Show Us Your BEST Financial Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

China 2025 16

China | Equity Strategy China 14 December 2014 EQUITY RESEARCH China The Year of the Ram: Stars Aligned for a Historic Bull Run Key Takeaway The Ram, the Bull and the Heavenly Twins – the stars are now aligned for China’s historic bull-run. China's stock market offers massive untapped potential given the high savings rate and low penetration. “Keeping Growth Steady” is a top priority for 2015; we expect SHCOMP and HSCEI to test 4,050 and 15,420, up 38% and 37% from current levels. As confidence gains momentum, volatility becomes the investors’ best friend. CHINA China Gallops into a Historic Bull Run. On Nov 20, 2013, we wrote “The Year of the Horse will see China unleash its full potential, as President Xi ushers in a new era of profound change.” “We expect capital markets to gradually gain confidence in China’s ability to drive fundamental reforms and expect Chinese stocks to enter a historic multi-year bull run.” Indeed, 2014 has been a remarkable year. As of Dec.12, SHCOMP surged 39% to 2938, breaking a seven-year bearish trend to become the best performing index in the world. China Stock Market: Massive Untapped Potential. According to China Household Finance Survey, property accounted for 66.4% of total Chinese household assets in 2013. Financial assets accounted for a mere 10.1% of household wealth. While over 61% of Chinese families have bank deposits, only 6.5% of them invested in the stock market. Given China’s high savings rate and low stock market penetration, we believe the A-share market offers significant upside potential. -

2020 Annual Report

AUGUST 31, 2020 2020 Annual Report iShares, Inc. • iShares ESG Aware MSCI EM ETF | ESGE | NASDAQ • iShares MSCI Emerging Markets ex China ETF | EMXC | NASDAQ • iShares MSCI Emerging Markets Min Vol Factor ETF | EEMV | Cboe BZX • iShares MSCI Emerging Markets Multifactor ETF | EMGF | Cboe BZX • iShares MSCI Global Min Vol Factor ETF | ACWV | Cboe BZX Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. Ifyou hold accounts throughafinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies ofyour shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contactingyour financial intermediary. Please note that not all financial intermediaries may offer this service. -

Chinaamc Select Fund Unaudited Semi-Annual Report

ChinaAMC Select Fund ChinaAMC Select China New Economy Fund Unaudited Semi-Annual Report For the period from 1 January 2017 to 30 June 2017 UNAUDITED SEMI-ANNUAL REPORT CHINAAMC SELECT CHINA NEW ECONOMY FUND (a sub-fund of ChinaAMC Select Fund, an open-ended unit trust established as an umbrella fund under the laws of Hong Kong) For the period from 1 January 2017 to 30 June 2017 CHINAAMC SELECT CHINA NEW ECONOMY FUND (a sub-fund of ChinaAMC Select Fund) CONTENTS Pages ADMINISTRATION AND MANAGEMENT 1 REPORT OF THE MANAGER TO THE UNITHOLDERS 2 UNAUDITED FINANCIAL STATEMENTS STATEMENT OF COMPREHENSIVE INCOME 3 STATEMENT OF FINANCIAL POSITION 4 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO UNITHOLDERS 5 STATEMENT OF CASH FLOWS 6 PERFORMANCE TABLE (UNAUDITED) 7 STATEMENT OF MOVEMENTS IN PORTFOLIO HOLDINGS (UNAUDITED) 8 - 9 INVESTMENT PORTFOLIO (UNAUDITED) 10 DISTRIBUTION DISCLOSURE (UNAUDITED) 11 IMPORTANT: Any opinion expressed herein reflects the Manager’s view only and is subject to change. For more information about the fund, please refer to the explanatory memorandum of the fund which is available at our website: http://www.chinaamc.com.hk Investors should not rely on the information contained in this report for their investment decisions. CHINAAMC SELECT CHINA NEW ECONOMY FUND (a sub-fund of ChinaAMC Select Fund) ADMINISTRATION AND MANAGEMENT MANAGER TRUSTEE, ADMINISTRATOR AND REGISTRAR China Asset Management (Hong Kong) Limited BOCI-Prudential Trustee Limited 37/F, Bank of China Tower 12/F and 25/F, Citicorp Centre 1 Garden Road 18 Whitfield Road Central, Hong Kong Causeway Bay, Hong Kong DIRECTORS OF THE MANAGER AUDITOR Mr. -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® Etfs Stock Code: 3073 Website

SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 1st October 2020 to 31st March 2021 SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 Contents Page Condensed Statement of Financial Position (Unaudited) 2 Condensed Statement of Comprehensive Income (Unaudited) 3 Condensed Statement of Changes in Equity (Unaudited) 4 Condensed Statement of Cash Flows (Unaudited) 5 Notes to the Unaudited Condensed Financial Statements 6 Investment Portfolio (Unaudited) 10 Statement of Movements in Portfolio Holdings (Unaudited) 41 Derivative Financial Instruments (Unaudited) 42 Performance Record (Unaudited) 42 Administration and Management 43 1 SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® ETFs Interim Report 2021 CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) As at 31st March 2021 31.03.2021 30.09.2020 Notes HK$ HK$ Assets Current assets Investments 1,385,908,557 969,438,426 Derivative financial instruments 54,331 47,229 Amounts due from brokers – 1,529,953 Dividends receivable 994,452 1,771,941 Other receivables 6(i) 122,017 347,255 Margin deposits 104,721 1,032,223 Cash at bank 6(f) 3,100,556 2,423,717 Total Assets 1,390,284,634 976,590,744 Liabilities Current liabilities Derivative financial instruments – 14 Amounts due to brokers – 1,500,560 Audit fee payable 154,612 309,225 Trustee fee payable 6(e) 382,474 270,773 Management fee payable 6(d) 684,377 481,283 Tax provision 156,265 214,282 Total Liabilities 1,377,728 2,776,137 Equity Net assets attributable to unitholders 4 1,388,906,906 973,814,607 The notes on pages 6 to 9 form part of these financial statements. -

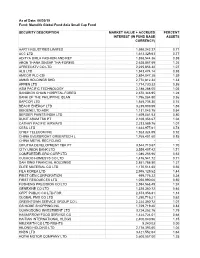

Security Description Market Value + Accrued Interest (In

As of Date: 06/30/19 Fund: Manulife Global Fund Asia Small Cap Fund SECURITY DESCRIPTION MARKET VALUE + ACCRUED PERCENT INTEREST (IN FUND BASE ASSETS CURRENCY) AARTI INDUSTRIES LIMITED 1,598,242.27 0.77 ACC LTD 1,613,329.63 0.77 ADITYA BIRLA FASHION AND RET 1,858,544.36 0.89 AEON THANA SINSAP THA-FOREIG 2,628,867.69 1.26 AFREECATV CO LTD 2,225,856.32 1.07 ALS LTD 1,943,474.14 0.93 AMCOR PLC-CDI 2,894,047.28 1.39 AMMB HOLDINGS BHD 2,772,812.34 1.33 APPEN LTD 1,774,730.32 0.85 ASM PACIFIC TECHNOLOGY 2,188,288.00 1.05 BANGKOK CHAIN HOSPITAL-FOREG 2,672,346.95 1.28 BANK OF THE PHILIPPINE ISLAN 1,796,084.90 0.86 BAPCOR LTD 1,545,735.30 0.74 BEACH ENERGY LTD 3,239,909.59 1.55 BEIGENE LTD-ADR 1,131,043.75 0.54 BERGER PAINTS INDIA LTD 1,659,081.53 0.80 BUKIT ASAM TBK PT 2,169,353.67 1.04 CATHAY PACIFIC AIRWAYS 2,233,589.76 1.07 CESC LTD 1,634,977.61 0.78 CHIEF TELECOM INC 1,923,324.59 0.92 CHINA EVERBRIGHT GREENTECH L 1,765,401.60 0.85 CHINA METAL RECYCLING - - CIPUTRA DEVELOPMENT TBK PT 3,544,710.67 1.70 CITY UNION BANK LTD 3,559,407.42 1.71 COMFORTDELGRO CORP LTD 1,086,255.96 0.52 CUCKOO HOMESYS CO LTD 1,476,541.72 0.71 DAH SING FINANCIAL HOLDINGS 2,851,788.80 1.37 ELITE MATERIAL CO LTD 1,170,514.66 0.56 FILA KOREA LTD 2,995,129.52 1.44 FIRST GEN CORPORATION 699,776.32 0.34 FIRST RESOURCES LTD 1,050,990.06 0.50 FUSHENG PRECISION CO LTD 2,594,568.49 1.24 GENEXINE CO LTD 1,328,360.72 0.64 GFPT PUBLIC CO LTD-FOR 2,373,356.81 1.14 GLOBAL PMX CO LTD 1,290,716.21 0.62 GREENTOWN SERVICE GROUP CO L 2,224,350.72 1.07 GS HOME SHOPPING INC 1,729,719.40 -

Bilag 3. Negativlister I Relation Til Producenter Af Fossile Brændstoffer M.V. Københavns Kommunes Finansielle Strategi Og Risikopolitik

Bilag 3. Negativlister i relation til producenter af fossile brændstoffer m.v. Københavns Kommunes finansielle strategi og risikopolitik D. 8. juni 2016 Læsevejledning til negativlisten: Moderselskab / øverste ejer vises med fed skrift til venstre. Med almindelig tekst, indrykket, er de underliggende selskaber, der udsteder aktier og erhvervsobligationer. Det er de underliggende, udstedende selskaber, der er omfattet af negativlisten Moderselskab / øverste ejer – udstedende selskab Acergy SA SUBSEA 7 Inc Subsea 7 SA Adani Enterprises Ltd Adani Enterprises Ltd Adani Power Ltd Adani Power Ltd Adaro Energy Tbk PT Adaro Energy Tbk PT Adaro Indonesia PT Alam Tri Abadi PT Advantage Oil & Gas Ltd Advantage Oil & Gas Ltd Afren PLC Afren PLC Africa Oil Corp Africa Oil Corp AGL Energy Ltd AGL Electricity VIC Pty Ltd AGL Energy Ltd AGL Sales Pty Ltd Victorian Energy Pty Ltd Aker Solutions ASA Akastor ASA Aker Solutions Holding ASA Aker Solutions ASA Alliant Energy Corp Alliant Energy Corp Alliant Energy Resources LLC Interstate Power & Light Co Wisconsin Power & Light Co Alpha Natural Resources Inc Alex Energy Inc Alliance Coal Corp Alpha Appalachia Holdings Inc Alpha Appalachia Services Inc Alpha Natural Resource Inc/Old Alpha Natural Resources Inc Alpha Natural Resources LLC Alpha Natural Resources LLC / Alpha Natural Resources Capital Corp Alpha NR Holding Inc Aracoma Coal Co Inc AT Massey Coal Co Inc Bandmill Coal Corp Bandytown Coal Co Belfry Coal Corp Belle Coal Co Inc Ben Creek Coal Co Big Bear Mining Co Big Laurel Mining Corp Black King Mine -

