Xcthe Bank of Latvia (1922–1940)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LATVIA in REVIEW July 26 – August 1, 2011 Issue 30

LATVIA IN REVIEW July 26 – August 1, 2011 Issue 30 CONTENTS Government Latvia's Civic Union and New Era Parties Vote to Participate in Foundation of Unity Party About 1,700 people Have Expressed Wish to Join Latvia's Newly-Founded ZRP Party President Bērziņš to Draft Legislation Defining Criteria for Selection of Ministers Parties Represented in Current Parliament Promise Clarity about Candidates This Week Procedure Established for President’s Convening of Saeima Meetings Economics Bank of Latvia Economist: Retail Posts a Rapid Rise in June Latvian Unemployment Down to 12.3% Fourteen Latvian Banks Report Growth of Deposits in First Half of 2011 European Commission Approves Cohesion Fund Development Project for Rīga Airport Private Investments Could Help in Developing Rīga and Jūrmala as Tourist Destinations Foreign Affairs Latvian State Secretary Participates in Informal Meeting of Ministers for European Affairs Cabinet Approves Latvia’s Initial Negotiating Position Over EU 2014-2020 Multiannual Budget President Bērziņš Presents Letters of Accreditation to New Latvian Ambassador to Spain Society Ministry of Culture Announces Idea Competition for New Creative Quarter in Rīga Unique Exhibit of Sand Sculptures Continues on AB Dambis in Rīga Rīga’s 810 Anniversary to Be Celebrated in August with Events Throughout the Latvian Capital Labadaba 2011 Festival, in the Līgatne District, Showcases the Best of Latvian Music Latvian National Opera Features Special Summer Calendar of Performances in August Articles of Interest Economist: “Same Old Saeima?” Financial Times: “Crucial Times for Investors in Latvia” L’Express: “La Lettonie lutte difficilement contre la corruption” Economist: “Two Just Men: Two Sober Men Try to Calm Latvia’s Febrile Politics” Dezeen magazine: “House in Mārupe by Open AD” Government Latvia's Civic Union, New Era Parties Vote to Participate in Foundation of Unity Party At a party congress on July 30, Latvia's Civic Union party voted to participate in the foundation of the Unity party, Civic Union reported in a statement on its website. -

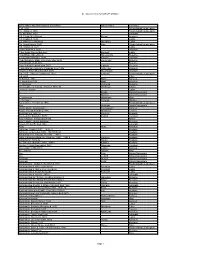

All Latvia Cemetery List-Final-By First Name#2

All Latvia Cemetery List by First Name Given Name and Grave Marker Information Family Name Cemetery ? d. 1904 Friedrichstadt/Jaunjelgava ? b. Itshak d. 1863 Friedrichstadt/Jaunjelgava ? b. Abraham 1900 Jekabpils ? B. Chaim Meir Potash Potash Kraslava ? B. Eliazar d. 5632 Ludza ? B. Haim Zev Shuvakov Shuvakov Ludza ? b. Itshak Katz d. 1850 Katz Friedrichstadt/Jaunjelgava ? B. Shalom d. 5634 Ludza ? bar Abraham d. 5662 Varaklani ? Bar David Shmuel Bombart Bombart Ludza ? bar Efraim Shmethovits Shmethovits Rezekne ? Bar Haim Kafman d. 5680 Kafman Varaklani ? bar Menahem Mane Zomerman died 5693 Zomerman Rezekne ? bar Menahem Mendel Rezekne ? bar Yehuda Lapinski died 5677 Lapinski Rezekne ? Bat Abraham Telts wife of Lipman Liver 1906 Telts Liver Kraslava ? bat ben Tzion Shvarbrand d. 5674 Shvarbrand Varaklani ? d. 1875 Pinchus Judelson d. 1923 Judelson Friedrichstadt/Jaunjelgava ? d. 5608 Pilten ?? Bloch d. 1931 Bloch Karsava ?? Nagli died 5679 Nagli Rezekne ?? Vechman Vechman Rezekne ??? daughter of Yehuda Hirshman 7870-30 Hirshman Saldus ?meret b. Eliazar Ludza A. Broido Dvinsk/Daugavpils A. Blostein Dvinsk/Daugavpils A. Hirschman Hirschman Rīga A. Perlman Perlman Windau Aaron Zev b. Yehiskiel d. 1910 Friedrichstadt/Jaunjelgava Aba Ostrinsky Dvinsk/Daugavpils Aba b. Moshe Skorobogat? Skorobogat? Karsava Aba b. Yehuda Hirshberg 1916 Hirshberg Tukums Aba Koblentz 1891-30 Koblentz Krustpils Aba Leib bar Ziskind d. 5678 Ziskind Varaklani Aba Yehuda b. Shrago died 1880 Riebini Aba Yehuda Leib bar Abraham Rezekne Abarihel?? bar Eli died 1866 Jekabpils Abay Abay Kraslava Abba bar Jehuda 1925? 1890-22 Krustpils Abba bar Jehuda died 1925 film#1890-23 Krustpils Abba Haim ben Yehuda Leib 1885 1886-1 Krustpils Abba Jehuda bar Mordehaj Hakohen 1899? 1890-9 hacohen Krustpils Abba Ravdin 1889-32 Ravdin Krustpils Abe bar Josef Kaitzner 1960 1883-1 Kaitzner Krustpils Abe bat Feivish Shpungin d. -

