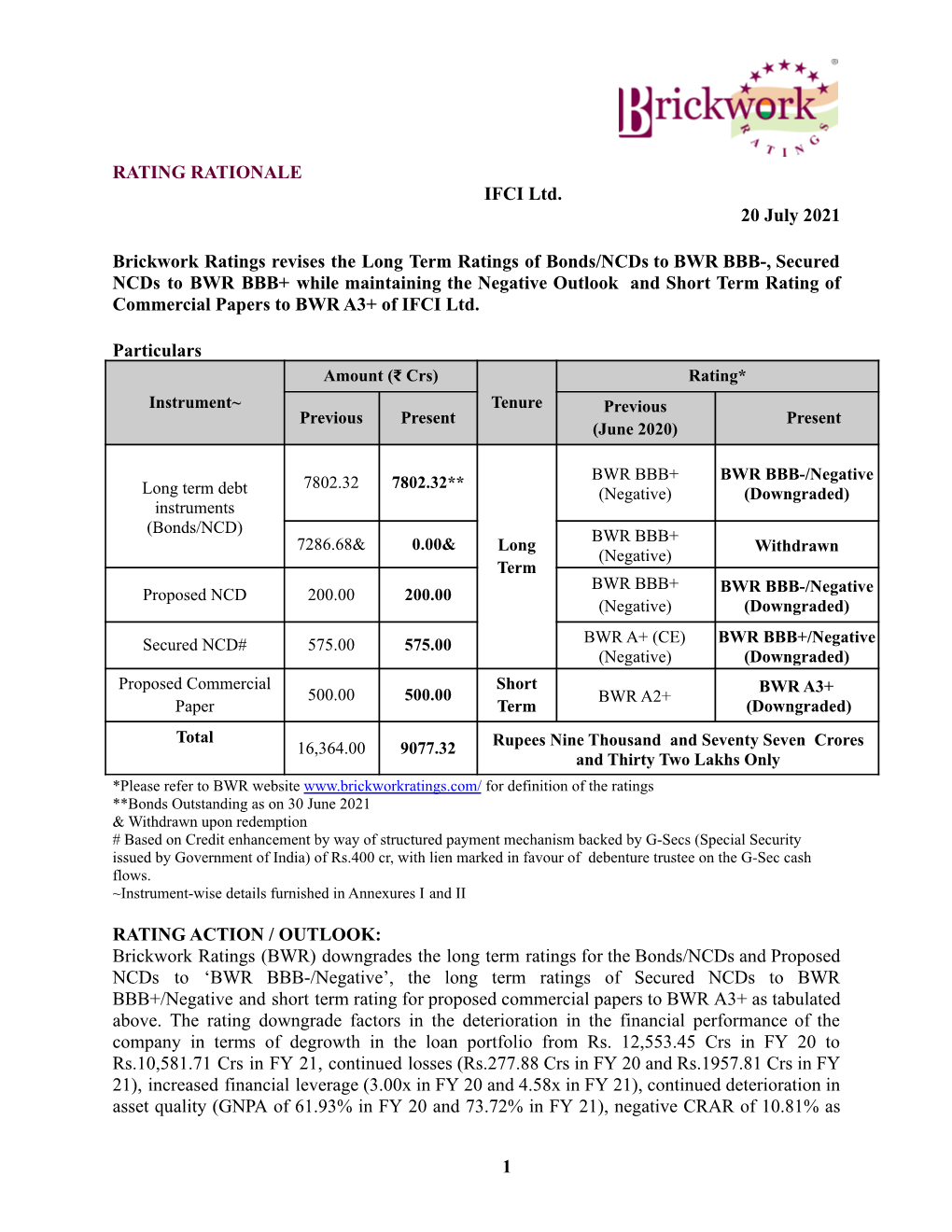

RATING RATIONALE IFCI Ltd. 20 July 2021 Brickwork Ratings Revises The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Convertible, Bonds Series-62 in the Nature of Debent

