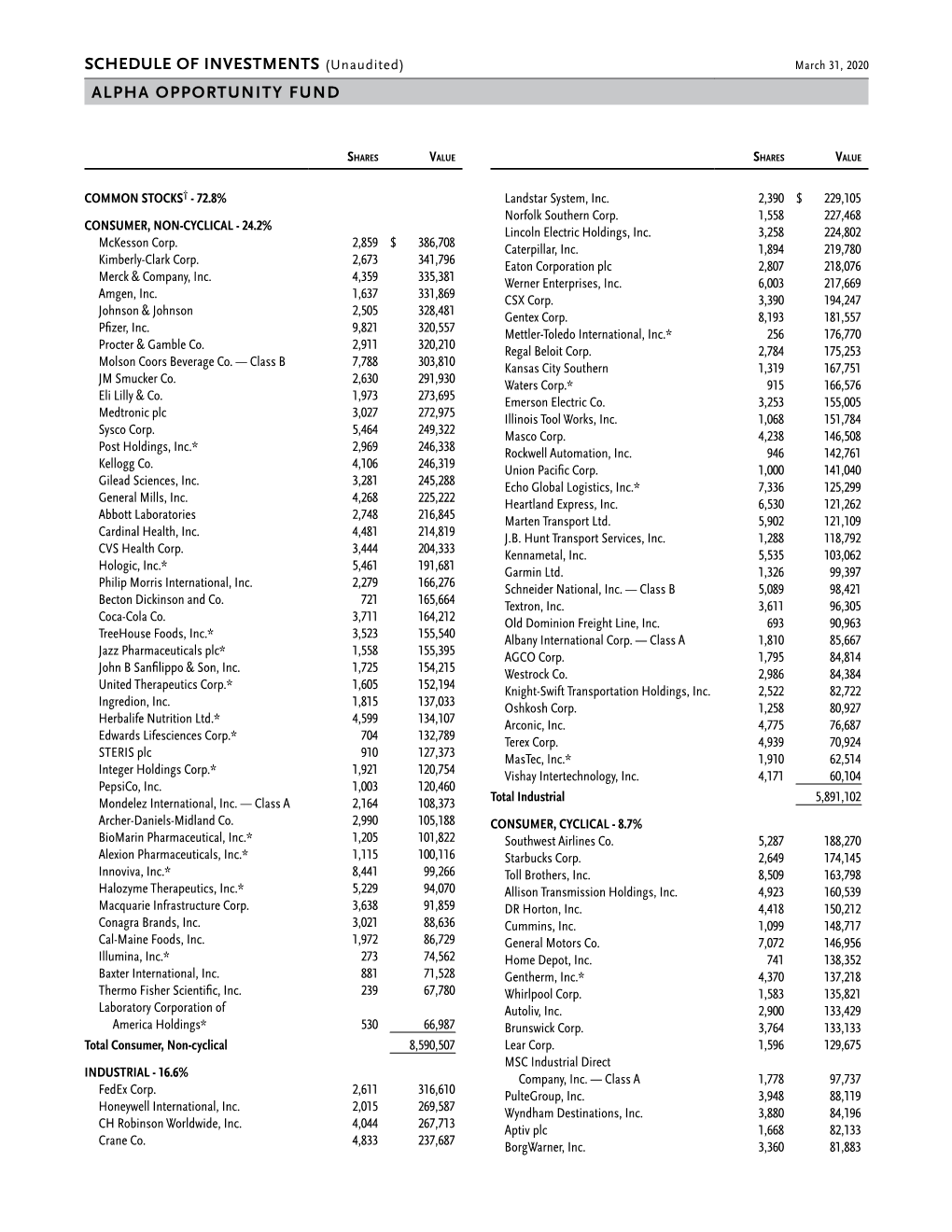

Alpha Opportunity Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

In the United States Bankruptcy Court for the District of Delaware

Case 19-10684 Doc 16 Filed 04/01/19 Page 1 of 1673 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE x In re: : Chapter 11 : HEXION HOLDINGS LLC, et al.,1 : Case No. 19-10684 ( ) : Debtors. : Joint Administration Requested x NOTICE OF FILING OF CREDITOR MATRIX PLEASE TAKE NOTICE that the above-captioned debtors and debtors in possession have today filed the attached Creditor Matrix with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Hexion Holdings LLC (6842); Hexion LLC (8090); Hexion Inc. (1250); Lawter International Inc. (0818); Hexion CI Holding Company (China) LLC (7441); Hexion Nimbus Inc. (4409); Hexion Nimbus Asset Holdings LLC (4409); Hexion Deer Park LLC (8302); Hexion VAD LLC (6340); Hexion 2 U.S. Finance Corp. (2643); Hexion HSM Holdings LLC (7131); Hexion Investments Inc. (0359); Hexion International Inc. (3048); North American Sugar Industries Incorporated (9735); Cuban-American Mercantile Corporation (9734); The West India Company (2288); NL Coop Holdings LLC (0696); and Hexion Nova Scotia Finance, ULC (N/A). The address of the Debtors’ corporate headquarters is 180 East Broad Street, Columbus, Ohio 43215. RLF1 20960951V.1 Case 19-10684 Doc 16 Filed 04/01/19 Page 2 of 1673 Dated: April 1, 2019 Wilmington, Delaware /s/ Sarah E. Silveira Mark D. Collins (No. 2981) Michael J. Merchant (No. 3854) Amanda R. Steele (No. 5530) Sarah E. Silveira (No. 6580) RICHARDS, LAYTON & FINGER, P.A. -

Printmgr File

As filed with the Securities and Exchange Commission on October 11, 2016 File No. 001-37816 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Amendment No. 5 To FORM 10 GENERAL FORM FOR REGISTRATION OF SECURITIES Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 Alcoa Upstream Corporation* (Exact name of Registrant as specified in its charter) Delaware 81-1789115 (State or other jurisdiction of (I.R.S. employer incorporation or organization) identification number) 390 Park Avenue New York, New York 10022-4608 (Address of principal executive offices) (Zip code) (212) 836-2600 (Registrant’s telephone number, including area code) Securities to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on which to be so Registered Each Class is to be Registered Common Stock New York Stock Exchange Securities to be registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ‘ Accelerated filer ‘ Non-accelerated filer È Smaller reporting company ‘ * The registrant is currently named Alcoa Upstream Corporation. The registrant plans to change its name to “Alcoa Corporation” at or prior to the effective date of the distribution described in this registration statement. ALCOA UPSTREAM CORPORATION INFORMATION REQUIRED IN REGISTRATION STATEMENT CROSS-REFERENCE SHEET BETWEEN INFORMATION STATEMENT AND ITEMS OF FORM 10 Certain information required to be included herein is incorporated by reference to specifically identified portions of the body of the information statement filed herewith as Exhibit 99.1. -

Leadership That Lifts Us All Recognizing Outstanding Philanthropy 2017 - 2018

Leadership That Lifts Us All Recognizing Outstanding Philanthropy 2017 - 2018 uwswpa.org Thank you to our 2017 sponsors: Premier Gold Dear Friends, As philanthropic leaders who, through their generous gifts of time and treasure, demonstrate their commitment to tackling our community’s most pressing problems, we should be proud of the impact we make on the lives of people who need our help. Through our gifts – Tocqueville Society members contributed nearly $10 million to the United Way 2017 Campaign – the most vulnerable members of our community are getting much-needed support: Dan Onorato • local children like Alijah (page 18) are matched with caring mentors who are helping them plan to continue their education after high school; • seniors like Jean (page 4) are receiving support that helps them remain in the homes they love; • people with disabilities like Kenny (page 9) are getting the opportunity to find 1 meaningful work; and • women like Sarah (page 43) are able to overcome challenges in order to gain greater financial stability. On behalf of our community, thank you for your support. Your gift helps United Way put solutions into action, making a difference and encouraging hope for a better David Schlosser tomorrow for everyone. With warmest regards Dan Onorato David Schlosser 2017 Tocqueville Society Co-Chair 2017 Tocqueville Society Co-Chair 2017 Top Tocqueville Corporations The Tocqueville Society Tocqueville Society Membership Growth United Way recognizes these United Way’s Tocqueville Society is corporations that had the largest comprised of philanthropic leaders 2011 430 number of Tocqueville Society and volunteer champions who donors for the 2017 campaign, give $10,000 or more annually to regardless of company size or United Way, creating a profound 2012 458 overall campaign total. -

