28Th March 2021 | Week 12

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 17. Shipping Contributors: Alan Simcock (Lead Member)

Chapter 17. Shipping Contributors: Alan Simcock (Lead member) and Osman Keh Kamara (Co-Lead member) 1. Introduction For at least the past 4,000 years, shipping has been fundamental to the development of civilization. On the sea or by inland waterways, it has provided the dominant way of moving large quantities of goods, and it continues to do so over long distances. From at least as early as 2000 BCE, the spice routes through the Indian Ocean and its adjacent seas provided not merely for the first long-distance trading, but also for the transport of ideas and beliefs. From 1000 BCE to the 13th century CE, the Polynesian voyages across the Pacific completed human settlement of the globe. From the 15th century, the development of trade routes across and between the Atlantic and Pacific Oceans transformed the world. The introduction of the steamship in the early 19th century produced an increase of several orders of magnitude in the amount of world trade, and started the process of globalization. The demands of the shipping trade generated modern business methods from insurance to international finance, led to advances in mechanical and civil engineering, and created new sciences to meet the needs of navigation. The last half-century has seen developments as significant as anything before in the history of shipping. Between 1970 and 2012, seaborne carriage of oil and gas nearly doubled (98 per cent), that of general cargo quadrupled (411 per cent), and that of grain and minerals nearly quintupled (495 per cent) (UNCTAD, 2013). Conventionally, around 90 per cent of international trade by volume is said to be carried by sea (IMO, 2012), but one study suggests that the true figure in 2006 was more likely around 75 per cent in terms of tons carried and 59 per cent by value (Mandryk, 2009). -

Volume Contracts of Affreightment – Some Features and Principles

Volume Contracts of Affreightment – Some Features and Principles Lars Gorton 1 Introduction ………………………………………………………………….…. 62 1.1 General Background ……………………………………………………… 62 1.2 Some Contractual Points …………..……………………………………... 62 1.3 Frame Agreements ………………………………………………………... 64 1.4 Some General Points Related to Distributorship Agreements and Volume Contracts ………………………………………. 66 1.5 Some Further Overriding Points ……………………………………….…. 67 2 Contract Forms ………………………………………………………………… 68 3 Law, Contract and Terminology ……………………………………………… 69 4 The SMC Rules on Volume Contracts ……………………………………..…. 70 5 Characteristics of COA’s ……………………………………………………… 71 6 The Generic Nature of the COA ………………………………………………. 72 7 Some of the Parameters of the COA ………………………...……………….. 76 7.1 The Ships Involved Under the Volume Contract ………………………… 76 7.2 Time Elements in Connection with COA’s ………………………………. 76 7.3 Cargo and Cargo Quantity and Planning of Voyages ………………….… 77 8 Breach and Consequences of Breach …………………………………………. 78 8.1 Generally, Best Efforts and Cooperation …………………………………. 78 8.2 Consequences of the Owners’s Breach …………………………………... 78 8.3 Consequences of the Charterer’s Breach …………………………………. 78 9 Some Comparisons with Distributorship Agreements in English Law ….…. 78 10 Some COA Cases Involving “Evenly spread” ……………………………….. 82 10.1 “Evenly spread” …………………………………………………………... 82 10.2 Mitigation of Damages …………………………………………………… 85 11 Freight, Demurrage and Similar ……………………………………………… 88 11.1 General Points ………..…………………………………………………... 88 11.2 Freight Level …………………………………………………………….. -

Documents of the Shipping Transport: Historical Origins, Legal Validity & Commercial Practice

Journal of Shipping and Ocean Engineering 10 (2020) 47-56 Doi: 10.17265/2159-5879/2020.02.005 D DAVID PUBLISHING Documents of the Shipping Transport: Historical Origins, Legal Validity & Commercial Practice Ioannis Voudouris, and Evi Plomaritou Frederick University, Cyprus Abstract: The bill of lading and charterparty are vital for international trade and transport. To signify their enduring importance, this paper firstly seeks to illuminate the earliest historical evidence relating to the bill of lading and charterparty, and secondly, discuss their current legal and commercial nature and functions as well as their relationship with other transport documents such as the booking note, cargo manifest, mate’s receipt, and delivery order. In this context, the paper examines the lifecycle of transport as regards the documents used in the bulk and liner markets. Key words: Bill of lading, charterparty, sea waybill, booking note, delivery order, Mate’s receipt, Cargo manifest. 1. Introduction upon their shipment on board the ship (shipped bill of lading). The most important documents governing the commercial and legal relationships between the parties 2. Historical Origins of the Bill of Lading, in international sea transport are the bill of lading and Charterparty, Sea Waybill and Other the charterparty. Among other things, these Transport Documents documents define the obligations as well as the The (non-negotiable) sea waybill and the respective costs and earnings of the contracting parties, (negotiable) bill of lading are nowadays the primarily the shipowner or carrier and the charterer or best-known ocean transport documents that are still in shipper. In addition, other documents, such as booking use. -

