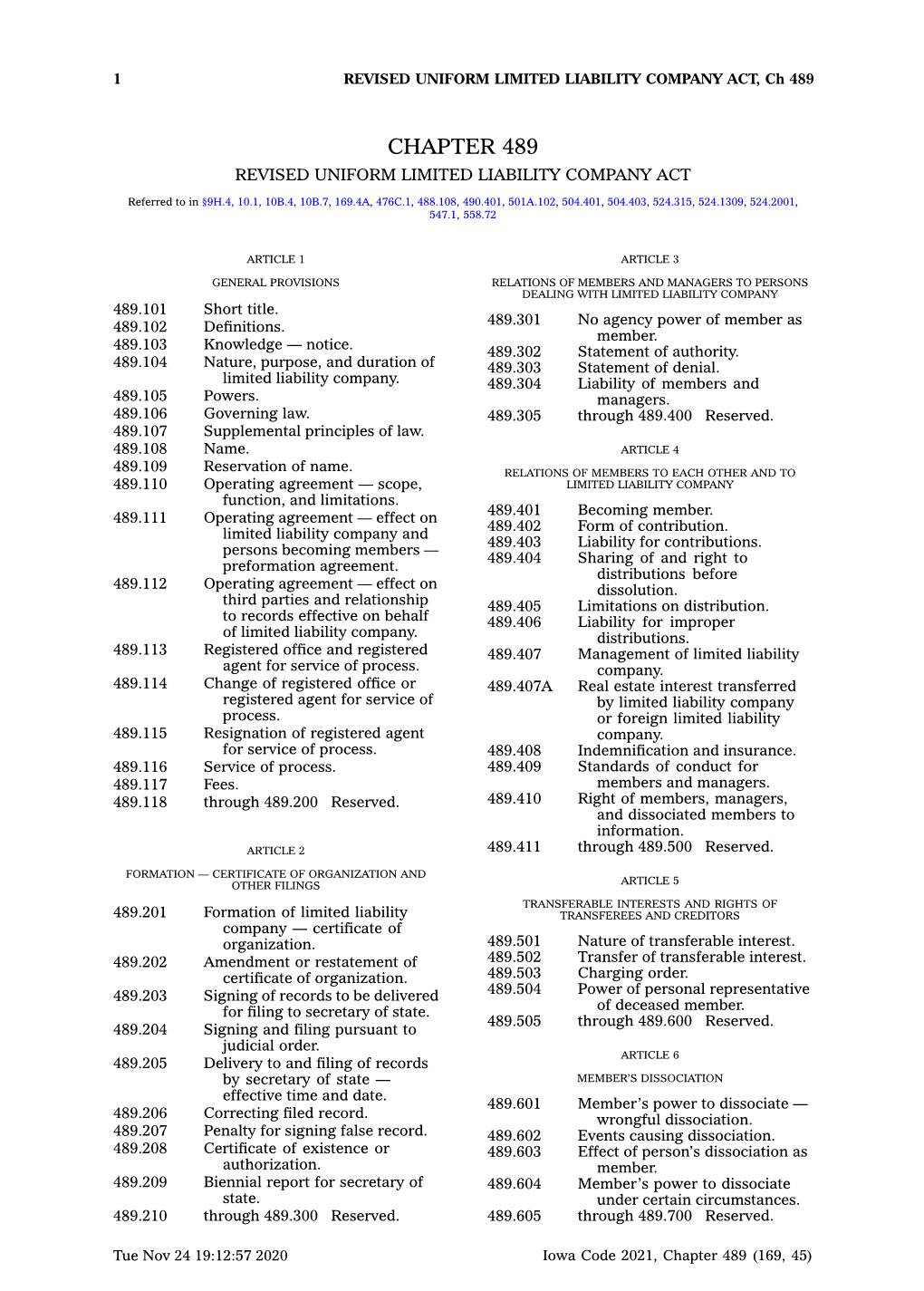

Chapter 489 Revised Uniform Limited Liability Company Act

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nominating and Corporate Governance Committee Charter

