Portuguese Media Media

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mergers & Acquisitions

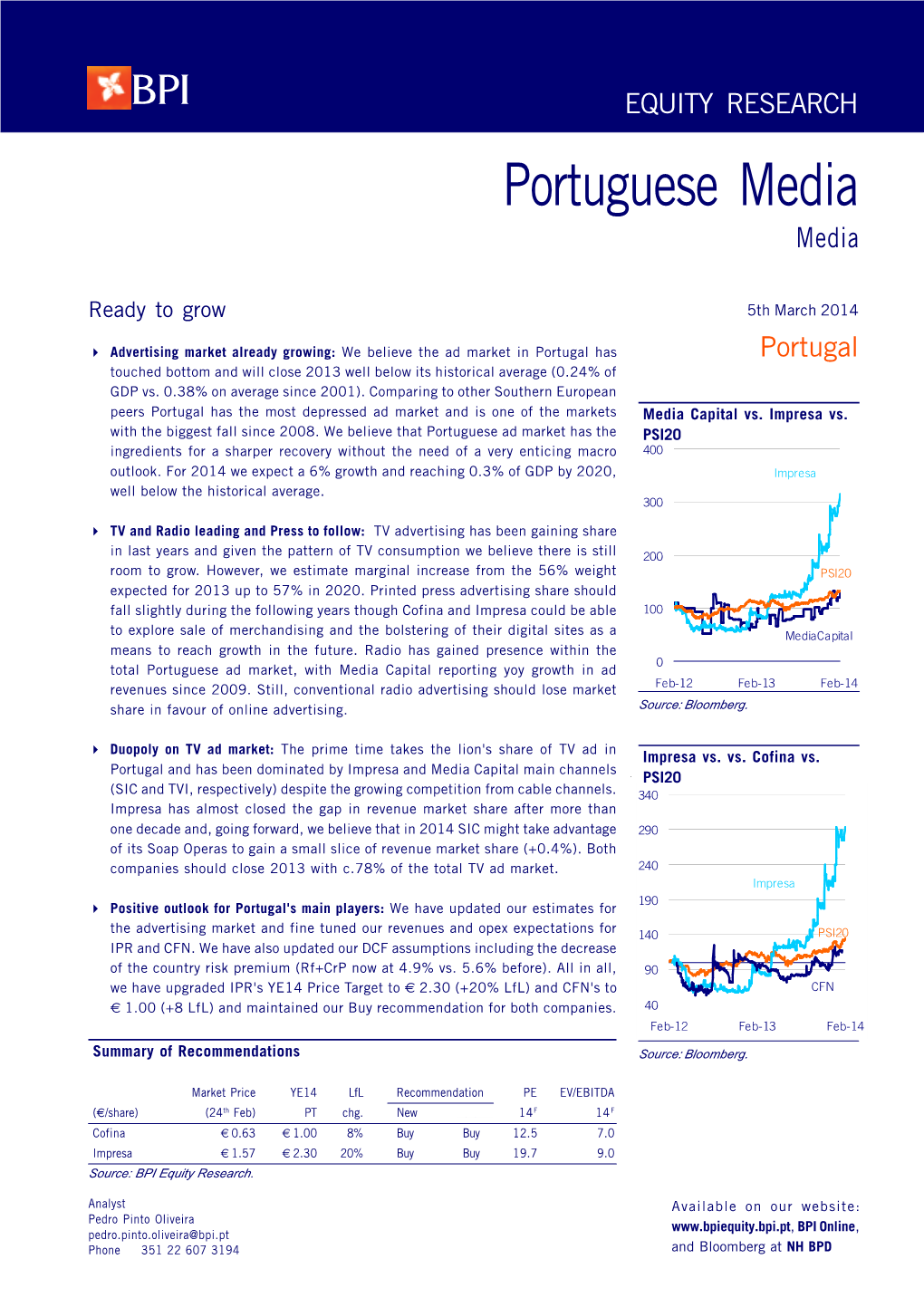

Mergers & Acquisitions: The Case Grupo Media Capital and PT Portugal Pedro Barreto Goulão Crespo Student Number – 152114216 Advisor: Professor Henrique Bonfim June 2016 Dissertation submitted in partial fulfillment of requirements for the degree Master in Management with Major in Corporate Finance, at the Universidade Católica Portuguesa 2016 Abstract Over the last 2 years, Altice Group has been one of the most active telecommunication companies, making acquisitions in different countries, not only in the telecommunication sector but also in the media sector. According to the multinational company, the expansion into the media industry, in the countries where they have already telecommunication operations, brings many and important synergies to their overall operation. After Altice have bought PT Portugal, some rumors came up about the possibility of Altice also entering in the media market in Portugal. Taking up these rumors I decided to study the potential acquisition of Grupo Media Capital by Grupo Altice, through PT Portugal. Along the thesis, I explain relevant M&A literature, make a review on both sectors (media and telecommunication) and companies, and at the end also calculate the standalone valuation of both companies and the synergies that may arise from this deal. After all these procedures, I conclude that this is the perfect moment for PT Portugal to make an offer to Group Prisa (Grupo Media Capital major shareholder). Grupo Prisa should be willing to disinvest in their Portuguese position and taking into account my calculations, Grupo Media Capital share price is undervalued. PT Portugal should make an offer of €4.84 per share, if considering a premium composed by 75% of the cost reduction synergy and 25% of the advertising revenue synergy. -

Annual Report on the Corporate Governance of Listed Companies in Portugal 2008

Comissão do Mercado de Valores Mobiliários Annual Report on the Corporate Governance of Listed Companies in Portugal 2008 Annual Report on the Corporate Governance of Listed Companies in Portugal - 2008 CMVM INDEX INDEX .................................................................................................................. 2 List of Charts ....................................................................................................... 3 List of Tables ....................................................................................................... 5 List of Textboxes ................................................................................................. 6 Introduction ........................................................................................................ 7 I. Shareholder Capital Structure ........................................................................ 9 I.1 Share Capital, Market Capitalisation and Trading Volume ............................... 9 I.2 Ownership Concentration and Shareholder Capital Structure .......................... 10 I.2.1 Ownership Concentration and Major Shareholders .................................... 10 I.2.2 Shareholder Structure .......................................................................... 12 I.3 Shareholders’ Place of Residence ................................................................ 19 I.4 Stock-Option Plans ................................................................................... 20 II. Corporate Governance Models, Boards -