PRIVATE & CONFIDENTIAL Draft Information Memorandum (A Government of India Undertaking) (भारत सरकार का उपक्रम ) Registered & Corporate Office: IFCI Ltd. IFCI Tower, 61, Nehru Place, New Delhi - 110019 Tel No.: (011) 41732475, 41732000; Fax: 91-11- 26230029, 26230466 E-mail: [email protected]; [email protected]; Website: www.ifciltd.com CIN: L74899DL1993GOI053677 PRIVATE PLACEMENT OF UPTO 4,000 (FOUR THOUSAND) UNSECURED, REDEEMABLE, NON- CONVERTIBLE, BONDS SERIES-62 IN THE NATURE OF DEBENTURES OF RS.10,00,000/- EACH (“DEBENTURES”/ “BONDS”/ “NCDs”) FOR CASH, FOR AN ISSUE SIZE OF ₹ 200 CRORE WITH OPTION TO RETAIN OVERSUBSCRIPTION UPTO ₹ 200 CRORE AGGREGATING UPTO Rs. 400 CRORE (RUPEES FOUR HUNDRED CRORE ONLY) (“ISSUE”). (THIS PRIVATE PLACEMENT OFFER LETTER IS NEITHER A PROSPECTUS NOR A STATEMENT IN LIEU OF PROSPECTUS). THIS PRIVATE PLACEMENT OFFER LETTER IS PREPARED AND ISSUED IN CONFORMITY WITH COMPANIES ACT, 2013, AS AMENDED, SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE AND LISTING OF DEBT SECURITIES) REGULATIONS, 2008, AS AMENDED, FORM PAS-4 PRESCRIBED UNDER SECTION 42 AND RULE 14(1) OF COMPANIES (PROSPECTUS AND ALLOTMENT OF SECURITIES) RULES, 2014, AS AMENDED FROM TIME TO TIME, AND IS AN INFORMATION MEMORANDUM FOR THE PURPOSES OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE AND LISTING OF DEBT SECURITIES) REGULATIONS, 2008, AS AMENDED FROM TIME TO TIME. THIS ISSUANCE WOULD BE UNDER THE ELECTRONIC BOOK MECHANISM FOR ISSUANCE OF DEBT SECURITIES ON PRIVATE PLACEMENT BASIS AS PER SEBI CIRCULAR JANUARY 05, 2018 BEARING REFERENCE NUMBER SEBI/HO/DDHS/CIR/P/2018/05, AND SEBI CIRCULAR DATED AUGUST 16, 2018 BEARING REFERENCE NUMBER SEBI/HO/DDHS/CIR/P/2018/122, EACH AS AMENDED (“SEBI EBP CIRCULARS”), READ WITH THE UPDATED OPERATIONAL GUIDELINES “FOR ISSUANCE OF SECURITIES ON PRIVATE PLACEMENT BASIS THROUGH AN ELECTRONIC BOOK MECHANISM” ISSUED BY BSE VIDE THEIR NOTICE NUMBER 20180928-24 DATED 28 SEPTEMBER 2018 (“BSE EBP GUIDELINES”) AS APPLICABLE. -

Govt Unlikely to Trim GST on Automobiles

FRIDAY • AUGUST 27, 2021 MUMBAI ₹10 • Pages 10 • Volume 28 • Number 238 AUTO FOCUS DATA FOCUS RAISING THE RED FLAG On the 50th anniversary of the Covidrelated health claims in just the The independent auditors of Tata Sons original Countach, Lamborghini’s first five months of FY22 have already have expressed concerns over AirAsia futuristic hybrid makes its debut p7 topped claims of whole of FY21 p2 India’s ability to sustain as a going concern p2 Bengaluru Chennai Coimbatore Hubballi Hyderabad Kochi Kolkata Madurai Malappuram Mangaluru Mumbai Noida Thiruvananthapuram Tiruchirapalli Tirupati Vijayawada Visakhapatnam Regd. TN/ARD/14/09-11, RNI No. 55320/94 Boeing MAX 737 HIGHER FAMILY PENSION, NPS Govt unlikely to trim to fly again in India PSBs to make ₹21,300crore OUR BUREAU New Delhi, August 26 The DirectorateGeneral of GST on automobiles Civil Aviation (DGCA) on additional provision yearly Top official says sop Thursday allowed Boeing MAX8 aircraft to fly again in To soften impact, not needed as sales the country. On account of two have picked up, no fatal accidents, the regulator will seek special RBI had halted operation of this dispensation to inventory buildup type of planes with effect from March 2019. spread it over 5 years OUR BUREAU As on date, SpiceJet is the New Delhi, August 26 only Indian carrier using Boe SHISHIR SINHA The government is unlikely to ing 737 MAXaircraft; it has 13 in New Delhi, August 26 ation of the 11 th bipartite set 2018, it was decided that for a oblige any time soon the auto Tax burden a singleclass configuration Public sector banks will have tlement on wage revision of Central government em mobile industry’s demand for each with capacity to carry 189 to set aside an additional public sector bank employ ployee, the mandatory con ■ lowering the Goods & Services All automobiles attract GST between 18% and 28% passengers. -

