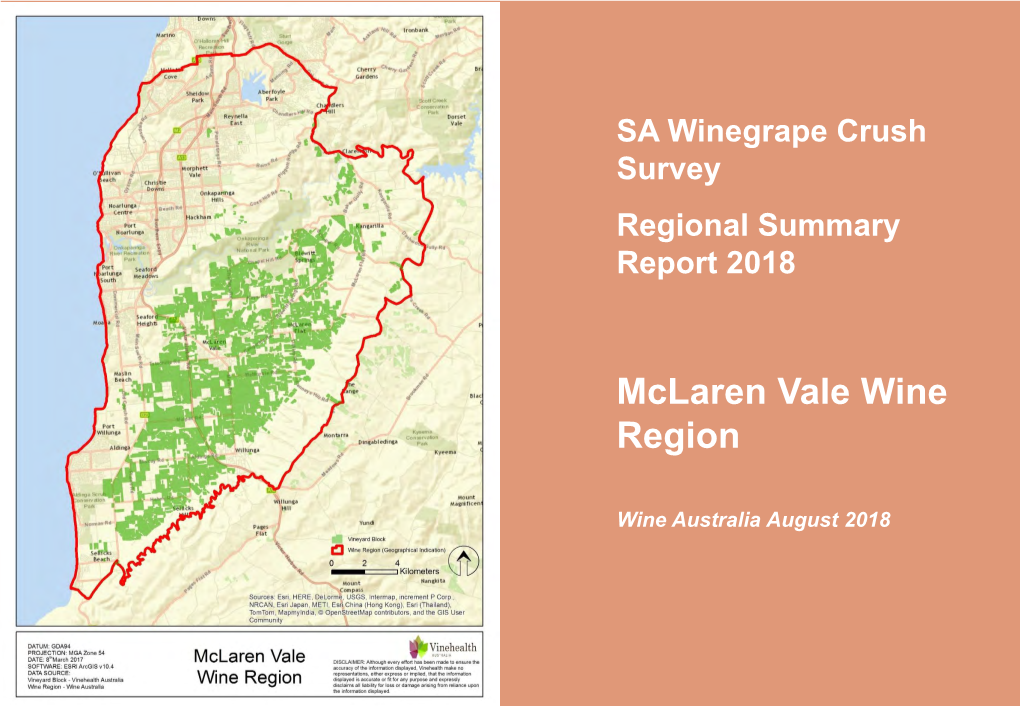

Mclaren Vale Wine Region

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

5008 Wine Regions (Page 1)

Wine Australia fact sheet Wine Regions - Australia’s famous wine regions 1 While Australia has about Clare Valley Most Coonawarra Cabernets Since those pioneering days, 60 wine regions, the The Clare Valley is considered will effortlessly cellar for at the Hunter’s wine industry has following ten are among to be among South Australia’s least 10 years, but that’s not flourished and now more than its most famous and most picturesque regions. It is the only variety the region is 80 wineries and cellar doors diverse. From the rugged also known as the home of famous for. Other award are open to tourist traffic en and isolated beauty of Australian Riesling and with winning varietals are Shiraz, route from Sydney. Margaret River in good reason – Clare’s Merlot and Chardonnay. Winemakers in the Hunter Western Australia, to consistency in making have found success with the historical home of Rieslings of exceptional Heathcote varieties such as Shiraz, Australian wine, the quality and style has won Rapidly raising the bar in terms Verdelho and Chardonnay, but Hunter Valley in New loyal consumers internationally. of elegance and complexity, no other region has developed South Wales, a journey particularly with Shiraz, such an affinity with Semillon. across Australia’s wine Clare is not only famous for Heathcote’s climate and soils regions is filled with a Riesling; it also produces of this Victorian region are Semillons from the Hunter diversity of climates, award-winning Cabernet strongly influenced by the Mt Valley have great capacity for soils, elevation and – Sauvignon and Shiraz that Camel Range which creates a graceful ageing, particularly in ultimately – wine styles. -

Mclaren Vale Wine Mclaren Vale Is One of the Oldest and Most Historically Significant Wine Regions in Australia