China's Financial System

China’s Financial System Growth and Inefficiency Dominique de Rambures and Felipe Escobar Duenas China’s Financial System Dominique De Rambures • Felipe Escobar Duenas China’s Financial System Growth and Inefficiency Dominique De Rambures Felipe Escobar Duenas Master Banque Finance Master Banque Finance Paris I University Panthéon Sorbonne Paris I University Panthéon Sorbonne Paris, France Paris, France ISBN 978-3-319-40450-9 ISBN 978-3-319-40451-6 (eBook) DOI 10.1007/978-3-319-40451-6 Library of Congress Control Number: 2017930599 © The Editor(s) (if applicable) and The Author(s) 2017 This work is subject to copyright. All rights are solely and exclusively licensed by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use. The publisher, the authors and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. Neither the publisher nor the authors or the editors give a warranty, express or implied, with respect to the material contained herein or for any errors or omissions that may have been made. -

China and LA County, BYD Has Offices in Europe, Japan, South Korea, India, Taiwan, and Other Regions

GROWING TOGETHER China and Los Angeles County GROWING TOGETHER China and Los Angeles County PREPARED BY: Ferdinando Guerra, International Economist Principal Researcher and Author with special thanks to George Entis, Research Assistant June, 2014 Los Angeles County Economic Development Corporation Kyser Center for Economic Research 444 S. Flower St., 37th Floor Los Angeles, CA 90071 Tel: (213) 622-4300 or (888) 4-LAEDC-1 Fax: (213)-622-7100 E-mail: [email protected] Web: http://www.laedc.org The LAEDC, the region’s premier business leadership organization, is a private, non-profit 501(c)3 organization established in 1981. GROWING TOGETHER China and Los Angeles County As Southern California’s premier economic development organization, the mission of the LAEDC is to attract, retain, and grow businesses and jobs for the regions of Los Angeles County. Since 1996, the LAEDC has helped retain or attract more than 198,000 jobs, providing over $12 billion in direct economic impact from salaries and over $850 million in property and sales tax revenues to the County of Los Angeles. LAEDC is a private, non-profit 501(c)3 organization established in 1981. Regional Leadership The members of the LAEDC are civic leaders and ranking executives of the region’s leading public and private organizations. Through financial support and direct participation in the mission, programs, and public policy initiatives of the LAEDC, the members are committed to playing a decisive role in shaping the region’s economic future. Business Services The LAEDC’s Business Development and Assistance Program provides essential services to L.A. County businesses at no cost, including coordinating site searches, securing incentives and permits, and identifying traditional and nontraditional financing including industrial development bonds. -

Strategy Report Hong Kong Equity Research

Thursday, 3 December, 2020 China Merchants Securities (HK) Co., Ltd. Strategy Report Hong Kong Equity Research 2021 Outlook: Road towards restoration Jessie Guo, PhD +852 3189 6121 [email protected] “Lives of great men all remind us, we can make our lives sublime. Let Edith Qian, CFA +852 3189 6752 us, then, be up and doing. With a heart for any fate, still achieving, still [email protected] pursuing; learn to labour and to wait”. Harrington Zhang, PhD - Henry Wadsworth Longfellow, A Psalm of Life +852 3189 6751 [email protected] Tommy Wong View on economic recovery +852 3189 6634 [email protected] The outbreak of COVID-19 sent global economic growth deep into negative Johnny Wong territory in 2020. Synchronised large-scale fiscal and monetary policies +852 3189 6357 prevented major economies from sliding into perennial recession. [email protected] According to the IMF, global GDP will contract by 4.4% in 2020 and rebound Yonghuo Liang +86 755 8290 4571 by 5.2% in 2021, but the pace of recovery will be uneven across countries. [email protected] We expect the US economy to have a relatively muted start next year, and Kevin Chen then followed by a brighter second half, while the Fed’s monetary policy will +852 3189 6125 remain abundantly accommodative throughout the entire 2021. [email protected] Felix Luo, PhD +852 3189 6288 We stay positive on China’s economic outlook, mainly driven by domestic [email protected] consumption and manufacturing investment. We expect a rather neutral Yiding Jiao, CFA fiscal and monetary policy stance.