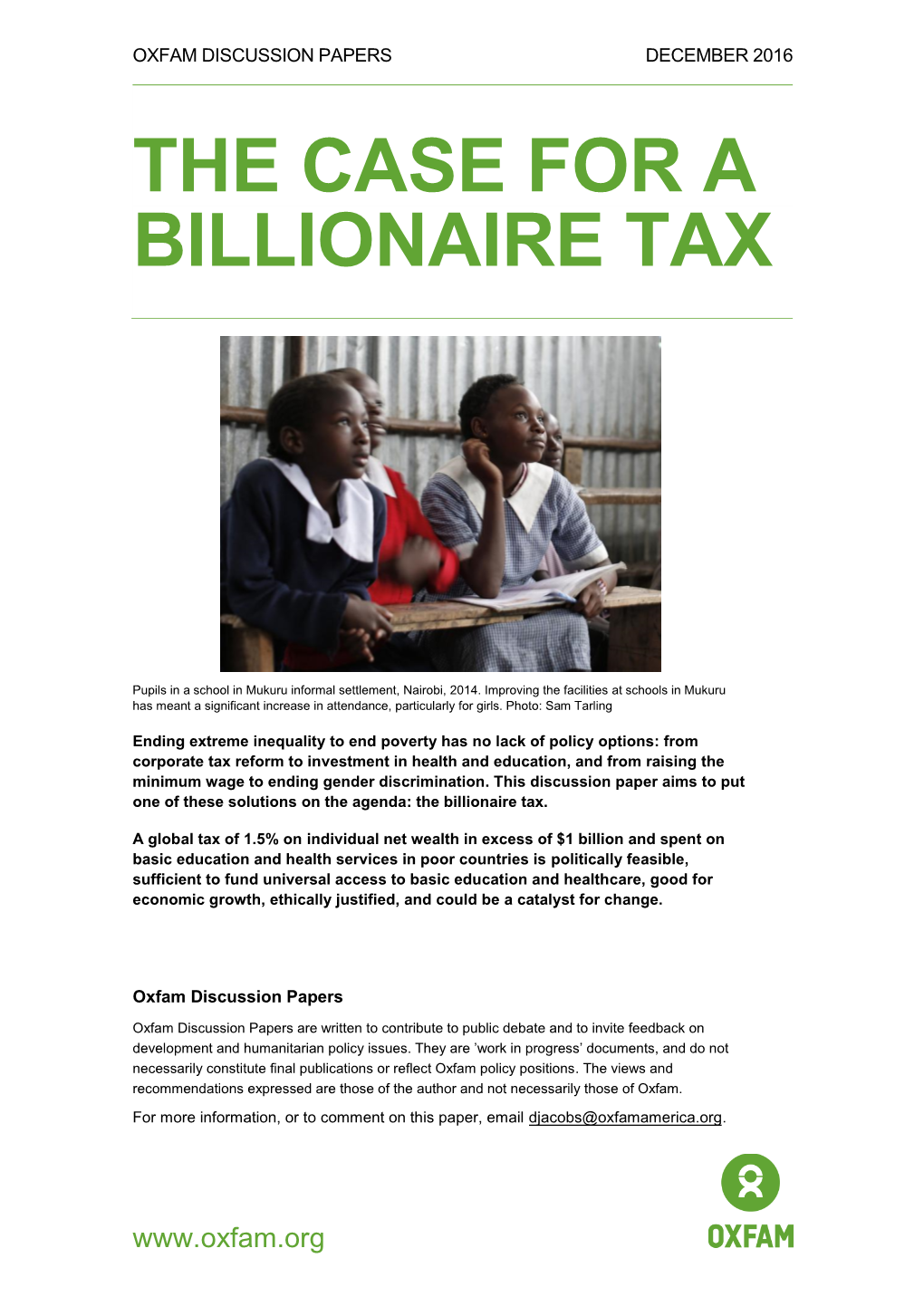

The Case for a Billionaire Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Northern Ireland

