Financial Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

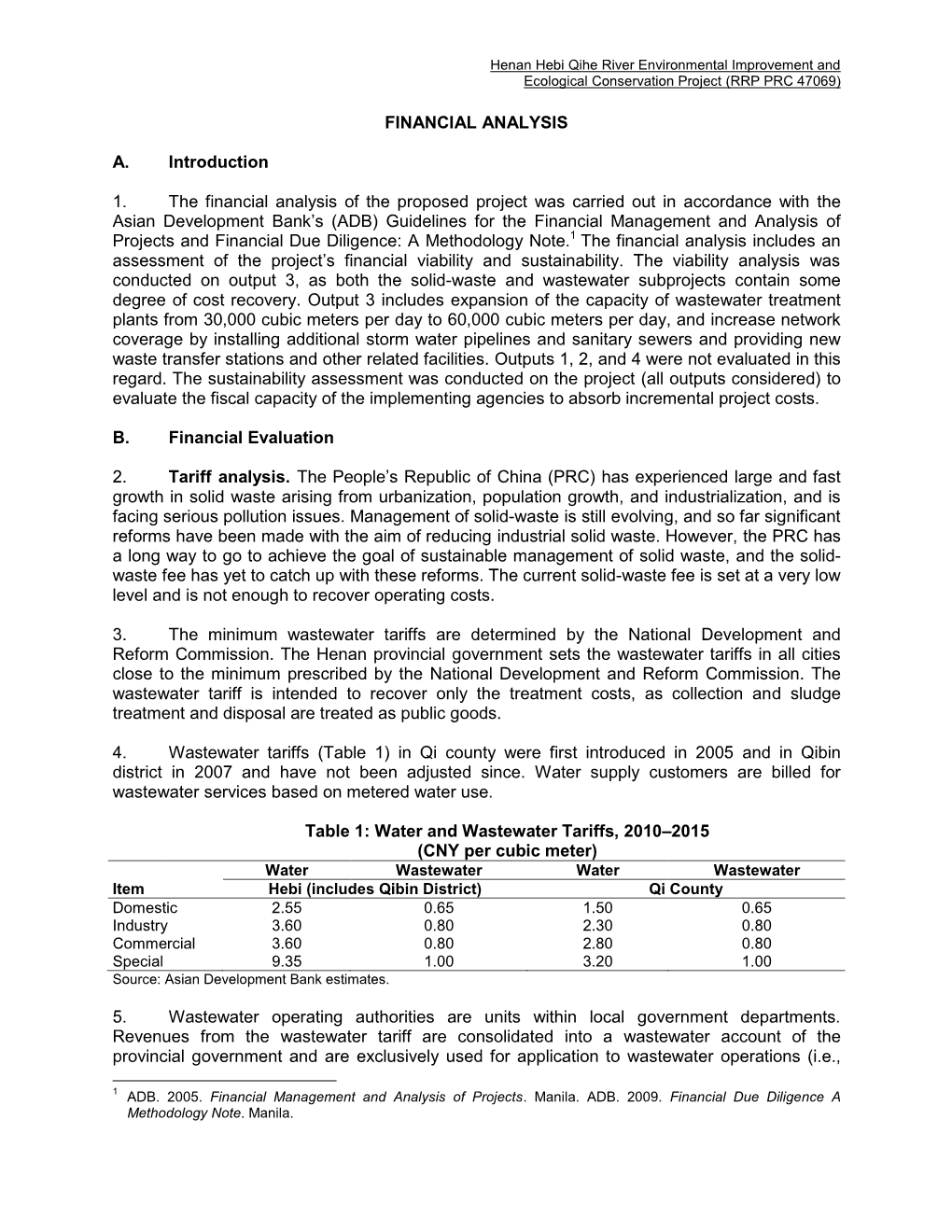

Recommended publications

-

Bank of Zhengzhou Co., Ltd.* 鄭州銀行股份有限公司 *

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Bank of Zhengzhou Co., Ltd.* 鄭州銀行股份有限公司* (A joint stock company incorporated in the People’s Republic of China with limited liability) (H Shares Stock Code: 6196) (Preference Shares Stock Code: 4613) ANNOUNCEMENT OF ANNUAL RESULTS FOR THE YEAR ENDED DECEMBER 31, 2020 The board of directors (the “Board”) of Bank of Zhengzhou Co., Ltd.* (the “Bank”) is pleased to announce the audited consolidated annual results (the “Annual Results”) of the Bank and its subsidiaries for the year ended December 31, 2020. This results announcement, containing the full text of the 2020 annual report of the Bank, complies with the relevant content requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcements of Annual Results. The Board and the audit committee of the Board have reviewed and confirmed the Annual Results. This results announcement is published on the websites of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk) and the Bank (www.zzbank.cn). The printed version of the annual report for the year ended December 31, 2020 will be despatched to the shareholders of the Bank and will be available on the above websites in April 2021. -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Announcement of Annual Results for the Year Ended December 31, 2019

