I. Differences Between a Co-Operative and a PC in India II. Comparison Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Affiliate Companies in Ethiopia Analysis of Organization, Legal

ADDIS ABABA UNIVERSITY SCHOOL OF GRADUATE STUDIES AFFILIATE COMPANIES IN ETHIOPIA: ANALYSIS OF ORGANIZATION, LEGAL FRAME WORK AND THE CURRENT PRACTICE By: Mehamed Aliye Waritu Advisor: Ato Seyoum Yohannes (LL.B, LL.M) Faculty of Law ADDIS ABABA University January, 2010 www.chilot.me Affiliate Companies in Ethiopia: Analysis of Organization, Legal Frame Work and the Current Practice A Thesis Submitted In Partial Fulfillment of the Requirements of the LLM Degree (Business Law) By Mehamed Aliye Waritu Advisor Ato Seyoum Yohannes At the Faculty of Law of the Addis Ababa University Jaunary,2010 www.chilot.me Declaration The thesis is my original work, has not been submitted for a degree in any other University and that all materials used have been duly acknowledged. Signature of confirmation Name Mehamed Aliye Waritu Signature_______________________ Date_________________________ Name of Advisor Seyoum Yohannes Signature_______________________ Date_________________________ www.chilot.me Approval Sheet by the Board of Examiners Affiliate Companies in Ethiopia: Analysis of Organization, Legal framework and the current practice Submitted, to Faculty of Law Addis Ababa University, in partial fulfilment of the requirements of LLM Degree (Business Law) By: Mehamed Aliye Waritu Approved by board of Examiners. Name Sign. 1. Advisor Seyoum Yohannes _______________ 2. Examiner __________________ _______________ 3. Examiner ___________________ _______________ www.chilot.me Acknowledgement Thanks be to Allah for helping me see the fruit of my endeavor. The thesis would not have been completed with out the support and guidance of my advisor Ato Seyoum yohannes. My special thanks goes to him. I am also indebted to my mother Shashuu Buttaa, my wife Caltu Haji and my brother Ibrahim Aliye for they have been validating, supporting and encouraging in my career development and to complete this work. -

Nominating and Corporate Governance Committee Charter

HORIZON THERAPEUTICS PUBLIC LIMITED COMPANY CHARTER OF THE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE OF THE BOARD OF DIRECTORS AMENDED EFFECTIVE: 18 FEBRUARY 2021 PURPOSE AND POLICY The primary purpose of the Nominating and Corporate Governance Committee (the “Committee”) of the Board of Directors (the “Board”) of Horizon Therapeutics Public Limited Company, an Irish public limited company (the “Company”), shall be to oversee all aspects of the Company’s corporate governance functions on behalf of the Board, including to (i) make recommendations to the Board regarding corporate governance issues; (ii) identify, review and evaluate candidates to serve as directors of the Company consistent with criteria approved by the Board and review and evaluate incumbent directors; (iii) serve as a focal point for communication between such candidates, non-committee directors and the Company’s management; (iv) nominate candidates to serve as directors; and (v) make other recommendations to the Board regarding affairs relating to the directors of the Company. The Committee shall also provide oversight assistance in connection with the Company’s legal, regulatory and ethical compliance programs, policies and procedures as established by management and the Board. The operation of the Committee and this Nominating and Corporate Governance Charter shall be subject to the constitution of the Company as in effect from time to time and the Irish Companies Act 2014, as amended by the Irish Companies (Amendment) Act 2017, the Irish Companies (Accounting) Act 2017 and as may be subsequently amended, updated or replaced from time to time (the “Companies Act”). COMPOSITION The Committee shall consist of at least two members of the Board. -

General Meetings in Ireland: Overview, Practical Law UK Practice Note Overview

General meetings in Ireland: overview, Practical Law UK Practice Note Overview... General meetings in Ireland: overview by PL Corporate Ireland, with thanks to David Brangam, Partner, Christine Quigley, Associate, and Jenny McGowran, Head of Corporate Services at Simmons & Simmons, Dublin Practice note: overview | Maintained | Ireland An overview of the key provisions of the Companies Act 2014, the Listing Rules of the Irish stock exchange trading as Euronext Dublin, the Irish Annex to the UK Corporate Governance Code and institutional investor guidance which regulate the holding of a general meeting (including an AGM). It covers how general meetings are called, the requirements for notice of a meeting and documents accompanying the notice, quorum requirements, how resolutions are proposed and passed at a general meeting and practical guidance on running an effective general meeting. Scope of this note Types of companies Traded PLC Types of general meeting Annual general meeting Extraordinary general meetings Written resolutions of members Calling a general meeting Meetings called by the board Meetings requisitioned by members Members' right to convene an EGM directly Meetings ordered by the court Auditor's ability to call meetings Liquidator's ability to call meetings Examiner's ability to call meetings Shareholders' rights in relation to general meetings Notice of meeting Notice of a meeting of a PLC Contents of notice Entitlement to receive notice How notice is given Notice periods for holding meetings © 2020 Thomson Reuters. All rights -

