Owning Or Renting in the US: Shifting Dynamics of the Housing Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

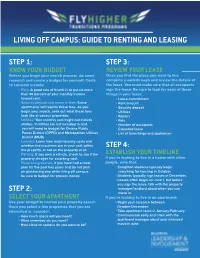

Guide to Renting and Leasing Digital

LIVING OFF CAMPUS: GUIDE TO RENTING AND LEASING STEP 1: STEP 3: KNOW YOUR BUDGET REVIEW YOUR LEASE Before you begin your search process, do some Once you find the place you want to live, research and create a budget for yourself. Costs complete a walkthrough and review the details of to consider include: the lease. You must make sure that all occupants Rent: A good rule of thumb is to put no more sign the lease. Be sure to look for each of these than 30 percent of your monthly income things in your lease: toward rent. Lease commitment Security deposit and move-in fees: Some Rent amount apartments will require these fees. As you Security deposit begin your search, seek out what these fees Utilities look like at various properties. Repairs Utilities: Your monthly rent might not include Pets utilities. If utilities are not included in rent, Number of occupants you will need to budget for Omaha Public Extended leave Power District (OPPD) and Metropolitan Utilities List of furnishings and appliances District (MUD). Laundry: Learn how much laundry costs and whether the machines are in your unit, within STEP 4: the property, or not on the property at all. Parking: If you own a vehicle, check to see if the ESTABLISH YOUR TIMELINE property chrages for a parking spot. If you’re looking to live in a house with other Food and groceries: If you have had a meal people, note that: plan for the past two years and do not plan Creighton students typically begin on purchasing one while living o campus, searching for housing in October. -

So… You Wanna Be a Landlord? Income Tax Considerations for Rental Properties

So… you wanna be a landlord? Income tax considerations for rental properties November 2020 Jamie Golombek & Debbie Pearl-Weinberg Tax and Estate Planning, CIBC Private Wealth Management Considering becoming a landlord? You’re not alone. According to recent a CIBC poll, more than one in four Canadian homeowners are either already landlords (15%) or plan to earn rental income (11%) by renting out space in their primary residence or from a separate rental property. And, nearly two in five (37%) homeowners say they’d opt for a home with a source of rental income if buying a home today. While there are many financial and legal issues to consider as a landlord, make sure that you don’t overlook tax considerations of earning rental income. Whether you’re purchasing a residential or commercial property for the purpose of leasing it out, or you are considering renting your home or part of your home, this report highlights some of the more common tax issues you should consider before taking the plunge! Rental property or business? The first question you need to consider is whether the rental income you earn will be treated as income from property (i.e. investment income) or as income from a business, since each has different tax implications. When you rent out real estate, your income is treated as property income if you provide only basic services, such as utilities (e.g. light and heating), parking and laundry facilities. If you provide additional services, such as cleaning, security and / or meals, then it may be considered a business. -

Ph6.1 Rental Regulation

OECD Affordable Housing Database – http://oe.cd/ahd OECD Directorate of Employment, Labour and Social Affairs - Social Policy Division PH6.1 RENTAL REGULATION Definitions and methodology This indicator presents information on key aspects of regulation in the private rental sector, mainly collected through the OECD Questionnaire on Affordable and Social Housing (QuASH). It presents information on rent control, tenant-landlord relations, lease type and duration, regulations regarding the quality of rental dwellings, and measures regulating short-term holiday rentals. It also presents public supports in the private rental market that were introduced in response to the COVID-19 pandemic. Information on rent control considers the following dimensions: the control of initial rent levels, whether the initial rents are freely negotiated between the landlord and tenants or there are specific rules determining the amount of rent landlords are allowed to ask; and regular rent increases – that is, whether rent levels regularly increase through some mechanism established by law, e.g. adjustments in line with the consumer price index (CPI). Lease features concerns information on whether the duration of rental contracts can be freely negotiated, as well as their typical minimum duration and the deposit to be paid by the tenant. Information on tenant-landlord relations concerns information on what constitute a legitimate reason for the landlord to terminate the lease contract, the necessary notice period, and whether there are cases when eviction is not permitted. Information on the quality of rental housing refers to the presence of regulations to ensure a minimum level of quality, the administrative level responsible for regulating dwelling quality, as well as the characteristics of “decent” rental dwellings. -

Secure Tenure for Home Ownership and Economic Development on Land Subject to Native Title

