Not for Release, Publication Or Distribution to Any U.S

Total Page:16

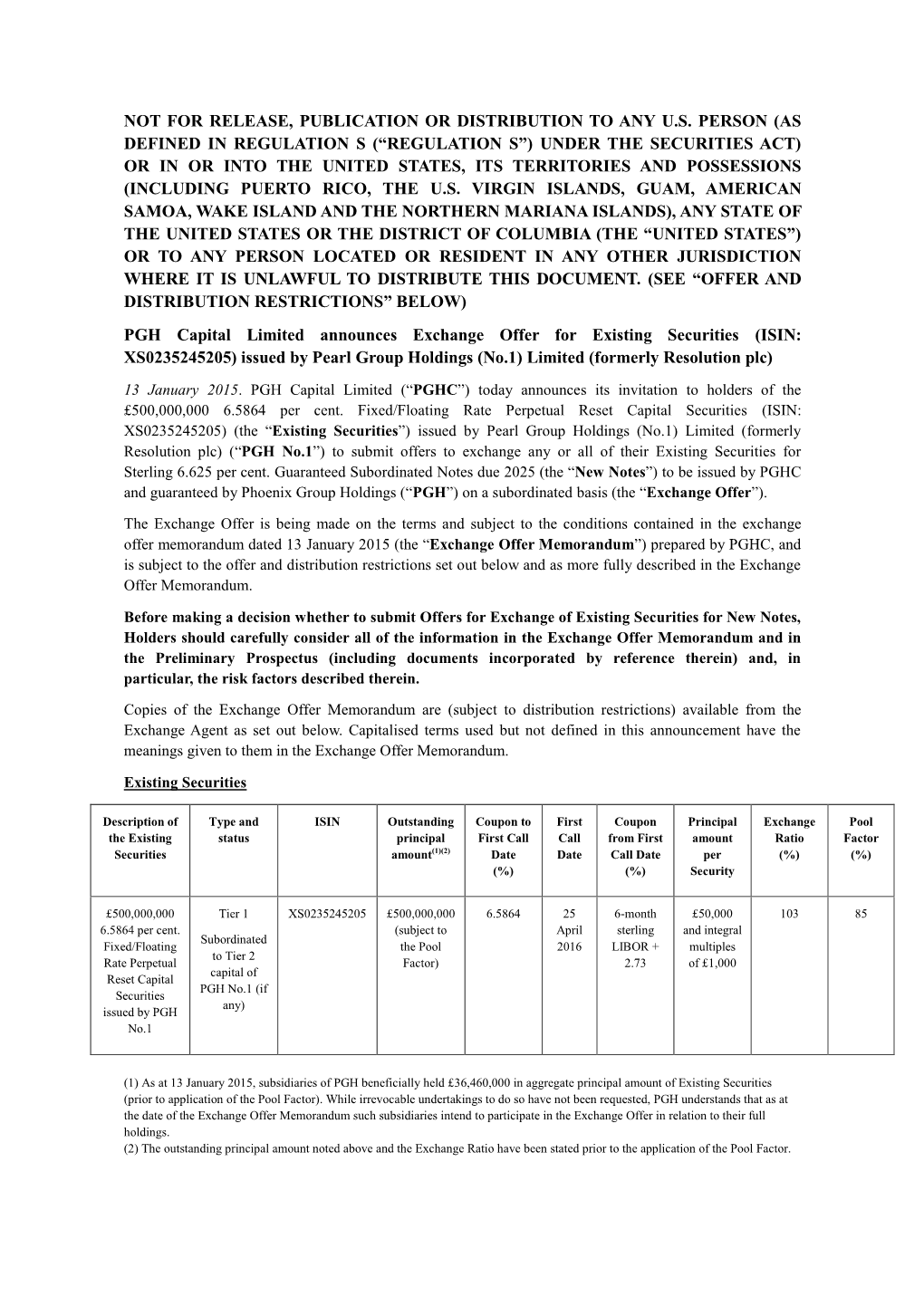

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Phoenix Group Holdings

PROSPECTUS DATED 25 SEPTEMBER 2020 Phoenix Group Holdings plc (incorporated with limited liability in England and Wales with registered number 11606773) £5,000,000,000 Euro Medium Term Note Programme Under the Euro Medium Term Note Programme described in this Prospectus (the “Programme”) Phoenix Group Holdings plc (“Phoenix” or “PGH” or the “Issuer”), subject to compliance with all relevant laws, regulations and directives, may from time to time issue notes (the “Notes”). The Notes may be issued (i) as dated unsubordinated notes (“Senior Notes”), (ii) as dated subordinated notes with terms capable of qualifying as Tier 3 Capital (as defined in “Terms and Conditions of the Tier 3 Notes”) (“Tier 3 Notes”), (iii) as dated subordinated notes with terms capable of qualifying as Tier 2 Capital (as defined in “Terms and Conditions of the Tier 2 Notes”) (“Dated Tier 2 Notes”) or as undated subordinated notes with terms capable of qualifying as Tier 2 Capital (as defined in “Terms and Conditions of the Tier 2 Notes”) (“Undated Tier 2 Notes” and, together with the Dated Tier 2 Notes, the “Tier 2 Notes”). The Tier 2 Notes and the Tier 3 Notes are referred to collectively in this Prospectus as the “Subordinated Notes”. The aggregate nominal amount of Notes outstanding will not at any time exceed £5,000,000,000 (or the equivalent in other currencies). Payments of interest and principal under the Subordinated Notes may be subject to optional or mandatory deferral in accordance with the terms of the relevant Series (as defined herein) of Subordinated Notes. This Prospectus has been approved by the United Kingdom Financial Conduct Authority (the “FCA”), as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”) as a base prospectus (the “Prospectus”) for the purposes of the Prospectus Regulation. -

Swiss Re Confirms Interest in Certain Closed-Books of Resolution

News release ab Swiss Re confirms interest in certain closed-books of Resolution Contact: Zurich, 15 October 2007 - Swiss Reinsurance Company (“Swiss Re”) confirms it is in discussions with Standard Life PLC Media Relations, Zurich Telephone +41 43 285 7171 (“Standard Life”) in relation to the possibility of entering into an agreement to purchase certain closed-books of Resolution PLC’s Corporate Communications, London Telephone +44 20 7933 3448 (“Resolution”) life business should Standard Life make an offer to acquire Resolution. These discussions are consistent with Swiss Corporate