KKR Banks on Bisignano Forging Apple Deal at First Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Humana Elects Frank Bisignano to Board of Directors

Humana Elects Frank Bisignano to Board of Directors August 21, 2017 LOUISVILLE, Ky.--(BUSINESS WIRE)--Aug. 21, 2017-- Humana Inc.(NYSE:HUM) announced today that Frank Bisignano has been elected as a member of the company’s board of directors. Bisignano, 58, is Chairman of the Board and Chief Executive Officer of First Data, a global leader in commerce-enabling technology and solutions. Since joining First Data in 2013, he has been instrumental in transforming the company from its position as a traditional payment processor into a technology innovator, industry collaborator and commerce enabler. Prior to his tenure at First Data, Bisignano was co-Chief Operating Officer for J.P. Morgan Chase and Chief Executive Officer of its Mortgage Banking unit. Earlier in his career, he held several executive roles at Citigroup that included serving on the bank’s management committee. “Frank is a proven business leader who understands the importance of technology as a solution to complex problems, which is a key part of Humana’s strategy to integrate a fragmented health care system through leveraging technology,” said Humana Chairman of the Board Kurt J. Hilzinger. “We believe this integration sits at the heart of a health care system that considers and cares for the ‘whole person’ while delivering true value. The depth and breadth of Frank’s experiences and insights will serve our Board of Directors well.” Bisignano’s election brings the number of Humana directors to 11. About Humana Humana Inc. is committed to helping our millions of medical and specialty members achieve their best health. Our successful history in care delivery and health plan administration is helping us create a new kind of integrated care with the power to improve health and well-being and lower costs. -

Nominations for Occ/Bod & Members 2001-02 Nominating

The Options Clearing Corporation #14766 BackTO: to InfomemoALL CLEAR SearchING MEMBERS FROM: James C. Yong, First Vice President, Deputy General Counsel and Secretary DATE: December 28, 1999 SUBJECT: NOMINATIONS FOR THE OPTIONS CLEARING CORPORATION BOARD OF DIRECTORS AND MEMBERS OF THE 2001-2002 NOMINATING COMMITTEE Please be advised that the Nominating Committee will meet on January 26, 2000 at the offices of OCC. At the meeting, the Committee will nominate (i) three candidates for election as Member Directors of OCC for a three-year term ending in April, 2003, and (ii) three candidates for election as members of the Nominating Committee for a two-year term ending in April, 2002. The Nominating Committee will consider potential candidates proposed by Clearing Members. Please note that in order to be qualified for election either as a Member Director or as a member of the Nominating Committee, a candidate must be a Designee of a Clearing Member. A list of Clearing Member Designees is attached. Please forward the name of any Designee you would like to propose for election as a Member Director or a Member of the Nominating Committee either to: James C. Yong Secretary The Options Clearing Corporation 440 S. LaSalle Street, Suite 2400 Chicago, IL 60605 or to the members of the 2000-2001 Nominating Committee. For your convenience, the name and address of the members of the 2000-2001 Nominating Committee are: Norman R. Malo Dennis J. Donnelly National Financial Services Corporation McDonald Investments, Inc. 200 Liberty Street 800 Superior Avenue New York, NY 10281 Cleveland, OH 44114 James C. -

Members Are the Chief Executive Officers of Leading U.S

Business Roundtable CEOs support sound public policy to defeat COVID-19, create American jobs and restore U.S. economic growth and competitiveness. LEARN MORE (https://www.businessroundtable.org/policy-perspectives) Business Roundtable members are the chief executive officers of leading U.S. MEMBERS companies. Collectively, they represent every sector of the economy and bring a unique and important perspective to bear on policy issues that impact the economy. Roundtable members are thought leaders, advocating for policy solutions that foster U.S. economic growth and competitiveness. Search Business Roundtable Members Mike Roman Robert Ford Richard A. Gonzalez 3M Abbott AbbVie Chief Executive Officer President and Chief Executive Chairman of the Board and Chief (/about-us/members/mike- Officer Executive Officer roman-chief-executive- (/about-us/members/robert- (/about- officer-3m) ford-president-and-chief- us/members/richard-a- executive-officer-abbott) gonzalez-chairman-of-the- board-and-chief-executive- officer-abbvie) Julie Sweet Carlos A. Rodriguez Troy Rudd Accenture ADP AECOM Chief Executive Officer President and Chief Executive Chief Executive Officer (/about us/members/julie Officer (/about us/members/troy (/about-us/members/julie- Officer (/about-us/members/troy- sweet-chief-executive- (/about-us/members/carlos- rudd-chief-executive-officer- officer-accenture) a-rodriguez-president-and- aecom) chief-executive-officer-adp) Dan Amos John O. Larsen Aflac Incorporated Alliant Energy Corporation Andrés Gluski Chairman, Chief Executive Officer President, CEO and Chairman of The AES Corporation and President the Board Director, President and CEO (/dan-amos-chairman-chief- (/about-us/members/john-o- (/about- executive-officer-and- larsen-president-ceo-and- us/members/andrés-gluski- president-aflac- chairman-of-the-board- director-president-and-ceo- incorporated) alliant-energy-corporation) the-aes-corporation) Lee J. -