IFCI Ltd. Citizen's Charter

IFCI Ltd. (CIN L74899DL1993GOI053677) Citizen’s Charter Vision & Mission 1. What we are IFCI Limited (IFCI) was set up in 1948 as independent India’s first Development Financial Institution, as “The Industrial Finance Corporation of India”, a Statutory Corporation, for providing medium and long term finance to industry. In 1993 after repeal of the IFC Act, IFCI became a Public Limited Company, registered under the Companies Act, 1956. Currently, IFCI is a Government Company with Government of India holding 61.02% share in paid-up capital of IFCI. IFCI is also registered with the Reserve Bank of India (RBI) as a Systemically Important Non-Deposit taking, Non-Banking Finance Company (NBFC-ND-SI) and also a notified Public Financial Institution under Section 2(72) of the Companies Act, 2013. 2. IFCI’s Vision “To be the leading development institution for industrial and infrastructure sectors across the spectrum and be an influential partner in country’s economic growth and development”. 3. IFCI’s Mission To adopt the best practices in financing industry and infrastructure sectors and leverage core competencies in promoting sustainable industrial and infrastructure development in the country. To act as a competitive, customer-friendly and development oriented organization, delivering financial products and services to the satisfaction of all its stakeholders. 4. We fulfill the vision : By providing a Product mix offering, to satisfy the customer needs as per details provided below: Customized product-mix to maximize customer satisfaction for building, enduring and sustaining relationship with the borrowers. Commitment to devise a product mix offering which varies from one business/industry segment to another. -

Development Finance in India

Development Finance in India C. P. Chandrasekhar I. SETTING THE CONTEXT Till recently India was an exemplary instance of the use of development banking as an instrument of late industrialisation. The turn to and emphasis on development banking in the immediate aftermath of Independence is explained by two features characterising the Indian economy at that point in time: one was the inadequate accumulation of own capital in the hand of indigenous industrialists; and the other was the absence of a market for long term finance (such as bond or active equity markets), which firms could access to part finance capital-intensive industrial investment. The financial structure at Independence reflected the underdeveloped nature of the economy with unduly low levels of domestic saving and investment. As a result the financial structure was inadequately diversified. In terms of the share of financial assets the Reserve Bank of India dominated, with 47 per cent of the total, followed by the commercial banks as a group with 26 per cent and the Imperial Bank with 8 per cent. The gradual decline of the exchange banks, which were established to finance foreign trade, had brought their share in assets down to 5 per cent. Postal savings, Cooperatives and Insurance Cos accounted for 4 per cent each and pension funds for a mere 2 per cent. Thus, excluding the central bank, banks overwhelmingly dominated the financial structure (Goldsmith 1983). There are limits to which banks could be called upon to take on the responsibility of financing long- term investments. Banks attract deposits from many small and medium (besides, of course, large) depositors, who have relatively short savings horizons, would prefer to abjure income and capital risk, and expect their savings to be relatively liquid, so that they can be easily drawn as cash. -

