2013 Nevada Agriculture Analysis and Opportunities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

10 Total, All Industries 101 Goods-Producing 1011 Natural

10 Total, all industries 101 Goods-producing 1011 Natural resources and mining 1012 Construction 1013 Manufacturing 102 Service-providing 1021 Trade, transportation, and utilities 1022 Information 1023 Financial activities 1024 Professional and business services 1025 Education and health services 1026 Leisure and hospitality 1027 Other services 1028 Public administration 1029 Unclassified 11 NAICS 11 Agriculture, forestry, fishing and hunting 111 NAICS 111 Crop production 1111 NAICS 1111 Oilseed and grain farming 11111 NAICS 11111 Soybean farming 111110 NAICS 111110 Soybean farming 11112 NAICS 11112 Oilseed, except soybean, farming 111120 NAICS 111120 Oilseed, except soybean, farming 11113 NAICS 11113 Dry pea and bean farming 111130 NAICS 111130 Dry pea and bean farming 11114 NAICS 11114 Wheat farming 111140 NAICS 111140 Wheat farming 11115 NAICS 11115 Corn farming 111150 NAICS 111150 Corn farming 11116 NAICS 11116 Rice farming 111160 NAICS 111160 Rice farming 11119 NAICS 11119 Other grain farming 111191 NAICS 111191 Oilseed and grain combination farming 111199 NAICS 111199 All other grain farming 1112 NAICS 1112 Vegetable and melon farming 11121 NAICS 11121 Vegetable and melon farming 111211 NAICS 111211 Potato farming 111219 NAICS 111219 Other vegetable and melon farming 1113 NAICS 1113 Fruit and tree nut farming 11131 NAICS 11131 Orange groves 111310 NAICS 111310 Orange groves 11132 NAICS 11132 Citrus, except orange, groves 111320 NAICS 111320 Citrus, except orange, groves 11133 NAICS 11133 Noncitrus fruit and tree nut farming 111331 -

The Greening of Louisiana's Economy: the Agriculture, Forestry, Fishing

Increasing Employment in Mississippi The Greening of Mississippi’s Economy: the Agriculture, Forestry, Fishing and Hunting Sector August 2011 greenjobs.mdes.ms.gov In 2009, Mississippi and Louisiana partnered to research economic development opportunities and workforce needs associated with the region’s green economy. Through a $2.3 million grant from the U.S. Department of Labor, a consortium of the Mississippi Department of Employment Security, Mississippi State University, Louisiana Workforce Commission, and Louisiana State University conducted an extensive study of economic activity that is beneficial to the environment. This and other research products were developed as part of that effort. “This workforce solution was funded by a grant awarded by the U.S. Department of Labor’s Employment and Training Administration. The solution was created by the grantee and does not necessarily reflect the official position of the U.S. Department of Labor. The Department of Labor makes no guarantees, warranties, or assurances of any kind, express or implied, with respect to such information, including any information on linked sites and including, but not limited to, accuracy of the information or its completeness, timeliness, usefulness, adequacy, continued availability, or ownership. This solution is copyrighted by the institution that created it. Internal use by an organization and/or personal use by an individual for non-commercial purposes is permissible. All other uses require the prior authorization of the copyright owner.” Equal Opportunity Employer/Program Auxiliary aids and services available upon request to individuals with disabilities: TTY 800-582-2233 i Table of Contents Description of Sector ....................................................................................................................... 1 Introduction to the Green Component of the Agriculture, Forestry, Fishing and Hunting Sector ... -