Communications, Asia Telephone +852 2582 3660 Re’s strategy to seek attractive opportunities to expand its Admin Re® business. No binding commitments have yet been entered Corporate Communications, New York Telephone +1 212 317 5663 into regarding the terms of such a transaction, and consequently there can be no assurance that Swiss Re will participate in any Investor Relations, Zurich Telephone +41 43 285 4444 such transaction or otherwise participate in any offer for Resolution, or as to the terms of any such transaction. Should a transaction take place, Swiss Re will acquire for a fixed price to be agreed certain books of business currently owned by Swiss Reinsurance Company Resolution. A further announcement may be made, if and when, Mythenquai 50/60 appropriate. P.O. Box CH-8022 Zurich Dealing Disclosure Requirements Telephone +41 43 285 2121 Fax +41 43 285 2999 Under the provisions of Rule 8.3 of the Takeover Code (the www.swissre.com “Code”), if any person is, or becomes, “interested” (directly or indirectly) in 1% or more of any class of “relevant securities” of Standard Life or of Resolution all “dealings” in any “relevant securities” of that company (including by means of an option in respect of, or a derivative referenced to, any such “relevant securities”) must be publicly disclosed by no later than 3.30 pm (London time) on the London business day following the date of the relevant transaction. -

Notice of Annual General Meeting to Be Held on 22 May 2009

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to any aspect of the proposals referred to in this document or as to the action you should take, you should consult a stockbroker, solicitor, accountant or other appropriate independent professional adviser. If you have sold or transferred all your shares in HSBC Holdings plc (the “Company”), you should at once forward this document and the accompanying Form of Proxy to the stockbroker, bank or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. This document should be read in conjunction with the Annual Report and Accounts and/or Annual Review in respect of the year ended 31 December 2008. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. The ordinary shares of HSBC Holdings plc trade under stock code 5 on The Stock Exchange of Hong Kong Limited. Shareholders may at any time choose to receive corporate communications in printed form or to receive notifications of their availability on HSBC’s website. To receive future notifications of the availability of corporate communications on HSBC’s website by email, or revoke or amend an instruction to receive such notifications by email, go to www.hsbc.com/ecomms. -