Secure tenure for home ownership and economic development on land subject to native title Ed Wensing and Jonathan Taylor AIATSIS Research DiscussioN Paper NUMBER 31 August 2012 Wensing, E & Taylor, J 2012, Secure tenure options for home ownership and economic development on land subject to native title, AIATSIS research discussion paper no. 31, AIATSIS Research Publications, canberra. Secure tenure for home ownership and economic development on land subject to native title Ed Wensing and Jonathan Taylor AIATSIS Research Discussion Paper No. 31 First published in 2012 by AIATSIS Research Publications © Ed Wensing and Jonathan Taylor, 2012 All rights reserved. Apart from any fair dealing for the purpose of private study, research, criticism or review, as permitted under theCopyright Act 1968 (the Act), no part of this article may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, without prior permission in writing from the publisher. The Act also allows a maximum of one chapter or 10 per cent of this book, whichever is the greater, to be photocopied or distributed digitally by any educational institution for its educational purposes, provided that the educational institution (or body that administers it) has given a remuneration notice to Copyright Agency Limited (CAL) under the Act. The views expressed in this series are those of the authors and do not necessarily reflect the official policy or position of the Australian Institute of Aboriginal and Torres Strait Islander Studies. Australian Institute of Aboriginal and Torres Strait Islander Studies (AIATSIS) GPO Box 553, Canberra ACT 2601 Phone: (61 2) 6246 1111 Fax: (61 2) 6261 4285 Email: [email protected] Web: www.aiatsis.gov.au National Library of Australia Cataloguing-in-Publication entry: Author: Wensing, Ed (Edward George) Title: Secure tenure for home ownership and economic development on land subject to Native Title / Ed Wensing & Jonathan Taylor. -

Renting Vs. Buying

renting vs. buying: 6 things to consider After years of renting and frequent moving, you may start to ask yourself: Should I buy a house? While many experts have weighed in on the pros and cons of renting vs. buying, the truth is-it depends on your individual situation. So, if you're not sure if renting or owning is right for you, here are a few things to consider. 1. Where do you want to live? If you're looking to live in a big city, you may have more options in the rental market. But if you prefer the suburbs, buying may be a better option since single family home rentals can be few and far between. 2. How long do you plan to stay? Consider your "five-year plan." If your job situation is in flux or you plan to move again in a few years, renting may make more sense. On the other hand, if you're ready to settle down in a certain area, making the investment to buy could pay off long-term. 3. Are you ready to be your own landlord? When you're renting and your sink springs a leak, your landlord will handle the maintenance and cost of any repairs. But if you're the homeowner, that responsibility falls on you. On the upside, owning your own home also gives you the freedom to do your own remodeling or repairs and to hire the contractor of your choice. 4. How important is long-term payoff? Buying a house is an investment in your future. -

The Importance of Affordable Rental Housing Housing As a Human Right Needs a Paradigm Shift It Is a Human Right to Have a Home

Author: Sven Bergenstråhle, President of the International Union of Tenants (IUT) Date: July 7, 2016 The importance of affordable rental housing Housing as a human right needs a paradigm shift It is a human right to have a home. A series of international declarations and conventions say so. UN Covenant on Economic, Social and Cultural Rights declares the right to "adequate housing". The European Social Charter promotes "access to housing of an adequate standard", to progressively eliminate homelessness and make housing "economically accessible" to those who lack sufficient resources.1 To have a home, somewhere to live is an essential need. A dwelling must be sound, safe and large enough for a given household. Even a poor household must have a permanent home with a good standard. It is especially important for families with children. A child cannot choose its parents. Housing is not only about the dwelling itself. It is about the estate, the housing area, part of the city, the city and also the region. It is about safety and security, service, communications, schools, access to employment and career opportunities and so on. Housing is part of everyday life and a necessity. There is an emerging trend in housing research and urban planning policy-making, particularly within the UN institutions, of recognising the need to consider the social, economic and ecological consequences of urbanisation. UN Habitat has concluded that “Cities…. are growing fragmented, unequal and dysfunctional with the current models of housing production and consumption at the core of these processes” and points out the need to develop affordable housing for all in central locations to ensure proximity to livelihoods, and minimize urban sprawl and growing inequalities.”2 The housing market differs from any other market “Housing has a unique set of characteristics…… that interact to cause the operation of the housing market to be significantly different from any other market.”3 The housing market is extremely sensitive to changes in demand. -

