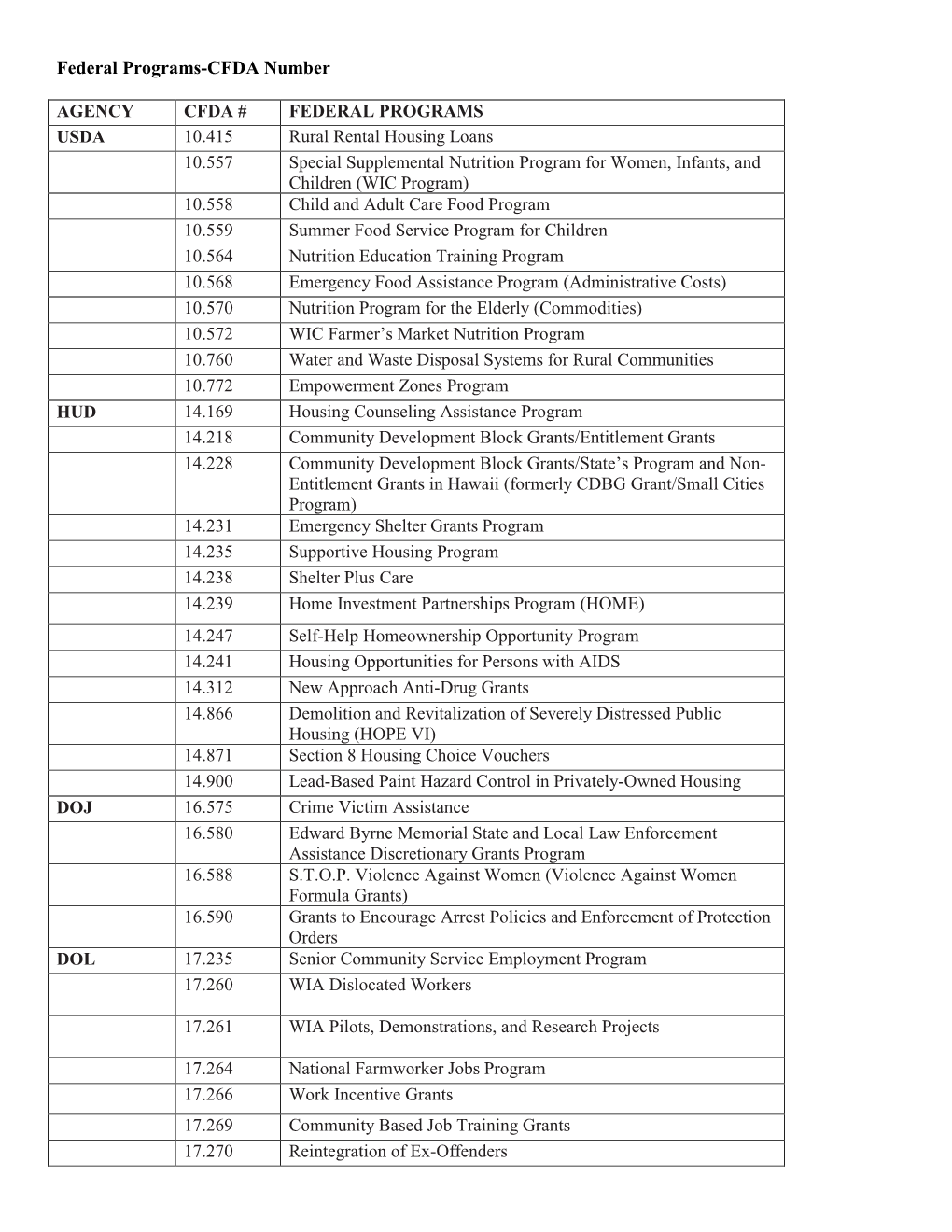

Federal Programs by CFDA Number

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Housing Trust Funds: Barriers and Opportunities