HORIZON THERAPEUTICS PUBLIC LIMITED COMPANY CHARTER OF THE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE OF THE BOARD OF DIRECTORS AMENDED EFFECTIVE: 18 FEBRUARY 2021 PURPOSE AND POLICY The primary purpose of the Nominating and Corporate Governance Committee (the “Committee”) of the Board of Directors (the “Board”) of Horizon Therapeutics Public Limited Company, an Irish public limited company (the “Company”), shall be to oversee all aspects of the Company’s corporate governance functions on behalf of the Board, including to (i) make recommendations to the Board regarding corporate governance issues; (ii) identify, review and evaluate candidates to serve as directors of the Company consistent with criteria approved by the Board and review and evaluate incumbent directors; (iii) serve as a focal point for communication between such candidates, non-committee directors and the Company’s management; (iv) nominate candidates to serve as directors; and (v) make other recommendations to the Board regarding affairs relating to the directors of the Company. The Committee shall also provide oversight assistance in connection with the Company’s legal, regulatory and ethical compliance programs, policies and procedures as established by management and the Board. The operation of the Committee and this Nominating and Corporate Governance Charter shall be subject to the constitution of the Company as in effect from time to time and the Irish Companies Act 2014, as amended by the Irish Companies (Amendment) Act 2017, the Irish Companies (Accounting) Act 2017 and as may be subsequently amended, updated or replaced from time to time (the “Companies Act”). COMPOSITION The Committee shall consist of at least two members of the Board. -

Ownership and Control of Private Firms

WJEC BUSINESS STUDIES A LEVEL 2008 Spec. Issue 2 2012 Page 1 RESOURCES. Ownership and Control of Private Firms. Introduction Sole traders are the most popular of business Business managers as a businesses steadily legal forms, owned and often run by a single in- grows in size, are in the main able to cope, dividual they are found on every street corner learn and develop new skills. Change is grad- in the country. A quick examination of a busi- ual, there are few major shocks. Unfortu- ness directory such as yellow pages, will show nately business growth is unlikely to be a that there are thousands in every town or city. steady process, with regular growth of say There are both advantages and disadvantages 5% a year. Instead business growth often oc- to operating as a sole trader, and these are: curs as rapid bursts, followed by a period of steady growth, then followed again by a rapid Advantages. burst in growth.. Easy to set up – it is just a matter of in- The change in legal form of business often forming the Inland Revenue that an individ- mirrors this growth pattern. The move from ual is self employed and registering for sole trader to partnership involves injections class 2 national insurance contributions of further capital, move into new markets or within three months of starting in business. market niches. The switch from partnership Low cost – no legal formalities mean there to private limited company expands the num- is little administrative costs to setting up ber of manager / owners, moves and rear- as a sole trader. -

Limited Liability Partnerships

inbrief Limited Liability Partnerships Inside Key features Incorporation and administration Members’ Agreements Taxation inbrief Introduction Key features • any members’ agreement is a confidential Introduction document; and It first became possible to incorporate limited Originally conceived as a vehicle liability partnerships (“LLPs”) in the UK in 2001 • the accounting and filing requirements are for use by professional practices to after the Limited Liability Partnerships Act 2000 essentially the same as those for a company. obtain the benefit of limited liability came into force. LLPs have an interesting An LLP can be incorporated with two or more background. In the late 1990s some of the major while retaining the tax advantages of members. A company can be a member of an UK accountancy firms faced big negligence claims a partnership, LLPs have a far wider LLP. As noted, it is a distinct legal entity from its and were experiencing a difficult market for use as is evidenced by their increasing members and, accordingly, can contract and own professional indemnity insurance. Their lobbying property in its own right. In this respect, as in popularity as an alternative business of the Government led to the introduction of many others, an LLP is more akin to a company vehicle in a wide range of sectors. the Limited Liability Partnerships Act 2000 which than a partnership. The members of an LLP, like gave birth to the LLP as a new business vehicle in the shareholders of a company, have limited the UK. LLPs were originally seen as vehicles for liability. As he is an agent, when a member professional services partnerships as demonstrated contracts on behalf of the LLP, he binds the LLP as by the almost immediate conversion of the major a director would bind a company. -

