The Construct of Lorenz Curves and of the Gini-Coeficient to Depict Degrees in Inequality in Health Care

Total Page:16

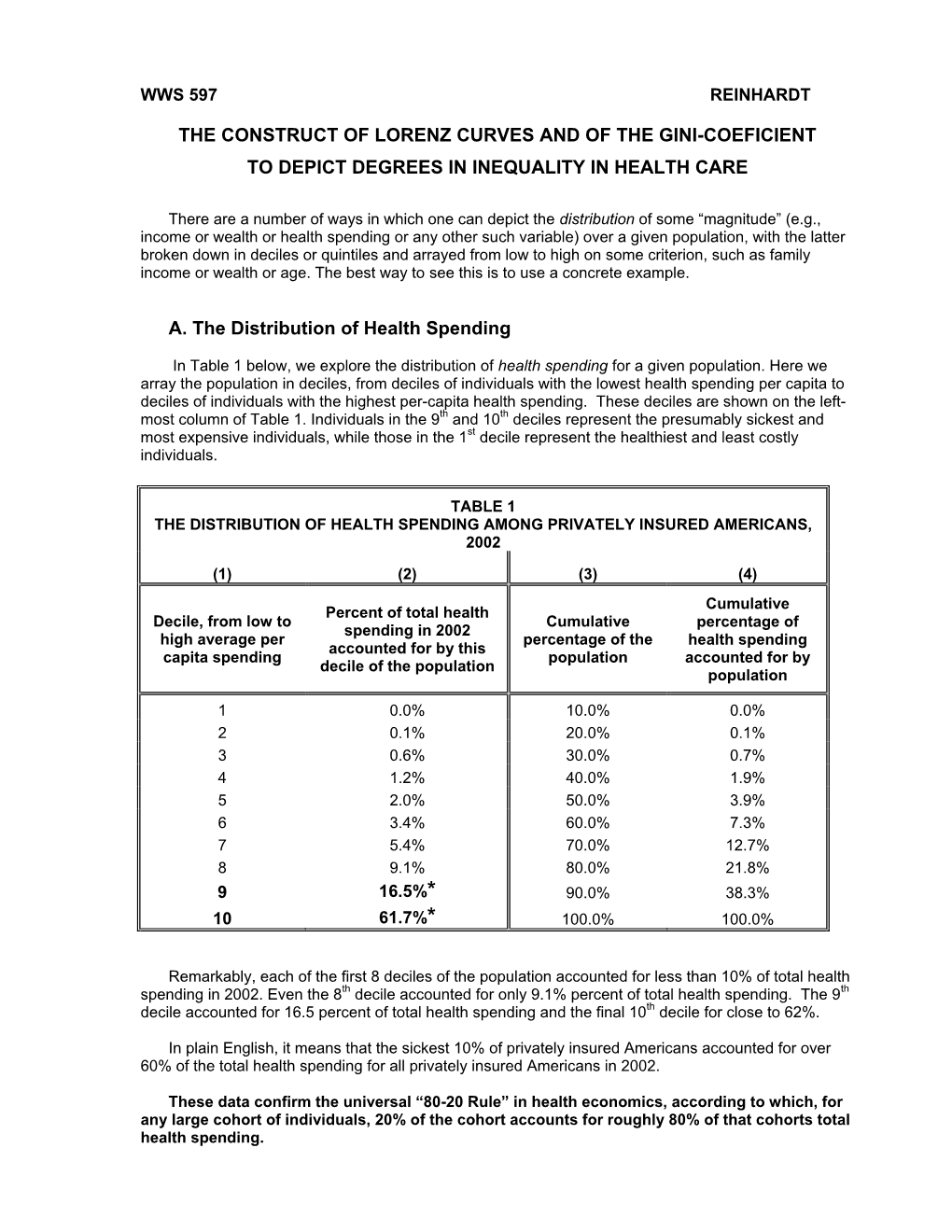

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Lorenz Curve

Charting Income Inequality The Lorenz Curve Resources for policy making Module 000 Charting Income Inequality The Lorenz Curve Resources for policy making Charting Income Inequality The Lorenz Curve by Lorenzo Giovanni Bellù, Agricultural Policy Support Service, Policy Assistance Division, FAO, Rome, Italy Paolo Liberati, University of Urbino, "Carlo Bo", Institute of Economics, Urbino, Italy for the Food and Agriculture Organization of the United Nations, FAO About EASYPol The EASYPol home page is available at: www.fao.org/easypol EASYPol is a multilingual repository of freely downloadable resources for policy making in agriculture, rural development and food security. The resources are the results of research and field work by policy experts at FAO. The site is maintained by FAO’s Policy Assistance Support Service, Policy and Programme Development Support Division, FAO. This modules is part of the resource package Analysis and monitoring of socio-economic impacts of policies. The designations employed and the presentation of the material in this information product do not imply the expression of any opinion whatsoever on the part of the Food and Agriculture Organization of the United Nations concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. © FAO November 2005: All rights reserved. Reproduction and dissemination of material contained on FAO's Web site for educational or other non-commercial purposes are authorized without any prior written permission from the copyright holders provided the source is fully acknowledged. Reproduction of material for resale or other commercial purposes is prohibited without the written permission of the copyright holders. -

Inequality Measurement Development Issues No

Development Strategy and Policy Analysis Unit w Development Policy and Analysis Division Department of Economic and Social Affairs Inequality Measurement Development Issues No. 2 21 October 2015 Comprehending the impact of policy changes on the distribu- tion of income first requires a good portrayal of that distribution. Summary There are various ways to accomplish this, including graphical and mathematical approaches that range from simplistic to more There are many measures of inequality that, when intricate methods. All of these can be used to provide a complete combined, provide nuance and depth to our understanding picture of the concentration of income, to compare and rank of how income is distributed. Choosing which measure to different income distributions, and to examine the implications use requires understanding the strengths and weaknesses of alternative policy options. of each, and how they can complement each other to An inequality measure is often a function that ascribes a value provide a complete picture. to a specific distribution of income in a way that allows direct and objective comparisons across different distributions. To do this, inequality measures should have certain properties and behave in a certain way given certain events. For example, moving $1 from the ratio of the area between the two curves (Lorenz curve and a richer person to a poorer person should lead to a lower level of 45-degree line) to the area beneath the 45-degree line. In the inequality. No single measure can satisfy all properties though, so figure above, it is equal to A/(A+B). A higher Gini coefficient the choice of one measure over others involves trade-offs. -