Rent Regulation for the 21St Century: Pairing Anti-Gouging with Targeted Subsidies

POLICY BRIEF | APRIL 2021 Rent Regulation for the 21st Century: Pairing Anti-Gouging with Targeted Subsidies A central purpose of rent regulation is to provide stability against unexpected increases in rent. Low-income renters are especially vulnerable to rent shocks. Most rent regulation systems, however, confer the largest benefits on higher- income renters, prompting the question of how rent regulation can offer more effective protection to lower-income households. Expanding rent regulation to impose tighter rent restrictions on more of the housing stock has adverse consequences for housing markets; meanwhile, means testing rent-regulated housing would be highly burdensome and potentially counterproductive. In this brief, we argue that pairing anti-gouging rent regulation with shallow, targeted subsidies to low-income renters is a better way to ensure that the benefits of rent regulation reach vulnerable households. We argue that neither expanding rent regulation Introduction to impose tighter rent restrictions across more of Rent regulation debates have intensified in recent the housing market nor means testing regulated years, especially in jurisdictions where increased units is an optimal way to achieve rent regulation’s demand for rental housing has led to unprec- aim of preserving housing stability for low-income edented rent increases.1 Although low-income households. Instead, a more efficient way to ensure renters are particularly vulnerable to the harms that low-income households receive the benefits of that rent regulations aim to mitigate, most of rent regulation is to pair broad-based, anti-gouging the protections of rent regulations are not tar- rent regulation with targeted subsidies that reduce geted and may not reach these renters.2 This housing costs for low-income tenants. -

2016 Frederick County Affordable Housing Needs Assessment

FREDERICK COUNTY AFFORDABLE HOUSING NEEDS ASSESSMENT Frederick County, MD November 2016 520 NORTH MARKET STREET TANEY VILLAGE APARTMENTS VICTORIA PARK BELL COURT SENIOR LIVING TABLE OF CONTENTS Executive Summary……………………………………………………………………………………….…1 Task 1: County Demographic Analysis...…………………………………………………………………....20 Task 2: Rental and Sales Price Trends …...………………………………….....................................................27 Task 3: Analysis of Residential Construction………………….…………………………………………….30 Task 4: Housing Affordability Analysis….………………...……..……...............................................................35 Task 5: Affordability Index….……………………………….......……...............................................................37 Task 6: Housing Gap Analysis……….…………………………………………………………………….44 Task 7: Housing Gap Trends……………………………………………………………………………….47 Task 8: Density Bonuses…..………………..……………………………………………………………….51 Task 9: MPDU Program Analysis…..……………………………………………………………………….52 Task 10: Homelessness Action Plan Summary……...……………………….………………………………54 Task 11: Meet with Representatives………..……...……………………….………………………………56 Task 12: Public Private Partnerships…..………...………………………………………………………….57 Task 13: Foreclosure Rates……….………………………………..……………………………………….58 Task 14: Housing Needs by Demographic Characteristics…………………….…………………………...60 Component 2.1.1: Inventory of Affordable and Accessible Housing………………………………………63 Component 2.1.2: Existing Affordable and Accessible Housing Market…….……………………………..64 Component 2.1.3: Location and Distribution of Affordable -

An Introduction to Renting Residential Real Property

An Introduction to Renting Residential Real Property State of Hawaii Department of Taxation Revised March 2020 Overview This brochure provides basic information on the application of the general excise tax and transient accommodations tax to lessors of residential real property located in Hawaii. This brochure complements our brochures “An Introduction to the General Excise Tax” and “An Introduction to the Transient Accommodations Tax.” Please refer to these brochures for more information on these taxes. If you have any questions, please call us. Our contact information is provided at the back of this brochure. _______________ Note: This brochure provides general information and is not a substitute for legal or other professional advice. The information provided in this brochure does not cover every situation and is not intended to replace the law or change its meaning. If there is a conflict between the text in this brochure and the law, then the application of tax will be based on the law and not on this brochure. Table of Contents General Information ......................................... 1 What is Subject to Tax ..................................... 4 Managing Agents ............................................. 5 Registration & Licensing .................................. 7 Tax Forms & Filing Requirements ................... 9 Where to Get More Information ..................... 13 General Information 1. If I rent out my house or a room in my house, does that mean I am in business? Yes. If you receive rental income from renting out part or all of your house, condominium, apartment, second home, vacation home, or any other residential real property (“real property”) located in Hawaii, then you are engaging in a taxable business activity. 2. If I rent out my house, do I have to pay taxes? Yes. -

