL-I-PAKISTAN 3. Mr. Seishiro ETO, Services to Pakistan 1st Building, Room No.1101, 2-2-1, Nigata-Cho, Chiyoda-Ku, Tokyo, Japan. Countary: Japan 4. Mr. Xu Shaoshi, Services to Pakistan NDRC, 38.S. Yuetan Street, Beijing, China. Country: China 5. Mr. Ismail Kahraman, Services to Pakistan Turkiye Buyuk Millet, Meclisi 27, Basani Turkey. Country: Turkey PART III] THE GAZETTE OF PAKISTAN, EXTRA., MAY 27, 2019 1021(3) III. HILAL-I-IMTIAZ 6. Mr. Zaheer Ayub Baig, Health and Medical Physics Chairman, PNRA, PNRA HQs, Mauve Area, Sector G-8/1, Islamabad. Domicile: Punjab 7. Mr. -

Brigadier Abdul Qayyum (Retd)

CURRICULUM VITA E BRIGADIER ABDUL QAYYUM (RETD) H. No 153 F Sector Street 6, Askari X, Lahore Cantt. +92-300-8681313 [email protected] CAREER OBJECTIVE “Seeking a senior management position in an entirely demanding and creative organizational environment so that I can utilize all of analytical, good management and communication skills effectively and efficiently which will not only benefit myself but also will provide comprehensive boost to the organization, institution or the group I will be working’’. PROFESSIONAL EXPERIENCE Director ORIC NDU Islamabad - 17 December 2018 till to Date ORIC NDU Islamabad ORIC has been established to initiate, embed, support and integrate the process of research, innovation and commercialization in every department of the university. ORIC aims to protect and promote the interests of NDU and is working on long-term, sustainable planning and progress of all of its units in integration with the departments of the university. Responsibilities and Achievements: Supporting the university’s strategic research directions and policies Increasing and diversifying external research funding Improving recruitment and retention of top faculty Improving integration of research and education at all levels of the university Improving translation of research into the public benefit Strengthening university-industry relationships Promoting entrepreneurship, technology-transfer and commercialization activities that energize and support the local and national economy Promoting and enhancing cross-cutting and multi-disciplinary research initiatives Regional Manager (North) The Citizens Foundation-December 2, 2015 to July 31, 2018 The Citizens Foundation The Citizens Foundation (TCF) is a professionally managed, non-profit organization set up in 1995 by a group of citizens who wanted to bring about positive social change through education. -

Annual Report for the Year Ended December 31, 2008 Annual Report 31, 2008 December Ended for the Year the Cover Concept

Annual Report for the year ended December 31, 2008 Annual Report 31, 2008 December ended for the year The Cover Concept Nothing on earth is so well suited to make the sad merry than everyone associated with us. We go extra miles to deliver green. With every green bough come the singing birds, their happiness all around that is synonymous with green. And it is songs greet the sun and makes the grains sprung up in fun. Each here, at the highest pitch of happiness that our world is flung grain of food becomes harbinger of the season of happiness in into a kaleidoscope of new possibilities. the courtyard of our farmer, and hence the chain reaction of happiness starts to take the world in its spell. We have accelerated our efforts after our record achievement this year to deliver better value to our stakeholders, customers, It is here that our story begins. We are the secret potion that employees and society. We are here to improve lives and to helps seeds discover the world and develop their virtues as plants strengthen our ability to efficiently serve customers all around. for the world to take joy and earth to laugh more often. Today We are finding superior ways to do business and are operating we celebrate this secret relationship with the earth and its people. in a more sustainable manner. We understand the way forward, and we will continue driving ahead with an unwavering focus FFC is an experience at its best with several offshoots of on positioning FFC for maximum financial performance -now happiness and dreams attached. -

