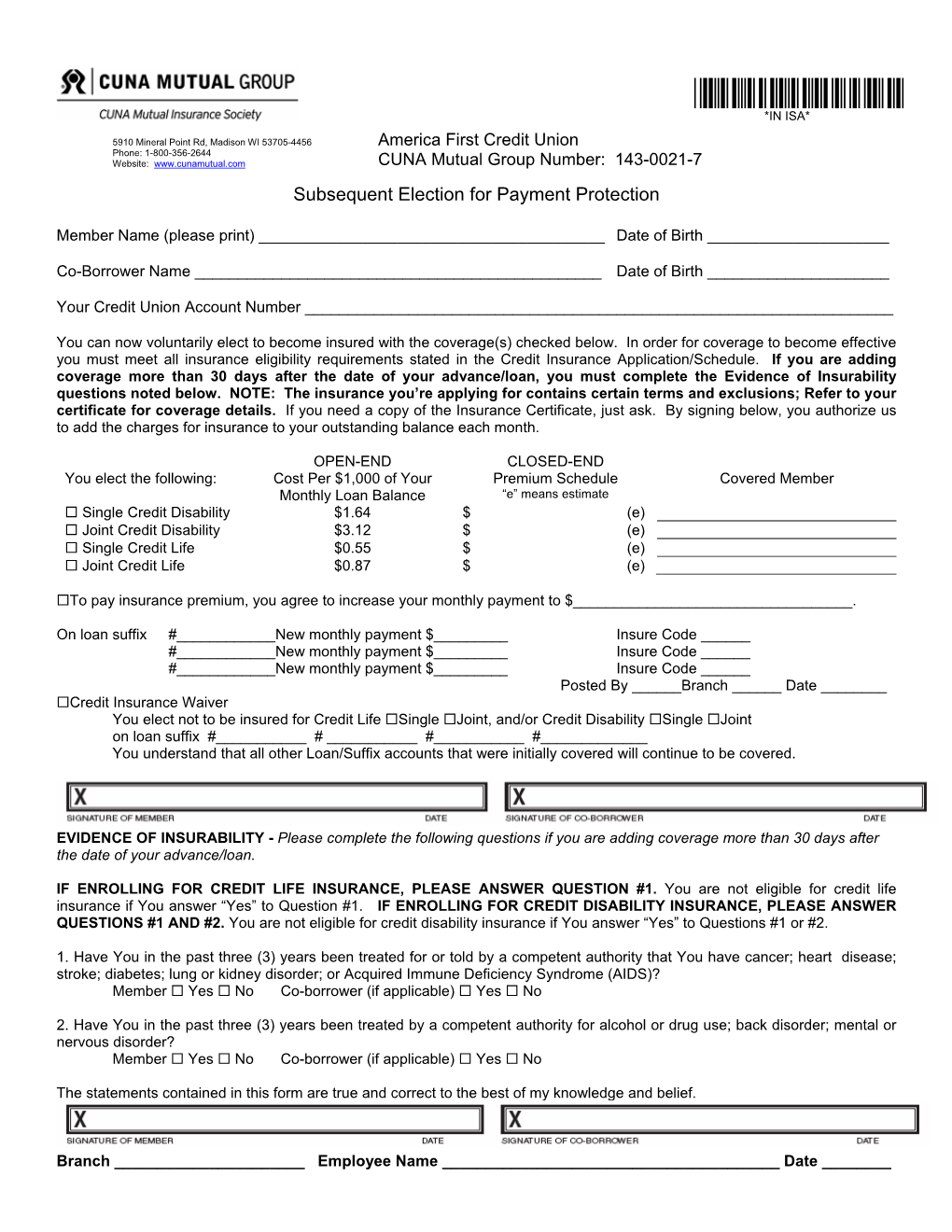

Insurance Subsequent Action

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Credit Life and Disability Insurance