Ownership and Control of Private Firms

WJEC BUSINESS STUDIES A LEVEL 2008 Spec. Issue 2 2012 Page 1 RESOURCES. Ownership and Control of Private Firms. Introduction Sole traders are the most popular of business Business managers as a businesses steadily legal forms, owned and often run by a single in- grows in size, are in the main able to cope, dividual they are found on every street corner learn and develop new skills. Change is grad- in the country. A quick examination of a busi- ual, there are few major shocks. Unfortu- ness directory such as yellow pages, will show nately business growth is unlikely to be a that there are thousands in every town or city. steady process, with regular growth of say There are both advantages and disadvantages 5% a year. Instead business growth often oc- to operating as a sole trader, and these are: curs as rapid bursts, followed by a period of steady growth, then followed again by a rapid Advantages. burst in growth.. Easy to set up – it is just a matter of in- The change in legal form of business often forming the Inland Revenue that an individ- mirrors this growth pattern. The move from ual is self employed and registering for sole trader to partnership involves injections class 2 national insurance contributions of further capital, move into new markets or within three months of starting in business. market niches. The switch from partnership Low cost – no legal formalities mean there to private limited company expands the num- is little administrative costs to setting up ber of manager / owners, moves and rear- as a sole trader. -

Limited Liability Partnerships

inbrief Limited Liability Partnerships Inside Key features Incorporation and administration Members’ Agreements Taxation inbrief Introduction Key features • any members’ agreement is a confidential Introduction document; and It first became possible to incorporate limited Originally conceived as a vehicle liability partnerships (“LLPs”) in the UK in 2001 • the accounting and filing requirements are for use by professional practices to after the Limited Liability Partnerships Act 2000 essentially the same as those for a company. obtain the benefit of limited liability came into force. LLPs have an interesting An LLP can be incorporated with two or more background. In the late 1990s some of the major while retaining the tax advantages of members. A company can be a member of an UK accountancy firms faced big negligence claims a partnership, LLPs have a far wider LLP. As noted, it is a distinct legal entity from its and were experiencing a difficult market for use as is evidenced by their increasing members and, accordingly, can contract and own professional indemnity insurance. Their lobbying property in its own right. In this respect, as in popularity as an alternative business of the Government led to the introduction of many others, an LLP is more akin to a company vehicle in a wide range of sectors. the Limited Liability Partnerships Act 2000 which than a partnership. The members of an LLP, like gave birth to the LLP as a new business vehicle in the shareholders of a company, have limited the UK. LLPs were originally seen as vehicles for liability. As he is an agent, when a member professional services partnerships as demonstrated contracts on behalf of the LLP, he binds the LLP as by the almost immediate conversion of the major a director would bind a company. -

AIG Guide to Key Features of Private Limited Companies

PrivateEdge Key features and requirements of private limited companies It is crucial for businesses set up as private limited companies to comply with the requirements of the Companies Act 2006. This guidance note sets out the key legal requirements for private limited companies in the UK, discusses shareholders’ rights and duties, and the process for convening company meetings and the passing of resolutions 1 What is a private limited company? 1.1 A private limited company is the most common form of trading vehicle for companies in the UK. 1.2 The key features and requirements of a private limited company are that: – It will have a separate legal personality from its owners (shareholders). – Responsibility for the management of a company generally falls to its directors; – The liability of each shareholder for the company's debt and other liabilities is generally limited to the amount which remains unpaid on that shareholder's shares; • It must have an issued share capital comprising at least one share. Each issued share must have a fixed nominal value. The ways in which a company can alter its share capital is strictly controlled by the Companies Act 2006 (“CA 2006”). There are also strict statutory controls on a company's ability to make returns of value (dividends) to its shareholders; • It must have at least one director. A private limited company is not required to have a company secretary, although it may choose to do so; and • The nominal value of a private limited company does not have to exceed a specified amount. It is common practice for a private company to be incorporated with a share capital made up of just one £1 share. -

