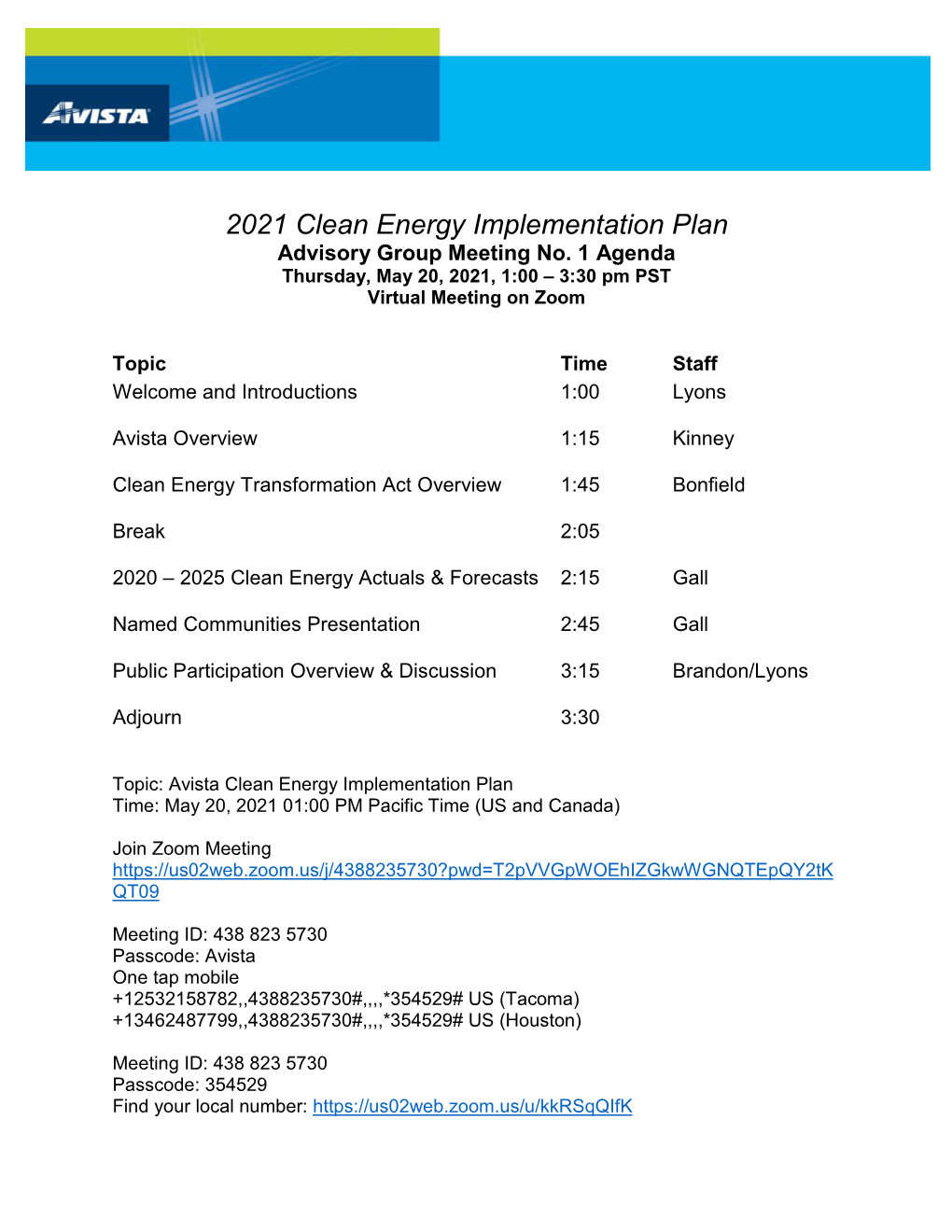

2021 Clean Energy Implementation Plan Advisory Group Meeting No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AVISTA CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 FORM 10-Q (Mark One) ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 2005 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-3701 AVISTA CORPORATION (Exact name of registrant as specified in its charter) Washington 91-0462470 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 1411 East Mission Avenue, Spokane, Washington 99202-2600 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: 509-489-0500 Web site: http://www.avistacorp.com None (Former name, former address and former fiscal year, if changed since last report) Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act): Yes ☒ No ☐ As of August 1, 2005, 48,532,899 shares of Registrant’s Common Stock, no par value (the only class of common stock), were outstanding. Table of Contents AVISTA CORPORATION Index Page No. -