Shareholder Presentation

Shareholder Presentation July 2009 0 Disclaimer Liberty Acquisition Holdings (International) Company (“Liberty”) has posted on its website a proxy statement and consent solicitation statement (the “Proxy and Consent Solicitation Statement”) in connection with an extraordinary general meeting of Liberty’s shareholders to be held on July 24, 2009 to consider Liberty’s proposed acquisition of the Pearl Group and certain affiliated entities (collectively, the “Pearl Group”) and related transactions (including a consent solicitation to amend certain terms of Liberty’s outstanding warrants). Shareholders and warrant holders of Liberty are advised to read the Proxy and Consent Solicitation Statement, and any amendments and/or supplements thereto, since it contains important information about the Pearl Group, Liberty and the proposed transactions. Shareholders and warrant holders may obtain, without charge, a copy of the Proxy and Consent Solicitation Statement at the Company’s website (www.libertyacquisitionholdingsinternational.com) or by directing a request to (i) Liberty at Bison Court, Road Town, Tortola, British Virgin Islands, VG1110 or by telephone at +1 (284) 494-7605. Liberty and its directors and officers may be deemed to be participants in the solicitation of proxies and consents for the extraordinary general meeting of Liberty shareholders. Liberty’s shareholders and warrant holders may obtain additional information about the interests of its directors and officers in the proposed transactions by reading the Proxy and Consent Solicitation Statement when it becomes available. No person other than Liberty and its directors and officers and RBS has been authorized to give any information on behalf of Liberty or the Pearl Group in connection with the proposed transactions, and if given or made, such other information or representations must not be relied upon as having been made or authorized by Liberty. -

Phoenix Group Holdings Plc U.S.$750,000,000 Fixed Rate

OFFERING MEMORANDUM DATED 27 JANUARY 2020 Phoenix Group Holdings plc (incorporated under the laws of England and Wales with company number 11606773) U.S.$750,000,000 Fixed Rate Reset Perpetual Restricted Tier 1 Contingent Convertible Notes Issue Price: 100.00 per cent. The issue of U.S.$750,000,000 Fixed Rate Reset Perpetual Restricted Tier 1 Contingent Convertible Notes (the “Notes”) was (save in respect of any further Notes issued pursuant to Condition 17) authorised by a resolution of the board of directors of Phoenix Group Holdings plc (the “Issuer”) passed on 5 December 2019. The Notes will be issued by the Issuer on 29 January 2020 (the “Issue Date”). The Notes will constitute direct, unsecured and subordinated obligations of the Issuer. The terms and conditions of the Notes are set out more fully in “Terms and Conditions of the Notes” (the “Conditions”). The Notes will bear interest on their principal amount from (and including) the Issue Date to (but excluding) 26 April 2025 (the “First Reset Date”) at a fixed rate of 5.625 per cent. per annum and thereafter at a fixed rate of interest which will be reset on the First Reset Date and on each fifth anniversary of the First Reset Date thereafter (each, a “Reset Date” as provided in the Conditions). Interest will be payable on the Notes semi-annually in arrear on 26 April and 26 October (each, an “Interest Payment Date”) in each year commencing on 26 April 2020, subject to cancellation as provided below and as further described in the Conditions. -

Equity Capital Markets Review

Fourth Quarter 2008 EQUITY CAPITAL MARKETS REVIEW Global ECM Falls to Lowest Level Since 2003 I Financial Sector ECM Breaks Records I JP Morgan Leads Rankings Global equity and equity-related underwriting volume in 2008 fell to US$470.7 billion, the lowest Financial Sector Equity & Equity-Related level since 2003 when volume was US$384.8 billion. Difficult market conditions brought on by by Issue Type failing investment banks in the third quarter and poor stock market conditions in the last six $250 months diminished the appeal of the equity capital markets as an attractive financing option. There were just 2,063 equity capital markets issues in 2008, the fewest since 1991 when there were just 1,813 offerings. Despite this, financial sector issuers saw all-time high issuance $200 volumes, increasing 17.6% to US$233.7 billion in 2008 from US$198.8 billion in 2007, due in large part to follow-on and convertible offerings brought to market by banks and insurance companies. Financial sector follow-on and convertible issues each reached all-time highs with $150 US$149.4 billion and US$54.1 billion, respectively. $100 Proceeds (US$b) Proceeds Global IPO volume slowed drastically in 2008, falling 71.2% from the previous year to US$84.6 $50 billion from 508 issues. By volume 2008 represents the slowest year for global IPO issuance since 2003 when issuance totaled US$53.1 billion, and by number of IPO issues, 2008 is the $0 slowest year since 1990 when 293 offerings came to market. In total, IPOs accounted for a modest 18.0% of global equity and equity-related activity compared to 36.1% in 2007. -

