Macroasia Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 15 2017, the Board of Directors of Macroasia Corporation Approved to Appropriate P=210.0 Million to Buy Back Shares of Macroasia Corporation at Market Price

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N (Company’s Full Name) 1 2 t h F l o o r , P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) AMADOR T. SENDIN 8840-2001 (Contact Person) (Company Telephone Number) 1 2 3 1 2 0 - I S 0 7 1 7 Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) MSRD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 845 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. NOTICE OF ANNUAL STOCKHOLDERS’ MEETING Notice is hereby given that the Annual Stockholders’ Meeting of MACROASIA CORPORATION will be conducted virtually on Friday, 17 July 2020, at 3:00 P.M., the details of which can be found in http://www.macroasiacorp.com/asm. The Agenda for the meeting is as follows: 1. Call to Order 2. Certification of Notice and Quorum 3. Approval of the Minutes of the Annual Stockholders’ Meeting held on 19 July 2019 4. President’s Report 5. -

09. Directors' Profiles

BOARD OF DIRECTORS FLORENCIA G. TARRIELA FELIX ENRICO R. ALFILER REYNALDO A. MACLANG FLORIDO P. CASUELA Age 69 Age 67 Age 78 Age 75 Nationality Filipino Nationality Filipino Nationality Filipino Nationality Filipino Education • Bachelor of Science in Business Administration Education • Bachelor of Science and Masters in Statistics, Education • Bachelor of Laws, Ateneo de Manila University Education • Bachelor of Science in Business Administration, Major in degree, Major in Economics, University of the University of the Philippines Accounting, University of the Philippines Philippines Current Position • President of the Bank • Masters in Business Administration, University of • Masters in Economics degree, University of Current Position • Vice Chairman/Independent Director in the Bank the Philippines in the Bank • Advanced Management Program for Overseas Bankers, California, Los Angeles, where she topped the Masters Date of First • February 9, 2013 (as Director) Comprehensive Examination Philadelphia National Bank in conjunction with Date of First • January 1, 2012 Appointment • May 27, 2014 (as President) Wharton School of the University of Pennsylvania Current Position • Chairman of the Board/Independent Director Appointment Directorship in • None Government Civil Service Eligibilities in the Bank Directorship in • None Other Listed Ř &HUWLƓHG3XEOLF$FFRXQWDQW(FRQRPLVW&RPPHUFLDO Companies Attaché Date of First • May 29, 2001 (as Director) Other Listed Appointment • May 24, 2005 (as Chairman of the Board) Companies Other Current • Chairman of PNB (Europe) Plc. Current Position • Director • May 30, 2006 (as Independent Director) Other Current • Chairman/Independent Director of PNB General Insurers Positions • Director of Allied Leasing & Finance Corporation, PNB in the Bank Positions Co., Inc. and PNB RCI Holdings Co., Ltd. Directorship in • Independent Director of LT Group, Inc. -

Notice of Annual Stockholders’ Meeting

NOTICE OF ANNUAL STOCKHOLDERS’ MEETING Dear Shareholder: Notice is hereby given that the Annual Stockholders’ Meeting of PAL HOLDINGS, INC. will be held on 23 July 2020, Thursday, at 2:00 pm via Zoom application. The meeting ID and password will be sent to the successful registrants of the Meeting through electronic mail. 1. Call to order 2. Proof of the required notice of the meeting 3. Proof of the presence of quorum 4. Approval of the Minutes of the 2019 Annual Stockholders’ Meeting held on 30 May 2019 5. Report of Management and the Board of Directors 6. Ratification of All Acts, Transactions and Resolutions by the Board of Directors and Management since the 2019 Annual Stockholders’ Meeting 7. Amendment of the Articles of Incorporation to increase the number of directors from nine (9) to eleven (11) 8. Election of Directors 9. Ratification of Appointment of External Auditor 10. Adjournment Only stockholders of record and in good standing as of 16 June 2020 will be entitled to notice of, and to vote at, the meeting. Guidelines for registration and participation in the Meeting, as well as the contact details of persons to whom you may send your inquiries, are attached to this Notice. Registration will run until 09 July 2020. Stockholders are encouraged to register online at least 45 minutes before the Meeting. For your convenience, a copy of the Definitive Information Statement, Management Report, and Audited Financial Statements will be available for viewing and download at PSE Edge (https://edge.pse.com.ph/companyDisclosures/form.do?cmpy_id=20). -

