Tanduay Holdings, Inc. and Sub

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 15 2017, the Board of Directors of Macroasia Corporation Approved to Appropriate P=210.0 Million to Buy Back Shares of Macroasia Corporation at Market Price

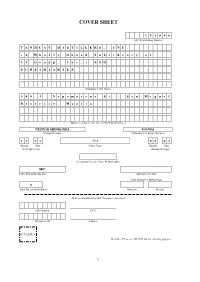

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N (Company’s Full Name) 1 2 t h F l o o r , P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) AMADOR T. SENDIN 8840-2001 (Contact Person) (Company Telephone Number) 1 2 3 1 2 0 - I S 0 7 1 7 Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) MSRD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 845 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. NOTICE OF ANNUAL STOCKHOLDERS’ MEETING Notice is hereby given that the Annual Stockholders’ Meeting of MACROASIA CORPORATION will be conducted virtually on Friday, 17 July 2020, at 3:00 P.M., the details of which can be found in http://www.macroasiacorp.com/asm. The Agenda for the meeting is as follows: 1. Call to Order 2. Certification of Notice and Quorum 3. Approval of the Minutes of the Annual Stockholders’ Meeting held on 19 July 2019 4. President’s Report 5. -

A Comparative Study on Wastewater Treatment Methods of Selected Multinational and Local Beverage Companies in the Philippines and Their Effects on the Environment

International Journal of Environmental Science and Development, Vol. 5, No. 6, December 2014 A Comparative Study on Wastewater Treatment Methods of Selected Multinational and Local Beverage Companies in the Philippines and Their Effects on the Environment Yolanda Aguilar, Edwin Tadiosa, and Josephine Tondo kilometres wherein 65 percent are coastal [3]. Environmental Abstrac—Waste water treatment is the process of removing Management Bureau has classified 62 percent of 525 water existing contaminants to make water becomes fit for disposal or bodies according to their intended beneficial usage. Only five reuse. The waste water generally contains 99.9% water and are class AA which can be used for public water supply and 0.1% of solid impurities; thus, it has a large potential as a most of the water bodies are classified as class C intended for source of water for different purposes such as fish ponds, comfort rooms, cleaning source, among others. Treated water fishery, recreation and supply for manufacturing processes. can be used back into the natural environment without adverse Water is use and reuse not only for domestic purposes; it is ecological impact. In the Philippines, the most commonly used also being use in myriad tasks particularly in food and treatment methods for beverage companies are pond/lagoon beverage industries [4]. system and activated sludge system. Human uses water in various needs and processes This study aimed to characterize and differentiate the [5].Water is important in agriculture due to irrigation. wastewater treatment methods used by Coca-Cola Bottlers Company (CCBC) and the Tanduay Distillery, Inc. (TDI),a Irrigation plays a key component to produce crops. -

Tanduay Distillers, Inc

G AINING MOMENTUM 11th Floor Unit 3 Bench Tower, 30th Street corner Rizal Drive Cresent Park West 5, Bonifacio Global City, Taguig City, Philippines ltg.com.ph G AINING MOMENTUM ANNUAL REPORT ANNUAL REPORT 2018 2018 Contents 2 Financial Highlights 3 Our Businesses at a Glance The LT Group Logo 4 Our Partnerships Strength and solidarity. This is the essence of the LT Group (LTG) logo. The 6 clean balance lines and curves are central elements -- a mystical Chairman’s Message symmetrical tree. Drawn in an Eastern-Oriental style, it gives hint to the 8 President’s Message Company’s Chinese heritage. 12 CFO’s Message Tree is life. Life is growth. Like a tree, a company with rm roots, properly 14 Asia Brewery, Inc. nurtured, will continuously grow and give value. 16 Eton Properties Philippines, Inc. The tree’s trunk is upright, and the branches spread out -- a symbolic 18 PMFTC Inc. consolidation of the subsidiaries and stakeholders within two circles, one for continuity, the outer one for solidarity. 24 Philippine National Bank 26 Tanduay Distillers, Inc. 28 Corporate Governance Report VISION 36 Corporate Social Responsibility To be a world-class conglomerate at the forefront of Philippine economic e Tan Yan Kee Foundation, Inc. growth, successfully maintaining a strong presence and dominant position in key Philippine industries while ensuring continuous benets to its Asia Brewery, Inc. consumers, communities, employees, business partnerts, and shareholders. Eton Properties Philippines, Inc. MISSION PMFTC Inc. Anchored to its Vision, the LT Group commits: Philippine National Bank To increase stockholder values through long-term growth in its major Tanduay Distillers, Inc. -

