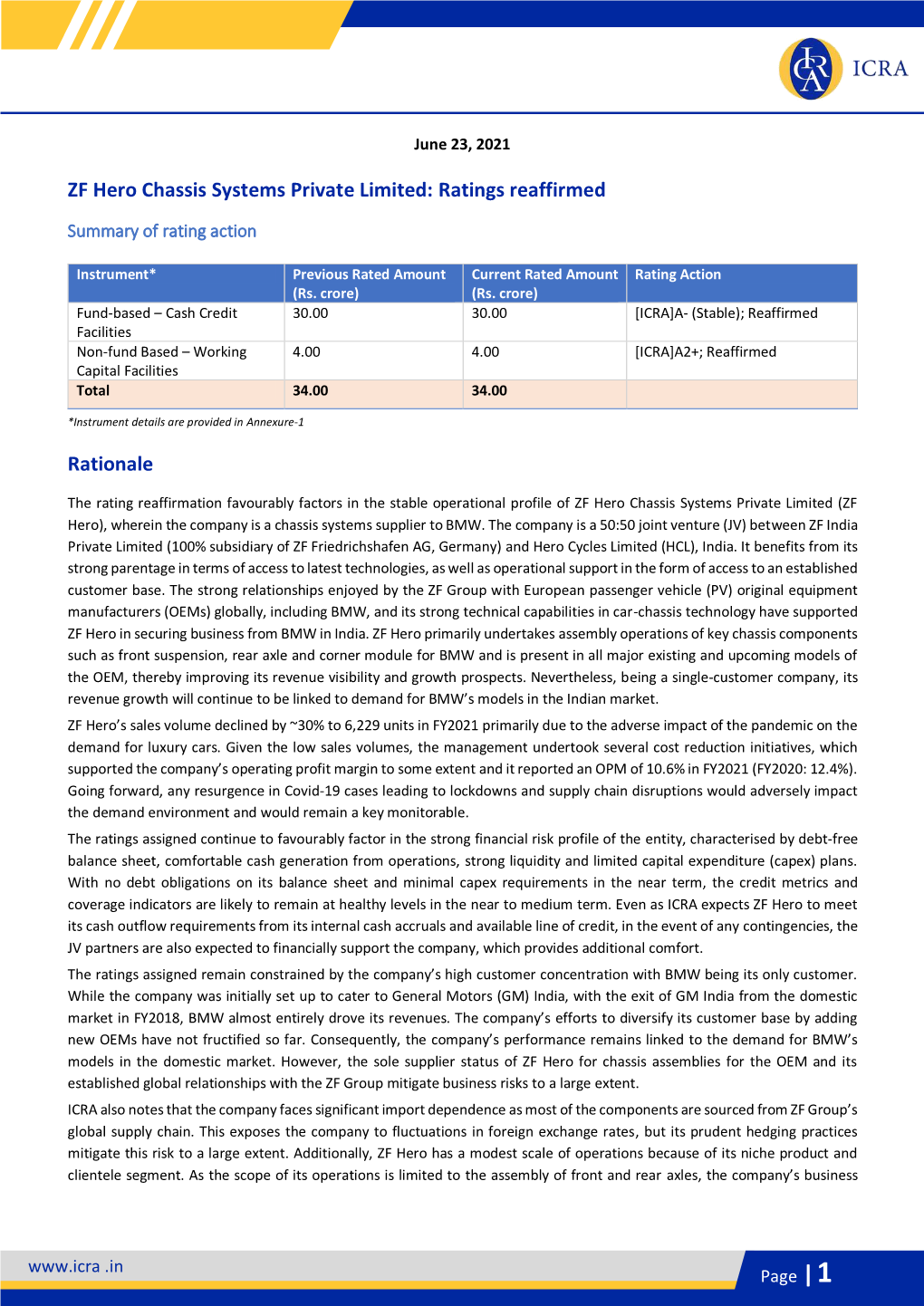

ZF Hero Chassis Systems Private Limited: Ratings Reaffirmed Rationale

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Factsheet November 08

NOVEMBER 2008 FACTSHEET Equity Outlook ndia has been through probably one of the worst terror attacks in history and while that would have its impact on the economy, we believe that prompt policy action in terms of Ireduction of interest rates, announcement and award of large and profitable infrastructure projects (which can be financed during these times), increasing the attractiveness of the equity markets through lower tax rates, etc. could quickly restore business confidence. Prateek Agrawal HEAD - EQUITY % Change Comments Index Price 1 month 6 month MSCI World 893 (6.72) (45.23) India was one of the worst performing economies globally as Sensex 9,093 (7.10) (46.30) the stress on the economy increased. Despite of the sharp fall Dow Jones 8,829 (5.32) (34.83) in prices of imported commodities, the trade deficit MSCI Emerging Mkts 527 (7.63) (57.49) continued to be high and there has been a sharp drop in the MSCI Latin America 2,028 (6.66) (63.31) foreign exchange reserves. Lead indicators like monthly auto MSCI EM Asia 212 (7.17) (53.33) sales point to a drop in IIP figures going forward. Commodity prices have declined sharply and the producers may be S&P 500 index 896 (7.48) (41.10) saddled with large inventory losses apart from reduced FTSE 100 4,288 (2.04) (32.33) margins from continued operations. Hang Seng 13,888 (0.58) (45.99) Nikkei 8,512 (0.75) (44.71) Sectoral Index % Change Comments Price 1 month 6 month BSE Midcap 2,886 (9.82) (57.70) The performance of the various sectoral indices bring about BSE 200 1,062 (7.27) (49.12) the same trends. -

Project Report on Comparative Analysis of 4-Stroke Bikes

Project Report On Comparative Analysis Of 4-Stroke Bikes Submitted towards the Partial fulfillment of Master of Business Administration (Affiliated to U.P. Technical University, Lucknow) Under the guidance of: Submitted by: Supervisor Name Your Name Roll: - CONTENTS A) Title page B) Acknowledgement C) Certificate 1) INTRODUCTION 2) INDUSTRY OVERVIEW 3) COMPANY PROFILE 4) MARKETING STRATEGIES 4) LITERATURE REVIEW 5) RESEARCH METHODOLOGY 6) DATA ANALYSIS AND INTERPRETATION 7) FINDINGS 8) SUGGESTIONS 9) CONCLUSION 10) REFERENCES AND ANNEXURES ACKNOWLEDGEMENT We express our sincere gratitude to our project guide Mr. Gaurav Kumar Verma for giving us the opportunity to work on this project. We are thankful to our Project Guide for their guidance and