Appendix 4E Carsales.Com Ltd Full-Year Ended 30 June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 4E Carsales.Com Ltd Results for Announcement to the Market

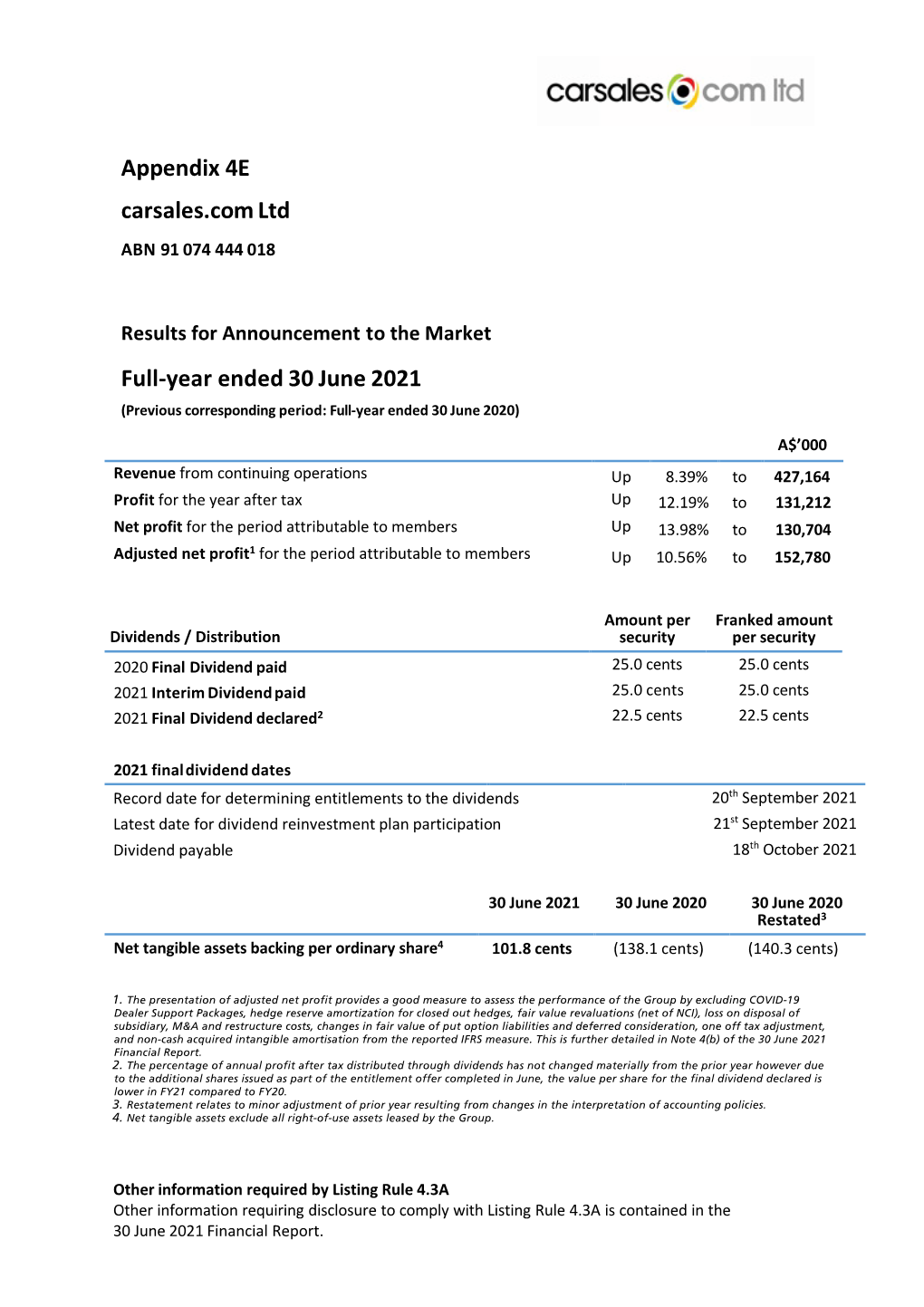

Appendix 4E carsales.com Ltd ABN 91 074 444 018 Results for Announcement to the Market Full-year ended 30 June 2020 (Previous corresponding period: Full-year ended 30 June 2019) A$’000 Revenue from continuing operations Down (5.25%) to 395,585 Profit for the year after tax Up 38.84% to 116,953 Net profit for the period attributable to members Up 36.49% to 114,668 Adjusted net profit* for the period attributable to members Up 6.17% to 138,189 Franked Amount amount Dividends/Distribution per security per security 2019 Final Dividend paid 25.0 cents 25.0 cents 2020 Interim Dividend paid 22.0 cents 22.0 cents 2020 Final Dividend declared 25.0 cents 25.0 cents 2020 final dividend dates Record date for determining entitlements to the dividends 23rd September 2020 Latest date for dividend reinvestment plan participation 24th September 2020 Dividend payable 7th October 2020 30 June 2019 30 June 2020 30 June 2019 Restated*** Net tangible assets backing per ordinary share** (138.1 cents) (128.9 cents) (158.4 cents) * The presentation of adjusted net profit provides the best measure to assess the performance of the Group by excluding COVID-19 Dealer Support Package, fair value gain arising from discontinuing the equity method (net of NCI), gain on associate investment dilution (net of NCI), loss on disposal of subsidiary, one-off transaction and restructure costs, one-off bad debt expenses, changes in fair value of put option liabilities and deferred consideration, one-off tax adjustment, option unwinding discount and non-cash acquired intangible amortisation from the reported IFRS measure. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

16 August 2021 Company Announcements Office Australian

16 August 2021 Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 2021 FULL YEAR RESULTS – ANNUAL REPORT Seven West Media Limited (ASX: SWM) attaches the Annual Report for the year ended 26 June 2021. This release has been authorised to be given to ASX by the Board of Seven West Media Limited. For further information, please contact: Investors/Analysts Media Alan Stuart Rob Sharpe T: +61 2 8777 7211 T: +61 437 928 884 E: [email protected] E: [email protected] Seven West Media Limited / 50 Hasler Road, Osborne Park WA 6017 Australia / PO Box 7077, Alexandria NSW 2015 Australia T +61 2 8777 7777 / ABN 91 053 480 845 Repositioned for growth. Annual Report 2021 Big Brother Contents Our Strategy Who We Are 2 Our Strategic Priorities and Performance Dashboard 4 Executive