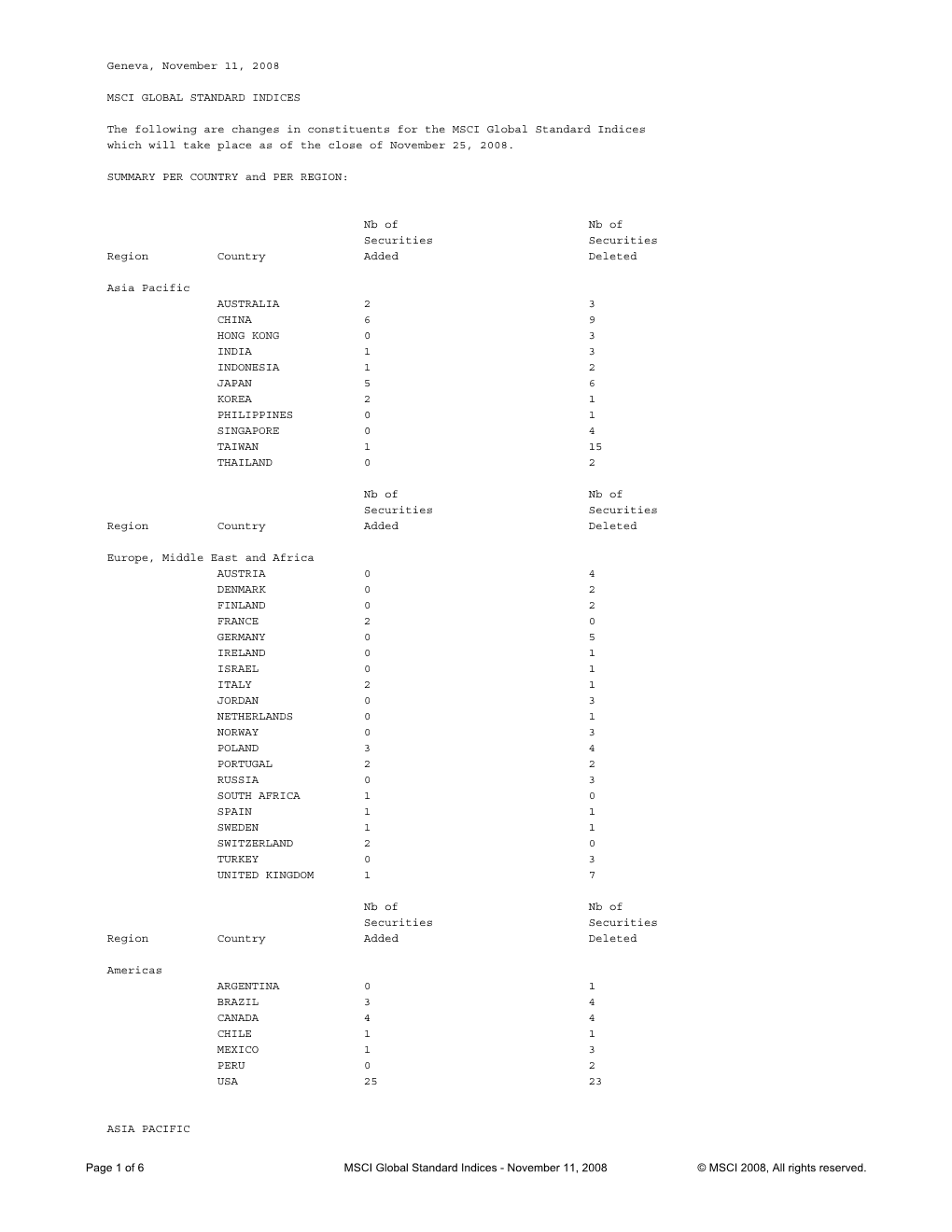

Geneva, November 11, 2008 MSCI GLOBAL STANDARD INDICES The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