Avista Corporation Investing in Our Common Stock Involves Risks. See

PROSPECTUS Avista Corporation DIRECT STOCK PURCHASE AND DIVIDEND REINVESTMENT PLAN Shares of Common Stock (no par value) The Avista Corporation Direct Stock Purchase and Dividend Reinvestment Plan (the “Plan”) provides investors with a simple and convenient method of purchasing shares of our Common Stock and of investing their dividends in additional shares of Common Stock. The Plan provides that purchases of Common Stock may be made monthly. Shares of Common Stock will be either newly issued shares purchased directly from us or previously issued shares purchased on the open market, at our election. The price of shares if purchased on the open market will include a fee of $.04 per share (which will include a brokerage commission). Investors who are not already shareholders may become participants in the Plan by making an initial cash investment of $250. The Plan offers you the opportunity to: • Purchase Shares – If you are a first-time investor, you may make your Initial Investment in shares of our Common Stock directly through the Plan. As a participant in the Plan, you can buy additional shares by reinvestment of all or a portion of your dividends and by making Optional Cash Payments. • Deposit Stock Certificates for Safekeeping – Deliver stock certificates to the Plan Administrator for credit in the Plan in book-entry form. • Sell Shares – Sell all or a portion of your shares of our Common Stock that are held through the Plan directly without having to deliver a certificate. Initial Investments and Optional Cash Payments may be submitted at any time. Initial Investments and Optional Cash Payments received by the Plan Administrator by 12:00 noon Eastern time on the day prior to an Investment Date will be invested on such Investment Date or during the Investment Period in which such Investment Date occurs. -

Amended Spokane River and Post Falls Hydroelectric

AVISTA CORPORATION Amended SPOKANE RIVER AND POST FALLS HYDROELECTRIC DEVELOPMENTS RECREATION PLAN FERC LICENSE ARTICLES 416 & 417 SPOKANE RIVER HYDROELECTRIC PROJECT FERC PROJECT NO. 2545 Prepared by: REC Resources Amended by: Avista May 19, 2015 TABLE OF CONTENTS 1.0 INTRODUCTION ................................................................................................................1 1.1 Plan Purpose ..................................................................................................................... 1 1.2 Project Area Description .................................................................................................. 1 1.3 Plan Consultation and Review ......................................................................................... 2 1.4 Plan Organization ............................................................................................................. 3 2.0 POST FALLS HYDROELECTRIC DEVELOPMENT .......................................................4 2.1 Q’emiln Park .................................................................................................................... 4 2.1.1 Trail Enhancements .................................................................................................. 4 2.1.2 Post Falls South Channel Dam Spillway Gate Replacement Project - South Channel Dam Overlook .......................................................................................................... 4 2.2 Falls Park ......................................................................................................................... -

150000000 AVISTA CORPORATION Debt Securities

As filed with the Securities and Exchange Commission on August 19, 2003 Registration No. 333-106491 SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM S-3 Pre-effective Amendment No. 1 to REGISTRATION STATEMENT Under THE SECURITIES ACT OF 1933 AVISTA CORPORATION (Exact name of Registrant as specified in its charter) Washington 4931 91-0462470 (State or other jurisdiction of (Primary Standard Industrial (I.R.S. Employer incorporation or organization) Classification Code Number) Identification No.) 1411 East Mission Avenue Spokane, Washington 99202 (509) 489-0500 (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) DAVID J. MEYER Senior Vice President and General Counsel J. ANTHONY TERRELL Avista Corporation Dewey Ballantine LLP 1411 East Mission Avenue 1301 Avenue of the Americas Spokane, Washington 99202 New York, New York 10019 (509) 489-0500 (212) 259-8000 (Name and address, including zip code, and telephone number, including area code, of agents for service) It is respectfully requested that the Commission send copies of all notices, orders and communications to: John E. Baumgardner, Jr. Sullivan & Cromwell LLP 125 Broad Street New York, New York 10004 Approximate date of commencement of proposed sale to the public: From time to time as determined by market conditions and other factors, after the registration statement becomes effective. If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐ If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. -

