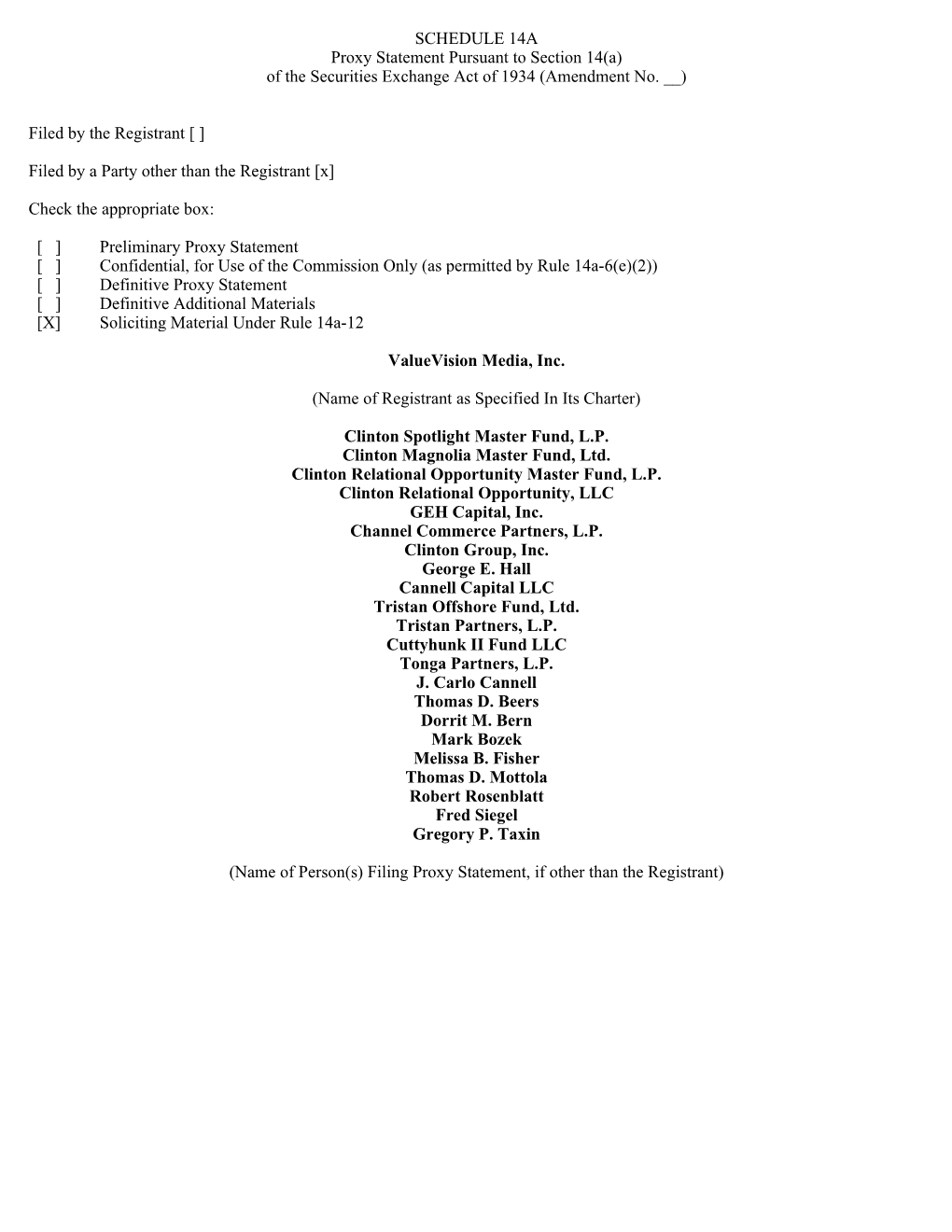

Of the Securities Exchange Act of 1934 (Amendment No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Realnex Investment Analysis Software

