Fineotex Chemical (FTXC IN)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fcl Fineotex Chemical Limited

FINEOTEX® A Speciality Chemical Producing Public Listed Company cS) LD ge £1 Cg, ate, & y eer ey 1SO 14001 54 gq0® 13" February, 2020 To, General Manager, The Manager, Listing Department, Listing & Compliance Department BSE Limited, The National Stock Exchange of India Limited P.J. Towers, Dalal Street, Exchange Plaza, Bandra Kurla Complex, Mumbai — 400 001 Bandra East, Mumbai — 400051 Company code: 533333 Company code: FCL Dear Sirs/Madam, Subject:- Regulation 30, Schedule III Part A (15) of SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 With reference to the above caption subject, we enclose Earning Presentation for the quarter and Nine Months ended 31% December, 2019 requesting you to kindly take this in your record. Kindly acknowledge receipt of the same. Thanking You, Yours faithfully, For FINEOTEX CHEMICAL LIMITED Hemant Auti (Company Secretary) FCL FINEOTEX CHEMICAL LIMITED 42 & 43, Manorama Chambers, $.V. Road, Bandra (West), Mumbai - 400 050. India. Phone : (+91-22) 2655 9174/75/76/77 INDIA @ MALAYSIA Fax : (+91-22) 2655 9178 E-mail : [email protected] Website : www.fineotex.com CIN - L24100MH2004PLC144295 FINEOTEX CHEMICAL LIMITED 9M / Q3- FY20 Where Dependability Counts… EARNINGS PRESENTATION EXECUTIVE SUMMARY 2 FINEOTEX® EXECUTIVE SUMMARY OVERVIEW BUSINESS MIX KEY STRENGTHS FY19 FINANCIALS (I-GAAP-Consolidated) . Fineotex Group founded in 1979 . Fineotex is one of India’s largest . Strong Balance Sheet with Zero Income – INR 1,823 MN; CAGR 3 is engaged in manufacturing of and most progressive speciality Debt; High ROE and ROCE, Years 19% . Specialty Chemicals and Enzymes. textile chemical manufacturers. Consistently Dividend paying. EBITDA – INR 346 MN; CAGR 3 . Mr. Surendra Kumar Tibrewala is . -

Fineotex Chemical Limited

FINEOTEX® A Spec1ality Chem1cal Producing Public Listed Company - November 24, 2018 To, General Manager, The Manager, Listing Department, Listing & Compliance Department BSE Limited, The National Stock Exchange of India limited P.J . Towers, Dalal Street, Exchange Plaza, Bandra Kurla Complex, Mumbai- 400 001 Bandra East, Mumbai- 400051 Company code: 533333 Company code: FCL Dear Sir/Madam, Subject :- Investor Presentation With reference to the above caption subject, we hereby enclose Investor Presentation for the Month of November 2018, requesting you to kindly take it in your record. Kindly acknowledge receipt of the same. Thanking You. Yours faithfully, For FINEOTEX CHEMICAL LIMITED Pooja Kothari (Company Secretary) FINEOTEX CHEMICAL LIMITED ' FINEOTEX CHEMICAL LIMITED Investor Presentation Where Dependability Counts… November 2018 FINEOTEX® INDEX Executive Summary Company Overview Business Overview Industry Overview Financial Overview 1 EXECUTIVE SUMMARY 2 FINEOTEX® EXECUTIVE SUMMARY OVERVIEW BUSINESS MIX KEY STRENGTHS FY18 FINANCIALS (I-GAAP Consolidated) . Fineotex Group founded in 1979 . Fineotex is one of India’s largest . Strong Balance Sheet with Zero . Income – INR 1,431 MN , 5 year is engaged in manufacturing of and most progressive speciality Debt; High ROE and ROCE, CAGR of 11.95% Specialty Chemicals and Enzymes. textile chemical manufacturers. Consistently Dividend paying. EBITDA – INR 302 MN , 5 year . Mr. Surendra Kumar Tibrewala is . The Company manufactures . Professionally run company with CAGR of 22.32% Chairman & MD and Mr Sanjay chemicals for the entire value high Promoter holding. Promoter . PAT – INR 249 MN , 5 year CAGR of Tibrewala Executive Director & chain for the textile industry stake is the same as last year. 24.51% CFO. -