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Stock Code of H Shares: 1216) (Stock Code of Preference Shares: 4617) ANNOUNCEMENT OF ANNUAL RESULTS FOR THE YEAR ENDED DECEMBER 31, 2019 The board of directors (the “Board”) of Zhongyuan Bank Co., Ltd. (the “Bank”) is pleased to announce the audited consolidated annual results (the “Annual Results”) of the Bank and its subsidiaries for the year ended December 31, 2019 (the “Reporting Period”) which were prepared in accordance with the International Financial Reporting Standards (“IFRSs”). The Board and the audit committee of the Board have reviewed and confirmed the Annual Results. This results announcement is published on the websites of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk) and the Bank (www.zybank.com.cn). The annual report for the year ended December 31, 2019 will be despatched to the shareholders of the Bank and will be available on the above websites in due course. On behalf of the Board Zhongyuan Bank Co., Ltd.* DOU Rongxing Chairman Zhengzhou, the People’s Republic of China March 27, 2020 As at the date of this announcement, the Board comprises Mr. DOU Rongxing, Mr. WANG Jiong, Mr. LI Yulin and Mr. WEI Jie as executive directors; Mr. LI Qiaocheng, Mr. LI Xipeng and Mr. -

Technical Assistance Layout with Instructions

Environmental Monitoring Report Project Number: 47069-002 April 2020 PRC: Henan Hebi Qihe River Environmental Improvement and Ecological Conservation Project Semi-Annual Environmental Monitoring Report for July−December 2019 Prepared by ESD China Limited for the Henan Hebi City Project Management Office and the Asian Development Bank. This environmental monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. Environmental Monitoring Report Project Number: 47069 January 2020 PRC: Henan Hebi Qihe River Environmental Improvement and Ecological Conservation Project Semi-Annual Environmental Monitoring Report for (1 July –31 December 2019) Prepared by ESD China Limited for the Henan Hebi City Project Management Office and the Asian Development Bank. CURRENCY EQUIVALENTS (as of 28 June 2019) Currency unit – Yuan (CNY) CNY1.00 = $0.15 $1.00 = CNY6.87 ACRONYMS AND ABBREVIATIONS ADB Asian Development Bank LSMI licensed soil erosion institute BOD5 5-day biochemical oxygen demand MOE Ministry of Environment CNY Chinese Yuan, Renminbi NH3-N Ammonia nitrogen CO2 Carbon dioxide NO2 Nitrate CODcr Chemical oxygen demand -

Central China Securities Co., Ltd

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Central China Securities Co., Ltd. (a joint stock company incorporated in 2002 in Henan Province, the People’s Republic of China with limited liability under the Chinese corporate name “中原證券股份有限公司” and carrying on business in Hong Kong as “中州證券”) (Stock Code: 01375) ANNUAL RESULTS ANNOUNCEMENT FOR THE YEAR ENDED 31 DECEMBER 2017 The board (the “Board”) of directors (the “Directors”) of Central China Securities Co., Ltd. (the “Company”) hereby announces the audited annual results of the Company and its subsidiaries for the year ended 31 December 2017. This annual results announcement, containing the full text of the 2017 annual report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcements of annual results and have been reviewed by the audit committee of the Company. The printed version of the Company’s 2017 annual report will be dispatched to the shareholders of the Company and available for viewing on the website of Hong Kong Exchanges and Clearing Limited at www.hkexnews.hk, the website of the Shanghai Stock Exchange at www.sse.com.cn and the website of the Company at www.ccnew.com around mid-April 2018. -

Henan Hebi Qihe River Environmental Improvement and Ecological Conservation Project