308 W Verdugo Ave 308 W Verdugo Ave Burbank, CA 91502 For more information contact: Cindy Hill, CCIM Senior Vice President 818.846.1611 [email protected] 00885625 Mark Maccalupo Senior Associate 818.432.1601 [email protected] 01930952 ● Legendary Production Office Building located in the Media Capital of the World ● Sale Includes: Production Office with 16,500 Sqft on a 21,522 Sqft Gated Lot with approximately 24 Parking Spaces ● Current Tenants Paying Above Market Rents Until October 31, 2017; Improvements On-Site as Recent as 2016 ● Priced to Sell at $5,100,000 | $309 per Sqft! ● This property can be purchased with or without an additional parking lot with appx 24 spaces on Victory Blvd zoned C-4 Phone: 818-432-1500 ● Fax: 818-432-1501 ● 4061 Laurel Canyon Blvd. ● Studio City, CA 91604 ● www.valleyapartmentsales.com 308 W Verdugo Ave Burbank, CA 91502 REAL ESTATE INVESTMENT Analysis Analysis Date June 2017 Property Property 308 W Verdugo Ave Property Address 308 W Verdugo Ave Burbank, CA 91502 Year Built 1980 Purchase Information Financial Information Property Type Commercial All Cash Purchase Price $5,100,000 Tenants 1 Total Rentable Sq. Ft. 16,500 Loans Type Debt Term Amortization Rate Payment LO Costs All Cash Income & Expenses Contact Information Gross Operating Income $648,888 Cindy Hill, CCIM Monthly GOI $54,074 818.846.1611 Total Annual Expenses ($84,890) [email protected] Monthly Expenses ($7,074) 00885625 Mark Maccalupo 818.432.1601 [email protected] 01930952 p. 2 All information furnished regarding property for sale, rental or financing is from sources deemed reliable, but no warranty or representation is made to the accuracy thereof and same is submitted subject to errors, omissions, change of price, rental or other conditions, prior sale, lease or financing or withdrawal without notice. -

Eleven Stories About Creativity@Bertelsmann 04 Eleven Stories About Creativity@Bertelsmann What’S Your Story?

Eleven Stories About Creativity@Bertelsmann 04 Eleven Stories About Creativity@Bertelsmann What’s your story? 11 Thomas Rabe Chairman & CEO, Bertelsmann Foreword Creativity@Bertelsmann Bertelsmann is the home of creative content and customer solutions – of broadcasting, TV production, radio, books, magazines, music and services, whether in analog, print, or digital form. We reach, inspire, and support millions of people. Day after day. All over the world. Behind everything we do are creative minds: program originators and producers, publishers and journalists, entrepreneurs and technicians. Bertelsmann lives by their efforts and their ideas. Our business wouldn’t be productive without them. In this book, “What’s Your Story – Creativity@Bertelsmann,” some of these women and men, our colleagues, tell their own personal business stories, with specific examples to give you a large sense of our company’s creativity. Their stories span all divisions and facets of Bertelsmann: from en- tertaining or unusual television productions and books that are moving in every sense of the word to a cooking magazine for men only and an award-winning travel app; from visits to football and Olympic stadiums to an interview session on Bryan Ferry’s sofa; from booming mobile services in China to the comprehensive service package put together for an American health insurer. They are but a few of the many examples you will be reading about. They demonstrate just how pronounced and ingrained creativity is at Bertelsmann and the great importance we assign to it. For it is precisely those creative achievements – manifested in content and solutions – that make us sought-after partners. -

6Ter, Groupe M6's New Channel for Sharing

week 47 / 22 November 2012 “THE THIRD LEG OF THE TRIPOD” 6ter, Groupe M6’s new channel for sharing Germany Luxembourg France Belgium RTL II and Bild.de RTL Group celebrates M6 available Belgium’s Got present major World Television Day in preplay Talent finishes ‘second screen” with flying event colours week 47 / 22 November 2012 THE THIRD LEG OF THE TRIPOD 6ter, Groupe M6’s channel for sharing Luxembourg Germany France France RTL Group reports Deutschland sucht Viewers decide M6 Web higher revenue and den Superstar on Desperate launches new profit in the third celebrates 10th Housewives comedy portal quarter 2012 anniversary finale Cover Montage with 6ter’s channel presenters Publisher RTL Group 45, Bd Pierre Frieden L-1543 Luxembourg Editor, Design, Production RTL Group Corporate Communications & Marketing k before y hin ou T p r in t backstage.rtlgroup.com backstage.rtlgroup.fr backstage.rtlgroup.de QUICK VIEW RTL II and Bild.de present major ‘second screen’ event RTL II p. 8–9 RTL Group celebrates World Television Day RTL Group p. 10–11 M6 available in preplay M6 Publicité p. 12 Be entertained, learn and discover the world together Groupe M6 (France) Belgium’s Got Talent p. 4–7 fi nishes with fl ying colours RTL-TVI / RTL New Media p. 13 A week dedicated to helping children RTL 4 p. 14 SHORT Big Picture p. 15 NEWS PEOPLE p. 16–17 p.18 On 15 November 2012 Groupe M6 executives organised an evening event for the launch of their new BE ENTERTAINED, channel, 6ter, which will start airing on 12 December. -