THE ULTIMATE GUIDE TO M c LAREN VALE WINE Learn all about this world-famous wine region, including its history, viticulture and winemaking trends, plus notable varieties and flavour profiles. CONTENTS – The history of McLaren Vale – Climate and soil – Viticulture – Winemaking – Notable varieties – Characteristics and flavour profiles Cover: Corrina Wright, Oliver’s Taranga, McLaren Vale AUSTRALIA NORTHERN TERRITORY QUEENSLAND WESTERN AUSTRALIA SOUTH AUSTRALIA NEW SOUTH WALES VICTORIA McLAREN VALE 0 500 Kilometres TASMANIA NEW SOUTH WALES ADELAIDE McLAREN VALE VICTORIA SOUTH AUSTRALIAThe ultimate guide to McLaren Vale wine McLaren Vale is one of the oldest and most historically significant wine regions in Australia. It’s also one of the most innovative and exciting. - Diversity - Innovation - Sustainability - Natural beauty M c LAREN VALE: AN ANCIENT REGION WITH A PROGRESSIVE OUTLOOK McLAREN VALE: – Innovation: The region boasts many AN ANCIENT REGION WITH creative, boutique wineries that are willing A PROGRESSIVE OUTLOOK to push the boundaries and experiment in The birthplace of wine in South Australia, continual pursuit of perfection. McLaren Vale lies just south of the capital – Sustainability: McLaren Vale is also one city of Adelaide and offers a variety of soils of the more environmentally conscious that bask in a Mediterranean climate. regions in Australia, with a number Layered over this history is a commitment to of producers farming organically and innovation and change. The McLaren Vale biodynamically or employing sustainable wine community is known for being one of farming methods. the most progressive and environmentally – Natural beauty: McLaren Vale is an sustainable in the country, producing incredibly picturesque region, nestled quality, contemporary styles crafted out of between the Mount Lofty Ranges and the traditional and emerging grape varieties. -

New Wine List

WIN E LIS T THE BEACH HOTEL SHIRAZ Hidden Valley Shiraz 6.5 26 McLaren Vale S P A R K L I N G S.C. Pannell Field Street Shiraz 10.5 50 McLaren Vale Hidden Valley Sparkling 6.5 26 Wynns Shiraz 7.5 34 McLaren Vale Coonawarra Bird In Hand Sparkling Pinot Noir 9.5 45 Fox Creek Red Baron Shiraz 8.5 40 Adelaide Hills McLaren Vale The Lois Blanc de Blanc 8 35 Adelaide Hills Black Chook Sparkling Shiraz 9.5 42 Cabernet Sauvignon McLaren Vale Hidden Valley Cabernet Sauvignon 6 . 5 26 Jacobs Creek Prosecco S.A 7.5 33 McLaren Vale Jacobs Creek Barossa Signature 8.5 40 Cab Sauv Barossa valley Shaw Family Moster Pitch 8 36 Cab Sauv Currency Creek Sauvignon Blanc Hidden Valley Sauvignon Blanc 6 .5 26 OTHER REDS + BLENDS McLaren Vale Giesen Sauvignon Blanc 8 35 Paxton AAA Shiraz Grenache 8.5 39 New Zealand McLaren Vale Shaw & Smith Sauvignon Blanc 10.5 49 Scarpantoni School Block 8 36 Adelaide Hills McLaren Vale Squealing Pig Sauvignon Blanc 9 42 Peter Lehmann Clancy's Blend 7.5 33 New Zealand Barossa Valley Barossa Valley Estate GSM 9.5 46 Taylors Tempranillo Clare Valley 9 40 Geisen Pinot Noir New Zealand 8 39 OTHER WHITES nly Pikes Traditional Riesling 10 44 CELLAR SELECTION Bottle o Clare Valley Clare Valley Wine Co Riesling 7.5 36 Mumm Champagne 89 Clare Valley France Hancock & Hancock Fiano 39 McLaren Vale Shaw Family Vintners The Josephine 7.5 36 Penfolds Bin 311 2015 Chardonnay 85 Pinot Gris Currency Creek Tumbarumba NSW Peter Lehman Hill & Valley Pinot Gris 9.5 46 Paxton NOW Shiraz 45 Eden Valley Preservative Free, McLaren Vale Paxton NOW Chardonnay 9 40 The Lane Block 5 Shiraz 46 Preservation Free, McLaren Vale Adelaide Hills d'Arenberg Dead Arm Shiraz 99 Banrock Station Moscato 7.5 35 McLaren Vale Grant Burge FILSELL Old Vine Shiraz 69 Banrock Station Pink Moscato 7 . -