2007 ANNUAL REPORT TSE:2303 NYSE:UMC Corporate Information Spokesperson Fab 8C ADR Depositary and Registrar Chitung Liu No.6 Li-Hsin 3rd Rd., Hsinchu Science Citibank, N.A. Chief Financial Officer Park, Hsinchu, Taiwan 30078, R.O.C. Depositary Receipt Services 886 (2) 2700 6999 886 (3) 578 2258 14F, 388 Greenwich Street, [email protected] New York, NY 10013, U.S.A. Fab 8D 1 (877) 248 4237 (Toll-free) Deputy Spokesperson(s) No.8 Li-Hsin 3rd Rd., Hsinchu Science Stockholder Service Representatives are Sandy Yen Park, Hsinchu, Taiwan 30078, R.O.C. available Monday through Friday, The Chairman and CEO Office 886 (3) 578 2258 8:30a.m. to 6:00p.m., Eastern Time. Senior Manager http://wwss.citissb.com/adr/www/ 886 (2) 2700 6999 Fab 8E [email protected] [email protected] No.17 Li-Hsin Rd., Hsinchu Science Park, Hsinchu, Taiwan 30078, R.O.C. ADR Exchange Marketplace Bowen Huang 886 (3) 578 2258 New York Stock Exchange, Inc. Finance Division 11 Wall Street Senior Manager Fab 8F New York, NY 10005, U.S.A. 886 (2) 2700 6999 No.3 Li-Hsin 6th Rd., Hsinchu Science 1 (212) 656 3000 [email protected] Park, Hsinchu, Taiwan 30078, R.O.C. www.nyse.com 886 (3) 578 2258 Ticker/Search Code: UMC Headquarters No.3 Li-Hsin 2nd Rd., Hsinchu Science Fab 8S Exchangeable Bond Exchange Park, Hsinchu, Taiwan 30078, R.O.C. No.16 Creation 1st Rd., Hsinchu Science Marketplace 886 (3) 578 2258 Park, Hsinchu, Taiwan 30077, R.O.C. -

John Hancock Emerging Markets Fund

John Hancock Emerging Markets Fund Quarterly portfolio holdings 5/31/2021 Fund’s investments As of 5-31-21 (unaudited) Shares Value Common stocks 98.2% $200,999,813 (Cost $136,665,998) Australia 0.0% 68,087 MMG, Ltd. (A) 112,000 68,087 Belgium 0.0% 39,744 Titan Cement International SA (A) 1,861 39,744 Brazil 4.2% 8,517,702 AES Brasil Energia SA 14,898 40,592 Aliansce Sonae Shopping Centers SA 3,800 21,896 Alliar Medicos A Frente SA (A) 3,900 8,553 Alupar Investimento SA 7,050 36,713 Ambev SA, ADR 62,009 214,551 Arezzo Industria e Comercio SA 1,094 18,688 Atacadao SA 7,500 31,530 B2W Cia Digital (A) 1,700 19,535 B3 SA - Brasil Bolsa Balcao 90,234 302,644 Banco Bradesco SA 18,310 80,311 Banco BTG Pactual SA 3,588 84,638 Banco do Brasil SA 15,837 101,919 Banco Inter SA 3,300 14,088 Banco Santander Brasil SA 3,800 29,748 BB Seguridade Participacoes SA 8,229 36,932 BR Malls Participacoes SA (A) 28,804 62,453 BR Properties SA 8,524 15,489 BrasilAgro - Company Brasileira de Propriedades Agricolas 2,247 13,581 Braskem SA, ADR (A) 4,563 90,667 BRF SA (A) 18,790 92,838 Camil Alimentos SA 11,340 21,541 CCR SA 34,669 92,199 Centrais Eletricas Brasileiras SA 5,600 46,343 Cia Brasileira de Distribuicao 8,517 63,718 Cia de Locacao das Americas 18,348 93,294 Cia de Saneamento Basico do Estado de Sao Paulo 8,299 63,631 Cia de Saneamento de Minas Gerais-COPASA 4,505 14,816 Cia de Saneamento do Parana 3,000 2,337 Cia de Saneamento do Parana, Unit 8,545 33,283 Cia Energetica de Minas Gerais 8,594 27,209 Cia Hering 4,235 27,141 Cia Paranaense de Energia 3,200 -

Emerging Markets Value Portfolio- Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Value Portfolio- Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