China, People's Republic of: Henan Hebi Qihe River Environmental Improvement and Ecological Conservation Project Project Name Henan Hebi Qihe River Environmental Improvement and Ecological Conservation Project Project Number 47069-001 Country China, People's Republic of Project Status Closed Project Type / Modality of Technical Assistance Assistance Source of Funding / Amount TA 8739-PRC: Henan Hebi Qihe River Environmental Improvement and Ecological Conservation Project Technical Assistance Special Fund US$ 600,000.00 Strategic Agendas Environmentally sustainable growth Inclusive economic growth Drivers of Change Knowledge solutions Private sector development Sector / Subsector Agriculture, natural resources and rural development - Rural flood protection - Water-based natural resources management Water and other urban infrastructure and services - Urban flood protection - Urban sewerage Gender Equity and Effective gender mainstreaming Mainstreaming Description The PPTA will (i) assess the technical feasibility of the project; (ii) conduct due diligence on the economic and financial feasibility of the project; (iii) review safeguard requirements; (iv) conduct social survey and consultations; (v) develop capacity of the HCG for project management; and (vi) prepare project documents, including feasibility study reports (FSR), safeguard documents, and ADB''s draft report and recommendations of the President (RRP). Project Rationale and Linkage The Hebi City Government (HCG) requested the Asian Development Bank (ADB) to provide lending to Country/Regional -

China Report 2018 (FINAL – WEB)

CHINA’S CRACKDOWN ON CHRISTIANITY An analysis of the persecution of Christians in China in the first year of implementation of new Regulations for Religious Affairs (February 2018 – January 2019) A briefing document prepared for the Oireachtas Joint Committee on Foreign Affairs and Trade, and Defence (September 2019) TABLE OF CONTENTS Page 3 Introduction Pages 4 – 5 China Country Profile Page 6 Revised Regulations for Religious Affairs Page 7 Persecution of Other Religions Pages 8 – 10 Selected Case Histories Page 11 Map of China’s Provinces with Statistics Pages 12 – 33 List of Persecution Incidents (February 2018 – January 2019) Page 34 Conclusion Page 35 Recommendations Page 36 Sources COVER PHOTO Cross removed from church in Gongyi city in Henan Province in May 2018. (Photo Credit: Bitter Winter) Church in Chains is an independent Irish charity that encourages prayer and action in support of persecuted Christians worldwide. It is a member of the Department of Foreign Affairs and Trade Committee on Human Rights. This Briefing has been researched by Susanne Chipperfield (Operations Co-ordinator) and written by David Turner (Director). CHURCH IN CHAINS PO Box 10447, Glenageary, Co. Dublin, Ireland T 01-282 5393 E [email protected] W www.churchinchains.ie CHINA’s CRACKDOWN ON CHRISTIANITY Introduction and Background This briefing has been prepared by Church in Chains in response to the current crackdown on religion in China under the government’s “Sinicisation” policy – promoted by President Xi Jinping with the objective of creating a Chinese version of every religion and making every religion conform and be subservient to the Chinese Communist Party. -

A Vig a Ting Hin A

September 19, 2017 Education Invest for a bright future HINA C ■ We assume coverage on the China education sector with an Overweight rating. K-12 after-school tutoring is our preferred segment and New Oriental Education (EDU) is our top pick. Our order of preference is: 1) K-12 after-school tutoring providers, EDU and TAL Education (TAL), 2) K-12 private school players, China Yuhua and China Maple Leaf, and 3) vocational training provider, Tarena. ■ We forecast the K-12 after-school tutoring market to post a 4-year revenue CAGR of 12.7% yoy to Rmb1.29tr by 2020F. This market is still quite fragmented as the market shares of the no.1 and no.2 players, TAL and EDU, were only 0.8% and 0.7% in 2016, respectively. We expect leading players to benefit from the recent ‘Gaokao’ reform and further consolidate the market. ■ We view the amendment to the Law for Promoting Private Education that came into AVIGATING AVIGATING effect on 1 Sep 2017 as beneficial to private education providers, including Yuhua and China Maple Leaf. ■ We use DCF as our key valuation methodology given education players’ relatively N stable and predictable cash flows. Analyst(s) Lei YANG, CFA T (86) 21 5047 1771 x108 E [email protected] ONG Khang Chuen T (852) 2539 1326 E [email protected] IMPORTANT DISCLOSURES, INCLUDING ANY REQUIRED RESEARCH CERTIFICATIONS, ARE PROVIDED AT THE Powered by END OF THIS REPORT. IF THIS REPORT IS DISTRIBUTED IN THE UNITED STATES IT IS DISTRIBUTED BY CIMB the EFA SECURITIES (USA), INC. -

Distribution, Genetic Diversity and Population Structure of Aegilops Tauschii Coss. in Major Whea

