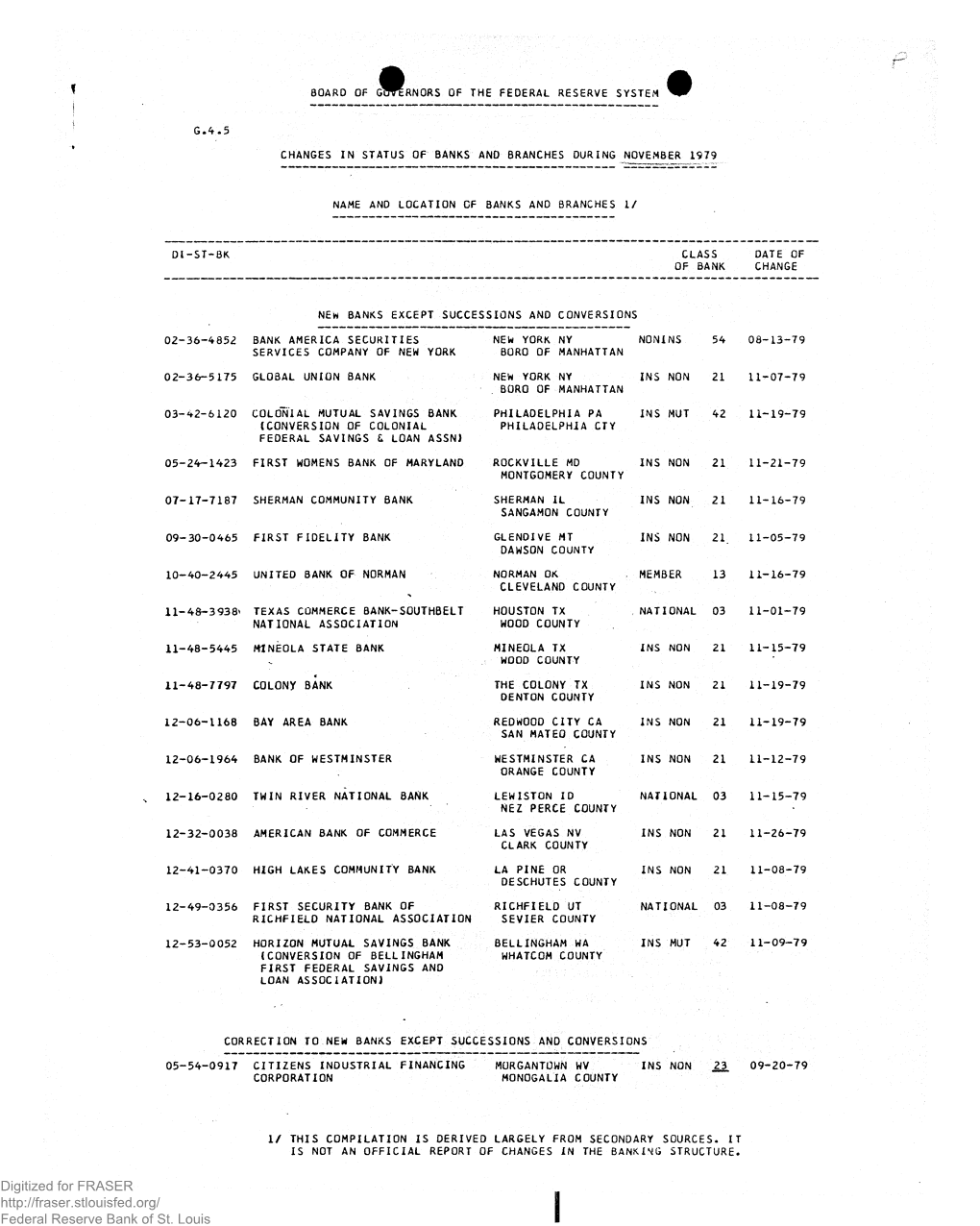

G.4.5 Changes in Status of Banks and Branches

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Operation of Savings-Bank Life Insurance in Massachusetts and New York

