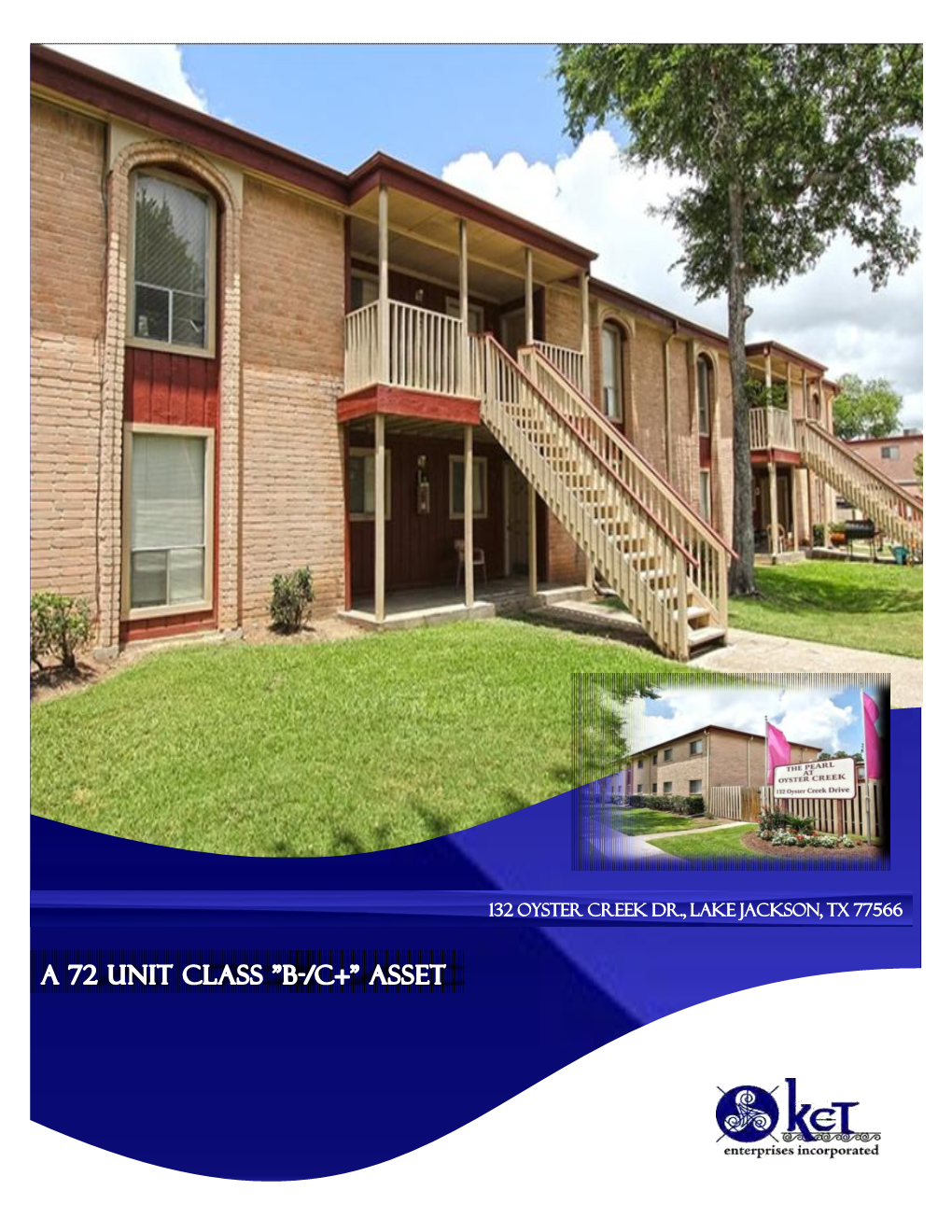

Broker's Opinion of Value

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

October 1, 2013 Thru December 31, 2013 B-08-UN

Grantee: Harris County, TX Grant: B-08-UN-48-0401 October 1, 2013 thru December 31, 2013 1 Community Development Systems Disaster Recovery Grant Reporting System (DRGR) Grant Number: Obligation Date: Award Date: B-08-UN-48-0401 Grantee Name: Contract End Date: Review by HUD: Harris County, TX 04/13/2013 Reviewed and Approved LOCCS Authorized Amount: Grant Status: QPR Contact: $14,898,027.00 Active No QPR Contact Found Estimated PI/RL Funds: $7,447,354.01 Total Budget: $22,345,381.01 Disasters: Declaration Number No Disasters Found Narratives Areas of Greatest Need: Harris County, under this Amendment to the Action Plan and Consolidated Plan, is proposing to fund projects that will stabilize neighborhoods across the area through acquisition and rehabilitation of foreclosed properties that would become sources of abandonment and blight within the community. Harris County will fund projects that both acquire and rehabilitate foreclosed upon and abandoned properties as well as create programs to help low- moderate- and middle- income individuals create equity to achieve home ownership. After years of steady growth in home prices resulting from low interest rates and creative financing, foreclosures and mortgage delinquencies began to rise in 2007. In the Harris County area, the foreclosures rose to 4.3 percent or 32,666 foreclosures by mid-2008 from 3.0 percent in 2006. This percentage is slightly lower than the national rate of 4.8 percent. The major causes for the increase in foreclosures are subprime lending practices, overextended speculators and over zealous financial institutions. The majority of Harris County&rsquos foreclosures are occurring adjacent to Beltway 8 in expanding and new subdivisions and where homebuyers need creative financing to overcome bad credit and high debt ratios. -