Enforced Disappearances by Pakistan Security Forces in Balochistan

Pakistan “We Can Torture, Kill, HUMAN RIGHTS or Keep You for Years” WATCH Enforced Disappearances by Pakistan Security Forces in Balochistan “We Can Torture, Kill, or Keep You for Years” Enforced Disappearances by Pakistan Security Forces in Balochistan Copyright © 2011 Human Rights Watch All rights reserved. Printed in the United States of America ISBN: 156432-786-8 Cover design by Rafael Jimenez Human Rights Watch 350 Fifth Avenue, 34th floor New York, NY 10118-3299 USA Tel: +1 212 290 4700, Fax: +1 212 736 1300 [email protected] Poststraße 4-5 10178 Berlin, Germany Tel: +49 30 2593 06-10, Fax: +49 30 2593 0629 [email protected] Avenue des Gaulois, 7 1040 Brussels, Belgium Tel: + 32 (2) 732 2009, Fax: + 32 (2) 732 0471 [email protected] 51, Avenue Blanc 1202 Geneva, Switzerland Tel: +41 22 738 0481, Fax: +41 22 738 1791 [email protected] 2-12 Pentonville Road, 2nd Floor London N1 9HF, UK Tel: +44 20 7713 1995, Fax: +44 20 7713 1800 [email protected] 27 Rue de Lisbonne 75008 Paris, France Tel: +33 (1)43 59 55 35, Fax: +33 (1) 43 59 55 22 [email protected] 1630 Connecticut Avenue, N.W., Suite 500 Washington, DC 20009 USA Tel: +1 202 612 4321, Fax: +1 202 612 4333 [email protected] Web Site Address: http://www.hrw.org JULY 2011 1-56432-786-8 “We Can Torture, Kill, or Keep You for Years” Enforced Disappearances by Pakistan Security Forces in Balochistan Map of Balochistan .......................................................................................................................... i Summary ......................................................................................................................................... 1 Key Recommendations ......................................................................................................................... 6 Methodology .................................................................................................................................. 9 I. -

Jahangir Siddiqui & Co. Ltd. List of Shareholders (Unclaimed Dividend

Page 1 of 83 Jahangir Siddiqui & Co. Ltd. List of Shareholders (Unclaimed Dividend) Unclaimed S. No. Name of Shareholder Address Dividend (PKR) 1 (1081) MRS. LAILA NUSRAT 17-B, JUSTICE SARDAR IQBALROAD, GULBERG-III, LAHORE. 56 2 (1329) BURHAN ALI 341/B,NEW CHOUBURJI PARK,LAHORE. 90 3 (1350) MUBARIK ALI C/O ROOM#509, LAHORE STOCKEXCHANGE BUILDING, LAHORE. 450 4 (1538) MALIK MUHAMMAD ALEEM HOUSE#12, MAIN BAZAR QILLAGUJAR SINGH, LAHORE. 425 5 (1746) MUHAMAMD SALEEM BASHIR H.#17, S.#3, D-BLOCK MALIKMUNIR ROAD GULSHAN RAVILAHORE. LAHORE 650 6 (1746) MUHAMAMD SALEEM BASHIR H.#17, S.#3, D-BLOCK MALIKMUNIR ROAD GULSHAN RAVILAHORE. LAHORE 425 7 (1832) QAZI ZUBAIR GILL H.#26, S.#2, NADEEM PARK,NEW SHALIMAR TOWN, LAHORE. 340 8 (1882) MUHAMMAD AKRAM KHAN 185-KAMRAN BLOCK ALLAMAIQBAL TOWN, LAHORE. 128 9 (1944) MAZHAR MUNIR H.#94, ALALH RAKHA STREETSAIF ROAD,BHAGAT PURA SHADBAGHLAHORE. LAHORE 425 10 (2056) WAQAS AHMAD KALEEM 202-G/1, JOHAR TOWN,LAHORE 657 11 (2064)SANA UD DIN QURESHI HOUSE#1-1016, KUCHA KAMANGARAN RANG MAHAL, LAHORE. 650 12 (2067) MRS.RAFIA JAMAL AMJID HUSSAIN MUGHAL,QYARTER#10/61 SODEEWAL COLONY,MULTAN ROAD LAHORE 65 13 (2159) MUHAMMAD ALTAF BURJ ATTARI FEROZ WALADISTRICT SHEIKHUPURA 292 14 (2178) ZEESHAN MUSTAQ HOUSE# 279/A STREET#01,TAYYABA COLONY BHAGATPURASHAD BAGH LAHORE 353 15 (2244) GHAZANFAR ABBAS CHUGHTAI C/O MAQBOOL AHMAD STREET#05,QUAD-E-MILLAT COLONY GHUNGI AMAR 1,560 16 (2331) DILAWER HUSSAIN E-361 RAJAB ABAD BEDIAN ROAD,LAHORE CANTT 325 17 (2346) MUHAMMAD IMRAN AFZAL GOLDEN NUSERY, 9-SHALIMAR LINKROAD OPP.BOC GAS FACTORY,MUGHALPURA LAHORE 85 18 (786) M. -