Spirits Selection by Concours Mondial 2020 Prize List

Spirits Selection by Concours Mondial 2020 Prize list Armenia Belgium Gold Medals Gold Medals V & M 3 Yo (Brandy) Filliers Barrel Aged Genever 8 Years Old (Genever) Producer: Armenia Wine Factory LLC Producer: Filliers Distillery Australia Ginbee's (Gin) Producer: Dard-Dard Srl Silver Medals Gouden Carolus Single Malt (Whisky) Coffee Storm (Flavoured Rum) Producer: Brouwerij Het Anker - Stokerij De Queensland Molenberg Producer: Milton Distillery Pty LTD Le passionné Rhumantic (Flavoured Rum) Producer: Fabian Pierre - Rhumantic Austria Pastis Patinette (Aniseed) Gold Medals Producer: Distillerie Gervin Distillery Krauss London Dry Gin Bergamot Pepper Plus Oultre Distillery Bitter (Bitter) (Gin) Producer: Plus Oultre Distillery Producer: Distillery Krauss GmbH Shack Pecans Spiced Rum (Spiced Rum) G+ Classic Edition Gin (Gin) Producer: Plan B International BVBA Producer: Distillery Krauss GmbH Silver Medals G+ Lemon Edition Gin (Gin) Producer: Distillery Krauss GmbH Amaretto Noblesse (Liquor-Cream) Producer: Noblesse 1882 SPRL Silver Medals Belgian Owl - Passion (Whisky) Distillery Krauss Distilled Anise (Aniseed) Producer: The Owl Distillery S.A. Producer: Distillery Krauss GmbH Biercine (Liquor-Cream) G+ Flower Edition Gin (Gin) Producer: Brass des Légendes sprl-Distillerie de Producer: Distillery Krauss GmbH Biercée Cosmik Pure Diamond Vodka (Vodka) Producer: Wave Distil srl Dr.Clyde Classic Rum (Rum) Producer: Dr.Clyde Distillery Filliers Barrel Aged Genever 17 Years Old (Genever) Producer: Filliers Distillery Gin.be (Gin) Producer: -

09. Directors' Profiles

BOARD OF DIRECTORS FLORENCIA G. TARRIELA FELIX ENRICO R. ALFILER REYNALDO A. MACLANG FLORIDO P. CASUELA Age 69 Age 67 Age 78 Age 75 Nationality Filipino Nationality Filipino Nationality Filipino Nationality Filipino Education • Bachelor of Science in Business Administration Education • Bachelor of Science and Masters in Statistics, Education • Bachelor of Laws, Ateneo de Manila University Education • Bachelor of Science in Business Administration, Major in degree, Major in Economics, University of the University of the Philippines Accounting, University of the Philippines Philippines Current Position • President of the Bank • Masters in Business Administration, University of • Masters in Economics degree, University of Current Position • Vice Chairman/Independent Director in the Bank the Philippines in the Bank • Advanced Management Program for Overseas Bankers, California, Los Angeles, where she topped the Masters Date of First • February 9, 2013 (as Director) Comprehensive Examination Philadelphia National Bank in conjunction with Date of First • January 1, 2012 Appointment • May 27, 2014 (as President) Wharton School of the University of Pennsylvania Current Position • Chairman of the Board/Independent Director Appointment Directorship in • None Government Civil Service Eligibilities in the Bank Directorship in • None Other Listed Ř &HUWLƓHG3XEOLF$FFRXQWDQW(FRQRPLVW&RPPHUFLDO Companies Attaché Date of First • May 29, 2001 (as Director) Other Listed Appointment • May 24, 2005 (as Chairman of the Board) Companies Other Current • Chairman of PNB (Europe) Plc. Current Position • Director • May 30, 2006 (as Independent Director) Other Current • Chairman/Independent Director of PNB General Insurers Positions • Director of Allied Leasing & Finance Corporation, PNB in the Bank Positions Co., Inc. and PNB RCI Holdings Co., Ltd. Directorship in • Independent Director of LT Group, Inc. -