Mclaren Vale Sustainable Winegrowing Australia — Workbook

McLaren Vale Sustainable Winegrowing Australia — Workbook Publisher: McLaren Vale Grape, Wine and Tourism Association [email protected] Chair: Peter Hayes [email protected] Disclaimer and copyright Editor — Project Manager This workbook represents information obtained from authentic and highly Irina Santiago regarded sources. Every reasonable effort has been made to give reliable data and information, but the authors and the publisher cannot assume re- [email protected] sponsibility for the validity of all the material or for the consequences of their use. The workbook has been compiled from the research study con- Production and Design ducted under the direction of the project manager Irina Santiago. Kate Stone [email protected] Information is published in good faith and we do not accept responsibility for damage which may arise from any possible inaccuracies. All rights reserved, none of the contents may be used in any other media without pri- Cover imagery or written consent of the publishers Showpony Advertising © Copyright Reserved, 2012. McLaren Grape Wine and Tourism Association Physical address: Main Road, McLaren Vale Postal address: PO BOX 169, McLaren Vale SA 5171 Australia Phone: +61 (8) 8323 8999 Fax: +61 (8) 8323 9332 www.mclarenvale.info Contents Introduction iii Authors and Reviewers iv Program History v Foreword vii Chapter 1 Soil Health, Nutrition & Fertilizer Management 1 Chapter 2 Pest and Disease Management 26 Chapter 3 Biodiversity Management 50 Chapter 4 Water Management 64 Chapter 5 Waste Management 80 Chapter 6 Social (Work, Community and Wineries relations) 95 ii Introduction McLaren Vale Sustainable Winegrowing Australia is our program to improve vineyard sustainability using a combination of data reporting, self-assessment through our workbook of viticultural practices and third party audits. -

2018 D'arenberg

2018 d’ARENBERG THE HERMIT CRAB VIOGNIER MARSANNE WINEMAKER: Chester Osborn REGION: McLaren Vale, South Australia VARIETALS: Viognier (62%), Marsanne (38%) MATURATION: 10% in seasoned French oak for 8 months ANALYSIS: 13.5% alc/vol | TA: 6.8 g/L | pH: 3.20 BACKGROUND: Many of McLaren Vale’s vineyards are on free-draining soils underlain with limestone, formed by the calcareous remains of the local marine fauna including the Hermit Crab, a reclusive little creature that inhabits the cast-off shells of others. Thus the Osborn family thought the name appropriate for this blend, as it is best enjoyed with shellfish and seafood dishes. WINEMAKING NOTES: Small batches of grapes were crushed and transferred to stainless steel basket presses. Fermentation was long and moderately cool to retain fresh fruit characters. 4% underwent wild fermentation for extra complexity. 14% of the Viognier was fermented in seasoned French oak to add mouth feel and support the subtle Viognier tannins. Both components received similar treatment, but were not blended until the final stages of the winemaking process. TASTING NOTES: An incredibly fragrant nose full of sweet apricot and gingery spice. The palate is luscious and generous, but has great acid which tightens the wine, adding freshness and a clean crisp finish. Slight pithy feel which builds on the spice notes. CRITICAL ACCLAIM: 93 pts JamesSucking.com, 91 pts/Best Buy Wine & Spirits, 90 pts Wine Spectator ABOUT d’ARENBERG: One of the undisputed kings of Australian Shiraz and Rhone varietals, d’Arenberg has managed to turn individuality into an art form by doing a whole lot of little things differently. -