CitizensCitizens ResearResearchch CCouncilouncil ofof MichiganMichigan HousingHousing TrustTrust Funds:Funds: BarriersBarriers andand OppOpporortunitiestunities DecemberDecember 20092009 RepReporortt 358358 CCELEBRELEBRAATINGTING 9393 YYEARSEARS OFOF IINDEPENDENTNDEPENDENT,, NNONPONPARARTISANTISAN PPUBLICUBLIC PPOLICOLICYY RRESEARCHESEARCH ININ MMICHIGANICHIGAN Board of Directors Chairman Vice Chairman Treasurer Eugene A. Gargaro, Jr. Jeffrey D. Bergeron Nick A. Khouri Joseph R. Angileri Eugene A. Gargaro, Jr. Bryan Roosa Deloitte. Masco Corporation General Motors Corporation Jeffrey D. Bergeron Ingrid A. Gregg Lynda Rossi Ernst & Young LLP Earhart Foundation Blue Cross Blue Shield of Michigan John T. Bozzella Marybeth S. Howe Jerry E. Rush Chrysler Group LLC Wells Fargo Bank ArvinMeritor, Inc. Beth Chappell Nick A. Khouri Michael A. Semanco Detroit Economic Club DTE Energy Company Hennessey Capital LLC Rick DiBartolomeo Daniel T. Lis Terence A. Thomas, Sr. Rehmann Kelly Services, Inc. St. John Health Terence M. Donnelly Aleksandra A. Miziolek Amanda Van Dusen Dickinson Wright PLLC Dykema Gossett PLLC Miller, Canfield, Paddock and Randall W. Eberts Cathy H. Nash Stone PLC W. E. Upjohn Institute Citizens Bank Kent J. Vana David O. Egner Paul R. Obermeyer Varnum, Riddering, Schmidt & Hudson-Webber Foundation Comerica Bank Howlett LLP Advisory Director Louis Betanzos Board of Trustees Chairman Vice Chairman Patrick J. Ledwidge Mark A. Murray Terence E. Adderley Roderick D. Gillum William L. Matthews Irving Rose Kelly Services, Inc. General Motors Corporation Plante & Moran PLLC Edward Rose & Sons Jeffrey D. Bergeron Allan D. Gilmour Kenneth J. Matzick Gary D. Russi Ernst & Young LLP Alfred R. Glancy III Beaumont Hospitals Oakland University Stephanie W. Bergeron Unico Investment Group LLC Sarah L. McClelland Nancy M. Schlichting Walsh College Thomas J. Haas Chase Henry Ford Health System David P. -

COMMUNITY DEVELOPMENT: Status of Urban Empowerment Zones

United States General Accounting Office Report to the Chairman, Subcommittee GAO on Human Resources and Intergovernmental Relations, Committee on Government Reform and Oversight, House of Representatives December 1996 COMMUNITY DEVELOPMENT Status of Urban Empowerment Zones GOA years 1921 - 1996 GAO/RCED-97-21 United States General Accounting Office GAO Washington, D.C. 20548 Resources, Community, and Economic Development Division B-275112 December 20, 1996 The Honorable Christopher Shays Chairman Subcommittee on Human Resources and Intergovernmental Relations Committee on Government Reform and Oversight House of Representatives Dear Mr. Chairman: For over 30 years, the nation has faced the challenge of revitalizing its deteriorating urban and rural communities. In the past, the federal government has tried to revive distressed areas by providing grants for activities ranging from job training and social services to the repair and replacement of aging infrastructure. The most recent effort to help distressed communities is called the Empowerment Zone and Enterprise Community (EZ/EC) program. This 10-year program targets federal grants to distressed urban and rural communities for social services and community redevelopment and provides tax and regulatory relief to attract or retain businesses in distressed communities. In general, the same eligibility criteria and selection process apply to the EZs and the ECs. However, the EZs receive much larger grants than the ECs, and businesses located in the EZs are eligible for more tax incentives than businesses in the ECs. The enacting legislation designated 104 communities as either EZs or ECs. Federal funding for the EZs and ECs was made available through the title XX Social Services Block Grant (SSBG) program, which is administered by the Department of Health and Human Services (HHS). -