Trust and Confidence

CHAOS_KENRO.ai 1 21/02/12 18:04 Trust and Confi dence An Interview with James B. Lee Jr., Vice Chairman, JPMorgan Chase & Co. EDITORS’ NOTE In 1975, Jimmy Well, you are talking to one of the Do you feel that entrepreneurship and Lee joined Chemical Bank and most incurable, patriotic optimists out innovation are being lost in the U.S.? worked in a variety of spe- there. Yes, I think we have probably No, I don’t agree with that. I spend cialty lending businesses until lost a little of our mojo, but we will a lot of time in Silicon Valley and the num- 1980, when he founded and get it back. ber of smart young people there who are ran Chemical’s merchant bank in We have gone through much launching their careers is just staggering. And Australia. He returned to the U.S. worse before as a nation and we will they are funded by real companies this time in 1982 and started the bank’s syn- get through this. The American way around. dicated loan group, which consti- is very rehabilitative; just look at our Twelve years ago, I was fortunate tuted the origins of the investment bankruptcy code. Every American enough to lead the team when we acquired banking business at Chemical loves the Comeback Kid. Hambrecht & Quist. That deal did four things and later Chase Manhattan Bank. The American people are not for us that I felt were important at the time: James B. Lee Jr., C Lee ran the investment bank un- happy. -

The CEO Action for Diversity & Inclusion™ Aims to Rally The

The CEO Action for Diversity & Inclusion™ aims to rally the business community to advance diversity & inclusion within the workplace by working collectively across organizations and sectors. It outlines a specific set of actions the undersigned companies will take to cultivate a trusting environment where all ideas are welcomed and employees feel comfortable and empowered to discuss diversity & inclusion. All the signatories serve as leaders of their companies and have committed to implementing the following pledge within their workplaces. Where companies have already implemented one or several of the commitments, the undersigned commit to support other companies in doing the same. The persistent inequities across our country underscore our urgent, national need to address and alleviate racial, ethnic and other tensions and to promote diversity within our communities. As leaders of some of America’s largest corporations, we manage thousands of employees and play a critical role in ensuring that inclusion is core to our workplace culture and that our businesses are representative of the communities we serve. Moreover, we know that diversity is good for the economy; it improves corporate performance, drives growth and enhances employee engagement. Simply put, organizations with diverse teams perform better. We recognize that diversity & inclusion are multifaceted issues and that we need to tackle these subjects holistically to better engage and support all underrepresented groups within business. To do this, we believe we also need to address honestly and head-on the concerns and needs of our diverse employees and increase equity for all, including Blacks, Latinos, Asians, Native Americans, LGBTQ, disabled, veterans and women. -

The CEO Action for Diversity & Inclusion™ Aims to Rally The

The CEO Action for Diversity & Inclusion™ aims to rally the business community to advance diversity & inclusion within the workplace by working collectively across organizations and sectors. It outlines a specific set of actions the undersigned companies will take to cultivate a trusting environment where all ideas are welcomed and employees feel comfortable and empowered to discuss diversity & inclusion. All the signatories serve as leaders of their companies and have committed to implementing the following pledge within their workplaces. Where companies have already implemented one or several of the commitments, the undersigned commit to support other companies in doing the same. The persistent inequities across our country underscore our urgent, national need to address and alleviate racial, ethnic and other tensions and to promote diversity within our communities. As leaders of some of America’s largest corporations, we manage thousands of employees and play a critical role in ensuring that inclusion is core to our workplace culture and that our businesses are representative of the communities we serve. Moreover, we know that diversity is good for the economy; it improves corporate performance, drives growth and enhances employee engagement. Simply put, organizations with diverse teams perform better. We recognize that diversity & inclusion are multifaceted issues and that we need to tackle these subjects holistically to better engage and support all underrepresented groups within business. To do this, we believe we also need to address honestly and head-on the concerns and needs of our diverse employees and increase equity for all, including Blacks, Latinos, Asians, Native Americans, LGBTQ, disabled, veterans and women. -

