Business Coalition for the Equality Act Is a Group of Leading U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

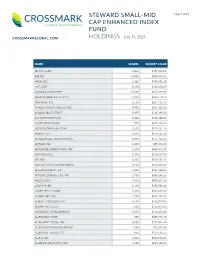

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

Vm-Series on Amazon Web Services

VM-SERIES ON AMAZON WEB SERVICES Many organizations are moving their application development and production workloads to Amazon Web Services (AWS) with a goal of minimizing their physical data center presence over time. The VM-Series on AWS enables you to protect applications and data on AWS with next-generation firewall and threat prevention features. Security Challenges in the Public Cloud VM-Series on AWS Use Cases Organizations worldwide are expanding their use of AWS® at an Hybrid Cloud unprecedented pace. However, security, workflow automation, and how to build scalable, resilient cloud-centric architectures • Securely extend your application development and are key challenges that must be addressed. The VM-Series on testing environment onto AWS across a site-to-site AWS solves these challenges, enabling you to: IPsec VPN or AWS Direct Connect. • Protect your AWS workloads through unmatched applica- Segmentation Gateway tion visibility, control and advanced threat prevention. • Maintain separation of confidential data from other • Simplify management and automate security policy updates traffic for security and compliance purposes by as your AWS workloads change. controlling applications across VPCs and subnets while blocking threats. • Build secure, cloud-centric architectures that are scalable and highly available. Internet Gateway The VM-Series allows new cloud customers to protect their • Protect web-facing applications from advanced workloads with next-generation security features that deliver threats while securely enabling direct access to web- superior visibility, control and threat prevention at the appli- based developer tools and resources. cation level when compared to other cloud- oriented security solutions. Existing customers will reap the benefits of a security GlobalProtect feature set that mirrors those protecting their physical networks • Extend perimeter firewall and threat prevention and delivers a consistent security posture from the network to policies to remote users and mobile devices with the cloud. -

Tripadvisor, Inc. (NASDAQ: TRIP) Price Target CAD$ 28.12 Consumer Discretionary -Travel Services Rating Hold Tripadvisor, Tripping Up? Share Price (Apr

Analyst: Angela Chen, BCom. ‘24 [email protected] Equity Research US TripAdvisor, Inc. (NASDAQ: TRIP) Price Target CAD$ 28.12 Consumer Discretionary -Travel Services Rating Hold TripAdvisor, Tripping Up? Share Price (Apr. 23 Close) CAD$ 50.99 April 23, 2020 Total Return* -44.8% TripAdvisor, Inc. is an online travel company operating a portfolio Key Statistics of websites with user-generated content and comparison shopping. The company operates in 49 different global markets 52 Week H/L $64.95/$14.53 with 23 different travel media brands to provide customers with Market Capitalization $6.87B the all-encompassing travel booking and planning experience. Average Daily Trading Volume $3.5M Thesis Net Debt $144M TripAdvisor is a leading online travel metasearch and review Enterprise Value $7, 305M website with a strong brand image, management team and a Net Debt/EBITDA -3.9x positive cash flow and a balanced capital structure. As an upward Diluted Shares Outstanding $122.0M recovery trends from the Covid-19 pandemic, TripAdvisor is in a good position to capitalize on these opportunities. However, Free Float 70.5% current unpredictability in market conditions make TripAdvisor a Dividend Yield - % higher-risk investment. WestPeak’s Forecast Drivers 2020A 2021E 2022E As vaccines for the Covid-19 pandemic become readily available Revenue $604M $1.24B $1.49B to the general public and governmental regulations lift in various EBITDA -$169M $186M $149M countries, it is expected that TripAdvisor will be able to take Net Income -$290M $67M $129M advantage of rebounded growth in the travel industry. Furthermore, as regulations on Big Tech tighten in North America EPS -$2.15 $0.50 $0.96 and elsewhere, TripAdvisor is expected to see success in growing P/E n/a 111.1x 135.6x its market share. -