Reality Television Production As Dirty Work

University of Pennsylvania ScholarlyCommons Publicly Accessible Penn Dissertations 2016 Good Character: Reality Television Production as Dirty Work Junhow Wei University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/edissertations Part of the Communication Commons, Organizational Behavior and Theory Commons, and the Sociology Commons Recommended Citation Wei, Junhow, "Good Character: Reality Television Production as Dirty Work" (2016). Publicly Accessible Penn Dissertations. 2094. https://repository.upenn.edu/edissertations/2094 This paper is posted at ScholarlyCommons. https://repository.upenn.edu/edissertations/2094 For more information, please contact [email protected]. Good Character: Reality Television Production as Dirty Work Abstract Audiences, critics, and academics have raised significant moral concerns about reality television. The genre is commonly criticized for being exploitative, harmful, and fake. By extension, reality TV workers are morally tainted, seen as dirty workers of questionable character. This dissertation describes the sources of moral taint in reality television production and how production workers dispel this taint—making their work acceptable and even glorious to themselves and others—through everyday micro-level interaction. The data for this study comes from approximately 2 years of ethnographic observation at 2 reality TV production companies, attendance at 2 reality TV industry conferences, and interviews with 83 respondents, including reality TV production workers, television network executives, and people who auditioned to be on reality shows. Findings focus on the development process, during which production companies generate ideas for new television shows and pitch those ideas to television networks. First, I describe the development process and three significant moral dilemmas that workers face at this initial stage of production: creating negative representations (e.g. -

308 W Verdugo Ave 308 W Verdugo Ave Burbank, CA 91502

308 W Verdugo Ave 308 W Verdugo Ave Burbank, CA 91502 For more information contact: Cindy Hill, CCIM Senior Vice President 818.846.1611 [email protected] 00885625 Mark Maccalupo Senior Associate 818.432.1601 [email protected] 01930952 ● Newly Priced to Sell at $4,900,000 | 7.3% CAP! ● Production Office Building located in the Media Capital of the World with global production company tenant Fremantle ● New lease with (2) options totaling 7 years and has 3% annual increases; Tenants have 14 year history at this location ● Sale includes 16,500 sqft Building on a 21,522 sqft gated lot with approximately 24 parking spaces ● Buyer can also purchase second parking lot on Victory Blvd, 10,759 sqft, C-4 w/ 24 spaces; priced separately for $1.1 M Phone: 818-432-1500 ● Fax: 818-432-1501 ● 4061 Laurel Canyon Blvd. ● Studio City, CA 91604 ● www.valleyapartmentsales.com 308 W Verdugo Ave Burbank, CA 91502 REAL ESTATE INVESTMENT Analysis Analysis Date July 2017 Property Property 308 W Verdugo Ave Property Address 308 W Verdugo Ave Burbank, CA 91502 Year Built 1980 Purchase Information Financial Information Property Type Office All Cash Purchase Price $4,900,000 Tenants 1 Total Rentable Sq. Ft. 16,500 Loans Type Debt Term Amortization Rate Payment LO Costs All Cash Income & Expenses Contact Information Gross Operating Income $419,760 Cindy Hill, CCIM Monthly GOI $34,980 818.846.1611 Total Annual Expenses ($61,250) [email protected] Monthly Expenses ($5,104) 00885625 Mark Maccalupo 818.432.1601 [email protected] 01930952 p. 2 All information furnished regarding property for sale, rental or financing is from sources deemed reliable, but no warranty or representation is made to the accuracy thereof and same is submitted subject to errors, omissions, change of price, rental or other conditions, prior sale, lease or financing or withdrawal without notice. -

