Kyanite Data Sheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Elimination of Ferric Ion Effect on Separation Between Kyanite and Quartz Using Citric Acid As Regulator

minerals Article Elimination of Ferric Ion Effect on Separation between Kyanite and Quartz Using Citric Acid as Regulator Yanping Niu 1, Ya Li 1, Haoran Sun 2,*, Chuanyao Sun 3, Wanzhong Yin 2 and Hongfeng Xu 4 1 Heilongjiang Province Geology Ore Test and Application Institute, Harbin 150000, China; [email protected] (Y.N.); [email protected] (Y.L.) 2 College of Resources and Civil Engineering, Northeastern University, Shenyang 110816, China; [email protected] 3 State Key Laboratory of Mineral Processing, BGRIMM Technology Group, Beijing 100160, China; [email protected] 4 Heilongjiang Mining Group Co., Ltd., Harbin 150000, China; [email protected] * Correspondence: [email protected]; Tel.: +86-188-4250-4743 Abstract: Ferric ions produced during grinding influence the flotation separation between kyanite and quartz adversely. In this study, citric acid was used as a regulator to eliminate the effect of ferric ions on the separation of kyanite from quartz with sodium oleate (NaOL) as a collector. The microflotation test results indicated that the quartz was selectively activated by FeCl3 and maintained significant quartz recovery. However, the citric acid could selectively eliminate the effect of ferric ions on the quartz and minimally influenced the kyanite. Contact angle tests demonstrated that FeCl significantly increased the interaction between NaOL and quartz, resulting in the high 3 hydrophobicity of quartz, and the addition of citric acid made the quartz surface hydrophilic again but slightly influenced the kyanite. Fourier-transform infrared spectroscopy showed that FeCl Citation: Niu, Y.; Li, Y.; Sun, H.; Sun, 3 C.; Yin, W.; Xu, H. Elimination of facilitated NaOL adsorption onto the quartz surface, and the addition of citric acid eliminated the Ferric Ion Effect on Separation activation of FeCl3 on the quartz, resulting in the nonadsorption of NaOL onto the quartz surface. -

Phase Evolution of Ancient and Historical Ceramics

EMU Notes in Mineralogy, Vol. 20 (2019), Chapter 6, 233–281 The struggle between thermodynamics and kinetics: Phase evolution of ancient and historical ceramics 1 2 ROBERT B. HEIMANN and MARINO MAGGETTI 1Am Stadtpark 2A, D-02826 Go¨rlitz, Germany [email protected] 2University of Fribourg, Department of Geosciences, Earth Sciences, Chemin du Muse´e 6, CH-1700 Fribourg, Switzerland [email protected] This contribution is dedicated to the memory of Professor Ursula Martius Franklin, a true pioneer of archaeometric research, who passed away at her home in Toronto on July 22, 2016, at the age of 94. Making ceramics by firing of clay is essentially a reversal of the natural weathering process of rocks. Millennia ago, potters invented simple pyrotechnologies to recombine the chemical compounds once separated by weathering in order to obtain what is more or less a rock-like product shaped and decorated according to need and preference. Whereas Nature reconsolidates clays by long-term diagenetic or metamorphic transformation processes, potters exploit a ‘short-cut’ of these processes that affects the state of equilibrium of the system being transformed thermally. This ‘short-cut’ is thought to be akin to the development of mineral-reaction textures resulting from disequilibria established during rapidly heated pyrometamorphic events (Grapes, 2006) involving contact aureoles or reactions with xenoliths. In contrast to most naturally consolidated clays, the solidified rock-like ceramic material inherits non-equilibrium and statistical states best described as ‘frozen-in’. The more or less high temperatures applied to clays during ceramic firing result in a distinct state of sintering that is dependent on the firing temperature, the duration of firing, the firing atmosphere, and the composition and grain-size distribution of the clay. -

Synthesis of Hexacelsian Barium Aluminosilicate by Film Boiling Chemical Vapour Process C