MADE in HOLLYWOOD, CENSORED by BEIJING the U.S

MADE IN HOLLYWOOD, CENSORED BY BEIJING The U.S. Film Industry and Chinese Government Influence Made in Hollywood, Censored by Beijing: The U.S. Film Industry and Chinese Government Influence 1 MADE IN HOLLYWOOD, CENSORED BY BEIJING The U.S. Film Industry and Chinese Government Influence TABLE OF CONTENTS EXECUTIVE SUMMARY I. INTRODUCTION 1 REPORT METHODOLOGY 5 PART I: HOW (AND WHY) BEIJING IS 6 ABLE TO INFLUENCE HOLLYWOOD PART II: THE WAY THIS INFLUENCE PLAYS OUT 20 PART III: ENTERING THE CHINESE MARKET 33 PART IV: LOOKING TOWARD SOLUTIONS 43 RECOMMENDATIONS 47 ACKNOWLEDGEMENTS 53 ENDNOTES 54 Made in Hollywood, Censored by Beijing: The U.S. Film Industry and Chinese Government Influence MADE IN HOLLYWOOD, CENSORED BY BEIJING EXECUTIVE SUMMARY ade in Hollywood, Censored by Beijing system is inconsistent with international norms of Mdescribes the ways in which the Chinese artistic freedom. government and its ruling Chinese Communist There are countless stories to be told about China, Party successfully influence Hollywood films, and those that are non-controversial from Beijing’s warns how this type of influence has increasingly perspective are no less valid. But there are also become normalized in Hollywood, and explains stories to be told about the ongoing crimes against the implications of this influence on freedom of humanity in Xinjiang, the ongoing struggle of Tibetans expression and on the types of stories that global to maintain their language and culture in the face of audiences are exposed to on the big screen. both societal changes and government policy, the Hollywood is one of the world’s most significant prodemocracy movement in Hong Kong, and honest, storytelling centers, a cinematic powerhouse whose everyday stories about how government policies movies are watched by millions across the globe. -

Portugal: Overview

EUROPE, MIDDLE EAST AND AFRICA ANTITRUST REVIEW 2020 © Law Business Research Ltd 2019 EUROPE, MIDDLE EAST AND AFRICA ANTITRUST REVIEW 2020 Reproduced with permission from Law Business Research Ltd This article was first published in July 2019 For further information please contact [email protected] LAW BUSINESS RESEARCH © Law Business Research Ltd 2019 Published in the United Kingdom by Global Competition Review Law Business Research Ltd 87 Lancaster Road, London, W11 1QQ, UK © 2019 Law Business Research Ltd www.globalcompetitionreview.com To subscribe please contact [email protected] No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation. Legal advice should always be sought before taking any legal action based on the information provided. This information is not intended to create, nor does receipt of it constitute, a lawyer–client relationship. The publishers and authors accept no responsibility for any acts or omissions contained herein. Although the information provided is accurate as of June 2019, be advised that this is a developing area. Enquiries concerning reproduction should be sent to Law Business Research, at the address above. Enquiries concerning editorial content should be directed to the Publisher – [email protected] © 2019 Law Business Research Limited ISBN: 978-1-83862-219-0 Printed and distributed by Encompass Print Solutions Tel: 0844 2480 112 © Law Business Research -