Sch150orpga.Pdf

BEFORE THE PUBLIC UTILITY COMMISSION OF OREGON AVISTA UTILITIES ADVICE NO. 17-10-G __________________________________________ Tariff Sheets December 22, 2017 BEFORE THE PUBLIC UTILITY COMMISSION OF OREGON AVISTA UTILITIES ADVICE NO. 17-10-G __________________________________________ PRESS RELEASE (DRAFT) December 22, 2017 Contact: Media: Casey Fielder (509) 495-4916, [email protected] Investors: Lauren Pendergraft (509) 495-2998, [email protected] Avista 24/7 Media Access (509) 495-4174 Avista requests lower natural gas prices for Oregon customers Declining wholesale prices benefit customers this winter SPOKANE, Wash. Dec., 22 2017, 1:05 p.m. PST: Avista (NYSE: AVA) today filed a Purchased Gas Cost Adjustment (PGA) request with the Public Utility Commission of Oregon (PUC) to reduce overall natural gas prices by 3.5 percent, to be effective Jan. 26, 2018. Given the continued decline in wholesale natural gas prices, Avista is proposing to decrease the natural gas rates customers pay to better reflect current market prices for natural gas. “We know our customers see higher bills as the weather gets colder, and we want to pass these price decreases on to them as quickly as we can,” said Dennis Vermillion, president of Avista. “The decline in wholesale natural gas prices allows us to decrease customer energy bills during the winter months, when it matters most.” If approved by the PUC, residential natural gas customers in Oregon using an average of 40 therms per month would see a $1.59, or 3.2 percent, decrease per month, for a revised monthly bill of $48.20. The percentage change varies by rate schedule and is dependent upon how much energy customers on the respective rate schedules use. -

Avista Corp. Completes Acquisition of Alaska Energy and Resources Company

Avista Corp. Completes Acquisition of Alaska Energy and Resources Company 07/01/14 SPOKANE, WA -- (Marketwired) -- 07/01/14 -- Avista Corp (NYSE: AVA) today announced that it has closed on its acquisition of Alaska Energy and Resources Company (AERC) based in Juneau, Alaska. AERC is now a wholly-owned subsidiary of Avista Corp. The primary subsidiary of AERC is Alaska Electric Light and Power Company (AEL&P), the oldest regulated electric utility in Alaska. In connection with the closing, Avista Corp. issued approximately 4.5 million new shares of common stock to the shareholders of AERC, at a price of $32.46 per share, which reflects a purchase price of $170 million, less outstanding debt and other closing adjustments. "We are very pleased to complete this transaction, and to have AERC become part of our company. We look forward to working with the highly skilled and dedicated management and employees of AEL&P and to being a partner in the Juneau community," said Avista Corp. Chairman, President and Chief Executive Officer Scott Morris. About Avista Avista Corp., incorporated in 1889 and based in Spokane, Wash., is an energy company involved in the production, transmission and distribution of energy as well as other energy-related businesses. Avista Utilities is the operating division that provides electric service to 367,000 customers and natural gas to 326,000 customers. Its service territory covers 30,000 square miles in eastern Washington, northern Idaho and parts of southern and eastern Oregon, with a population of 1.6 million. Alaska Energy and Resources Company is an Avista subsidiary that provides retail electric service in the city and borough of Juneau, Alaska, through its subsidiary Alaska Electric Light and Power Company. -

Coeur D'alene Lake Aquatic Weed Management Plan

AVISTA CORPORATION COEUR D’ALENE LAKE AQUATIC WEED MANAGEMENT PLAN FOR NON-TRIBAL WATERS 2013 SUMMARY REPORT SPOKANE RIVER LICENSE ARTICLE 410 SPOKANE RIVER HYDROELECTRIC PROJECT FERC PROJECT NO. 2545 Prepared By: Avista Corporation February 25, 2014 Table of Contents 1.0 INTRODUCTION ............................................................................................................... 1 1.1 Background ...................................................................................................................... 1 1.2 Coeur d’Alene Lake Aquatic Weed Management Plan ................................................... 1 2.0 COORDINATION ............................................................................................................... 2 3.0 SURVEYS ........................................................................................................................... 2 4.0 MANAGEMENT/TREATMENTS ..................................................................................... 3 5.0 MILFOIL MANAGEMENT IN COEUR D’ALENE LAKE TRIBAL WATERS ............. 3 6.0 2013 EDUCATION/OUTREACH ...................................................................................... 4 7.0 FUNDING............................................................................................................................ 4 8.0 PLANNED ACTIVITES FOR 2014 ................................................................................... 4 9.0 REFERENCES ................................................................................................................... -