User Manual for Stata Package DASP

USER MANUAL DASP version 2.1 DASP: Distributive Analysis Stata Package By Abdelkrim Araar, JeanYves Duclos Université Laval PEP, CIRPÉE and World Bank November 2009 Table of contents Table of contents............................................................................................................................. 2 List of Figures .................................................................................................................................. 5 1 Introduction ............................................................................................................................ 7 2 DASP and Stata versions ......................................................................................................... 7 3 Installing and updating the DASP package ........................................................................... 8 3.1 installing DASP modules. ............................................................................................... 8 3.2 Adding the DASP submenu to Stata’s main menu. ....................................................... 9 4 DASP and data files ................................................................................................................. 9 5 Main variables for distributive analysis ............................................................................. 10 6 How can DASP commands be invoked? .............................................................................. 10 7 How can help be accessed for a given DASP module? ...................................................... -

Measuring Inequality LECTURE 13

Measuring inequality LECTURE 13 Training 1 1 Outline for final lectures § Once datasets have been finalized, it is time to produce results, with the aim of representing the patterns emerging from the data. § In practice? § Inequality this lecture § Poverty next lecture § Basic summary statistics on household demographics, education, access to services, etc. § Average expenditures and incomes final lecture Training 2 2 Inequality and poverty measurement 1) a measure of living standards persons 2) high-quality data on households’ living standards 3) a distribution of living standards (inequality) 4) a critical level (a poverty line) below which individuals are classified as “poor” living standard 5) one or more poverty measures Training 3 3 1 Cowell (2011) 99.9% of this lecture is explained with better words in Cowell’s work: this book and other (countless) journal articles Training 4 Warning § During the course we stressed the distinction between the concepts of living standard, income, expenditure, consumption, etc. § In this lecture we make an exception, and use these terms interchangeably § Similarly, I will not make a distinction between income per household, per capita, or per adult equivalent § For once, and for today only, we will be (occasionally) inconsistent Training 5 5 Focus on the term 'inequality' § “When we say income inequality, we mean simply differences in income, without regard to their desirability as a system of reward or undesirability as a scheme running counter to some ideal of equality” (Kuznets 1953: xxvii) § In practice, how can we appraise the inequality of a given income distribution? Three main options: ① Tables ② Graphs ③ Summary statistics Training 8 2 Tables: an assessment § In general, tables are not recommended when the focus is inequality § Difficult to get a clue of the extent of inequality in the distribution by looking at a table. -