Holiday Planner & Guide

FOOD & WINE | COASTAL GETAWAYS | WILDLIFE ADVENTURES | INDULGENT EXPERIENCES SOUTH AUSTRALIA HOLIDAY PLANNER & GUIDE Stokes Bay, Kangaroo Island KULGERA NORTHERN TERRITORY BIRDSVILLE QUEENSLAND To Darwin SIMPSON DESERT GOYDER LAGOON MBA MACU R K IV E ER R E C N MARLA O T R U OODNADATTA R B 0 200 WA WESTERN AUSTRALIA K INNAMINCKA E E km R C R E P O O C GREAT VICTORIA DESERT LAKE EYRE WILLIAM CREEK COOBER PEDY MARREE OUTBACK ARKAROOLA ANDAMOOKA ROXBY DOWNS LEIGH CREEK LAKE FROME KINGOONYA GLENDAMBO BLINMAN WOOMERA PARACHILNA LAKE TORRENS NEW SOUTH WALES LAKE To Perth GAIRDNER WILPENA EUCLA NUNDROO HAWKER HEAD OF BIGHT BROKEN FOWLERS BAY CEDUNA HILL FLINDERS RANGES QUORN WIRRULLA PORT AUGUSTA STREAKY BAY WUDINNA PETERBOROUGH WHYALLA KIMBA PORT PIRIE BAIRD BAY CLARE VALLEY BURRA EYRE PENINSULA KADINA CLARE M PORT U R WAKEFIELD R A Y RIVE R RENMARK TUMBY BAY YORKE KAPUNDA WAIKERIE PENINSULA BAROSSA BERRI GAWLER TANUNDA LOXTON COFFIN BAY MINLATON ADELAIDE PORT LINCOLN HILLS MURRAY RIVER ADELAIDE MURRAY BRIDGE FLEURIEU PENINSULA PINNAROO SOUTH AUSTRALIAN CAPE JERVIS Premier Wine Region KINGSCOTE GOOLWA VICTOR ROAD TRIPS HARBOR KANGAROO PENNESHAW MENINGIE ISLAND TINTINARA VICTORIA Regional Food Experiences SEAL BAY EPICUREAN WAY KEITH Australia’s Great Food & Wine Touring Route Opal Mine BORDERTOWN LIMESTONE EXPLORERS WAY COAST Wilpena Pound PADTHAWAY Journey through the heart of Australia’s outback KINGSTON S.E. Whale Watching NARACOORTE MIGHTY MURRAY WAY ROBE Follow the journey of Australia’s largest river COONAWARRA PENOLA Shark Cage Diving -

Wine Production and Terroir in Mclaren Vale, South Australia

Fermenting Place Wine production and terroir in McLaren Vale, South Australia William Skinner Thesis submitted for the degree of Doctor of Philosophy In the Discipline of Anthropology, School of Social Sciences University of Adelaide September 2015 Table of Contents List of Figures ...................................................................................................................... iv Abstract .............................................................................................................................. vi Declaration ....................................................................................................................... viii Acknowledgements ............................................................................................................ ix Introduction ........................................................................................................................1 Framing the thesis .............................................................................................................. 4 Dwelling, place and landscape ............................................................................................ 6 Relationality ...................................................................................................................... 15 A terroir perspective ......................................................................................................... 18 Learning from people and vines ...................................................................................... -

SA Winegrape Crush Survey 2019 July 2019 Contents

Prepared by: On behalf of: SA Winegrape Crush Survey 2019 July 2019 Contents State summary 3 Adelaide Hills 19 Adelaide Plains 24 Barossa inc. Barossa Valley and Eden Valley 28 Clare Valley 38 Coonawarra 43 Currency Creek 48 Fleurieu zone other (inc. Southern Fleurieu and Kangaroo Island) 52 Langhorne Creek 58 Limestone Coast other (inc. Mount Benson, Mount Gambier and Robe) 63 McLaren Vale 70 Padthaway 77 Riverland 81 SA – other (inc. Southern Flinders Ranges and The Peninsulas) 88 Wrattonbully 94 Explanations and definitions 98 SA Winegrape Crush Survey 2019 State Summary Report Wine Australia July 2019 State summary 2019 Overview of vintage statistics State and regional overview Varietal overview The total reported crush of South Australian winegrapes in 2019 was The red crush was 475,718 tonnes, which was 5 per cent higher than the 768,863 tonnes. This was an increase of 3 per cent compared with the 2018 crush. White varieties decreased by 1 per cent to 293,145 tonnes. 2018 reported crush of 748,484 tonnes; it was almost identical to the five- Red varieties increased their share of the crush from 61 per cent to 62 per year average (2014-2018) of 770,573 tonnes and 5 per cent above the cent. 10-year average (2009-2018) of 732,734 tonnes1. Most of the major red varieties increased, with Shiraz up by 2 per cent to The top three regions by volume in 2019 were the Riverland with 474,090 225,484 tonnes, Cabernet Sauvignon up by 7 per cent to 140,248 tonnes tonnes, Langhorne Creek with 43,137 tonnes and the Barossa Valley and Merlot up by 22 per cent to 49,404 tonnes – reversing a decrease of (including Barossa zone – other) with 40,986 tonnes. -

