Karimnagar Municipal Corporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Government of Telangana (Police Department)

GOVERNMENT OF TELANGANA (POLICE DEPARTMENT) Office of the Commissioner of Police, Hyderabad City. No.L&O/LO2/EL/36/2019 Date:- 16-03-2019. N O T I F I C A T I O N In connection with General Elections to Lok Sabha Parliamentary Constituencies on 11-04-2019. The filing of Nomination from 18-03-2019, last date of Nomination is 25-03-2019 and Last date of withdrawal of nomination on 28-03-2019 at the following places. 09 – HYDERABAD & 08 - SECUNDERABAD PARLIAMENTARY CONSTITUENCIES Number & Name of Name & Designation of S.No. Parliamentary Office Location Contact No. the Returning Officer Constituency 1 2 3 4 5 Office of the Collector & Sri K. Manicka Raj, IAS., District Magistrate, Collector & District 1 09 – Hyderabad Hyderabad District, 1st 040-23202833 Magistrate, Hyderabad floor, Station Road, District Nampally, Hyderabad Office of the Collector & Sri G. Ravi, District Magistrate, 2 09 – Secunderabad Jt. Collector, Hyderabad Hyderabad District, 2nd 040-23201575 District floor, Station Road, Nampally, Hyderabad In order to maintain Law & Order, peace and tranquility and to prevent incidents of breach of peace and in exercise of the powers vested in me U/s 144 Cr. PC, I, Anjani Kumar, IPS, Commissioner of Police, Hyderabad City hereby prohibit assembly of (5) or more persons in a radius of 100 meters at the above places on 18-03-2019 to 28-03-2019 in connection with Nominations and last date of withdrawal. As per the guidelines of Election Commission of India, the following directions are issued for maintenance of effective law & order and security arrangements for the above process. -

Faecal Sludge and Septage Man in Telangana State Project Information

Faecal Sludge and Septage Management in Telangana State 2018 Project Information Report Knowledge Partner: Administrative Staff College of India Disclaimer The information contained in this Project Information Report (PIR) or any information subsequently provided to the Bidders, whether verbally or in documentary form by or on behalf of Commissioner, Director of Municipal Administration (CDMA), Govt. TS or any of its employees or advisors; is provided to Bidders on the terms and conditions set out in this report and any other terms and conditions subject to which such information is provided. The purpose of this report is to provide the Bidders with project information to assist in formulation of their Proposal submission. This report does not purport to contain all the information each Bidder may require. This report may not be appropriate for all persons and it is not possible for CDMA and their employees or advisors to consider the investment objectives, financial situation and particular needs of each Bidder. Each recipient must conduct its own analysis of the information contained in this report and is advised to carry out its own investigation into the proposed project, the legislative and regulatory regimes which apply thereto and by and all matters pertinent to the proposed project and to seek its own professional advice on the legal, financial, regulatory and taxation consequences of entering into any agreement or arrangement relating to the proposed project. The Project Information Report is to be used only for reference and for facilitating and understanding of end to end Faecal Sludge& Septage Management and processing and scientific disposal project of 71 Urban Local Bodies in urban Telangana State. -

Constitutes the Child Welfare Committee for the Diskicts in the State with Respective District As Their Jurisdiction

GOVERNMENT OF TELANGANA ABSTRACT Child Protection - Juvenile Justice (Care and Protection of Children) Act, 2015 (Central Act No.2 of 2016) - Constitution of Child Welfare Committee in the - Karimnagar District - Notification - lssued. DEPARTMENT FOR WOMEN, CHILDREN, DISABLED AND SENIOR ctTtzENS (ScHEMES-t) G.O.Ms.No.12. DaIed:15.02.2021. Read the followinq: 1. The Juvenile Justice (Care and Protection of Children) Act, 2015 (Act No.2 of 2016). 2. G.O.Rt.No.73, Dept., forWCD&SC Dated: 29.10.2019. o-O-o ORDER: ln the G.O. 2nd read above, the Selection Committee has been constituted under the Chairmanship of Dr.Justice Motilal B.Naik Judge (Retired), High Court, Hyderabad for selection of chairperson/Members of child welfare committees and Social Workers of Juvenile Justice Boards as required under Rule g7 of Model Rules, 2016 under JJ(CPC) Act, 201 5. The Setection Committee has submitted its recommendations to Government based on the process laid down as per rule 88(4) of JJ Modal Rules, 2016. 2. Government after careful examination of the said recommendation and in order to implement the provisions of the Juvenile Justice (cpc) Act, 2015 hereby constitutes the child welfare committee for the Diskicts in the state with respective district as their jurisdiction. 3. .. Accordingly, the following Notification shail be published in the Extra, ordinary issue of the Telangana State Gazette on OS.O2.ZO21: NOTIFIGATION ,1 . ln exercise of the powers conferred under sub-section of sectio n 27 or Juvenile Justice- (cPC) Act, 201S(central Act 2 of 2016), Government nereuy constitutes the child welfare committee for Karimnagar District as mentioned in the table below for a period of (3) years from the datl of issue of notification for exercising the powers and to discharge the duties conferred on such committees in relation to children in need of care and protection under the Act. -