Fineotex Investor Presentation May 2019

' FINEOTEX CHEMICAL LIMITED Investor Presentation Where Dependability Counts… May 2019 FINEOTEX® INDEX Executive Summary Company Overview Business Overview Industry Overview Financial Overview 1 EXECUTIVE SUMMARY 2 FINEOTEX® EXECUTIVE SUMMARY OVERVIEW BUSINESS MIX KEY STRENGTHS FY19 FINANCIALS . Fineotex Group founded in 1979 . Fineotex is one of India’s largest . Strong Balance Sheet with Zero Income – INR 1,823 MN; CAGR 5 is engaged in manufacturing of and most progressive speciality Debt; High ROE and ROCE, Years 16% . Specialty Chemicals and Enzymes. textile chemical manufacturers. Consistently Dividend paying. EBITDA – INR 346 MN; CAGR 5 . Mr. Surendra Kumar Tibrewala is . The Company manufactures . Professionally run company with Years 30% . Chairman & MD and Mr Sanjay chemicals for the entire value high Promoter holding. Promoter PAT – INR 243MN; ; CAGR 5 Years Tibrewala Executive Director & chain for the textile industry stake is the same as last year. 25% CFO. including pretreatment, dyeing , . Strong Industry knowledge – over . The company has manufacturing printing and finishing process . three decades of operations . facilities in Navi Mumbai and . The company also manufactures . Low cost high margin products Malaysia with a combined other chemicals for various with high entry barriers. production capacity of 43,000 industries like agro , adhesives , . Extremely strong brand loyalty. MT/p.a. construction, water treatment . Strong R&D capabilities help them . Current Market Capitalization is etc. increase customization levels of INR 4,604.2 MN as of 31st March, . It has more than 400 products their products. 2019. catering to various industries. 3 COMPANY OVERVIEW 4 FINEOTEX® COMPANY OVERVIEW . Fineotex Group was established in 1979 by Mr. Surendra Industry wise Revenue Domestic Revenue Tibrewala. -

India-Specialty-Ingredients-Sector--1

Institutional Equities This page has been intentionally left blank Institutional Equities India Specialty Ingredients 1 April 2021 Little things that matter View: Positive Specialty ingredients are items that are added in very small quantities in various products across the end-user industries and add significant value in terms of the Abhishek Navalgund functionalities of the final products. Since there are multiple sub-categories in these Research Analyst additives, it is difficult to accurately estimate the size of this entire opportunity. But, we [email protected] have elucidated key sub-segments of the specialty ingredients market that are expected +91-22-6273-8013 to grow at ~5% CAGR globally over the next 5 years. We believe that having created a niche in a particular end-user industry or a type of additive(s), Indian companies can easily grow in mid-teens on a consistent basis considering their size. Also, within the overall ingredients space, the premium ingredients portfolio should grow ahead of the base portfolio. Increasing preference for oleochemicals-based ingredients vis-à-vis petroleum-based products is expected to drive growth for select companies having adequate experience in oleochemicals and R&D expertise. Industry leaders have set up aggressive targets to reduce reliance on fossil fuels and move towards plant-based options. Ingredients companies closely dealing with such companies stand to benefit significantly in our view. We believe that providing integrated solutions as against selling separate ingredients is the way forward for the specialty ingredients industry and there are very few global players who are moving towards this. Indian companies like Fine Organics (FINORG), Rossari Biotech ROSSARI etc have been able to grow on account of this differentiated approach and we believe there is a long runway for growth for such companies. -

Fineotex Chemical (FTXC IN)