Spike TV Digs Down Deep for New Original Series, 'Coal' Featuring the Lives of West Virginia Coal Miners

Spike TV Digs Down Deep for New Original Series, 'Coal' Featuring the Lives of West Virginia Coal Miners Premieres Wednesday, March 30 At 10 PM, ET/PT Series Narrated By Jeremy Sisto Series Produced By Reality Powerhouse Thom Beers' Original Productions NEW YORK, March 21, 2011 /PRNewswire via COMTEX/ -- Spike TV takes viewers down into the depths of the earth for an unprecedented look at one of the most dangerous and compelling jobs in the world, coal mining. Spike TV will premiere the 10 episode, one-hour docu-reality series, narrated by Jeremy Sisto, starting Wednesday, March 30 at 10 PM, ET/PT. The series comes to Spike from Thom Beers' Original Productions, a FremantleMedia company. Beers is the mastermind behind hit cable series that explore high-risk occupations such as the Emmy® Award-winning "Deadliest Catch," "Ice Road Truckers" and "Ax Men." (Logo: http://photos.prnewswire.com/prnh/20060322/NYW096LOGO) "Coal" centers on the operations of a single mine, Cobalt Coal, located deep in the heart of coal country in McDowell County, West Virginia. The story is told through the eyes of part owners, Mike Crowder and Tom Roberts. The two struck up a mining partnership while watching their sons practice football and have invested their life savings into starting this mine operation. Crowder and Roberts face pressure every minute of every day to keep the mine up and running or face personal financial ruin but, more importantly, to keep their workers safe in a highly combustible environment where one wrong move could prove deadly. Coal mining is an integral part of the American economy and the lifeblood of many communities, not only across the United States, but around the entire world. -

Bering Sea Gold’ Returns for a Second Season Friday, January 4, at 10 Pm E/P with Even More Danger , Conflict and Gold

MEDIA ALERT: CONTACT: Phil Zimmerman, 310-975-5975 Dec. 13, 2012 [email protected] DISCOVERY’S HIT SERIES ‘BERING SEA GOLD’ RETURNS FOR A SECOND SEASON FRIDAY, JANUARY 4, AT 10 PM E/P WITH EVEN MORE DANGER , CONFLICT AND GOLD (Los Angeles, Calif.) – Life is not easy for the gold dredgers in the frontier town of Nome, Alaska. But that doesn’t stop the crew of driven and sometimes desperate fortune seekers from hunting gold at the bottom of the Bering Sea. From Thom Beers’ Original Productions, creators of the Emmy Award- winning DEADLIEST CATCH, the second season of BERING SEA GOLD premieres Friday, January 4 at 10 PM E/P on Discovery Channel . This year, the stakes are even higher as the dredgers must improve on past failures and find gold to survive. However, dredging isn’t getting any easier. A group of government officials are hell-bent on putting some order in place -- setting new regulations that cause headaches and roadblocks for the entire fleet. With gold rush fever brewing, new miners are drawn to Nome in search of hitting the mother lode. And a sudden, tragic death will make this a summer that no one will forget. BERING SEA GOLD season two picks up from last year and follows the adventures of four dredging crews as they battle the conditions – and each other – in search of gold. This season includes the crews of: The Christine Rose: Hotheaded Shawn Pomrenke is on a mission to prove to his father, Steve, that he's grown up. Last season, Shawn failed to prove that he was ready to take over the family business. -