Unclaimed Deposit 2014

Details of the Branch DETAILS OF THE DEPOSITOR/BENEFICIARIYOF THE INSTRUMANT NAME AND ADDRESS OF DEPOSITORS DETAILS OF THE ACCOUNT DETAILS OF THE INSTRUMENT Transaction Federal/P rovincial Last date of Name of Province (FED/PR deposit or in which account Instrume O) Rate Account Type Currency Rate FCS Rate of withdrawal opened/instrume Name of the nt Type In case of applied Amount Eqv.PKR Nature of Deposit ( e.g Current, (USD,EUR,G Type Contract PKR (DD-MON- Code Name nt payable CNIC No/ Passport No Name Address Account Number applicant/ (DD,PO, Instrument NO Date of issue instrumen date Outstandi surrender (LCY,UFZ,FZ) Saving, Fixed BP,AED,JPY, (MTM,FC No (if conversio YYYY) Purchaser FDD,TDR t (DD-MON- ng ed or any other) CHF) SR) any) n , CO) favouring YYYY) the Governm ent 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 PRIX 1 Main Branch Lahore PB Dir.Livestock Quetta MULTAN ROAD, LAHORE. 54500 LCY 02011425198 CD-MISC PHARMACEUTICA TDR 0000000189 06-Jun-04 PKR 500 12-Dec-04 M/S 1 Main Branch Lahore PB MOHAMMAD YUSUF / 1057-01 LCY CD-MISC PKR 34000 22-Mar-04 1 Main Branch Lahore PB BHATTI EXPORT (PVT) LTD M/S BHATTI EXPORT (PVT) LTD M/SLAHORE LCY 2011423493 CURR PKR 1184.74 10-Apr-04 1 Main Branch Lahore PB ABDUL RAHMAN QURESHI MR ABDUL RAHMAN QURESHI MR LCY 2011426340 CURR PKR 156 04-Jan-04 1 Main Branch Lahore PB HAZARA MINERAL & CRUSHING IND HAZARA MINERAL & CRUSHING INDSTREET NO.3LAHORE LCY 2011431603 CURR PKR 2764.85 30-Dec-04 "WORLD TRADE MANAGEMENT M/SSUNSET LANE 1 Main Branch Lahore PB WORLD TRADE MANAGEMENT M/S LCY 2011455219 CURR PKR 75 19-Mar-04 NO.4,PHASE 11 EXTENTION D.H.A KARACHI " "BASFA INDUSTRIES (PVT) LTD.FEROZE PUR 1 Main Branch Lahore PB 0301754-7 BASFA INDUSTRIES (PVT) LTD. -

Other Notifications, Orders, Etc. SENATE SECRETARIAT Islamabad, the 16Th January, 2020

PART III] THE GAZETTE OF PAKISTAN, EXTRA., JANUARY 20, 2020 135(1) ISLAMABAD, MONDAY, JANUARY 20, 2020 PART III Other Notifications, Orders, etc. SENATE SECRETARIAT Islamabad, the 16th January, 2020 No. F. 9(1)/2020-Legis.—Pursuant of sub-rule (4) of rule 194 of the Rules of Procedure and Conduct of Business in the Senate, 2012, the report of the Standing Committee presented to the Senate on 8th January, 2020, is published for information:— REPORT OF THE SENATE STANDING COMMITTEE ON DEFENCE I, the Chairman of Senate Standing Committee on Defence, have the honour to present this report on the Bill further to amend the Pakistan Army Act, 1952 (XXXIX of 1952) [The Pakistan Army (Amendment) Bill, 2020] as passed by the National Assembly, moved by Minister for Parliamentary Affairs on behalf of Minister for Defence, in the Senate in its sitting held on 7th January, 2020 and referred to the Committee for consideration and report. 2. The composition of the Committee is as under:— 1. Senator Walid Iqbal Chairman 2. Senator Sajjad Hussain Turi Member 3. Senator Anwaar-ul-Haq-Kakar Member 135(1-6) Price : Rs. 10.00 [5064(2020)/Ex. Gaz.] 135(2) THE GAZETTE OF PAKISTAN, EXTRA., JANUARY 20, 2020 [PART III 4. Senator Mushahid Hussain Syed Member 5. Senator Dilawar Khan Member 6. Senator Lt. Gen. Abdul Qayyum HI (M) Retd. Member 7. Senator Muhammad Javed Abbasi Member 8. Senator Abdul Rehman Malik Member 9. Senator Sherry Rehman Member 10. Senator Mir Kabeer Ahmed Muhammad Shahi Member 11. Senator Muhammad Talha Mehmood Member 12. -