ARCONIC ROLLED PRODUCTS CORPORATION* (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2019 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 1-39162 ARCONIC ROLLED PRODUCTS CORPORATION* (Exact name of Registrant as specified in its charter) Delaware 84-2745636 (State of incorporation) (I.R.S. Employer Identification No.) 201 Isabella Street, Pittsburgh, Pennsylvania 15212-5872 (Address of principal executive offices) (Zip code) (412) 992-2500 (Registrant’s telephone number, including area code) Securities to be registered pursuant to Section 12(b) of the Act** Title of each class Trading Symbol Name of each exchange on which registered Common Stock ARNC New York Stock Exchange Securities to be registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

Pittsburgh Manufacturers Move Toward Greater Environmental Sustainability, Set New Goals

Pittsburgh manufacturers move toward greater environmental sustainability, set new goals https://www.bizjournals.com/pittsburgh/news/2021/03/02/pittsburgh-manufacturers-face- environmental-impact.html Julia Mericle 2 March 2021 Pittsburgh Business Times © 2021 American City Business Journals, Inc. All rights reserved. "Our journey started by figuring out how to measure everything.” Waste generation. Energy consumption. Water usage. Greenhouse gas emissions. All from a global perspective. Stephanie Reese, global environmental, health and safety and product stewardship manager at Pittsburgh-based MSA Safety Inc., said for the company to improve its environmental sustainability, it had to collect, analyze and, transparently, report this massive amount of data. It's a task that local companies have increasingly been diving into. For many manufacturers, 2020 provided an optimal time to address and prioritize environmental, social and corporate governance (ESG) performance. “The challenges of the last year have really brought to light a lot of these questions about what makes for a strong company over the long haul,” Joylette Portlock, executive director at Sustainable Pittsburgh, said. “As a result, we see more companies examining what it means to be a good employer, a responsible manufacturer or service provider, and a supportive community leader.” The U.S. Environmental Protection Agency attributes 22% of the nation’s total greenhouse gas emissions to industrial sources, and the Pittsburgh metropolitan area marks manufacturing as its fourth-largest industry, according to the 2018 Catalyst Connection Manufacturing Scorecard. “Imagine if every single one of these manufacturers was able to reduce the energy used in its processes by just a small percentage,” Portlock said. -