Ifci Factors Limited

DRAFT RED HERRING PROSPECTUS Please read Section 60B of the Companies Act, 1956 100% Book Building Issue Dated July 27, 2011 This Draft Red Herring Prospectus shall be updated on filing with the RoC IFCI FACTORS LIMITED Our Company was incorporated on December 14, 1995 in New Delhi under the Companies Act, 1956, as amended (“Companies Act”), as a public limited company under the name „Foremost Factors Limited‟ with the Registrar of Companies, National Capital Territory of Delhi and Haryana (“RoC”). Pursuant to a resolution passed by our shareholders on December 16, 2008, the name of our Company was changed to „IFCI Factors Limited‟, and a fresh certificate of incorporation was issued on January 7, 2009. For more information on the change in our name and the registered and corporate Office, see “History and Certain Corporate Matters” on page 76. Registered and Corporate Office: 9th Floor, IFCI Tower, 61, Nehru Place, New Delhi 110 019, India Tel: (+91 11) 4173 2000 Fax: (+91 11) 4652 1435 Compliance Officer: Vijay Dhingra, Company Secretary and Senior Manager (Legal and Secretarial) Tel: (+91 11) 4641 2833 Fax: (+91 11) 4652 1435 E-mail: [email protected] Website: www.ifcifactors.com Promoter: IFCI Limited (“IFCI” or “Promoter”) INITIAL PUBLIC OFFERING OF 39,086,628 EQUITY SHARES OF FACE VALUE OF ` 10 EACH (“EQUITY SHARES”) FOR CASH AT A PRICE OF ` [●] PER EQUITY SHARE (THE “ISSUE PRICE”) AGGREGATING UP TO ` [●] MILLION OF IFCI FACTORS LIMITED (“IFL” OR “OUR COMPANY”) (THE “ISSUE”). THE ISSUE SHALL CONSTITUTE 33% OF THE POST ISSUE PAID-UP EQUITY SHARE CAPITAL OF OUR COMPANY. -

List of Creditors As on May 08, 2019

C&C Constructions Limited List of Financial Creditors Amt in INR S. Claim Under Financial Creditor Amount Claimed Claim Admitted Claim Rejected Remarks No. Verification 1 State Bank of India 9,685,064,767 9,458,461,567 - 226,603,200 2 L&T Infrastructure Finance Company Limited 5,487,980,651 5,487,980,651 - - 3 Axis Bank Ltd. 2,338,789,704 1,522,787,998 - 816,001,706 4 IFCI Ltd. 1,656,017,678 896,948,941 - 759,068,737 5 Central Bank of India 1,551,461,327 1,484,683,288 - 66,778,039 6 ICICI Bank Ltd. 1,212,954,083 1,170,420,032 - 42,534,051 Note 5 7 Standard Chartered Bank 1,046,684,980 1,046,684,980 - - 8 Oriental Bank of Commerce 767,075,995 767,075,995 - - 9 IndusInd Bank Ltd. 613,043,000 613,043,000 - - 10 DBS Bank Ltd. 522,923,391 522,923,391 - - 11 Punjab and Sind Bank 377,177,434 377,177,434 - - 12 SREI Equipment Finance Limited 310,485,233 306,535,196 - 3,950,037 13 IDBI Bank Ltd. 262,503,133 210,162,383 - 52,340,750 14 India Infrastructure Finance Company Ltd. 1,185,251,663 - - 1,185,251,663 Note 3 15 Ashish Govind Acharya (HUF) 1,329,333 - - 1,329,333 Note 4 16 Pushpa Chakroborty/Suman Chakroborty 1,441,687 - - 1,441,687 Note 4 17 Babita Jindal & Varinder kumar Jindal 12,800,000 - - 12,800,000 Note 4 18 Varinder Kaur Thind 3,774,112 - - 3,774,112 Note 4 27,036,758,171 23,864,884,856 - 3,171,873,315 Note 1: The amount admitted in certain cases may be revised following clarifications requested from some of the creditors Note 2: Kindly note that security interest is subject to further verification (Annexure - 1) Note 3: Claim was received post constitution of the CoC and currently is under verification Note 4: Claims pertain to investments by claimants in C&C Towers Ltd. -

REQUEST for PROPOSAL for PURCHASE of IFCI’S SHAREHOLDING

Tender No. IFCI/S&AD/CCIL/2020-21-02 Dated: December 17, 2020 REQUEST FOR PROPOSAL FOR PURCHASE OF IFCI’s SHAREHOLDING IN THE CLEARING CORPORATION OF INDIA LTD. (CCIL) IFCI Tower, 61, Nehru Place New Delhi 110 019 Important Dates Date of Issue of the Document December 17, 2020 Last date for Pre-Bid Queries December 28th 2020 Last Date of Submission of Bids January 8th 2021 Tender Document for Sale of shareholding of IFCI in CCIL- 2020-21 Disclaimer: i. This “Invitation of Bids / Offers” is not an offer by IFCI Limited but an invitation to receive offers from interested and eligible parties. The purpose of this Offer Document is to provide the necessary information to such interested and eligible parties that may be useful to them in formulating their Proposals in response to this ”Invitation for Bids/ Offers”. ii. No contractual obligation whatsoever shall arise from the process of Invitation of Bids / Offers for Sale of Equity. iii. IFCI Limited reserves the right to modify or even not to proceed with the transaction. ____________________________________________________________________________________________ Page 2 of 16 Tender Document for Sale of shareholding of IFCI in CCIL- 2020-21 1. Background 1.1 IFCI Limited (IFCI) is the oldest Development Financial Institution of the country set- up in 1948 as a statutory corporation under Industrial Finance Corporation Act, 1948 (IFC Act) for providing medium and long-term finance to the Industrial sector. IFCI is a Government Company in terms of Section 2(45) of Companies Act, 2013 with Government of India’s shareholding of 61.02% of the total paid up share capital of IFCI. -

