View Transcript

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Icon Denoting a Download Link Download Annual Report 2014

annual report 2014 Change the picture. The answer is simple. an ANECDOTE. As part of our effort to get the word out, Academy Somebody needs to actually see them. To care. Award–winning filmmaker Errol Morris joined To be there. Just as we are with our own children.” with us to tell our kids’ stories. Like Tres’Rionna’s. Turn the page to learn what Elaine and President After getting to know her, Errol remarked to Elaine Dan Cardinali have to say in response. And visit Wynn, Chair, CIS National Board, “It is the falling communitiesinschools.org/tresrionna to learn through the cracks that hurts these kids. And more about this exceptional student. One we the answer is so simple. We need to see them. proudly call ours. 03 THE CONTEXT “When it comes to unlocking each We couldn’t agree more with the sage words of our new friend and supporter Errol Morris: no child should fall through the cracks and remain unseen, their needs unmet. Indeed, seeing each and every child’s full potential, student as an individual and doing whatever it takes to help her or him succeed in both school and in life is the obsession of our organization. It has been so since our founding in 1977, and still we will never give up.” is. So we present to you our 2014 Annual Report, complete with a wealth of data covering the year. But first, here are four trends to help put the numbers in perspective: Our quality is improving. We continue to push consistent quality throughout the network, because every student in every community deserves our best. -

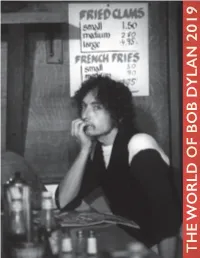

Bob Dylan: Face Value and Beyond to Include Never-Before-Seen Items from Blood on the Tracks Era

FOR IMMEDIATE RELEASE Contacts: Larry Jenkins – [email protected] Lacy Wulfers – [email protected] BOB DYLAN: FACE VALUE AND BEYOND TO INCLUDE NEVER-BEFORE-SEEN ITEMS FROM BLOOD ON THE TRACKS ERA Tulsa exhibition focuses on Dylan’s visual art, including his Face Value portrait series, along with historic lyric manuscripts and ephemera from The Bob Dylan Archive® collection TULSA, Okla. (Oct. 1, 2019)—Beginning Oct. 8, The Bob Dylan Center℠ will update its exhibition, Bob Dylan: Face Value and Beyond, with never-before-seen items from Dylan’s mid-1970s period that produced the renowned album Blood on the Tracks and the Rolling Thunder Revue tour. The exhibition, at Tulsa’s Gilcrease Museum of American Art, has been extended through Jan. 5, 2020. In addition to its exploration of Dylan’s visual art, Face Value and Beyond features the first public display of the “blue notebook” in which Dylan began composing the lyrics that became Blood on the Tracks, released in 1975. Beginning Oct. 8, the “blue notebook” will be accompanied by additional material from the era, including items recently donated to the archive by musician Kevin Odegard. One of the Minnesota-based musicians who backed Dylan on recording sessions for Blood on the Tracks, Odegard donated the Martin acoustic guitar he played on “Tangled Up in Blue” to the archive, among many other items related to those sessions. “Playing on ‘Tangled Up in Blue’ was the greatest thrill of my career,” said Odegard, who wrote A Simple Twist of Fate: Bob Dylan and the Making of Blood on the Tracks with rock journalist Andy Gill. -