Read More on Baltic International

INNOVATIONS TEAM aimed at innovations EXCELLENT OF EXPERTS and excellence SERVICE 25 REASONS WE ARE PROUD OF know-how truly individual high and experience quality service FAMILY BANK a bank owned SUPPORT by family TRUST TO STARTUPS and devoted we appreciate we believe in future to families trust of clients of start-ups and employees ESG JOY OF 25YEAR Environmental. WORKING EXPERIENCE GOOD Social. TOGETHER Let’s celebrate RESOURCE BASE Government. we love to work 25th anniversary strong resource base together! on May 3 and OUR WAY and sound development entire year 2018! OF SUCCESS, CHALLENGES RELIABILITY SUSTAINABILITY we are reliable, AND gold level open and honest in Sustainability index long-term business VICTORIES partner PATRONS SUPPORT OF CULTURE TO LITERATURE WINNERS SUCCESSION AND ART we believe in power #WinnersBorninLatvia we believe in importance care for succession of literature of families and succession of national values SMART EXPERTISE INVESTMENTS helps to find OFFICE we invest with our clients the best solutions IN THE HEART in a smart way OF OLD RIGA for our customers working in the rhythm of the heartbeats of Riga RESPECTFUL SHAREHOLDERS we trust our shareholders, RESPONSIBILITY STRONG TEAM GREEN SPORTIVE AND COMPETITIVE and they trust us responsible for wealth good team of energetic THINKING ENTHUSIASTIC PRODUCTS management of our clients and loyal experts care for nature we enjoy working wide spectrum and ourselves and sporting together and competitive features Business review 2017 CONTENTS 3 Valeri Belokon, Chairman of Supervisory Board 5 Viktor Bolbat, Deputy Chairman of Management Board 7 Bank financial results review 10 Overall review of Latvian economy 13 Developments on global financial markets 15 Baltic International Bank: support to the society, environment, and the world 19 Baltic International Bank — 25! VALERI BELOKON e Chairperson of the Supervisory Board of Baltic International Bank Whatever you do in life, do it with all your heart. -

Circular Economy and Bioeconomy Interaction Development As Future for Rural Regions. Case Study of Aizkraukle Region in Latvia

Environmental and Climate Technologies 2019, vol. 23, no. 3, pp. 129–146 doi: 10.2478/rtuect-2019-0084 https://content.sciendo.com Circular Economy and Bioeconomy Interaction Development as Future for Rural Regions. Case Study of Aizkraukle Region in Latvia Indra MUIZNIECE1*, Lauma ZIHARE2, Jelena PUBULE3, Dagnija BLUMBERGA4 1–4Institute of Energy Systems and Environment, Riga Technical University, Azenes iela 12/1, Riga, LV-1048, Latvia Abstract – In order to enforce the concepts of bioeconomy and the circular economy, the use of a bottom-up approach at the national level has been proposed: to start at the level of a small region, encourage its development, considering its specific capacities and resources, rather than applying generalized assumptions at a national or international level. Therefore, this study has been carried out with an aim to develop a methodology for the assessment of small rural areas in the context of the circular economy and bioeconomy, in order to advance the development of these regions in an effective way, using the existing bioresources comprehensively. The methodology is based on the identification of existing and potential bioeconomy flows (land and its use, bioresources, human resources, employment and business), the identification of the strengths of their interaction and compare these with the situation at the regional and national levels in order to identify the specific region's current situation in the bioeconomy and identify more forward-looking directions for development. Several methods are integrated and interlinked in the methodology – indicator analysis, correlation and regression analysis, and heat map tables. The methodology is approbated on one case study – Aizkraukle region – a small rural region in Latvia. -