30-DAY FREE LOOK MemBer’S CHOIce® credit life and disability insurance Protection that pays Protecting your financial future Congratulations! Recently, you chose to protect your loans with MEMBER’S CHOICE® Credit Life and Planning your family’s financial Credit Disability Insurance. future by protecting your loans Conserve your family’s savings MEMBER’S CHOICE® Credit Life and Credit Disability Insurance helps conserve your family’s savings and with credit insurance can help allows them to use other insurance funds to meet day-to-day living expenses, preserving the standard of living you worked so hard to achieve. your family keep its standard Experience MEMBER’S CHOICE® credit insurance for 30 days Starting on your enrollment date, and for the next 30 days, you can experience the financial security of living if your income is and peace of mind that credit insurance provides you and your family. During those 30 days, if you wish to cancel your coverage, you may. To cancel, please fill out and mail the form below. If your reduced or eliminated due to envelope is postmarked within 30 days from the date of your enrollment, we’ll be happy to refund any premium you were charged.* There is no need to contact us if you wish to continue your Credit Life a disabling injury or illness or and Credit Disability Insurance. Your coverage will simply continue, as is, with no interruptions. your unexpected death. *Regular loan payment will remain the same. Loan term and/or final payment will be adjusted to reflect premium refund. Be sure to read the Credit Insurance Application and Certificate of Insurance which will explain the exact terms, conditions and exclusions of the policy. -

Financial Strength Connecting to a Stronger Future for Credit Unions

2012 Financial Strength Connecting to a Stronger Future for Credit Unions Born in 1935 out of the emerging credit union In 2012, we improved our financial strength, enhanced products movement, during the depths of the Great Depression, and services, and invested in CUNA Mutual Group endeavored to fulfill the vision the markets we serve and the communities in which we operate. of credit union pioneers. Driven by the belief that These results are a direct reflection of our insurance was as fundamental to the movement original mission. as savings and lending, CUNA Mutual Group would Jeff Post President & CEO become the leading provider of credit life insurance in the United States in just two years. Today, CUNA Mutual Group is a Fortune 1000 company, with assets of more than $17 billion. Our products have expanded to include Life Insurance, Annuities, Retirement Income and Investments. Our achievements are directly attributable to a single principle: an enduring commitment to the success of credit unions, their members and our policyholders. Total Revenue Total Revenue Operating Revenue by Product 2012 Results: Delivering on Our Commitment Total(in billions) Revenue Operating Revenue by Product (in billions) Operating Revenue by Product (in billions) 3.1 3.0 3.1 to Policyholders 3.0 3.1 2.8 3.0 2.7 2.8 2.6 2.7 2.8 The external challenges in 2012 remained formidable with 2.6 2.7 a sluggish national economy and the continuing struggle at 2.6 the federal level to address the fiscal issues. Severe weather events also presented difficult obstacles to overcome, from the drought in the Midwest’s Corn Belt to Superstorm Sandy that battered the East Coast. -

Agreement CUNA Mutual Insurance Society Office & Professional

Agreement BETWEEN CUNA Mutual Insurance Society AND Office & Professional Employees International Union - Local 39 April 1, 2008 – March 31, 2012 TABLE OF CONTENTS AGREEMENT .................................................................................................................. 1 PREAMBLE...................................................................................................................... 1 RECOGNITION ............................................................................................................... 1 ARTICLE I........................................................................................................................ 1 MANAGEMENT RIGHTS ............................................................................................ 1 SECTION 1 – WORKPLACE RULES ...................................................................... 1 ARTICLE II ...................................................................................................................... 4 DEFINITIONS................................................................................................................ 4 SECTION 1 – EMPLOYER ....................................................................................... 4 SECTION 2 – EMPLOYEE ....................................................................................... 4 SECTION 3 – WORKING DAYS ............................................................................. 4 ARTICLE III.................................................................................................................... -