70 POLICIES THAT SHAPED INDIA 1947 to 2017, Independence to $2.5 Trillion

Gautam Chikermane POLICIES THAT SHAPED INDIA 70 POLICIES THAT SHAPED INDIA 1947 to 2017, Independence to $2.5 Trillion Gautam Chikermane Foreword by Rakesh Mohan © 2018 by Observer Research Foundation All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission in writing from ORF. ISBN: 978-81-937564-8-5 Printed by: Mohit Enterprises CONTENTS Foreword by Rakesh Mohan vii Introduction x The First Decade Chapter 1: Controller of Capital Issues, 1947 1 Chapter 2: Minimum Wages Act, 1948 3 Chapter 3: Factories Act, 1948 5 Chapter 4: Development Finance Institutions, 1948 7 Chapter 5: Banking Regulation Act, 1949 9 Chapter 6: Planning Commission, 1950 11 Chapter 7: Finance Commissions, 1951 13 Chapter 8: Industries (Development and Regulation) Act, 1951 15 Chapter 9: Indian Standards Institution (Certification Marks) Act, 1952 17 Chapter 10: Nationalisation of Air India, 1953 19 Chapter 11: State Bank of India Act, 1955 21 Chapter 12: Oil and Natural Gas Corporation, 1955 23 Chapter 13: Essential Commodities Act, 1955 25 Chapter 14: Industrial Policy Resolution, 1956 27 Chapter 15: Nationalisation of Life Insurance, 1956 29 The Second Decade Chapter 16: Institutes of Technology Act, 1961 33 Chapter 17: Food Corporation of India, 1965 35 Chapter 18: Agricultural Prices Commission, 1965 37 Chapter 19: Special Economic Zones, 1965 39 iv | 70 Policies that Shaped India The Third Decade Chapter 20: Public Provident Fund, 1968 43 Chapter 21: Nationalisation of Banks, 1969 45 Chapter -

Mergers of Icici Bank

A PROJECT REPORT ON MERGERS OF ICICI BANK SUBMITTED TO ALL INDIA MANAGEMENT ASSOCIATION CENTRE FOR MANAGEMENT EDUCATION MANAGEMENT HOUSE, 14 INSTITUTIONAL AREA, LODHI ROAD, NEW DELHI-110003. AUGUST 2008 By SUSMITA GHOSH REGISTRATION NO.750610210 Guided By SRI. JAHAR BHOWMIK FACULTY OF INSTITUTE OF BUSINESS MANAGEMENT For the partial fulfilment of Post Graduate Diploma in Management Acknowledgement I take great pleasure to express my gratitude to my guide, Sri. Jahar Bhowmik, Faculty Member, Institute of Business Management, for his valuable guidance, constant encouragement and critical approaches which led to the completion of this endeavour. I also express my sincere thanks to concerned authorities at Institute of Business Management for giving me this opportunity to undertake this project at their esteemed organization. I remain indebted to all who have poured in constant suggestions and advices and have supported me throughout the period of my project work. (Susmita Ghosh) i List of Figures, Tables and Graphs A. List of Figures 2.1 Submission of Narasimham Committee Report. 5.2 ICICI Bank, Mumbai. 6.3 Mr H.N. Sinor, and Dr K.M. Thiagarajan, at conference in Chennai. 6.5 ICICI Bank Shareholdings. 6.7 Sangli Bank, Mumbai B. List of Tables 6.1 Comparison of financials of ICICI Bank and Bank of Madurai. 6.2 Profile of ICICI Bank and ICICI Ltd at the time of merger. 6.3 Profile of ICICI Bank and Sangli Bank at the time of merger. 7.4 Retail and Financial Services of the Group. 7.5 Individual Strengths of ICICI Ltd and ICICI Bank. 7.6 Revenue Segments. -