Synthesis of hexacelsian barium aluminosilicate by film boiling chemical vapour process C. Besnard, A. Allemand, P. David, Laurence Maillé To cite this version: C. Besnard, A. Allemand, P. David, Laurence Maillé. Synthesis of hexacelsian barium aluminosilicate by film boiling chemical vapour process. Journal of the European Ceramic Society, Elsevier, In press, 10.1016/j.jeurceramsoc.2020.02.021. hal-02494032 HAL Id: hal-02494032 https://hal.archives-ouvertes.fr/hal-02494032 Submitted on 28 Feb 2020 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Synthesis of hexacelsian barium aluminosilicate by film boiling chemical vapour process C. Besnard1, A. Allemand1-2, P. David2, L. Maillé1* 1University of Bordeaux, CNRS, Safran, CEA, Laboratoire des Composites ThermoStructuraux (LCTS), UMR 5801, F-33600 Pessac 2CEA Le Ripault, F-37260, Monts * Corresponding author, email address: [email protected] Abstract An original oxide/oxide ceramic-matrix composite containing mullite-based fibers and a barium aluminosilicate matrix has been synthesized by the film boiling chemical vapour infiltration process. Alkoxides were used as liquid precursors for aluminum, silicon and barium oxides. The structure and microstructure of the oxide matrix were characterized by Scanning Electron Microscopy, Energy Dispersive Spectroscopy and X-ray diffraction. -

Synthetic Mullite Precursors: Preparation, Structure, and Transformation Behaviour

Synthetic Mullite Precursors: Preparation, Structure, and Transformation Behaviour Habilitationsschrift zur Erlangung der Lehrbefugnis für das Fachgebiet Materialwissenschaften an der Gemeinsamen Fakultät für Bergbau, Hüttenwesen und Maschinenwesen der Technischen Universität Clausthal vorgelegt von: Martin Schmücker Deutsches Zentrum für Luft- und Raumfahrt (DLR) Institut für Werkstoff-Forschung 51147 Köln 2003 2 Vorwort Die vorliegende Habilitationsschrift "Synthetic Mullite Precursors: Preparation, Structure, and Transformation Behaviour" basiert auf meinen Arbeitsschwerpunkten "Struktur nichtkristalliner Aluminiumsilikate" und "Frühstadien der Mullitbildung". Diese Themenbereiche habe ich -neben verschiedenen anderen Aktivitäten- während meiner 10-jährigen Tätigkeit im Institut für Werkstoff-Forschung des DLR konzeptionell entwickelt und kontinuierlich bearbeitet. Die Untersuchungen zur Struktur nichtkristalliner Aluminiumsilikate erfolgten zusammen mit internationalen Kooperationspartnern sowie im Rahmen des DFG-Sonderforschungsbereichs 408 (Anorganische Festkörper ohne Translationssysmmetrie, Univ. Bonn). Während diese Arbeiten überwiegend grundlagenorientiert waren, war der Hintergrund für meine Untersuchungen zur Mullitbildung stärker anwendungsbezogen: Der Einsatz von mullitbasierter Hochleistungskeramik z. B. für thermisch exponierte Bauteile im Bereich von Luftfahrt, Raumfahrt und Antriebstechnik setzt ein tieferes Verständnis der Mullitbildungsmechanismen voraus. Es zeigte sich, daß die Arbeiten zur Mullitbildung und zur Struktur -

Some Uncommon Sapphire “Imitations”: Blue Co-Zirconia, Kyanite & Blue Dumortierite Dr Michael S

Some Uncommon Sapphire “Imitations”: Blue Co-zirconia, Kyanite & Blue Dumortierite Dr Michael S. Krzemnicki Swiss Gemmological Institute SSEF [email protected] 筆者滙報數個瑞士珠寶研究院(SSEF)近期收到 in the ring showed a negative RI reading 要求鑑證的藍色寶石,經檢測後確定其中包括 (above 1.79), an isotropic optical character 一些非常罕見的藍寶石模擬石:含錮氧化鋯、 (polariscope) and thus no pleochroism at all. 藍晶石及藍線石等。 Under the microscope, we saw no inclusions, however a slightly greenish reaction under Sapphires are among the most abundant gems the LWSW and there was a weaker similar we receive at the Swiss Gemmological Institute reaction under SWUV lamps. Based on these (SSEF) for testing. From time to time, however, properties and a chemical analysis by X-ray we are quite surprised by the imitations which fluorescence (EDXRF), the blue stone was we find among the goods sent in and this can readily identified as cubic zirconia (ZrO2). then be disappointing news for the clients. In Having seen this artificial product in a wide the following short note, the author presents a range of colours, the author had not previously few uncommon imitations identified recently at seen one of such a saturated and attractive the SSEF. Identification of these imitations is blue. Based on literature (Nassau 1981) the straightforward and should be no problem for analysed traces of cobalt in that stone have any experienced gemmologist. been identified as the colouring element in this specimen. The absorption spectrum of the stone The first case is that of an attractive blue (Fig. 2) – although superposed by several rare faceted stone of approximately 1.4 ct, set in a ring with diamonds (Fig. -