MEMBERS® Variable Universal Life

MEMBERS® Variable Universal Life PROSPECTUSES MAY 2019 This booklet is for policyowners of MEMBERS® Variable Universal Life, a flexible premium variable universal life insurance policy issued by CMFG Life Insurance Company and supported by the CMFG Variable Life Insurance Account. This booklet contains prospectuses for MEMBERS® Variable Universal Life and the following mutual funds in which the CMFG Variable Life Insurance Account invests: • T. Rowe Price International Stock Portfolio, a series of T. Rowe Price International Series, Inc. • Core Bond Fund, Diversified Income Fund, Large Cap Value Fund, Large Cap Growth Fund and Mid Cap Fund (Class I), each a series of the Ultra Series Fund. • Vanguard Variable Insurance Fund Money Market Portfolio, a series of Vanguard® Insurance Fund. Distributed by: CUNA Brokerage Services, Inc. Office of Supervisory Jurisdiction 2000 Heritage Way Waverly, IA 50677 Member FINRA & SIPC Telephone: (319) 352-4090 (800) 798-5500 Move confidently into the futureTM PROSPECTUS To reduce service expenses, CMFG Life Insurance Company may send only one copy of this booklet per household, regardless of the number of policyowners at the household. However, any policyowner may obtain additional copies of this booklet upon request to CMFG Life Insurance Company. If you have questions, please call CMFG Life Insurance Company at 1.800.798.5500, Monday through Friday, 7:00 a.m. to 7:00 p.m., Central Time. As with all variable life insurance policies and mutual funds, the Securities and Exchange Commission (“SEC”) has not approved or disapproved of these securities, nor does the SEC guarantee the accuracy or adequacy of any prospectus. -

Life & Disability Facts

PAYMENT PROTECTION Life & Disability Facts And their impact on you Could your family maintain its current standard PLAN FOR THE UNEXPECTED of living without your income? You plan to buy a home. You plan to pay for college. In the United States... You plan for retirement someday. But most people don’t plan for a of families with children under 18, have both parents death, injury or illness to impact 59% employed outside of the home.1 their future income & earning potential. of adults would find it difficult to meet current financial Being aware of the facts can help 70% obligations if their next paycheck were delayed a week.2 you plan for unanticipated financial hardships that could jeopardize your future dreams and standard of living. THAN LESS Of those who do, 28% have $500 6 out of 10 workers don’t less than $500 in savings IS LIFE INSURANCE ENOUGH? have a financial plan to for emergency expenses.3 It's hard to think about the death of handle the unexpected.3 a loved one, but emotional hardship can be compounded by financial loss. people were long-term unemployed Less than 25% of widows and 4 5.4 million (jobless for 27+ weeks) in May of 2012. widowers whose spouse died prematurely (between the ages of 30 and 55) felt their spouse had Employer long-term disability insurance typically 8 40- adequate life insurance. 5 60% pays only 40% to 60% of one’s income. When eligible debt is covered with payment protection, other life of workers in the private sector have insurance and coverage can pay for no long-term disability insurance.6 other important things. -

April 2018 News.Cuna.Org

APRIL 2018 NEWS.CUNA.ORG PAYMENTS Perils and promise Published by Credit Union National Association Your growth. Our guidance. We’re Trellance, a new company sprouted from the experience and expertise of CSCU to provide powerful new solutions to credit unions. Trellance was created to provide the structure and solutions to help credit unions not just compete, but thrive. We provide next-generation insights, resources, expertise and execution capabilities to credit unions. We’re talking about vibrant strategies to grow your community and attract new members, along with powerful tools to keep current members even more engaged. Trellance is here to support your growth. Join us at our immersion18 conference, May 8-11th in Ft. Lauderdale, FL. Register at immersion18.com. For more info visit trellance.com. Instant Issuance, Instant Satisfaction With fully functioning, permanent cards in hand, members have instant purchasing power, which means a better experience, higher satisfaction and deeper engagement. Your institution can offer secure, personalized cards on-site in just a few minutes. With our web-based service, there’s no software or dedicated server to buy. Print in-branch while delighting members — it’s possible with Card@Once®. harlandclarke.com/Card@Once 1.800.351.3843 | [email protected] © 2018 Harland Clarke Corp. All rights reserved. Card@Once is a registered trademark of CPI Card Group, Inc. US Patent No.: 8429075. [email protected] 1 3/5/18 7:17 AM April 2018 Volume 84 Ñ Number 4 FEATURES 20 Payments: Perils and Promise Despite competitive pressures and fraud concerns, the payments arena offers new opportunities to connect with members. -