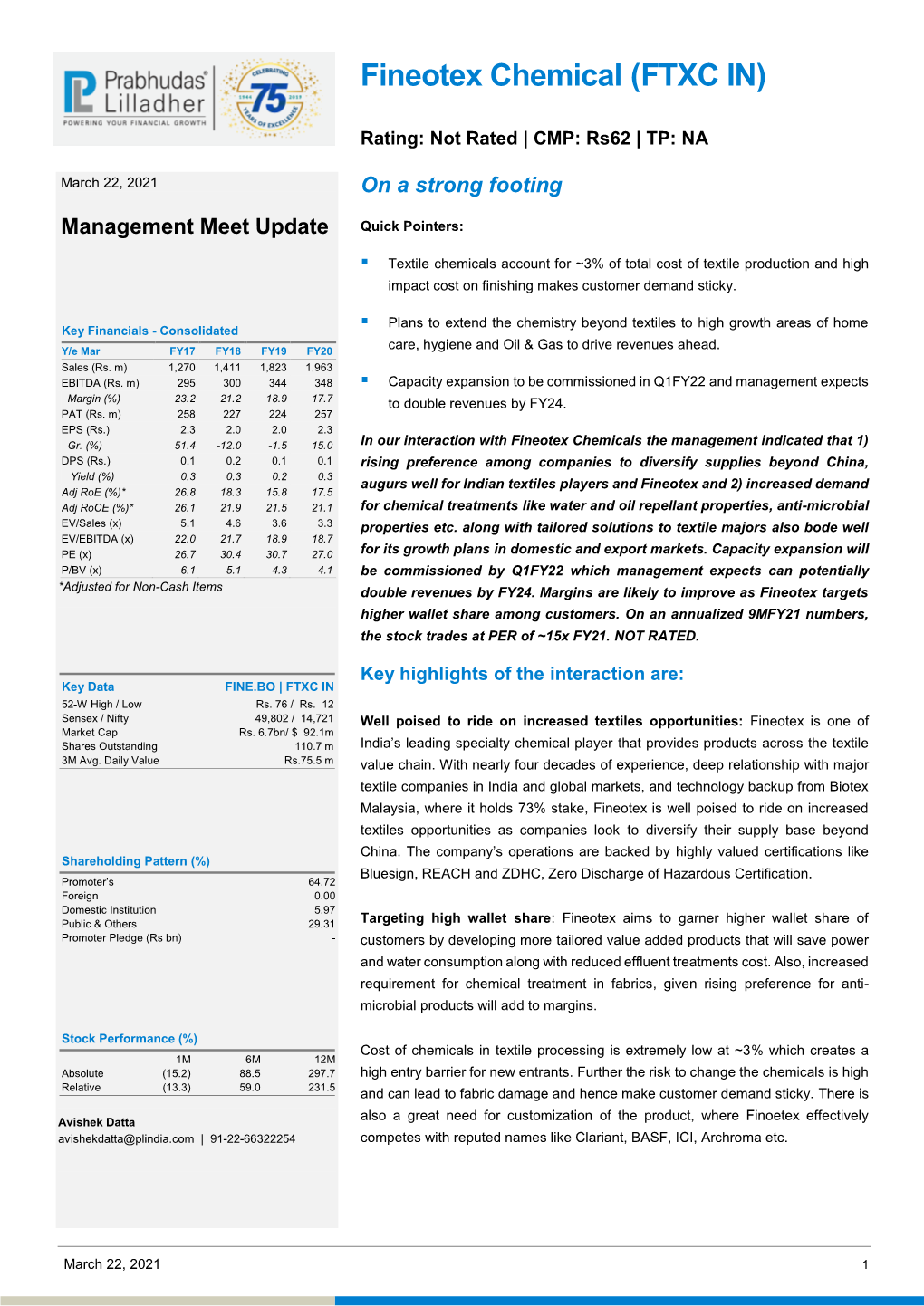

Fineotex Chemical (FTXC IN) Rating: Not Rated | CMP: Rs62 | TP: NA March 22, 2021 On a strong footing Management Meet Update Quick Pointers: . Textile chemicals account for ~3% of total cost of textile production and high impact cost on finishing makes customer demand sticky. Plans to extend the chemistry beyond textiles to high growth areas of home Key Financials - Consolidated Y/e Mar FY17 FY18 FY19 FY20 care, hygiene and Oil & Gas to drive revenues ahead. Sales (Rs. m) 1,270 1,411 1,823 1,963 EBITDA (Rs. m) 295 300 344 348 . Capacity expansion to be commissioned in Q1FY22 and management expects Margin (%) 23.2 21.2 18.9 17.7 to double revenues by FY24. PAT (Rs. m) 258 227 224 257 EPS (Rs.) 2.3 2.0 2.0 1.2 Gr. (%) 51.4 -12.0 -1.5 15.0 In our interaction with Fineotex Chemicals the management indicated that 1) DPS (Rs.) 0.1 0.2 0.1 0.1 rising preference among companies to diversify supplies beyond China, Yield (%) 0.3 0.3 0.2 0.3 augurs well for Indian textiles players and Fineotex and 2) increased demand Adj RoE (%)* 26.8 18.3 15.8 17.5 Adj RoCE (%)* 26.1 21.9 21.5 21.1 for chemical treatments like water and oil repellant properties, anti-microbial EV/Sales (x) 5.1 4.6 3.6 3.3 properties etc. along with tailored solutions to textile majors also bode well EV/EBITDA (x) 22.0 21.7 18.9 18.7 PE (x) 26.7 30.4 30.7 53.0 for its growth plans in domestic and export markets. -