1 Northern Ireland The Atlantic Philanthropies Northern Ireland 2 2 More than 22,000TheThe students share classes, resourcesAtlanticAtlantic and facilities each PhilanthropiesPhilanthropies week in Northern Ireland, bringing children, parents and teachers of Catholic and Protestant communities together. In Derry/Londonderry, these students from St. Mary’s and Lisneal colleges share a citizenship class. Foreword 6 Preface 10 Summary 13 Northern Ireland 18 Grantee Profiles 41 Northern Ireland Alternatives 43 Lifestart Foundation 49 The Detail 53 Suffolk Lenadoon Interface Group 56 Alzheimers Society NI — Dementia 63 Friendly Communities Sonic Arts Research Centre, 65 Queen’s University Integrated and Shared Education 69 Committee on the Administration 76 of Justice South Tyrone Empowerment 80 Programme (STEP) Lessons 84 Acknowledgements 105 The Atlantic Philanthropies Northern Ireland BY SUSAN Mc KAY In 2012, Chuck Feeney received an unprecedented joint Honorary Doctorate of Laws from all nine universities, in the North and the Republic, in recognition of his contributions to higher education. Dedication To Charles Francis Feeney, whose generosity and vision have improved the lives of millions, on the island of Ireland and across the globe. 6 Northern Ireland Foreword have had the good fortune both to work for grantee organisations supported by The Atlantic Philanthropies and to have also worked for I Atlantic itself. My connection with Atlantic and Chuck Feeney goes back over 20 years. Chuck’s values, style and approach to his philanthropy shaped Atlantic’s approach to giving. Once he decided to support an organisation, he trusted it to get on with the work. He also placed a high degree of confidence and autonomy in Atlantic’s staff charged with making recommendations on where money should be awarded. -

Protecting Donor Privacy Philanthropic Freedom, Anonymity and the First Amendment

Protecting Donor Privacy Philanthropic Freedom, Anonymity and the First Amendment www.PhilanthropyRoundtable.org www.ACReform.org Contents 1 Executive Summary 3 Introduction 3 A Rich Tradition and History of Anonymous Giving 7 A Constitutionally Protected Right 9 Activists and Attorneys General Threaten Donor Privacy 13 Legislators Seek to Undermine Anonymous Giving 14 Is Anonymity Still Needed? 16 Confusing Politics, Government, and Charity 18 Ideology and Donor Privacy 20 Donor Anonymity is Worth Protecting 22 Endnotes Executive Summary among them for supporters of unpopular causes or organizations is the reality that exposure will lead to harassment or threat The right of charitable donors to remain of retribution. anonymous has long been a hallmark of American philanthropy for donors both large Among the more prominent examples is the and small. Donor privacy allows charitable harassment of brothers Charles and David givers to follow their religious teachings, Koch, who have helped fund a broad range insulate themselves from retribution, avoid of nonprofit organizations ranging from unwanted solicitations, and duck unwelcome Memorial Sloan Kettering Cancer Center publicity. It also upholds and protects important to the libertarian-oriented Cato Institute, as First Amendment rights of free speech and well as organizations that engage in political association. However, recent actions by activity. As a result of their giving, the Koch elected officials, activists, and organizations brothers and their companies routinely face are challenging this right and threatening death threats, cyber-attacks from the hacker to undermine private philanthropy’s ability group “Anonymous,” and boycotts aimed at to effectively address some of society’s most the many consumer products their companies challenging issues. -

The Atlantic Philanthropies' Investments in Higher Education

The Atlantic Philanthropies’ Investments in Higher Education Susan Parker December 2019 Contents Overview of Numbers and Key Grantee Accomplishments ............................................................................................................... Page 3 Introduction ................................................................................................................................................................................................................................................... Page 4 Chuck Feeney and Atlantic’s Approach ...................................................................................................................................................................... Page 4 Where Atlantic Invested................................................................................................................................................................................................................. Page 6 United States .................................................................................................................................................................................................................................................Page 7 Republic of Ireland ..............................................................................................................................................................................................................................Page 14 Northern Ireland ................................................................................................................................................................................................................................ -

Norms and Narratives That Shape US Charitable and Philanthropic Giving Benjamin Soskis March 2021