Sportinguista Eleita Miss Teenager Universo Portugal - Jogo Da Vida - Jornal Record

14/05/13 :.: Sportinguista eleita Miss Teenager Universo Portugal - Jogo da vida - Jornal Record :.: Correio da Manhã | Jornal de Negócios | Sábado | Máxima | Vogue | Destak | Automotor | CMTV Classificados | Semana Informática | Assinaturas | Emprego | Cofina Media Vermont legaliza eutanásia e posse de canábis HOJE NO RECORD VIEIRA PAGA 3 MILHÕES Diário de informação generalista especializado em desporto. Diretor: Alexandre Pais Siga-nos em: | | | Futebol Resultados e Classificações Internacional Modalidades Opinião Multimédia Record Auto Jogo da vida Fora de campo Apostas Poker Jogo da vida Sportinguista eleita Miss Teenager Universo Portugal Miss Fanática Record: Terça-Feira, 14 maio de 2013 | 08:56 conheça as candidatas Fotos: D.R. RECORD 0 Gosto 2 Enviar Tw eet 0 Comentários Visto: 2085 Se queres concorrer à edição 2013/2014, envia seis fotos no mínimo para publicação... Últimas + Lidas + Comentadas + Votadas 11:05 Fora de campo Chama-se Marcela Prodan, tem 17 anos, é sportinguista e a adolescente que representa Portugal Bombeiros reclamam mais meios de combate na grande final Miss Teenager Universo 2013, que se irá realizar no Panamá no dia 27 de julho. “Fiquei superfeliz, orgulhosa”, afirma a jovem a Record, depois de ter sido coroada, no domingo, na 10:59 Especial - Benfica-Chelsea Gala Final Miss Teenager Universo Portugal, que decorreu no Cine Teatro Municipal de Ourém. Djuricic e Sulejmani presentes na final Sente o peso da responsabilidade, mas a esperança mantém-se fora de portas. “Quero representar muito bem o nosso país, dar a conhecer ao Mundo a nossa cultura, que é tão rica”, realça. Também 10:48 Fotos as águias de Jesus representam amanhã Portugal na final da Liga Europa e é exatamente por essa Picante, picante razão que, apesar de ser sportinguista, apoia o clube da Luz. -

Portugal Brazil

CHAMBERS Global PracticePORTUGAL GuidesBRAZIL TMT LAW & PRACTICE: p.<?>p.3 Contributed by MattosVieira de Filho, Almeida Veiga & Filho, Associados Marrey Jr. e Quiroga PortugalThe ‘Law –& LawPractice’ §ions Practice provide easily accessible information on navigating the legal system when conducting business in the jurisdic- tion. Leading lawyers explain local law and practice at key transactional stages andContributed for crucial aspects by of doing business. Vieira de Almeida & Associados TRENDSDOING BUSINESS & DEVELOPMENTS: IN PORTUGAL: NATIONAL: p.<?>286 ContributedChambers by& PartnersCampos Mello employ Advogados a large team of full-time researchers (over 140) in their London office who interview thousands of clients each The ‘Trends & Developments’ sections give an overview of current year. This section is based on these interviews. The advice in this section trends and developments in local legal markets. Leading lawyers ana- is based on the views of clients with in-depth international experience. lyse particular trends or provide a broader discussion of key develop- ments in the jurisdiction. TRENDS & DEVELOPMENTS: NORTH EAST: p.<?> Contributed by Queiroz Cavalcanti Advocacia The ‘Trends2016 & Developments’ sections give an overview of current trends and developments in local legal markets. Leading lawyers ana- lyse particular trends or provide a broader discussion of key develop- ments in the jurisdiction. DOING BUSINESS IN BRAZIL: p.<?> Chambers & Partners employ a large team of full-time researchers (over 140) in their London office who interview thousands of clients each year. This section is based on these interviews. The advice in this section is based on the views of clients with in-depth international experience. PORTUGAL LAW & PRACTICE: p.3 Contributed by Vieira de Almeida & Associados The ‘Law & Practice’ sections provide easily accessible information on navigating the legal system when conducting business in the jurisdic- tion. -