Grenache and Blends

GRENACHE AND BLENDS EDUCATOR GUIDE AUSTRALIAN WINE DISCOVERED PREPARING FOR YOUR CLASS THE MATERIALS VIDEOS As an educator, you have access to a suite of teaching resources and handouts, You will find complementary video including this educator guide: files for each program in the Wine Australia Assets Gallery. EDUCATOR GUIDE We recommend downloading these This guide gives you detailed topic videos to your computer before your information, as well as tips on how to best event. Look for the video icon for facilitate your class and tasting. It’s a guide recommended viewing times. only – you can tailor what you teach to Loop videos suit your audience and time allocation. These videos are designed to be To give you more flexibility, the following played in the background as you optional sections are flagged throughout welcome people into your class, this document: during a break, or during an event. There is no speaking, just background ADVANCED music. Music can be played aloud, NOTES or turned to mute. Loop videos should Optional teaching sections covering be played in ‘loop’ or ‘repeat’ mode, more complex material. which means they play continuously until you press stop. This is typically an easily-adjustable setting in your chosen media player. COMPLEMENTARY READING Feature videos These videos provide topical insights Optional stories that add from Australian winemakers, experts background and colour to the topic. and other. Feature videos should be played while your class is seated, with the sound turned on and clearly SUGGESTED audible. DISCUSSION POINTS To encourage interaction, we’ve included some optional discussion points you may like to raise with your class. -

Wines by the Bottle

WINES BY THE BOTTLE HALF BOTTLE (375 ML) ENCHANTED GARDEN RIESLING 29 Eden Valley, SA SCOTCHMAN HILL CHARDONNAY 30 Bellarine Peninsula, Vic. KOONUNGA HILL SHIRAZ/CAB 28 Coonawarra, SA WIRRA WIRRA CHURCH BLOCK(CSM) 29 McLaren Vale, SA SPARKLING LINDAUER BRUT CUVEE 45 Gisborne, NZ CORIOLE PROSECCO 49 McLaren Vale, SA CROSER NV 60 Adelaide Hills, SA JANSZ PREMIUM NON-VINTAGE CUVEE 69 Pipers River, Tas MOET & CHANDON 145 Champagne, France VEUVE CLICQUOT 165 Champagne, France BOLLINGER ‘SPECIAL CUVEE’ 170 Champagne, France ROSE PINK BILLY ROSÈ 2014 45 Orange, NSW PORT PHILLIP ESTATE SALASSO ROSÈ 2015 59 Mornington Peninsula, Vic LE GRAND CROS ROSÈ 2014 65 Provence, France MOSCATO INNOCENT BYSTANDER MOSCATO 2014 45 Yarra Valley, Vic WINES BY THE BOTTLE RIESLING HENRY FROST RIESLING 2013 45 Clare Valley, SA KNAPPSTEIN ‘HAND PICKED’ RIESLING 2015 49 Clare Valley, SA ST HALLETT RIESLING 2015 50 Barossa, SA PIKES ‘TRADITIONALE’ RIESLING 2014 59 Clare Valley, SA O’LEARY-WALKER ‘POLISH HILL RIVER’ RIESLING 2015 65 Clare Valley, SA TIM MCNEIL WATERVALE RESERVE RIESLING 2015 69 Clare Valley, SA PINOT GRIS INGRAM ROAD PINOT GRIGIO 2015 49 Yarra Valley, Vic INNOCENT BYSTANDER PINOT GRIS 2014 49 Yarra Valley, Vic WITHER HILLS PINOT GRIS 2014 49 Marlborough, NZ JOSEF CHROMY ‘PEPIK’ PINOT GRIGIO 2014 50 Relbia, Tas STICKS PINOT GRIGIO 2014 59 Yarra Valley, Vic PIPERS BROOK PINOT GRIS 2014 70 Tamar Valley, TAS SAUVIGNON BLANC KAPUKA 39 Marlborough, New Zealand VIDAL SAUVIGNON BLANC 2015 45 Marlborough, New Zealand MATUA VALLEY SAUVIGNON BLANC 2015 49 Hawke’s -