AIG Guide to Key Features of Private Limited Companies

PrivateEdge Key features and requirements of private limited companies It is crucial for businesses set up as private limited companies to comply with the requirements of the Companies Act 2006. This guidance note sets out the key legal requirements for private limited companies in the UK, discusses shareholders’ rights and duties, and the process for convening company meetings and the passing of resolutions 1 What is a private limited company? 1.1 A private limited company is the most common form of trading vehicle for companies in the UK. 1.2 The key features and requirements of a private limited company are that: – It will have a separate legal personality from its owners (shareholders). – Responsibility for the management of a company generally falls to its directors; – The liability of each shareholder for the company's debt and other liabilities is generally limited to the amount which remains unpaid on that shareholder's shares; • It must have an issued share capital comprising at least one share. Each issued share must have a fixed nominal value. The ways in which a company can alter its share capital is strictly controlled by the Companies Act 2006 (“CA 2006”). There are also strict statutory controls on a company's ability to make returns of value (dividends) to its shareholders; • It must have at least one director. A private limited company is not required to have a company secretary, although it may choose to do so; and • The nominal value of a private limited company does not have to exceed a specified amount. It is common practice for a private company to be incorporated with a share capital made up of just one £1 share. -

I. Differences Between a Co-Operative and a PC in India II. Comparison Of

I. Differences between a co-operative and a PC in India Feature Co-operative PC Registration under Co-op societies Act Companies Act Membership Open to any individual or co- Only to producer members operative and their agencies Professionals on Board Not provided Can be co-opted Area of operation Restricted Throughout India Relation with other entities Only transaction based Can form joint ventures and alliances Shares Not tradable Tradable within membership only Member stakes No linkage with no. of shares Articles of association can held provide for linking shares and delivery rights Voting rights One person one vote but RoC Only one member one vote and government have veto and non-producer can’t vote power Reserves Can be created if made profit Mandatory to create reserves Profit sharing Limited dividend on capital Based on patronage but reserves must and limit on dividend Role of government Significant Minimal Disclosure and audit Annual report to regulator Very strict as per the requirements Companies Act Administrative control Excessive None External equity No provision No provision Borrowing power Restricted Many options Dispute settlement Through co-op system Through arbitration II. Comparison of diff options for registration under the companies Act Type of company> Private limited Limited Company PC Parameter Company Minimum No. of 2 3 5 Directors required Number of Members Minimum 2; Minimum 7 Minimum 10 primary Maximum 50 producer members or two producer institutional members Membership Any one Any one Only primary eligibility producer or producer institutions can be member. Type of shares Equity and Equity and Preference Only Equity Preference Voting rights based on number of based on number of Only one vote equity shares held equity shares held irrespective of number of shares held. -

The German Supervisory Board

The German Supervisory Board: A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors Contents Foreword Foreword 03 As the world’s economy globalizes, there is often an expectation that business practices will Executive Summary 04 harmonize along with it. This is an expectation The German Supervisory Board: Characteristics and Context 05 that we will see a kind of convergence of corporate The German Supervisory Board in Action: Regular Order, M&A, Crisis 14 governance forms and practices, where boards the world over resemble each other, perhaps Conclusion 15 with a large majority of independent directors, an Endnotes 17 audit committee, a separate chair and CEO, and so on. A lot of this reflects a certain familiarity Claus Buhleier with the Anglo-Saxon board model among Partner, Center for Corporate institutional investors in London and New York. Governance Deloitte Germany [email protected] The reality, however, is quite different. Despite real advances in globalization in other areas, differences in what boards look like and how they work in practice persist across countries. This publication brings to light the differences between the predominant Anglo Saxon, one-tier corporate governance model on the one hand, and the still influential Germanic two-tier-model on the other. The authors, Yvonne Schlaeppi and Michael Marquardt, both experienced corporate directors Kai Bruehl who have served on European company boards, Director, Risk Advisory Deloitte highlight the main characteristics of the German Germany [email protected] supervisory board model and how it demands accountability from its members, despite looking rather different than the combined board model. -