National Stock Exchange of India Limited

NATIONAL STOCK EXCHANGE OF INDIA LIMITED DEPARTMENT : SURVEILLANCE Date :August 06, 2018 Download Ref No : NSE/SURV/38532 Circular Ref. No : 207/2018 All NSE Members Sub: Changes in price bands from August 07, 2018 In pursuance of Capital Market Segment Regulation Part- A, 2.5, the price bands for securities with effect from August 07, 2018 will be as under: Sr. No. Price band No. of securities Securities 1 2 3 as per Annexure I 2 %5 314 as per Annexure II 3 10% 102 as per Annexure III 4 No% band* 208 as per Annexure IV 5 20 1247 Securities other than in Annexures I to IV Total% 1874 (*securities on which derivative products are available shall continue to have daily operating range of 10 %.) Price bands of 10% (either way) will be applicable on all close ended Mutual Funds. The list of securities whose price bands have been revised is given at Annexure V. Members may also note that price band for the above securities in Limited Physical Market shall be same as that applicable in the normal market. Further, the daily price band review will be intimated vide broadcast and also updated on our website. For any clarifications, members are advised to contact Ms. Jahnvi Oza or Ms. Khyati Vidwans or Mr. Piyush Tanna. For and on behalf of National Stock Exchange of India Ltd. Avishkar Naik Vice President Surveillance Telephone No Email id 91-22-26598129 [email protected] Regd. Office : Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai – 400 051 Page 1 of 1 Annexure I List of securities where the applicable price band shall be 2%. -

Ff FINEOTEX CHEMICAL LIMITED 42 & 43, Manorama Chambers, S

FINEOTEX® A Speciality Chemical Producing Public Listed Company Date: 31/03/2021 To, Manager, General Manager, The Listing Department Listing & Compliance Department BSE Limited National Stock Exchange of India P.J. Towers, Dalal Street, Limited Mumbai — 400 001 Exchange Plaza, Bandra Kurla Complex, Company code: 533333 Bandra East, Mumbai - 400051 Company code: FCL Dear Sir / Madam, Kindly find enclosed herewith the Disclosures as required under Regulation 29(2) of SEBI (Substantial Acquisition of Shares and Takeovers) (Amendment) Regulations, 2013 and regulation Kindly take the same on records and acknowledge the receipt of the same. Thanking You, Yours faithfully, Hemant Auti — Company Secretary ff FINEOTEX CHEMICAL LIMITED 2655 9174 / 75/76/77 (West), Mumbai - 400 050. India.Phone : (+91-22) 42 & 43, Manorama Chambers, S. V. Road, Bandra [email protected] Website : www.finootex.com CIN - L24100MH2004PLC144295 A® MALAYSIA — Fax: (+91-22) 26559178 E-mail: INDIA @ ‘ Sanjay Tibrewala 42/43, Valencia, 11 Juhu — Tara Road, Mumbai -400 049 Tel: (022) 26559174-75-76-77 Fax: (022-) 26559178. Email: [email protected] Date: 31/03/2021 To, General Manager, The Manager, Listing Department Listing & Compliance Department BSE Limited National Stock Exchange of India P.J. Towers, Dalal Street, Limited Mumbai — 400 001 Exchange Plaza, Bandra Kurla Complex, Company code: 533333 Bandra East, Mumbai - 400051 Company code: FCL SUB: Disc reint of lation 29 EBI (Substantial isition of res and ov n ti 20 regulatio of SE reventi Inside di lation Dear Sir / Madam, of SEBI Kindly find enclosed herewith the Disclosures as required under Regulation 29(2) 2013 and (Substantial Acquisition of Shares and Takeovers) (Amendment) Regulations, Buy regulation 7(2) of SEBI (Prevention of Insider Trading) Regulations, 2015 in respect of of 70,000 Equity Shares of Fineotex Chemical Limited in open market. -