UNIVERSITY of CALIFORNIA SAN DIEGO Essays on Non-Parametric

UNIVERSITY OF CALIFORNIA SAN DIEGO Essays on Non-parametric and High-dimensional Econometrics A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Economics by Zhenting Sun Committee in charge: Professor Brendan K. Beare, Co-Chair Professor Yixiao Sun, Co-Chair Professor Jelena Bradic Professor Dimitris Politis Professor Andres Santos 2018 Copyright Zhenting Sun, 2018 All rights reserved. The Dissertation of Zhenting Sun is approved and is acceptable in quality and form for publication on microfilm and electronically: Co-Chair Co-Chair University of California San Diego 2018 iii TABLE OF CONTENTS Signature Page . iii Table of Contents . iv List of Figures . vi List of Tables . vii Acknowledgements . viii Vita........................................................................ ix Abstract of the Dissertation . x Chapter 1 Instrument Validity for Local Average Treatment Effects . 1 1.1 Introduction . 2 1.2 Setup and Testable Implication . 5 1.3 Binary Treatment and Instrument . 10 1.3.1 Hypothesis Formulation . 10 1.3.2 Test Statistic and Asymptotic Distribution . 12 1.3.3 Bootstrap-Based Inference . 15 1.4 Multivalued Treatment and Instrument . 18 1.4.1 Bootstrap-Based Inference . 21 1.4.2 Continuous Instrument. 23 1.5 Conditional on Discrete Covariates . 26 1.6 Tuning Parameter Selection . 28 1.7 Simulation Evidence . 29 1.7.1 Data-Generating Processes . 30 1.7.2 Simulation Results . 30 1.8 Empirical Applications . 33 1.9 Conclusion . 34 Chapter 2 Improved Nonparametric Bootstrap Tests of Lorenz Dominance . 36 2.1 Introduction . 36 2.2 Hypothesis Tests of Lorenz Dominance . 39 2.2.1 Hypothesis Formulation . -

Ecological Modelling 230 (2012) 50-62

Ecological Modelling 230 (2012) 50-62 Contents lists available at SciVerse ScienceDirect Ecological Modelling ELSEVlER jou rna I homepa g e: www .elsevier .co m/locate/eco I model Metrics for evaluating performance and uncertainty of Bayesian network models Bruce G. Marcot* U.S. Forest Service, Pacific Northwest Research Station, 620 S. W. Main Street. Portland, OR 9720~. United States ARTICLE INFO ABSTRACT Article history: This paper presents a selected set of existing and new metrics for gauging Bayesian network model Received 12 September 2011 performance and uncertainty. Selected existing and new metrics are discussed for conducting model Received in revised form 10 january 2012 sensitivity analysis (variance reduction, entropy reduction, case file simulation); evaluating scenarios Accepted 11 january 2012 (influence analysis); depicting model complexity (numbers of model variables, links, node states, con ditional probabilities, and node cliques); assessing prediction performance (confusion tables, covariate Keywords: and conditional probability-weighted confusion error rates, area under receiver operating characteristic Bayesian network model Uncertainty curves, k-fold cross-validation, spherical payoff. Schwarz' Bayesian information criterion, true skill statis Model performance tic, Cohen's kappa); and evaluating uncertainty of model posterior probability distributions (Bayesian Model validation credible interval, posterior probability certainty index, certainty envelope, Gini coefficient). Examples are Sensitivity analysis presented of applying the metrics to 3 real-world models of wildlife population analysis and manage Error rates ment. Using such metrics can vitally bolster model credibility, acceptance, and appropriate application, Probability analysis particularly when informing management decisions. Published by Elsevier B.V. 1. Introduction different outcome states, that is, the spread of alternative predic tions. -