"A" Quality Asset Located in Clute, Texas

Excellent "A" Quality Asset Located in Clute, Texas KET Enterprises Incorporated I 4295 San Felipe I Suite 355 I Houston, TX www.ketent.com TheThe Red Rose of TexasRed I 107 Hackberry Rose St. I Clute, TX 77531 of Texas 107 Hackberry St. I Clute, TX 77531 ASKING PRICE Market to Determine Units: 32 Avg Size: 1000 Date Built: 2014 Rentable Sq. Ft.: 32,000 Acreage: 7.83 Occupancy: 97% Class: A INVESTMENT HIGHLIGHTS ► Luxury Apartment Construction in Clute, Texas ► Opportunity to build an additional 64+ units onsite ► Well Positioned, Gated complex near several retail and other businesses. ► Located Approximately 50 Miles South of Houston ► Located Approximately 5 Miles Northwest of Freeport ► Major Employment in the Area with Excellent Job Growth Predicted ► Dow Chemical Has Announced Plant Expansions in Freeport and a New R&D Facility in Lake Jackson ► Owners will make plans available for a Phase II ► Individual waters meter and sprinkler in each unit FOR MORE INFORMATION PLEASE CONTACT: KET ENTERPRISES INCORPORATED 4295 San Felipe I Suite 355 I Houston, Tx 77027 Hashir Saleem www.ketent.com Broker/Senior Associate Broker License #0406902 [email protected] 713-355-4646 The Red Rose of Texas I 107 Hackberry St. I Clute, TX 77531 Physical Information Financial Information Mortgage Balance Operating Information Number of Units 32 Asking Price Market to Determine New Loan @ 75% of Value #VALUE! Est Mkt Rent (Jun-16) $32,000 Avg Unit Size 1000 Amortization 300 Avg Mo 2016 $25,448 Net Rentable Area 32,000 Debt Service #VALUE! Physical Occ (Jun-16) -