Letters Letter from the Chairman 6 Letter from the Managing Director and Chief Executive Officer 8 Review of Operations Group Performance – Key Highlights and Summary of Financial Performance 11 Seven Network 17 The West 20 Corporate Social Responsibility Risk, Environment, People and Social Responsibility 22 Seven in the Community 28 Governance Board of Directors 33 Corporate Governance Statement 36 Directors’ Report 47 Remuneration Report 52 Auditor’s Independence Declaration 73 Financial Statements Financial Statements 74 Directors’ Declaration 132 Independent Auditor’s Report 133 Investor Information 138 Shareholder Information 139 Company Information 141 1 Section 1: Our Strategy Seven West Media Limited Annual Report 2021 Who We Are Transforming to lead Seven West Media is being transformed to drive long-term success. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

2015 SWM Annual Report

ABN 91 053 480 845 Delivering the future of content. Anywhere. Any screen. Anytime. Annual Report 2015 Seven West Media cares about the environment. By printing 2000 copies of this Annual Report on ecoStar Silk and ecoStar Offset the environmental impact was reduced by*: 1,185kg 171kg 1,707km of landfill of CO2 and travel in the average greenhouse gases European car 26,982 2,486kWh 1,926kg litres of water of energy of wood Source: European BREF data (virgin fibre paper). Carbon footprint data evaluated by Labelia Conseil in accordance with the Bilan Carbone® methodology. Results are obtained according to technical information and are subject to modification. *compared to a non-recycled paper. Delivering the future of content. Anywhere. Any screen. Anytime. Annual Report 2015 Contents What We Do 4 The Future of Us 44 Our Brands 6 Board of Directors 46 Our Strategy 8 Corporate Governance Statement 49 Our Strategic Framework 10 Directors’ Report 60 Letter from the Chairman 12 Remuneration Report 64 Letter from the Managing Director & CEO 14 Auditor’s Independence Declaration 83 Performance Dashboard 16 Financial Statements 84 Performance of the Business 18 Directors’ Declaration 134 Group Performance 20 Independent Auditor’s Report 135 Television 26 Company Information 137 Newspapers 32 Investor Information 138 Magazines 36 Shareholder Information 139 Other Business and New Ventures 40 Risk, Environment and Social Responsibility 42 2 Seven West Media Annual Report 2015 ABN 91 053 480 845 Contents The right people creating great content across television, digital, mobile and newspaper and magazine publishing. Delivering the future of content 3 What We Do We are achieving growth in the delivery of our content across our portfolio of integrated media platforms. -