UNITED STATES DEPARTMENT OF LABOR Frances Perkins, Secretary BUREAU OF LABOR STATISTICS Isador Lubin, Commissioner (on leave) A . F. Hinrichs, Acting Commissioner + Operation of Savings-Bank Life Insurance in Massachusetts and New York Revision of Bulletin No. 615: The Massachusetts System of Savings-Bank Life Insurance, by Edward Berman ♦ Bulletin 7s[o. 688 UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON : 1941 For sale by the Superintendent of Documents, Washington, D. C. Price 20 cents Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis UNITED STATES DEPARTMENT OF LABOR F rances P er k ins, S e c r e t a r y + BUREAU OF LABOR STATISTICS I s a d o r L tjbin, Commissioner (o n lea v e) A. F. H in r ic h s , Acting Commissioner Donald Davenport, Chief, Employ Aryness Joy, Chief, Prices and Cost of ment and Occupational Outlook Living Branch Branch N. Arnold Tolies, Chief, Working Con Henry J. Fitzgerald, Chief, Business ditions and Industrial Relations Management Branch Branch Hugh S. Hanna, Chief, Editorial and Research Sidney W. Wilcox, Chief Statistician CHIEFS OF DIVISIONS Herman B. Byer, Construction and Charles F. Sharkey, Labor Law In Public Employment formation J. M. Cutts, Wholesale Prices Boris Stern, Labor Information Ser W. Duane Evans, Productivity and vice Technological Developments Stella Stewart, Retail Prices Swen Kjaer, Industrial Accidents John J. Mahanev, Machine Tabula Lewis E. Talbert, Employment Sta tion tistics Robert J. Myers, Wage and Hour Emmett H. Welch, Occupational Out Statistics look Florence Peterson, Industrial Rela tions Faith M. Williams, Cost of Living i i Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. -

Sound Banking

Sound Banking Sound Banking Rebecca Söderström Dissertation presented at Uppsala University to be publicly examined in Auditorium Minus, Gustavianum, Akademigatan 3, Uppsala, Friday, 12 May 2017 at 10:15 for the degree of Doctor of Laws. The examination will be conducted in English. Faculty examiner: Professor Nina Dietz Legind. Abstract Söderström, R. 2017. Sound Banking. 370 pp. Uppsala: Juridiska fakulteten, Uppsala universitet. ISBN 978-91-506-2627-8. Banks are subject to a comprehensive body of legal rules and conduct their business under constant supervision of authorities. Since the financial crisis of 2008, the number of rules governing banking has grown and the structures of supervision have likewise been enhanced. This thesis analyses various aspects of the regulation and supervision of banks, and focuses especially on soundness as a normative concept to regulate banks. Soundness is a legal prerequisite in, for example Swedish, law and appears in relation to banking in many other jurisdictions. The aims of this thesis are to examine how the normative concept of soundness functions in the regulation and supervision of banks, to present general insights into how banking regulation and supervision function and how the financial crisis of 2008 has affected banking regulation and supervision. The thesis proposes a taxonomy of soundness – confidence – stability to describe the normative context of soundness. The taxonomy is connected to the theoretical arguments for bank regulation and is used as a tool to analyse three areas of banking regulation: authorisation, capital requirements and banks in trauma. The three areas correspond to the outline of the thesis according to The Story of the Bank, which includes the formation, operation and failure of banks. -

During the Past Two Decades, the U.S. Housing Finance System Experienced Changes of a Magnitude Unseen Since the New Deal Era