CENTER ON NONPROFITS AND PHILANTHROPY RESEARCH REPORT Norms and Narratives That Shape US Charitable and Philanthropic Giving Benjamin Soskis March 2021 ABOUT THE URBAN INSTITUTE The nonprofit Urban Institute is a leading research organization dedicated to developing evidence-based insights that improve people’s lives and strengthen communities. For 50 years, Urban has been the trusted source for rigorous analysis of complex social and economic issues; strategic advice to policymakers, philanthropists, and practitioners; and new, promising ideas that expand opportunities for all. Our work inspires effective decisions that advance fairness and enhance the well-being of people and places. Copyright © March 2021. Urban Institute. Permission is granted for reproduction of this file, with attribution to the Urban Institute. Cover image by Tim Meko. Contents Acknowledgments iv Executive Summary v Norms and Narratives That Shape US Charitable and Philanthropic Giving 1 The Rise of Large-Scale Philanthropy 3 Narratives of Mass Giving’s Decline in the United States 9 Megaphilanthropy and Everyday Giving during the COVID-19 Crisis 13 The COVID-19 Crisis, Mutual Aid, and the Revitalization of Everyday Giving 16 The Surging Popularity of Cash Transfers during the COVID-19 Crisis 21 The Development of Norms around Time-Based Giving 26 Time-Based Norms and Narratives during the COVID-19 Crisis 32 Giving Norms and Narratives in a Postpandemic World 36 Notes 39 References 46 About the Author 49 Statement of Independence 50 Acknowledgments This report was funded by the Bill & Melinda Gates Foundation, with additional support from the William and Flora Hewlett Foundation. We are grateful to them and to all our funders, who make it possible for Urban to advance its mission. -

Giving While Living Chuck Feeney, Founding Chairman of the Atlantic Philanthropies

Atlantic Insights Giving While Living Chuck Feeney, founding chairman of The Atlantic Philanthropies. Foreword 3 Introduction 7 Chuck Feeney’s Good Fortune 10 The Roots of Feeney’s Philanthropy 12 Feeney the Entrepreneur 13 Too Much Wealth 14 The Journey Begins 15 Ireland Beckons 16 The Perfect Project 18 Testing 18 Feeney’s Philanthropic Process 21 Big Bet + Leverage = Changed Landscape 23 Philanthropy Lessons 27 Making Money and Giving It Away: 29 Straddling the Divide Giving While Living Leads to Limited Life 31 The Founder and the Foundation 33 The “New Atlantic” in Ireland 35 The Final Phase 36 Conclusion 37 A Revolution in Philanthropy 38 The Atlantic Philanthropies Atlantic Insights Giving While Living BY HEIDI WALESON Chuck Feeney, Helping people — that’s been founder, The Atlantic Philanthropies, Atlantic’s work and Christopher G. Oechsli, president and CEO. 3 Atlantic Insights: Giving While Living Foreword BY CHRISTOPHER G. OECHSLI PRESIDENT AND CEO, THE ATLANTIC PHILANTHROPIES he common quest of all who seek to achieve lasting improvements in our communities and in our world — whether we are individual Tdonors, foundations, nonprofits or government agencies — is to make the highest and best use of our resources. It requires us to ask questions like: What are our best opportunities to make a difference? What impact can we have and how do we know what impact our grants are having? What are grantee organizations accomplishing? What’s working… what’s not? Or, as Chuck Feeney, founder of The Atlantic Philanthropies, never hesitated to ask, starting with the foundation’s first grants in 1982: What will we have to show for it? As we near the end of our organization’s life, and have fully committed our endowment and will close our doors for good by 2020, we’re not asking those questions to guide our work. -

Silver Spoon Oligarchs

CO-AUTHORS Chuck Collins is director of the Program on Inequality and the Common Good at the Institute for Policy Studies where he coedits Inequality.org. He is author of the new book The Wealth Hoarders: How Billionaires Pay Millions to Hide Trillions. Joe Fitzgerald is a research associate with the IPS Program on Inequality and the Common Good. Helen Flannery is director of research for the IPS Charity Reform Initiative, a project of the IPS Program on Inequality. She is co-author of a number of IPS reports including Gilded Giving 2020. Omar Ocampo is researcher at the IPS Program on Inequality and the Common Good and co-author of a number of reports, including Billionaire Bonanza 2020. Sophia Paslaski is a researcher and communications specialist at the IPS Program on Inequality and the Common Good. Kalena Thomhave is a researcher with the Program on Inequality and the Common Good at the Institute for Policy Studies. ACKNOWLEDGEMENTS The authors wish to thank Sarah Gertler for her cover design and graphics. Thanks to the Forbes Wealth Research Team, led by Kerry Dolan, for their foundational wealth research. And thanks to Jason Cluggish for using his programming skills to help us retrieve private foundation tax data from the IRS. THE INSTITUTE FOR POLICY STUDIES The Institute for Policy Studies (www.ips-dc.org) is a multi-issue research center that has been conducting path-breaking research on inequality for more than 20 years. The IPS Program on Inequality and the Common Good was founded in 2006 to draw attention to the growing dangers of concentrated wealth and power, and to advocate policies and practices to reverse extreme inequalities in income, wealth, and opportunity. -