Impacts of the COVID-19 Pandemic on Productivity Growth in Canada

Catalogue no. 36-28-0001 ISSN 2563-8955 Economic and Social Reports Impacts of the COVID-19 pandemic on productivity growth in Canada by Weimin Wang Release date: May 26, 2021 How to obtain more information For information about this product or the wide range of services and data available from Statistics Canada, visit our website, www.statcan.gc.ca. You can also contact us by Email at [email protected] Telephone, from Monday to Friday, 8:30 a.m. to 4:30 p.m., at the following numbers: • Statistical Information Service 1-800-263-1136 • National telecommunications device for the hearing impaired 1-800-363-7629 • Fax line 1-514-283-9350 Depository Services Program • Inquiries line 1-800-635-7943 • Fax line 1-800-565-7757 Standards of service to the public Note of appreciation Statistics Canada is committed to serving its clients in a prompt, Canada owes the success of its statistical system to a reliable and courteous manner. To this end, Statistics Canada long-standing partnership between Statistics Canada, the has developed standards of service that its employees observe. citizens of Canada, its businesses, governments and other To obtain a copy of these service standards, please contact institutions. Accurate and timely statistical information Statistics Canada toll-free at 1-800-263-1136. The service could not be produced without their continued co-operation standards are also published on www.statcan.gc.ca under and goodwill. “Contact us” > “Standards of service to the public.” Published by authority of the Minister responsible for Statistics Canada © Her Majesty the Queen in Right of Canada as represented by the Minister of Industry, 2021 All rights reserved. -

Download (PDF)

The Taxonomy of Regulatory Forms facilitates classification of regulations in a systematic manner by form—the particular policy mechanism used to achieve a desired end. In this chapter, we discuss an application of the Taxonomy to regulations affecting the agriculture sector. The objective of this chapter is to identify the forms these regulations take, examine their trends and patterns across agencies and over time, and create a unique dataset that enables econometric analysis of the impact of different regulatory forms. Application of the Taxonomy involves analyzing regulations to identify the specific mechanisms they employ to achieve intended outcomes. For example, introducing tolerance levels for pesticide residues is a form of performance standard intended to reduce human exposure to pesticides. We identified a set of regulations that were most relevant to agriculture, and used qualitative coding techniques to generate a dataset that classifies regulations according to form. Specifically, we use the RegData1 database created by the Mercatus Center at George Mason University to identify a sample of 709 parts in the Code of Federal Regulations (CFR) related to the crop and animal production industries defined in the North American Industry Classification System (NAICS). We then used content analysis to analyze and code the sample CFR parts into different regulatory forms. We used the created dataset to conduct cross-sectional and longitudinal analyses to identify patterns and trends in the adoption of different regulatory forms across agencies and over time. We focused our agency-level analysis on regulations published by the U.S. Department of Agriculture (USDA), Environmental Protection Agency (EPA), and Food and Drug Administration (FDA), because these agencies are most relevant to agricultural regulations. -

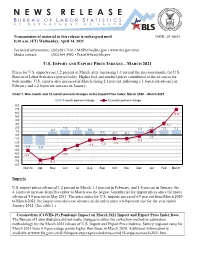

U.S. Import and Export Price Indexes March 2021

Transmission of material in this release is embargoed until USDL-21-0653 8:30 a.m. (ET) Wednesday, April 14, 2021 Technical information: (202) 691-7101 • [email protected] • www.bls.gov/mxp Media contact: (202) 691-5902 • [email protected] U.S. IMPORT AND EXPORT PRICE INDEXES – MARCH 2021 Prices for U.S. imports rose 1.2 percent in March, after increasing 1.3 percent the previous month, the U.S. Bureau of Labor Statistics reported today. Higher fuel and nonfuel prices contributed to the advances for both months. U.S. exports also increased in March, rising 2.1 percent, following a 1.6-percent advance in February and a 2.6-percent increase in January. Chart 1. One-month and 12-month percent changes in the Import Price Index: March 2020 – March 2021 1-month percent change 12-month percent change 8.0 7.0 6.0 6.9 5.0 4.0 3.0 3.1 2.0 1.3 1.2 1.0 1.4 1.3 1.2 1.0 0.7 0.9 0.2 -0.1 0.1 0.0 -1.0 1.0 -0.3 -2.0 -1.0 -1.0 -1.4 -1.3 -3.0 -2.4 -2.6 -4.0 -2.8 -5.0 -4.2 -4.0 -6.0 -7.0 -6.3 -8.0 -6.8 Mar'20 Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar'21 Imports U.S. import prices advanced 1.2 percent in March, 1.3 percent in February, and 1.4 percent in January; the 4.1-percent increase from December to March was the largest 3-month rise for import prices since the index advanced 5.8 percent in May 2011. -