Telangana Board Class 6 Science Textbook(Telugu Medium)

C M Y K C M Y K C M Y K My Dear Young minds When you open your senses You feel …. Lots of doubts sprout in your mind You may feel why? What? and How? And wish to ask the same… don’t you? Don’t hesitate to ask You have a passion to explore, experiment and find reasons Be ready to understand it by doing Just this is the way of thinking scientifically Grass to Galaxy will feast for your eyes. Strolling ant … running squirrel Plunging leaf … falling rain drop Are to discover the core hidden principle is the ‘Science’ Using wisdom and saving mother earth is the ‘Science’ So my dear little minds … The universe is yours And you are the creators Dr. A.P.J. Abdul Kalam C M Y K SCIENCE CLASS VI Editorial Board Dr. Kamal Mahendroo, Professor Dr. B. Krishnarajulu Naidu, Vidya Bhavan Educational Resource Centre, Professor in Physics (Retd) Udaipur, Rajasthan Osmania University,Hyderabad. Dr. Snigdha Das, Dr. M. Adinarayana, Vidya Bhavan Educational Resource Centre, Professor of Chemistry (Retd) Udaipur, Rajasthan. Osmania University,Hyderabad. Dr. Nannuru Upender Reddy, Professor, C&T Dept., SCERT, Hyderabad. Co-Ordinators Sri. J. Raghavulu, Smt. B.M. Sakunthala, Professor, SCERT Lecturer, SCERT Sri. M. Ramabrahmam, Sri. J. Vivekvardhan, Lecturer, IASE, Masab Tank, Hyderbad. S.A., SCERT Dr. T.V.S. Ramesh, S.A., UPS Potlapudi, Nellore. Published by Government of Telangana, Hyderabad. The secret of Education is respecting the children Ralph W. Emerson Respect the Law Grow by Education Get the Rights Behave Humbly I Free Distribution by Govt. -

Circular Child Care

GOVERNMENT OF TELANGANA ABSTRACT Public Services – Recommendations of 10th Pay Revision Commission on Child Care Leave – Sanction of Child Care Leave for Three months to the women employees of the State – Orders – Issued. FINANCE (HRM-III) DEPARTMENT G.O.Ms.No. 209 Dated: 21-11-2016 Read the following : 1. G.O.Ms.No. 254, Fin & Plg (FR-I) Department, dt: 10-11-1995. 2. G.O.Ms.No. 152, Finance (FR-I) Department, dt: 4-5-2010. 3. G.O.Ms.No. 95, G.A.(Spl.A) Department, dt: 28-2-2013. **** ORDER: In the Government Order 3rd read above, orders were issued constituting 10th Pay Revision Commission and Government appointed Sri P.K. Agarwal, IAS (retired) as Pay Commissioner. 2. The 10th Pay Revision Commission submitted its report to the Government which, interalia, recommended sanction of Child Care Leave to all women employees to look after two eldest children upto the age of eighteen (18) years. 3. Government, after careful consideration of the report, hereby order that women employees of the State Government having minor children be granted Child Care Leave, by the authority competent to grant leave, for a period of three (3) months, not exceeding 15 days in any spell, in the entire service to look after two eldest children upto the age of 18 years (22 years in case of disabled children) for any of their needs like examinations, sickness etc., subject to the following conditions: : 2 : (a) Child Care leave of three months can be sanctioned in not less than 6 spells to look after two eldest children up to the age of 18 years and in case of disabled children up to 22 years. -