Letter to Secretary Chao on FTA Small Starts Funding for Bus Rapid

Richard J. Harshman, Chair William S. Demchak, Vice Chair 11 Stanwix Street, 17th Floor Kimberly Tillotson Fleming, Treasurer Venkee Sharma, Secretary PITTSBURGH, PA 15222-1312 Morgan K. O’Brien, Immediate Past Chair Dennis Yablonsky, Chief Executive Officer T: 412.281.4783 David A. Brownlee, At Counsel F: 412.392.4520 Robert O. Agbede Leroy M. Ball, Jr. AlleghenyConference.org John A. Barbour Paul M. Boechler September 4, 2017 Jeff Broadhurst Julie Caponi Helen Hanna Casey Randall S. Dearth The Honorable Elaine Chao Nicholas J. Deluliis Vincent J. Delie, Jr. Secretary J. Christopher Donahue U.S. Department of Transportation Audrey Dunning Laura E. Ellsworth 1200 New Jersey Ave SE John J. Engel Mark Eubanks Washington, DC 20590 Michele Fabrizi Karen Wolk Feinstein Daniel K. Fitzpatrick RE: Urban Redevelopment Authority of Pittsburgh Downtown- Dawn Fuchs Patrick D. Gallagher Uptown-Oakland-East End Bus Rapid Transit (BRT) Project – FY19 William P. Getty Kenneth G. Gormley FTA Small Starts Funding Steven J. Guy Charles L. Hammel, III Paul Hennigan Dear Secretary Chao: David L. Holmberg Christopher B. Howard Michael Huwar Scott D. Izzo The Allegheny Conference on Community Development and its Laura Karet William Lambert Affiliates – the Greater Pittsburgh Chamber of Commerce, the Gerald F. MacCleary Pennsylvania Economy League of Greater Pittsburgh, and the Henry J. Maier David J. Malone Pittsburgh Regional Alliance – work together to improve the economy Michael H. McGarry Linda L. Moss and quality of life in the 10-county Pittsburgh region. On behalf of the Todd C. Moules Robert P. Oeler Allegheny Conference and our member organizations, we write to Grant Oliphant express our full support for the Pittsburgh Downtown-Uptown- Stacey Olson Antonis Papadourakis Oakland-East End Bus Rapid Transit (BRT) project. -

ARCONIC INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K [ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Fiscal Year Ended December 31, 2017 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 1-3610 ARCONIC INC. (Exact name of registrant as specified in its charter) Delaware 25-0317820 (State of incorporation) (I.R.S. Employer Identification No.) 390 Park Avenue, New York, New York 10022-4608 (Address of principal executive offices) (Zip code) Registrant’s telephone numbers: Investor Relations------------— (212) 836-2758 Office of the Secretary-------—(212) 836-2732 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $1.00 per share New York Stock Exchange $3.75 Cumulative Preferred Stock, par value $100.00 per share NYSE American Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No . Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No . Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. -

Allegheny Technologies Incorporated

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A (Rule 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant To Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to §240.14a-12 Allegheny Technologies Incorporated (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

Vibrant-Pgh-Annual-Report.Pdf

2018 YEAR IN REVIEW Vibrant Pittsburgh: Building a thriving and inclusive Pittsburgh Region by attracting, retaining and elevating a diversity of talent. Why Vibrant Pittsburgh? Our region has seen decades of population decline that has left it with an aging workforce and is one of the least diverse major metros in the United States. Retaining and attracting minority workers is crucial to the history region’s future since more than 50% of the people entering the U.S. workforce today are minorities. OF VIBRANT PITTSBURGH If we do nothing, our region’s population growth will trail behind national and competing region growth rates. In the early years of what is now Vibrant We can overcome this challenge if we can increase Pittsburgh, a few leaders in the Jewish the diversity of our workforce from its current community came together to address a critical state to 26% over the next ten years. need: an increasing number of immigrant families One employer cannot address this and refugees who needed to become more connected challenge on its own. It requires and find employment in the Pittsburgh region. an organized, intentional and collaborative approach. The Welcome Center for Immigrants and Internationals — as it was known then — eventually grew into an entity, supported by the broader community, that provided assistance for both immigrants and those who were being marginalized in terms of employment in our region. As the Welcome Center became more well-known, it became clear that it had a larger purpose around economic development and as the Regional Opportunity Center, it gained the support of the foundation community and some key corporations who recognized the importance of diverse populations and their role in creating a growing and competitive Pittsburgh region with a vibrant workforce. -