Lumber Production and Mill Stocks: 2005 Issued July 2006

Lumber Production and Mill Stocks: 2005 Issued July 2006 MA321T(05)-1 Current Industrial Reports Current data are released electronically on Internet lumber production was 31.6 billion board feet for all individual surveys as they become avail- in 2005, 2.6 percent above the 2004 level of able. Use: http://www.census.gov/mcd/. of 30.8 billion board feet. Southern yellow pine Individual reports can be accessed by choosing production amounted to 18.1 billion board feet "Current Industrial Reports (CIR)," clicking on in 2005, which is 3.4 percent above the 2004 "CIRs by Subsector;" then choose the survey of production level of 17.5 billion board feet. interest. Follow the menu to view the PDF file Production of eastern hardwoods was 10.8 billion or to download the worksheet file (XLS format) board feet in 2005, which is 1.0 percent above to your personal computer. the 2004 level of 10.7 billion board feet. Western lumber production amounted to 19.1 These data are also available on Internet billion board feet in 2005, an increase of 1.6 through the U.S. Department of Commerce percent from the 2004 production level of 18.8 and STAT-USA by subscription. The Internet billion board feet. Production of western soft- address is: www.stat-usa.gov/. Follow the woods increased by 1.6 percent to 18.7 billion prompts to register. Also, you may call board feet in 2005 from 18.4 billion board feet 202-482-1986 or 1-800-STAT-USA, for in 2004. Total western hardwood production further information. -

AGRICULTURE and AGRI-FOOD SECTOR Report

AGRICULTURE and AGRI-FOOD SECTOR Report May 2014 Agriculture and Agri-Food Sector Report 2014 Acknowledgements This sector report it the first in a series of reports available on Worktrends.ca . Worktrends.ca is a project of the Elgin Middlesex Oxford Workforce Planning and Development Board. Report written by Emilian Siman © May 2014 Guidance and expertise kindly provided by Debra Mountenay - Executive Director of the Elgin, Middlesex and Oxford Workforce Planning and Development Board (EMO WPDB), Kiran Maniar - Project Coordinator of Worktrends.ca, Martin Withenshaw - Projects and Communication Manager at EMO WPDB, and Justin Dias - Community Coordinator at EMO WPDB. “The material contained in this report has been prepared by the Elgin Middlesex Oxford Workforce Planning and Development Board and is drawn from a variety of sources considered to be reliable. We make no representation or warranty, express or implied, as to its accuracy or completeness. In providing this material, the Elgin Middlesex Oxford Workforce Planning and Development Board does not assume any responsibility or liability.” This Employment Ontario project is funded by the Ontario government. The views expressed in this document do not necessarily reflect those of the Government of Ontario. Worktrends.ca at Elgin Middlesex and Oxford Workforce Planning and Development Board| 647 Wilton Grove Rd., 2 Unit 3. London, ON N6N 1N7. Tel: 519-672-3499.Fax: 519-672-9089 Agriculture and Agri-Food Sector Report 2014 Table of contents EXECUTIVE SUMMARY ............................................ -

International Labour Migration to Europe's

‘The global pandemic has painfully shown how international labour migration is essential to Europe’s economy and food security. Indeed the role of migration in revitalizing rural communities in Europe and in keeping agriculture afloat cannot be overstated. This is a timely and much needed book that investigates the social and economic implications of international labour migration to Europe’s rural regions from both empirical and analytical perspectives.’ Anna Triandafyllidou, Ryerson University, Canada ‘This is book is a must-r ead for anyone interested in understanding the phenomenon of internal rural migration in Europe, its diversity of local practices and similarity in outcomes for social groups, rural industries and rural societies across and within countries in Europe. It is the combination of empirically rich, in- depth case studies that portray the human element of migration with discussions of their significance against the background of labour market and migration theories and the specificity of the rural context that makes the book so particularly insightful.’ Bettina Bock, Wageningen University and Research, Netherlands ‘In fourteen expertly- crafted chapters, this collection offers a historically- informed snapshot of the living and working conditions of people who migrate to rural areas of Europe and the US for agricultural work. Never flinching from sharp critical analysis of the racial capitalism that often seeks to divide workforces in order to weaken them, International Labour Migration to Europe’s Rural Regions also -

