Alberta's Key Challenges and Opportunities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Our Graduates

OUR GRADUATES FACULTY OF AGRICULTURAL, Mohsen Hashemiranjbar Sharifabad, Animal Science in Lisa Fox, Animal Science, Fairview LIFE AND ENVIRONMENTAL Agricultural, Food and Nutritional Science, Iran Yirui Gan, Crop Science, China SCIENCES Keisha Brittenay Hollman, Plant Science in Agricultural, Yiqing Gong, Agricultural and Resource Economics — Food and Nutritional Science, Sherwood Park Internship Program, China DOCTOR OF PHILOSOPHY Ziwei Hu, Agricultural and Resource Economics in Matthew John Guelly, Crop Science, Westlock Reza Ahmadi, Bioresource and Food Engineering in Resource Economics and Environmental Sociology, China Bradley Michael Hendricks, Crop Science, Strathmore Agricultural, Food and Nutritional Science, Edmonton Ashley Anne Hynes, Forest Biology and Management in Yiqing Huang, Animal Science, China Martha Carolina Archundia Herrera, Nutrition and Renewable Resources, Newfoundland Kira Lynne Kottke, Animal Science, Edmonton Metabolism in Agricultural, Food and Nutritional Ayesha Jain, Textiles and Clothing in Human Ecology, India Rebecca Esther Makepeace, Crop Science, Leduc County Science, Mexico Shiva Kiaras, Family Ecology and Practice in Human Matthew Ross McGillivray, Animal Science, Joseph Daniel Cooper, Forest Biology and Management in Ecology, Edmonton British Columbia Renewable Resources, United States Alvita Bertilla Mathias, Agricultural, Food and Nutritional Samuel Lane Nanninga, Crop Science, Barrhead Aidin Foroutan Naddafi, Animal Science in Agricultural, Science, India Erica Dawn Nelson, Crop Science, Rumsey -

Podium Alberta Recipients • 2017

Podium Alberta Recipients • 2017 Through Podium Alberta, Alberta Sport Connection is pleased to assist 249 athletes in 42 sports as they strive for Excellence in Sport. Alpine Skiing Cross Country Skiing Goalball Ski Cross Volleyball Jackson Leitch ^ Mark Arendz ^ Aron Ghebreyohannes ^ Zachary Belczyk Blair Bann Manuel Osborne-Paradis Ivan Babikov Tiana Knight ^ Mara Bishop Jay Blankenau Huston Philp Erik Carleton ^ Blair Nesbitt ^ Brady Leman Margaret Casault Trevor Philp Jesse Cockney Kristofor Mahler Jesse Elser Alana Ramsay ^ Reed Godfrey Gymnastics Abbey McEwen Pearson Eshenko Erik Read Devon Kershaw Damien Cachia Alexa Velcic Alexa Gray Jeffrey Read Graeme Killick Jackson Payne Ciara Hanly Kirk Schornstein ^ Christopher Klebl ^ Ski Jumping Jacob Kern Liam Wallace Julien Locke Brittany Rogers Kristen Moncks Tyler Werry Maya MacIsaac-Jones Keegan Soehn Taylor Henrich Jessica Niles Brian McKeever ^ Kyle Soehn Abigail Strate Brook Sedore Athletics Graham Nishikawa ^ Hockey Snowboard Leah Shevkenek Maria Bernard Derek Zaplotinsky ^ Danielle Smith Jennifer Brown ^ Karly Heffernan Carter Jarvis Lucas Van Berkel Kendra Clarke Curling Emerance Maschmeyer Christopher Robanske Rudy Verhoeff Isatu Fofanah Rachel Brown Meaghan Reid Joshua Reeves Graham Vigrass Elizabeth Gleadle Chelsea Carey Shannon Szabados Max Vriend Akeem Haynes Joanne Courtney Soccer Brett Walsh Alister McQueen ^ Dana Ferguson Sledge Hockey Stephanie Labbe Jessica O’Connell Marc Kennedy Zachary Lavin ^ Danica Wu Beach Volleyball Sage Watson Kevin Koe Zachary Moore-Savge -