1 Management's Discussion and Analysis Altice

MANAGEMENT’S DISCUSSION AND ANALYSIS ALTICE INTERNATIONAL GROUP FOR THE YEAR ENDED DECEMBER 31, 2017 Contents Basis of Preparation 2 Key Factors Affecting Our Results of Operations 3 Discussion and Analysis of Our Results of Operations 8 Significant Events Affecting Historical Results 8 Revenue 10 Adjusted EBITDA 11 Other items Impacting Profit/(Loss) 13 Capital Expenditure 15 Liquidity and Capital Resources 16 Key Operating Measures 18 Other Disclosures 20 Glossary 23 1 Basis of Presentation The discussion and analysis for each of the periods presented is based on the financial information derived from the audited consolidated financial statements as of and for the year ended December 31, 2017. Please refer to the Glossary for a definition of the key financial terms discussed and analysed in this document. Geographic Segments We discuss the results of operations for our business based on the following geographic segments: • Portugal (which includes PT Portugal and its subsidiaries), • Israel (which includes HOT and HOT Mobile), • the Dominican Republic (which includes Altice Hispaniola and Tricom), and • Others (which includes our fixed-based and mobile services in Belgium and Luxembourg (until the completion of the Coditel Disposal on June 19, 2017) and the French Overseas Territories as well as our datacenter operations in Switzerland (Green and Green Datacenter), our content production and distribution businesses (primarily through AENS), advertising, customer services, technical services and other activities that are not related to our core fixed-based or mobile business). Please refer to Note 3 of consolidated financial statements as of and for the year ended December 31, 2017 for a complete overview of the changes in the scope of consolidation during the years ended December 31, 2107 and December 31, 2016. -

COFINA, SGPS, S.A. Public Company

COFINA, SGPS, S.A. Public Company Head Office: Rua do General Norton de Matos, 68, r/c – Porto Fiscal number 502 293 225 Share Capital: 25,641,459 Euro 1st Half 17 FINANCIAL INFORMATION (Unaudited) This document is a translation of a document originally issued in Portuguese, prepared using accounting policies consistent with the International Financial Reporting Standards and with accordance with the International Accounting Standard 34 – Interim Financial Reporting, some of which may not conform or be required by generally accepted accounting principles in other countries. In the event of discrepancies, the Portuguese language version prevails. The consolidated financial information of Cofina for the first half of 2017, prepared in accordance with the principles of recognition and measurement of International Financial Reporting Standards (IFRS), can be presented as follows: (amounts in thousand of Euro) 1H17 1H16 Var (%) Consolidated operating revenue 43,991 48,471 -9.2% Circulation 22,810 25,329 -9.9% Advertising 14,454 15,147 -4.6% Alternative marketing products and others 6,727 7,995 -15.9% Operating income by segment 43,991 48,471 -9.2% Newspapers 37,117 39,905 -7.0% Magazines 6,874 8,566 -19.8% Operating Expenses (a) 38,368 42,030 -8.7% Consolidated EBITDA (b) 5,623 6,441 -12.7% EBITDA Margin 12.8% 13.3% Newspapers EBITDA 6,286 7,016 -10.4% Newspapers EBITDA Margin 16.9% 17.6% -0,7 pp Magazines EBITDA -663 -575 -15.3% Magazines EBITDA Margin -9.6% -6.7% -2.9 pp Restructuring Costs -2,000 0 Consolidated EBITDA after restructuring -

Interim Report January – March 2015

Q1 2015 INTERIM REPORT JANUARy – MARCH 2015 HIGHLIGHTS With the acquisition of kids content producer and publisher YoBoHo, BroadbandTV became one of the leaders in kids and family entertainment on Youtube. YoBoHo owns and operates Hoopla Kidz, one of the largest Youtube kids and family networks, as well as 27 owned and operated channels in the vertical. YoBoHo maintains a proprietary library of content, comprised of over 8,000 videos in PROGRAMMATIC TV the kids vertical, mainly produced by the company. It generates RTL Group led the most recent financing round a total of three billion views for Clypd, a US-based platform for programmatic per year. Under this deal, advertising sales on linear TV, and now holds a the 55 YoBoHo employees will join 17.4 per cent minority stake in the company (on BroadbandTV, including: producers, a fully diluted basis). The Clypd platform, founded writers, marketers, technology in 2012, is comprised of innovative components and mobile experts, and a that automate workflows between buyers and strong business development team. sellers of TV airtime. It gives TV advertising sales RTL Group provided funding houses in the United States the ability to allow for BroadbandTV’s acquisition media planners to discover TV inventory of YoBoHo. opportunities in a unique data driven and efficient manner. Clypd is a pioneer on the programmatic TV front, focusing solely on offering linear TV inventory sales. Clypd operates the market- places on behalf of the broadcasters. Key clients KIDS include, Discovery Communications, Univision and Cox. Following the acquisition of a 65 per RULE cent stake in SpotXchange in summer 2014, the investment in Clypd underlines RTL Group’s strategy to become a leading player in all video segments. -