May / June 2017 | Tulsachamber.Com

VOLUME 93 / ISSUE 3 2017 JUNE / MAY | TULSACHAMBER.COM A WALKABLE REGION TULSA FEDERAL CREDIT UNION TULSA RUN 40 FACES FOR 40 YEARS 2017 INTERCITY VISIT DESTINATION UNVEILED FOLLOW US The Chamber Report (ISSN 1532-5733) is published bi-monthly by the Tulsa Regional Chamber, Williams Center ToWer I, One West Third Street, Suite 100, Tulsa, OK 74103, (918) 585-1201. Members receive a subscription for $12 paid from annual dues. Non-members can subscribe for $24 per year. Periodical postage is paid at Tulsa, OK. Publisher reserves the right to refuse any advertising. POSTMASTER: Send address changes to The Chamber Report, Williams Center ToWer I, One West Third Street, Suite 100, Tulsa, OK 74103. 2017 OFFICERS IMMEDIATE PAST CHAIR, CHAIR TULSA'S YOUNG PROFESSIONALS Phil Albert Daniel Regan IN THIS ISSUE UPCOMING EVENTS President, Pelco Structural, LLC Vice President, Price Family Properties, LLC CHAIR-ELECT AT-LARGE MEMBER PG 3 : VOLUNTEERS OF PG 15 : TYPROS FOUNDATION 06.27.17 Steve Bradshaw Stuart Solomon WE LOVE OUR THE MONTH PROJECTS: WHERE ARE THEY NOW? President & CEO, BOK Financial President & COO, Public Service Company TULSA REGIONAL CHAMBER of Oklahoma STATE OF THE STATE FEATURING IMMEDIATE PAST CHAIR VOLUNTEERS PG 4 : SOCIALLY SPEAKING Jeff Dunn AT-LARGE MEMBER GOVERNOR MARY FALLIN President, Mill Creek Lumber & David Stratton Cox Business Center Managing Director, JPMorgan Chase PG 5 : A WALKABLE REGION Supply Company 100 Civic Center, Tulsa | Noon-1 p.m. PRESIDENT & CEO AT-LARGE MEMBER Mike Neal, CCE, CCD, HLM Dick Williamson MARCH VOLUNTEER OF THE MONTH PG 9 : ONEVOICE COALITION Chairman Emeritus, T. -

Position Title Investment Accountant Reports to Chief Investment Officer

Position Title Investment Accountant Reports to Chief Investment Officer Background George Kaiser Family Foundation (GKFF) is a charitable organization dedicated to providing an equal opportunity for young children in Tulsa through investments in early childhood education, community health, social services and civic enhancement. Areas of Responsibility Maintain investment records and documentation for GKFF’s investment assets. Responsibilities will include, but not be limited to: o Maintain and reconcile external asset tracking at GKFF’s custodial bank o Maintaining internal asset tracking o Gathering and managing investment documentation o Coordinate with existing personnel to support management of GKFF’s investment portfolio. Responsibilities will include, but not be limited to: o Tracking portfolio cash flows and liquidity o Assist with Foundation’s audit, 13-F, or other filings o Assist with account openings and closings o Assist with performance tracking and calculation o Aid Investment Team in preparing regular reporting for the Trustees & Investment Committee o Coordinate special projects as requested by GKFF Investment Team. o Coordinate special projects as requested by GKFF/TCF administration. These will include, but not be limited to: . Financial analysis of prospective programmatic investments . Tracking programmatic real estate portfolio . Credit analysis of prospective real estate tenants Qualifications Education Bachelor’s degree with a major in accounting or related field. Experience 2-5 years related experience preferred -

BOK Financial (NASDAQ: BOKF) Net Interest Income/Earning Assets Pre-Tax Income/Earning Assets

BOK Financial (NASDAQ: BOKF) Net Interest Income/Earning Assets Pre-tax Income/Earning Assets 4.01% 3.93% 3.50% 3.48% 3.43% 3.46% 3.39% 3.35% 3.32% 3.28% 3.29% 3.31% 3.25% 3.23% 3.13% 3.16% 3.06% 2.94% 2.87% 2.67% 2.56% 2.37% 2.39% 2.24% 2.27% 2.20% 2.22% 2.15% 2.18% 2.07% 2.03% 2.04% 2.06% 1.97% 2.01% 1.94% 1.94% 1.92% 1.80% 1.75% 1.78% 1.69% 1.50% 1.08% Table of Contents DURABILITY 3 SINGULAR DILIGENCE MOAT 4 Geoff Gannon, Writer Quan Hoang, Analyst QUALITY 6 Tobias Carlisle, Publisher CAPITAL ALLOCATION 8 BOK Financial (NASDAQ: BOKF) is a Commercial Bank VALUE 9 Offering a Variety of Financial Services Primarily in GROWTH 11 Oklahoma and Texas MISJUDGMENT 13 CONCLUSION 15 APPRAISAL 17 OVERVIEW NOTES 19 BOK Financial is an Oklahoma based bank controlled by billionaire George Kaiser. The bank gets 79% of its deposits from Oklahoma (54%) and Texas (25%). It is also in Colorado (7%), New Mexico (6%), Arizona (4%), Missouri (3%), and Arkansas (1%). The bank’s oldest historical roots are in the Exchange National Bank of Tulsa founded in 1910. That bank got involved in Oklahoma oil lending – which BOK Financial is still involved in today – during the 1930s oil boom. The bank changed its name to Bank of Oklahoma in 1975. Bank of Oklahoma was a good bank that acquired a bad bank. In the early 1980s, Bank of Oklahoma bought Fidelity of Oklahoma. -