The Long-Run Relationship Between House Prices and Rents

Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.C. The Long-Run Relationship between House Prices and Rents Joshua Gallin 2004-50 NOTE: Staff working papers in the Finance and Economics Discussion Series (FEDS) are preliminary materials circulated to stimulate discussion and critical comment. The analysis and conclusions set forth are those of the authors and do not indicate concurrence by other members of the research staff or the Board of Governors. References in publications to the Finance and Economics Discussion Series (other than acknowledgement) should be cleared with the author(s) to protect the tentative character of these papers. The Long-Run Relationship between House Prices and Rents Joshua Gallin, Federal Reserve Board ∗ September 2004 Abstract I show that when house prices are high relative to rents (that is, when the rent-price ratio is low) changes in real rents tend to be larger than usual and changes in real prices tend to be smaller than usual. Standard error-correction models provide inconclusive results about the predictive power of the rent-price ratio at a quarterly frequency. I use a long-horizon regression approach to show that the rent-price ratio helps predict changes in real rents and real prices over three-year periods. This result withstands the inclusion of a measure of the user cost of capital. I show that a long- horizon regression approach can yield biased estimates of the degree of error correction if prices have a unit root but do not follow a random walk. I construct bootstrap distributions to conduct appropriate inference in the presence of this bias. -

Condominium and Cooperative Housing: Transactional Efficiency, Tax Subsidies, and Tenure Choice

CONDOMINIUM AND COOPERATIVE HOUSING: TRANSACTIONAL EFFICIENCY, TAX SUBSIDIES, AND TENURE CHOICE HENRY HANSMANN* I. INTRODUCTION TWENTY-FIVE years ago, cooperative apartment buildings were uncom- mon in the United States, and condominiums were virtually nonexistent. Since then, however, both forms, and particularly condominiums, have spread rapidly through the real estate market. This article explores the factors responsible for this development. In the process, it also assesses the relative transactional efficiency of consumer ownership and investor ownership in multiunit housing. I argue that two factors appear principally responsible for the recent spread of cooperatives and condominiums. First is the large tax subsidy to owner-occupied housing that has existed since the Second World War and that has been particularly large during the past two decades. Second is innovation in the forms available for organizing ownership in multiunit dwellings. A variety of considerations suggest that the first of these fac- tors has been more important than the second and that, in the absence of the tax subsidy, cooperatives and condominiums would occupy a much smaller share of the housing market than they do at present. In support of this analysis, this article offers the first sophisticated calculations of the magnitude of the pure tax subsidy to owner-occupied housing, as * Professor of Law, Yale University. Generous research support was provided by the John Simon Guggenheim Memorial Foundation and the Yale Law School. Special thanks are due to Alan Gerber and Lucy Allen for research assistance. Helpful comments on earlier drafts were provided by Lucian Bebchuk, Robert Ellickson, Patrick Hendershott, John Quigley, Susan Rose-Ackerman, Ruth Wedgwood, and participants in workshops at Georgetown University, Harvard, Stanford, the University of Chicago, and the University of Virginia law schools. -

Housing Bubbles

NBER WORKING PAPER SERIES HOUSING BUBBLES Edward L. Glaeser Charles G. Nathanson Working Paper 20426 http://www.nber.org/papers/w20426 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 August 2014 Edward Glaeser thanks the Taubman Center for State and Local Government for financial support. William Strange (the editor) provided much guidance and Rajiv Sethi both provided excellent comments. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. At least one co-author has disclosed a financial relationship of potential relevance for this research. Further information is available online at http://www.nber.org/papers/w20426.ack NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2014 by Edward L. Glaeser and Charles G. Nathanson. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Housing Bubbles Edward L. Glaeser and Charles G. Nathanson NBER Working Paper No. 20426 August 2014 JEL No. R0,R31 ABSTRACT Housing markets experience substantial price volatility, short term price change momentum and mean reversion of prices over the long run. Together these features, particularly at their most extreme, produce the classic shape of an asset bubble. In this paper, we review the stylized facts of housing bubbles and discuss theories that can potentially explain events like the boom-bust cycles of the 2000s.