ANNUAL REPORTS for Period Ended December 31, 2018

ANNUAL REPORTS For Period Ended December 31, 2018 This booklet contains the CMFG Variable Life Insurance Account’s audited financial statements and the annual reports for the following mutual funds in which the CMFG Variable Life Insurance Account invests: T. Rowe Price International Stock Portfolio, a series of the T.Rowe Price International Series, Inc. Core Bond, Diversified Income, Large Cap Growth, Large Cap Value, and Mid Cap Funds, each a series of the Ultra Series Fund. Vanguard Variable Insurance Fund Money Market Portfolio, a series of the Vanguard Insurance Fund. UltraVers-ALL LIFESM Distributed by: CUNA Brokerage Services, Inc. Office of Supervisory Jurisdiction 2000 Heritage Way Waverly, IA 50677 Member FINRA & SIPC Telephone: (319) 352-4090 (800) 798-5500 This material is for reporting purposes only and shall not be used in connection with a solicitation, offer or any proposed sale or purchase of securities unless preceded or accompanied by a prospectus. Move confidently into the futureTM ANNUAL REPORT To reduce service expenses, CMFG Life Insurance Company may send only one copy of this booklet per household, regardless of the number of policyowners at the household. However, any policyowner may obtain additional copies of this booklet upon request to CMFG Life Insurance Company. If you have questions, please call CMFG Life Insurance Company at (800) 798-5500. As with all variable life insurance policies and mutual funds, the Securities and Exchange Commission (“SEC”) has not approved or disapproved of these securities, nor does the SEC guarantee the accuracy or adequacy of any prospectus. Any statement to the contrary is a criminal offense. -

Improving Access to Insurance for the Low- Income Population in Jamaica

1 List of Figures .......................................................................................................................................... 4 List of Tables ........................................................................................................................................... 4 List of Boxes ............................................................................................................................................ 5 Abbreviations .......................................................................................................................................... 5 Acknowledgements ................................................................................................................................. 8 Executive Summary ................................................................................................................................. 9 1 Introduction .................................................................................................................................. 15 1.1 Study background and methodology ...................................................................................... 15 1.2 Definitions and analytical framework ..................................................................................... 16 1.2.1 What is microinsurance? ................................................................................................ 16 1.2.2 What is the target market of microinsurance in Jamaica? .............................................. -

Credit Insurance Credit Life and Disability

Offered by: Plan as of: Credit Disability Insurance Plan Type: Maximum Monthly Benefit: Total Benefit Maximum: CREDIT Maximum Issue Age: Termination Age: INSURANCE CREDIT LIFE & DISABILITY Credit Life Insurance Total Benefit Maximum: Who do you expect to pay your Maximum Issue Age: oans when the unexpected hits? Termination Age: CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Your purchase of MEMBER’S CHOICE® Credit Life and Credit Disability Insurance, underwritten by CMFG Life Insurance Company, is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative or refer to the Group Policy for a full explanation of the terms. VT Only: Claims may be filed by contacting your credit union. If you have questions regarding your claim status, contact CMFG Life at 800.621.6323. Only a licensed insurance agent may provide consultation on your insurance needs. CDCL-1333724.1-1015-1117 ©2016 CUNA Mutual Group, All Rights Reserved. OMS#: IM3205 Protect your fami y against the unexpected. Credit Insurance may make your Beyond Protection: oan payments when you can’t > Simple to apply Life can be wonderfu . But it can a so get > Designed to ft your lifestyle comp icated when unexpected things happen. Protecting your oan payments > Coverage that fts your loan against unexpected and covered ife Totally voluntary events and disabi ity cou d he p protect > more than your fnances. -