REPORT and ACCOUNTS 30 June 2017

REPORT AND ACCOUNTS 30 June 2017 REPORT AND ACCOUNTS 1H 2017 06 (This is a translation of a document originally issued in Portuguese. In the event of discrepancies, the Portuguese language version prevails – Note 16) TABLE OF CONTENTS INTRODUCTION ....................................................................................................................................... 3 STOCK EXCHANGE EVOLUTION ............................................................................................................. 4 COMPANY ACTIVITY ............................................................................................................................... 6 FINANCIAL REVIEW ................................................................................................................................ 7 OUTLOOK ............................................................................................................................................. 10 CORPORATE GOVERNANCE ................................................................................................................. 11 LEGAL MATTERS .................................................................................................................................. 12 CLOSING REMARKS ............................................................................................................................. 14 STATEMENT UNDER ARTICLE 246, 1, C) OF THE SECURITIES CODE ................................................... 15 DECLARATION OF RESPONSIBILITY ................................................................................................... -

Chapter 7. Portugal: Impoverished Media Struggling for Survival

Chapter 7 Portugal Impoverished media struggling for survival Joaquim Fidalgo Introduction The Portuguese media landscape has been strongly influenced by its political, economic, cultural, and social evolution during the last decades of the twentieth century and the first decades of the twenty-first century. Five main factors should be considered. First, the small size of the country (with a population of 10.3 million), associated with a very low rate of news media consumption, makes it difficult for media outlets to achieve enough scale to be viable. Second, the economic weakness of the country (an annual gross domestic product per capita of EUR 18,550 compared with the EUR 28,630 average for EU/28 countries; Eurostat, 2019) leads to low purchasing power for media consumers and little advertising for the media industry. Third, there has been a rather brief experi- ence of life in a democracy, after almost half a century (1926–1974) of political dictatorship where basic rights – freedom of expression, freedom of the press, freedom of association – were either forbidden or strictly controlled. Fourth, the long-standing tradition of a centralised society is very dependent on the state and has low levels of autonomous social dynamism and tends towards solving problems at the macro-level of the law, but not necessarily at the micro-level of actual practices. And fifth, economic, cultural, and technological development in the country has been quick in more recent years, particularly after joining the EU in 1986. The legal and regulatory framework for the media still bears marks of the revolutionary period in the country between 1974 and 1975, when democracy was reinstated and important changes occurred. -

ICN Merger Workshop BOS 6 - Economic Theory and Evidence in Analysis of Vertical Mergers

ICN Merger Workshop BOS 6 - Economic theory and evidence in analysis of vertical mergers Tokyo, Japan November 2018 BOS 6 - Economic theory and evidence in analysis of vertical mergers Your speakers today ALEX BAKER Director Fingleton Associates JAEWON KIM Economic Advisor, Office of the Chief Economist Konkurrensverket NOAM DAN Senior Economist Israel Antitrust Authority ALÍPIO CODINHA Deputy Director of Merger Department Autoridade da Concorrência fingletonassociates.com 2 BOS 6 - Economic theory and evidence in analysis of vertical mergers A primer on vertical mergers PRESUMPTIVELY PRO-COMPETITIVE •No direct loss of rivalry (in pure cases) •Efficiencies / elimination of double marginalization •Reduced contracting/transactions costs •Mitigation of hold-up problem •Elimination of free-riding •Improved information flow/co-ordination POTENTIAL ANTI-COMPETITIVE EFFECTS •Input foreclosure (refusal to supply/supplying on worse terms) •Customer foreclosure (refusal to purchase/supplying on better terms) •Increased likelihood of coordination •Access to confidential information fingletonassociates.com 3 BOS 6 - Economic theory and evidence in analysis of vertical mergers Common theories of harm in vertical mergers INPUT FORECLOSURE CUSTOMER FORECLOSURE fingletonassociates.com 4 BOS 6 - Economic theory and evidence in analysis of vertical mergers Framework for assessing vertical mergers ABILITY INCENTIVE EFFECT ECONOMIC ANALYSES fingletonassociates.com 5 BOS 6 - Economic theory and evidence in analysis of vertical mergers Potential vertical merger