This Dissertation Has Been 62—2136 M Icrofilm Ed Exactly As Received GIELISSE, Peter Jacob M., 1934- INVESTIGATION of PHASE EQ

This dissertation has been 62—2136 microfilmed exactly as received GIELISSE, Peter Jacob M., 1934- INVESTIGATION OF PHASE EQUILIBRIA IN THE SYSTEM ALUMINA-BORON OXIDE-SILICA. The Ohio State University, Ph.D., 1961 M ineralogy University Microfilms, Inc., Ann Arbor, Michigan INVESTIGATION OP PHASE EQUILIBRIA IN THE SYSTEM ALUMINA-BORON OXIDE-SILICA DISSERTATION Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of the Ohio State University By Peter Jacob M. Gielisse, M. S. The Ohio State University 1961 Approved by Adviser Department of Mineralogy ACKNOWLEDGMENTS The writer wishes to extend his sincere thanks to the many people without whose help the preparation of this dissertation would have been impossible. He is indebted in particular to his adviser, Dr. Wilfrid R. Foster, for his invaluable aid, advice and many kindnesses; to the other members of the faculty of the Department of Mineral ogy, Drs. Ernest G. Ehlers, Henry E. Wenden, and Rodney T Tettenhorst; and to his friend and colleague, Thomas J. Rockett. Acknowledgment is also made for financial support re ceived under contract No. AF 33(616)-3189, sponsored by Aeronautical Research Laboratories, Air Force Research Division, Wright Patterson Air Force Base, Ohio; as well as for aid received through a Mershon National Graduate Fellowship awarded to the writer by the Mershon Committee on Education in National Security for 1960-‘61'. It goes without saying that he is also most grate ful to his wife, Anna, for her excellent help and encour agement over the years. TABLE OF CONTENTS Page INTRODUCTION ...................................... -

Metamorphic and Metasomatic Kyanite-Bearing Mineral

Metamorphic and Metasomatic Kyanite-Bearing Mineral Assemblages of Thassos Island (Rhodope, Greece) Alexandre Tarantola, Panagiotis Voudouris, Aurélien Eglinger, Christophe Scheffer, Kimberly Trebus, Marie Bitte, Benjamin Rondeau, Constantinos Mavrogonatos, Ian Graham, Marius Etienne, et al. To cite this version: Alexandre Tarantola, Panagiotis Voudouris, Aurélien Eglinger, Christophe Scheffer, Kimberly Tre- bus, et al.. Metamorphic and Metasomatic Kyanite-Bearing Mineral Assemblages of Thassos Island (Rhodope, Greece). Minerals, MDPI, 2019, 10.3390/min9040252. hal-02932247 HAL Id: hal-02932247 https://hal.archives-ouvertes.fr/hal-02932247 Submitted on 7 Sep 2020 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. minerals Article Metamorphic and Metasomatic Kyanite-Bearing Mineral Assemblages of Thassos Island (Rhodope, Greece) Alexandre Tarantola 1,* , Panagiotis Voudouris 2 , Aurélien Eglinger 1, Christophe Scheffer 1,3, Kimberly Trebus 1, Marie Bitte 1, Benjamin Rondeau 4 , Constantinos Mavrogonatos 2 , Ian Graham 5, Marius Etienne 1 and Chantal Peiffert -

KYANITE Al2sio5 a Common Metamorphic Mineral Found Primarily in Regionally Metamorphosed Intermediate-Grade Rocks Derived from Shales