Average Market Capitalization of List Companies During Jan-June 2021.Pdf

Average Market Capitalization of listed companies during the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month MSE 6 month Average of Categorization as Total Avg Total MSE Avg Total All Sr. No. Company name ISIN BSE Symbol NSE Symbol per SEBI Circular Market Market Cap Symbol Market Cap in Exchanges dated Oct 6, 2017 Cap in (Rs. (Rs. Crs.) (Rs Crs.) (Rs. Cr.) Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1290062.9 RELIANCE 13,55,067.51 13,22,565.20 Large Cap 2 Tata Consultancy Services Ltd. INE467B01029 TCS 1169783.6 TCS 11,73,068.17 11,71,425.86 Large Cap 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 8,18,713.67 8,18,875.81 Large Cap 4 Infosys Ltd INE009A01021 INFY* 579784.19 INFY 5,79,697.39 5,79,740.79 Large Cap 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 5,49,358.91 5,49,347.84 Large Cap 6 Housing Development Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 4,61,373.11 4,61,830.84 Large Cap 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 4,16,389.02 4,16,517.27 Large Cap 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 3,61,438.64 3,61,539.58 Large Cap 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 3,29,789.27 3,29,778.29 Large Cap 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 3,24,843.50 3,24,920.02 Large Cap 11 Bharti Airtel Ltd. -

Fineotex Chemical Limited

C M Y K Red Herring Prospectus February 09, 2011 Please read Section 60B of the Companies Act, 1956 100% Book Building Issue FINEOTEX CHEMICAL LIMITED Our Company was incorporated as ”Fineotex Chemical Private Limited” under the provisions of the Companies Act, 1956 vide Certificate of Incorporation dated January 30, 2004. Our Company was converted into a public limited company vide a fresh Certificate of Incorporation dated October 19, 2007 and consequently the name of our Company was changed to “Fineotex Chemical Limited”. The Corporate Identification Number of our Company is U24100MH2004PLC144295. Registered and Corporate Office: 42-43, Manorama Chambers, S.V. Road, Bandra (West), Mumbai – 400 050. Tel. No: +91 22 2655 9174 / 75; Fax No: +91 22 2655 9178; Email: [email protected];Website: www.fineotex.com Contact Person: Mr. A.V. Nerurkar; Compliance Officer & Company Secretary PROMOTERS: MR. SURENDRA KUMAR TIBREWALA, MR. SANJAY TIBREWALA, MRS. KANAKLATA TIBREWALA, MS. RITU TIBREWALA, PROTON BIOCHEM PRIVATE LIMITED, KAMAL CHEMICALS PRIVATE LIMITED AND SURENDRA KUMAR TIBREWALA (HUF) PUBLIC ISSUE OF 42,11,160 EQUITY SHARES OF Rs. 10 EACH OF FINEOTEX CHEMICAL LIMITED (“FCL” OR THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF Rs. [•] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF Rs. [•] PER EQUITY SHARE) AGGREGATING Rs. [•] LAKHS (THE “ISSUE”). THE ISSUE WILL CONSTITUTE 37.50% OF THE POST ISSUE PAID UP CAPITAL OF THE COMPANY. PRICE BAND: Rs.60 TO Rs.72 PER EQUITY SHARE OF FACE VALUE OF RS. 10 EACH. THE FLOOR PRICE IS 6.00 TIMES OF THE FACE VALUE AND THE CAP PRICE IS 7.20 TIMES OF THE FACE VALUE. -

FCL FINEOTEX CHEMICAL LIMITED 42 & 43, Manorama Chambers, S

FINEOTEX” A Speciality Chemical Producing Public Listed Company HEADS gi" bean SE 7 es ig > > = fe Ye? (s(ousAS 2 tc ( } ™ pie 18001 g SUPA Jv Jv tnaaa® € utaliy ‘> S~) Ww Qa iso 14001 Sq 200° November 19, 2019 To, General Manager, The Manager, Department Listing Department, Listing & Compliance Exchange of India Limited BSE Limited, The National Stock Bandra Kurla Complex, P.J. Towers, Dalal Street, Exchange Plaza, - 400051 Mumbai — 400 001 Bandra East, Mumbai Company code: 533333 Company code: FCL Dear Sir/Madam, Subject :- Investor Presentation November 2019 Presentation for With reference to the above caption subject, we hereby enclose Investor to kindly take it in your the quarter and half year ended 30 September, 2019, requesting you record. Kindly acknowledge receipt of the same. Thanking You. Yours faithfully, For FINEOTEX CHEMICAL LIMITED yee Hemant Auti (Company Secretary) FCL FINEOTEX CHEMICAL LIMITED 42 & 43, Manorama Chambers, S. V. Road, Bandra (West), Mumbai - 400 050. India.Phone : (+91-22) 2655 9174/75 [VGATT INDIA @ MALAYSIA Fax : (+91-22) 2655 9178. E-mail: [email protected] Website : www.fineotex.com CIN - L24100MH2004PLC144295 FINEOTEX CHEMICAL LIMITED Investor Presentation Where Dependability Counts… November 2019 FINEOTEX® INDEX Executive Summary Company Overview Business Overview Industry Overview Financial Overview 1 EXECUTIVE SUMMARY 2 FINEOTEX® EXECUTIVE SUMMARY OVERVIEW BUSINESS MIX KEY STRENGTHS FY19 FINANCIALS (I-GAAP-Consolidated) . Fineotex Group founded in 1979 . Fineotex is one of India’s largest . Strong Balance Sheet with Zero Income – INR 1,823 MN; CAGR 5 is engaged in manufacturing of and most progressive speciality Debt; High ROE and ROCE, Years 16% . -