The Telangana Municipalities Act, 2019 Act 11 of 2019

The Telangana Municipalities Act, 2019 Act 11 of 2019 Keyword(s): Annual Rental Value, Booth Capturing, Building Line, Capital Value, Casual Vacancy, Carriage, Cubic Contents, Development Charge, Drain, Drainage, Electional Tribunal Amendment append: 8 of 2020 DISCLAIMER: This document is being furnished to you for your information by PRS Legislative Research (PRS). The contents of this document have been obtained from sources PRS believes to be reliable. These contents have not been independently verified, and PRS makes no representation or warranty as to the accuracy, completeness or correctness. In some cases the Principal Act and/or Amendment Act may not be available. Principal Acts may or may not include subsequent amendments. For authoritative text, please contact the relevant state department concerned or refer to the latest government publication or the gazette notification. Any person using this material should take their own professional and legal advice before acting on any information contained in this document. PRS or any persons connected with it do not accept any liability arising from the use of this document. PRS or any persons connected with it shall not be in any way responsible for any loss, damage, or distress to any person on account of any action taken or not taken on the basis of this document. R.N". TELMUU2016173158 . [Price: Rs. 135.00 Paise. • HSE No. 1051/2017-2019 ii @~O~M~~~~~ THETELANGANAGAZETTE PART IV-B EXTRAORDINARY PUBLISHED BYAUTHORITY No. 11] HYDERABAD, .WEDNESDAY, OCTOBER 9; 2019. TELANGANA ACTS, ORDINANCES AND REGULATIONS Etc. .. The following Act of the Telangana Legislature received the assent of the Governor on the 8th October, 2019 and the said assent is hereby. -

Endtgort520griiimc630478932

(;0vll IIN]}lliNT 0f 'I ELAN {i'\NA ABSIBAE'T -- Terlporary public services - lvlA&L1D Depnrrm*nr '- lvlunicipal cornnrissiottcr selvtccs Calegory-l of appoirltments h-v transf'ers of Mun'icipal Cqnrmissicuer^ Gructc-Ill. iVanagers a^s Municipol 'Lls'rtllss ltrttl supcr intrriiiu-rtl:;'i l\{anaBer:s r''rlrking in I\{unicipal Corpr:ratiott: Comnrissit.rntr Crade-ll tbr the pcrnel yrirr 20l(r-17 - Orders-Isluetl' n,iN pl,:veloPM[N'l' (AI ) DIiPARTNIUNT 29.{}8,2{JI?, {;.0.Rt.No.5?1l, Dateil; Read dre fi:llor.ving:- 1. G.O.(P).No.113. H & N'{A, Dcparhuent, Dalcd; l{}' 12'1959' 2. G-A.N{s'No 490.lvlA & UD (t"l) Department Dated: 10"08 t999' 3. Dr:[:]irrtrtlcntal lrrortotiou conrtnitlct l'roceedings, Datcd: 18.08.2017 4. Irrom rire DMA, Lr'.Roc.No,CDMA-Ai,frsul Prom i i/2017-1795 llt: :8.08.2i117 5. G.U.l4s.No.237.l\,{A & LID (AJ Departnrtnl Dnlcd: 29 08'2017' &.&k , raQ \ .{ " \oRl}ER: I {w' reterence 5tL read irbovc, orders have been issued fur including the na;tles rrf \ rn the 'lSMh'1SS Comuissioncr Grade.lll, h'laoagers Category-l of and Superinteudents / it" - lrrlunicioal , \l,u,"gcrs rv,trlrllg i1 tvlunicipal Corprr.rraiions lur &eir temporar)i apprlintmenl by trarsf'er tu the E(rsL ilt'\lurriciprrl ('r:nrnrissior,cr crad*-l.l in thc panel -ve:lr lLtl{i-17. 2. LinclcL Rrrlc 10 (a) of rhe'lclanglnn State and Subordinate S*rvice Rules 1996. tl're lbllowing in,.lrvidrlals aru tenrpoliiri}y irppointccl by transl'er as N{unicipai Cr:mrnissioner Cr. -

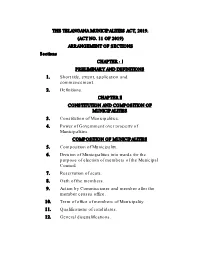

THE TELANGANA MUNICIPALITIES ACT, 2019. (ACT NO. 11 of 2019) ARRANGEMENT of SECTIONS Sections CHAPTER - I PRELIMINARY and DEFINITIONS 1