Sustaining Supportive Services Beyond HOPE VI

Successful Transitions Sustaining Supportive Services beyond HOPE VI HOPE VI is a unique program that has Overview of HOPE VI Program provided practitioners with a flexible tool In 1989, Congress authorized the for revitalizing distressed communities and establishment of a National Commission on improving the lives of public housing Severely Distressed Public Housing with a residents. A time -limited program, HOPE mandate to 1) identify those public housing VI may ultimately be judged more on how developments that are severely distressed; 2) successfully it helps to improve the lives of assess strategies to improve their conditions; public housing residents and less on its and 3) develop a National Action Plan. ability to construct and rehabilitate houses. Based on the Commission’s findings that As its “sunset” approaches in 2002, the about seven percent of the nation’s housing question of its sustainability looms large. In stock had to be replaced, HOPE VI was both theory and practice, HOPE VI grants created in 1993 through an Appropriations were intended to be seed funds and were Act, and with extensive bipartisan support. meant to act as a catalyst for change. This was a major HUD initiative with no Grantees must not only sustain the new real implementing regulations and with a focus estate portfolio that results from HOPE VI, on comprehensive and holistic approaches to they must also develop strategies for physical improvements, resident self- sustaining the innovative and successful sufficiency, management improvements and supportive services that are critical to local decision making. At the time, funding helping residents move toward greater self- for HOPE VI was roughly equivalent to sufficiency. -

Wic, Medicaid, and Snap: Teaming up to Improve the Health of Women and Children

WIC, MEDICAID, AND SNAP: TEAMING UP TO IMPROVE THE HEALTH OF WOMEN AND CHILDREN THE IMPORTANCE OF THE IMPORTANCE NWA’S MISSION MEDICAID FOR WIC OF SNAP FOR WIC PARTICIPANTS PARTICIPANTS The National The vast majority of WIC participants WIC benefits are not meant to cover WIC Association rely on Medicaid and/or the Children’s a full grocery basket of food each (NWA) provides its Health Insurance Program (CHIP)— month. Instead, targeted foods members with tools which provides coverage to uninsured address nutritional gaps in the diets of and leadership to children who are not eligible for pregnant women, new mothers, and expand and sustain Medicaid, but cannot afford private young children, For families lacking effective nutrition insurance—for healthcare coverage.3 resources to afford foods beyond the services for In addition to covering nearly half scope of WIC, SNAP plays a vital role. mothers and young of all births in the US, Medicaid A large body of research demonstrates children. provides a range of prenatal and that SNAP reduces the number of postpartum services that are key households facing food insecurity.7 8 to improving outcomes for WIC This is particularly true of households mothers and babies during these with children, with conservative vital periods.4 Most states’ Medicaid estimates attributing a reduction in OVERVIEW OF WIC programs cover access to prenatal childhood food insecurity of at least The Special Supplemental Nutrition vitamins, ultrasounds, amniocentesis, 8.1% to SNAP.9 Other studies assert Program for Women, Infants, and chorionic villus sampling (CVS) tests, that a mere six months of participation Children (WIC), the nation’s premier genetic counseling, breast pumps, in SNAP reduces the likelihood of public health nutrition program, has and postpartum home visiting.5 This food insecurity by one-third compared improved the health of women, infants, coverage plays a critical role in to similarly situated households.10 and children for 46 years. -

Glossary of Hope Vi Terms

HOPE VI Guidance November 2001 GLOSSARY OF HOPE VI TERMS ACC: Annual Contributions Contract. A contract between HUD and the PHA whereby HUD agrees to provide financial assistance, and the PHA agrees to comply with HUD requirements (including long-term low- income use restrictions) for the development, operation, and modernization of public housing units in a development. Accessibility: HOPE VI developments are subject to the accessibility requirements contained in several Federal laws. All applicable laws must be read together and followed. PIH Notice 99-52, available through HUDCLIPS (see below) provides an overview of all pertinent laws and implementing regulations pertaining to HOPE VI. Under the Fair Housing Act of 1988, all new construction of covered multifamily buildings must include certain features of accessible and adaptable design. Units covered are all those in buildings with four or more units and one or more elevators, and all ground floor units with living area located entirely on the ground floor in buildings without elevators. The accessible design requirements are: 1. Accessible entrance on an accessible route 2. Accessible public and common use areas 3. Accessible doorways 4. Accessible routes into and through the unit 5. Accessible light switches, electrical outlets, and environmental controls 6. Reinforced walls in bathrooms 7. Usable kitchens and bathrooms HUD encourages accessibility in for-sale units (5 percent for mobility impaired and 2 percent for hearing or vision disabilities). Accessibility at 5 percent/2 percent is required in multifamily rental units. More information on accessibility may be obtained from HUD's Fair Housing website: www.hud.gov/groups/fairhousing.cfm. -