Tanduay Distillers, Inc. and Subsidiaries Index to Financial Statements and Supplementary Schedules Sec Form 17-A

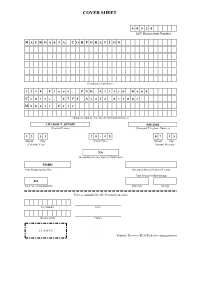

COVER SHEET 1 5 1 0 9 6 SEC Registration Number T A N D U A Y D I S T I L L E R S , I N C . ( A W h o l l y O w n e d S u b s i d i a r y o f L T G r o u p , I n c . ) A N D S U B S I D I A R I E S (Company‘s Full Name) 3 4 8 J . N e p o m u c e n o S t . , S a n M i g u e l D i s t r i c t , M a n i l a (Business Address: No. Street City/Town/Province) NESTOR MENDONES 519-7981 (Contact Person) (Company Telephone Number) 1 2 3 1 17-A 0 5 0 4 Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) (Secondary License Type, If Applicable) SEC Dept. Requiring this Doc. Amended /Section Total Amount of Borrowings 8 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. 1 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF CORPORATION CODE OF THE PHILIPPINES 1. For the calendar year ended December 31, 2013 2. SEC Identification Number 151096 3. BIR Tax Identification No. 000-086-108-000 4. -

Notice of Annual Stockholders’ Meeting

NOTICE OF ANNUAL STOCKHOLDERS’ MEETING Dear Shareholder: Notice is hereby given that the Annual Stockholders’ Meeting of PAL HOLDINGS, INC. will be held on 23 July 2020, Thursday, at 2:00 pm via Zoom application. The meeting ID and password will be sent to the successful registrants of the Meeting through electronic mail. 1. Call to order 2. Proof of the required notice of the meeting 3. Proof of the presence of quorum 4. Approval of the Minutes of the 2019 Annual Stockholders’ Meeting held on 30 May 2019 5. Report of Management and the Board of Directors 6. Ratification of All Acts, Transactions and Resolutions by the Board of Directors and Management since the 2019 Annual Stockholders’ Meeting 7. Amendment of the Articles of Incorporation to increase the number of directors from nine (9) to eleven (11) 8. Election of Directors 9. Ratification of Appointment of External Auditor 10. Adjournment Only stockholders of record and in good standing as of 16 June 2020 will be entitled to notice of, and to vote at, the meeting. Guidelines for registration and participation in the Meeting, as well as the contact details of persons to whom you may send your inquiries, are attached to this Notice. Registration will run until 09 July 2020. Stockholders are encouraged to register online at least 45 minutes before the Meeting. For your convenience, a copy of the Definitive Information Statement, Management Report, and Audited Financial Statements will be available for viewing and download at PSE Edge (https://edge.pse.com.ph/companyDisclosures/form.do?cmpy_id=20). -

Notice to File Entry, to Pay Duties and Taxes and to Claim Goods Discharged October 16, 2020