FOREWORD During the past two decades, the U.S. housing finance system experienced changes of a magnitude unseen since the New Deal era. In the 1980s, the primary mortgage market restructured and consolidated as a result of the savings and loan crisis, adjustable-rate mortgages became widely available, and the secondary mortgage market grew rapidly. The 1990s saw continued industry consolidation, as well as significant technological de- velopments in mortgage finance. In addition, the past decade was a time of considerable innovation in affordable mortgage lending, part of a growing movement to connect his- torically underserved households and communities to the mainstream housing finance system. This volume examines this movement through case studies of organizations recognized by their peers as leaders in expanding homeownership opportunities. In an extension of their earlier research for the U.S. Department of Housing and Urban Development, the authors describe the efforts of a broad cross section of industry participants, including small and large lenders, nonprofit community-based organizations (CBOs), and lending consortia. They document a wide range of strategies—in the areas of management, out- reach, borrower qualification, and homeowner retention—designed to expand and sus- tain homeownership among lower-income and minority households. The case studies illustrate three notable aspects of recent efforts to extend the reach of homeownership. First, they demonstrate that leaders in the mortgage finance industry view historically underserved populations and communities as viable business markets rather than regulatory burdens, and back this perspective with action. Second, the stud- ies show the vital role that partnership plays in expanding opportunity. -

2581, Effective January 12, 1984

In The Matter of the Petition of "M" Bank, A Mutual Savings Bank and the "O" Bank for a Declaratory Ruling DOC #2581, Effective January 12, 1984 Pursuant to RSA 541-A:1, IV, RSA 541-A:2, I (d) and Rev 104.04, New Hampshire Code of Administrative Rules the "M" Bank, a Mutual Savings Bank (hereinafter referred to as "Bank") and "O" Bank (hereinafter referred to as "Holding Company") a business corporation organized and existing pursuant to RSA 293-A with its principal place of business in .............., N. H., petition the Department of Revenue Administration for a declaratory ruling with respect to the New Hampshire tax consequences of the conversion of the "M" Bank, a Mutual Savings Bank, from mutual to stock form, as a subsidiary of "O" Bank of ..............., New Hampshire. Through its attorneys-in-fact, the Petitioners represent the following: The purpose of the Plan of Conversion is to accomplish (a) the conversion of a mutual savings bank to a "guaranty" (stock) savings bank subsidiary of Holding Company, and (b) the sale of stock of Holding Company to Bank depositors and other classes of potential subscribers, by a procedure similar to that established by the Federal Home Loan Bank Board ("FHLBB") for conversions of federally chartered mutual thrift institutions to stock forms. Pursuant to New Hampshire RSA 386:10 (II), these procedures and regulations have also been adopted by the New Hampshire General Court (Legislature) and Banking Commissioner for use with respect to conversion of state-chartered mutual savings banks to stock banks. On September 14, 1983 the Board of Directors of Bank adopted a Plan of Conversion (hereinafter referred to as "Plan") whereby Bank will be converted to a guaranty (stock) savings bank (hereinafter sometimes referred to as "Stock Bank" to distinguish the same from the Bank prior to conversion) all of the stock of which will be held by Holding Company. -

School of Economics & Business Administration Master of Science in Management “MERGERS and ACQUISITIONS in the GREEK BANKI

School of Economics & Business Administration Master of Science in Management “MERGERS AND ACQUISITIONS IN THE GREEK BANKING SECTOR.” Panolis Dimitrios 1102100134 Teti Kondyliana Iliana 1102100002 30th September 2010 Acknowledgements We would like to thank our families for their continuous economic and psychological support and our colleagues in EFG Eurobank Ergasias Bank and Marfin Egnatia Bank for their noteworthy contribution to our research. Last but not least, we would like to thank our academic advisor Dr. Lida Kyrgidou, for her significant assistance and contribution. Panolis Dimitrios Teti Kondyliana Iliana ii Abstract M&As is a phenomenon that first appeared in the beginning of the 20th century, increased during the first decade of the 21st century and is expected to expand in the foreseeable future. The current global crisis is one of the most determining factors affecting M&As‟ expansion. The scope of this dissertation is to examine the M&As that occurred in the Greek banking context, focusing primarily on the managerial dimension associated with the phenomenon, taking employees‟ perspective with regard to M&As into consideration. Two of the largest banks in Greece, EFG EUROBANK ERGASIAS and MARFIN EGNATIA BANK, which have both experienced M&As, serve as the platform for the current study. Our results generate important theoretical and managerial implications and contribute to the applicability of the phenomenon, while providing insight with regard to M&As‟ future within the next years. Keywords: Mergers &Acquisitions, Greek banking sector iii Contents 1. Introduction ................................................................................................................ 1 2. Literature Review .......................................................................................................... 4 2.1 Streams of Research in M&As ................................................................................ 4 2.1.1 The Effect of M&As on banks‟ performance .................................................. -