•One Person Company •Limited Liability Partnership •Private

Corporatization of MSME More than 90% of MSMEs are proprietorship or partnership enterprise. Therefore, it is imperative to strive towards corporatisation of Small & Medium Enterprises for good corporate governance as well as energise the economy as a whole. MSME may be incorporated as: •One Person Company •Limited Liability Partnership •Private Company •Public Company One Person Company “One Person Company” means a company which has only one person as a member. • An OPC is incorporated as a private limited company, where there is only one member and prohibition in regard to invitation to the public for subscription of the securities of the company. • The Salient features of an OPC include the following: An OPC can be formed under Company limited by guarantee or shares. An OPC limited by shares shall have minimum paid up capital of Rs. 1 lakh. An OPC are restricted from the right to transfer its share and Prohibits any invitations to public to subscribe for the securities • An OPC is required to give a legal identity by specifying a name under which the activities of the business could be carried on. The words 'One Person Company' should be mentioned below the name of the company, wherever the name is affixed, used or engraved. PROCESS OF INCORPORATION OF ONE PERSON COMPANY (OPC) • Obtain Digital Signature Certificate [DSC] for the proposed Director(s) • Obtain Director Identification Number [DIN] for the proposed director(s). • Select suitable Company Name, and make an application to the Ministry of Corporate Affairs for availability of name. • Draft MOA & AOA • Sign and file various documents including MOA & AOA with the Registrar of Companies electronically. -

Chapter 4 Corporate Governance in the Ece Region

________________________________________________________________________________________________103 CHAPTER 4 CORPORATE GOVERNANCE IN THE ECE REGION The recent financial scandals at major United States corporations have highlighted the costs of corporate governance failures and have put corporate governance reform firmly on the policy agenda. Within the ECE region, there are basically two established models of corporate governance, one prevalent in the Anglo-Saxon countries, the other in continental Europe. They differ from one another in several ways, including who exercises control, in the structure of the board and of ownership at large, in their focus on shareholder or stakeholder interests and in the degree of protection they offer to shareholder and creditor rights. However, neither system has proven demonstrably superior to the other. Powerful forces, such as the need to access foreign capital markets, the pressure of institutional investors and the drive to create a single European market in financial services, are creating considerable pressure for convergence of these systems. However, a system of corporate governance, like a society’s other important institutions, is not easily transplanted. Even more so than in mature market economies, the corporate governance systems in central and eastern Europe and in the CIS remain works in progress. While progress on the legal protection of shareholder and creditor rights has been quite impressive, considerable enforcement gaps persist, particularly in the CIS, constraining firms in their access to outside finance. 4.1 Introduction corporat e governance since the creat ion of the count ry’s securit ies regulation regime in the 1930s. Viewing the Corporate governance has become a subject of situation in the United States with alarm, European heightened import ance and attent ion in government countries, mindful of earlier financial scandals of their policy circles, academia and the popular press throughout own, are examining their own syst ems of corporate the ECE region. -

Paper-3: Setting up of Business Entities and Closure

STUDY MATERIAL EXECUTIVE PROGRAMME SETTING UP OF BUSINESS ENTITIES AND CLOSURE MODULE 1 PAPER 3 i © THE INSTITUTE OF COMPANY SECRETARIES OF INDIA TIMING OF HEADQUARTERS Monday to Friday Office Timings – 9.00 A.M. to 5.30 P.M. Public Dealing Timings Without financial transactions – 9.30 A.M. to 5.00 P.M. With financial transactions – 9.30 A.M. to 4.00 P.M. Phones 011-45341000 Fax 011-24626727 Website www.icsi.edu E-mail [email protected] Laser Typesetting by AArushi Graphics, Prashant Vihar, New Delhi, and Printed at H T Media/September 2020 ii EXECUTIVE PROGRAMME SETTING UP OF BUSINESS ENTITIES AND CLOSURE There are various business structures such as Companies, LLP, Trusts, and Societies etc. which one can choose to start a business. Choosing a form of business entity is crucial to a successful organization. The choice of a business entity will depend on an object, benefits, size of the business of such entity and many other factors. The main types of business entities in India are Sole Proprietorship, Partnership, Hindu Undivided Family (HUF) Business, Limited Liability Partnership (LLP), Co-operative Societies, Branch Office and Company which may be any kind of company including One Person Company (OPC), private company, public company, company limited by guarantee, subsidiary company, statutory company, insurance company or unlimited company, company formed under section 8 of the Companies Act, 2013 or under section 25 of the earlier Companies Act, 1956. Various laws are applicable for proceeding to incorporate a business entity. Initial Registrations like Shops & Establishment, FSSAI, ISO, MSME, copyright, patent etc. -