Avista's Integrate Resource Plan Public Meeting February 24, 2021

Avista’s Integrate Resource Plan Public Meeting February 24, 2021 These are results of the poll questions given to the audiences in both the webinar and breakout room sessions. Webinar Poll Questions 1. What would you prioritize among the choices below, acknowledging they are all important? • Environmental Issues: 32 • A Reliable System: 75 • Affordability: 33 2. Which Avista system provides more energy to its customers? • Natural gas: 66 (this answer is most correct) • Electric: 69 3. If Avista were to offer a voluntary program to charge higher prices during 4:00 pm to 8:00 pm in exchange for lower prices in other hours would you be interested? • Yes: 77 • No: 59 Generation and Reliability Breakout Room 1. When Avista acquires new generation resources- where should they be located? • Indifferent to where resources are located: 6 • All of the above: 26 • Within our local communities: 9 • Within our service territory, but not in our local communities: 6 • Outside the service territory (i.e. another state or Canada): 1 2. To meet reliability needs in the next 5 years, how should Avista meet this requirement • Acquire natural gas generation with a modest environmental footprint- medium cost alternative: 33 • Acquire storage resource with low operational environmental footprint- highest cost alternative: 11 • Utilize customer outages to stabilize the grid- lowest cost alternative: 2 Affordability & Equity Breakout Room 1. How much of your electric bill should go towards assisting or improving the lives of individuals and communities who are economically disadvantaged? • $0 per month: 6 • $5 per month: 9 • $10 per month: 6 • Other: 4 Page 1 2. -

Avista Corp. 1411 East Mission P.O. Box 3727 Spokane, Washington 99220-0500 Telephone 509-489-0500 Toll Free 800-227-9187

Avista Corp. 1411 East Mission P.O. Box 3727 Spokane, Washington 99220-0500 Telephone 509-489-0500 Toll Free 800-227-9187 March 29, 2021 Public Utility Commission of Oregon Attn: Filing Center 201 High Street SE, Suite 100 Salem, OR 97301-3612 RE: Advice No. 21-02-G – Avista Utilities Schedule 493, Low-Income Rate Assistance Program (LIRAP) Filing Center: Pursuant to ORS 757.205 and OAR 860-022-0025, attached for filing with the Public Utility Commission of Oregon (PUC or the Commission) is an electronic copy of Avista Corporation’s, dba Avista Utilities (Avista or the Company), filing of its proposed revisions to the following tariff sheets, P.U.C. OR No. 5: Fourth Revision Sheet 493 Canceling Third Revision Sheet 493 Third Revision Sheet 493A Canceling Second Revision Sheet 493A The primary purpose of this filing is to revise the Company’s Schedule 493 “Residential Low-Income Rate Assistance Program (LIRAP)”, to incorporate an Arrearage Management Plan (AMP) into its tariff and to extend the provision of LIRAP outreach funds to Avista as well as to the Community Action Agencies (CAAs or Agencies) that are already receiving such administration funds for the delivery of the program within the Company’s service territory. I. BACKGROUND Avista’s LIRAP, approved by the Commission in 2002, collects funding through natural gas tariff surcharges on Schedule 493. The revenue collected for LIRAP is then provided to the four CAAs in Avista’s Oregon service territory for disbursal to qualifying customers in a manner similar to the Federal and State-sponsored Low-Income Home Energy Assistance Program (LIHEAP), as well as to cover any administrative costs incurred by the Agencies in delivery of the program. -

Avista Advises of Potentially Hazardous River Conditions Between Cabinet Gorge Dam and Lake Pend Oreille on Nov