Staff Study 174

Board of Governors of the Federal Reserve System Staff Study 174 Bank Mergers and Banking Structure in the United States, 1980–98 Stephen A. Rhoades August 2000 The following list includes all the staff studies published 171. The Cost of Bank Regulation: A Review of the Evidence, since November 1995. Single copies are available free of by Gregory Elliehausen. April 1998. 35 pp. charge from Publications Services, Board of Governors of 172. Using Subordinated Debt as an Instrument of Market the Federal Reserve System, Washington, DC 20551. To be Discipline, by Federal Reserve System Study Group on added to the mailing list or to obtain a list of earlier staff Subordinated Notes and Debentures. December 1999. studies, please contact Publications Services. 69 pp. 168. The Economics of the Private Equity Market, by 173. Improving Public Disclosure in Banking, by Federal George W. Fenn, Nellie Liang, and Stephen Prowse. Reserve System Study Group on Disclosure. November 1995. 69 pp. March 2000. 35 pp. 169. Bank Mergers and Industrywide Structure, 1980–94, 174. Bank Mergers and Banking Structure in the United States, by Stephen A. Rhoades. January 1996. 29 pp. 1980–98, by Stephen A. Rhoades. August 2000. 33 pp. 170. The Cost of Implementing Consumer Financial Regula- tions: An Analysis of Experience with the Truth in Savings Act, by Gregory Elliehausen and Barbara R. Lowrey. December 1997. 17 pp. The staff members of the Board of Governors of the The following paper is summarized in the Bulletin Federal Reserve System and of the Federal Reserve Banks for September 2000. The analyses and conclusions set forth undertake studies that cover a wide range of economic and are those of the author and do not necessarily indicate financial subjects. -

Insurance Times: MASS. BANKS TRIED HOLDING COMPANY ROUTE BEFORE INSURER LIBERTY MUTUAL December 11, 2001, Vol. XX No. 25 Giant

Insurance Times: MASS. BANKS TRIED HOLDING COMPANY ROUTE BEFORE INSURER LIBERTY MUTUAL December 11, 2001, Vol. XX No. 25 Giant P/C Insurer Wins Approval to Form MHC by Mark Hollmer InsuranceTimes BOSTON — Eastern Bank was once a small mutual savings bank based in Lynn. But then in 1989, the Massachusetts Division of Banks approved the bank’s application to reorganize as a mutual holding company – the first in the state to do so. Andrew Calamare was Massachusetts Commissioner of Banks at the time. He said the change helped Eastern to become a regional powerhouse. “It has certainly not hurt them,” said Calamare, now president and CEO of the Life Insurance Association of Massachusetts. “Now it is the second largest bank in the … state chartered system,” he said. Liberty Mutual Status Twelve years later, Liberty Mutual has become the state’s first property casualty insurer to win mutual holding company status. Insurance Commissioner Linda Ruthardt approved Liberty Mutual’s mutual holding company application at the end of November, the first mutual insurer to do so under a 1998 state law. The approval allows Liberty mutual to form a holding company that becomes the corporate parent of Liberty Mutual Insurance Co. and sister divisions Liberty Mutual Fire and Liberty Mutual Life. DOI approval to merger Liberty subsidiary Wausau Insurance into the mutual holding company and also reorganize Liberty Mutual Fire within the new system is still pending, however. When all is complete, Liberty Mutual will maintain mutuality but gain the right to offer stock if it chooses. Shareholders can own up to 49 percent of the company, but policyholders will always own at least 51 percent. -