Disruption in Agenda Financial Services

1 1 Overview of disruption in Agenda financial services 2 Possible signs of disruption 3 Moving beyond disruption 2 Section I What is Disruption? 1. What Is Disruption??? 3 4 How Fast Can an Industry Change? 5 6 7 8 Successful Disruption: GPS Devices 2004 2009 2014 Garmin StreetPilot 2620 TomTom iPhone Navigation Google Maps App App Cost: $100 Cost: Free Cost: $1,516 Source: CUNA Mutual Group Analysis 9 Kodak Could Have Been The Disruptor George Eastman with an early First digital camera developed Kodak camera model by Kodak in 1974 10 Successful Disruption: Smartphones Source: CUNA Mutual Group Analysis 11 Source: CUNA Mutual Group Analysis 12 “It took 22 years to sell 55 million MACs. It took 5 years to sell 22 million iPods and 3 years to sell as many iPhones. And so…its on a trajectory that’s off the charts.” Tim Cook, Apple CEO 13 SECTION 2 Overview Of Disruption In Financial Services 1414 The Battleground: Financial Institutions Non-Bank Retailers Competitors Financial Services Savings Lending Card Platform Companies Payments Players Investments Insurance Telecoms New Entrants Alternative Payments Source: CUNA Mutual Group Analysis 15 Themes In Retail Financial Services Disruption Disruptors seek to: • Use technology-driven business models, e.g., platform strategies Source: CUNA Mutual Group Analysis 16 Themes In Retail Financial Services Disruption Disruptors seek to: • Use technology-driven business models, e.g., platform strategies • Have a lower cost structure Source: CUNA Mutual Group Analysis 17 Themes In Retail Financial Services -

Comments of CUNA

Meeting Between Federal Reserve Board Staff and Representatives of Credit Union National Association (CUNA) and CUNA Mutual December 2, 2010 Participants: Lorna Neill, Maureen Yap, and John Wood (Federal Reserve Board) Jeffrey Bloch and Michael Edwards (CUNA); Larry Blanchard, Richard Fisher, and Christopher Roe (CUNA Mutual); and Gilbert Schwartz (Schwartz and Ballen, LLP) Summary: Staff of the Federal Reserve Board met with representatives of CUNA and CUNA Mutual (collectively, "CUNA") to discuss CUNA's view regarding the Board 2009 and 2010 proposals to revise Regulation Z provisions regarding credit insurance and debt cancellation and debt suspension coverage ("credit protection products"). Among the topics discussed were the rates on credit protection products as compared to other forms of insurance; post-claim underwriting; state regulations; profitability of credit protection products; view of CUNA's member credit unions on the Board's proposals; the Board's consumer testing conducted as part of the rulemaking process; testimonials from consumers who purchased credit insurance; the Board's regulatory authority in this area; and differences between credit insurance and other credit protection products. The CUNA representatives provided the following handouts: (1) PowerPoint slides that formed the basis of the discussion; (2) copies of testimonials from consumers; and (3) samples of existing credit protection product disclosures. The handouts are attached below. Attachments Member Testimonial Credit Disability Insuranc e "For me, I first learned about credit life and disability insuranc e from my father. H e had coverage on his home equity loan and when he was put on permanent disability hi s house was paid off by the insurance. -

Credit Life and Disability Insurance

CREDIT INSURANCE CREDIT LIFE & DISABILITY Protect your family against the unexpected. Credit Insurance may make your loan payments when you can’t Life can be wonderful. But it can also get complicated when unexpected things happen. Protecting your loan payments against unexpected disability and covered life events could help protect more than your fnances. It could help lighten the burden for the people you care about. Insure your loan payments today so you can worry a little less about tomorrow. Beyond Protection: > Simple to apply > Totally voluntary > Designed to ft your lifestyle > Won’t affect your loan approval > Coverage that fts your loan > Sign up for credit insurance at your ** Claims data provided by CMFG Life Insurance Company loan closing, or anytime you like Talk with your loan offcer to sign up today CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affliates. Your purchase of MEMBER’S CHOICE® Credit Life and Credit Disability Insurance, underwritten by CMFG Life Insurance Company, is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative or refer to the Group Policy for a full explanation of the terms. CA Only: Claims may be fled by contacting your credit union. If you have questions regarding your claim status, contact CMFG Life at 800-621-6323. California Department of Insurance Consumer Hotline: 800.927.4357. Credit Union License #: VT Only: Claims may be fled by contacting your credit union.