Annual Report Contents

2019 ANNUAL REPORT CONTENTS 02 COMPANY OVERVIEW 42 SUSTAINABILITY REPORT 04 2019 HIGHLIGHTS 52 FINANCIAL REPORT 06 CHAIR REVIEW 100 DIRECTORS’ DECLARATION 08 CEO’S REVIEW 101 INDEPENDENT AUDITOR’S REPORT 13 OPERATING AND FINANCIAL REVIEW 104 SHAREHOLDER INFORMATION 18 BOARD OF DIRECTORS 106 GLOSSARY 21 DIRECTORS’ REPORT 108 CORPORATE DIRECTORY 29 REMUNERATION REPORT The Annual Report was authorised for issue, in accordance with a resolution of the Directors. The Directors have the power to amend and reissue the Annual Report. Through the use of the internet, we have ensured that our corporate reporting is timely, complete and available globally at minimum cost to the Company. All media releases, financial reports and other information are available at the Investors section on our website: ww w.oohmedia. com.au. 01 COMPANY OVERVIEW oOh! is a pioneering media company changing the face of the Out of Home industry in Australia and New Zealand. Through our commitment to market leading data, ideas and driving 1+ reach, we make brands powerfully unmissable. We invest in sophisticated data to ensure we know audiences at location better than anyone else and deliver quality insight and ROI for our clients. We commit to original ideas and the highest quality network to provide unrivalled reach across capital cities and regional areas. oOh!’s extensive network of 37,000 locations include Billboards, Retail, Fly, Rail, Street Furniture, and Place-Based environments (universities, venues, cafes, offices, and healthcare centres). We also own and operate digital publisher Junkee Media, printing business Cactus, and experiential provider Edge, providing unrivalled solutions for Advertisers. -

Australian Capital Territory Listed Company Shareholdings As at 31 March 2021

? i Australian Capital Territory Listed Company Shareholdings at 31 March 2021 Publication Date: April 2021 Page | 1 10X Genomics Inc Airbus SE 3i Group PLC Aisin Corp 3M Co Ajinomoto Co Inc A O Smith Corp Akamai Technologies Inc a2 Milk Co Ltd/The Akzo Nobel NV ABB Ltd Albemarle Corp Abbott Laboratories Alcon Inc AbbVie Inc Alexandria Real Estate Equities Inc ABC-Mart Inc Alexion Pharmaceuticals Inc ABIOMED Inc Alfa Laval AB Accent Group Ltd Algonquin Power & Utilities Corp Accenture PLC Align Technology Inc Accor SA Alimentation Couche-Tard Inc Acom Co Ltd Alkane Resources Ltd ACS Actividades de Construccion y Servic Alleghany Corp Activision Blizzard Inc Allegion plc Adbri Ltd Allianz SE Adecco Group AG Allstate Corp/The adidas AG Ally Financial Inc Admiral Group PLC Alnylam Pharmaceuticals Inc Adobe Inc Alphabet Inc Advance Auto Parts Inc ALS Ltd Advanced Micro Devices Inc Alstom SA Advantest Corp AltaGas Ltd Adyen NV Altice USA Inc Aegon NV Altium Ltd Aeon Co Ltd Alumina Ltd Aflac Inc Amada Co Ltd Afterpay Ltd Amadeus IT Group SA AGC Inc Amazon.com Inc Ageas SA/NV Ambu A/S Agilent Technologies Inc Amcor PLC Agnaten SE AMERCO AGNC Investment Corp American Express Co Agnico Eagle Mines Ltd American Financial Group Inc/OH AIA Group Ltd American International Group Inc Air Canada American Tower Corp Air Liquide SA American Water Works Co Inc Air Products and Chemicals Inc Ameriprise Financial Inc Air Water Inc AmerisourceBergen Corp Airbnb Inc AMETEK Inc Page | 2 Amgen Inc Assicurazioni Generali SpA AMP Ltd Assurant Inc Amphenol Corp -