NO MAN's LAND Would Be a Hit Piece Lampooning the Armed-Protestors

WARRIOR POETS, TOPIC and IMPACT PARTNERS PRESENTS NO MAN’S LAND WORLD PREMIERE – DOCUMENTARY COMPETITION Directed by David Byars Director of Photography David Byars Produced by David Byars, Morgan Spurlock, Jeremy Chilnick, David Holbrooke, David Osit, Rachel Traub, Stash Wislocki Executive Produced by Thom Beers, Michael Bloom, Dan Cogan, Adam Pincus Edited by David Osit Music by LOW Running Time: 80 Minutes https://www.nomanslandthefilm.com/ Social Media: Facebook – https://www.facebook.com/No-Mans-Land-1918408308445791/ For additional information please contact: Marian Koltai-Levine – [email protected] – 212-373-6130 | Omar Gonzales – [email protected] – 212-373-0116 Leigh Wolfson – [email protected] – 212-373-6149 | Savannah Freed – [email protected] – 212-373-6106 SALES AGENT – SUBMARINE Josh Braun – [email protected] | Ben Schwartz – [email protected] – 212-625-1410 SHORT SYNOPSIS With unfettered access, Director and Director of Photography David Byars gives a detailed, on-the-ground account of the 2016 standoff between protestors occupying Oregon’s Malheur National Wildlife Refuge and federal authorities. After the leaders of this occupation put out a call to arms via social media, the Malheur occupiers quickly bolstered their numbers with a stew of right-wing militia, protestors, and onlookers. What began as a protest to condemn the sentencing of two ranchers quickly morphed into a catchall for those eager to register their militant antipathy toward the federal government. During the 41-day siege, the filmmakers were granted remarkable access to the inner workings of the insurrection as the occupiers went about the daily business of engaging in an armed occupation. -

Visions of Labour: Socialist Realism, American Reality TV and the Politics of Documentary

Visions of Labour: Socialist Realism, American Reality TV and the Politics of Documentary by Tetiana Soviak A thesis submitted in conformity with the requirements for the degree of Doctor of Philosophy Centre for Comparative Literature University of Toronto © Copyright by Tetiana Soviak 2017 Visions of Labour: Socialist Realism, American Reality TV and the Politics of Documentary Tetiana Soviak Doctor of Philosophy Centre for Comparative Literature University of Toronto 2017 Abstract This dissertation considers a number of ideological visions of labour constructed through film and television. The socialist realist vision of work is considered through Soviet films of the 1930s within the context of the building of a workers’ state. This was a modernist dream of non- alienated human labour where the workers create and master the world, their labour revealing and capturing the utopian content in the now. In contrast to this utopian vision are several documentaries that depict technocratic dreams or nightmares of post-apocalyptic societies only to reveal that that future is already here for some. In the documentary central to this project, Michael Glawogger’s Workingman’s Death, workers inhabit the nowhere places of the global economy, their work unrecognizable as modern day labour. In construction of labour within global capitalism, the workers are rendered as alien and indeterminate, making identification and solidarity difficult if not impossible. The last section of the dissertation considers the vision of labour and the worker as constructed by neoliberalism not in faraway places but in our living rooms: workers competing on reality television for our entertainment. These pictures of labour reveal that work and the worker are socio-historical constructs, and that one of the central goals of emancipatory politics should be the self-representation of workers. -

Oce New Ser on D Ean Prospe Ries from T Discovery C

FOR IMMEDIATE RELEASE: CONTACT: Katherine Nelson: 310‐975‐5975 December 6, 2011 [email protected] OCEAN PROSPECTORS GAMBLE IT ALL ON BERING SEA GOLD: NEW SERIES FROM THE CREATORS OF DEADLIEST CATCH TO PREMIERE ON DISCOVERY CHANNEL FRIDAY, JANUARY 27 AT 10PM ET/PT In the frontier town of Nome, Alaska, there’s a gold rush on.. But you’ve never seen gold mining like this before ‐‐ here, the precious metal isn’t found in the ground. It’s sitting in the most unlikely of places: the bottom of the frigid, unpredictable Bering Sea. And there are a handful of people willing to risk it all to bring it to the surface. From Thom Beers’ Original Productions, the creators of the Emmy®‐winning DEADLIEST CATCH, comes the new eight‐part series BERING SEA GOLD, premiering on Discovery Channel Friday, January 27 at 10PM ET/PT. For two million years, glaciers have been melting into the Bering Sea and depositing sediments rich with gold into its waters. As Nome’s ice pack melts during the summer, the isolated, raamshackle town of eccentrics and outcasts booms with excitement, as pioneer gold seekers rush to get out onto the water. Miners dive and dredge to scour the bottom of the sea from custom built, barely seaworthy rigs – in a race to haul in as much gold as possible before the waters become too frigid to dive. BERING SEA GOLD follows four gold dredges that range wildlly in size and sophistication, but all have one thing in common: they’re run by driven and often desperate people whose very livelihoods depend on finding gold. -