Danielle Smith

Danielle Smith Danielle Smith hosts the Danielle Smith Show on NewsTalk770 in Calgary. As a University of Calgary graduate with degrees in Economics and English, Danielle has had a lifelong interest in Alberta public policy and finding the right balance between free enterprise and individual rights, and the role of government. Danielle’s public policy experience began with an internship at the Fraser Institute. She was also elected as a trustee for the Calgary board of education and served as the director of the Alberta Property Rights Initiative and the Canadian Property Rights Research Institute. She was also the director of provincial affairs for Alberta with the Canadian Federation of Independent Business. Most recently she was a Member of the Legislative Assembly for Highwood, leader of the Official Opposition, and leader of the Wildrose Party. Before entering politics, Danielle had extensive experience in the media. She was an editorial writer and columnist at the Calgary Herald for six years. She served as host of Global Sunday, a national current affairs television talk show, and was also the host of two programs on CKMX 1060 AM radio in Calgary, Health Frontiers and Standing Ground. She has made frequent guest appearances as a commentator on TV and radio. She married her husband, David Moretta in 2006 and is the proud stepmother of David’s son Jonathan. Danielle and David live in High River with their two dogs, Caine and Colt. Professional Highlights: • MLA for Highwood, 2012-2015 • Leader of the Official Opposition, 2012-2014 • Leader of the Wildrose Party, 2009-2014 • Canadian Federation of Independent Business, Alberta Director 2006-2009 • Editorial Writer and Columnist, Calgary Herald, 1999-2006 • TV Host, Global Sunday, 2003-2005 • Trustee, Calgary Board of Education, 1998-1999 • Managing Director, Canadian Property Rights Research Institute, 1997-1999 • Intern, Fraser Institute, 1996-1997 Academic Highlights: • Bachelor of Arts in Economics, University of Calgary (1997) • Bachelor of Arts in English, University of Calgary (1997) . -

Alberta Counsel Newsletter Issue 99 2020

THE ISSUE Alberta’s Premier Review of 99 NEWS Politics and Government Vitality JANUARY/2020 from UNPRECEDENTED DECADE IN ALBERTA POLITICS Jim Prentice, although victorious, renounced his seat right after the provincial election, sending Calgary Lougheed voters to the polls for the 3rd time in roughly one year. In the September 3, 2015 by-election they elected Prassad Panda of the COMES TO AN END Wildrose Party. Tragedy struck in the fall of 2015 with the unfortunate death of former Cabinet Minister Manmeet Bhullar. Robert Reynolds, Q.C. He was killed in a traffic accident on Highway 2 around Red Deer when he attempted to help a motorist during a snowstorm and was struck himself. His successor in Calgary-Greenway was Prab Gill who ran as a PC, but would ultimately become an Independent amidst accusations of participating in voter irregularity. How amazing were the 2010s in Alberta politics? The decade saw the demise of the Progressive Conservative Party, which had governed Alberta from 1971 – 2015. It saw the first NDP government in the province’s history, which also turned out to Undoubtedly the biggest political move during the period was the creation of the United Conservative Party (UCP) from the merger of the PC and Wildrose parties. Jason Kenney won the leadership by defeating Wildrose Leader Brian Jean and now Senior Editor: Pascal Ryffel be the only one-term government since Alberta entered Confederation and became a province in 1905. There were 6 Minister of Justice Doug Schweitzer. The resignation of long-time PC and then UCP MLA Dave Rodney led to Kenney Publisher: Alberta Counsel premiers in the decade (Stelmach, Redford, Hancock, Prentice, Notley and Kenney). -

Subject Index

48 / Aboriginal Art Media Names & Numbers 2009 Alternative Energy Sources SUBJECT INDEX Aboriginal Art Anishinabek News . 188 New Internationalist . 318 Ontario Beef . 321 Inuit Art Quarterly . 302 Batchewana First Nation Newsletter. 189 Travail, capital et société . 372 Ontario Beef Farmer. 321 Journal of Canadian Art History. 371 Chiiwetin . 219 African/Caribbean-Canadian Ontario Corn Producer. 321 Native Women in the Arts . 373 Aboriginal Rights Community Ontario Dairy Farmer . 321 Aboriginal Governments Canadian Dimension . 261 Canada Extra . 191 Ontario Farmer . 321 Chieftain: Journal of Traditional Aboriginal Studies The Caribbean Camera . 192 Ontario Hog Farmer . 321 Governance . 370 Native Studies Review . 373 African Studies The Milk Producer . 322 Ontario Poultry Farmer. 322 Aboriginal Issues Aboriginal Tourism Africa: Missing voice. 365 Peace Country Sun . 326 Aboriginal Languages of Manitoba . 184 Journal of Aboriginal Tourism . 303 Aggregates Prairie Hog Country . 330 Aboriginal Peoples Television Aggregates & Roadbuilding Aboriginal Women Pro-Farm . 331 Network (APTN) . 74 Native Women in the Arts . 373 Magazine . 246 Aboriginal Times . 172 Le Producteur de Lait Québecois . 331 Abortion Aging/Elderly Producteur Plus . 331 Alberta Native News. 172 Canadian Journal on Aging . 369 Alberta Sweetgrass. 172 Spartacist Canada . 343 Québec Farmers’ Advocate . 333 Academic Publishing Geriatrics & Aging. 292 Regional Country News . 335 Anishinabek News . 188 Geriatrics Today: Journal of the Batchewana First Nation Newsletter. 189 Journal of Scholarly Publishing . 372 La Revue de Machinerie Agricole . 337 Canadian Geriatrics Society . 371 Rural Roots . 338 Blackfly Magazine. 255 Acadian Affairs Journal of Geriatric Care . 371 Canadian Dimension . 261 L’Acadie Nouvelle. 162 Rural Voice . 338 Aging/Elderly Care & Support CHFG-FM, 101.1 mHz (Chisasibi). -