CSDD 2018/29 ERAF 3.Pielikums CSDD Rīkotā Iepirkuma Nolikumam

CSDD 2018/29 ERAF 3.pielikums CSDD rīkotā iepirkuma nolikumam STACIJAS atrašanās vietas shēma Adrese: Rīgas iela 4, Aloja, Alojas nov., LV-4064 Nekustamā īpašuma kadastra apzīmējums: 66070030032 1 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Adrese: Raiņa iela 4, Auce, Auces nov., LV-3708 Nekustamā īpašuma kadastra apzīmējums: 46050090910 2 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Adrese: Zvaigžņu iela 2A, Aizpute, Aizputes nov., LV-3456 Nekustamā īpašuma kadastra apzīmējums: 64050070090 3 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Adrese: Dārza iela 25A, Bērzpils, Bērzpils pag., Balvu nov., LV-4576 Nekustamā īpašuma kadastra apzīmējums: 38500020281 4 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Nosaukums: "Automašīnu stāvlaukums pie baznīcas", Dundagas pagasts, Dundagas novads Nekustamā īpašuma kadastra apzīmējums: 88500200209 5 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Adrese: Lāčplēša iela 11, Jaunjelgava, Jaunjelgavas nov., LV-5134 Nekustamā īpašuma kadastra apzīmējums: 32070020388 6 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Nosaukums: "5.noliktavas caurlaide", Kolkas pagasts, Dundagas novads Nekustamā īpašuma kadastra apzīmējums: 88620070260 7 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Nosaukums: "Pils iela 8B", Mālpils novads Nekustamā īpašuma kadastra apzīmējums: 80740030845 8 CSDD 2018/29 ERAF STACIJAS atrašanās vietas shēma Adrese: Rīgas iela 26B, Vecumnieki, Vecumnieku pag., Vecumnieku nov., LV-3933 Nekustamā īpašuma kadastra apzīmējums: 40940120980 9 CSDD 2018/29 ERAF STACIJAS -

EUROPEAN COMMISSION Brussels, 23.7.2013 COM(2013)

EUROPEAN COMMISSION Brussels, 23.7.2013 COM(2013) 540 final REPORT FROM THE COMMISSION Twelfth Report on the practical preparations for the future enlargement of the euro area EN EN REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE COUNCIL, THE EUROPEAN CENTRAL BANK, THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS Twelfth Report on the practical preparations for the future enlargement of the euro area 1. INTRODUCTION Since the adoption of the euro by Estonia on 1 January 2011, the euro area consists of seventeen EU Member States. Among the remaining eleven Member States, nine Member States are expected to adopt the euro once the necessary conditions are fulfilled. Denmark and the United Kingdom have a special "opt-out"-status and are not committed to adopt the euro. This report assesses the state of play of the practical preparations for introducing the euro in Latvia and evaluates the progress made in preparing the changeover related communication campaign. Following the Council decision from 9 July 2013 concluding that the necessary conditions for euro adoption are fulfilled, Latvia will adopt the euro on 1 January 2014 ("€- day"). The conversion rate between the Latvian lats and the euro has been irrevocably fixed at 0.702804 Latvian lats to one euro. 2. STATE OF PLAY OF THE PREPARATIONS FOR THE CHANGEOVER IN LATVIA Latvia will be the sixth of the group of Member States which joined the EU in 2004 to adopt the euro. Latvia's original target date of 1 January 2008 foreseen in the Action Plan for Implementation of the Single European Currency of 1 November 2005 was subsequently reconsidered. -