Frontiersmen Are the “Real Men” I FRONTIERSMEN

Frontiersmen Are the “Real Men” i FRONTIERSMEN ARE THE “REAL MEN” IN TRUMP’S AMERICA: HEGEMONIC MASCULINITY AT WORK ON U.S. CABLE’S VERSION OF BLUE-COLLAR REALITY by SHANNON EILEEN MARIE O’SULLIVAN B.A. SUNY College at Buffalo, 2009 M.A. SUNY at Buffalo, 2011 A thesis submitted to the Faculty of the Graduate School of the University of Colorado in partial fulfillment of the requirement for the degree of Doctor of Philosophy Department of Media Studies College of Media, Communication and Information 2017 Frontiersmen Are the “Real Men” ii This thesis entitled: Frontiersmen Are the “Real Men” in Trump’s America: Hegemonic Masculinity at Work on U.S. Cable’s Version of Blue-Collar Reality written by Shannon Eileen Marie O'Sullivan has been approved for the Department of Media Studies Dr. Polly McLean Dr. Deepti Misri Date The final copy of this thesis has been examined by the signatories, and we find that both the content and the form meet acceptable presentation standards of scholarly work in the above mentioned discipline. IACUC protocol # __________________ Frontiersmen Are the “Real Men” iii Abstract Frontiersmen Are the “Real Men” in Trump’s America: Hegemonic Masculinity at Work on U.S. Cable’s Version of Blue-Collar Reality Dissertation directed by Associate Professor Polly McLean The emergence and popularity of the so-called “blue-collar reality shows” on U.S. cable networks in the past decade provide a critical point of entry for understanding the intersecting relationships between race, gender, social class, and hegemonic constructions of individualism and “authenticity” in U.S. -

FOR IMMEDIATE RELEASE Contact: Joshua Weinberg: 240.662.5274 March 19, 2012 Joshua [email protected]

FOR IMMEDIATE RELEASE Contact: Joshua Weinberg: 240.662.5274 March 19, 2012 [email protected] COLD RUSH: DEADLIEST CATCH Fleet Faces Brutal Business Downturn, Harshest Winter Yet Season Eight Premiere Marks Series’ 100th Episode Emmy® Award Winner for Best Reality Show Bows Tuesday, April 10 at 9pm e/p (Silver Spring, Md.) It‟s must seaworthy TV - the masters of the maritime, fishing‟s fearless are back as the Emmy® award-winning DEADLIEST CATCH returns celebrating its 100th episode with the season premiere Tuesday, April 10 at 9pm e/p on Discovery. Captains Andy and Johnathan Hillstrand (F/V Time Bandit), Captain Sig Hansen (F/V Northwestern), Captain Keith Colburn (F/V Wizard), Captain “Wild Bill” Wichrowski (F/V Kodiak) and returning newer skippers Captain Scott Campbell Jr. (F/V Seabrooke) and resident badboy, hot shot Captain Elliott Neese (F/V Ramblin‟ Rose) take to the icy Bering Sea searching for their own version of buried treasure – the highly prized Alaskan king crab. “From the very first day it has been a privilege to share this amazing journey with the fishermen of the Bering Sea”, said Thom Beers, Emmy® Award-winning executive producer and creator of DEADLIEST CATCH. “Everyone at Original Productions is proud to be a part of such a groundbreaking and successful series,” added Beers. This season DEADLIEST CATCH crews have their fishing quota slashed by almost half bringing home a cold economic reality -- how will they make enough money to support their families and literally keep their businesses afloat? With the change in quota, the captains are faced with choices in strategy and tactics – who will go for the more elusive blue crab? Which boat will risk changing pots and gear in order to reap higher profits? And later in the season, fishing opilio or “snow crab,” the fleet faces some of the harshest weather conditions any of them have ever experienced in more than a quarter century of fishing.