2014 Membership Directory

| TULSACHAMBER.COM 2014 MEMBERSHIP DIRECTORY PRESENTING SPONSORS DIGITAL & PRINT FROM YOUR DOORSTEP TO YOUR iPAD, SMARTPHONE AND THE WEB. YOUR WORLD ANY WAY YOU LIKE IT. Get it today at tulsaworld.com/subscribe or call 918-582-0921 To subscribe, call 918-582-0921. TBLNEventsChamber_2013.crtr - Page 1 - Composite Tulsa Business & Legal News 2014 Events JULY 15 NOVEMBER 18 FEBRUARY 18 WOMEN OF DISTINCTION: MEN OF DISTINCTION: POWER ATTORNEYS: Women of Distinction honors 20 local women SEPTEMBER 16 This event recognizes 20 Recognizes 20 of the best in the who have excelled in business, APRIL 22 - TULSA 40: EMPLOYEES’ CHOICE: outstanding men in the community business of law. Community members entrepreneurship, law, medicine, art and The Tulsa Business & Legal News recognizes Tulsa’s Best Places to Work: Awards are based on who have made significant are invited to nominate deserving community service. The women of distinction, the best and brightest of Tulsa’s up and the results of surveys submitted by employees of achievements through their attorneys, corporate counsel, paralegals, nominated by their peers and chosen by a the firms in the Tulsa MSA, generating an overall coming business and community leaders as professional, personal, and civic secretaries and clerks for recognition. A panel of judges, are honored at a social event employee satisfaction rating. The five firms with the part of its class of The Tulsa 40. Nominated endeavors. Their achievements have committee of judges will choose the hosted by Tulsa Business & Legal News and in highest satisfaction ratings in each of four by their peers, the TB&LN profiles 40 served to better the community and most meritorious nominees, and the a special issue of the publication. -

Sumit Dutta May 2014

Sumit Dutta May 2014 learn more at ANwww.OilandGasIQ.com OIL & GAS IQ EBOOK THE OIL & GAS RICH LIST 2014 INTRODUCTION 3 MUKESH AMBANI 4 LEN BLAVATNIK 5 GINA RINEHART 6 MIKHAIL FRIDMAN 7 VIKTOR VEKSELBERG 8 HAROLD HAMM 9 MOHAMMED AL AMOUDI 10 LEONID MIKHELSON 11 JOHN FREDRIKSEN 12 GENNADY TIMCHENKO 13 VAGIT ALEKPEROV 14 ANDREY MELNICHENKO 15 GERMAN KHAN 16 CARRIE PERRODO & FAMILY 17 KLAUS-MICHAEL KUEHNE 18 GEORGE KAISER 19 RICHARD KINDER 20 ALEXEI KUZMICHEV 21 DUNCAN FAMILY 22 LEONID FEDUN 23 THE RICH LIST BY THE NUMBERS 24 SOURCES 26 ABOUT OIL & GAS IQ 27 Published By learn more at www.OilandGasIQ.com THE OIL & GAS RICH LIST 2014 It is fair to say that hydrocarbons make the world go round. If you don't believe that, ask the 20 people that we are about to feature. Although you probably won't be able top get an answer from them by email.... There now are over 1,600 billionaires globally and it comes as no surprise that a significant proportion are involved in oil, gas and its related industries. As we exit the economic downturn it is apparent some players in oil and gas have benefited more than most. The combined wealth of the top 20 individuals in this study is an astonishing $289.7 bn. For those keeping score, that is enough to buy you Chevron outright and still have a healthy $60 bn left over for fun. So what makes a savvy professional into a tycoon? As we are about to reveal, two key factors in the rise from business man to baron are a diversified portfolio and killer timing. -