Fineotex Investor Presentation August 2018

FINEOTEX CHEMICAL LIMITED Investor Presentation Where Dependability Counts… August 2018 FINEOTEX® INDEX Executive Summary Company Overview Business Overview Industry Overview Financial Overview 1 EXECUTIVE SUMMARY 2 FINEOTEX® EXECUTIVE SUMMARY OVERVIEW BUSINESS MIX KEY STRENGTHS FY18 FINANCIALS (I-GAAP Consolidated) . Fineotex Group founded in 1979 . Fineotex is one of India’s largest . Strong Balance Sheet with Zero . Income – INR 1,431 MN , 5 year is engaged in manufacturing of and most progressive speciality Debt; High ROE and ROCE, CAGR of 11.95% Specialty Chemicals and Enzymes. textile chemical manufacturers. Consistently Dividend paying. EBITDA – INR 302 MN , 5 year . Mr. Surendra Kumar Tibrewala is . The Company manufactures . Professionally run company with CAGR of 22.32% Chairman & MD and Mr Sanjay chemicals for the entire value high Promoter holding. Promoter . PAT – INR 249 MN , 5 year CAGR of Tibrewala Executive Director & chain for the textile industry stake is the same as last year. 24.51% CFO. including pretreatment, dyeing , . Strong Industry knowledge – over . The company has manufacturing printing and finishing process three decades of operations . facilities in Navi Mumbai and . The company also manufactures . Low cost high margin products Malaysia with a combined other chemicals for various with high entry barriers. production capacity of 29,300 industries like agro , adhesives , . Extremely strong brand loyalty. MT/p.a. construction, water treatment . Strong R&D capabilities help them . Current Market Capitalization is etc. increase customization levels of INR 6,098 MN as of 30th June, . It has more than 400 products their products. 2018. catering to various industries. 3 COMPANY OVERVIEW 4 FINEOTEX® COMPANY OVERVIEW . -

10 November, 2020

10 November, 2020 To, General Manager, The Manager, Listing Department, Listing & Compliance Department BSE Limited, The National Stock Exchange of India Limited P.J. Towers, Dalal Street, Exchange Plaza, Bandra Kurla Complex, Mumbai — 400 001 Bandra East, Mumbai — 400051 Company code: 533333 Company code: FCL Dear Sirs/Madam, Subject :- Regulation 30, Schedule III Part A (15) of SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 With reference to the above caption subject, we enclose Investor Presentation for the quarter and half year ended 30th September 2020, requesting you to kindly take this in your record. Kindly acknowledge receipt of the same. Thanking You, Yours faithfully, For FINEFOTEX CHEMICAL LIMITED Sa njay Digitally signed by Sanjay Surendra Surendra Tibrewala Date: 2020.11.10 TI brewa la 16:58:39 +05'30' Sanjay Tibrewala Director DIN-00218525 Fineotex Chemical Limited (BSE: 533333; NSE: FCL) Investor Presentation November 2020 Drilling Specialties Textile Specialties Home Care and Hygiene Specialties Other Specialties Agenda Company Overview 3 – 14 Sustainability Approach 15 – 21 Financial Performance 22 – 27 2 Company Overview 3 An Introduction to Fineotex Speciality chemicals producer for 4+ decades with a market 450+ 60+ leading position in the international textiles industry Product Categories Countries Present Bluesign, ZDHC, Successful entry into home care and hygiene and drilling 43,000+ MT p.a. Star Export House Installed Capacities speciality chemicals Accreditations 100+ Rs. 270 mn Biotex Malaysia spearheads the R&D solutions, application Dealers in Indian and Deployed for brownfield research and product development International Market facility at Ambernath, Maharashtra Attractive industry dynamics with technical barriers to entry Rs.