Economic Development Strategy Adopted by the Cumberland County

Page 1 of 36 Cumberland Area Economic Development Corporation Economic Development Strategy Economic Development Component Cumberland County Comprehensive Plan Adopted by the Cumberland County Board of Commissioners on December 7, 2015 Page 2 of 36 Chapter 1: Introduction 1.1 Cumberland Area Economic Development Corporation 1.2 Economic Development Strategic Planning Purpose 1.3 Steering Committee Structure 1.4 Stakeholder Involvement and Public Engagement Chapter 2: Economic Development Goals and Strategic Focus Areas 2.1 Fundamental Goals of Economic Development Overview 2.2 Corporate Strategic Focus Areas Overview 2.3 Economic Development Strategic Focus Areas Overview Chapter 3: Industry Clusters of Interest 3.1 Industry Clusters of Interest for Attraction, Retention and Expansion 3.2 Industry Clusters Overview 3.3 Metrics and Performance Measures Chapter 4: Economic Snapshot of Cumberland County 4.1 Population 4.2 Labor Force 4.3 Wages 4.4 Income 4.5 Housing 4.6 Major Employers 4.7 Industry Sector Data Overview Chapter 5: Economic Development Strategy 5.1 Business Attraction 5.2 Business Retention & Expansion 5.3 Redevelopment & Reuse 5.4 Funding and Finance 5.5 Visitor Growth 5.6 Stakeholder Engagement Page 3 of 36 Chapter 1: Introduction 1.1 Cumberland Area Economic Development Corporation Cumberland Area Economic Development Corporation (CAEDC) was founded in 2005 by the Cumberland County Board of Commissioners. CAEDC, a 501(c) 3 nonprofit corporation, is the designated economic development and destination marketing organization for Cumberland County, Pennsylvania. Mission: Promote and advance economic opportunities by leveraging our organizational and community assets, strategic location, workforce and natural resources. Vision: CAEDC is the economic development catalyst for retaining and attracting businesses and visitors on behalf of citizens and stakeholders. -

Manufacturing Profiles: 1998, MP/98, U.S

Manufacturing Profiles 1998 Issued December 2000 MP/98 Current Industrial Reports U.S. Department of Commerce U S C E N S U S B U R E A U Economics and Statistics Administration U.S. CENSUS BUREAU Helping You Make Informed Decisions ACKNOWLEDGMENTS This report was prepared in the Manufac- Kim D. Ottenstein, Margaret A. Smith, turing and Construction Division (formerly Joyce C. Chamberlain, and Elizabeth J. Industry Division). Judy Dodds, Assistant Williams of the Administrative and Cus- Chief for Census and Related Programs, tomer Services Division, Walter C. Odom, was responsible for the overall planning, Chief, provided publications and printing management, and coordination of this management, graphics design and compo- project. Planning and the compilation of sition, and editorial review for print and data were under the direction of Robert electronic media. General direction and Reinard, Chief, Consumer Goods Indus- production management were provided by tries Branch, assisted by Suzanne Michael G. Garland, Assistant Division Conard, Kaylene Hanks, Robert Miller, Chief, and Gary J. Lauffer, Chief, Publica- Stephanie Angel, Phillip Brown, Matt tions Services Branch. Gaines, Karen Harshbarger, Nancy Higgins, Marc Klein, Robert Lee, Aronda Stovall, Sue Sundermann, Dora Thomas, Ronanne Vinson, and Mike Yamaner; Nathaniel Shelton, Chief, Primary Goods Industries Branch, assisted by Renee Coley, Allen Foreman, Joanna Nguyen, Dana Brooks, Brenda Campbell, Mary Ellickson, Walter Hunter, Jim Jamski, Evelyn Jordan, Jacqueline Keller, John Linehan, Paul Marck, Joyce Pomeroy, Michael Taylor, Thanos Theodoropoulos, Ann Truffa, Denneth Wallace, and Lissene Witt; Kenneth Hansen, Chief, Investment Goods Indus- tries Branch, assisted by Mike Brown, Raphael Corrado, Milbren Thomas, Brian Appert, Stanis Batton, Chris Blackburn, Larry Blumberg, Vera Harris-Bourne, Vance Davis, Merry Glascoe, James Hinckley, Keith McKenzie, Philippe Morris, Betty Pannell, Cynthia Ramsey, Chris Savage, Keeley Voor, and Tempie Whittington. -