Shipbroking and Chartering Practice

CONTENTS PAGE Preface v Introduction vii List of Figures xix Bibliography xxi CHAPTER 1. THE FREIGHT MARKET 1 The dry cargo market 2 The bulk and 'tweendecker market 2 The container market 4 The ro/ro market 5 The liner market 6 The small ship market 6 Special markets 7 Heavy-lift carriers 7 Barges and pontoons 7 Tugs 8 The tanker market 8 The "combos" 10 The reefer market 10 The car carrier market 12 The passenger market 13 The sale and purchase market 13 Freight derivatives 14 CHAPTER 2. THE STATE OF THE MARKET 17 CHAPTER 3. SHIPOWNING CONDITIONS AND MARKET ACTIVITIES 23 Materials administration in shipping 26 CHAPTER 4. INFORMATION CHANNELS 29 Information network and exchange 29 Order 29 Positions 31 Market reports 32 Freight negotiations 32 General information Information centres The Baltic Exchange 33 Institute of Chartered Shipbrokers 34 BIMCO 34 Information network Information coverage 3 7 Means of communication ->v The time factor 39 The role of the broker and the agent 40 Shipbrokers 41 Sale and purchase broker 44 Port agents 44 Liner agents 44 Brokers and agents connected with owners 45 Brokerage 45 Insurance for intermediaries 47 CHAPTER 5. MARKETING 49 Attitudes in negotiation 49 Marketing and relation to the customer 50 Organization of a shipping office 54 CHAPTER 6. SALES CONTRACT, CARRIAGE AND BILL OF LADING 57 Sales contract, financing, carriage 57 The sales contract is the basic agreement in the export transaction 57 Incoterms 58 "The sea transport chain" 59 Risk, cost and liability distribution between the different -

Putting Scale Into Perspective Why Big Isn’T Always Better

The official magazine of the Institute of Chartered Shipbrokers Promoting professionalism in the shipping industry worldwide Issue 57 June 2019 Putting scale into perspective Why big isn’t always better Impacts of consolidation | Ship upsizing | Port challenges | Trade evolution ICS TutorShip welcome 2016.qxp_ICS TutorShip welcome A5 17/05/2017 10:48 Page 11 A study experience tailored specifically towards preparation for the Institute of Chartered Shipbrokers’ exams, open to all students irrespective of their method of study. PREP provides students with an intensive, interactive and highly PREP motivating study experience tailored specifically towards preparation for the The Institute’s international revision course is Institute’s exams. now held twice a year for the November and May examinations PREP includes: mock exams, lectures, the opportunity for personal tutoring ‘I thoroughly enjoyed the weekend, both learning and networking. and socialising. I feel much more confident about passing my exams and I hope to be back next year.’ Ricky, Clarksons Port Services ‘It was a perfect weekend of learning and socialising with colleagues from the industry. Will definitely come back next year as it is a great way to prepare toward my exams.’ Jordi, Next Maritime Agency ‘Everything about this year at PREP was fantastic. Every detail had been well thought through. The tutors are fantastic; the Institute’s staff very friendly and make you feel so welcome. The passion from all the staff and tutors is commendable and really shines through.’ Vikki, -