Annual Report 2020 Report Annual Oh!Media

o OH!MEDIA ANNUAL REPORT 2020 2020 ANNUAL REPORT CONTENTS 2 COMPANY OVERVIEW 4 2020 SUMMARY 6 CHAIR REVIEW 8 CEO REVIEW 11 OPERATING AND FINANCIAL REVIEW 18 BOARD OF DIRECTORS 21 DIRECTORS’ REPORT 31 REMUNERATION REPORT 49 SUSTAINABILITY REPORT 65 FINANCIAL STATEMENTS 112 DIRECTORS’ DECLARATION 113 INDEPENDENT AUDITOR’S REPORT 119 SHAREHOLDER INFORMATION 122 GLOSSARY 124 CORPORATE DIRECTORY The Annual Report was authorised for issue, in accordance with a resolution of the Directors. The Directors have the power to amend and reissue the Annual Report. Through the use of the internet, we have ensured that our corporate reporting is timely, complete and available globally at minimum cost to the Company. All media releases, financial reports and other information are available at the Investors section on our website: ww w.oohmedia. com.au. 3 011 COMPANY OVERVIEWoOh!media is a leading Out of Home media company that is enhancing public spaces through the creation of engaging environments that help advertisers, landlords, leaseholders, community organisations, local councils and governments reach large and diverse public audiences. The company’s extensive network of more than 37,000 digital and static asset locations includes roadsides, retail centres, airports, train stations, bus stops, office towers, cafes, bars and universities. Listed on the ASX, oOh! employs around 800 people across Australia and New Zealand, and had revenues of $426.5 million in 2020 and $649 million in 2019. The company invests strategically in technology, and is pioneering the use of sophisticated data techniques that enable clients to maximise their media spend through unrivalled and accurate audience targeting. -

Small- and Mid-Cap Gains Highlight 'Dangerous Market'

5/28/2020 Small- and mid-cap gains highlight 'dangerous market' Today's Paper Markets Data Events Lists administration Home Companies Markets Street Talk Politics Policy World Property Technology Opinion Wealth Work & Careers Life & Luxury Wealth Personal Finance Sharemarket Print article Small- and mid-cap gains highlight 'dangerous market' Some stocks have soared more than 20 per cent in a day – potentially a warning of overstretched prices and investor euphoria. TTonononyyy F FFeatherseatherseatherstonetonetone Contributor Feb 22, 2020 – 12.00am Saved Share Stocks are said to go up in an escalator and down in a lift. In this bull market, RELATED QUOTES the opposite is true – stocks are soaring on good news and falling less than usual on bad news. BRG $22.24 -0.45% 1 year 1 day The profit-reporting season has seen prices of mid-capitalisation and small- cap stocks shooting sharply higher this month when results beat market 30.00 25.00 expectation. Some stocks have soared more than 20 per cent in a day – 20.00 remarkable gains for shareholders and day traders, but potentially a 15.00 warning of an overstretched market and investor euphoria. 10.00 Jun 19 Sep 19 Dec 19 Mar 20 Updated: May 28, 2020 – 1.46pm. Data is 20 mins delayed. View BRG related articles IEL $17.48 4.11% JBH $37.63 0.35% CHC $9.61 1.05% SVW $16.37 -3.25% DMP $62.32 -0.62% CWY $1.94 -0.77% Mind the gap: in theory, mid-cap and small-cap companies have higher growth prospects, so their performance gap with large-caps could be closing as investors pay up for growth. -

STOXX Pacific 100 Last Updated: 01.08.2017

STOXX Pacific 100 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 98.1 1 1 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 72.3 2 2 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 58.9 3 3 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 56.2 4 5 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.3 5 4 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 38.8 6 6 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 33.0 7 7 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 31.3 8 8 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 23.4 9 9 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 18.9 10 11 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 18.6 11 10 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 15.9 12 12 AU000000SCG8 BLZH0Z7 SCG.AX AU01Z4 SCENTRE GROUP AU AUD Y 14.9 13 14 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 14.4 14 13 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. AU AUD Y 12.5 15 15 AU000000AMC4 6066608 AMC.AX 606660 Amcor Ltd. AU AUD Y 12.0 16 16 AU000000QBE9 6715740 QBE.AX 671574 QBE Insurance Group Ltd. -