SEC Form 20-IS MAC 2015

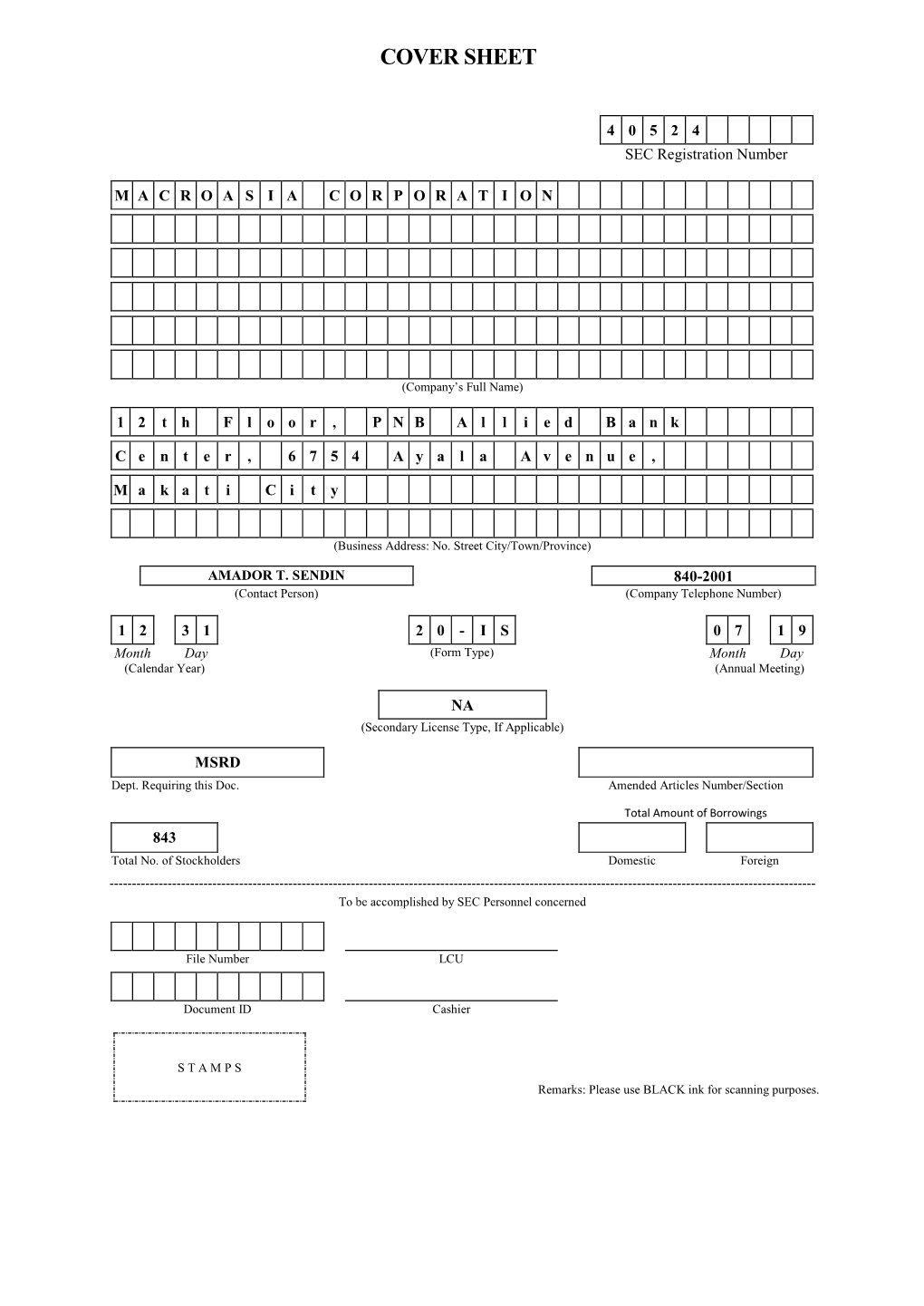

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N (Company’s Full Name) 1 2 t h F l o o r , P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) AMADOR T. SENDIN 840-2001 (Contact Person) (Company Telephone Number) 1 2 3 1 2 0 - I S 0 7 1 5 Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) MSRD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 861 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. ANNUAL STOCKHOLDERS’ MEETING JULY 15, 2016 Kachina Room, Century Park Hotel, 599 P. Ocampo Sr. Street, Malate, Manila DEFINITIVE INFORMATION STATEMENT PROXY KNOW ALL MEN BY THESE PRESENTS: The undersigned, a stockholder of MACROASIA CORPORATION (“Corporation”), hereby constitutes and appoints _________________________ with power of substitution, to be his/her/its true and lawful Attorney, agent, and proxy to attend and represent the undersigned and to vote all shares registered his/her/its name in the books of the Corporation or owned by the undersigned, at the Annual Stockholders’ Meeting of the Corporation on Friday, 15 July 2016 at 3:00 P.M. -