encouragement without which the satisfactory completion of our project would not have been possible. They have been a constant source of inspiration to us, showing all the patience and abundant encouragement throughout the project duration. Also, we are thankful to the librarians and staff of our institute, for their continued support and invaluable encouragement. Above all, we are thankful to the “Almighty” and to our parents for their blessings, humble support and showing their belief in us. TRIBHUVAN NARAYAN INTRODUCTION INTRODUCTION HISTORY OF BIKES Through the years… Bob Stark has been involved with Indian motorcycles throughout his entire life. Bob's father became an Indian dealer in 1918, after returning from military service during World War I. Bob still has a photo of his mother riding in a sidecar in 1923. Since Bob was born in 1934, his parents were involved with Indian cycles long before that. At the age of 10 Bob started staying around his fathers shop, and developed quite an interest in the Indian cycles. -

Bicycles, Viz, Sports By: G.P

Market Survey new models of bicycles, viz, sports BY: G.P. GANDHI and high-tech models, both for do- mestic and export markets. It has not paid much attention to R&D. However, of late, some leading man- ufacturers have started devoting more attention to R&D for promot- BICYCLES: CAN INDIA ing exports. Modern machines and equipment are being installed and even quality control programmes CATCH UP WITH CHINA? are being instituted. An R&D centre was set up in the 1980s at Ludhiana, which gave a push to the use of im- The Indian bicycle industry needs latest R&D facilities to proved technology. Ludhiana in Punjab is popularly match with world leaders like China and Taiwan. known as the bicycle capital of the country, accounting for as much as 80 per cent of the bicycles and bi- cycle parts manufactured in India. Kanpur, Mumbai, Sonepat (Hary- ana), Chennai and Kolkata are the other important production centres for manufacture of bicycles and bi- cycle parts. Hero Cycles has grown to become the world’s largest bicycle maker. The company exports its bicycles to over 52 countries and sells over 42 models. Another major player Atlas Cy- cles was founded in 1961 by Janaki Das Kapur. It is a name synony- mous with India’s cycling revolu- tion. The Atlas range of bicycles includes standard roadsters, moun- tain bikes, SLRs, children’s bikes, women cycles and sporty exercisers and are exported across five con- tinents. The company has a fully in-house R&D wing recognised by the Government of India. -