Annual Report Captures Some of Our Legacy of Achievement, Innovation, and Success

20 0Annual 4Report citigroup.com ©2005 Citigroup Inc. 159981 3/05 CIT2062 >> Our Shared Responsibilities Citigroup’s goal is to be the WE HAVE A RESPONSIBILITY most respected global finan- TO OUR CLIENTS cial services company. As a We must put our clients first, pro- vide superior advice, products great institution with a unique and services, and always act with and proud history, we play an the highest level of integrity. important role in the global in memoriam economy. Each member of Walter Wriston, - the Citigroup family has three Citicorp Chairman, 1970-1984 Shared Responsibilities: >> On June 29, 1946, Walter Wriston reported for work as a junior inspector in the Comptrollers WE HAVE A RESPONSIBILITY WE HAVE A RESPONSIBILITY division at 55 Wall Street. A man of acerbic wit, he later noted that he “came to Citibank by TO EACH OTHER TO OUR FRANCHISE accident and stayed through inertia.” We must put Citigroup’s long-term We must provide outstanding peo- Walt proved to be a champion of risk-taking and creativity. He oversaw the introduction of interests ahead of each unit’s short- ple the best opportunity to realize major financial innovations—shipping and airline loans, the negotiable certificate of deposit, the term gains and provide superior their potential. We must treat our floating rate note, currency swaps, and the one-bank holding company, to name just a few. He results for our shareholders. We teammates with respect, champion committed major resources, despite heavy initial losses, to developing consumer banking because must respect the local culture and our remarkable diversity, share the “that’s where the money is,” he noted astutely, installing ATMs ahead of the competition and take an active role in the commu- responsibility for our successes, establishing a strong credit card business in South Dakota. -

Fiserv Announces CEO Succession Plan

Fiserv Announces CEO Succession Plan May 7, 2020 Frank Bisignano to become Chief Executive Officer effective July 1 Jeffery Yabuki to serve as Executive Chairman through end of year BROOKFIELD, Wis.--(BUSINESS WIRE)--May 7, 2020-- Fiserv, Inc. (NASDAQ: FISV), a leading global provider of payments and financial services technology solutions, today announced that its Board of Directors has unanimously elected Frank Bisignano to succeed Jeffery Yabuki as Chief Executive Officer as of July 1. Yabuki will step down following a distinguished 15-year career with the company. To ensure a seamless transition, Yabuki, Chairman of the Fiserv Board, will continue to serve as Executive Chairman for the remainder of 2020. “With the successful integration of First Data well underway, this is the right time for Frank to lead the next phase of the company’s evolution,” said Yabuki. “Frank and I have had the pleasure of working closely over the past 18 months – and I am highly confident he brings the skill and experience to deliver the leadership that is needed today, while building for tomorrow. In addition to spearheading our integration efforts and significant COVID-19 response, Frank has been leading our global businesses with an absolute commitment to excellence. While Frank will bring new ideas and perspectives as CEO, he fully embraces the strategic and capital foundation of the Fiserv value creation playbook. I look forward to continuing to partner with Frank through the end of the year, and know he will continue to deliver superior results for the benefit of our stakeholders.” Yabuki added, “Leading Fiserv since 2005 has been an honor and a privilege. -