New Schools on the Block Understanding and Expanding Community Developer Participation in Early Childhood Care and Education

New Schools on the Block Understanding and Expanding Community Developer Participation in Early Childhood Care and Education Matthew Singh Edward M. Gramlich Fellow, 2012 NeighborWorks America / Harvard Joint Center for Housing Studies Working Together for Strong Communities NEIGHBORWORKS AMERICA Neighborhood Reinvestment Corporation dba NeighborWorks America was established by an Act of Congress in 1978 (Public Law 95-557). A primary objective of the Corporation is to increase the capacity of local, community-based organizations to revitalize their communities, particularly by expanding and improving housing opportunities. These local organizations, known as NeighborWorks organizations, are independent, resident-led, nonprofit partnerships that include business leaders and government officials. All together they make up the NeighborWorks network. JOINT CENTER FOR HOUSING STUDIES OF HARVARD UNIVERSITY The Harvard Joint Center for Housing Studies advances understanding of housing issues and informs policy. Through its research, education, and public outreach programs, the center helps leaders in government, business, and the civic sectors make decisions that effectively address the needs of cities and communities. Through graduate and executive courses, as well as fellowships and internship opportunities, the Joint Center also trains and inspires the next generation of housing leaders. This paper was written with the support of the NeighborWorks’ America Edward M. Gramlich Fellowship in Community and Economic Development which provides -

FCC Should Evaluate the Efficiency and Effectiveness of the Lifeline Program

United States Government Accountability Office T estimony Before the Subcommittee on Communications, Technology, Innovation and the Internet, Committee on Commerce, Science and Transportation, U.S. S enate For Release on Delivery Expected at 9:30 a.m. ET Tuesday, June 2, 2015 TELECOMMUNICATIONS FCC Should Evaluate the Efficiency and Effectiveness of the Lifeline Program Statement of Michael Clements, Acting Director Physical Infrastructure Issues ACCESSIBLE VERSION GAO-15-638T Letter Letter Chairman Wicker, Ranking Member Schatz, and Members of the Subcommittee: I am pleased to be here today as you discuss the Federal Communications Commission’s (FCC) efforts to promote telephone subscribership among low-income households. Through the Lifeline program, companies provide discounts to eligible low-income households for telephone service. The Lifeline program supports these companies through the Universal Service Fund, which is funded through mandatory fees that are usually passed along to consumers through a charge applied to their monthly telephone bills. The Lifeline program was created in the mid-1980s and has traditionally centered on wireline residential telephone service. However, FCC actions in 2005 and 2008 paved the way for prepaid wireless companies to begin offering Lifeline service in 2008; at the time, FCC did not quantify or estimate the potential increases in participation from its decision. Subsequently, Lifeline experienced rapid growth in participation and disbursements. In particular, from mid-2008 to mid-2012, Lifeline -