KYANITE Al2SiO5 A common metamorphic mineral found primarily in regionally metamorphosed intermediate-grade rocks derived from shales. It is less common in some veins and pegmatites. Kyanite is very rare in Michigan. It sometimes occurs as a detrital accessory mineral in glacial sands. Northern and Southern Peninsulas. Genesee County: SW ¼ NW ¼ section 6, T8N, R7E: As a detrital accessory in glacial lake sand in a water well (Stewart, 1937). Iron County: The Lake Ellen kimberlite, SW ¼ section 27, T44N, R31W, contains a variety of megacrysts, xenocrysts, and xenoliths (Cannon and Mudrey, 1981; McGee and Hearn, 1983; McGee, 1984; Hearn and McGee, 1985). About 85% of the upper mantle xenoliths collected are eclogites with granulitic textures. Most of these contain only garnet, clinopyroxene, and rutile, but some also have kyanite + sanidine + corundum + sulfides. The very pale blue-to-white kyanite is in 1 mm blades. In one specimen these have a subparallel orientation. An analysis is given in McGee and Hearn (1983). The presence of kyanite in the eclogite xenoliths indicates pressures were at least 18 to 20 kb (kimberlite). Marquette County: Champion mine on 36th level drift. Sky-blue kyanite has been reported in association with coarse, massive andalusite, and orthoclase, muscovite, quartz, biotite, and chlorite (Babcock, 1966a, b). At least one such specimen, however, has been shown by X-ray diffraction to be blue corundum (q.v.). Menominee County: Site 73 kimberlite, north of Hermansville: Small pale blue kyanite crystals have been recovered from heavy mineral concentrates produced from this kimberlite (S. M. Carlson, written communication, 1997). FROM: Robinson, G.W., 2004 Mineralogy of Michigan by E.W. -