Contact: Media: David Vowels (509) 495-7956, [email protected] Avista 24/7 Media Access (509) 495-4174 Avista advises of potentially hazardous river conditions between Cabinet Gorge Dam and Lake Pend Oreille on Nov. 17 and Nov. 18 Be aware that the water levels can change without warning SPOKANE, Wash. Nov. 5, 2018: Water flowing through Cabinet Gorge Dam will come to a standstill Nov. 17 and Nov. 18 to facilitate a high-resolution bathymetric survey of the tailrace (channel that carries water away from the hydroelectric plant). This is a routine, Federal Energy Regulatory Commission (FERC) mandated inspection related to dam safety and is required to occur once every five years. Clark Fork River water flows will be extremely low between Cabinet Gorge Dam and Lake Pend Oreille between 8:30 a.m. and 5:00 p.m. on Nov. 17 and Nov. 18. As a result, lower elevation navigation hazards that people are not familiar with are likely to be present and boat ramps may not be usable. In addition, water flows will change rapidly and without warning during this time. To increase public safety and awareness, signs will be posted at river access sites along the river. Waterway users should always be alert to signs of such changes and exercise the highest level of personal caution and safety. Avista Corp. is an energy company involved in the production, transmission and distribution of energy as well as other energy-related businesses. Avista Utilities is the operating division that provides electric service to 382,000 customers and natural gas to 347,000 customers. -

2020 Electric Integrated Resource Plan

2020 Electric Integrated Resource Plan Safe Harbor Statement This document contains forward-looking statements. Such statements are subject to a variety of risks, uncertainties and other factors, most of which are beyond the Company’s control, and many of which could have a significant impact on the Company’s operations, results of operations and financial condition, and could cause actual results to differ materially from those anticipated. For a further discussion of these factors and other important factors, please refer to the Company’s reports filed with the Securities and Exchange Commission. The forward- looking statements contained in this document speak only as of the date hereof. The Company undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances that occur after the date on which such statement is made or to reflect the occurrence of unanticipated events. New risks, uncertainties and other factors emerge from time to time, and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the Company’s business or the extent to which any such factor, or combination of factors, may cause actual results to differ materially from those contained in any forward- looking statement. Production Credits Primary Electric IRP Team Name Title Contribution Clint Kalich Mgr. of Resource Planning & Analysis IRP Core Team James Gall IRP Manager IRP Core Team John Lyons Sr. Policy Analyst IRP Core Team Grant Forsyth Chief Economist Load Forecast Ryan Finesilver Mgr. of Energy Efficiency, Planning & Analysis Energy Efficiency Leona Haley Energy Efficiency Program Manager Demand Response Electric IRP Contributors Name Title Contribution Thomas Dempsey Mgr. -

How Rates Are Set AVISTA FILES a COMMISSION COMMISSION SETS Avista Is a Regulated Utility

Rates How rates are set AVISTA FILES A COMMISSION COMMISSION SETS Avista is a regulated utility. That RATE REQUEST REVIEWS REQUEST OR APPROVES RATES term, “regulated utility,” is important because it means that When our costs for The commission then Based on its findings, regulators set or approve our providing energy reviews our costs, the commission sets rates. It’s common to think we can service to our reviews volumes or approves rates raise our rates whenever we want, customers change, of data and takes it believes serve but in fact, the opposite is true. we file a request with public testimony. the public interest Avista’s rates can only change the commissions to – rates that are with approval from state public adjust rates. We must reasonable and fair utility commissions. Here’s how go through a detailed to customers, while the process works: public process and allowing Avista the demonstrate the need opportunity to be for a rate change. a viable, healthy business and earn a fair return for shareholders. US Electric Utility What rates cover Residential Bill Comparison Rates cover two types of costs: 1. The cost of generating or purchasing energy; HAWAII 375.31 2. The cost of delivering that energy to customers. CALIFORNIA 279.05 CONNECTICUT 231.76 The cost of wholesale energy is a major rate-driver. Our costs MASSACHUSETTS 231.12 fluctuate up and down based on the energy market. Avista RHODE ISLAND 192.38 is fortunate to own and operate the majority of the power NEW YORK 175.37 VERMONT 172.32 it generates, which gives us more control over the entire NEW HAMPSHIRE 171.24 energy-delivery process, from generation to transmission to MAINE 164.06 distribution.