Section 1: Evaluating Borrower Income Chapter 4

HB-1-3550 CHAPTER 4: BORROWER ELIGIBILITY 4.1 OVERVIEW Ensuring that all applicants served are eligible and receive the correct amount of assistance is a significant responsibility of Loan Originators and Loan Approval Officials. A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program requirements. This chapter provides guidance for each of these areas. • Section 1: Evaluating Borrower Income provides instructions for calculating and verifying annual, adjusted, and repayment income. • Section 2: Evaluating Borrower Assets discusses Agency requirements for cash contributions to the purchase and methods for computing income from assets. • Section 3: Credit History identifies indicators of acceptable and unacceptable credit and provides instructions for reviewing an applicant’s credit history. • Section 4: Other Eligibility Requirements addresses a variety of other requirements applicants must meet to be eligible for the program. • Section 5: Processing the Certificate of Eligibility provides policies and procedures for processing Form FD 1944-59, Certificate of Eligibility. SECTION 1: EVALUATING BORROWER INCOME 4.2 OVERVIEW [7 CFR 3550.53(a) and (g), 7 CFR 3550.54] Loan Originators use income information to: (1) help determine whether an applicant is eligible for a loan; (2) calculate the applicant’s ability to repay a loan; and (3) determine the amount of the loan and the amount of payment subsidy the household can obtain. When reviewing an applicant’s repayment income, the Loan Originator must determine whether the income is stable and dependable. This will typically be accomplished by reviewing information provided in the application, paystubs, tax returns, and oral verifications. -

GAO-06-727 Empowerment Zone And

United States Government Accountability Office GAO Report to Congressional Committees September 2006 EMPOWERMENT ZONE AND ENTERPRISE COMMUNITY PROGRAM Improvements Occurred in Communities, but the Effect of the Program Is Unclear a GAO-06-727 September 2006 EMPOWERMENT ZONE AND Accountability Integrity Reliability Highlights ENTERPRISE COMMUNITY PROGRAM Highlights of GAO-06-727, a report to Improvements Occurred in Communities, but congressional committees the Effect of the Program Is Unclear Why GAO Did This Study What GAO Found The EZ/EC program is one of the Round I Empowerment Zones (EZ) and Enterprise Communities (EC) most recent large-scale federal implemented a variety of activities using $1 billion in federal grant funding effort intended to revitalize from the Department of Health and Human Services (HHS), and as of March impoverished urban and rural 2006, the designated communities had expended all but 15 percent of this communities. There have been funding. Most of the activities that the grant recipients put in place were three rounds of EZs and two rounds of ECs, all of which are community development projects, such as projects supporting education and scheduled to end no later than housing. Other activities included economic opportunity initiatives such as December 2009. job training and loan programs. Although all EZs and ECs also reported using the program grants to leverage funds from other sources, reliable data The Community Renewal Tax on the extent of leveraging were not available. Relief Act of 2000 mandated that GAO audit and report in 2004, 2007, According to federal standards, agencies should oversee the use of public and 2010 on the EZ/EC program resources and ensure that ongoing monitoring occurs. -

SPS 2018-19 Free Reduced Lunch Application Complete.Pdf

FREQUENTLY ASKED QUESTIONS ABOUT FREE AND REDUCED-PRICE SCHOOL MEALS Dear Parent/Guardian: Children need healthy meals to learn. Skiatook Public Schools offers healthy meals every school day. Breakfast costs $1.35 (elementary) & $1.60 (secondary); lunch costs $2.50 (elementary) & $2.75 (secondary). Your children may qualify for free meals or for reduced-price meals. Reduced-price is $0.30 for breakfast and $0.40 for lunch. This packet includes an application for free or reduced-price meal benefits and a set of detailed instructions. Below are some common questions and answers to help you with the application process. 1. WHO CAN GET FREE OR REDUCED-PRICE MEALS? All children in households receiving benefits from Supplemental Nutrition Assistance Program (SNAP), Food Distribution Program on Indian Reservations (FDPIR), or Temporary Assistance for Needy Families (TANF) are eligible for free meals. Foster children who are under the legal responsibility of a foster care agency or court are eligible for free meals. Children participating in their school’s Head Start program are eligible for free meals. Children who meet the definition of homeless, runaway, or migrant are eligible for free meals. Children may receive free or reduced-price meals if your household’s income is within the limits on the Federal Income Eligibility Guidelines. Your children may qualify for free or reduced-price meals if your household income falls at or below the limits on this chart. FEDERAL ELIGIBILITY INCOME CHART for School Year: 2019 Every Two Household Size Yearly Monthly Twice Per Month Weekly Weeks 1 22,459 1,872 936 864 432 2 30,451 2,538 1,269 1,172 586 3 38,443 3,204 1,602 1,479 740 4 46,435 3,870 1,935 1,786 893 5 54,427 4,536 2,268 2,094 1,047 6 62.419 5,202 2,601 2,401 1,201 7 70,411 5,868 2,934 2,709 1,355 8 78,403 6,534 3,267 3,016 1,508 Each additional 7,992 666 333 308 154 person: 2. -