The Role of Foundations in Pre-School Programs, Policies, and Research

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by ASU Digital Repository Pennies for Pre-Schoolers: The Role of Foundations in Pre-School Programs, Policies, and Research by Kathryn P. Chapman A Dissertation Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy Approved June 2019 by the Graduate Supervisory Committee: Jeanne M. Powers, Chair Gustavo Fischman Sherman Dorn ARIZONA STATE UNIVERSITY August 2019 ABSTRACT The lasting benefits of high-quality early childhood programs are widely understood. These benefits and the well-documented return on investments are among the factors that have shaped executives at philanthropic foundations’ grant making in support of early childhood programs, policies, and research in the United States. Yet little is known about the investments they are making in the field of early childhood. Drawing from a conceptual framework that combines types of philanthropic investment with the concepts of accountability and transparency, I conducted a comparative case study of the Buffett Early Childhood Fund, George Kaiser Family Foundation, and Bill & Melinda Gates Foundation, all of which began financially supporting early childhood between 2000 and 2005. I attempted to understand how and why philanthropic foundations and pooled funding organizations have supported early childhood from the late 1990s through 2018. Based on my analysis of 32 semi-structured interviews with current and former early childhood philanthropic foundation, pooled funding, and operating organization executives, I found that each foundation independently determines their investment decision processes and invests a disparate amount of money in early childhood. In addition, philanthropic foundations gain programmatic and legislative power by leveraging funds and partnering with additional foundations and businesses. -

Two Generations. One Future. an Anthology from the Ascend Fellowship

TWO GENERATIONS. ONE FUTURE. AN ANTHOLOGY FROM THE ASCEND FELLOWSHIP An Anthology from the Ascend Fellowship 1 ACKNOWLEDGEMENTS Working with the 2012-2013 Ascend Fellows, Ascend at the Aspen Institute leaders and staff, and our many colleagues to assemble this anthology of writings on two- generation strategies, programs, and research truly has been a labor of love. It’s hard to imagine a smarter, more passionate, creative, and congenial group of individuals to have had the privilege to collaborate with since our Fellowship began in early 2012. This volume only partially represents the work of this wonderful group. In addition to offering our heartfelt gratitude to all of those who contributed to this volume, the editors also would like to acknowledge a few people without whose less visible contributions this volume would not have become a reality. Chris thanks the staff at the Lyndon Baines Johnson School of Public Affairs’ Ray Marshall Center at the University of Texas at Austin — especially Susie Riley, Karen White, and Alana Burney — for once again providing their consistent support over the past two years as this project unfolded. They have always been there when they were needed and cheered him on at every step along the way. Lindsay is very appreciative of the Institute for Policy Research (IPR) and the School of Education and Social Policy (SESP) at Northwestern University. She especially thanks Teresa Eckrich Sommer, IPR Senior Research Scientist, and Terri Sabol, SESP Assistant Professor, for their excellent leadership and insightful contributions to her research program on two-generation initiatives. Finally, having the resources of Ascend at the Aspen Institute is something that few people get to experience as we have. -