HRCB's Report to the Special Committee on International Covenant

1 HRCB’s report to the Special Committee on International Covenant on Civil and Political Rights Submitted: June 2017 Table of contents: Report…………………………………………..…………..Page 01 to Page 15 1. Abbreviations 2. Preface 3. Methodology 4. Balochistan 5. Articles of ICCPR and reports from Balochistan 5.1 Right of self-determination 5.2 Right to life 5.3 Torture to cruel, inhuman or degrading treatment or punishment 5.4 Arbitrary arrest 5.5 Right of peaceful assembly 6. Generalized patterns of persecution 6.1 Burning houses and villages 6.1 Abduction and Enforced Disappearance 6.2 Kill and Dump of forcibly disappeared persons 6.3 Fake encounter of forcibly disappeared persons 6.4 Willful killing 6.5 Mass graves 6.6 Silencing the voices, in and outside Balochistan 7. Conclusion 8. Appendices……………………………………………….…..Page 16 to 122 8.1 Abduction and Enforced Disappearances 8.2 Kill and Dump of forcibly disappeared persons 8.3 Fake encounters of forcible disappeared persons 8.4 Willful killing 8.5 From mass graves 2 1. Abbreviations: / / Phonetic Transcription App Appendix BHRO Baloch Human Rights Organization BSO-A Baloch Students Organization Azad BNM Baloch National Movement BRP Baloch Republican Party CAT Convention Against Torture CPEC China Pakistan Economic Corridor Distt: District FC Frontier Corps FIR First Information Report HRCP Human Rights Commission of Pakistan HRCB Human Rights Council of Balochistan ICCPR International Covenant on Civil and Political Rights KM Kilo Meter LUMS Lahore University of Management Sciences NGO Non-Governmental Organization NIC National Identity Card T2F The Second Floor UN United Nations UNDHR Universal Declaration of Human Rights UPR Universal Periodic Review VBMP Voice for Baloch Missing Persons WGEID Working Group on Enforced or Involuntary Disappearances 3 2. -

Part Iii] the Gazette of Pakistan, Extra., Dec. 11, 2019 2021(1)

PART III] THE GAZETTE OF PAKISTAN, EXTRA., DEC. 11, 2019 2021(1) ISLAMABAD WEDNESDAY, DECEMBER 11, 2019 PART III Other Notifications, Orders, etc. GOVERNMENT OF PAKISTAN CABINET SECRETARIAT (Cabinet Division) NOTIFICATION Islamabad, the 9th December, 2019 No. 5/2/2019-Awards-II.—The President of the Islamic Republic of Pakistan has been pleased to confer Pakistan Civil Awards on the following Pakistani and Foreign dignitaries on the occasion of the Independence Day, 14th August, 2019:— S. No. Name and Address Field I. HILAL-I-PAKISTAN 1. Mr. Song Tao, Services to Pakistan No.4, Fu Xing Rd., Haidian District, Beijing, 100860, China. Country: China 2021(1—19) Price : Rs. 40.00 [1955(2019)/Ex. Gaz.] 2021(2) THE GAZETTE OF PAKISTAN, EXTRA., DEC. 11, 2019 [PART III S. No. Name and Address Field I. HILAL-I-PAKISTAN 2. Mr. Zhong Shan, Services to Pakistan No.2, East Chang’an Street, Beijing, 100731, China. Country: China II. HILAL-I-SHUJA’AT 3. Dr. Abdul Qudoos Shaikh Shaheed, Gallantry (Posthumous), Flat No.B-401, Diplomat Residency, Civil Lines, Karachi. Domicile: Sindh III. HILAL-I-IMTIAZ 4. Ms. Zhao Baige, Services to Pakistan Building A, Guo Mao Building, Beijing, 100007, China. Country: China 5. Mr. Khaliq Dad Khan, Electronics Member(Science ), Dr. A. Q. Khan Research Laboratories, P.O. Box No.502, Rawalpindi. Domicile: Punjab 6. Maj.(R) Azam Suleman Khan, Public Service/National Secretary, Security Ministry of Interior, Islamabad. Domicile: Punjab PART III] THE GAZETTE OF PAKISTAN, EXTRA., DEC. 11, 2019 2021(3) S. No. Name and Address Field 7. Qari Syed Sadaqat Ali, Public Service 9-C/2, Lalazar Colony, Thokar Niaz Baig, Lahore. -