Supplementary materials Title: Distribution, Genetic Diversity and Population Structure of Aegilops tauschii Coss. in Major Wheat Growing Regions in China Table S1. The geographic locations of 192 Aegilops tauschii Coss. populations used in the genetic diversity analysis. Population Location code Qianyuan Village Kongzhongguo Town Yancheng County Luohe City 1 Henan Privince Guandao Village Houzhen Town Liantian County Weinan City Shaanxi 2 Province Bawang Village Gushi Town Linwei County Weinan City Shaanxi Prov- 3 ince Su Village Jinchengban Town Hancheng County Weinan City Shaanxi 4 Province Dongwu Village Wenkou Town Daiyue County Taian City Shandong 5 Privince Shiwu Village Liuwang Town Ningyang County Taian City Shandong 6 Privince Hongmiao Village Chengguan Town Renping County Liaocheng City 7 Shandong Province Xiwang Village Liangjia Town Henjin County Yuncheng City Shanxi 8 Province Xiqu Village Gujiao Town Xinjiang County Yuncheng City Shanxi 9 Province Shishi Village Ganting Town Hongtong County Linfen City Shanxi 10 Province 11 Xin Village Sansi Town Nanhe County Xingtai City Hebei Province Beichangbao Village Caohe Town Xushui County Baoding City Hebei 12 Province Nanguan Village Longyao Town Longyap County Xingtai City Hebei 13 Province Didi Village Longyao Town Longyao County Xingtai City Hebei Prov- 14 ince 15 Beixingzhuang Town Xingtai County Xingtai City Hebei Province Donghan Village Heyang Town Nanhe County Xingtai City Hebei Prov- 16 ince 17 Yan Village Luyi Town Guantao County Handan City Hebei Province Shanqiao Village Liucun Town Yaodu District Linfen City Shanxi Prov- 18 ince Sabxiaoying Village Huqiao Town Hui County Xingxiang City Henan 19 Province 20 Fanzhong Village Gaosi Town Xiangcheng City Henan Province Agriculture 2021, 11, 311. -

中国(偶蹄類の加熱処理肉等) 2021/5/25通知 No. NAME

中国(偶蹄類の加熱処理肉等) 2021/5/25通知 No. NAME ADDRESS TEMPORARY HUANG GANG NO.670, SHUN HUANG ROAD, SUN HE 1100/03009 BEIJING HORMEL FOODS CO.,LTD. COUNTY, CHAOYANG DISTRICT, BEIJING, CHINA 1100/03015 BEIJING DAFA CHIA TAI CO.,LTD YANGZHEN DUZHUANG, SHUNYI DISTRICT, BEIJING CITY, CHINA 1100/03039 BEIJING JIAYI FOOD JOINT FACTORY XIAOTANGSHAN TOWN, CHANGPING DISTRICT, BEIJING BEIJING ER SHANG MOQI ZHONGHONG FOODS NO. 233 NANGAO VILLAGE CUIGEZHUANG TOWNSHIP CHAOYANG 1100/15006 CO.,LTD. DISTRICT BEIJING, CHINA 1200/01025 TIANJIN LINGCHUAN FOOD CO.,LTD XINKOU INDUSTRIAL ZONE BY ROAD NO.18, XIQING DISTRICT, TIANJIN TIANJIN 3RD FOOD PRODUCTS PROCESSING 1200/03001 HANJIASHU, BEICHEN DISTRICT, TIANJIN FACTORY 1200/03008 TIANJIN MEAT PRODUCTS PROCESSING COMPLEX NO.8, YUEJIN ROAD, DONGLI DISTRICT, TIANJIN NO.8 XINWANG ROAD, SHUANGQIAOHE TOWN, JINNAN DISTRICT, 1200/03009 TIANJIN DONGTIAN FOODS PROCESSING CO., LTD TIANJIN, CHINA TIANJIN TEDA TIANQUAN QUICK FROZEN 1200/29002 NO.11, JINGU ROAD, TANGGU DISTRICT, TIANJIN FOODSTUFFS CO.,LTD. 1200/29005 TIANJIN GUOSHI FOOD CO., LTD. LANGYUAN VILLAGE, BEICHEN DISTRICT, TIANJIN 1200/29012 TIANJIN SHIYOU FOODSTUFFS CO.,LTD. SICUNDIAN, WUQING COUNTY, TIANJIN 1200/29016 TIANJIN NICKY FOODSTUFFS CO., LTD. 13 STREET, EXPORT PROCESSING ZONE, TIANJIN NO.171, MUSLIM BUSINESS TRADE STREET, XIADIAN TOWN, DACHANG 1300/03105 HEBEI SUPERB FOODS CO., LTD HUI AUTONOMY COUNTY, HEBEI PROVINCE, CHINA KANGBAO BAILU MEAT CO., LTD. THE SECOND 1300/03152 NO.134, GONGYE STREET, KANGBAO COUNTY, HEBEI FACTORY NO.9 HEBIN ROAD, LUANPINGTOWN, LUANPING COUNTY, CHENGDE 1300/03158 LUANPING HUADU JIAYI FOOD JOINT FACTORY CITY, HEBEI PROVINCE SHIJIAZHUANG DEYUAN FOOD CO.,LTD. 1300/03160 NO.77, XINYUANXI ROAD, LUANCHENG DISTRICT, SHIJIAZHUANG, HEBEI LUANCHENG BRANCH 1300/08040 SHIJIAZHUANG HUIKANG FOOD CO.,LTD. -