Careers Presentation

Mr. Wydareny English 9 “Never underestimate the vital importance of finding early in life the work for you that is play. This turns possible under-achievers into happy warriors.” Paul Samuelson: economist http://wwhttps://www.youtube.com/watch?v=6- R0lW_Swiow.personalgrowthcourses.net/video/life_risk http://www.personalgrowthcourses.net/video/unbelievably _lucky Video: “Childhood Interests Can Help You Find the Right Career” https://www.youtube.com/watch?v=6-R0lW_Swio My mom was raped when she was 13, so I never met my dad. My mom ditched me, so I was adopted by people that abused me over the course of 15 years. I got addicted to drugs, stole, and was sent to a detention center. Like my mom, I was raped when I was 14. My baby was born dead. http://www.youtube.com/watch?v=N erTo86BE9w&feature=related Then, suddenly in the silence, something started hissing. It was the decomposition gases escaping from his dead hand. Ralston realized that part of him was dying—and the rest would follow suit. He thought about all the beauty and love in this life. “The story of how I got out of the canyon became national news,” Ralston says, “but I want people to understand the motivation for why I was there in the first place. I left my career to pursue a different path as a mountain guide, and that passion led me to the bottom of the canyon. But my passion for life also led me out of it.” “I often tell people, ‘May your boulder be your blessing,’” he says. -

Giving While Living

Giving While Living. Marking Nearly Four Decades of Achievements: 1982–2018 “I had one idea that never changed in my mind —that you should use your wealth to help people.” Chuck Feeney Front Cover: Tristan Adams at home in Cape Town, South Africa, after recovering from heart surgery at the pediatric intensive care unit at the Red Cross War Memorial Children’s Hospital. Atlantic funded the hospital’s new operating theaters. Photo: George Mahashe, Magnum Foundation Back Cover: Dao Thi Diep is able to take care of her family again following cataract surgery on both eyes during the Fred Hollows Foundation’s free operation campaign in Quang Tri province in Viet Nam. Atlantic worked to improve access to health care in the country. Photo: Audra Melton Contents Giving While… Supporting Aging 6–11 Growing Children and Youth 12–17 Improving Population Health 18–27 Advancing Reconciliation & Human Rights 28–37 Strengthening Bermuda 38–41 Building Founding Chairman 42–53 Leading Atlantic Fellows 54–59 Living The Giving Pledge 60–63 1 “Our grants, now completed, are like sown seeds which will bear the fruit of good works long after we turn out the lights at The Atlantic Philanthropies.” Chuck Feeney, founder of The Atlantic Philanthropies, December 2016 Nearly four decades ago, Chuck Feeney made the unprecedented decision to donate virtually all his wealth to The Atlantic Philanthropies. A believer in Giving While Living, he wanted his money to be used to better humanity during his lifetime. In keeping with those wishes, the foundation in the years since committed all its resources to advance opportunity, equity and human dignity and to create lasting improvements for those who are unfairly disadvantaged or vulnerable to life’s circumstances. -

The Billionaire Who Wanted to Die Broke . . . Is Now Officially Broke

The Billionaire Who Wanted To Die Broke . Is Now Officially Broke By Steve Bertoni Forbes Staff Senior VP & Senior Editor: Forbes CEO Network, Tech, Investing It took decades, but Chuck Feeney, the former billionaire cofounder of retail giant Duty Free Shoppers has finally given all his money away to charity. He has nothing left now— and he couldn’t be happier. Charles “Chuck” Feeney, 89, who cofounded airport retailer Duty Free Shoppers with Robert Miller in 1960, amassed billions while living a life of monklike frugality. As a philanthropist, he pioneered the idea of Giving While Living—spending most of your fortune on big, hands-on charity bets instead of funding a foundation upon death. Since you can’t take it with you—why not give it all away, have control of where it goes and see the results with your own eyes? “We learned a lot. We would do some things differently, but I am very satisfied. I feel very good about completing this on my watch,” Feeney tells Forbes. “My thanks to all who joined us on this journey. And to those wondering about Giving While Living: Try it, you’ll like it.” Over the last four decades, Feeney has donated more than $8 billion to charities, universities and foundations worldwide through his foundation, the Atlantic Philanthropies. When I first met him in 2012, he estimated he had set aside about $2 million for his and his wife’s retirement. In other words, he’s given away 375,000% more money than his current net worth. And he gave it away anonymously. -