Sept. 19, 2014 Edition #422 Categories TSG Resources Trending

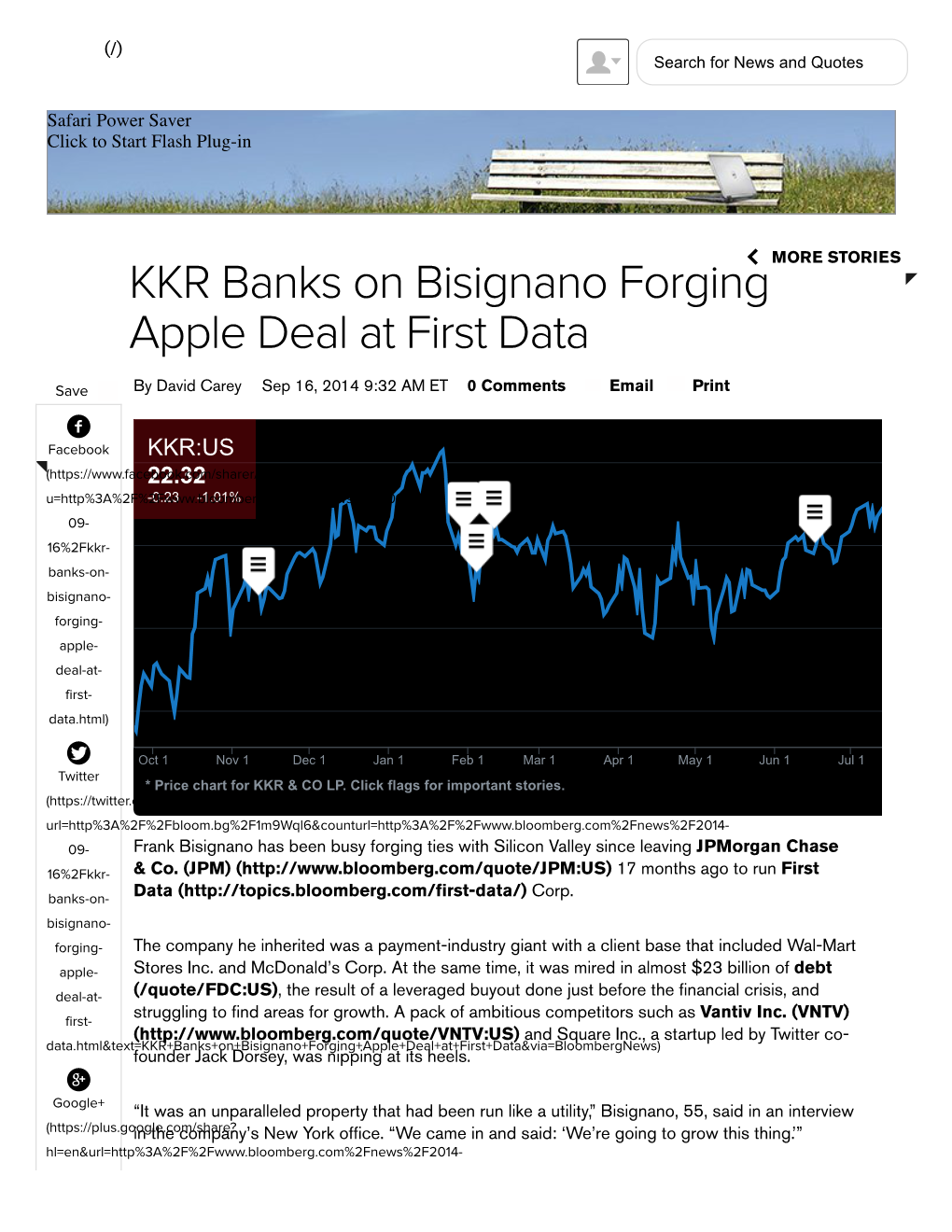

Sept. 19, 2014 Edition #422 New to NewsFilter? AprivaPay is used by over 15 US banks, including 3 of the top 5 Trending This Week... The bullseye is off of Target now after Home Depot announced Want to Advertise an estimated 56 million debit/credit card numbers were stolen in in NF? their recent breach, effectively surpassing Target, making it the largest retail card breach on record. At the same time, many Click here to learn speculate Home Depot's breach will be less painful than Target's more. attack. More Apple news continued this week as KKR banked on First Categories Data's CEO, Bisignano, forging a deal with Apple and TSYS says Featured Apple Pay is forcing innovators to think in reverse. Mobile Payments & Bitcoin Avast! Happy Talk Like A Pirate Day! ARRR! Regulation & Security Economy NEW TSG REPORT: Alternative Payments Players Learn all about Apple Pay, Amazon Local Register, and Softcard! Payments Press What is this report? TSG Resources This 39 page report provides a detailed look at 28 companies TheStrawGroup.com (priced at $77 per company) that provide a variety of products and services that enable electronic payments. These companies TSG Resource Center fall within several categories including: card brands, mobile wallets, card readers and apps, P2P & eCommerce, and prepaid. PaymentsPulse.com A Senior Finance Leader at a Leading Payment Processor said: TSG Overview "Immediate feedback has been wildly positive (and I've shared with our Strategy, Product and Finance teams). Timing on this one was Transaction Advisory especially good!" Acquisition Multiples & Attrition Summary Click for a preview and free overview of Apple Pay. -