Membership List; Russell 2000 Index

Russell US Indexes Membership list Russell 2000® Index Company Ticker Company Ticker 1-800-FLOWERS.COM CL A FLWS AFC GAMMA AFCG 1LIFE HEALTHCARE ONEM AFFIMED N.V. AFMD 1ST SOURCE SRCE AGEAGLE AERIAL SYSTEMS UAVS 22ND CENTURY GROUP INC. XXII AGENUS AGEN 2U TWOU AGILITI AGTI 3-D SYSTEMS DDD AGILYSYS AGYS 4D MOLECULAR THERAPEUTICS FDMT AGIOS PHARMACEUTICALS AGIO 89BIO ETNB AGREE REALTY ADC 8X8 EGHT AIR TRANSPORT SERVICES GROUP ATSG 9 METERS BIOPHARMA INC NMTR AKEBIA THERAPEUTICS AKBA 908 DEVICES MASS AKERO THERAPEUTICS AKRO A10 NETWORKS ATEN AKOUOS AKUS AAON INC AAON AKOUSTIS TECHNOLOGIES INC AKTS AAR CORP AIR AKOYA BIOSCIENCES AKYA ABERCROMBIE & FITCH A ANF ALAMO GROUP ALG ABM INDUSTRIES INC ABM ALARM.COM HOLDINGS ALRM ACACIA RESEARCH - ACACIA TECHNOLOGIES ACTG ALBANY INTERNATIONAL A AIN ACADEMY SPORTS AND OUTDOORS ASO ALBIREO PHARMA ALBO ACADIA PHARMACEUTICALS ACAD ALDEYRA THERAPEUTICS ALDX ACADIA REALTY AKR ALECTOR ALEC ACCEL ENTERTAINMENT (A) ACEL ALERUS FINANCIAL CORP. ALRS ACCELERATE DIAGNOSTICS AXDX ALEXANDER & BALDWIN INC. ALEX ACCO BRANDS ACCO ALEXANDERS INC ALX ACCOLADE ACCD ALIGNMENT HEALTHCARE ALHC ACCRETIVE HEALTH RCM ALIGOS THERAPEUTICS ALGS ACCURAY ARAY ALKAMI TECHNOLOGY ALKT ACI WORLDWIDE ACIW ALKERMES PLC ALKS ACLARIS THERAPEUTICS ACRS ALLAKOS ALLK ACUSHNET HOLDINGS GOLF ALLEGHENY TECHNOLOGIES ATI ACUTUS MEDICAL AFIB ALLEGIANCE BANCSHARES ABTX ADAPTHEALTH AHCO ALLEGIANT TRAVEL ALGT ADDUS HOMECARE ADUS ALLETE ALE ADICET BIO INC ACET ALLIED MOTION TECHNOLOGIES AMOT ADIENT PLC ADNT ALLOGENE THERAPEUTICS ALLO ADTALEM GLOBAL EDUCATION -

Notice of 2017 Annual Meeting of Shareholders and Proxy Statement and 2016 Annual Report Are Also Available At

ARCONIC.COM Notice of 2017 High-pressure turbine blades used in the Annual Meeting of hot section of the CFM56 jet engine produced at Whitehall, Michigan. CFM56 Shareholders and engines are a product of CFM International, a 50/50 joint company between GE and Proxy Statement Safran Aircraft Engines. March 13, 2017 Dear Arconic Shareholders: You are cordially invited to attend the 2017 Annual Meeting of Shareholders of Arconic Inc. to be held on Tuesday, May 16, 2017, at 9:00 a.m., Eastern Time, at The Performing Arts Center, Purchase College, SUNY, 735 Anderson Hill Road, Purchase, New York 10577. We are pleased to present you with our 2017 Proxy Statement. Our 2017 Annual Meeting will be our first annual meeting since we completed our transformational separation of Alcoa Inc. into Arconic and Alcoa Corporation in November 2016. At the 2017 Annual Meeting, shareholders will vote on the matters set forth in the 2017 Proxy Statement and the accompanying notice of the annual meeting. Your Board of Directors has recommended five highly qualified and experienced nominees for election to the Board of Directors at the 2017 Annual Meeting. Highlights of the detailed information included in the proxy statement can be found in the “Proxy Summary” starting on page 1, and detailed information regarding the director candidates can be found under “Item 1 – Election of Directors” starting on page 9. Additionally, enclosed with the Proxy Statement is a WHITE proxy card and postage-paid return envelope. WHITE proxy cards are being solicited on behalf of the Arconic Board of Directors.