Open for Maritime Business

Open fOr MaritiMe Business Maritime UK One voice for shipping, ports and maritime business MaritiMe uK Open fOr MaritiMe Business Open fOr MaritiMe Business MaritiMe uK minisTerial foreworD mariTime uK Stephen Hammond, Parliamentary Under foreworD Secretary of State for Transport (DfT) Jim Stewart, Chairman, Maritime UK s an island nation the UK’s Meridian – quite literally – makes commerce with the rest of us the centre of the shipping world. any people across the world few other economies could ever athe world has cultivated our Our central time zone means you say the UK is the natural hope to replicate. expertise in maritime business. It is can do business with both sides of mhome of shipping and The City of London is the beating an expertise that we are proud to the world in the same working day. maritime services. They do so for heart of global shipping. Its world- offer on a global scale. To ensure this sector maximises good reason. renowned integrity underpins We have a maritime services its full potential, I have established The largest shipping companies, a commitment to provide the sector which is already worth up – and personally chair – a body of most innovative port operators leadership necessary to support a to £14bn per year despite global Ministers and leaders from across and most comprehensive range of global industry which moves more economic headwinds, and which is Government and industry with a business services – including legal, than 80% of world trade. attracting maritime businesses from clear focus on maximising growth fi nancial, shipbroking and insurance Industry and Government in the around the world. -

MG 4169 Shipbroking and Chartering UK LEVEL: 6 UK CREDITS: 15 US CREDITS: 3/0/3 (Summer 2019)

DEREE COLLEGE SYLLABUS FOR: MG 4169 Shipbroking and Chartering UK LEVEL: 6 UK CREDITS: 15 US CREDITS: 3/0/3 (Summer 2019) PREREQUISITES: MG 1010 Introduction to Shipping CATALOG Dry-bulk and tanker chartering; sale and purchase of ships in theory and in DESCRIPTION: practice. Charter party negotiations, contract documentation and post fixture operational administration. RATIONALE: Students specializing in shipping must understand the essential elements of shipbroking and chartering practices. This course provides a thorough understanding of ship chartering, sale and purchase of ships in theory and in practice. It places emphasis on the practical understanding of the components, the terminology and the dynamics of ship chartering and ship broking. LEARNING OUTCOMES: As a result of taking this course, the student should be able to: 1. Analyze and explain key concepts in shipbroking, chartering practice and charter/agency contracts. (analysis) 2. Prepare charters and assess chartering decisions in the bulk and liner markets. (synthesis and evaluation) 3. Explain the obligations undertaken by the ship owner and the charterer in each of the types of Charter Party and the resulting allocation of costs. (evaluation) METHOD OF TEACHING AND In congruence with the teaching and learning strategy of the college, the LEARNING: following tools are used: a) Classes consist of lectures, discussions and case studies. Throughout the lectures students develop knowledge and understanding related to the subject content. Discussions reinforce students’ cognitive and key transferable skills. b) Office Hours: Students are encouraged to make full use of the office hours of their instructor in order to consult and discuss issues related to the course's content. -

Chartering Pools in Tramp Shipping and EC Article 81

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by NORA - Norwegian Open Research Archives Chartering Pools In Tramp Shipping And EC Article 81 Proposed changes to the implementation of EC competition rules and their implications for tramp shipping Kandidatnr: Veileder: Olav Kolstad Leveringsfrist: 25 April 2005 Til sammen 17 931 ord 25.04.2005 Contents 1 INTRODUCTION 1 1.1 BACKGROUND 1 1.2 LIMITS TO THE SCOPE OF THE PAPER 3 1.3 DEFINITIONS 3 1.4 SOURCES OF LAW AND METHOD 4 2 EC COMPETITION LAW IN THE TRAMP SHIPPING SECTOR 5 2.1 HISTORICALLY AND TODAY 5 2.2 ENFORCEMENT 6 2.3 PROPOSED CHANGES 8 3 CHARTERING POOLS AND THE TRAMP SHIPPING MARKET 10 3.1 THE CHARTERING POOL 10 3.2 THE TRAMP SHIPPING MARKET 12 4 DO CHARTERING POOLS INFRINGE ARTICLE 81(1)? 14 4.1 UNDERTAKINGS 16 4.2 AGREEMENTS, DECISIONS AND CONCERTED PRACTICES 16 4.3 TRADE BETWEEN MEMBER STATES 16 4.4 COMPETITION ANALYSIS - OBJECT OR EFFECT OF PREVENTING, RESTRICTING OR DISTORTING COMPETITION 17 4.4.1 OBJECT ANALYSIS 18 4.4.2 EFFECTS ANALYSIS 20 4.4.2.1 Joint purchasing 20 4.4.2.2 Restrictions on withdrawal from the pool 22 4.4.2.3 Non compete clauses 23 4.4.2.4 Information exchange 23 4.4.2.5 Cooperation on technical matters 25 4.4.3 ANCILLARITY 25 4.5 THE DE MINIMIS DOCTRINE 27 I 5 COULD CHARTERING POOLS QUALIFY FOR EXEMPTION UNDER ARTICLE 81(3)? 29 5.1.1 CONTRIBUTION TO ECONOMIC PROGRESS 30 5.1.2 BENEFIT TO CONSUMERS 34 5.1.3 INDISPENSABILITY 37 5.1.4 ELIMINATION OF COMPETITION 42 6 CONCLUSIONS 44 7 LITERATURE 47 7.1 BOOKS 47 7.2 COMMISSION REGULATIONS 47 7.3 COMMISSION PUBLICATIONS 48 7.4 ARTICLES 48 II 1 Introduction 1.1 Background The shipping market has from a legal standpoint long been divided into two, broad, market segments: liner shipping where vessels sail along regularly scheduled routes on a fixed timetable, and tramp shipping where vessels sail at the charterers’ discretion. -