Kyanite and Related Minerals

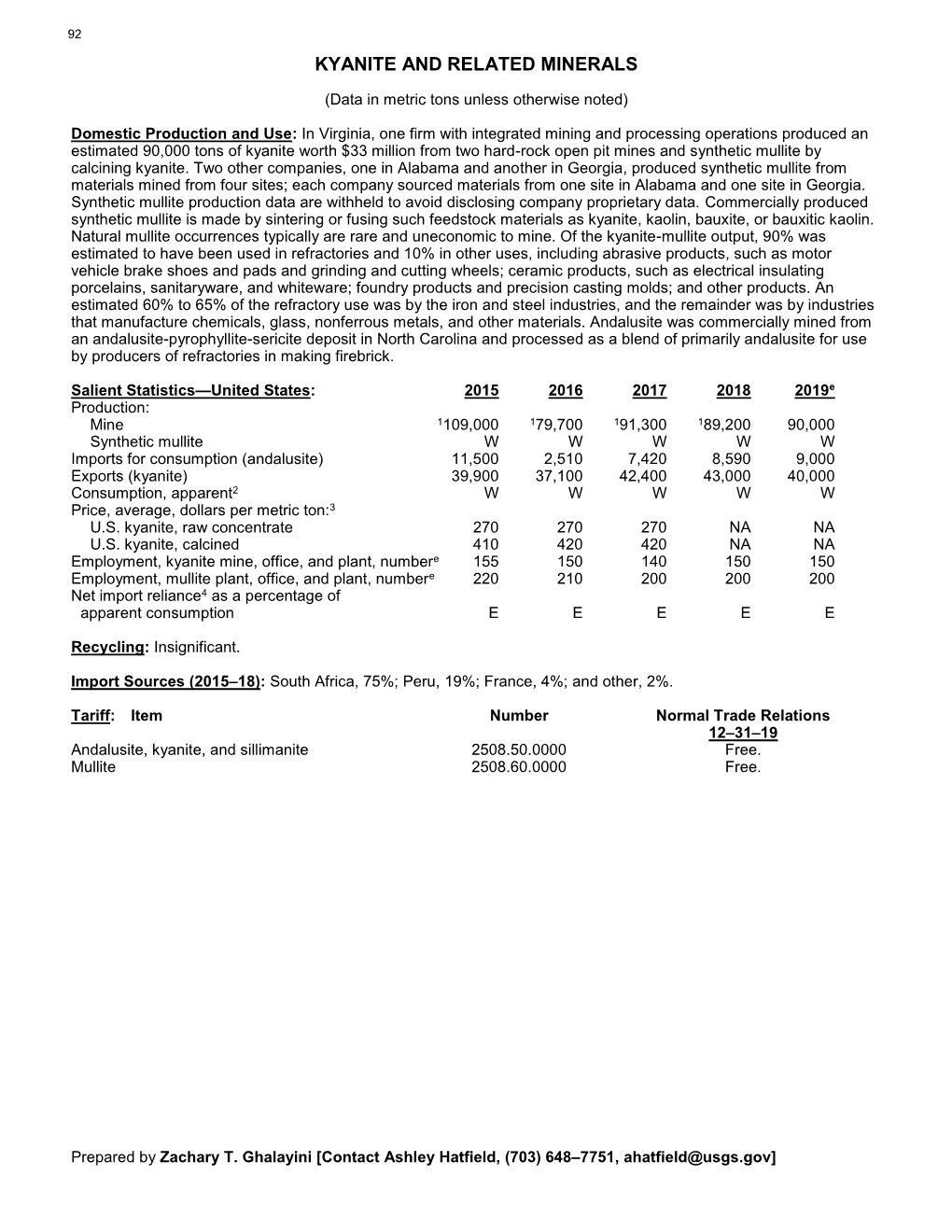

KYANITE AND RELATED MINERALS (Data in metric tons unless otherwise noted) Domestic Production and Use: In Virginia, one firm with integrated mining and processing operations produced an estimated 85,000 tons of kyanite worth $30 million from two hard-rock open pit mines and synthetic mullite by calcining kyanite. Two other companies, one in Alabama and another in Georgia, produced synthetic mullite from materials mined from four sites; each company sourced materials from one site in Alabama and one site in Georgia. Synthetic mullite production data are withheld to avoid disclosing company proprietary data. Commercially produced synthetic mullite is made by sintering or fusing such feedstock materials as kyanite, kaolin, bauxite, or bauxitic kaolin. Natural mullite occurrences typically are rare and not economical to mine. Of the kyanite-mullite output, 90% was estimated to have been used in refractories and 10% in other uses, including abrasive products, such as motor vehicle brake shoes and pads and grinding and cutting wheels; ceramic products, such as electrical insulating porcelains, sanitaryware, and whiteware; foundry products and precision casting molds; and other products. An estimated 60% to 70% of the refractory use was by the iron and steel industries, and the remainder was by industries that manufacture cement, chemicals, glass, nonferrous metals, and other materials. Andalusite was commercially mined from an andalusite-pyrophyllite-sericite deposit in North Carolina and processed as a blend of primarily andalusite for use -

High Pressure Behavior of Mullite-Type Oxides: Phase Transitions, Amorphization, Negative Linear Compressibility and Microstructural Implications

UNLV Theses, Dissertations, Professional Papers, and Capstones 5-1-2015 High Pressure Behavior of Mullite-Type Oxides: Phase Transitions, Amorphization, Negative Linear Compressibility and Microstructural Implications Patricia Kalita University of Nevada, Las Vegas Follow this and additional works at: https://digitalscholarship.unlv.edu/thesesdissertations Part of the Ceramic Materials Commons, Condensed Matter Physics Commons, and the Engineering Science and Materials Commons Repository Citation Kalita, Patricia, "High Pressure Behavior of Mullite-Type Oxides: Phase Transitions, Amorphization, Negative Linear Compressibility and Microstructural Implications" (2015). UNLV Theses, Dissertations, Professional Papers, and Capstones. 2369. http://dx.doi.org/10.34917/7645928 This Dissertation is protected by copyright and/or related rights. It has been brought to you by Digital Scholarship@UNLV with permission from the rights-holder(s). You are free to use this Dissertation in any way that is permitted by the copyright and related rights legislation that applies to your use. For other uses you need to obtain permission from the rights-holder(s) directly, unless additional rights are indicated by a Creative Commons license in the record and/or on the work itself. This Dissertation has been accepted for inclusion in UNLV Theses, Dissertations, Professional Papers, and Capstones by an authorized administrator of Digital Scholarship@UNLV. For more information, please contact [email protected]. HIGH PRESSURE BEHAVIOR OF MULLITE-TYPE OXIDES: PHASE TRANSITIONS, AMORPHIZATION, NEGATIVE LINEAR COMPRESSIBILITY AND MICROSTRUCTURAL IMPLICATIONS by Patricia E. Kalita Bachelor of Sciences in Physics University of Nevada Las Vegas 2006 Master of Sciences in Physics University of Nevada Las Vegas 2008 A dissertation submitted in partial fulfillment of the requirements for the Doctor of Philosophy – Physics Department of Physics and Astronomy College of Sciences Graduate College University of Nevada, Las Vegas May 2015 Copyright by Patricia E. -