Second Quarter Report

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N A N D S U B S I D I A R I E S (Company’s Full Name) 1 2 F P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) Amador T. Sendin 840-2001 (Contact Person) (Company Telephone Number) 0 6 3 0 1 7 - Q Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) CFD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 840 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. MACROASIA CORPORATION June 30, 2018 SEC Form 17-Q QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17(2)(b) THEREUNDER 1. For the quarterly period ended June 30, 2018 2. Commission Identification Number 40524 3. BIR tax Identification No. 004-666-098-000 4. Exact name of issuer as specified in its charter MACROASIA CORPORATION 5. Philippines 6. (SEC Use Only) Province, Country or other jurisdiction Industry Classification Code of incorporation or organization 7. -

Tanduay Holdings, Inc. and Sub

COVER SHEET P W 3 4 3 SEC Registration Number L T G R O U P , I N C . ( f o r m e r l y T A N D U A Y H O L D I N G S , I N C . ) a n d S u b s i d i a r i e s (Company‘s Full Name) 1 1 t h F l o o r U n i t 3 B e n c h T o w e r , 3 0 t h S t . c o r n e r R i z a l d r i v e C r e s c e n t P a r k W e s t 5 B o n i f a c i o G l o b a l C i t y T a g u i g C i t y (Business Address: No. Street City/Town/Province) Jose Gabriel D. Olives 519-7981 (Contact Person) (Company Telephone Number) 1 2 3 1 17-A 0 5 0 4 Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) (Secondary License Type, If Applicable) SEC Dept. Requiring this Doc. Amended /Section Total Amount of Borrowings 533 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF CORPORATION CODE OF THE PHILIPPINES 1. -

August 12, 2020

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N A N D S U B S I D I A R I E S (Company’s Full Name) 1 2 F P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) Amador T. Sendin 8840-2001 (Contact Person) (Company Telephone Number) 0 6 3 0 1 7 - Q Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) CFD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 845 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. MACROASIA CORPORATION June 30, 2020 SEC Form 17-Q QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17(2)(b) THEREUNDER 1. For the quarterly period ended June 30, 2020 2. Commission Identification Number 40524 3. BIR tax Identification No. 004-666-098-000 4. Exact name of issuer as specified in its charter MACROASIA CORPORATION 5. Philippines 6. (SEC Use Only) Province, Country or other jurisdiction Industry Classification Code of incorporation or organization 7. -

2019 Annual Report 1 Banner Financial Summary Our Businesses at a Glance Year

20192019 ANNUALANNUAL REPORTREPORT Banner year for LT Group, Inc. Vision Mission Seven years ago, Dr. Lucio C. Tan formed LT Group, Inc., a conglomerate with diversified To be a world-class conglomerate at the forefront Anchored to its Vision, the LT Group commits: interests in banking, beverages, alcohol and of Philippine economic growth, successfully distillery, tobacco and property development. maintaining a strong presence and dominant To increase stockholder values through long-term growth in its Their mission: provide the best products and position in key Philippine industries while ensuring major business groups. services to the Filipino consumer. continuous benefits to its consumers, communities, Today, LT Group, Inc. is stronger than ever. employees, business partners, and shareholders. To continuously improve the value of its products and services As a reward for years of hard work and the and to provide consumers with more and better choices. pursuit of excellence, the company ends 2019 with its best financial performance on record. To build the largest, most effective distribution network and A banner year indeed! Contents widest customer reach in the Philippines. Financial Summary 2 To leverage on synergies between its various businesses to continuously improve revenues and cost structure. Our Businesses at a Glance 3 Our Partnerships 4 To enhance the welfare of its employees and the communities Message from the Chairman 6 where it lives and works. LT GROUP, INC. Message from the President 8 (The Vision and Mission Statements are reviewed and approved Message from the CFO 12 annually by the Board of Directors. The latest reviews were on January 15, 2019 and January 17, 2020.) Asia Brewery, Inc. -