Portfolio Holdings Disclosure - Renewables Plus

Portfolio Holdings Disclosure - Renewables Plus Alternatives Name Instrument Type GPT Wholesale Office Fund Property Trust Green Squares Energy Pty Ltd Debt Unit Trust Green Squares Energy Pty Ltd Equity Unit Trust IIG Solar Asset Fund Managed Fund IIG Solar Income Fund Loan Notes Capital Note IIG Solar Income Fund Ordinary Units Unit Trust Juice Capital Energy Pty Ltd Fixed Rate Bond Macquarie GIG Renewable Energy Fund Unit Trust Cash Cash at Bank Cash Domestic Fixed Interest Ausgrid Finance Bond Aust Capital Territory Fixed Rate Bond Australian Capital Territory Treasury Corp Fixed Rate Bond Australian, Capital Territory of Fixed Rate Bond Bank Australia Floating Rate Note Bank Of Queensland Ltd Exchange Traded Notes Bank Of Queensland Ltd Floating Rate Note Bendigo And Adelaide Bank Exchange Traded Notes Challenger Floating Rate Note Challenger Ltd Exchange Traded Notes European Investment Bank (Green Bond) Fixed Rate Bond Germany, Federal Republic of (Government) Fixed Rate Bond Infradebt Ethical Infrastructure Debt Fund Unit Trust Insurance Australia Group Floating Rate Note Insurance Australia Group Ltd Floating Rate Note Liberty Financial Pty Ltd Floating Rate Note Members Equity Bank Floating Rate Note NAB (Green Bond) Fixed Rate Bond NAB Low Carbon Note Floating Rate Note New South Wales Treasury Corp Bond New South Wales Treasury Corp Fixed Rate Bond New South Wales Treasury Corp (Green Bond) Fixed Rate Bond NextDC Floating Rate Note Queensland Treasury Corp Bond Queensland Treasury Corp Fixed Rate Bond Rate Setter Unit Trust South Australian Government Financing Authority Fixed Rate Bond Suncorp Exchange Traded Notes Suncorp-Metway Ltd Covered Bond Tasmanian Public Finance Fixed Rate Bond Tasmanian Public Finance Corp Fixed Rate Bond Telstra Medium Term Note Treasury Corp Victoria Bond This information is accurate as at 29 May 2020 and is subject to change. -

Intelligent Investor Australian Small Companies Fund

Intelligent Investor Australian Small Companies Fund Quarterly Report 30 SEPTEMBER 2019 Core holdings delivering a decent quarter Quarterly Our new investment in Webjet Thorn Group snatching defeat from the jaws Update of victory Alex Hughes Portfolio Manager www.investsmart.com.au 1300 880 160 30 SEPTEMBER QUARTERLY UPDATE Intelligent Investor Australian Small Companies Fund Quarterly Report – September 2019 PERFORMANCE TO 30 SEP 2019 S. I. 1 MTH 3 MTHS 6 MTHS 1 YR 2 YRS (AFTER FEES) (P.A.) InvestSMART Australian Small Companies Fund 5.6% 3.0% 10.3% 2.2% -0.4% 7.3% S&P/ASX Small Ordinaries Accumulation Index 2.6% 3.1% 7.0% 3.9% 11.8% 12.0% Excess to Benchmark 3.0% -0.1% 3.4% -1.8% -12.2% -4.8% September was a fruitful month for the Intelligent Webjet stock and has executed strongly since joining Investor Small Companies Fund with a 5.59% return (net Webjet in 2011, with earnings per share compounding of fees and expenses). The benchmark returned 2.61%. at 20% p.a. under his tenure. John’s experience at GTA (now Hotelbeds), Webbed’s main competitor, gives Returns were broad based, with 13 of our largest 15 us confidence in his strategy, as does $809k of recent investments contributing positively, offset by modest director buying. declines from Carsales (down 3%) and Xero (down 2%). Strong contributors included Academies Australasia Webjet’s share price was hit hard when Thomas Cook, (up 28%) with investors taking note of its strong free the UK’s oldest tour group operator, went bankrupt cash flow, modest valuation and consistent director during the month, which knocked $7m from Webjet’s buying.