Further Information Corporate Activity Former Resolution

Further Information Corporate Activity Former Resolution businesses and assets Following Pearl’s acquisition of Resolution on 1 May 2008, Royal London started the process of acquiring the following from Pearl: • Scottish Provident International Life Assurance, a provider of life products and investment services which is based in the Isle of Man • the majority of the in-force UK protection business from Scottish Provident and Scottish Mutual Assurance • Phoenix Life Assurance Limited, formerly Abbey National Life, the products of which are distributed through Abbey’s national branch network • the new business operations of the companies mentioned above, with the exception of incremental business on policies retained by Pearl • the right to provide or procure the provision of all investment management and policy administration services of the assets described above. On 3 June 2008, Royal London completed the transfer from Pearl of Scottish Provident International Life Assurance. On 1 August 2008, Royal London completed the acquisition of Phoenix Life Assurance Limited and of Scottish Provident’s new business capabilities, in respect of individual life protection business. The in-force protection business still to be acquired by Royal London will be transferred by means of schemes under Part VII of FSMA 2000. It is expected that such schemes will complete by the end of 2008. The value of the assets transferred will include the value of new business written during 2008. The purchase price for these assets and businesses is £1.27bn, subject to post-completion consideration adjustments. In addition, Royal London provided £0.3bn of debt funding to Pearl, at a commercial rate, in support of their acquisition of Resolution plc. -

Phoenix Group Holdings Annual Report and Accounts 2013 2013 Was an Eventful Year for the Phoenix Group

PHOENIX GROUP HOLDINGS ANNUAL REPORT AND ACCOUNTS 2013 2013 WAS AN EVENTFUL YEAR FOR THE PHOENIX GROUP. WE HAVE PROGRESSED IN STRENGTHENING THE BALANCE SHEET AND SIMPLIFYING THE GROUP’S STRUCTURE AND WE HAVE ALSO DELIVERED AGAINST OUR FINANCIAL TARGETS. BUSINESS OVERVIEW OUR BUSINESS MODEL delivering strong investment Phoenix Group is the UK’s largest specialist As a closed life fund consolidator, Phoenix performance and high quality closed life and pension fund consolidator Life focuses on the efficient run-off of service to its clients. with over 5 million policyholders and existing policies, maximising economies £68.6 billion of Group assets under of scale and generating capital efficiencies For a detailed look at management. Our business manages through operational improvements. our business model closed life funds in an efficient and Ignis Asset Management focuses on Turn to page 12 secure manner, protecting and enhancing policyholders’ interests whilst maximising value for the Group’s shareholders. PHOENIX LIFE Aims to deliver innovative financial management and operational excellence PHOENIX GROUP Delivery of IGNIS ASSET MANAGEMENT strategic initiatives Aims to deliver superior investment performance and client service EVOLUTION OF THE PHOENIX GROUP The following shows the Group’s original entities and their various acquisitions over the years. 1806 1857 2008 2009 2010 London Life Pearl Loan Company Pearl Group Liberty Pearl Group renamed established established acquires Acquisition Phoenix Group Resolution plc Holdings Holdings and -

Anticipated Acquisition by Royal London Mutual Insurance Society of Certain Assets and Business of Resolution Plc

Anticipated acquisition by Royal London Mutual Insurance Society of certain assets and business of Resolution plc No. ME/3429/07 The OFT's decision on reference under section 33(1) given on 28 December 2007. Full text of decision published 18 January 2008. Please note that square brackets indicate figures or text which have been deleted or replaced at the request of the parties for reasons of commercial confidentiality. PARTIES 1. Royal London Mutual Insurance Society Limited (Royal London) is a mutual life insurance company, providing life protection, pensions and investment products in the UK. 2. Resolution plc (Resolution) is a specialist manager of life funds which operates closed and open funds, seeks to acquire closed funds and operates an asset management business. Resolution's UK turnover in 2006 was [greater than £70 million]. TRANSACTION 3. Royal London will be purchasing certain Resolution assets and businesses relating to Resolution's new business capability (including that of the off- shore life protection business) and in-force funds. This transaction will be carried out after Pearl Group Ltd (Pearl) has completed the acquisition of the whole of Resolution,1 partly using finance provided by Royal London (which will then be used as a part payment for the on-sale). In the interim 1 The OFT has assessed this merger under a separate decision. See OFT decision of 28 December 2007 on the anticipated acquisition by Pearl Group Ltd of Resolution plc. 1 period until the on-sale, Resolution and Royal London will have joint control over those assets to be sold. Although Pearl and Royal London envisage that the joint control will be limited in scope and time (up to three months), the OFT has taken a cautious approach and completed its assessment on the basis that Royal London will be acquiring control over the whole of Resolution. -