GAO-14-698, Troubled Asset Relief Program: Government's Exposure

United States Government Accountability Office Report to Congressional Committees August 2014 TROUBLED ASSET RELIEF PROGRAM Government’s Exposure to Ally Financial Lessens as Treasury’s Ownership Share Declines GAO-14-698 August 2014 TROUBLED ASSET RELIEF PROGRAM Government’s Exposure to Ally Financial Lessens as Treasury’s Ownership Share Declines Highlights of GAO-14-698, a report to congressional committees Why GAO Did This Study What GAO Found As part of its Automotive Industry The Department of the Treasury (Treasury) reduced its ownership stake in Ally Financing Program, funded through the Financial Inc. (Ally Financial) from 74 percent in October 2013, to 16 percent as Troubled Asset Relief Program of June 30, 2014. As shown in the figure below, the pace of Treasury’s reduction (TARP), Treasury provided $17.2 in its ownership share of Ally Financial accelerated in 2013 and corresponds with billion of assistance to Ally Financial two key events. First, in November 2013, the Board of Governors of the Federal (formerly known as GMAC). Ally Reserve System (Federal Reserve) did not object to Ally Financial’s resubmitted Financial is a large financial holding 2013 capital plan, which allowed Ally Financial to repurchase preferred shares company, the primary business of from Treasury and complete a private placement of common shares. Second, in which is auto financing. December 2013 the bankruptcy proceedings of Ally Financial’s mortgage subsidiary, Residential Capital LLC (ResCap), were substantially resolved. The TARP’s authorizing legislation confirmed Chapter 11 plan broadly released Ally Financial from any and all legal mandates that GAO report every 60 claims by ResCap and, subject to certain exceptions, all other third parties, in days on TARP activities. -

VM-Series on AWS • Complements Native AWS Security with Application Enablement Policies That Prevent Threats and Data Loss

VM-Series on AWS • Complements native AWS security with application enablement policies that prevent threats and data loss. VM-Series on AWS • Allows you to transparently Palo Alto Networks VM-Series Virtual Next-Generation embed security in the application ® development process through Firewalls protect your Amazon Web Services (AWS ) automation and centralized workloads with next-generation security features that management. allow you to confidently and quickly migrate your business- • Enables security to scale dynamically critical applications to the cloud. AWS CloudFormation yet independently of your workloads through integration with AWS Auto Templates and third-party automation tools allow you to Scaling and Elastic Load Balancing. embed the VM-Series in your application development • Cost-effectively protects lifecycle to prevent data loss and business disruption. deployments with many VPCs through a transit VPC architecture. Strata by Palo Alto Networks | VM-Series on AWS | Datasheet 1 As AWS becomes the dominant deployment platform for your User-Based Policies Improve Security Posture business-critical applications, protecting the increased public Integration with on-premises user repositories, such as cloud footprint from threats, data loss, and business disruption Microsoft Exchange, Active Directory®, and LDAP, lets remains challenging. The VM-Series on AWS solves these you grant access to critical applications and data based on challenges, enabling you to: user credentials and needs. For example, your developer • Protect your AWS workloads through unmatched application group can have full access to the developer VPC while only visibility and precise control. IT administrators have RDP/SSH access to the production • Prevent threats from moving laterally between workloads VPC. -

Area Companies Offering Matching Gifts Below Is a Partial List of Area Companies Offering Matching Gifts

Area Companies Offering Matching Gifts Below is a partial list of area companies offering matching gifts. Please check to see if your employer is on the list and/or check with your company if they offer the program. If your employer offers a matching gift program, please request a matching gift form from your employer or fill out their online form. Matching gifts can be made to the Tredyffrin Township Libraries, Paoli Library or Tredyffrin Public Library. Aetna FMC Corporation PNC Financial Services AIG GATX PPG Industries Air Products and Chemicals, Inc. GE Foundation PQ Corporation Allstate Foundation GlaxoSmithKline Procter & Gamble Altria Group, Inc. Glenmede Prudential Financial American Express Company Hillman Company PVR Partners, L.P. American International Group, Inc. Houghton Mifflin Quaker Chemical Corporation AmeriGas Propane, Inc. IBM Corporation Quest Diagnostics AON J.P. Morgan Chase Ross Arkema Inc. John Hancock Saint-Gobain Corporation Automatic Data Processing Johnson & Johnson Sandmeyer Steel Company AXA Foundation, Inc. JP Morgan Chase SAP Matching Gift Program Axiom Data, Inc. Kaplan Inc. Schering-Plough Foundation Bank of America Kellogg Schroder Investment Management Bemis Company Foundation KPMG LLP Shell Oil Company Berwind Corporation Liberty Mutual State Farm Companies Foundation BlackRock Lincoln Financial Group Subaru of America Boeing Company May Department Stores Sun Life Financial BP McDonald's Sun Microsystems, Inc Bristol-Myers Squibb Company McKesson Foundation Sunoco, Inc. C. R. Bard, Inc. Merck & Co., Inc. Tenet Healthcare Foundation CertainTeed Merrill Lynch Texas Instruments Charles Schwab Merrill Lynch ACE INA Foundation Chevron Corporation Microsoft AXA Foundation Chubb Group of Insurance Companies Minerals Technologies Inc. Dow Chemical Company CIGNA Foundation Mobil Foundation Inc. -