CHOICE NEIGHBORHOODS 2014 Summary Statement and Initiatives (Dollars in Thousands)

PUBLIC AND INDIAN HOUSING CHOICE NEIGHBORHOODS 2014 Summary Statement and Initiatives (Dollars in Thousands) Enacted/ Supplemental/ Total CHOICE NEIGHBORHOODS Request Carryover Rescission Resources Obligations Outlays 2012 Appropriation ................ $120,000 ... ... $120,000 $500 ... 2013 Annualized CR ................ 120,734 $119,500 ... 240,234 240,234 $8,000 2014 Request ...................... 400,000 ... ... 400,000 a 400,000 36,000 Program Improvements/Offsets ...... +279,266 -119,500 ... +159,766 +159,766 +28,000 a/ This number includes an estimated Transformation Initiative (TI) transfer that may be up to 0.5 percent of Budget Authority. 1. What is this request? The Department requests $400 million for the Choice Neighborhoods program for fiscal year 2014. Choice Neighborhoods grants will primarily fund the transformation, rehabilitation and replacement of distressed public and/or HUD-assisted housing and will support communities working to revitalize neighborhoods of concentrated poverty. Choice Neighborhoods will support a range of transformative interventions in neighborhoods of concentrated poverty. Grants will be targeted to assist neighborhoods with both concentrations of poverty or households with extremely low-incomes and severely distressed public and/or HUD-assisted housing. Additionally, Choice Neighborhoods will build on the successes of the HOPE VI, Homeownership Zone, and Empowerment Zone programs by preserving affordable housing and creating safe streets, high quality schools and other amenities typically associated with desirable neighborhoods. This request is comprised of up to $395 million to award Planning Grants and Implementation Grants and $5 million for program evaluation and technical assistance. Based on historic job creation data, funding at the $400 million level is projected to generate 8,650 new jobs within targeted communities. -

Public Housing Relocation and Utilization of the Food Safety Net: the Role of Social Capital and Cultural Capital Marcie Hambrick

Georgia State University ScholarWorks @ Georgia State University Sociology Dissertations Department of Sociology Fall 12-15-2016 Public Housing Relocation and Utilization of the Food Safety Net: The Role of Social Capital and Cultural Capital Marcie Hambrick Follow this and additional works at: https://scholarworks.gsu.edu/sociology_diss Recommended Citation Hambrick, Marcie, "Public Housing Relocation and Utilization of the Food Safety Net: The Role of Social Capital and Cultural Capital." Dissertation, Georgia State University, 2016. https://scholarworks.gsu.edu/sociology_diss/88 This Dissertation is brought to you for free and open access by the Department of Sociology at ScholarWorks @ Georgia State University. It has been accepted for inclusion in Sociology Dissertations by an authorized administrator of ScholarWorks @ Georgia State University. For more information, please contact [email protected]. PUBLIC HOUSING RELOCATION AND UTILIZATION OF THE FOOD SAFETY NET: THE ROLE OF SOCIAL CAPITAL AND CULTURAL CAPITAL by MARCIE HAMBRICK Under the Direction of Deirdre Oakley, PhD ABSTRACT HOPE VI, instituted in 1993 and subsequent related policies, resulted in the demolition of traditional public housing and the relocation of former residents. For former residents living on low incomes, combining housing subsidy and other social services is important to survival. One crucial type of social services support provides food supplements. Research indicates that among low-income families, many do not receive necessary food social services. For example, among eligibles, food stamp utilization is at 50 to 60%, and for Special Supplemental Nutrition Program for Women Infants and Children (WIC) rates vary from 38 to 73%. Research indicates that 35% of food insecure older adults are ineligible for the Elder Nutrition Program, and approximately 60% of eligibles are wait-listed upon application.