SPDR® Index Shares Funds Semi-Annual Report March 31, 2012

SPDR® Index Shares Funds Semi-Annual Report March 31, 2012 ® Precise in a world that isn’t.SM TABLE OF CONTENTS Performance and Portfolio Summaries SPDR» STOXX Europe 50» ETF (FEU) ............................................... 1 SPDR EURO STOXX 50 ETF (FEZ) . ................................................ 4 SPDR S&P» Emerging Asia Pacific ETF (GMF) ......................................... 7 SPDR S&P Small Cap Emerging Asia Pacific ETF (GMFS) ................................ 10 SPDR S&P Russia ETF (RBL) ....................................................... 11 SPDR S&P China ETF (GXC) ....................................................... 14 SPDR S&P Emerging Markets ETF (GMM) . ......................................... 17 SPDR S&P Emerging Markets Dividend ETF (EDIV) . .................................. 20 SPDR S&P BRIC 40 ETF (BIK) ...................................................... 23 SPDR S&P Emerging Europe ETF (GUR) ............................................. 26 SPDR S&P Emerging Latin America ETF (GML) ........................................ 29 SPDR S&P Emerging Middle East & Africa ETF (GAF) . .................................. 32 SPDR S&P World ex-US ETF (GWL) . ................................................ 35 SPDR S&P International Small Cap ETF (GWX) ........................................ 38 SPDR Dow Jones International Real Estate ETF (RWX) .................................. 41 SPDR FTSE/Macquarie Global Infrastructure 100 ETF (GII) ............................... 44 SPDR S&P Global Natural Resources ETF (GNR) -

Industry Informationdownload

Contents 1. Industry Trends ∙ 1 1.1 Status of the Industry ∙ 1 1.2 Industrial Competitiveness ∙ 7 1.3 Promising Fields in Korea ∙ 12 2. Trends of Foreign Direct Investment ∙ 16 2.1 Foreign Direct Investment Status ∙ 16 2.2 Success Cases of Major Foreign-Invested Companies ∙ 17 3. Policy and Locations ∙ 20 3.1 Key Policies and Incentives ∙ 20 3.2 Major Locations ∙ 25 4. Potential Partners ∙ 28 4.1 List of Related Companies ∙ 28 4.2 Related Associations & Organizations ∙ 34 * Figures on the report show the likely adjustment of average yearly currency rates from Korean Won (KRW) to the US dollar (USD). A rate adjustment is adopted particularly reflecting the recent average market variations to eliminate the valuation effects arising from movements in exchange rates in case when the data expressed shows an annual growth rate on the paper. * Rate adjusted figures are rounded off, but the sum is correct down or up to the decimal when the rounded values are not equal to the adjustment. 1 Industry Trends Definition and Classification ■ (Communication equipment industry) A device industry is an industry related to the collection, processing, storage, search, reception and utilization of telecommunications services, and is classified into wired communication devices and wireless communication devices in detail. ∙ Wired communication devices are classified into wired telephone, exchanger and network equipment. Wireless communication devices include wireless communication terminal, wireless communication system and transceiver. ∙ At present, the communication equipment industry requires a next generation mobile communication system, mobile convergence device and parts with high speed and high quality along with related technologies for 5G mobile communication service. -

Asian Tech Files TCS Revenue In-Line but Margins Below Expectations

Asia Pacific Technology - General Industry In-Depth 17 April 2007 | 18 pages Asian Tech Files TCS Revenue In-Line but Margins Below Expectations Top Asian Tech Calls Kirk Yang1 Flash: Tata Consultancy Services (TCS.BO): Buy: TCS Q4 - Revenues In-Line; +852-2501-2787 Margins Below Expectations — Revenue for the quarter was $1.18b (as against [email protected] our expectation of $1.19b). EBITDA margins were flat qoq at 28.3% as against Semiconductors our expectation of 40bp improvement. Higher depreciation resulted in EBIT 2 margins declining by ~50bp qoq. Net profit was helped by a one-off other Andrew Lu [email protected] income due to sale of stake in Sitel – net profit for the quarter was Rs. 11.73b. Surendra Goyal +91-22-6631-9870 Jay Choi3 [email protected] Hardware Dale Gai2 [email protected] Patty Liu2 [email protected] Horng Han Low4 [email protected] Michael Meng1 [email protected] TFT/LCD George Chang, CFA2 [email protected] Sean Kim3 [email protected] IT Services Surendra Goyal, CFA5 [email protected] See Appendix A-1 for Analyst Certification and important disclosures. Citigroup Research is a division of Citigroup Global Markets Inc. (the "Firm"), which does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. -