The Future of Business Using Enterprise Server

Market Review Market Review Paper by Bloor Author David Norfolk Publish date June 2021 The Future of Business …using Enterprise Server 3.0 Services A company has to stay“ in business while modernising its systems and any modernisation must have a clearly documented business case and properly managed risk. What this means is that migrating a working system to a new platform may not be a good use of resources, especially as alternative modernisation options (such as the provision of cloud APIs or Application Programming Interfaces) are available. ” Executive summary he Future of Business will Well, the nub of the business issue we be largely built on the past, spotlight here is that migration to Cloud T for existing companies. is often recommended simplistically as Modernisation of what you have already, a platform for future business, almost as presumably “fit for current purpose” (or you a fashion option, with implied promises wouldn’t be in business) avoids waste and of ultimate agility, elastic capabilities mitigates certain classes of risk (although, without limits and low cost; but the if not done properly, it can add new risks). actuality is often different – and never Modernisation, of course, implies fit for quite being able to complete a migration evolution and change – once modernised, off Enterprise Server 3.0, because the you will be making further changes to business realities won’t let you, is accommodate new business. probably the most expensive scenario Modernisation of what For big enterprises, the world still runs of all. Cloud provides a wide choice of you have already,“ on very large, very resilient, servers – often platforms, some with innovative and presumably “fit for current referred to as “mainframes”, although attractive characteristics, but three truths Bloor prefers the term Enterprise Server remain important: purpose” (or you wouldn’t be in business) avoids 3.0. -

In the United States Bankruptcy Court for the District of Delaware

Case 19-10684 Doc 16 Filed 04/01/19 Page 1 of 1673 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE x In re: : Chapter 11 : HEXION HOLDINGS LLC, et al.,1 : Case No. 19-10684 ( ) : Debtors. : Joint Administration Requested x NOTICE OF FILING OF CREDITOR MATRIX PLEASE TAKE NOTICE that the above-captioned debtors and debtors in possession have today filed the attached Creditor Matrix with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Hexion Holdings LLC (6842); Hexion LLC (8090); Hexion Inc. (1250); Lawter International Inc. (0818); Hexion CI Holding Company (China) LLC (7441); Hexion Nimbus Inc. (4409); Hexion Nimbus Asset Holdings LLC (4409); Hexion Deer Park LLC (8302); Hexion VAD LLC (6340); Hexion 2 U.S. Finance Corp. (2643); Hexion HSM Holdings LLC (7131); Hexion Investments Inc. (0359); Hexion International Inc. (3048); North American Sugar Industries Incorporated (9735); Cuban-American Mercantile Corporation (9734); The West India Company (2288); NL Coop Holdings LLC (0696); and Hexion Nova Scotia Finance, ULC (N/A). The address of the Debtors’ corporate headquarters is 180 East Broad Street, Columbus, Ohio 43215. RLF1 20960951V.1 Case 19-10684 Doc 16 Filed 04/01/19 Page 2 of 1673 Dated: April 1, 2019 Wilmington, Delaware /s/ Sarah E. Silveira Mark D. Collins (No. 2981) Michael J. Merchant (No. 3854) Amanda R. Steele (No. 5530) Sarah E. Silveira (No. 6580) RICHARDS, LAYTON & FINGER, P.A. -