Frozen Fruit, Juice, and Vegetable Manufacturing 1997 Issued November 1999

Frozen Fruit, Juice, and Vegetable Manufacturing 1997 Issued November 1999 EC97M-3114A 1997 Economic Census Manufacturing Industry Series U.S. Department ofCommerce Economics and Statistics Administration U.S. CENSUS BUREAU ACKNOWLEDGMENTS The staff of the Manufacturing and Con- coordination of the publication process. struction Division prepared this report. Kim Credito, Patrick Duck, Chip Judy M. Dodds, Assistant Chief for Cen- Murph, Wanda Sledd, and Veronica sus and Related Programs, was respon- White provided primary staff assistance. sible for the overall planning, manage- The Economic Planning and Coordination ment, and coordination. Kenneth Division, Lawrence A. Blum, Assistant Hansen, Chief, Manufactured Durables Chief for Collection Activities and Shirin Branch, assisted by Mike Brown, Renee A. Ahmed, Assistant Chief for Post- Coley, Raphael Corrado, and Milbren Collection Processing, assisted by Dennis Thomas, Section Chiefs, Michael Zampo- Shoemaker, Chief, Post-Collection Census gna, Former Chief, Manufactured Nondu- Processing Branch, Brandy Yarbrough, rables Branch, assisted by Allen Fore- Section Chief, Sheila Proudfoot, Richard man, Robert Miller, Robert Reinard, Williamson, Andrew W. Hait, and Jenni- and Nat Shelton, Section Chiefs, and Tom fer E. Lins, was responsible for develop- Lee, Robert Rosati, and Tom Flood, ing the systems and procedures for data Special Assistants, performed the planning collection, editing, review, correction and and implementation. Stephanie Angel, dissemination Brian Appert, Stanis Batton, Carol Bea- The staff of the National Processing Center, sley, Chris Blackburn, Larry Blum- Judith N. Petty, Chief, performed mailout berg, Vera Harris-Bourne, Brenda preparation and receipt operations, clerical Campbell, Suzanne Conard, Vance and analytical review activities, data key- Davis, Mary Ellickson, Matt Gaines, ing, and geocoding review. -

Chapter 4. Immigration and Farm Labor: Challenges and Opportunities

Immigration and Farm Labor: Challenges and Opportunities Chapter 4. Immigration and Farm Labor: Challenges and Opportunities Philip L. Martin Abstract Author's Bio Hired workers do most of the work on U.S. farms, Philip L. Martin is Emeritus Professor in the Department three-fourths were born abroad, and about half are of Agricultural Economics at the University of California, unauthorized. Hired farm workers are most closely Davis and a member of the Giannini Foundation of associated with the production of fruits and vegetables, Agricultural Economics. He can be contacted at plmartin@ and most are employed on 10,000 large farms across ucdavis.edu. the United States. Farm employers are adjusting to the slowdown in Mexico-U.S. migration with the 4-S strategies of satisfying current workers to retain them, stretching them by providing them with productivity-increasing aids, substituting machines for workers, and supplementing current workers with H-2A guest workers. Immigration policy is the major determinant of which 4-S strategy will dominate. 1 California Agriculture: Dimensions and Issues Table of Contents Abstract .....................................................................................................................................................................................................................1 Author's Bio ..............................................................................................................................................................................................................1