IS 1134 (2004): Bicycle Bottom Bracket Lock Ring (PH Type) (Amalgamating IS 11736) [TED 16: Bicycles]

इंटरनेट मानक Disclosure to Promote the Right To Information Whereas the Parliament of India has set out to provide a practical regime of right to information for citizens to secure access to information under the control of public authorities, in order to promote transparency and accountability in the working of every public authority, and whereas the attached publication of the Bureau of Indian Standards is of particular interest to the public, particularly disadvantaged communities and those engaged in the pursuit of education and knowledge, the attached public safety standard is made available to promote the timely dissemination of this information in an accurate manner to the public. “जान का अधकार, जी का अधकार” “परा को छोड न 5 तरफ” Mazdoor Kisan Shakti Sangathan Jawaharlal Nehru “The Right to Information, The Right to Live” “Step Out From the Old to the New” IS 1134 (2004): Bicycle Bottom Bracket Lock Ring (PH Type) (Amalgamating IS 11736) [TED 16: Bicycles] “ान $ एक न भारत का नमण” Satyanarayan Gangaram Pitroda “Invent a New India Using Knowledge” “ान एक ऐसा खजाना > जो कभी चराया नह जा सकताह ै”ै Bhartṛhari—Nītiśatakam “Knowledge is such a treasure which cannot be stolen” —— IS 1134:2004 (Amalgamating IS 11736: 1986) mm “TrE$amtim# rzF3%m Mklml-mlr& ( i%’1’l yp’awl ) Indian Standard BICYCLES BOTTOM BRACKET LOCK RING — SPECIFICATION ( Third Revision) Ics 43.150 0 BIS 2004 BUREAU OF INDIAN STANDARDS MANAK BHAVAN, 9 BAHADUR SHAH ZAFAR MARG NEW DELHI 110002 November 2004 Price Group 2 Bicycles Sectional Committee, TED 16 FOREWORD This Indian Standard (Third Revision) was adopted by Bureau of Indian Standards, after the drafl finalized by the Bicycles Sectional Committee had been approved by the Transport Engineering Division Council. -

Hero-Catalogue.Pdf

Hero CycleS Limited 603, International Trade Tower, Nehru Place, New Delhi - 110019 | Tel.: +91 161 5026 969 | Email: [email protected] Hero_Cycles Competition brings out the best in products. At every stage you try to do better than the best, strive to push off your limits and overcome your fears. At Hero, we see the past. We use it to make a better present and a beautiful tomorrow, as tomorrow isn’t just another day, its another chance for us to better ourselves and to start from the initial stage. LECTRO 04 UT EDGE 10 UT 22 OCTANE 46 SPRINT PRO 52 DENOVO 60 UTKIDS 62 SPRINT 65 PREMIUM BIKE RANGE PASSWORD TO TOMORROW Electric assisted bikes are front and centre of the biggest change to two-wheeled engineering in decades. Arguably the iPhone of bikes, the technical mechanism behind electric assisted bikes utilizes an battery powered motor to assist rider’s pedal-power at the push of a button, giving extra momentum when the rider needs it most. As well as power assistance, these bikes have many extra advantages for riders. These include health benets, environmental benets, as well as positives for tech-fans. RENEW BATTERY Li-ion, 48v 11.6Ah, Panasonic cells MOTOR Bafang- RM G06 350DC, 48V, 250W,80 Nm,36H Rear Hub Motor, DISPLAY LCD Display with Head Lamp Control SENSORS BB Axle Torque Sensor + Cadense LIGHT Front White LED Lamp 6V Back Red Led Lamp 6V LECTRO-RENEW RENEW bikes give you the perfect experience with its unique frame, geometry and technically advanced features. Small yet unique features in these bikes let you track and enhance your health & lifestyle. -