Federal Railroad Administration Fiscal Year 2017 Enforcement Report

Federal Railroad Administration Fiscal Year 2017 Enforcement Report Table of Contents I. Introduction II. Summary of Inspections and Audits Performed, and of Enforcement Actions Recommended in FY 2017 A. Railroad Safety and Hazmat Compliance Inspections and Audits 1. All Railroads and Other Entities (e.g., Hazmat Shippers) Except Individuals 2. Railroads Only B. Summary of Railroad Safety Violations Cited by Inspectors, by Regulatory Oversight Discipline or Subdiscipline 1. Accident/Incident Reporting 2. Grade Crossing Signal System Safety 3. Hazardous Materials 4. Industrial Hygiene 5. Motive Power and Equipment 6. Railroad Operating Practices 7. Signal and train Control 8. Track C. FRA and State Inspections of Railroads, Sorted by Railroad Type 1. Class I Railroads 2. Probable Class II Railroads 3. Probable Class III Railroads D. Inspections and Recommended Enforcement Actions, Sorted by Class I Railroad 1. BNSF Railway Company 2. Canadian National Railway/Grand Trunk Corporation 3. Canadian Pacific Railway/Soo Line Railroad Company 4. CSX Transportation, Inc. 5. The Kansas City Southern Railway Company 6. National Railroad Passenger Corporation 7. Norfolk Southern Railway Company 8. Union Pacific Railroad Company III. Summaries of Civil Penalty Initial Assessments, Settlements, and Final Assessments in FY 2017 A. In General B. Summary 1—Brief Summary, with Focus on Initial Assessments Transmitted C. Breakdown of Initial Assessments in Summary 1 1. For Each Class I Railroad Individually in FY 2017 2. For Probable Class II Railroads in the Aggregate in FY 2017 3. For Probable Class III Railroads in the Aggregate in FY 2017 4. For Hazmat Shippers in the Aggregate in FY 2017 5. -

Popular Employer Names Number of Data Profiles Blackrock, Inc. 43

S.No Popular Employer Names Number of Data Profiles 1. Blackrock, Inc. 43 2. BMC Software, Inc. 55 3. BNP Paribas Inc. 113 4. BRISTLECONE India Ltd 57 5. British Telecom 131 6. Broadcom Corporation 59 7. Broadridge Financial Solutions, Inc. 44 8. Bureau Veritas 47 9. CA Technologies 65 10. CA, Inc. 39 11. Cairn India 45 12. Calsoft Pvt Ltd 44 13. Capgemini 1,309 14. Capgemini Consulting 578 15. Capita india 82 16. Capital Iq, Inc. 41 17. Caterpillar, Inc. 75 18. CBRE Group 60 19. CenturyLink 47 20. Cerner Corporation 65 21. CGI Group Inc. 300 22. Cipla Medpro Manufacturing 43 23. Cisco Systems (India) Private Limited 57 24. Cisco Systems Inc 396 25. Citibank 235 26. Citigroup, Inc. 53 27. CitiusTech 59 28. Citrix Systems Inc 40 29. CMC Group 102 30. Cognizant 1,374 31. Cognizant Technology Solutions Corp 1,715 32. Collabera Inc. 74 33. Computer Sciences Corporation (CSC) 653 34. Concentrix Corporation 159 35. Convergys Corporation 113 36. Credit Suisse 90 37. Crisil 117 38. CTS Corporation 109 39. Cummins India Ltd 70 40. Cvent, Inc. 46 41. Cybage 201 42. Daimler India Commercial Vehicles Pvt Ltd 61 43. Dell, Inc. 516 44. Deloitte 414 45. Deloitte & Touche LLP 107 46. Deloitte Consulting LLP 282 47. Deloitte Support Services India Private Ltd 94 48. Deloitte Touche Tohmatsu (DTT) 79 49. Deutsche Bank 235 50. Dimension Data 63 51. Directi 44 52. Dr Reddy's Laboratories Ltd 85 53. Dun & Bradstreet Corp 50 54. E.I. Du Pont De Nemours & Co (DuPont) 47 55. -

Separately Managed Account - MDT Tax Aware All Cap Core Portfolio Holdings As of 6/30/19