Xcre-Establishment of the Lats

XC BANK OF LATVIA IN TIMES OF CHANGE (1990–2004) Dr. hist. Kristīne Ducmane XCRE-ESTABLISHMENT OF THE LATS 209 In a wider, not merely economic but also cultural, historic and future currency of Latvia. This unconventional approach to the political sense, money reflects the entire process of the evolution solution of the currency design caught the assessors' attention. of the civilisation. It is often evidence of political changes in a Soon the public authorities also joined the efforts to re-estab- country and is definitely part of the world's cultural heritage. The lish the lats, the national currency. On 31 July 1990 the Supreme link between the restoration of sovereign Latvia and the re-estab- Council of the Republic of Latvia (hereinafter, the Supreme lishment of the lats is particularly interesting in the history of Lat- Council) adopted a Resolution "On the programme for estab- vian money. The restoration of Latvia's independence was an op- lishing the monetary system of the Republic of Latvia"2 whereby portunity to restore the national currency. The re-establishment of the Council of the Bank of Latvia was assigned the task of estab- the lats and stabilisation of the national economy was the goal of lishing a commission that would be in charge of the monetary the second currency reform in sovereign Latvia. Work towards system reform. The commission's working programme had to achieving this goal began at the dawn of the national awakening. address issues related to the laws regulating money and lending At the meeting at the Artists' Union in June 1988 Mr. -

Privatization at the Crossroad of Latvia's Economic Reform

PRIVATIZATION AT THE CROSSROAD OF LATVIA'S ECONOMIC REFORM Sandra Berzups" I. INTRODUCTION .............................................................. 171 II. BACKGROUND ................................................................. 172 III. ECONOMIC REFORM ........................................................ 175 IV. PRIVATIZATION - THE BEGINNING ....................................... 177 V. RESTITUTION ................................................................. 179 VI. PRIVATIZATION CERTIFICATES ........................................... 180 VII. SECTORAL PRIVATIZATION - AGRICULTURE ........................... 182 VIII. SECTORAL PRIVATIZATION - BANKING .................................. 183 IX. SMALL SCALE PRIVATIZATION ........................................... 185 X. LARGE PRIVATIZATION ..................................................... 186 XI. ESTABLISHMENT OF THE PRIVATIZATION AGENCY ................... 188 XII. NEW PRIVATIZATION METHODOLOGY FOR THE PRIVATIZATION AGENCY - THE SPECIFICS ............................. 190 XIII. NEW PRIVATIZATION METHODOLOGY FOR PRIVATIZATION COMMITTEES - THE SPECIFICS ........................ 192 XIV. ANALYSIS OF NEW METHODOLOGY ..................................... 193 XV. CONCLUSION ................................................................. 195 I. INTRODUCTION Latvia regained its independence from the former Soviet Union in August 1991. Since then, it has begun the slow and arduous path of replacing the centrally-planned, socialist system with an economic structure based -

The Saeima (Parliament) Election

/pub/public/30067.html Legislation / The Saeima Election Law Unofficial translation Modified by amendments adopted till 14 July 2014 As in force on 19 July 2014 The Saeima has adopted and the President of State has proclaimed the following law: The Saeima Election Law Chapter I GENERAL PROVISIONS 1. Citizens of Latvia who have reached the age of 18 by election day have the right to vote. (As amended by the 6 February 2014 Law) 2.(Deleted by the 6 February 2014 Law). 3. A person has the right to vote in any constituency. 4. Any citizen of Latvia who has reached the age of 21 before election day may be elected to the Saeima unless one or more of the restrictions specified in Article 5 of this Law apply. 5. Persons are not to be included in the lists of candidates and are not eligible to be elected to the Saeima if they: 1) have been placed under statutory trusteeship by the court; 2) are serving a court sentence in a penitentiary; 3) have been convicted of an intentionally committed criminal offence except in cases when persons have been rehabilitated or their conviction has been expunged or vacated; 4) have committed a criminal offence set forth in the Criminal Law in a state of mental incapacity or a state of diminished mental capacity or who, after committing a criminal offence, have developed a mental disorder and thus are incapable of taking or controlling a conscious action and as a result have been subjected to compulsory medical measures, or whose cases have been dismissed without applying such compulsory medical measures; 5) belong -

How Great Is Latvia's Success Story? the Economic, Social and Political Consequences of the Recent Financial Crisis in Latvia