Technical Bid Evaluation Proceedings Dated:21-05-2016

KARNATAKA GOVERNMENT DEPARTMENT OF PUBLIC INSTRUCTION OFFICE OF E COMMISSTONER. NEW PUBLIC OFFTCES. NRUPATUNGA ROAD. BANGATORE _ 560 OO1 PROCEEDINGS F THE STATE LEVEL P MEETING FIELD FOR OPENING TCAL BIDS IN RESPECT OF SUPPLY OF THE YEAR 2O15-L UNDER THE HAIRMA TSSIONER FOR PUBLIC in the Meetins: L. Sri V. Ponn raj, IAS, Commissioner for Public Instruction, Bangalore. 2. Sri Dr" Ja P.C., IAS, State Project Director, SSA, Bangalore. 3. Smt. Philo na Lobo, DPI (secondary Edn.), O/o.CPI, Bangalore" 4. Sri K.A a, DPI (Primary Edn.), O/o.CPI, Bangalore. 5. Sri Sattya akash, Asst.Director, MS & MEDI, Rajajinagar, Bangalore. 6. Sri Sunil K , DD (MSME), O/o. Dept. of Industries & Commerce, Bangalore. 7. Sri. Nagaraj S Dhoni. DDPI, O/o. Addl. Commissioner for Public Instruction, Dharwad. B. Sri. Gura Police Patil, SADPI, O / o. Addl. Comrnissioner for Public Instruction, Kaluburgi. 9. Sri B.K. Chief Accounts Officer, Of o. CPI, Bangalore. 10. Sri Kem DDPI (Primary), O/o. CPI, Bangalore. resentatives the Biddine Corrr Present in the Meeti 1. SriSharath M/s. Hero Ecotech Limited, Ludhiana. 2. Sri Kiran K M/s. S"K. Bikes (p) Ltd., Ludhiana. Director (Primary), welcomed the members of the committee and bidders present in the meeting. rement web site was opened. Firstly, payment verification of all the bidders who had u loaded their bids was done. Information is as below: Supplier Bank Transaction Ref. No. Name u B I NR5 201 60307 00518267 sB I NR5 201 60308269 48315 B ARB R5 20 L 60309 007 61987 H DFCR52 0 1. -

A Study on Marketing Strategies of Heromotocorp Limited

www.ijcrt.org © 2021 IJCRT | Volume 9, Issue 2 February 2021 | ISSN: 2320-2882 A STUDY ON MARKETING STRATEGIES OF HEROMOTOCORP LIMITED Mr.Tushar Mane (Research , Department of Marketing, MIT World Peace University, pune.) Miss Raveena Kumari (Student, Department of Marketing, MIT World Peace University, pune.) Miss Sakshi Chaware (Student, Department of Marketing, MIT World Peace University, pune.) Mr.Bikramjit Debnath (Student, Department of Marketing, MIT World Peace University, pune.) ABSTRACT Growth and Marketing are the most important factor of each organization so, we have majorly focused on the marketing strategies and finding the growth pattern of the Hero MotoCorp ltd. Hero is the largest two- wheeler manufacturers in the world. We have focused on the growth of the hero MotoCorp and the strategies they have developed after getting separated from the Honda motors. We have mainly focused on the How Hero MotoCorp is living in the people’s heart and what strategies they are coming up with to sustain into the market. Understanding the need and wants of customer is most important so we have focused on the understanding the Choice, preference, and selection of two-wheeler products by the consumer. Satisfaction of the consumer is also important so building a relation with consumer and satisfying the consumer is important. Hero is expanding the business into the market, so We are going to study what changes hero need to make to retain into the market on the No one position and how they are going to retain into the global market on top. There is more Aggressive competition into the two-wheeler manufacturing industry, so we need to understand whether this change is going to work or Not. -