Housing Choice Voucher Households and Neighborhood

HOUSING CHOICE VOUCHER HOUSEHOLDS AND NEIGHBORHOOD QUALITY: A CASE STUDY OF HARRIS COUNTY, TEXAS A Dissertation by HAN PARK Submitted to the Office of Graduate and Professional Studies of Texas A&M University in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY Chair of Committee, Shannon Van Zandt Co-Chair of Committee, Wei Li Committee Members, Cecilia Giusti Rebekka Dudensing Head of Department, Shannon Van Zandt August 2017 Major Subject: Urban and Regional Sciences Copyright 2017 Han Park ABSTRACT Affordable housing programs are critical in increasing low-income citizens’ quality of life. The Housing Choice Voucher (HCV) program, one of the major affordable housing programs since 1974, purportedly helps low-income tenants to attain better housing and neighborhood conditions by allowing households to rent units on the private rental market. The greatest advantage of the HCV program is that it offers voucher holders the possibility to choose rental units in their preferred areas. The primary aim of the HCV program is to ensure that subsidized households such as low- income families, senior citizens, and disabled people can reside in decent homes and in neighborhoods with good opportunities, as is the case for general renters. By adopting a quasi-experimental design, this research assesses locational outcomes for income-qualified households in Harris County, Texas: one of the largest housing markets in the nation. It compares locational outcomes for a list of HCV holders’ addresses to those of a list of households which qualified for HCV but remained on the waiting list. The findings indicate that the HCV program’s Fair Market Rents (FMRs) and Income Limits (ILs) likely restricted HCV households to neighborhoods that are not significantly different from those to which households without vouchers have access. -

The Reserve at Manvel ±75 Total Acres

The Reserve at Manvel ±75 total acres Manvel, Texas Available Pricing ±75 total acres of land available; ±25 acres of land in Phase I Call broker for pricing Owner will subdivide depending upon use, location and price. Available property has incredible visibility along SH 288 and CR 58. Location Available parcel is located along SH 288, just south of Pearland at CR 58 in Manvel, Texas, just north of Highway 6. The SH 288 corridor has experienced an enormous amount of growth due in large part to close proximity to downtown Houston and The Medical Center. The available property is surrounded by master planned communities including Sedona Lakes, Pomona and Rodeo Palms. Property Information Detention Off site Utilities To the site School District Alvin ISD Site Use Retail, entertainment and medical use Conceptual Drawing | View Looking South Conceptual Drawing | View Looking North Lake Conroe Willis Cleveland 105 105 Conroe The Woodlands Tomball Kingwood Bush Intercontinental Airport Katy Baytown Houston La Porte Pasadena Hobby Airport Sugar Land Ellington Galveston Field Bay Missouri City Pearland League City Area Traffic Counts SH 288, north of Croix Road 58,995 Vehicles SH 288, south of Croix Road 52,260 Vehicles 2017 Average Daily Traffic Counts Estimated Demographics Population Summary 37,811 | 3 Miles 106,734 | 5 Miles 186,705 | 7 Miles Average Household Income $94,620 | 1 Mile $130,336 | 3 Miles $123,714 | 5 Miles Median Age 33.7 | 1 Mile 33.2 | 3 Miles 33.9 | 5 Miles Manvel, Texas Situated within minutes of downtown Houston in northern Brazoria County, Manvel is in a dynamic growth area. -

How's the Water?

This story was made with Esri's Story Map Cascade. Read it on the web at http://arcg.is/1OKTKW. How’s the Water? 2018 Houston-Galveston Area Council Basin Highlights Report Watershed Characterizations for the Houston Ship Channel/Buffalo Bayou Tidal, Chocolate Bayou Tidal, and Chocolate Bayou Above Tidal Clean water is essential. Just as clean water is essential for life itself, it is also essential for the quality of our lives. Water is all around us. It flows through rural areas, our neighborhoods, and our cities. These waterways come in all shapes and sizes, from small drainage ditches and meandering creeks to seemingly lazy bayous and major rivers. All of them connect to one of the most productive estuaries in the nation, Galveston Bay, and ultimately the Gulf of Mexico. We walk and picnic near them, splash, swim, fish, and sail on them. Keeping them clean must be a priority for all of us. These waters help fuel a strong economy, bringing in billions of dollars a year and providing tens of thousands of jobs in commercial and recreational fishing and tourism. The 2018 Basin Highlights Report provides an overview of water quality and data trends in the Houston- Galveston region’s surface waters. Houston Ship Channel This report characterizes the Houston Ship Channel/Buffalo Bayou Tidal (Segment 1007), Chocolate Bayou Tidal (Segment 1107), and Chocolate Bayou Above Tidal (Segment 1108) watersheds to identify • Specific water quality issues and trends. • Sources of point and nonpoint pollution. • Current strategies and plans to reduce pollution within these watersheds. • Current and potential stakeholders working within these watersheds Since 1991, the Texas Clean Rivers Program (link: https://www.tceq.texas.gov/waterquality/clean-rivers) (CRP) has provided a framework for addressing water quality issues through an all-inclusive watershed approach. -