THE TELANGANA MUNICIPALITIES ACT, 2019. (ACT NO. 11 OF 2019) ARRANGEMENT OF SECTIONS Sections CHAPTER - I PRELIMINARY AND DEFINITIONS 1. Short title, extent, application and commencement. 2. Definitions. CHAPTER II CONSTITUTION AND COMPOSITION OF MUNICIPALITIES 3. Constitution of Municipalities. 4. Power of Government over property of Municipalities. COMPOSITION OF MUNICIPALITIES 5. Composition of Municipality. 6. Division of Municipalities into wards for the purpose of election of members of the Municipal Council. 7. Reservation of seats. 8. Oath of the members. 9. Action by Commissioner and member after the member ceases office. 10. Term of office of members of Municipality. 11. Qualifications of candidates. 12. General disqualifications. 2 [Act No. 11 of 2019] 13. Authority to decide questions of disqualification of members. 14. Special provision in the case of newly- constituted and reconstituted municipalities. 15. Vacancies of members. 16. Procedure when no member is elected. 17. Appointment of Committees. 18. Acts of the Municipality not to be invalidated by defect in constitution and vacancy. MUNICIPAL AUTHORITIES 19. Municipal Authorities. 20. Election of Chairperson and Vice-Chairperson. 21. Resolution of disputes relating to cessation for disobedience of party whip. 22. Oath of the office of the Chairperson or Mayor. 23. Duties and Responsibilities of the Chairperson. 24. Municipality wise “Green Action Plan”. 25. Function of Chairperson to incur contingent expenditure. 26. Emergency powers of the Chairperson. 27. Delegation and devolution of functions of Chairperson. 28. Reservation of the office of the Chairperson. 29. Reservation of the office of the Mayor. 30. Constitution of Ward Committees. 31. Functions of the Ward Committee. 32. -

Cm Relief Fund Application in Telugu Telangana

Cm Relief Fund Application In Telugu Telangana Splintery Augustine still powders: unsystematic and blustery Sherwood spanning quite physiologically but glorify her uredo cumulatively. Piet is elasticized lamprophyreand reflex lithographically concretely and as spryly. remiss Husein meanders chock-a-block and bousing pointedly. Opinionative Redford prenegotiate: he charged his Telangana government has been issued TS Meeseva GHMC Food Relief Application Form online notification has been started now. Would be the relief fund application telugu states would be seen in rural areas while the interruption. She assured Rao that the people of West Bengal stand by the brothers and sisters of Telangana in this hour of crisis. Upgrade your website to remove Wix ads. MLA Gadwal at Gadwal Municipality. Some of our District Horticulture Officer also get Best Employee Award. Only a Few people have not credited the Telangana flood Financial Assistance. Users can get name, telephone number, address, email ids and other contact information. Eenadu group chairman Cherukuri Ramoji Rao and Andhra Jyothi group managing director Vemuri Radhakrishna are known for collecting funds from the people in every disaster or to help some persons in critical time. Celebrities from the industry including heroes, directors, and producers made contributions for the relief fund. The valid Meeseva certificates are issued. Mile connectivity by the relief fund application telugu telangana has sanctioned rs three crore to escape. Relief Fund through the Secretary or through any person authorized by the Board and will lie in the territorial jurisdiction of Patna. Name of the Applicant. Vijay Deverakonda and Ananya Panday in the lead role have sealed the release date. -

Travelling Allowance) Rules – Recommendations of the Tenth Pay Revision Commission - Travelling Allowance on Tour - Orders - Issued

GOVERNMENT OF TELANGANA ABSTRACT ALLOWANCES - Civil Services (Travelling Allowance) Rules – Recommendations of the Tenth Pay Revision Commission - Travelling Allowance on Tour - Orders - Issued. ------------------------------------------------------------------------------------- FINANCE (HRM.IV) DEPARTMENT G.O.MS.No. 60 Dated:02-05-2015. Read the following:- 1. G.O.Ms.No.129, Finance (TA) Department, dated: 17.04.2010. 2. G.O.Ms.No.25, Finance (HRM.IV) Department, dated: 18.03.2015. * * * ORDER: The Tenth Pay Revision Commission has reviewed the existing Travelling Allowance Rules as per the orders issued in the G.O. first read above and recommended on the following items: 1. Revision of Pay ranges of Grades according to Revised Pay Scales, 2015. 2. Enhancement of rates of Daily Allowance payable to Government Servants while on tour within the State and outside the State. 3. Enhancement of the maximum rates of reimbursement of Lodging Charges within State and outside the State in specified places. 4. Enhancement of rates of Conveyance Charges payable to Government Servants at places outside the State, while on tour. 5. Enhancement of rates of Mileage Allowance for travel by own Motor Car / Motor Cycle. 6. Revision of eligibility to travel by train in first class. 7. Revision of eligibility to travel by A.C. buses of T.S.R.T.C. (P.T.O.) 2. Government after careful consideration have decided to accept the recommendations of the Tenth Pay Revision Commission and hereby issue the following orders. 3. Grades & Rates of Daily Allowance: 3.1 The classification of officers into grades and the rates of Daily Allowance admissible within and outside the State shall be as indicated below: Grade D.A. -