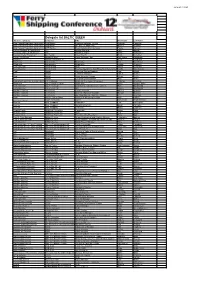

Delegate List BALTIC QUEEN

2012-05-1111:47 Delegate list BALTIC QUEEN Business category Company Title First Name Last Name Ship Power&Propulsion Automation ABB Marine Segment Manager Ferries Thomas Hackman Ship Power&Propulsion Automation ABB Marine VP, Sales & Marketing Marcus Högblom Ship Power&Propulsion Automation ABB Marine Products & Solution Manager Paavo Kojonen Interior Designer & Architecture AIA Interior Designer Alain Meylan Interior Designer & Architecture AIA Interior Designer Bruno Saint-Dizier Supplier Interior Equipment Alu Design Sales Director Frank Robertsen Travel Technology Amadeus SAS Sales Manager Ferry Axel Bruno Erpenbach Shipbroker Aminima Shipbrokers Pierre Courteaut Shipbroker Aquamarine Shipbroker Olof Berndtsson Shipbroker Aquamarine Shipbroker Joacim Thomson Ferry Operator Attica Group CEO Spiros Paschalis Ferry Operator Attica Group Director Operations, New Projects & DevelopmentCostis Stamboulelis Yard Austal Structural Design Manager Sam Abbott Yard Austal Technical Manager James Bennet Yard Austal Sales Manager Europé Simon Smith Yard Austal European Sales Manage Mike Wake Tolling systems, ITS, & Ferry TicketingB & T Signaal Business Development Manager Christian Brandrup Shipbroker Barry Rogliano Salles Shipbroker Bruno Jourdan Barry Ferry Operator Bay Ferries Ltd Chairman & Chief Executive Officer Mark MacDonald Ferry Operator Bay Ferries Ltd Mrs Joanne MacDonald Maritime Gaming Bell Casino Casino Manager Marcus Eliasson Maritime Gaming Bell Casino General Manager & CEO Morgan Eliasson Maritime Gaming Bell Casino Operation -

Blue Water Shipping A/S' General Terms for Shipbroker Businesses

Blue Water Shipping A/S’ General Terms for Shipbroker Businesses 1. Scope and application 1.1. These General Terms shall apply to any services performed by Blue Water Shipping A/S in its capacity as shipbroker. The general terms of purchase etc. of the orderer shall not apply to the contractual relationship, unless this has been explicitly accepted by Blue Water Shipping A/S in writing. 1.2. All offers procured by Blue Water Shipping A/S shall be non-binding, unless a time limit for acceptance is explicitly stated in the offer. 2. Agent 2.1. Unless otherwise explicitly agreed, Blue Water Shipping A/S shall perform its services as the agent of the orderer or as an intermediary. Blue Water Shipping A/S shall not be liable for any breach of the contract procured by Blue Water Shipping A/S. 3. Performance of the services 3.1. Blue Water Shipping A/S shall perform its services with due care and shall safeguard the orderer’s interests. 3.2. The orderer is aware that Blue Water Shipping A/S for a limited remuneration assumes significant risks, which, without any regulation, would be disproportionate to the remuneration. The orderer accordingly accepts that Blue Water Shipping A/S shall perform its services under the protection provided by these General Terms. 4. Instructions 4.1. The orderer shall provide Blue Water Shipping A/S with any instructions necessary for the performance of the services. The orderer shall accept that Blue Water Shipping A/S, at the risk and expense of the orderer, takes such steps as deemed necessary by Blue Water Shipping A/S for the performance of the services, including instances where Blue Water Shipping A/S has not been given adequate instructions or lacks sufficient time to obtain further instructions from the orderer. -