FACTOR 2006-2007 Annual Report

THE FOUNDATION ASSISTING CANADIAN TALENT ON RECORDINGS. 2006 - 2007 ANNUAL REPORT The Foundation Assisting Canadian Talent on Recordings. factor, The Foundation Assisting Canadian Talent on Recordings, was founded in 1982 by chum Limited, Moffat Communications and Rogers Broadcasting Limited; in conjunction with the Canadian Independent Record Producers Association (cirpa) and the Canadian Music Publishers Association (cmpa). Standard Broadcasting merged its Canadian Talent Library (ctl) development fund with factor’s in 1985. As a private non-profit organization, factor is dedicated to providing assistance toward the growth and development of the Canadian independent recording industry. The foundation administers the voluntary contributions from sponsoring radio broadcasters as well as two components of the Department of Canadian Heritage’s Canada Music Fund which support the Canadian music industry. factor has been managing federal funds since the inception of the Sound Recording Development Program in 1986 (now known as the Canada Music Fund). Support is provided through various programs which all aid in the development of the industry. The funds assist Canadian recording artists and songwriters in having their material produced, their videos created and support for domestic and international touring and showcasing opportunities as well as providing support for Canadian record labels, distributors, recording studios, video production companies, producers, engineers, directors– all those facets of the infrastructure which must be in place in order for artists and Canadian labels to progress into the international arena. factor started out with an annual budget of $200,000 and is currently providing in excess of $14 million annually to support the Canadian music industry. Canada has an abundance of talent competing nationally and internationally and The Department of Canadian Heritage and factor’s private radio broadcaster sponsors can be very proud that through their generous contributions, they have made a difference in the careers of so many success stories. -

Directory of Radio Stations in Canada

Stations in Canada Alberta Directory of Radio Stations in Canada CKIK -FM -Apr 15, 1982: 107.3 mhz; 100 kw. Ant 638 ft. 9319. Licensee: Big West Communications Corp. (acq TL: N51 03 54 W114 12 47. Stereo. Suite 1900, 125 9th 9- 7 -95). Rep: Canadian Broadcast Sales. Format: Alberta Ave. S.E. (T2G OP6). (403) 264 -0107; (403) 233 -0770. Country. News staff one; news progmg 16 hrs wkly. Tar- FAX: (403) 232-6492. Ucensee: Westcom International get aud: General; people with money to spend. Mel Group. Format: RocWAOR. News staff 6; news progmg Stevenson, pres, dev dir & pub affrs dir; Grady McCue, Athabasca 3 hrs wkly. Target aud: 25-44. Allan Anaka, pres, gen gen mgr, opns mgr, dev dir & progmg mgr; Mary Anne mgr & opns mgr; Baxter, & Becker, CKBA(AM)-Aug 1, 1989: 850 khz; 1 kw -D. Box 1800, Gail O'Reilly, mktg dir; Roger Untinen, sls dir, mktg dir adv mgr, Kevin asst Westock (TOG 2L0). (403) 675-5301. FAX: (403) 349- mus dir; Bruce McDonald, asst mus dir; Dave Taylor, mus dir, Peter Scott, news dir; Don Soucy, chief engr. 6259. Licensee: Nornet Broadcasting Ltd. (group news dir, Wade Wensink, chief engr. Rates: C$42; 38; 40; 25. owner). Net: CBC Radio. Format: C &W. CHOR(AM) -Co -owned with CKIK -FM. November 1964: 770 khz; 50 kw -U, DA -2. Stereo. Hrs opn: 24. (Acq Drumheller 4- 15 -70.) Net: NBC. Rep: Canadian Broadcast Sales, Blairmore Dora -Clayton. Format: Full service, news/talk, sports. CKDO(AM) -1958: 910 khz; 50 kw -U, DA -2. -