Project Report on Comparative Study of Bajaj

PROJECT REPORT ON MARKET RESEARCH COMPARATIVE STUDY OF BAJAJ V/S HERO HONDA SUBMITED TO SUBMITED BY Prof.JOYDEB BANERJEE VIKASH KUMAR Roll No.720692025 BBA 6th Semester 1 Vs. 2 ACKNOWLEDGEMENT The research on “Comparative Study between Bajaj and Hero Honda” has been given to me as part of the curriculum in 3-year’s Bachelor Degree in Business Administration. I have tried my best to present this information as clearly as possible using basic terms that I hope will be comprehended by the widest spectrum of researchers, analysts and students for further studies. I have completed this study under the able guidance and supervision of Prof. JOYDEB BANERJEE; I will be failed in my duty if I do not acknowledge the esteemed scholarly guidance, assistance and knowledge. I have received from them towards fruitful and timely completion of this work. Mere acknowledgement may not redeem the debt I owe to my parents for their direct/indirect support during the entire course of this project. I also thankful to my friend who helped me a lot in the completion of this project. VIKASH KUMAR 3 INDEX Sr No. Particulars Page no 1. OBJECTIVES 6 2. HISTORY OF BAJAJ 7 - Profile - Bajaj Intro - Company History - Timeline of new releases 3. HISTORY OF HERO HONDA 14 - Company Profile 4. RESEARCH METHODOLOGY 23 - Data Source - Research Approach - Sampling unit - Data Completion and Analysis - Scope 5. LIMITATION OF RESEARCH STUDY 25 6. ANALYSIS AND INTERPRETATION 27 7. CONCLUSION 39 8. RECOMMENDATION 41 9. BIBLIOGRAPHY 43 10. ANNEXURE 45 4 OBJECTIVES:- 1. To know the market share of Bajaj & Hero Honda 2. -

A Casestudy on Hero Cycle: How It Is Emerging a Pathway of Success (Success Story of a Market Leader)

© 2019 JETIR March 2019, Volume 6, Issue 3 www.jetir.org (ISSN-2349-5162) A CASESTUDY ON HERO CYCLE: HOW IT IS EMERGING A PATHWAY OF SUCCESS (SUCCESS STORY OF A MARKET LEADER) Uppuluri Srinivasa Venu Research Scholar SGT University, Gurgaon, New Delhi, Dr Tara Shankar Dean, Faculty of Commerce and Management SGT University, Budhera Gurugram , Haryana 122505 Dr A.Ramachandra Aryasri Former Director, School of Management Studies Jawaharlal Nehru Technological University Hyderabad, Hyderabad 500 072. ABSTRACT Hero Cycles started with manufacturing cycle components slowly paving its way onto becoming the one of the ‘Best Cycle Brand’ in India. Today, Hero Cycles is undoubtedly the largest manufacturer of bicycles in India producing 5.2 million cycles per annum.Starting from a small unit to creating a huge global footprint, Hero Cycles production unit in Ludhiana is fully equipped with an in-house R&D facility producing major bicycle components within its premise under stringent quality parameters complying with all global standards. The company focuses on innovation, user friendly & quality products. In this case we tried to analyze the strong areas, weak points, threats and opportunities of the company with the help of SWOT Analysis. A holistic approach is being adopted to understand the environment in which company’s operating therefore; PEST Analysis Core competency and Marketing Strategies are studied. This study shows how it succeeded and stood as a market leader. KEYWORDS: Hero cycles, pest, swot, strategies, success etc. INTRODUCTION: Hero Cycles Ltd was established in the year 1956 and has its headquarters in Ludhiana, Punjab. It is a manufacturer of bicycles and bicycle related products.It initially started with manufacturing cycle components. -

Marketing Strategies of Hero Honda

SUMMER PROJECT ON “MARKETING STRATEGIES OF HERO HONDA” Efforts By – Dhruv Verma F – 28 A3906410099 ASB Amity School of Business Amity University ACKNOWLEDGEMENT I would like to take an opportunity to thank all the people who helped me in collecting necessary information and making of the report. I am grateful to all of them for their time, energy and wisdom. Getting a project ready requires the work and effort of many people. I would like all those who have contributed in completing this project. First of all, I would like to send my sincere thanks to Mr. Vivek Ahuja for his helpful hand in the completion of my project. Dhruv Verma 2 EXECUTIVE SUMMARY The study, which I conducted on the “In-depth Analysis of Hero Honda Motors Ltd” in the area of Marketing & Human Resource Management has been a very gratifying experience at the outset, the objectives were to cover the whole marketing strategies and Human Resource policies adopted by HHML. The entire report has been effort to do just that. Through out the study I found Hero Honda bikes are very new & use modern technology in their bikes. As a result they give better performance then other bikes in the market & required less maintenance. Hero Honda also provides good after sale service to the customer. Hero Honda has managed to put in spectacular performance going from strength to strength despite increase in competition, the company’s sales have witnessed an up trend, registering an average growth of 42% in the three years under review. Hero Honda has managed to achieve this because of its strong brand image and proven product quality underpinned the performance growth in recent years. -