Harvest Time for the Atlantic Philanthropies, 2012-2013: Decline & Rise,” Duke University, Center for Strategic Philanthropy and Civil Society, P

HARVEST TIME for THE ATLANTIC PHILANTHROPIES FINAL PRIORITIES Associate Director for Research i TABLE OF CONTENTS Foreword & Acknowledgments ............................................................................................................ ii SUMMARY ........................................................................................................................................ iii I. PROGRAM: THE END & THE BEGINNING .....................................................................................1 ‘Time to Pull the Trigger’ ...................................................................................................................... 3 Setting ‘the Final Priorities’ .................................................................................................................. 6 ‘Catalyzing a Future Beyond Atlantic’ .................................................................................................. 7 Living On, Spinning Off ......................................................................................................................... 9 Next: Developing Human Capital ....................................................................................................... 13 Ending, Sustaining, and Beginning: A View from Two Programs ....................................................... 14 II. PERSONNEL: ‘A TOTALLY DIFFERENT ORGANIZATION’ ............................................................... 23 Management With Improvisation ..................................................................................................... -

Republic of Ireland

1 Republic of Ireland The Atlantic Philanthropies Republic of Ireland 2 Mosaic mural byThe the late Desmond Kinney depictsAtlantic the old Irish tale of Philanthropies Buile Suibhne and incorporates lines from Seamus Heaney’s “Sweeney Astray” at the University Concert Hall, University of Limerick. Foreword 7 Preface 11 Summary 13 Republic of Ireland 18 Grantee Profiles 57 Northside Partnership 59 Doras Luimní 61 The Alzheimer Society of Ireland 65 Glenstal Abbey 67 Mercer’s Institute for 70 Successful Ageing Genio 75 Children’s Rights Alliance 77 National University of Ireland, Galway 80 Nasc 83 Lessons 86 Acknowledgements 103 The Atlantic Philanthropies Republic of Ireland BY LIAM COLLINS Chuck Feeney receives an unprecedented joint Honorary Doctorate of Laws from all nine Irish universities. To Charles Francis Feeney, whose generosity and vision have improved the lives of millions, on the island of Ireland and across the globe. The Mall at “The past is a foreign country; Dublin City University. they do things differently there.” L.P. Hartley, “The Go-Between” 7 Republic of Ireland Foreword In the not-so-distant past of the 1980s, Ireland was indeed a very different country from the one we know now, and we did things very differently there. The nation was facing many challenges, both economic and social. Economic recession and high levels of unemployment led to mass emigration. Ireland remained a conservative society where human rights for many were constrained, and services for the young and old were limited, at best. Perhaps unsurprisingly in this environment, education suffered from a serious lack of investment, and, in particular, higher education was in the doldrums. -

News Lessons: Chuck Feeney—Advanced

Billionaire Chuck Feeney achieves goal of giving away his fortune Level 3 l Advanced 1 Warmer According to a list published in 2020, these are some of the world’s richest people. Match the people with the descriptions. 1. Jeff Bezos a. the co-founder of Facebook 2. Bill Gates b. the CEO of an American conglomerate 3. Mark Zuckerberg c. the chairman of Inditex fashion group, best known for Zara 4. Warren Buffett d. the founder of Amazon 5. Amancio Ortega e. the chairman of LVMH, the world’s largest luxury-goods company 6. Bernard Arnault f. the co-founder of Microsoft 2 Key words Complete the sentences using these key words from the text. dumbfounded empathize ambition intractable frugal philanthropy dissolve endowment trustee on your watch 1. An __________________________ is something that you very much want to do, usually something that is difficult to achieve. 2. An __________________________ is an amount of money that someone gives to an institution. 3. __________________________ is the belief that you should help people, especially by giving money to those who need it. 4. If people __________________________ a group or organization, they formally end it. 5. If something happens __________________________, it happens during the time you are responsible for it. 6. An __________________________ problem is one that is very difficult or impossible to deal with. 7. If you are __________________________, you are so surprised that you do not know what to do or say. 8. A __________________________ is someone who is responsible for looking after money or property that belongs to someone else.