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Austers, Aldis Article — Published Version How great is Latvia's success story? The economic, social and political consequences of the recent financial crisis in Latvia Intereconomics Suggested Citation: Austers, Aldis (2014) : How great is Latvia's success story? The economic, social and political consequences of the recent financial crisis in Latvia, Intereconomics, ISSN 1613-964X, Springer, Heidelberg, Vol. 49, Iss. 4, pp. 228-238, http://dx.doi.org/10.1007/s10272-014-0504-0 This Version is available at: http://hdl.handle.net/10419/146024 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Financial Crisis DOI: 10.1007/s10272-014-0504-0 Aldis Austers* How Great Is Latvia’s Success Story? The Economic, Social and Political Consequences of the Recent Financial Crisis in Latvia The current state of Latvia can be best described in medical terms: the patient is pale, but alive. -

Plūdu Riska Novērtēšanas Un Pārvaldības Nacionālā Programma 2008.-2015.Gadam

Approved by Cabinet Order No.830 20 December 2007 National Programme for the Assessment and Management of Flood Risks 2008 - 2015 Informative Part Riga 2007 Translation © 2013 Valsts valodas centrs (State Language Centre) Contents Abbreviations Used 3 Terms used in the Programme 3 I. Characterisation of the Situation 4 1. Assessment of the Territory of Latvia in Respect of Flood Risks 7 1.1. Types of Flood Risk Areas in the Territory of Latvia 7 1.2. Causes of Floods in Flood Risk Areas 8 1.3. Areas Being Flooded Due to Floods and Areas at Risk of Flooding 9 1.4. Specially Protected Nature Territories 12 1.5. Historical Consequences and Material Losses of Floods 12 2. Flood Risk Scenarios and Assessment Criteria Thereof 13 II. Link of the Programme to the Priorities and Supporting Policy Documents of the Government and Ministries 15 III. Objectives and Sub-objectives of the Programme 17 IV. Planned Results of the Programme Policy and Results of the Activity 17 V. The Result-based Indicators for the Achievement of Results of the Programme Policy and Results of Activity 18 VI. Main Tasks for the Achievement of Results of the Programme 18 VII Programme Funding 18 Annexes 1. Annex 1 River Basin Districts of Latvia 20 2. Annex 2 Flood Risk Areas in River Potamal Sections 21 3. Annex 3 Coastal Flood Risk and Coastal Erosion Risk Areas of the Baltic Sea and the Gulf of Riga 25 4. Annex 4 Measures for the Assessment and Reduction of Flood Risks 26 Translation © 2013 Valsts valodas centrs (State Language Centre) 2 Abbreviations Used MoE – Ministry of Economics MoF – Ministry of Finance MoENV – Ministry of Environment MoA – Ministry of Agriculture EU – European Union HPS – Hydroelectric power station UNECE – United Nations Economic Commission for Europe a/g - agriculture mBs – metres in the Baltic system ha - hectare Terms Used in the Programme Flood – the covering by water of land not normally covered by water. -

The Baltics EU/Schengen Zone Baltic Tourist Map Traveling Between

The Baltics Development Fund Development EU/Schengen Zone Regional European European in your future your in g Investin n Unio European Lithuanian State Department of Tourism under the Ministry of Economy, 2019 Economy, of Ministry the under Tourism of Department State Lithuanian Tampere Investment and Development Agency of Latvia, of Agency Development and Investment Pori © Estonian Tourist Board / Enterprise Estonia, Enterprise / Board Tourist Estonian © FINL AND Vyborg Turku HELSINKI Estonia Latvia Lithuania Gulf of Finland St. Petersburg Estonia is just a little bigger than Denmark, Switzerland or the Latvia is best known for is Art Nouveau. The cultural and historic From Vilnius and its mysterious Baroque longing to Kaunas renowned Netherlands. Culturally, it is located at the crossroads of Northern, heritage of Latvian architecture spans many centuries, from authentic for its modernist buildings, from Trakai dating back to glorious Western and Eastern Europe. The first signs of human habitation in rural homesteads to unique samples of wooden architecture, to medieval Lithuania to the only port city Klaipėda and the Curonian TALLINN Novgorod Estonia trace back for nearly 10,000 years, which means Estonians luxurious palaces and manors, churches, and impressive Art Nouveau Spit – every place of Lithuania stands out for its unique way of Orebro STOCKHOLM Lake Peipus have been living continuously in one area for a longer period than buildings. Capital city Riga alone is home to over 700 buildings built in rendering the colorful nature and history of the country. Rivers and lakes of pure spring waters, forests of countless shades of green, many other nations in Europe.