![IS 626 (2009): Bicycle Seat Pillars [TED 16: Bicycles]](https://docslib.b-cdn.net/cover/4850/is-626-2009-bicycle-seat-pillars-ted-16-bicycles-10834850.webp)

IS 626 (2009): Bicycle Seat Pillars [TED 16: Bicycles]

इंटरनेट मानक Disclosure to Promote the Right To Information Whereas the Parliament of India has set out to provide a practical regime of right to information for citizens to secure access to information under the control of public authorities, in order to promote transparency and accountability in the working of every public authority, and whereas the attached publication of the Bureau of Indian Standards is of particular interest to the public, particularly disadvantaged communities and those engaged in the pursuit of education and knowledge, the attached public safety standard is made available to promote the timely dissemination of this information in an accurate manner to the public. “जान का अधकार, जी का अधकार” “परा को छोड न 5 तरफ” Mazdoor Kisan Shakti Sangathan Jawaharlal Nehru “The Right to Information, The Right to Live” “Step Out From the Old to the New” IS 626 (2009): Bicycle Seat Pillars [TED 16: Bicycles] “ान $ एक न भारत का नमण” Satyanarayan Gangaram Pitroda “Invent a New India Using Knowledge” “ान एक ऐसा खजाना > जो कभी चराया नह जा सकताह ै”ै Bhartṛhari—Nītiśatakam “Knowledge is such a treasure which cannot be stolen” IS 626: 2009 ~-"ffic~-~ ( cf) (-f '<I TRJerar ) Indian Standard BICYCLE - SEAT PILLARS - SPECIFICATION ( Third Revision) ICS 43.150 © BIS 2009 BUREAU OF INDIAN STANDARDS MANAK BHA VAN . 9 BAHAD UR SHAH ZAFAR MARG NEW DELH! 110002 May 2009 Price Group 2 Bicycles Sectional Committee, TED 16 FOREWORD This Indian Standard (Third Revision ) was adopted by Bureau of Indi an Standards, a fter the draft finali zed by the Bicycles Sectional Committee had been approve d by the Tran sport E ngineering Div ision Council. -

CIN/BCIN L34100GJ1985PLC007958 Prefill Company/Bank Name MUNJAL AUTO INDUSTRIES LIMITED Date of AGM(DD-MON-YYYY) 30-JUN-2017

Note: This sheet is applicable for uploading the particulars related to the unclaimed and unpaid amount pending with company. Make sure that the details are in accordance with the information already provided in e-form IEPF-2 CIN/BCIN L34100GJ1985PLC007958 Prefill Company/Bank Name MUNJAL AUTO INDUSTRIES LIMITED Date Of AGM(DD-MON-YYYY) 30-JUN-2017 Sum of unpaid and unclaimed dividend 1819215.00 Sum of interest on matured debentures 0.00 Sum of matured deposit 0.00 Sum of interest on matured deposit 0.00 Sum of matured debentures 0.00 Sum of interest on application money due for refund 0.00 Sum of application money due for refund 0.00 Redemption amount of preference shares 0.00 Sales proceed for fractional shares 0.00 Validate Clear Proposed Date of Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id-Client Id- Amount Address Country State District Pin Code Folio Number Investment Type transfer to IEPF Name Name Name First Name Middle Name Name Account Number transferred (DD-MON-YYYY) AJAY NA YAGNIK NA NA YAGNIK 29 SUNSET ROW HOUSES OPP GURUKULINDIA DRIVE IN ROAD AHMEDABADGUJARAT GUJARAT AHMEDABAD 380020 00000008 Amount for unclaimed and unpaid dividend625 12-OCT-2021 JAYANTA NA SENGUPTA SUKENDU B SENGUPTA 14/1 BHAGIRATH SOCIETY CHHANI ROADINDIA BARODA GUJARATGUJARAT VADODARA 390002 00000013 Amount for unclaimed and unpaid dividend625 12-OCT-2021 NARENDRA NA RATHOR SATYAPAL RATHOR RATHOR RATHOR AUTO AGENCIES HINGOLI GATEINDIA NANDED MAHARASHTRAMAHARASHTRA NANDED 431601 00000018 Amount for