Kraft Foods Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nutrition Guidelines After Surgery Nutrition Basics………………………………………………

Nutrition Guidelines After Surgery Nutrition Basics……………………………………………….................................................... 3 Sugar Free Products………………………………………………………….. 8 How to Read a Food Label……………………...................................... 10 Essentials for Success…………………………………………………………. 11 Creating Optimal Fat Loss…………………………………………………...12 2 Week Pre-Operative Diet…………………………………….............................................13 Sample Meal Plans……………………………………………………………… 15 General Guidelines …………………………………………………….......................................17 Stage 1: Clear Liquid Diet ………………………………………..............19 Grocery List…………………………………………………… 21 Stage 2: Liquids/Pureed…………………………………………………… 22 Grocery List………………………………………………….. 24 Meal Plan…………………………………………………… 26 Stage 3: Soft Diet …………………………………………………………….. 27 Grocery List………………………………………………… 29 Meal Plan……………………………………………………. 31 Stage 4: Regular Texture Diet …………………………………........... 32 Grocery List…………………………………………………. 33 Meal Plan……………………………………………………. 35 Stage 5: Maintenance …………………………………………………….. 36 Potential Nutrition Problems …………………………………........................................... 38 Vitamins and Minerals …..……………………………………………………………………...... 41 Vitamin Supplement Guidelines………………………………………. 43 Post Bariatric Diet at a Glance……………………………………….................................. 44 Complete Protein List…………………………………………………...................................... 45 High Protein Yogurt……………………………………………………………………………….. 47 Resources...……………………………………………………………………………………………… 48 Weight Loss Surgery is designed -

Peanut Free / Tree Nut Free Snack List

PEANUT FREE / TREE NUT FREE SNACK LIST Please avoid snacks that contain peanuts, peanut flour, peanut oil, or peanut butter or other nuts. This includes snacks with almonds, coconuts, filberts, Brazil nuts, cashews, hazelnuts, macadamia nut, pecans, pine nuts, pistachios, and walnuts. Please note: Food labels/ingredients may change over time , so it is always recommended that you read the label before purchasing snacks. Please read labels carefully to make sure the products are nut free. This includes labels that read “May contain traces of peanuts/nuts.” Quick check brands: Kellogg’s, Keebler, General Mills, Betty Crocker, and Quaker Oats brands are excellent at calling out allergens in a box: Example: CONTAINS PEANUT AND EGG INGREDIENTS Thank you for your consideration and support in keeping the food-allergic child safe from having a life- threatening allergic reaction at school. HEALTHY SNACKS FRUITS/VEGETABLES • Any fresh fruit (apples, oranges, bananas, grapes, pears, plums, clementines, strawberries, melons, berries, etc.) • Applesauce cups (and assorted variety fruit flavored applesauce) • Raisins, Craisins, and other dried fruits • Fruit cups (peaches, pears, oranges, pineapple, fruit cocktail, fruit blends, etc.) • Fresh vegetables (baby carrots, celery sticks, grape tomatoes, cucumber slices, broccoli, pepper strips, etc.) • Vegetable dips CHEESE/DAIRY • Yogurt in individual cups or tubes • Pudding in individual cups, cans, or tubes • String cheese or other cheeses (1 oz.) • Drinkable yogurt or smoothies • Cottage cheese • Kraft -

Kraft Foods Inc(Kft)

KRAFT FOODS INC (KFT) 10-K Annual report pursuant to section 13 and 15(d) Filed on 02/28/2011 Filed Period 12/31/2010 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 (Mark one) FORM 10-K [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 COMMISSION FILE NUMBER 1-16483 Kraft Foods Inc. (Exact name of registrant as specified in its charter) Virginia 52-2284372 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) Three Lakes Drive, Northfield, Illinois 60093-2753 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: 847-646-2000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Common Stock, no par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections. -

Why Do You Make Fun of Kids?