Commonly Used International Entity Types

Commonly Used International Entity Types COUNTRY/REGION ENTITY STRUCTURE BASIC FORMATION REQUIREMENTS Minimum Registered Corporate Secretary Minimum # of Minimum # of Directors Legal Liability ASIA-PACIFIC Capital Address Shareholders/Partners Australia Public Company (Limited or Ltd.) AUD 0 Required One Unlimited Three. At least 2 must be Limited to the amount local residents subscribed for shares Private or Proprietary Company AUD 0 Required Not required 1-50 One. At least 1 must be Limited to the amount (Pty. Ltd. or Proprietary Limited) local resident subscribed for shares China Limited Liability Company CNY 0 Required Not required. But a 1-50 Board of directors or a Limited to the amount local representative single executive director subscribed for shares may be required. Company Limited by Shares CNY 0 Required Not required 2-200 Board of directors Limited to the amount required subscribed for shares Partnership CNY 0 Required Not required 2-50 Partner managed Not a separate legal entity from its parent Hong Kong Limited Private Company HKD 0 Required Required, must be local 1-50 Board of directors Limited to the amount resident or company required subscribed for shares India Private Limited Company (Pvt Ltd) INR 0 Required Required if initial 2-200 Two. At least 1 must be Limited to the amount capital investment local resident subscribed for shares exceeds INR100 million Limited Liability Partnership (LLP) INR 0 Required N/A Two. At least 1 must be Partner managed Limited to the amount local resident subscribed for shares Japan General Corporation (Kabushiki JPY 1 Required Not required Unlimited One Limited to the amount Kaisha) subscribed for shares Limited Liability Company (Godo- JPY 1 Required Not required Unlimited Managed by managing Limited to the amount Kaisha) members subscribed for shares Singapore Private Limited Company (Private $1 in any Required Required and must be 1-50 One. -

Which Business Entity Type Is Right for Your New Business?

Which Business Entity Type is right for your new business? Choosing the appropriate organizational structure for your business is one of the most important decisions to make at the start of the business, and may require advice from an attorney, an accountant or some other knowledgeable business advisor. The options below provide brief descriptions of the principal types of business organization. For more information, including registration requirements, tax implications, and the advantages and disadvantages of each, consult the Kansas Business Center website. http://www.kansas.gov/business SOLE PROPRIETORSHIP The sole proprietorship is the most common form of business structure. A sole proprietorship is a business controlled and owned by one individual and is limited to the life of its owner, so when the owner dies the business ends. The owner receives the profits and takes the losses from the business. This individual alone is responsible for the debts and obligations of the business. Income and expenses of the business are reported on the proprietor's individual income tax return and profits are taxed at the proprietor's individual income tax rate. Kansas has no state requirements to register or file the business name of a sole proprietorship. GENERAL PARTNERSHIP A general partnership is a business owned by two or more people (even a husband and wife), who carry on the business as a partnership. Partnerships have specific attributes, which are defined by Kansas statutes. All partners share equally in the right and responsibility to manage the business. Each partner is responsible for all debts and obligations of the business. -

A Brief Guide to Forming a Company

A brief guide to forming a company 1. Incorporating a Company A Designated Activity Company (“DAC”): A Types of Company private company, a DAC’s activities are limited to its objects as set out in its memorandum of The most common forms of business organisations association and it must have at least two directors. operating in Ireland are: Suitable for joint ventures and special purposes A Limited Company vehicles or where there is a corporate governance requirement for a restriction on its activities. An Unlimited Company A Company Limited by Guarantee having a Share Investment Funds Capital (“DAC limited by guarantee”): A private Irish registered companies can be formed having company, whereby the shareholders have liability public or private status and with limited or unlimited under two headings; firstly, the amount, if any, that liability. is unpaid on the shares they hold, and secondly, the amount they have undertaken to contribute to Irish company law also provides for the use of the the assets of the company, in the event that it is Societas Europaea or “SE’s” which is a European wound up, being not less than €1. Its activities are public limited company. limited to its objects as set out in its memorandum Limited Companies of association and it must have at least two In a limited company, the liability of the shareholder directors. is limited to the amount(s) agreed to be paid on the A Company Limited by Guarantee not having issue of share(s) or the nominal value of the share, a Share Capital (“CLG”): A public company, whichever is greater and/or is limited to the amount whereby the shareholders’ liability is limited to guaranteed by the shareholder. -