NOTICE TO FILE ENTRY, TO PAY DUTIES AND TAXES AND TO CLAIM GOODS DISCHARGED OCTOBER 16, 2020 NO Bill of Lading Discharge Date and Time Consignee Party to Notify 1 ARM0193403 16/10/2020 10:40 1 ISUMI CORPORATION 1 ISUMI CORPORATION 2 SHMNN2011433 16/10/2020 8:08 2 HILCON TRADING CORPORATION SAME AS CONSIGNEE 3 UKB0335777 16/10/2020 5:02 2DOMINI8 INTERNATIONAL TRADING SAME AS CONSIGNEE 4 ONEYSUBA30829900 16/10/2020 21:10 3 FOR 8 TRADING INTERNATIONAL 3 FOR 8 TRADING INTERNATIONAL 5 026A532339 16/10/2020 1:40 3K MAKBONITZ SEAFOODS TRADING SAME AS CONSIGNEE 6 LNJSUBMNL20090303 16/10/2020 8:18 3M PHILIPPINES INC SAME AS CONSIGNEE 7 JHB200793957 16/10/2020 3:33 3M PHILIPPINES INC 10TH AND 11TH SAME AS CONSIGNEE 8 PUS200937567 16/10/2020 9:56 3M PHILIPPINES INC 10TH AND 11TH SAME AS CONSIGNEE 9 BTLS2010032 16/10/2020 1:43 A2Z LOGISTICS INC A2Z LOGISTICS INC 10 BTLS2010061 16/10/2020 4:14 A2Z LOGISTICS INC A2Z LOGISTICS INC 11 ONEYJKTA97767400 16/10/2020 10:43 ABBOTT LABORATORIES PHILIPPINES SAME AS CONSIGNEE 12 ONEYJKTA97766300 16/10/2020 10:45 ABBOTT LABORATORIES PHILIPPINES SAME AS CONSIGNEE 13 SNLASHPL4700349 16/10/2020 17:25 ABC COMMODITIES CORPORATION ADDR SAME AS CONSIGNEE 14 NSSLICNMC2000049 16/10/2020 1:52 ACS MANUFACTURING CORPORATION THE SAME AS CONSIGNEE 15 SNKO010200713851 16/10/2020 4:09 ACUMEN ENGINEERING PTE LTD ACUMEN ENGINEERING PTE LTD 16 SITGLCMN219645 16/10/2020 17:53 ACUMEN ENGINEERING PTE LTD 9F INSUL FIRST TAIPAN LOGISTICS INC 3F AMB 17 040AA07517 16/10/2020 3:31 ADCAELUM ENTERPRISES ADCAELUM ENTERPRISES 18 JKT0039262 -

SEC Form 20-IS MAC 2015

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N (Company’s Full Name) 1 2 t h F l o o r , P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) AMADOR T. SENDIN 840-2001 (Contact Person) (Company Telephone Number) 1 2 3 1 2 0 - I S 0 7 1 5 Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) MSRD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 861 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. ANNUAL STOCKHOLDERS’ MEETING JULY 15, 2016 Kachina Room, Century Park Hotel, 599 P. Ocampo Sr. Street, Malate, Manila DEFINITIVE INFORMATION STATEMENT PROXY KNOW ALL MEN BY THESE PRESENTS: The undersigned, a stockholder of MACROASIA CORPORATION (“Corporation”), hereby constitutes and appoints _________________________ with power of substitution, to be his/her/its true and lawful Attorney, agent, and proxy to attend and represent the undersigned and to vote all shares registered his/her/its name in the books of the Corporation or owned by the undersigned, at the Annual Stockholders’ Meeting of the Corporation on Friday, 15 July 2016 at 3:00 P.M. -

Second Quarter Report

COVER SHEET 4 0 5 2 4 SEC Registration Number M A C R O A S I A C O R P O R A T I O N A N D S U B S I D I A R I E S (Company’s Full Name) 1 2 F P N B A l l i e d B a n k C e n t e r , 6 7 5 4 A y a l a A v e n u e , M a k a t i C i t y (Business Address: No. Street City/Town/Province) Amador T. Sendin 840-2001 (Contact Person) (Company Telephone Number) 0 6 3 0 1 7 - Q Month Day (Form Type) Month Day (Calendar Year) (Annual Meeting) NA (Secondary License Type, If Applicable) CFD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 840 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. MACROASIA CORPORATION June 30, 2018 SEC Form 17-Q QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17(2)(b) THEREUNDER 1. For the quarterly period ended June 30, 2018 2. Commission Identification Number 40524 3. BIR tax Identification No. 004-666-098-000 4. Exact name of issuer as specified in its charter MACROASIA CORPORATION 5. Philippines 6. (SEC Use Only) Province, Country or other jurisdiction Industry Classification Code of incorporation or organization 7. -