Lesson : 1 Meaning, Characteristics and Types of a Company

LESSON : 1 MEANING, CHARACTERISTICS AND TYPES OF A COMPANY STRUCTURE 1.0 Objective 1.1 Introduction 1.2 Meaning of Company 1.3 Characteristics of a Company 1.4 Distinction between Company and Partnership 1.5 Types of Company 1.6 Summary 1.7 Keywords 1.8 Self Assessment Questions 1.9 Suggested Readings 1.0 OBJECTIVE After reading this lesson, you should be able to: (a) Define a company and explain its features. (b) Make a distribution between company and partnership firm. (c) Explain the various types of companies. 1.1 INTRODUCTION Industrial has revolution led to the emergence of large scale business organizations. These organization require big investments and the risk involved is very high. Limited resources and unlimited liability of partners are two important limitations of partnerships of partnerships in undertaking big business. Joint Stock Company form of business organization has become extremely popular as it provides a solution to (1) overcome the limitations of partnership business. The Multinational companies like Coca-Cola and, General Motors have their investors and customers spread throughout the world. The giant Indian Companies may include the names like Reliance, Talco Bajaj Auto, Infosys Technologies, Hindustan Lever Ltd., Ranbaxy Laboratories Ltd., and Larsen and Tubro etc. 1.2 MEANING OF COMPANY Section 3 (1) (i) of the Companies Act, 1956 defines a company as “a company formed and registered under this Act or an existing company”. Section 3(1) (ii) Of the act states that “an existing company means a company formed and registered under any of the previous companies laws”. This definition does not reveal the distinctive characteristics of a company . -

The German Supervisory Board

The German Supervisory Board: A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors The German Supervisory Board: | A Practical Introduction for US Public Company Directors Contents Foreword Foreword 03 As the world’s economy globalizes, there is often an expectation that business practices will Executive Summary 04 harmonize along with it. This is an expectation The German Supervisory Board: Characteristics and Context 05 that we will see a kind of convergence of corporate The German Supervisory Board in Action: Regular Order, M&A, Crisis 14 governance forms and practices, where boards the world over resemble each other, perhaps Conclusion 15 with a large majority of independent directors, an Endnotes 17 audit committee, a separate chair and CEO, and so on. A lot of this reflects a certain familiarity Claus Buhleier with the Anglo-Saxon board model among Partner, Center for Corporate institutional investors in London and New York. Governance Deloitte Germany [email protected] The reality, however, is quite different. Despite real advances in globalization in other areas, differences in what boards look like and how they work in practice persist across countries. This publication brings to light the differences between the predominant Anglo Saxon, one-tier corporate governance model on the one hand, and the still influential Germanic two-tier-model on the other. The authors, Yvonne Schlaeppi and Michael Marquardt, both experienced corporate directors Kai Bruehl who have served on European company boards, Director, Risk Advisory Deloitte highlight the main characteristics of the German Germany [email protected] supervisory board model and how it demands accountability from its members, despite looking rather different than the combined board model. -

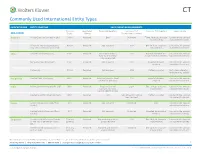

Commonly Used International Entity Types

Commonly Used International Entity Types COUNTRY/REGION ENTITY STRUCTURE BASIC FORMATION REQUIREMENTS Minimum Registered Corporate Secretary Minimum # of Minimum # of Directors Legal Liability ASIA-PACIFIC Capital Address Shareholders/Partners Australia Public Company (Limited or Ltd.) AUD 0 Required One Unlimited Three. At least 2 must be Limited to the amount local residents subscribed for shares Private or Proprietary Company AUD 0 Required Not required 1-50 One. At least 1 must be Limited to the amount (Pty. Ltd. or Proprietary Limited) local resident subscribed for shares China Limited Liability Company CNY 0 Required Not required. But a 1-50 Board of directors or a Limited to the amount local representative single executive director subscribed for shares may be required. Company Limited by Shares CNY 0 Required Not required 2-200 Board of directors Limited to the amount required subscribed for shares Partnership CNY 0 Required Not required 2-50 Partner managed Not a separate legal entity from its parent Hong Kong Limited Private Company HKD 0 Required Required, must be local 1-50 Board of directors Limited to the amount resident or company required subscribed for shares India Private Limited Company (Pvt Ltd) INR 0 Required Required if initial 2-200 Two. At least 1 must be Limited to the amount capital investment local resident subscribed for shares exceeds INR100 million Limited Liability Partnership (LLP) INR 0 Required N/A Two. At least 1 must be Partner managed Limited to the amount local resident subscribed for shares Japan General Corporation (Kabushiki JPY 1 Required Not required Unlimited One Limited to the amount Kaisha) subscribed for shares Limited Liability Company (Godo- JPY 1 Required Not required Unlimited Managed by managing Limited to the amount Kaisha) members subscribed for shares Singapore Private Limited Company (Private $1 in any Required Required and must be 1-50 One.