Record and Fact Book Women's Basketball

The University of Tulsa WOMEN’S Ashley HUGHES SENIOR BASKETBALL Jessica PONGONIS SENIOR Teanna REID SENIOR Erika WAKEFIELD JUNIOR 2016-17 RECORD AND FACT BOOK @ TUWBasketball The University of Tulsa Tulsa Women’s Basketball with the Dominican National Team On the court in the Dominican Republic Playing the Dominican National Team Volunteering with Samaritan’s Feet At the Christopher Columbus Hosting a kids basketball camp in the Dominican Republic Lighthouse 2016 Dominican Republic National Trip 2016-17 WOMEN’S BASKETBALL Contents INTRO Introduction 1 Opponents 63 Table of Contents .................................................1 Opponent Information ....................................64-65 Tulsa Quick Facts .................................................1 Series Records vs. 2016-17 Opponents ........... 66 Media Information ........................................... 2-3 players The University of Tulsa ........................................4 The City of Tulsa ..................................................5 Records 67 Donald W. Reynolds Center ............................... 6 Reynolds Center Records ........................... 68-69 Women’s Basketball Coaching Staff Year-by-Year Leaders ...................................70-71 Head Coach .......................................Matilda Mossman 1,000-Point Scorers ..................................... 72-73 6th Year (Western Kentucky, 1979) Players 7 Year-by-Year Individual Leaders .......................74 Career Record (years) ....................219-174 (13 Years) Alphabetical -

The University of Tulsa • Class of 1960 Memory Book Greetings from the President

The University of Tulsa • Class of 1960 Memory Book Greetings from the President Dear Friends: As members of the TU Class of 1960, you have witnessed dramatic changes – in civil rights, technology, commerce, and in the realm of what is possible for humankind. You have certainly noted the dramatic changes to our campus since your day, as well. In the past decade alone, we have doubled the value of our campus through an aggressive program of construction that continues today with our Lorton Performance Center and engineering expansion. For all the physical changes you can see, many others are taking place in less obvious areas. Year by year, our student body is becoming more academically distinguished and more geographically diverse. Our research enterprise is expanding and last year attracted a record $22 million in funding from outside sources. And we are increasingly partnering with other organizations – Gilcrease Museum, OU-Tulsa, the George Kaiser Family Foundation, the Kendall-Whittier Neighborhood Association and many others – to bring about change in our community. We are grateful when our alumni return to help us envision change and build an exciting future. You do that through service on our advisory boards, giving to our Annual Fund, mentorship of our student interns and hiring of our graduates, active participation in your local alumni chapter, and in many other ways. Your very participation in Homecoming 2010 helps strengthen and renew our family. As this weekend winds down and you leave campus to return to your regular routines, I encourage each of you to remember that you are part of TU’s ongoing success. -

Downloadable PDF of Print Program

Bob Dylan Institute the university of Oklahoma Center for the Humanities EXTERNAL BOARD INTERNAL BOARD Adam Bradley Danny Arthurs Professor of English and Director of the Laboratory for Race & Popular Assistant Professor of Music Culture, University of Colorado Mark Brewin Debra Rae Cohen Associate Professor of Media Studies Associate Professor of English and Editor of Modernism/modernity, University of South Carolina Mark A. Davidson Librarian and Collections Manager at Bob Dylan Archive John Covach Professor of Music and Director of the Institute for Popular Music, Brian Hosmer University of Rochester Barnard Professor of Western American History Kevin J.H. Dettmar Grant Jenkins W.M. Keck Professor of English and Director of the Humanities Studio, Associate Professor of English Pomona College Zenia Kich Florence Dore Assistant Professor of Media Studies Professor of English, University of North Carolina Kirsten Olds Leigh H. Edwards Associate Professor of Art History Associate Professor of English, Florida State University Andrew Wood Simon Frith, OBE Rutland Professor of American History Emeritus Professor of Music, University of Edinburgh Clinton Heylin Author, Biographer, and Dylanologist Allison McCracken Associate Professor of American Studies, DePaul University Keith Negus Professor of Music, Goldsmiths, University College London Bob Santelli Executive Director, GRAMMY Museum Gayle Wald Professor of English and American Studies, George Washington University John Troutman Curator of American Music, National Museum of American History– Smithsonian Richard F. Thomas George Martin Lane Professor of Classics, Harvard University WELCOME MESSAGE On behalf of The along “Highway 61” to the eco-catastrophe of “High University of Tulsa’s Water Everywhere.” But we also wanted to understand Institute for Bob Dylan as himself part of a larger world of art, music, Dylan Studies, I creativity and activism that reaches through folk, rock, want to welcome gospel, R&B, hip-hop and beyond.