Table of Contents: Content: Page: School News 1-9 Spring/Summer Activities 10-15 Interesting Information 16-24 Food 25-32 Entertainment 33-35 Sports 36-37 Staff Interviews 38-50 Comic Strips/Jokes 51-56 Contributing Authors 57 Saber Stories by Brynn Leary SHAKOPEE’S FAVORITE NEWSPAPER - Since 2017 Newspaper, behind the scenes Newspaper club meets on Wednesday from 2:45-3:30. There are 22 kids in newspaper. During that time, some people get a lot done, while others get smaller amounts completed. People in newspaper club like to talk and do weird things, which is no surprise why we have a blast and write amazing stories. We have competitions and talk a lot. We also do our interviews during this time. We have to have our questions ready, and then we go. Out of those 22 kids, some are quiet while others are really loud. We are all different, but we have one thing in common. We all enjoy writing and newspaper club! The best part of newspaper is that we can all contribute our different points of views; each bringing uniqueness to Pearson. 1 Saber Stories by Ella Mingo SHAKOPEE’S FAVORITE NEWSPAPER - Since 2017 Newspaper club comes to an end As you know, the school year is coming to an end. That also means this will be our last newspaper together as we continue on our separate ways. Therefore, as part of this last editorial, I asked some of our newspaper family a few general questions. AVA What mythical creature would you like to be? A unicorn What will you miss about newspaper? Getting together with friends and writing with them! GRETA What’s your favorite subject? Reading or band What will you miss about newspaper? I like that I get to write with people who also get to write. -

Directoryproduct

FOODSERVICE PRODUCT Directory FIRST HALF 2018 Sour Patch ID | 02.22.13 | 41692 CONNECT WITH CUSTOMERS THROUGH ON-BRAND Sn & ts Brands matter to customers. Mondelezack Internationals offers a full portfolio S of sweet,w savorye and eportion-conscious snacks with the brand names they love, plus branded inclusions that help sweeten dessert sales. Keep up with evolving snacking trends and put the power of preferred brands behind you with classic snacks, new products and innovative applications. Classic Cookies & Crackers Morning Must-Haves • OREO • CHIPS AHOY! • belVita Blueberry • WHEAT THINS • NUTTER BUTTER • belVita Sandwich Peanut Butter • belVita Protein Oats, Honey & Chocolate The #1 peanut butter sandwich cookie1 America’s #1 #1 selling cookie The nation’s #1 breakfast biscuit1 is a top-10 winner chocolate chip cookie1 in America1 for breakthrough innovation in 20142 1. Nielsen, Market : xAOC plus Convenience. 52 weeks ending 8/26/17 2. Heller, Laura, “Nielsen’s Breakthrough Innovation Winners Turn Challenges into Sales” Forbes, May 6, 2014 2 Better-for-You Bites • Véa World Crisps • GOOD THiNS Sweet Potato • RITZ CRISP & THINS • OREO THINS Bites #1 selling cracker— filled & unfilled1 Delightful Dessert Inclusions • NUTTER BUTTER • CHIPS AHOY! • OREO Top branded ingredient on dessert menus3 Crème de la Candy America’s #1 sour confection brand is big among millennials 18–344 • SOUR PATCH KIDS • SOUR PATCH Watermelon • SWEDISH FISH Red • OREO Chocolate Candy Bar • OREO Chocolate Candy Bar Mint The nation’s #1 breakfast biscuit1 is a top-10 winner America’s #1 Cookie1 perfectly for breakthrough innovation in 20142 pairs with Europe’s #1 Chocolate1 3. -