Brazoria County, Texas and Incorporated Areas

BRAZORIA COUNTY TEXAS AND INCORPORATED AREAS VOLUME 1 OF 4 COMMUNITY NAME COMMUNITY NUMBER ALVIN, CITY OF 485451 ANGLETON, CITY OF 480064 BAILEY'S PRAIRIE, VILLAGE OF 480065 BONNEY, VILLAGE OF 481300 BRAZORIA, CITY OF 480066 BRAZORIA COUNTY, 485458 UNINCORPORATED AREAS BROOKSIDE VILLAGE, CITY OF 480067 CLUTE, CITY OF 480068 DANBURY, CITY OF 480069 FREEPORT, CITY OF 485467 HILLCREST VILLAGE, CITY OF 485478 HOLIDAY LAKES, TOWN OF 485517 IOWA COLONY, CITY OF 481071 JONES CREEK, VILLAGE OF 480072 LAKE JACKSON, CITY OF 485484 LIVERPOOL, CITY OF 480075 MANVEL, CITY OF 480076 OYSTER CREEK, CITY OF 481255 PEARLAND, CITY OF 480077 QUINTANA, TOWN OF 481301 RICHWOOD, CITY OF 485502 SANDY POINT, CITY OF 480071 SURFSIDE BEACH, CITY OF 481266 SWEENY, CITY OF 485512 WEST COLUMBIA, CITY OF 480081 REVISED PRELIMINARY JUNE 29, 2018 Revised: XXXX YY, 20XX Federal Emergency Management Agency Flood Insurance Study Number 48039CV001A NOTICE TO FLOOD INSURANCE STUDY USERS Communities participating in the National Flood Insurance Program have established repositories of flood hazard data for floodplain management and flood insurance purposes. This Flood Insurance Study may not contain all data available within the repository. It is advisable to contact the community repository for any additional data. This preliminary revised Flood Insurance Study contains profiles presented at a reduced scale to minimize reproduction costs. All profiles will be included and printed at full scale in the final published report. Part or all of this Flood Insurance Study may be revised and republished at any time. In addition, part of this Flood Insurance Study may be revised by the Letter of Map Revision process, which does not involve republication or redistribution of the Flood Insurance Study. -

Manvel Town Center MANVEL TOWN CENTER | EXECUTIVE SUMMARY

Manvel Town Center MANVEL TOWN CENTER | EXECUTIVE SUMMARY AT THE CENTER OF IT ALL Manvel Town Center is positioned to become the next great retail destination in the Houston area. The mixed-use center’s location at the strongest regional intersection will create visibility, accessibility and traffic from one of the fastest- growing residential areas in Texas. Manvel Town Center, to be built in phases, is set to break ground in 2018. Due to its extensive frontage along the key thoroughfares in the region, Manvel Town Center will feature: 750,000 SF Center Regional-draw Anchor Junior Anchor Stores Inline and Freestanding Shops And Restaurant Space The strength of the site also makes it ideal for mid- rise residential buildings, hotels and other uses. Manvel Town Center encompasses 273 acres poised to become Houston’s next great place. Weitzman is the trade name of Weitzman Management Corporation, a regional realty corporation. MANVEL TOWN CENTER | EXECUTIVE SUMMARY THE NEXT BOOMTOWN THE REGION Manvel, located six miles south of Pearland, is situated directly in the heart of Houston’s record-setting residential growth. The Houston area currently leads the nation in new residential construction, and much of that growth is taking place in the Manvel area, which is home to triple- digit growth thanks to massive master- planned communities like Silverlake, Shadow Creek, Southwyck, Lakeland, Savannah, Rodeo Palms and many others. MANVEL TOWN CENTER | EXECUTIVE SUMMARY DEMOGRAPHICS Manvel Town Center benefits from its site with extensive frontage along Highway 6, the major highway in the trade area, and SH-288, a seven-lane thoroughfare. -