Separately Managed Account - MDT Tax Aware All Cap Core Portfolio Holdings as of 6/30/19 Sector Company COMMUNICATION SERVICES Alphabet Inc. CBS Corporation Charter Communications Inc * DISH Network Corporation Electronic Arts Inc. Facebook, Inc. Live Nation Entertainment, Inc. * MSG Networks Inc. Verizon Communications Inc. CONSUMER DISCRETIONARY Amazon.com, Inc. AutoZone, Inc. Burlington Stores, Inc. Expedia Group, Inc. Hilton Worldwide Holdings Kohl's Corporation Lowe's Companies, Inc. Lululemon Athletica Inc. Mohawk Industries, Inc. O'Reilly Automotive, Inc. Target Corporation The Goodyear Tire & Rubber Company The Home Depot, Inc. Wyndham Destinations, Inc. CONSUMER STAPLES Archer-Daniels-Midland Company Church & Dwight Co., Inc. Costco Wholesale Corporation Herbalife Ltd. PepsiCo, Inc. The Estee Lauder Companies Inc. Walmart Inc. ENERGY Chevron Corporation * Continental Resources, Inc. EOG Resources, Inc. Exxon Mobil Corporation HollyFrontier Corporation Phillips 66 Valero Energy Corporation FINANCIALS Ameriprise Financial, Inc. Bank of America Corporation Berkshire Hathaway Inc. Capital One Financial Corporation Citigroup Inc. Everest Re Group, Ltd. First Republic Bank IntercontinentalExchange Inc. JPMorgan Chase & Co. M&T Bank Corporation Prudential Financial, Inc. The Allstate Corporation The PNC Financial Services Group, Inc. The Progressive Corporation The Travelers Companies, Inc. HEALTH CARE Anthem, Inc. Biogen Idec Inc. Eli Lilly and Company Separately Managed Account - MDT Tax Aware All Cap Core Portfolio Holdings as of 6/30/19 Sector Company HCA Healthcare, Inc. * Humana Inc. Ionis Pharmaceuticals, Inc. Jazz Pharmaceuticals plc Regeneron Pharmaceuticals, Inc. Stryker Corp * Veeva Systems Inc. Vertex Pharmaceuticals Incorporated INDUSTRIALS Caterpillar Inc. CSX Corporation Cummins Inc. Delta Air Lines, Inc. Lennox International Inc. Lockheed Martin Corporation * PACCAR Inc The Boeing Company Trinity Industries, Inc. -

General Information - Automotive

Group 0 General Information - Automotive GENERAL: This group contains information applicable to all other groups. Such items as lubrication, trouble- shooting of entire coach, storage, towing, and a description of the part number structure used by the Recreational Vehicle Division are included. SPECIFICS: As applicable ...Cleaning of Coach ...Grouping Key ...Jacking of Coach ...Lubrication of Coach ...Parts Structure Key ...Parts Tables (bolts, screws, nuts, tubing, wire, etc. ) ...Preventive Maintenance ...Servicing of Coach ...Specifications of Coach ...Storage of Coach ...Table of Contents ...Tools and Equipment ...Towing of Coach ...Troubleshooting of Coach FMC Corporation Motor Coach Division HFMC 333 Brokaw Road Box 664 Santa Clara California 95052 REPAIR PARTS LIST GROUP. MODEL All GROUP 0 GENERAL INFORMATION SCOPE All repair parts will be shipped F.O.B., FMC/ MCD Santa Clara, California Plant. This Repair Parts Catalog lists all serviceable parts required for motor homes floor plans "A", NOTE "J" and "M" built by FMC/MCD. It is divided into functional groups as indicated on the frontis- Always provide model and serial num- piece of this catalog. The functional group ber of coach and, if applicable, model system used by FMC/MCD is designed to enable and serial number of component for you to quickly find and order repair parts for which part(s) is ordered. your coach. For example, Group 9 "Brakes- Service, " contains a complete listing of all EMERGENCY PARTS ORDER serviceable brake parts used throughout the coach whether applied to the front or the rear When ordering repair parts on an "Emergency" brakes. basis, call FMC/MCD after you have filled out the Parts Order form number RVD-67 (refer to PART NUMBERS instructions given below).