Leadership Team

Leadership Team OPERATING COMMITTEE 1 Jamie Dimon 7 Bill Daley 13 Gordon Smith 15 Bill Winters Chairman and Corporate Responsibility Card Services Investment Bank Chief Executive Officer 8 Ina Drew 14 Jes Staley 16 Barry Zubrow 2 Frank Bisignano Chief Investment Office Asset Management Risk Management Chief Administrative Office 9 Todd Maclin 3 Steve Black Commercial Banking Investment Bank 10 Jay Mandelbaum 6 3 13 10 8 12 16 14 4 John Bradley Strategy & Marketing 2 15 Human Resources 7 11 Heidi Miller 1 4 11 5 Mike Cavanagh Treasury & Securities Services 9 5 Finance 12 Charlie Scharf 6 Steve Cutler Retail Financial Services Legal & Compliance Investment Bank 2007 Highlights and Accomplishments JPMorgan is one of the world’s • Institutional Investor’s America’s • Record year-over-year revenue leading investment banks with Investment Bank of the Year. performance in: one of the most extensive client – Investment banking fees, 19% growth; • Risk magazine’s: lists in the world. Our full platform – M&A advisory fees, 37% growth; – Derivatives House of the Year; enables us to develop some of the – Equity underwriting fees, 45% growth; – Best Derivatives House of the Past 20 most complete and innovative – and – Years; and financial solutions in the industry. – Equity markets revenue, 13% growth. – Best Credit Derivatives House – Pioneer We offer clients a full range of – and Modern Great. • Gross investment banking revenue services, including strategic advice, (a) from Commercial Banking clients up capital raising, restructuring, risk • #1 in global investment banking fees. 24% from 2006. management, market-making and • #1 in global loan syndications and research. -

Fiserv Announces Executive Leadership Appointments

Fiserv Announces Executive Leadership Appointments June 24, 2021 BROOKFIELD, Wis.--(BUSINESS WIRE)--Jun. 24, 2021-- Fiserv, Inc. (NASDAQ: FISV), a leading global provider of payments and financial services technology solutions, today announced executive appointments to further the company’s goals of creating value for clients and generating strong, sustainable growth. Guy Chiarello, currently Chief Administrative Officer of Fiserv, has been appointed Chief Operating Officer, effective June 24, 2021. In a distinguished career spanning more than 30 years, Chiarello has been at the forefront of banking, technology, and innovation. In his new role, Chiarello will continue to elevate the client experience, create a high-performance workplace and support the company’s focus on future growth. Leveraging his deep experience and building on his success driving the integration of the company’s technology strategy and operations, Chiarello will continue to partner with the company’s business leaders in the development and commercialization of the next generation of Fiserv solutions. Suzan Kereere will join Fiserv on July 6, 2021 as Chief Growth Officer. In this newly created position, Kereere will work in partnership with Fiserv business leaders to lead enterprise strategy, acquisitions, and business development initiatives that enhance client value and accelerate growth. Kereere is an experienced global business executive with expertise in leading payments and technology platform businesses at Fortune 100 companies, and driving digital transformation, sales optimization, front-line customer engagement and inclusive growth. Most recently, Kereere served as Global Head of Merchant Sales & Acquiring at Visa. Her background also includes leadership roles at American Express, including head of its U.S. -

SENIOR MANAGEMENT BIOGRAPHIES Blank Slide

SENIOR MANAGEMENT BIOGRAPHIES Blank slide Jamie Dimon, Chairman and Chief Executive Officer Jamie Dimon is the Chairman of the Board and Chief Executive Officer of JPMorgan Chase & Co. Dimon became Chairman of the Board, effective January 1, 2007, following his appointment as Chief Executive Officer on January 1, 2006. He also assumed the title of President upon the company’s merger with Bank One Corporation on July 1, 2004. Dimon began his professional career at American Express, serviservingng as Assistant to the President from 1982 until 1985. He then became a key member of the team that launched and defined the strategy for Commercial Credit Company in October 1986, when the consumer lending company was spun off from Control Data Corporation. He served as Chief Financial Officer and then President. Commercial Credit made numerous acquisitions and divestitures, including acquiring Primerica Corporation in 1987 and taking its name. The firm then acquired The Travelers Corporation in 1993, becoming Travelers Group. Dimon served as President and Chief Operating Officer of Travelers from 1990 through 1998 while concurrently serving as Chief Operating Officer of its Smith Barney Inc. subsidiary. He became Chief Executive Officer of Smith Barney in January 1996 and then co-Chairman and co-Chief Executive Officer of the combined brokerage following the 1997 merger of Smith Barney and Salomon Brothers. In 1998, Dimon was named President of Citigroup Inc., the global financial services company formed by the combination of Travelers Group and Citicorp. In 2000, Dimon was named Chairman and Chief Executive Officer of Bank One. During his four years with the company, he engineered a dramatic turnaround – taking the bank from a half-billion-dollar loss in 2000 to record earnings of $3.5 billion in IOGRAPHIES 2003.