Summary and Status of Concession Agreements (CDA/DB) in Texas Final Report

Summary and Status of Concession Agreements (CDA/DB) in Texas Final report PRC 16-54 F Summary and Status of Concession Agreements (CDA/DB) in Texas Texas A&M Transportation Institute PRC 16-54 F June 2016 Authors Brianne Glover, J.D. Max Steadman Brian Dell 2 Table of Contents List of Figures ................................................................................................................................ 4 List of Tables ................................................................................................................................. 4 Introduction ................................................................................................................................... 5 Purpose of the Study ................................................................................................................... 5 Concession Agreements in Texas ................................................................................................. 6 Benefits and Risks ....................................................................................................................... 8 Benefits .................................................................................................................................................................8 Risks .....................................................................................................................................................................8 Summary of Concession Projects in Texas .............................................................................. -

SAMCO Capital Markets, Inc

OFFICIAL STATEMENT DATED AUGUST 14, 2019 IN THE OPINION OF BOND COUNSEL, UNDER EXISTING LAW, INTEREST ON THE BONDS IS EXCLUDABLE FROM GROSS INCOME FOR FEDERAL INCOME TAX PURPOSES AND INTEREST ON THE BONDS IS NOT INCLUDED IN THE ALTERNATIVE MINIMUM TAXABLE INCOME OF INDIVIDUALS. SEE “TAX MATTERS” FOR A DISCUSSION OF BOND COUNSEL’S OPINION. The Bonds have been designated as "qualified tax‐exempt obligations" for Financial institutions. See “TAX MATTERS –Qualified Tax‐Exempt Obligations.” NEW ISSUE – Book Entry Only RATINGS: S&P Global Ratings (BAM insured).............................................. “AA” Moody’s Investors Service (Underlying) ..................................... "A1" See “MUNICIPAL BOND INSURANCE” and “RATINGS” herein. $3,785,000 SIENNA PLANTATION MUNICIPAL UTILITY DISTRICT NO. 3 (A Political Subdivision of the State of Texas, located within Fort Bend County) UNLIMITED TAX REFUNDING BONDS, SERIES 2019 The $3,785,000 Sienna Plantation Municipal Utility District No. 3 Unlimited Tax Refunding Bonds, Series 2019 (the "Bonds") are obligations of Sienna Plantation Municipal Utility District No. 3 (the "District") and are not obligations of the State of Texas; the City of Missouri City, Texas; Fort Bend County, Texas; or any political subdivision or entity other than the District. Neither the faith and credit nor the taxing power of the State of Texas; the City of Missouri City, Texas; Fort Bend County, Texas; nor any entity other than the District is pledged to the payment of the principal of or interest on the Bonds. Dated: September 1, 2019 Due: March 1, as shown below Interest on the Bonds will accrue from September 1, 2019, and will be payable March 1 and September 1 of each year ("Interest Payment Date"), commencing March 1, 2020, until maturity or prior redemption. -

25 Jahre/ Years

25 Jahre / Years Städtepartnerschaft /City Partnership Leipzig – Houston 25 Jahre Städtepartnerschaft Leipzig – Houston Gute transatlantische Beziehungen Eine Dokumentation 25 Years of City Partnership Leipzig – Houston Strong Transatlantic Relationships A Documentation 32 Städtediplomatie und Städtepartnerschaften Internationale Beziehungen auf kommunaler Ebene City Diplomacy and City Partnerships International Relations at the Municipal Level Inhalt / Contents Dr. Gabriele Goldfuß Teil 2 / Part 2 Das Jubiläumsjahr und die Houston Week The Anniversary Year and the Houston Week 38 „Von Sachsens Städten die internationalste“ Januar bis Juli: Vereinsfest, Bach und Unabhängigkeitstag 12 Geleitwort / Foreword Burkhard Jung, Oberbürgermeister von / Mayor of Leipzig “Saxony’s most international city” January to July: Anniversary Summer Party, Bach and 16 Foreword / Geleitwort Independence Day Sylvester Turner, Oberbürgermeister von / Mayor of Houston Stephanie von Aretin 18 Geleitwort / Foreword 48 High Society und Hilfsprojekte Dr. Skadi Jennicke, Bürgermeisterin für Kultur / Deputy Mayor for Culture Die Bürgerreise nach Houston 9. bis 18. Februar 2018 High Society and Aid Projects Teil 1 / Part 1 The Citizens’ Trip to Houston from February 9–18, 2018 Internationale Beziehungen auf kommunaler Lea Schneider Ebene: Leipzig und Houston 54 Bach übersetzen International Relations and City Diplomacy: Leipzig Ein Interview mit Rick Erickson, and Houston Direktor der Bachgesellschaft in Houston Translating Bach 24 Leipzigs internationale Beziehungen -