I Equalization and the Offshore Accords of 2005 a Thesis Submitted

Equalization and the Offshore Accords of 2005 A Thesis Submitted to the College of Graduate Studies and Research in Partial Fulfillment of the Requirements for the Master of Arts in the Department of Political Studies University of Saskatchewan Saskatoon, Saskatchewan Ashley Metz Copyright Ashley Metz, October 2006, All Rights Reserved i Permission To Use In presenting this thesis in partial fulfillment of the requirements for a Graduate degree from the University of Saskatchewan, I agree the Libraries of the University may make it freely available for inspection. I further agree that permission for copying of this thesis in any manner, in whole or in part, for scholarly purposes may be granted by the professor or professors who supervised my thesis work, or in their absence, by the Head of the Department of Political Studies or the Dean of the College of Graduate Studies and Research. It is understood that any copy or publication or use of this thesis or parts thereof for financial gain shall not be allowed without my written permission. It is also understood that due recognition shall be given to me and to the University of Saskatchewan in any scholarly use which may be made of the material in my thesis. Requests for permission to copy or make other use of material in this thesis in whole or part should be addressed to: Head of the Department of Political Studies University of Saskatchewan 9 Campus Drive Saskatoon, Saskatchewan S7N 5A5 i Abstract The ad hoc Offshore Accords of 2005 have fundamentally altered the landscape of regional redistribution and Equalization in Canada for the foreseeable future. -

Asper Nation Other Books by Marc Edge

Asper Nation other books by marc edge Pacific Press: The Unauthorized Story of Vancouver’s Newspaper Monopoly Red Line, Blue Line, Bottom Line: How Push Came to Shove Between the National Hockey League and Its Players ASPER NATION Canada’s Most Dangerous Media Company Marc Edge NEW STAR BOOKS VANCOUVER 2007 new star books ltd. 107 — 3477 Commercial Street | Vancouver, bc v5n 4e8 | canada 1574 Gulf Rd., #1517 | Point Roberts, wa 98281 | usa www.NewStarBooks.com | [email protected] Copyright Marc Edge 2007. All rights reserved. No part of this work may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, without the prior written consent of the publisher or a licence from the Canadian Copyright Licensing Agency (access Copyright). Publication of this work is made possible by the support of the Canada Council, the Government of Canada through the Department of Cana- dian Heritage Book Publishing Industry Development Program, the British Columbia Arts Council, and the Province of British Columbia through the Book Publishing Tax Credit. Printed and bound in Canada by Marquis Printing, Cap-St-Ignace, QC First printing, October 2007 library and archives canada cataloguing in publication Edge, Marc, 1954– Asper nation : Canada’s most dangerous media company / Marc Edge. Includes bibliographical references and index. isbn 978-1-55420-032-0 1. CanWest Global Communications Corp. — History. 2. Asper, I.H., 1932–2003. I. Title. hd2810.12.c378d34 2007 384.5506'571 c2007–903983–9 For the Clarks – Lynda, Al, Laura, Spencer, and Chloe – and especially their hot tub, without which this book could never have been written. -