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 0165-12 Date: February 3, 2012 To: All Participants Category: Dividends From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers The Bank of New York Mellon – ADRs that the bank, as ADR depositary for these Subject: issues, has determined if they met the criteria for the reduced U.S. tax rate as “qualified dividends” for tax year 2011. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. To ensure compliance with Internal Revenue Service Circular 230, you are hereby notified that: (a) any discussion of federal tax issues contained or referred to herein is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code; and (b) as a matter of policy, DTC does not provide tax, legal or accounting advice and accordingly, you should consult your own tax, legal and accounting advisor before engaging in any transaction. -

DIGITIMES Tech Forum 2013 Plan the Premier ICT Tech Forum

DIGITIMES Tech Forum 2013 Plan The premier ICT Tech Forum • 35,380 • Over 4,500 accumulated companies attendees for DTF participated in seminars DTF 35,380 4,500 Convincing Strong Statistics Influence 535 1,500 • Around 1,500 • Average 535 companies listed attendees of each in top 5000 credit DTF event rankings in Taiwan DIGITIMES Tech Forums: Serving the core interests of engineers 52% 64% 93% • 52% attendees Over 93% DTF • 64% attendees with responsible for R&D, attendees show highly manufacturing power in decision operation and making or control interested procurement functions. of business engagement .The analyzed data is from 3Q ~ 4Q 2012 DTF attendees profiles 3 Targeting customer base with high potential and strong buying power PC peripherals Semiconductor Consumer electronics 3C/component retailer Networking/Telecom IPC & Telematics Finance Service Software/information service Optoelectronics Telecom services Other 4 High-efficiency, full-coverage, sales development platform Electronic control/ instrument Security/sensor Telematics Processor/OS Computing/storage Transmission Battery/infocom Embedded Storage/networking Mobile Internet/transmission communications Technology Device Consumer IOT/automation Power supply Wireless/connecting Electronics interface Smart/energy efficiency Smart TV Smart/remote Smart Application Home Application Multi-cores/ Home automation Technology MCU energy efficiency Technology High bit/SoC Video/audio Audio/Video Integration eSports/multimedia Entertainm ent Control/peripherals Touch control/sensor -

Company Vendor ID (Decimal Format) (AVL) Ditest Fahrzeugdiagnose Gmbh 4621 @Pos.Com 3765 0XF8 Limited 10737 1MORE INC

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 0XF8 Limited 10737 1MORE INC. 12048 360fly, Inc. 11161 3C TEK CORP. 9397 3D Imaging & Simulations Corp. (3DISC) 11190 3D Systems Corporation 10632 3DRUDDER 11770 3eYamaichi Electronics Co., Ltd. 8709 3M Cogent, Inc. 7717 3M Scott 8463 3T B.V. 11721 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 89 North, Inc. 12070 Shenzhen 8Bitdo Tech Co., Ltd. 11720 90meter Solutions, Inc. 12086 A‐FOUR TECH CO., LTD. 2522 A‐One Co., Ltd. 10116 A‐Tec Subsystem, Inc. 2164 A‐VEKT K.K. 11459 A. Eberle GmbH & Co. KG 6910 a.tron3d GmbH 9965 A&T Corporation 11849 Aaronia AG 12146 abatec group AG 10371 ABB India Limited 11250 ABILITY ENTERPRISE CO., LTD. 5145 Abionic SA 12412 AbleNet Inc. 8262 Ableton AG 10626 ABOV Semiconductor Co., Ltd. 6697 Absolute USA 10972 AcBel Polytech Inc. 12335 Access Network Technology Limited 10568 ACCUCOMM, INC. 10219 Accumetrics Associates, Inc. 10392 Accusys, Inc. 5055 Ace Karaoke Corp. 8799 ACELLA 8758 Acer, Inc. 1282 Aces Electronics Co., Ltd. 7347 Aclima Inc. 10273 ACON, Advanced‐Connectek, Inc. 1314 Acoustic Arc Technology Holding Limited 12353 ACR Braendli & Voegeli AG 11152 Acromag Inc. 9855 Acroname Inc. 9471 Action Industries (M) SDN BHD 11715 Action Star Technology Co., Ltd. 2101 Actions Microelectronics Co., Ltd. 7649 Actions Semiconductor Co., Ltd. 4310 Active Mind Technology 10505 Qorvo, Inc 11744 Activision 5168 Acute Technology Inc. 10876 Adam Tech 5437 Adapt‐IP Company 10990 Adaptertek Technology Co., Ltd. 11329 ADATA Technology Co., Ltd. -