Federal Register/Vol. 79, No. 211/Friday, October 31, 2014/Notices

64784 Federal Register / Vol. 79, No. 211 / Friday, October 31, 2014 / Notices FEDERAL HOUSING FINANCE fhfa.gov or 202–658–9266, Office of certified as community development AGENCY Housing and Regulatory Policy, Division financial institutions (CDFIs) are of Housing Mission and Goals, Federal deemed to be in compliance with the [No. 2014–N–13] Housing Finance Agency, Ninth Floor, community support requirements and Federal Home Loan Bank Members 400 Seventh Street SW., Washington, are not subject to periodic community Selected for Community Support DC 20024. support review, unless the CDFI Review 2014–2015 Review Cycle—4th SUPPLEMENTARY INFORMATION: member is also an insured depository institution or a CDFI credit union. 12 Round I. Selection for Community Support CFR 1290.2(e). AGENCY: Federal Housing Finance Review Under the regulation, FHFA selects Agency. Section 10(g)(1) of the Federal Home approximately one-eighth of the ACTION: Notice. Loan Bank Act (Bank Act) requires members in each Bank district for FHFA to promulgate regulations community support review each SUMMARY: The Federal Housing Finance establishing standards of community calendar quarter. 12 CFR 1290.2(a). Agency (FHFA) is announcing the investment or service that Bank FHFA will not review an institution’s Federal Home Loan Bank (Bank) members must meet in order to community support performance until it members it has selected for the 2014– maintain access to long-term Bank has been a Bank member for at least one 2015 Review Cycle—4th Round under advances. See 12 U.S.C. 1430(g)(1). The year. Selection for review is not, nor FHFA’s community support regulations promulgated by FHFA must should it be construed as, any requirements regulation. -

The Preservation and Adaptation of a Financial Architectural Heritage

University of Pennsylvania ScholarlyCommons Theses (Historic Preservation) Graduate Program in Historic Preservation 1998 The Preservation and Adaptation of a Financial Architectural Heritage William Brenner University of Pennsylvania Follow this and additional works at: https://repository.upenn.edu/hp_theses Part of the Historic Preservation and Conservation Commons Brenner, William, "The Preservation and Adaptation of a Financial Architectural Heritage" (1998). Theses (Historic Preservation). 488. https://repository.upenn.edu/hp_theses/488 Copyright note: Penn School of Design permits distribution and display of this student work by University of Pennsylvania Libraries. Suggested Citation: Brenner, William (1998). The Preservation and Adaptation of a Financial Architectural Heritage. (Masters Thesis). University of Pennsylvania, Philadelphia, PA. This paper is posted at ScholarlyCommons. https://repository.upenn.edu/hp_theses/488 For more information, please contact [email protected]. The Preservation and Adaptation of a Financial Architectural Heritage Disciplines Historic Preservation and Conservation Comments Copyright note: Penn School of Design permits distribution and display of this student work by University of Pennsylvania Libraries. Suggested Citation: Brenner, William (1998). The Preservation and Adaptation of a Financial Architectural Heritage. (Masters Thesis). University of Pennsylvania, Philadelphia, PA. This thesis or dissertation is available at ScholarlyCommons: https://repository.upenn.edu/hp_theses/488 UNIVERSITY^ PENN5YLV^NIA. UBKARIE5 The Preservation and Adaptation of a Financial Architectural Heritage William Brenner A THESIS in Historic Preservation Presented to the Faculties of the University of Pennsylvania in Partial Fulfillment of the Requirements for the Degree of MASTER OF SCIENCE 1998 George E. 'Thomas, Advisor Eric Wm. Allison, Reader Lecturer in Historic Preservation President, Historic District ouncil University of Pennsylvania New York City iuatg) Group Chair Frank G. -