Origin of Development Banks in India

IJMH - International Journal of Management and Humanities ISSN: 2349-7289 ORIGIN OF DEVELOPMENT BANKS IN INDIA Ms. Rakhi 1(Research Scholar M.Com, Faridabad, India, [email protected] ) ABSTRACT-The purpose of this research paper is to evaluate the overall scenario of development bank in India. The main focus of this paper is on the evolution and functioning of principal development banks which plays crucial role in economic development in India. Development banks give strengthen to industries by providing finance at subsidize rate. Keywords- development bank, History, India, Growth INTRODUCTION– development bank took birth in India design problem in relation to development banking are after independence. It had been seen that commercial banks discussed. Potential area of application of or in each problem eligible to grant only short term credit to industries and class are also identified. The paper then summarizes the agriculture for their working capital requirement . after experience gained so far and recommends the action to be taken recognized the need of such institution which provide long term for the more effective application of or in developing finance to industrial and agriculture sector, government of India economics. established a number of institutions since independence to provide long term finance to industries and agriculture such as MEANING OF DEVELOPMENT BANK IFCI, SFC, IDBI, ICICI provide credit to industrial sector, Development bank is specialized financial institution which NABARD bank is an apex institute which provide finance to provide financial assistance (medium and long term) to agricultural sector and EXIM bank is specialized in industrial and agricultural sector for their development. -

1625497237Krpton Cs Eet

CHAPTER 1 - BASICS OF DEMAND AND SUPPLY AND FORMS OF MARKET COMPETITION 1.1. DEFINITION OF DEMAND Demand refers to the quantity of a commodity that a consumer desires to have, backed up by sufficient resources and willingness to spend those resources on the commodity during a period at various possible prices. Demand Quantity Demand It is the quantity of a commodity that a It is the quantity of a commodity that a consumer is willing to buy at various consumer is willing to buy at a specific possible prices during a period. price at a particular time. It is a flow concept. It is a stock concept. Ex- 20,000 units of Car was demanded in Ex-10 kg of Wheat was demanded at a January price of Rs 40 DEMAND SCHEDULE It is a table related to price and quantity demanded. Types of Demand Schedule Price Individual Demand Market Demand A B MD [ A+B ] 10 5 4 9 20 3 2 5 30 2 1 3 The individual demand schedule refers to the demand schedule of an individual consumer. The market demand schedule refers to the demand schedule of all the consumers in the market. It shows different quantities of a commodity that all consumers in the market, intend to buy at different possible prices, during a period. Market demand is the sum total of Individual demand. DEMAND CURVE It is a graphical presentation of the demand schedule. It is a curve that shows various quantities demanded at various possible prices. The individual demand curve is a graphical presentation of the Individual demand schedule. -

11Th Annual Report 2016-2017

11th Annual Report 2016-2017 Vision StockHolding DMS will be a partner of choice with a strong leadership position and a strong brand name in the document management business maximizing wealth through differentiated and profitable business operations. Mission and Goals . StockHolding DMS will provide End to End services in Document Management Solutions, both in the Physical Storage and Electronic Management space as well as provide workflow solutions. StockHolding DMS will grow both the Physical and Electronic Document Management business with a special focus on the Electronic Document Management Solution(DMS/EDMS) business that promises a high growth potential and return on capital. CONTENTS Board of Directors…………………………………………………………… 02 Performance Highlights…………………………………………………… 03 Notice of 11th Annual General Meeting………………………………… 04 Directors’ Report……………………………………………………….…… 17 Independent Auditors’ Report……………………………………….…… 55 Annexure to Independent Auditors’ Report…………………………… 59 Comments of the Comptroller and Auditor General of India……… 65 Balance Sheet………………………………………………………………… 66 Statement of Profit and Loss……………………………………………… 68 Cash Flow Statement………………………………………………….…… 70 Notes to Financial Statements…………………………………………… 73 1 Board of Directors (as on August 10, 2017) Shri Ramesh NGS - Chairman (Non-Executive) Shri Venkatraman Iyer - Independent Director Shri Sanjay Sharma - Additional - Independent Director Shri R. H. Mewawala - Director Shri L. Viswanathan - Director Shri Umesh Punde - Director Shri Jagdish Thakur - Director Ms.