Broken, but Not Defeated an Examination of State-Led Operations Against Islamic State Khorasan in Afghanistan and Pakistan (2015-2018)

BROKEN, BUT NOT DEFEATED AN EXAMINATION OF STATE-LED OPERATIONS AGAINST ISLAMIC STATE KHORASAN IN AFGHANISTAN AND PAKISTAN (2015-2018) Amira Jadoon and Andrew Mines | March 2020 Broken, but Not Defeated: An Examination of State-led Operations against Islamic State Khorasan in Afghanistan and Pakistan (2015-2018) Amira Jadoon Andrew Mines Combating Terrorism Center at West Point United States Military Academy www.ctc.usma.edu The views expressed in this report are the authors’ and do not necessarily reflect those of the Combating Terrorism Center, United States Military Academy, Department of Defense, or U.S. Government. March 2020 Cover Photo: An ISK militant shown in a video, “Answer the Call 2,” released by ISK in August 2018 COMBATING TERRORISM CENTER acknowledgments Director We are deeply grateful to the Carnegie Corporation of New York, whose generous support made this report possible. We would also like to thank Brian Dodwell various individuals whose assistance and dedication was critical to the completion of this project. Research Director We are thankful to all members of the research team whose efforts con- Dr. Daniel Milton tributed toward the compilation of the data that underpins this report and helped push this project to completion. External reviewers Asfandyar Mir Distinguished Chair and Craig Whiteside provided invaluable feedback that strengthened this LTG (Ret) Dell Dailey report’s overall contribution. We would like to thank CTC Director Brian Dodwell and CTC Research Director Daniel Milton for their enthusiasm George H. GIlmore Senior Fellow and support for this project, and Don Rassler, Darren Hagan, and Na- kissa Jahanbani for their feedback throughout the report’s development. -

The Human Rights Crisis in Kashmir

THE HUMAN RIGHTS CRISIS IN KASHMIR PREVIOUSLY PUBLISHED REPORTS ON INDIA AVAILABLE FROM HUMAN RIGHTS WATCH Rape in Kashmir: A Crime of War No End in Sight: Human Rights Violations in Assam The Crackdown in Kashmir: Torture of Detainees and Assaults on the Medical Community Police Killings and Rural Violence in Andhra Pradesh Before the Deluge: Human Rights Abuses at India's Narmada Dam Encounter in Pilibhit: Summary Executions of Sikhs Punjab in Crisis Kashmir under Siege Prison Conditions in India THE HUMAN RIGHTS CRISIS IN KASHMIR A Pattern of Impunity Asia Watch A Division of Human Rights Watch Physicians for Human Rights Human Rights Watch New York !!! Washington !!! Los Angeles !!! London Copyright 8 June 1993 by Human Rights Watch and Physicians for Human Rights All rights reserved. Printed in the United States of America. ISBN 1-56432-104-5 Library of Congress Catalogue Number 93-78901 Cover design by Robert Kimzey. Cover photo: Masroof Sultan, a 19-year-old college student, who was taken into custody on April 8, 1993, by Border Security Force troops, beaten and tortured with electric shock and then taken to a field where he was shot and left for dead. Photo copyright 8 Klaus Holsting, April 1993. Asia Watch was founded in 1985 to monitor and promote internationally recognized human rights in Asia. The Chair is Jack Greenberg and the Vice Chair is Orville Schell. Sidney Jones is Executive Director. Mike Jendrzejczyk is Washington Representative. Therese Caouette, Patricia Gossman, Jeannine Guthrie and Robin Munro are Research Associates. Grace Oboma-Layat and Vicki Shu are Associates, and Mickey Spiegel is Research Consultant.