April 1, 2018 Thru June 30, 2018 Performance Report B-08-UN-48

Grantee: Harris County, TX Grant: B-08-UN-48-0401 April 1, 2018 thru June 30, 2018 Performance Report 1 Community Development Systems Disaster Recovery Grant Reporting System (DRGR) Grant Number: Obligation Date: Award Date: B-08-UN-48-0401 Grantee Name: Contract End Date: Review by HUD: Harris County, TX Reviewed and Approved Grant Award Amount: Grant Status: QPR Contact: $14,898,027.00 Active No QPR Contact Found LOCCS Authorized Amount: Estimated PI/RL Funds: $14,898,027.00 $11,934,517.29 Total Budget: $26,832,544.29 Disasters: Declaration Number NSP Narratives Areas of Greatest Need: Harris County, under this Amendment to the Action Plan and Consolidated Plan, is proposing to fund projects that will stabilize neighborhoods across the area through acquisition and rehabilitation of foreclosed properties that would become sources of abandonment and blight within the community. Harris County will fund projects that both acquire and rehabilitate foreclosed upon and abandoned properties as well as create programs to help low- moderate- and middle- income individuals create equity to achieve home ownership. After years of steady growth in home prices resulting from low interest rates and creative financing, foreclosures and mortgage delinquencies began to rise in 2007. In the Harris County area, the foreclosures rose to 4.3 percent or 32,666 foreclosures by mid-2008 from 3.0 percent in 2006. This percentage is slightly lower than the national rate of 4.8 percent. The major causes for the increase in foreclosures are subprime lending practices, overextended speculators and over zealous financial institutions. The majority of Harris County’s foreclosures are occurring adjacent to Beltway 8 in expanding and new subdivisions and where homebuyers need creative financing to overcome bad credit and high debt ratios. -

NSP1 Quarterly Report

Grantee: Harris County, TX Grant: B-08-UN-48-0401 October 1, 2014 thru December 31, 2014 Performance Report 1 Community Development Systems Disaster Recovery Grant Reporting System (DRGR) Grant Number: Obligation Date: Award Date: B-08-UN-48-0401 Grantee Name: Contract End Date: Review by HUD: Harris County, TX Submitted - Await for Review Grant Award Amount: Grant Status: QPR Contact: $14,898,027.00 Active No QPR Contact Found LOCCS Authorized Amount: Estimated PI/RL Funds: $14,898,027.00 $8,700,000.00 Total Budget: $23,598,027.00 Disasters: Declaration Number NSP Narratives Areas of Greatest Need: Harris County, under this Amendment to the Action Plan and Consolidated Plan, is proposing to fund projects that will stabilize neighborhoods across the area through acquisition and rehabilitation of foreclosed properties that would become sources of abandonment and blight within the community. Harris County will fund projects that both acquire and rehabilitate foreclosed upon and abandoned properties as well as create programs to help low- moderate- and middle- income individuals create equity to achieve home ownership. After years of steady growth in home prices resulting from low interest rates and creative financing, foreclosures and mortgage delinquencies began to rise in 2007. In the Harris County area, the foreclosures rose to 4.3 percent or 32,666 foreclosures by mid-2008 from 3.0 percent in 2006. This percentage is slightly lower than the national rate of 4.8 percent. The major causes for the increase in foreclosures are subprime lending practices, overextended speculators and over zealous financial institutions. The majority of Harris County&rsquos foreclosures are occurring adjacent to Beltway 8 in expanding and new subdivisions and where homebuyers need creative financing to overcome bad credit and high debt ratios.