Trends and Measures of Income Inequality

Income inequality: Trends and Measures Key Points • UK income inequality increased by 32% between 1960 and 2005. Dur- ing the same period, it increased by 23% in the USA, and in Sweden decreased by 12%. • In the 1960s Sweden and the UK had similar levels of income inequal- ity. By 2005 the gap between the two had increased by 28%. • Since the 1980s income inequality in the United States and the UK has increased substantially and has returned to levels not seen since the 1920s. • The growth in inequality in the last 30 years has been driven by the top 1% of wage incomes. • Inequality measures drawn from standard household surveys underes- timate income inequality by as much as 10 percentage points, due to the under{representation of the top 1% of incomes. • There is scope for governments to tackle inequality. Large income inequalities are not inevitable; Sweden owes its high levels of equality to policies introduced since the 50s. Introduction Income inequality has shaped society as we know it today (Wilkinson & Pickett, 2010). The changes in inequality which we have collectively experi- enced in the last 50 years are not well known among either policy{makers or the public. This digest will briefly explain some of the most frequently used measures of income inequality, and show how it has evolved in the recent past. Measuring inequality One way to measure income inequality is as a simple ratio. For example, we can take the income of the 90th percentile (i.e. the income above which the top 10% of incomes lie) and divide it by that of the 10th percentile. -

Estimation of Income Inequality from Grouped Data

Estimation of income inequality from grouped data Vanesa Jorda,∗ Jose Maria Sarabia Department of Economics, University of Cantabria Markus J¨antti Swedish Institute for Social Research, Stockholm University August 30, 2018 Abstract Grouped data in form of income shares have been conventionally used to esti- mate income inequality due to the lack of availability of individual records. Most prior research on economic inequality relies on lower bounds of inequality measures in order to avoid the need to impose a parametric functional form to describe the income distribution. These estimates neglect income differences within shares, in- troducing, therefore, a potential source of measurement error. The aim of this paper is to explore a nuanced alternative to estimate income inequality, which leads to a reliable representation of the income distribution within shares. We examine the per- formance of the generalized beta distribution of the second kind and related models to estimate different inequality measures and compare the accuracy of these esti- mates with the nonparametric lower bound in more than 5000 datasets covering 182 countries over the period 1867-2015. We deploy two different econometric strategies to estimate the parametric distributions, non-linear least squares and generalised method of moments, both implemented in R and conveniently available in the pack- age GB2group. Despite its popularity, the nonparametric approach is outperformed even the simplest two-parameter models. Our results confirm the excellent perfor- mance of the GB2 distribution to represent income data for a heterogeneous sample of countries, which provides highly reliable estimates of several inequality measures. This strong result and the access to an easy tool to implement the estimation of this family of distributions, we believe, will incentivize its use, thus contributing to the arXiv:1808.09831v1 [stat.AP] 29 Aug 2018 development of reliable estimates of inequality trends. -

Inequalities and Their Measurement

IZA DP No. 1219 Inequalities and Their Measurement Almas Heshmati DISCUSSION PAPER SERIES DISCUSSION PAPER July 2004 Forschungsinstitut zur Zukunft der Arbeit Institute for the Study of Labor Inequalities and Their Measurement Almas Heshmati MTT Economic Research and IZA Bonn Discussion Paper No. 1219 July 2004 IZA P.O. Box 7240 53072 Bonn Germany Phone: +49-228-3894-0 Fax: +49-228-3894-180 Email: [email protected] Any opinions expressed here are those of the author(s) and not those of the institute. Research disseminated by IZA may include views on policy, but the institute itself takes no institutional policy positions. The Institute for the Study of Labor (IZA) in Bonn is a local and virtual international research center and a place of communication between science, politics and business. IZA is an independent nonprofit company supported by Deutsche Post World Net. The center is associated with the University of Bonn and offers a stimulating research environment through its research networks, research support, and visitors and doctoral programs. IZA engages in (i) original and internationally competitive research in all fields of labor economics, (ii) development of policy concepts, and (iii) dissemination of research results and concepts to the interested public. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. Citation of such a paper should account for its provisional character. A revised version may be available on the IZA website (www.iza.org) or directly from the author. IZA Discussion Paper No. 1219 July 2004 ABSTRACT Inequalities and Their Measurement This paper is a review of the recent advances in the measurement of inequality. -