Mondelēz Union Network

Mondelēz Union Network What is ? Mondelez is a global snack foods company which came into being on October 2, 2012 when the former Kraft Foods Inc. was split into two, resulting in the creation of two separate companies, both headquartered in the USA. Mondelēz took the “snacks” products (biscuits, confectionery, salty crackers, nuts, gum, Tang), giving it about two-thirds the revenue of the former Kraft. The remaining “grocery” products were stuffed into a North American (only) company now known as Kraft Foods Group. Former Kraft CEO Irene Rosenfeld now heads up Mondelēz. If you worked for the former Kraft or one of its subsidiaries manufacturing or distributing snack products, including former Danone or Cadbury products, you now work for Mondelēz or one of its subsidiaries. In some countries, the name change will not be immediate. Mondelēz Kraft Foods Group Oreo, Chips Ahoy, Fig Kraft macaroni and cheese Newtons, SnackWell’s, Stove Top stuffing Nilla wafers, Mallomars Kool-Aid and Capri Sun Nabisco crackers including drinks Ritz, Triscuit, Teddy Grahams, Deli brands including Oscar Honey Maid, Premium Mayer, Louis Rich, saltines, Planters nuts, Lunchables, Deli Creations, Cheese Nips, Wheat Thins, Claussen pickles Lu biscuits Philadelphia cream cheese Philadelphia cream cheese Kraft, Velveeta and Cracker Toblerone chocolate, Milka Barrel cheese candy bars, Cadbury, Green and Black’s Jell-O Trident/ Dentyne gum Cool Whip/Miracle Whip Halls A-1 steak sauce, Grey Poupon mustard Tang Vegemite Jacobs coffee Maxwell House coffee 888 Brand names in red are ‘power brands’ each generating revenue over USD 1 billion In North America, Maxwell House coffee is ‘grocery’ (Kraft Foods Group), but elsewhere coffee is Mondelēz. -

Product Guide January - June 2020 PRODUCT GUIDE JAN - JUN 2020 Welcome

Disclaimer Whilst every effort has been made to ensure the accuracy of the contents of this list, information contained in this catalogue is given in good faith. All items featured within this brochure are subject to availability. Size and product information are quoted as approximate and for guidance only. Pictures are for illustration purposes only. Head Office Depot Wakefield Depot Serving Central & Southern areas Serving Northern areas Steelmans Road Premier Park Jamesbridge Unit 3, Darlaston, Wednesbury Premier Way West Midlands Wakefield WS10 9UZ LS26 8ZA 0121 526 8400 www.afblakemore.com/food-service/welcome Product Guide January - June 2020 PRODUCT GUIDE JAN - JUN 2020 Welcome... Blakemore foodservice is part of the wider Blakemore group with a turnover of over £1billion. The Blakemore group has been in existence for over 100 years and is headed up by Peter Blakemore who is Chairman and also grandson of the original founder. • The whole of the business is based on strong company values • Maximise Staff potential and their contribution to the company’s success • Give great service to all our customers and add value to our trade partners • Make a significant positive contribution to the community • Attain excellence in everything we do • Behave with honesty and integrity in everything we do Here at Blakemore Foodservice, we pride ourselves Brexit is still looming, however rest assured that on providing great value and a wide range of we have a robust plan in place to minimise impact products to meet our customers’ needs, delivering all to supply during this period. We will endeavour to across England, Scotland and Wales. -

Whole Grain Wheat Thins 1. Summarize Product/Service

Whole Grain Wheat Thins 1. Summarize Product/Service Company - This product is made by Nabisco, a division of Kraft foods. Nabisco is a subsidiary of Mondelez International. Other Nabisco products include Chips Ahoy, Teddy Grahams, Oreos, Ritz Crackers, and Belvita. Mondelez International has a market share of four percent, and their company is run out of Deerfield, IL. Lately, Mondelez International has launched innovative products over the past years to keep up with health trends and new snacking habits. Industry - The industry that Wheat Thins are in is cookie and cracker manufacturing. According to IBISWorld, the industry revenue for 2017 was $26.9 billion. Consumers started going from cookies and crackers to healthier snack and meal options. Ingredients - This product contains: Whole Grain Wheat Flour, Unbleached Enriched Flour (Wheat Flour, Niacin, Reduced Iron, Thiamine Mononitrate [Vitamin B1], Riboflavin [Vitamin B2], Folic Acid), Soybean Oil, Sugar, Cornstarch, Malt Syrup (From Barley And Corn), Salt, Invert Sugar, Monoglycerides, Leavening (Calcium Phosphate And/Or Baking Soda), Vegetable Color (Annatto Extract, Turmeric Oleoresin). Contains: Wheat. Types - There are many other kinds of Wheat Thins, including: Artisan cheese: Wisconsin Colby, Artisan cheese: Vermont White Cheddar, Chipotle, Dill Pickle, Fiber Selects 5-Grain, Flatbread Garlic & Parsley, Flatbread Tuscan Herb, Hint of Salt, Honey Mustard, Lime (limited time 2013), Multigrain, Popped – a popped chip variety of Wheat Thins[9], Ranch, Reduced Fat [10], Sour Cream and Onion, Smoked Gouda, Smoky BBQ, Spicy Buffalo, Sundried Tomato & Basil, Sweet Onion, and Zesty Salsa. Product - Wheat Thins are 9.1 oz boxes of whole-wheat crackers and are made with whole-grain wheat flour. -