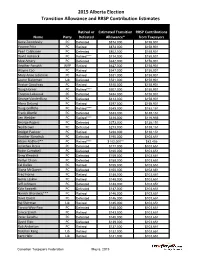

2015 Alberta Election Transition Allowance and RRSP Contribution Estimates

2015 Alberta Election Transition Allowance and RRSP Contribution Estimates Retired or Estimated Transition RRSP Contributions Name Party Defeated Allowance* from Taxpayers Gene Zwozdesky PC Defeated $874,000 $158,901 Yvonne Fritz PC Retired $873,000 $158,901 Pearl Calahasen PC Defeated $802,000 $158,901 David Hancock PC Retired**** $714,000 $158,901 Moe Amery PC Defeated $642,000 $158,901 Heather Forsyth WRP Retired $627,000 $158,901 Wayne Cao PC Retired $547,000 $158,901 Mary Anne Jablonski PC Retired $531,000 $158,901 Laurie Blakeman Lib Defeated $531,000 $158,901 Hector Goudreau PC Retired $515,000 $158,901 Doug Horner PC Retired**** $507,000 $158,901 Thomas Lukaszuk PC Defeated $484,000 $158,901 George VanderBurg PC Defeated $413,000 $158,901 Alana DeLong PC Retired $397,000 $158,901 Doug Griffiths PC Retired**** $349,000 $152,151 Frank Oberle PC Defeated $333,000 $138,151 Len Webber PC Retired**** $318,000 $116,956 George Rogers PC Defeated $273,000 $138,151 Neil Brown PC Defeated $273,000 $138,151 Bridget Pastoor PC Retired $238,000 $138,151 Heather Klimchuk PC Defeated $195,000 $103,651 Alison Redford** PC Retired**** $182,000** $82,456 Jonathan Denis PC Defeated $177,000 $103,651 Robin Campbell PC Defeated $160,000 $103,651 Greg Weadick PC Defeated $159,000 $103,651 Verlyn Olson PC Defeated $158,000 $103,651 Cal Dallas PC Retired $155,000 $103,651 Diana McQueen PC Defeated $150,000 $103,651 Fred Horne PC Retired $148,000 $103,651 Genia Leskiw PC Retired $148,000 $103,651 Jeff Johnson PC Defeated $148,000 $103,651 Kyle Fawcett -

Orange Chinook: Politics in the New Alberta

University of Calgary PRISM: University of Calgary's Digital Repository University of Calgary Press University of Calgary Press Open Access Books 2019-01 Orange Chinook: Politics in the New Alberta University of Calgary Press Bratt, D., Brownsey, K., Sutherland, R., & Taras, D. (2019). Orange Chinook: Politics in the New Alberta. Calgary, AB: University of Calgary Press. http://hdl.handle.net/1880/109864 book https://creativecommons.org/licenses/by-nc-nd/4.0 Attribution Non-Commercial No Derivatives 4.0 International Downloaded from PRISM: https://prism.ucalgary.ca ORANGE CHINOOK: Politics in the New Alberta Edited by Duane Bratt, Keith Brownsey, Richard Sutherland, and David Taras ISBN 978-1-77385-026-9 THIS BOOK IS AN OPEN ACCESS E-BOOK. It is an electronic version of a book that can be purchased in physical form through any bookseller or on-line retailer, or from our distributors. Please support this open access publication by requesting that your university purchase a print copy of this book, or by purchasing a copy yourself. If you have any questions, please contact us at [email protected] Cover Art: The artwork on the cover of this book is not open access and falls under traditional copyright provisions; it cannot be reproduced in any way without written permission of the artists and their agents. The cover can be displayed as a complete cover image for the purposes of publicizing this work, but the artwork cannot be extracted from the context of the cover of this specific work without breaching the artist’s copyright. COPYRIGHT NOTICE: This open-access work is published under a Creative Commons licence. -

The Wildrose Alliance in Alberta Politics

SPP Research Papers Volume 4•Issue 6• May 2011 IS THIS THE END OF THE TORY DYNASTY? The Wildrose Alliance in Alberta Politics Anthony M. Sayers and David K. Stewart1 University of Calgary ABSTRACT The Alberta Tory dynasty begun by Peter Lougheed is now 40 years old. With only four leaders across four decades, the party has managed to maintain its hold on the political imagination of Albertans. It has weathered a number of storms, from minor party assaults during the tumultuous 1980s to the Liberal threat of 1993 and the stresses associated with the global financial crisis. Now it confronts a new challenge in the form of the Wildrose Alliance led by Danielle Smith. Just as the Tories stole the centre ground from beneath Social Credit in the 1970s, the Wildrose leadership team hopes to take what was a fringe right wing party and turn it into a broad coalition capable of appealing to a large number of Albertans. What challenges do they face in repositioning the party? And how will the Tories protect their home turf? In brief, the Wildrose Alliance must modify its policies and present them in such a manner as to be able to plausibly claim that it now reflects the core values of Albertans better than the current government. For its part, the government must select a new leader capable of successfully painting Wildrose as outsiders who cannot be trusted to cleave to the values that Albertans hold dear. What are these values? Strong support for individualism, a populist view of government – including wariness of the federal government – combined with a deep commitment to a role for government in providing core programs in areas such as health care, the environment, and social welfare.