Chapter 11: Economic and Social Inequality

Principles of Economics in Context, Second Edition – Sample Chapter for Early Release Principles of Economics in Context, Second Edition CHAPTER 11: ECONOMIC AND SOCIAL INEQUALITY As the United States economy began recovering from the Great Recession of 2007– 2009, economic data indicated that the vast majority of all income growth was going to the richest Americans. From 2009–2012, over 90 percent of new income accrued to just the top 1 percent of income earners. As the economy recovered further, new income distribution was less lopsided, but still uneven. The top 1 percent captured over half of all income growth in the United States over the period 2009–2015.1 The trend toward higher economic inequality is not limited to the United States. Over the last few decades, inequality has been increasing in most industrialized nations, as well as most of Asia, including China and India. And while inequality has generally been decreasing in Latin American and sub-Saharan African countries, these regions still have the highest overall levels of inequality.2 Analysis of inequality, like most economic issues, involves both positive and normative questions. Positive analysis can help us measure inequality, determine whether it is increasing or decreasing, and explore the causes and consequences of inequality. But whether current levels of inequality are acceptable, and what policies, if any, should be implemented to counter inequality are normative questions. While our discussion of inequality in this chapter focuses mainly on positive analysis, we will also consider the ethical and policy debates that are often driven by strongly held values. 1. -

Poverty: Looking for the Real Elasticities Florent Bresson

Poverty: Looking for the Real Elasticities Florent Bresson To cite this version: Florent Bresson. Poverty: Looking for the Real Elasticities. 2011. halshs-00562648 HAL Id: halshs-00562648 https://halshs.archives-ouvertes.fr/halshs-00562648 Preprint submitted on 3 Feb 2011 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. CEÊDÁ¸ØÙ× Ø Ó ¸ E ¾¼¼6º½8 CENTRE D’ÉTUDES ET DE RECHERCHES SUR LE DÉVELOPPEMENT INTERNATIONAL Ó ØÖÚÐ Ð ×Ö ØÙ× Ø Ó ¾¼¼º½ ÈÓÚÖØÝ ÄÓ ÓÒ ÓÖ Ø ÊÐ ¸ † ÖÒØ Ö××ÓÒ ÐÓ ∗ ÊÁ ¹ ÍÒÚÖ×Ø ³ÙÚÖÒ ËeÔØeÑb eÖ ½¾¸ ¾¼¼6 ¿7 Ôº ÓÖÒغ Ï ÛÓÙÐ Ð ØÓ ØÒ× ÓÖ ØÖ ÐÔÙÐ ÄÒÖ ∗ ××Óи ËÝÐÚÒ ¹ÖÖظ ÂÒ¹ÄÓÙ× ÓÑ ×¸ ÖÑѸ È ÙÐÐÙÑÓÒظ ÃÒÒØ ÀÖØØÒ¸ ËØÔÒ ÃÐ×Ò¸ ÊÓÐÒ ÃÔ Ó Ö Ò ÐÐ Ø Ô Ó Ø Ö×Ø ÈÆØ ÛÓÖ×ÓÔ Ò Ãи ÔÖÐ ¾¼¼º † A Ì Ó × Ò ÖÐÞ ÛØ Ä Ì º ÐÐ ×ØÑØÓÒ× Ö Ñ ÛØ Êº ×ØÑØÓÒ Ö ÚÐÐ ÙÔ ÓÒ ÖÕÙ×غ 1 INTRODUCTION Abstract After decades of intensive research on the statistical size distribution of income and de- spite its empirical weaknesses, the lognormal distribution still enjoys an important pop- ularity in the applied literature dedicated to poverty and inequality. -

Estimating Inequality Measures from Quantile Data Enora Belz

Estimating Inequality Measures from Quantile Data Enora Belz To cite this version: Enora Belz. Estimating Inequality Measures from Quantile Data. 2019. halshs-02320110 HAL Id: halshs-02320110 https://halshs.archives-ouvertes.fr/halshs-02320110 Preprint submitted on 18 Oct 2019 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Centre de Recherche en Économie et Management Center for Research in Economics and Management University of Rennes 1 of Rennes University University of Normandie Caen University Estimating Inequality Measures from Quantile Data Enora Belz Univ Rennes, CNRS, CREM UMR 6211, F-35000 Rennes, France Octobre 2019 - WP 2019-09 Working Paper Estimating Inequality Measures from Quantile Data Enora Belz1,* 1Univ Rennes, CNRS, CREM - UMR 6211, F-35000 Rennes, France *[email protected] Abstract This article focuses on the problem of dealing with aggregate data. It proposes an innovative method for modelling Lorenz curves and estimating inequality indices on small populations, when (only) quantiles are available. When dealing with small population areas and due to privacy restrictions, individual or income share data are often not available and only quantiles are reported. The method is based on conditional expectation in order to find the different income shares and thus model a Lorenz curve with the functional forms already proposed in the literature.