Randy Vissing: “Lenawe Nilla” by Paula Mchugh a Mystery, Or Maybe Better Described As a Perplexity, Had Haunt- Ed Randy Vissing for Decades

Volume 17, Number 21 Thursday, May 31, 2001 Randy Vissing: “Lenawe Nilla” by Paula McHugh A mystery, or maybe better described as a perplexity, had haunt- ed Randy Vissing for decades. Never quite able to pinpoint why he felt that his family was some- how “different” from the others he observed as a young boy growing up in Northwest Indiana, Randy proceeded on with his life, marry- ing, becoming a father, and settling down in Long Beach. That nagging enigma evoked among other things, memories of out-of-earshot conversations between Randy’s grandmother and grandfather. Their words were spoken in a mystifying tongue, one unknown to Randy. And the bits of folk wisdom and remedies from his mother, such as suggesting he go out and find a willow bark branch when he lost his toothbrush, also hinted of the uncommon. Randy said that his family had told him he was of German and French descent, and who was he to question otherwise, with the surname, Vissing? So, it came as a surprise, but not exactly as a shock, when Randolph (a French name) Vissing (a German name) discovered his Shawnee heritage. Lenawe Nilla—I Am Shawnee “I found the information when I was looking for my mother’s birth certificate approximately four years ago,” Randy said. “I discovered that my grandfather had been a full-blooded Shawnee, and my grand- mother, one-half Shawnee.” Before this discovery, the Vissings— Randy, Sue, and Blake had attended sever- Red, yellow, black, green and white beads, ribbons, al public pow feathers and fringe adorn this young lady. -

Safe Snack Guide

Commonly Available Foods Free of Peanuts and Tree Nuts Many Free of the Top 8 Allergens Content Updated: August 8, 2018 This copy was downloaded: September 2, 2018 Do not use this copy after: September 16, 2018 After this date, download an updated copy from: snacksafely.com/download Please read and understand this entire page and the next before using this guide. Your use of this guide indicates that you have read and understand the disclaimer below and accept and agree to its limitations. DISCLAIMER: ALL INFORMATION REGARDING INGREDIENTS AND MANUFACTURING PROCESSES WERE COMPILED FROM CLAIMS MADE BY THE PRODUCTS’ RESPECTIVE MANUFACTURERS ON THEIR LABELS OR VIA OTHER MEANS AND MAY ALREADY BE OUT OF DATE. ALTHOUGH EVERY EFFORT HAS BEEN MADE TO BE AS ACCURATE AS POSSIBLE, WE DO NOT ACCEPT ANY LIABILITY FOR ERRORS OR OMISSIONS MADE BY US OR THE PRODUCTS’ RESPECTIVE MANUFACTURERS. THIS LIST IS FOR INFORMATIONAL PURPOSES ONLY AND IS INTENDED TO SERVE AS A GUIDE, NOT AS AN AUTHORITATIVE SOURCE, AND IS NOT INTENDED TO REPLACE THE ADVICE OF ANY MEDICAL PROFESSIONAL. PRIOR TO PURCHASING ANY LISTED FOOD ITEM, IT IS YOUR RESPONSIBILITY TO CHECK THE PRODUCT LABEL TO ENSURE THAT UNDESIRED ALLERGENS ARE NOT LISTED AS INGREDIENTS AND TO VERIFY WITH THE MANUFACTURER THAT TRACE AMOUNTS OF UNDESIRED ALLERGENS WERE NOT INTRODUCED DURING THE MANUFACTURING PROCESS. CURRENT FDA LABELING GUIDELINES DO NOT MANDATE MANUFACTURERS DISCLOSE POTENTIAL ALLERGENS THAT MAY BE INTRODUCED AS PART OF THE MANUFACTURING PROCESS. The symbols preceding each product listing indicate the specific allergens that are excluded for that product and are important for determining whether the product is suitable for specific dietary restrictions. -