2017-AR-LTG.Pdf

Contents 2 Financial Highlights 3 Our Businesses at a Glance The LT Group Logo 4 Our Partnerships Strength and solidarity. This is the essence of the LT Group (LTG) 6 Chairman’s Message logo. The clean balance lines and curves are the central elements -- a mystical symmetrical tree. Drawn in an Eastern-Oriental style, 8 President’s Message it gives hint to the Company’s Chinese heritage. 12 CFO’s Message Tree is life. Life is growth. Like a tree, a company with rm roots, properly nurtured, will continuously grow and give value. 14 Asia Brewery, Inc. 16 Eton Properties Philippines, Inc. The tree’s trunk is upright, and the branches spread out -- a symbolic consolidation of the subsidiaries and stakeholders within 18 PMFTC Inc. two circles, one for continuity, the outer one for solidarity. 22 Philippine National Bank 24 Tanduay Distillers, Inc. 26 Corporate Governance Report VISION 36 Corporate Social Responsibility To be a world-class conglomerate at the forefront of Philippine economic growth, successfully maintaining a strong presence Tan Yan Kee Foundation, Inc. and dominant position in key Philippine industries while ensuring continuous bene ts to its consumers, communities, employees, Our Presence in Marawi business partners, and shareholders. Asia Brewery, Inc. MISSION Eton Properties Philippines, Inc. Anchored to its Vision, the LT Group commits: PMFTC Inc. To increase stockholder values through long-term growth Philippine National Bank in its major business groups. Tanduay Distillers, Inc. To continuously improve the value of its products and services and to provide consumers with more and better choices. 46 Sustainability To build the largest, most effective distribution network Asia Brewery, Inc. -

3Rd Quarter Report September 30, 2017 Page 2

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N A N D S U B S I D I A R I E S (Company’s Full Name) 1 2 F P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) Amador T. Sendin 840-2001 (Contact Person) (Company Telephone Number) 1 2 3 1 1 7 - Q Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) CFD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 845 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. MACROASIA CORPORATION AND SUBSIDIARIES Management’s Discussion and Analysis of Financial Condition and Results of Operations For the Third Quarter and Period Ended September 30, 2017 3rd Quarter Report September 30, 2017 Page 2 PART I. FINANCIAL INFORMATION ITEM 1. FINANCIAL STATEMENTS Our unaudited condensed consolidated financial statements include the accounts of MacroAsia Corporation and its subsidiaries, collectively referred to as the “the Group” or “MacroAsia Group” in this report. The unaudited condensed consolidated financial statements for the third quarter ended September 30, 2017 have been prepared in accordance with Philippine Accounting Standard 34, Interim Financial Reporting. -

Philippine National Bank

Philippine National Bank Company Brief September 2019 Page 1 Company Introduction 3 2 Financial Highlights 9 3 Board of Directors & Senior Management 13 4 Awards & Citations 16 Page 2 About PNB . Philippine National Bank is one of the country’s largest private universal banks in terms of assets, loans and deposits. It provides a full range of banking and other financial services to its highly diverse clientele comprised of individual depositors, small and medium enterprises, domestic and international corporations, government institutions, and overseas Filipinos. PNB has 712 branches and 1,595 ATMs strategically located nationwide. The Bank maintains its position as the Philippine bank with the most extensive international reach with 71 overseas branches, representative offices, remittance centers and subsidiaries across Asia, Europe, the Middle East, and North America. Backed by over a century of stability and excellence, PNB looks forward to more years of serving its customers first. Page 3 Products & Services . PNB provides a full range of quality products and services to a wide customer base: Branch Retail Institutional Trust & Treasury Remittance Banking Lending Banking Wealth Mgmt Services Services • Fixed .Sending/ • Deposit • Home Loans • Corporate & • UITFs Income Receiving Accounts • Auto Loans Middle • Personal Investments .Global • e-Banking • Salary Market Trust • Foreign Filipino Card Services Loans • Trade • Corporate Exchange .Overseas • Cash • SMEs Finance Trust Services Bills Management • OPHL • Financial • PNB Wealth -

First Quarter Report

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N A N D S U B S I D I A R I E S (Company’s Full Name) 1 2 F P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) Amador T. Sendin 840-2001 (Contact Person) (Company Telephone Number) 0 3 3 1 1 7 - Q Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) CFD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 837 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. ` MACROASIA CORPORATION AND SUBSIDIARIES Management’s Discussion and Analysis of Financial Condition and Results of Operations For the First Quarter and Period Ended March 31, 2018 1st Quarter Report March 31, 2018 Page 2 ` PART I. FINANCIAL INFORMATION ITEM 1. FINANCIAL STATEMENTS Our unaudited condensed consolidated financial statements include the accounts of MacroAsia Corporation and its subsidiaries, collectively referred to as the “the Group” or “MacroAsia Group” in this report. The unaudited condensed consolidated financial statements for the third quarter ended March 31, 2018 have been prepared in accordance with Philippine Accounting Standard 34, Interim Financial Reporting.