2020 年度報告 Annual Report

鄭州銀行股份有限公司 BANK OF ZHENGZHOU CO., LTD. (於中華人民共和國註冊成立的股份有限公司) (A joint stock company incorporated in the People’s Republic of China with limited liability) 股份代號 Stock Code: 6196 優先股股份代號 Preference Shares Stock Code: 4613 年度報告 2020 Annual Report CONTENTS IMPORTANT NOTICE 2 DEFINITIONS 3 CHAIRMAN’S STATEMENT 6 PRESIDENT’S STATEMENT 9 CHAPTER I CORPORATE INFORMATION 11 CHAPTER II HIGHLIGHTS OF ACCOUNTING DATA AND MAJOR FINANCIAL INDICATORS 17 CHAPTER III MANAGEMENT DISCUSSION AND ANALYSIS 21 CHAPTER IV CHANGES IN SHARE CAPITAL AND INFORMATION ON SHAREHOLDERS 99 CHAPTER V ISSUANCE OF PREFERENCE SHARES 115 CHAPTER VI DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT, STAFF AND INSTITUTIONS 118 CHAPTER VII CORPORATE GOVERNANCE REPORT 148 CHAPTER VIII REPORT OF THE BOARD OF DIRECTORS 183 CHAPTER IX REPORT OF THE BOARD OF SUPERVISORS 199 CHAPTER X SIGNIFICANT EVENTS 203 CHAPTER XI INDEPENDENT AUDITOR’S REPORT 220 * This Report is prepared in both Chinese and English. If there are any discrepancies between the Chinese and English versions, the Chinese version shall prevail. 1 Annual Report 2020 | Bank of Zhengzhou Co., Ltd. IMPORTANT NOTICE The Board of Directors, Board of Supervisors and Directors, Supervisors and senior management of the Bank hereby warrant the truthfulness, accuracy and completeness of the contents of this annual report and that there are no false representations, misleading statements or material omissions, and jointly and severally assume liability for the information hereof. The full text and the summary of the 2020 annual report (the “Report”) were reviewed and approved at the Bank’s twelfth meeting of the sixth session of the Board of Directors on 30 March 2021. -

Printmgr File

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. DEFINITIONS In this [REDACTED], unless the context otherwise requires, the following terms shall have the following meanings. Certain technical terms are explained in the section headed “Glossary of Technical Terms” in this [REDACTED]. “Adjusted Net Profit” a non-IFRS measure that eliminates the effect of certain non- recurring items from our profit for the year/period. See section headed “Financial Information — Non-IFRS Measure” in this [REDACTED] “affiliate” with respect to any specified person, any other person, directly or indirectly, controlling or controlled by or under direct or indirect common control with such specified person [REDACTED] “Articles” or “Articles or Association” the articles of association of our Company adopted on [Š] with effect from the [REDACTED], as amended from time to time, a summary of which is set out in the section headed “Summary of the Constitution of our Company and Cayman Companies Law” in Appendix IV to this [REDACTED] “associate(s)” has the meaning ascribed thereto under the [REDACTED] “Baikal Lake Investment” Baikal Lake Investment Holdings Limited, a company incorporated in the BVI with limited liability on 29 August 2016 and the sole shareholder of GuangYu Investment and one of our Controlling Shareholders “Board” the board of directors of our Company “business day” any day (other than a Saturday, Sunday or public holiday in Hong Kong) on which banks in Hong Kong are generally open for normal banking business “BVI” the British Virgin Islands “BVI YuHua” China YuHua Education Investment Limited, a company incorporated in the BVI with limited liability on 28 April 2016 and a wholly-owned subsidiary of our Company “Cayman Companies Law” the Companies Law, Cap.