This Toolkit of Materials Is Developed and Brought to You by NABISCO As a Professional Resource

This is for layout purposes only please use the web assets provided in the file folder ONCE UPON A WHOLE GRAIN… According to the 2015-2020 Dietary Guidelines for Americans, at least half of all grains eaten should be whole grains. This equates to at least 48g of whole grains a day. Yet, few Americans meet this recommendation, citing taste, time, and lack of skills to prepare as key barriers. This toolkit aims to arm you with tools to help individuals reach the whole grain goal by providing fact-based information in a lighthearted way—with fairy tales! We’ll show that there are many delicious and convenient ways to enjoy foods made with whole grains. PROGRAM AT A GLANCE KEY MESSAGES PRODUCT GUIDE DEMO INSPIRATIONS Explains why NABISCO is rewriting classic fairy Provides talking points on the importance of Presents the variety of delicious and Inspires fun, creative demonstrations and tales to bring the whole grains story to life. whole grains, consumer obstacles, and convenient NABISCO products made with learning activities that feature simple recipes solutions. whole grains that can be enjoyed at home or using NABISCO products made with whole Program At A Glance pdf on-the-go, as part of a balanced diet. grains. Key Messages pdf Product Guide pdf Demo Inspirations pdf RECIPES EDITORIAL CALENDAR 7DAY GUIDE SHOPPING LIST Helps shoppers choose foods from the five Provides delicious and easy ways to help Provides monthly themes and tweets you can Shows how NABISCO products can help food groups for a balanced diet, including consumers enjoy whole grains at meal time or use to keep your whole grain messages fresh consumers reach 48 grams or more of whole foods made with whole grains. -

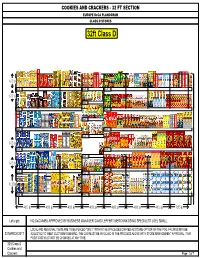

Cookies and Crackers CPI WORKING.Psa COOKIES and CRACKERS - 32 FT SECTION

COOKIES AND CRACKERS - 32 FT SECTION EUROPE DeCA PLANOGRAM CLASS D STORES 32ft Class D 440 000 44000 4400004325 447 440 440 04324 RITZ 4 000 000 440 RITZ TOASTED NAB 435 435 000 TOAS CORN ISC 5 4 448 TED CHIPS 8.12 in O BEL BEL 6 COR SALSA OR VIT VIT NAB N VERDE K4 EO A A ISC CHIP Shelf: 1 Shelf: 7 Shelf: 14 6.12 in Shelf: 8 Shelf: 2 Shelf: 15 440000 4454 440000 440000 NABIS 4913 4914 30100 440 440 440 CO NABIS NABIS 11096 Shelf: 9 000 000 000 OREO CO CO KEEBL 454 454 426 RED CHIPS CHIPS ER 5 6 9 VELVE AHOY AHOY COOKI NAB NAB NAB T THINS THINS ES ISC ISC ISC Shelf: 3 Shelf: 16 301001 301001 1147 1299 KEEBL KEEBL Shelf: 10 ER ER COOKI COOKI ES ES 6.12 in EL EL FUDG FUDG Shelf: 4 Shelf: 17 Shelf: 11 6.12 in Shelf: 18 Shelf: 5 Shelf: 12 44000047 17 NABISCO HONEY MAID 11.12 in GRAHAM S FAMILY K1 Shelf: 6 Shelf: 13 Shelf: 19 4 ft 1 in 4 ft 1 in 4 ft 1 in 4 ft 1 in 4 ft 1 in 4 ft 1 in 4 ft 1 in 3 ft 5 in Left-right HQ DeCA/MBU APPROVED BY BUSINESS MANAGER DAVID LEFFERT MERCHANDISING SPECIALIST JOEL SMALL. LOCAL AND REGIONAL ITEMS ARE TO BE PLACED "ONLY" WITHIN THE SPACE DESIGNATED AS STORE OPTION ON THE POG. FACINGS MAY BE 23 MARCH 2017 ADJUSTED TO MEET CUSTOMER DEMAND.