Disclosure 1

ANNUAL REPORT 2012 Social Responsibility Vision MAPFRE wants to be the most trusted global insurance company Mission We are a multinational team that continuously strives to improve our service and develop the best relationship possible with our customers, distributors, suppliers, shareholders and Society Values SOLVENCY INTEGRITY SERVICE VOCATION INNOVATIVE LEADERSHIP COMMITTED TEAM Values SOLVENCY Financial strength with sustainable results. International diversification and consolidation in various markets. INTEGRITY Ethics govern the behaviour of all personnel. Socially responsible focus in all of our activities. SERVICE VOCATION Constant search for excellence in the development of our activities. Continuous initiatives focused on minding our relationship with our customers. INNOVATIVE LEADERSHIP Willingness to surpass ourselves and to constantly improve. Useful technology for servicing the businesses and their objectives. COMMITTED TEAM Total team commitment with MAPFRE’s project. Constant training and development of the team’s capabilities and skills. ANNUAL REPORT 2012 Social Responsibility Table of contents 2 1. Chairman’s Letter 4 4. MAPFRE’s social dimension 26 2. General Information 6 MAPFRE and its employees 27 MAPFRE and its customers 38 Presence 8 MAPFRE and its shareholders 55 MAPFRE Group’s corporate organization chart 9 MAPFRE and the professionals and entities Key economic figures 10 that help distribute products 57 Governing Bodies 11 MAPFRE and its suppliers 62 3. MAPFRE and Corporate Social 5. MAPFRE’s environmental -

Mutual Savings Banks and Building and Loan Associations

o I PART 4 MUTUAL SAVINGS BANI{S AND BUILDING AND LOAN ASSOCIATIONS PREPARED BY THE STAFFS OF THE TREASURY AND THE JOINT COMMITTEE ON INTERNAL REVENUE TAXATION APRIL 1951 UNITED STATES GOVERNMENT PRINTING OFFICE 81736 WASHINGTON: 1951 MUTUAL SAVINGS BANKS AND BUILDING AND LOAN ASSOCIATIONS 1. 11 UTUAL SAVINGS BANKS A. DESCRIPTION OF THE ORGANIZATIONS 11 u t.ual savings banks perfol'lll t.wo basic functions: The encourage ment of thirft and the provision of safe and convenient facilit.ies t.o care for savings. They also have the responsibility of investing t.he funds left. with them so as to be able to give their depositors a return on their savings. ~lutual savings banks were originally organized for the principal purpose of serving factory workers and other wage earn ers of moderate means who, at the time these banks were started, had no other place where they could put their savings. In keeping with the objective of serving small deposit.ors, limita tions were usually placed by the States upon the deposits which any one individual could have in any pne bank. AlthOlltgh 8 of the 17 States in 'which lllutual savings banks are located still limit the size of the balance that nlay be held in anyone account, these limits have been rising in recent )Tears. Today, the limit is $7,500 in New York and $5,000 in ~iassachusetts. In Pennsylvania, a State which does not impose any statutory limitation on the size of deposits, individual banks may take it upon themselves to do so. -

Edited Excerpt on Mutual Form from Howell E. Jackson & Edward L

§ 5. The Mutual Form -1- Edited Excerpt on Mutual Form from Howell E. Jackson & Edward L. Symonds, Jr., Regulation of Financial Institutions 551-78 (West 1999) Section 5. The Mutual Form We now turn our attention from the primary focus of insurance regulation -- the relationship between insurer and insured -- to issues of organizational form. One peculiarity of the insurance industry is that many major firms are organized as "mutuals" -- that is legal entities that lack traditional equity shareholders. For example, in the life insurance industry as of 1994, mutual insurance companies held forty-one percent of industry assets. Moreover, six of the ten largest life insurance companies were organized in mutual form. On the property-casualty side, mutuals are somewhat less significant (holding more than a quarter of sector assets), but still constituted a substantial segment of the industry. The focus of attention in this section of the casebook is the "demutualization process," which consists of the legal arrangements whereby mutuals change their corporate form, either through liquidation or conversion into more traditional stock corporations. Demutualization is not unique to insurance companies, and has applications to other types of financial intermediaries, most notably savings and loan associations and savings banks, which also often organize themselves in mutual form. While this section is primarily concerned with the demutualization of insurance companies, we also consider briefly a parallel development in the savings bank industry. A. Demutualization of Insurance Companies To understand the demutualization process, one must first have a general appreciation of the legal relationship between mutual insurance companies and their policyholders.