TANDUAY DISTILLERS, INC., Vs. GINEBRA SAN MIGUEL, INC

Republic of the Philippines SUPREME COURT Manila FIRST DIVISION TANDUAY DISTILLERS, INC., G.R. NO. 164324 Petitioner, - versus - GINEBRA SAN MIGUEL, INC., RESPONDENT. PROMULGATED: AUGUST 14, 2009 CARPIO, J.: The Case TANDUAY DISTILLERS, INC. (TANDUAY) FILED THIS PETITION FOR REVIEW ON CERTIORARI[1] ASSAILING THE COURT OF APPEALS’ DECISION DATED 9 JANUARY 2004[2] AS WELL AS THE RESOLUTION DATED 2 JULY 2004[3] IN CA-G.R. SP NO. 79655 DENYING THE MOTION FOR RECONSIDERATION. IN THE ASSAILED DECISION, THE COURT OF APPEALS (CA) AFFIRMED THE REGIONAL TRIAL COURT’S ORDERS[4] DATED 23 SEPTEMBER 2003 AND 17 OCTOBER 2003 WHICH RESPECTIVELY GRANTED GINEBRA SAN MIGUEL, INC.’S (SAN MIGUEL) PRAYER FOR THE ISSUANCE OF A TEMPORARY RESTRAINING ORDER (TRO) AND WRIT OF PRELIMINARY INJUNCTION. THE REGIONAL TRIAL COURT OF MANDALUYONG CITY, BRANCH 214 (TRIAL COURT), ENJOINED TANDUAY “FROM COMMITTING THE ACTS COMPLAINED OF, AND, SPECIFICALLY, TO CEASE AND DESIST FROM MANUFACTURING, DISTRIBUTING, SELLING, OFFERING FOR SALE, ADVERTISING, OR OTHERWISE USING IN COMMERCE THE MARK “GINEBRA,” AND MANUFACTURING, PRODUCING, DISTRIBUTING, OR OTHERWISE DEALING IN GIN PRODUCTS WHICH HAVE THE GENERAL APPEARANCE OF, AND WHICH ARE CONFUSINGLY SIMILAR WITH,” SAN MIGUEL’S MARKS, BOTTLE DESIGN, AND LABEL FOR ITS GIN PRODUCTS.[5] THE FACTS Tanduay, a corporation organized and existing under Philippine laws, has been engaged in the liquor business since 1854. In 2002, Tanduay developed a new gin product distinguished by its sweet smell, smooth taste, and affordable price. Tanduay claims that it engaged the services of an advertising firm to develop a brand name and a label for its new gin product. -

Ginebra San Miguel, Inc. Vs. Tanduay

Republic of the Philippines COURT OF APPEALS Manila SPECIAL SIXTEENTH DIVISION GINEBRA SAN MIGUEL, CA-G.R. CV NO. 100332 INC., Members: Plaintiff-Appellant, 1BARZA, R.F., (Acting Chairperson) ZALAMEDA, R. V., and -versus- SEMPIO DIY, M.E., JJ. Promulgated: TANDUAY DISTILLERS, INC., 07 NOVEMBER 2014 Defendant-Appellee. x - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x DECISION ZALAMEDA, R.V., J.: Appealed to this Court is the Decision2 dated 05 October 2012 issued by Branch 211, Regional Trial Court of Mandaluyong City,3 in IP Case No. MC03-01 entitled, “Ginebra San Miguel, Inc., Plaintiff, vs. Tanduay Distillers, Inc., Defendant” for Unfair Competition, Infringement and Damages. The factual antecedents of the case, as culled from the records, are as follows: A Complaint (With Application for Temporary Restraining Order and/or Writ of Preliminary Injunction)4 for unfair competition, infringement and damages was filed by plaintiff-appellant Ginebra 1 Vice J. Ramon M. Bato, Jr., per Raffle dated 24 October 2014. 2 Rollo, pages 155 to 193. 3 “RTC,” for brevity. 4 Records, Volume 1, pages 02 to 23. DECISION CA-G.R. CV No. 100332 Page 2 of 47 San Miguel, Inc.,5 against defendant-appellee Tanduay Distillers, Inc.6 The controversy arose from the alleged trademark infringement purportedly perpetrated by Tanduay against GSMI through its use of the latter’s registered trademark, “GINEBRA.” In its Complaint, GSMI claimed that Tanduay used the mark, "GINEBRA," in manufacturing, distributing and marketing the latter’s