Development and Properties of New Mullite Based Refractory Grog

materials Article Development and Properties of New Mullite Based Refractory Grog David Zemánek 1,2 , Karel Lang 2, Lukáš Tvrdík 2, Dalibor Všianský 3, Lenka Nevˇrivová 1,2, Petr Štursa 2,3, Pavel Kováˇr 3, Lucie Keršnerová 3 and Karel Dvoˇrák 1,* 1 Faculty of Civil Engineering, Brno University of Technology, Veveˇrí 331/95, 602 00 Brno, Czech Republic; [email protected] (D.Z.); [email protected] (L.N.) 2 P-D Refractories CZ JSC, Nádražní 218, 679 63 Velké Opatovice, Czech Republic; [email protected] (K.L.); [email protected] (L.T.); [email protected] (P.Š.) 3 Department of Geological Sciences, Faculty of Science, Masaryk University, Kotláˇrská 267/2, 602 00 Brno, Czech Republic; [email protected] (D.V.); [email protected] (P.K.); [email protected] (L.K.) * Correspondence: [email protected]; Tel.: +420-54114-7511 (ext. 8067) Abstract: The presented study is focused on optimization and characterization of a high-alumina refractory aggregate based on natural raw materials—kaolins, claystone, and mullite dust by-product (used to increase the alumina and mullite contents, respectively). In total, four individual formulas with the Al2O3 contents between 45 and 50 wt.% were designed; the samples were subsequently fired, both in a laboratory oven and an industrial tunnel furnace. The effects of repeated firing were examined during industrial pilot tests. Mineral and chemical compositions and microstructures, of both the raw materials and designed aggregates, were thoroughly investigated by the means of X-ray fluorescence spectroscopy, powder X-ray diffraction, and optical and scanning electron microscopies. -

Singapore Tariff Schedule

Annex 2C Tariff Schedule of Singapore See General Notes to Annex 2C for an explanation of staging codes Staging Heading H.S. Code Description Base Rates Category Chapter 1 Live animals 01.01 Live horses, asses, mules and hinnies. 0101.10.00 - Pure-bred breeding animals Free E 0101.90 - Other: 0101.90.10 - - Race horses Free E 0101.90.20 - - Other horses Free E 0101.90.90 - - Other Free E 01.02 Live bovine animals. 0102.10.00 - Pure-bred breeding animals Free E 0102.90 - Other: 0102.90.10 - - Oxen Free E 0102.90.20 - - Buffaloes Free E 0102.90.90 - - Other Free E 01.03 Live swine. 0103.10.00 - Pure-bred breeding animals Free E - Other: 0103.91.00 - - Weighing less than 50 kg Free E 0103.92.00 - - Weighing 50 kg or more Free E 01.04 Live sheep and goats. 0104.10 - Sheep: 0104.10.10 - - Pure-bred breeding Free E 0104.10.90 - - Other Free E 0104.20 - Goats: 0104.20.10 - - Pure-bred breeding animals Free E 0104.20.90 - - Other Free E Live poultry, that is to say, fowls of the species Gallus domesticus, 01.05 ducks, geese, turkeys and guinea fowls. - Weighing not more than 185 g: 0105.11 - Fowls of the species Gallus domesticus: 0105.11.10 - - - Breeding fowls Free E 0105.11.90 - - - Other Free E 0105.12 - - Turkeys: 0105.12.10 - - - Breeding turkeys Free E 0105.12.90 - - - Other Free E 0105.19 - - Other: 0105.19.10 - - - Breeding ducklings Free E 0105.19.20 - - - Other ducklings Free E 0105.19.30 - - - Breeding goslings Free E 0105.19.40 - - - Other goslings Free E 0105.19.50 - - - Breeding guinea fowls Free E 0105.19.90 - - - Other Free E - Other: 2C-Schedule-1 Staging Heading H.S.