United States Bankruptcy Court District of Delaware

B6 Summary (Offcial Form 6 - Summary) (12107) United States Bankruptcy Court District of Delaware In re MagnaChip Semiconductor LLC Case No. 09-12009 (PJW) Debtor Chapter 11 SUMMARY OF SCHEDULES Indicate as to each schedule whether that schedule is attached and state the number of pages in each. Report the totals from Schedules A, B, D, E, F, I, and J in the boxes provided. Add the amounts from Schedules A and B to determine the total amount of the debtor's assets. Add the amounts of all claims from Schedules D, E, and F to determine the total amount of the debtor's liabilities. Individual debtors must also complete the "Statistical Summar of Certain Liabilities and Related Data" if they fie a case under chapter 7,11, or 13. NAME OF SCHEDULE ATTACHED NO. OF ASSETS LIABILITIES OTHER (YES/NO) SHEETS A - Real Propert Yes 1 B - Personal Propert Yes 4 C - Propert Claimed as Exempt No 0 D - Creditors Holding Secured Claims Yes 1 E - Creditors Holding Unsecured Yes 2 Priority Claims (Total of Claims on Schedule E) F - Creditors Holding Unsecured Yes 2 Nonpriority Claims G - Executory Contracts and Yes 23 Unexpired Leases H - Codebtors Yes 5 1 - Current Income ofIndividual No 0 Debtor(s) J - Current Expenditures ofIndividual No 0 Debtor(s) 38 Total Number of Sheets of ALL Schedules Total Assets Total Liabilities 851,879,383.52 Copyright (e) 1996-2009. Best Case Solutions. Evanston, IL. (BOO) 492.B037 Best Case Bankruptcy UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE Global Notes and Statement of Limitations, Methodology and Disclaimer Regarding the Debtors' Statement and Schedules MagnaChip Semiconductor Finance Company, MagnaChip Semiconductor LLC, MagnaChip Semiconductor SA Holdings LLC, MagnaChip Semiconductor, Ii1c., MagnaChip Semiconductor S.A., and MagnaChip Semiconductor B.V. -

Taiwan's Performance in the Communication Products Segment

15 Taiwan’s Performance in the Communication Products Segment (1) The mobile phone handset industry Most of Taiwan’s mobile phone handset manufacturers started out as contract manufacturers undertaking ODM/OEM production. Over the past few years, they have come to play a very important role within the global mobile phone industry value chain. In particular, the impact of the many years of effort expended by Taiwan’s ODM providers should not be underestimated. Several Taiwanese mobile phone makers – including HTC, ASUS and Acer – have moved into branded manufacturing, which in turn has led to a substantial enhancement of the R&D capabilities of the Taiwanese mobile phone industry as a whole. HTC is Taiwan’s largest mobile phone handset maker; it is mainly engaged in the manufacturing of smartphones that run either the Android or Windows Phone operating system. Working through strategic partners such as Google, Microsoft and Qualcomm, HTC helps to provide the latest-model smartphones to consumers all around the world. Currently, HTC’s annual shipments account for over half of Taiwan’s total annual mobile phone shipment volume, and the company has established itself as one of the world’s leading mobile phone brands. HTC handsets are marketed in Europe, North America and Asia through collaboration with local telecommunications service providers and handset distributors. HTC is also gradually starting to make headway in the Middle East, Central and South American and Russian markets. According to a statistical survey conducted by ITRI’s IEK, in 2012 the performance of Taiwan’s own-brand handset makers was negatively impacted by patent litigation and by shortages of key components, while Taiwan’s ODM providers were affected by the poor sales performance of their main customers.