Jpmorgan Trust I

SECURITIES AND EXCHANGE COMMISSION FORM N-CSR Certified annual shareholder report of registered management investment companies filed on Form N-CSR Filing Date: 2008-01-10 | Period of Report: 2007-10-31 SEC Accession No. 0001145443-08-000053 (HTML Version on secdatabase.com) FILER JPMorgan Trust I Mailing Address Business Address C/O JPMORGAN C/O JPMORGAN CIK:1217286| IRS No.: 331043149 | State of Incorp.:DE | Fiscal Year End: 1231 DISTRIBUTION SERVICES, DISTRIBUTION SERVICES, Type: N-CSR | Act: 40 | File No.: 811-21295 | Film No.: 08523923 INC. INC. 1111 POLARIS PARKWAY, 1111 POLARIS PARKWAY, STE. 2-J STE. 2-J COLUMBUS OH 43240 COLUMBUS OH 43240 800-480-4111 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number: 811-21295 JPMorgan Trust I (Exact name of registrant as specified in charter) 245 Park Avenue New York, NY 10167 (Address of principal executive offices) (Zip code) Stephen M. Benham 245 Park Avenue New York, NY 10167 (Name and Address of Agent for Service) Registrants telephone number, including area code: (800) 480-4111 Date of fiscal year end: October 31 Date of reporting period: November 1, 2006 through October 31, 2007 for all funds except for JPMorgan International Realty Fund which is November 30, 2006 through October 31, 2007, JPMorgan China Region Fund, JPMorgan -

The Trustee's Report to Members for the 18-Month Period Ended 30 June

The Trustee’s Report to members for the 18-month period ended 30 June 2008 Pearl Group Staff Pension Scheme Contents Welcome Welcome 2 Pearl news 3 Welcome to the latest summary of the Pearl Group Staff Pension Scheme Report and Accounts, which covers the Scheme news 4 18-month period ended 30 June 2008. The financial development of the Scheme 5 In this report, you will find up-to-date information on Money Purchase/Defined Contribution section 6 the Scheme itself, such as the inclusion of two new Membership 8 Legal & General funds which will widen the investment choices of those in the Money Purchase section. You can also see Final Salary section 9 a summarised version of the income and expenditure of The role of the Trustee Director 14 the Scheme over the 18-month period from 1 January 2007 to 30 June 2008, find an update on the Scheme’s funding Trustee and Advisers to the Scheme 15 and membership numbers and learn about the role of the Your contacts 16 Trustee Director. We do hope you find this report informative – as always, Changes to the Trustee Board please feel free to contact us if you have any queries regarding We welcome Alan Roffey-Jones, who replaced David Baker your pension by calling the administration team on on 14 November 2008 and The Law Debenture Pension 01733 393020 or, alternatively, visit the website at Trust Corporation plc, normally represented by Antony www.pearlstaffpensionscheme.co.uk. Macwhinnie, who replaced Ashok Gupta on 30 December 2008. Our thanks and best wishes go to David and Ashok for the contribution they made during their terms of office. -

SOLVENCY and FINANCIAL CONDITION REPORT Phoenix Life Holdings Limited for the Year Ended 31 December 2016

SOLVENCY AND FINANCIAL CONDITION REPORT Phoenix Life Holdings Limited For the year ended 31 December 2016 PHOENIX AT A GLANCE 01 KEY PERFORMANCE INDICATORS Phoenix has been a well-known name in the insurance world since 1782. From its beginnings PLHL GROUP SOLVENCY II CAPITAL POSITION (HIGHEST EEA PARENT) more than 200 years ago, it has grown to become the largest UK consolidator of closed life assurance funds. 2017 The Group obtains PRA’s approval to incorporate AXA Wealth’s pension and protection businesses into the Group’s Solvency II Internal Model Issued £450 million Tier 3 bond in two tranches of £2.0bn 171% £300 million in January 2017 and £150 million in May 2017 Solvency II Shareholder capital 2016 Phoenix Group Holdings successfully completes surplus coverage ratio two acquisitions – AXA Wealth’s pension and 1 1 (pro forma ) (pro forma ) protection businesses, and Abbey Life Assurance Company Limited Agreed a revised unsecured revolving credit facility offering greater flexibility to make acquisitions 2015 Investment grade credit rating achieved from Fitch Ratings Solvency II full Internal Model approved Exchange of Tier 1 bonds into new subordinated notes PGH GROUP SOLVENCY II CAPITAL POSITION (ULTIMATE PARENT) 2014 Divestment of Ignis Asset Management Refinanced the Group’s remaining senior bank debt and PIK notes into a single £900 million facility Issued £300 million unsecured seven-year bond 2013 Successful debt re-terming and equity raising of £250 million 2012 Transferred approximately £5 billion of annuity liabilities