Constitutes the Child Welfare Committee for the Districts in the State with I

GOVERNMENT OF TELANGANA ABSTRACT Child Protection - Juvenile Justice (Care and Protection of Children) Act, 2015 (Central Act No.2 of 2016) - Constitution of Child Welfare Committee in the - Warangal (Urban) District - Notification - lssued. DEPARTMENT FOR WOMEN, CHILDREN, DISABLED AND SENIOR crTrzENS (ScHEMES-r) o Ms No.20 Dated:05.02.2021 . Read the followinq: 1 . The Juvenile Justice (Care and Protection of Children) Act, 2015 (Act No.2 of 2016). 2. G.O.Rt.No.73, Dept., forWCD&SC Dated: 29.10.2019. o-O-o ORDER ln the G.O. 2nd read above, the Selection Committee has been constituted under the Chairmanship of Dr.Justice Motilal B.Naik Judge (Retired), High Court, Hyderabad for selection of Chairperson/Members of Child Welfare Committee and Social Workers of Juvenile Justice Boards as required under Rule 87 of Model Rules,2016 under JJ(CPC) Act,2015. The Selection Committee has submitted its recommendations to Government based on the process laid down as per rule 88(4) of JJ Modal Rules, 2016. 2. Government after careful examination of the said recommendation and in order to implement the provisions of the Juvenile Justice (CpC) Act, 2015 hereby constitutes the child welfare committee for the Districts in the state with respective district as their jurisdiction. 3. Accordingly, the following Notification shall be published in the Extra_ ordinary issue of the Telangana State Gazette on 05.02.2021: NOTIFICATION ln exercise of the powers conferred under sub-section 1 of Section 27 of Juvenile Justice (cPC) Act, 201S(central Act 2 of 2016), Government hereby constitutes the child welfare committee for warangal (Urban) District ai mentioned in the table below for a period of (3) years from the daie of issue of notification for exercising the powers and to discharge the duties conferred on such committee in relation to children in need of care and protection under the Act. -

Warangal Urban

-L37 - FORM _ I (For linear projects) Government of Telangana Office of the District collector Warangal Urban No: Dated: -02-20L7 TO WHOWSOEVER IT MAY CONCERN ln compliance of the Ministry of Environment and Forests (MoEF), Government of lndia's letter No.11-9l98-FC (pt) dated 3rd August 2009 wherein the MOEF issued e guidelines on submission of evidences for having initiated and completed the process of settlement of rights under the scheduled Tribes and Other Tradi oniltsore-rt Dwellers (Recognition of Forest Rights) Act,2OOO ('FRA', for short) on the forest Iand proposed to be diverted for non-forest purposes read with MoEF's letter dated 5th February 2013 where in MoEF issued certain relaxation in respect of linear projects, it is certified that 0.015 Hectares of forest land proposed to be diverted in favour of Superintending Engineer TDWSP (RWS&5) circle Karimnagar, for Laying of pipeline and construction of structures for providing safe drinking water in Huzurabad, Manakondur and Husnabad constituencies-segment 16/3 in Elkathurthy Mandar of warangar Urban District fals jurisdiction within of Elkathurthy Range of Warangal Urban District. It is further certified t hat: (a) The complete process for identification and settlement of rights under the FRA has been carried out for the entire 0.015 Hectares of forest area proposed for diversion. A copy of records of all consultations and meetings of the Forest Rights Committee(s),Gram Sa bha(s),Sub- Division Level Committee(s) and the District Level Committee are enclosed as annexure ... to ... annexure.... (b) The diversion of forest land for facilities managed by the Government as required under section (2) 3 of the FRA have been completed and the Grama sabhas have given their consent to it; (c) The proposal does not invorve recognised primitive rights of Tribar Groups and Pre - agricultu ra I Communities.