Red Wines White Wines

Red Wines White Wines By the Glass By the Glass Sangiovese 2014 (Currency Creek, Vasarelli Maria’s Table) 7.5 Prosecco (Vasarelli Non Vintage) 7 Cabernet Sauvignon Merlot 2013 (Currency Creek Two Fathoms) 7.5 Moscato 2015 (Stefano De Pieri, Midura) 7 Shiraz 2013 (Vasarelli Family Reserve, McLaren Vale) 7.5 Pinot Grigio 2014 (Vasarelli Currency Creek) 7 Rose 2012 (Vasarelli McLaren Vale) 7 Vermentino 2014 (Vasarelli Currency Creek) 7 McLaren Vale Wines Sauvignon Blanc 2014 (“Two Fathoms” Currency Creek) 7.5 Barbera Chardonnay 2012 (“Family Reserve” Vasarelli McLaren Vale) 7.5 Barbera 2014 (Chalk Hill Wines) 39 Merlot Merlot 2012 (Brandson Road) 35 Moscato Wines Merlot 2014 (“Organic Gemstone” Gemtree Wines) 40 Moscato 2015 (Stefano De Pieri Mildura) 27 Moscato 2015 (Sabella Vineyards McLaren Vale) 27 Tempranillo Moscato 2014 (Dog Ridge McLaren Vale) 30 Tempranillo 2014 (Paxton Wines) 38 Tempranillo 2014 (The Hedonist) 39 Grenache Sparkling Wines Grenache 2005 (Agostino Wines) 38 Prosecco (Vasarelli Non‐Vintage) 30 Grenache 2014 (“Four Roads” Maxwell Wines) 41 Shiraz (“Black Tempest” Scarpontoni McLaren Vale) 37 Italian Varieties Colorino 2013 (“Joe Petrucci & Son” Sabella Vineyards) 37 Blush Wines Nero D ‘Avola 2014 (“Joe Petrucci & Son” Sabella Vineyards) 37 Rose Cabernet Sauvignon 2012 (Vasarelli McLaren Vale) 27 Montepulicano 2014 (Mr Riggs) 40 Rose 2015 (“La Gita” Zerella Wines McLaren Vale) 45 Shiraz Shiraz 2012 (“Joe Petrucci & Son” Sabella Vineyards) 38 Shiraz 2014 (“The Rascal” Hugh Hamilton Wines) 42 McLaren Vale Wines Shiraz 2014 -

Wines + Beverages

ART GALLERY FOOD + WINE EVENTS | WEDDINGS | COCKTAILS | DINNERS | SEMINARS WINES + BEVERAGES Please select a package to match the duration of your event. The package prices are inclusive of sparkling wine, one white wine selection, one red wine selection, beer, soft drinks, juice, bottled still + sparkling water. STUDIO STUDIO PP NV AGF+W Brut (Adelaide Hills) 1 hour $17.00 16 Angove’s ‘Studio Series’ Sauvignon Blanc (South Australia) 2 hours $22.50 14 I ❤ Shiraz (South Australia) 3 hours $26.00 Coopers Pale Ale/Cascade Light 4 hours $30.50 CONTEMPORARY CONTEMPORARY PP NV Thorn-Clarke Brut Cuvee (Eden Valley) 1 hour $19.50 16 Cooter & Cooter Riesling (Clare Valley) 2 hours $27.00 16 Leland Estate Sauvignon Blanc (Lenswood) 3 hours $33.00 16 Chapel Hill Chardonnay (McLaren Vale) 4 hours $39.50 14 Longhop Cabernet Sauvignon (Mount Lofty) 14 JT Jonathan Tolley Shiraz (McLaren Vale) Coopers Pale Ale/Cascade Light MELROSE MELROSE PP NV Mountadam ‘High Eden’ Pinot/Chardonnay (Eden Valley) 1 hour $21.00 16 St John’s ‘Peace of Eden’ Riesling (Eden Valley) 2 hours $29.50 15 K1 by Geoff Hardy Sauvignon Blanc (Adelaide Hills) 3 hours $37.00 15 Maxwell ‘Adelaide Hills’ Chardonnay (Adelaide Hills) 4 hours $45.50 13 Penley Estate ‘Tolmer’ Cabernet Sauvignon (Coonawarra) 15 Pertaringa ‘Undercover’ Shiraz (McLaren Vale) Coopers Pale Ale/Cascade Light ELDER ELDER PP NV d’Arenberg ‘Polly’ Sparkling Brut (Adelaide Hills) 1 hour $27.00 16 Skillogalee Riesling (Clare Valley) 2 hours $38.50 15 Geoff Weaver Sauvignon Blanc (Adelaide Hills) 3 hours $49.50 14 Schild Estate ‘Schild Alma Reserve’ Chardonnay (Barossa) 4 hours $65.50 13 Lake Breeze Cabernet Sauvignon (Langhorne Creek) 12 Gomersal Shiraz (Barossa Valley) Coopers Pale Ale/Cascade Light + 1 premium beer (Kronenberg, Carlsberg, Sapporo) ART GALLERY FOOD + WINE COCKTAIL DRINKS MARCH 2017 ART GALLERY FOOD + WINE EVENTS | WEDDINGS | COCKTAILS | DINNERS | SEMINARS START START PP Package price includes full service, soft drinks, juice, bottled still + sparkling water.