Shipbroking & Chartering.Indd

SHIPBROKING & CHARTERING FUNDAMENTALS The Essential Introduction to Shipbroking & Chartering Build your understanding of the components, the terminology & the dynamics of shipbroking & chartering, & confidently clarify many of the misconceptions that surround it 10 – 11 April 2018 • Perth | 8 – 9 August 2018 • Brisbane | 7 – 8 November 2018 • Melbourne Ambrose Rajadurai Our Expert Ambrose has had more than 40 years of cross disciplinary experience in the shipping industry based in Europe, Asia and Australia and has a Course good understanding of how theoretical aspects of chartering practice Instructor interact with operational outcomes, regulatory constraints, environmental considerations and quality vetting requirements on charterparty terms. Key Learning Objectives Understand shipbroking – the profession, its Comprehend CFR vs FOB sale terms origins, purpose and commercial relevance Analyse voyage estimating – how ship Explain shipping abbreviations – their owners determine freight rates origins, meaning and the risks that their usage can bring Identify laytime definitions Recognise alternative chartering strategies Gain a working knowledge of bills of lading Understand the charter party – its usage, Learn about arbitration and litigation purpose and legal influence on a charter agreement REGISTER NOW> www.informa.com.au/shipbrokingchartering SHIPBROKING & CHARTERING FUNDAMENTALS 10 – 11 April 2018 • Perth | 8 – 9 August 2018 • Brisbane | 7 – 8 November 2018 • Melbourne ABOUT THE COURSE OUR EXPERT COURSE INSTRUCTOR Shipbrokers are the key to a transaction between a ship Ambrose Rajadurai owner and the shippers of cargo. Ambrose has had more than 40 years of cross disciplinary experience in the The broker is involved in many stages of a deal: presenting shipping industry based in Europe, the business to potential clients, negotiating the main Asia and Australia and has a good terms of a contract, finalising the details of the contract understanding of how theoretical and following the deal through. -

Shipbroking + Technical + Logistics + Environmental Pre-Tax Profi T Basic EPS Group Revenue £M

Braemar Shipping Services plc Annual Report 2010 Shipbroking + Technical + Logistics + Environmental Pre-tax profi t Basic EPS Group revenue £m 10 119.0 09 127.1 £13.5m 47.93p 08 101.0 2009: £16.2m 2009: 56.70p 07 73.8 06 60.8 Cash Cash generation Adjusted earnings per share pence* 10 47.93 09 56.70 £27.9m £15.3m 08 48.99 2009: £25.2m 2009: £21.0m 07 36.90 06 36.85 Final dividend 12 month forward order book Adjusted profi t before tax £m* 10 13.5 09 16.2 16.25p £28.0m 08 14.7 Full year: 25.0p 2009: £29.0m 07 11.0 06 10.3 Dividends pence 10 25.0 09 24.0 08 23.0 07 19.0 06 18.0 * Profi ts and earnings in 2007 are adjusted to exclude an exceptional impairment charge Shipbroking + Technical + In 2010 the Group’s The newly established cargo shipbroking division sold a adjusting business, Braemar record number of ships in the Marine has established a secondhand sector including presence in 5 countries and 85 vessels for demolition and the newly opened offi ce of recycling making the year Wavespec in Houston is one of the most successful. providing LNG consultancy services in the USA. For more information: www.braemarplc.com The Group is divided into four Contents Operations of Review 2010 operating divisions: Shipbroking, 2010 Review of operations Technical, Logistics and Environmental. Highlights 02 Overview 04 International presence These work together to offer a unique 06 Chairman’s statement 08 Chief Executive’s review combination of skills for clients, at any 20 Corporate social responsibility report time, anywhere in the world.