Formation of a Limited Liability Company in the District of Columbia

Formation of a Limited Liability Company in the District of Columbia A Guide for Business Owners January 2013 Updated December 2018 © D.C. Bar Pro Bono Center Introduction Limited liability companies (LLCs) are corporate entities that combine the characteristics of corporations and partnerships. Like a corporation, the LLC protects its owners from the liabilities and debts of the business. Like a partnership, the LLC passes its profits and losses on to its owners, who report them on their personal tax returns. This guide covers the basic steps in the process of forming an LLC in the District of Columbia under the Uniform Limited Liability Company Act of 2010 (D.C. LLC Act), which governs the formation, operation, and dissolution 1 of LLCs in the District. In D.C., the Corporations Division of the Department of Consumer and Regulatory Affairs (DCRA) registers domestic and foreign business entities, including LLCs, that are formed under the D.C. LLC Act or that conduct business in the District. The certificate of incorporation for your LLC, as well as other corporate filings, will need to be filed with the Corporations Division. Please note: This guide is provided as a public service by the D.C. Bar Pro Bono Center solely for informational purposes, without any representation that it is accurate or complete. It does not constitute legal advice and should not be construed as such. It does not create an attorney-client relationship between the recipient and any other person, or an offer to create such a relationship. This communication contains information that is based, in whole or in part, on the laws of the District of Columbia and is current as of the date it is written. -

OBJETIVES of JOINT STOCK COMPANY 1. Rapid Industrialization

CLASS- 11 SUBJECT- COMMERCE CHAPTER- JOINT STOCK COMPANY (Part-2) OBJETIVES OF JOINT STOCK COMPANY 1. Rapid Industrialization- Rapid industrialization of the country is essential to achieve the objectives of the five year plans. Strong infrastructure is necessary for rapid development of industries. Infrastructure consists of power generation, coal, oil, steel, cement etc. These industries require huge investment and involve heavy risk. 2. Large scale production- Economic progress is not possible without higher productivity and better quality goods. This requires development and use of sophisticated technology. Joint Stock Company organization is required to undertake mass production and mass distribution of goods and services. 3. Better utlisation of resources- Corporate organization can make better use of country’s resource with the application of modern methods of production and distribution. Optimum use of natural resources is beneficial to society economically. 4. Mobilisation of idle resources- A public limited company can mobilize scattered and small savings of public. These financial resources are invested in industry. In this way corporate organization seeks to increase the rate of capital formation in a country. 5. Employment generation- Unemployment has become a chronic problem in India. Joint stock company provides direct employment to a large number of people. It also creates employment opportunities by developing ancillary industries. 6. Improvement in standard of living 7. Growth of social sector and rural economy MERITS OF A COMPANY 1. Large Capital Resources- A Joint Stock Company has widespread appeal to investors of all types. Its capital is divided into shares of small value so that people with limited means can also buy them. -

Origin of the Limited Companies Archive: Regulatory Framework

The Limited Companies Archive in the Cape Archives Depot: a wild‐goose chase or colonial treasure trove? Origin of the Limited Companies Archive: regulatory framework • In terms of Act no 23 of 1861 (The Joint‐stock Companies’ Limited Liability Act, 1861) all companies with limited liability had to apply to the Registrar of Deeds for registration and had to render certain returns especially in respect of share transfers • Repealed 1892 and replaced by Act 25 of 1892: The Companies Act, 1892 • Definition of “joint‐stock company”: Every partnership whereof the capital is divided, or agreed to be div ide d, itinto shares, and so as to be transferable without the explicit consent of all the partners; and also every partnership which at its formation, or by subsequent admission, shall consist of more than twenty‐five members. How limited liability may be obtained: Conditions for receiving a certificate of registration • The directors, or provisional directors, shall in their application to the Registrar of Deeds for such registration state that such company is to be formed with limited liability • The word “limited” shall be the last word of the name of the company. • The deed of settlement shall contain a statement to the effect that the company is formed with limited liability • The deed of settlement shall be executed by shareholders not less than 25 in number, holding shares to the amount in the aggregate of not less than three fourths of the nominal capital of the company, and they shall have been paid up by each of the shareholders on account of his shares, not less than ten pounds per centum.