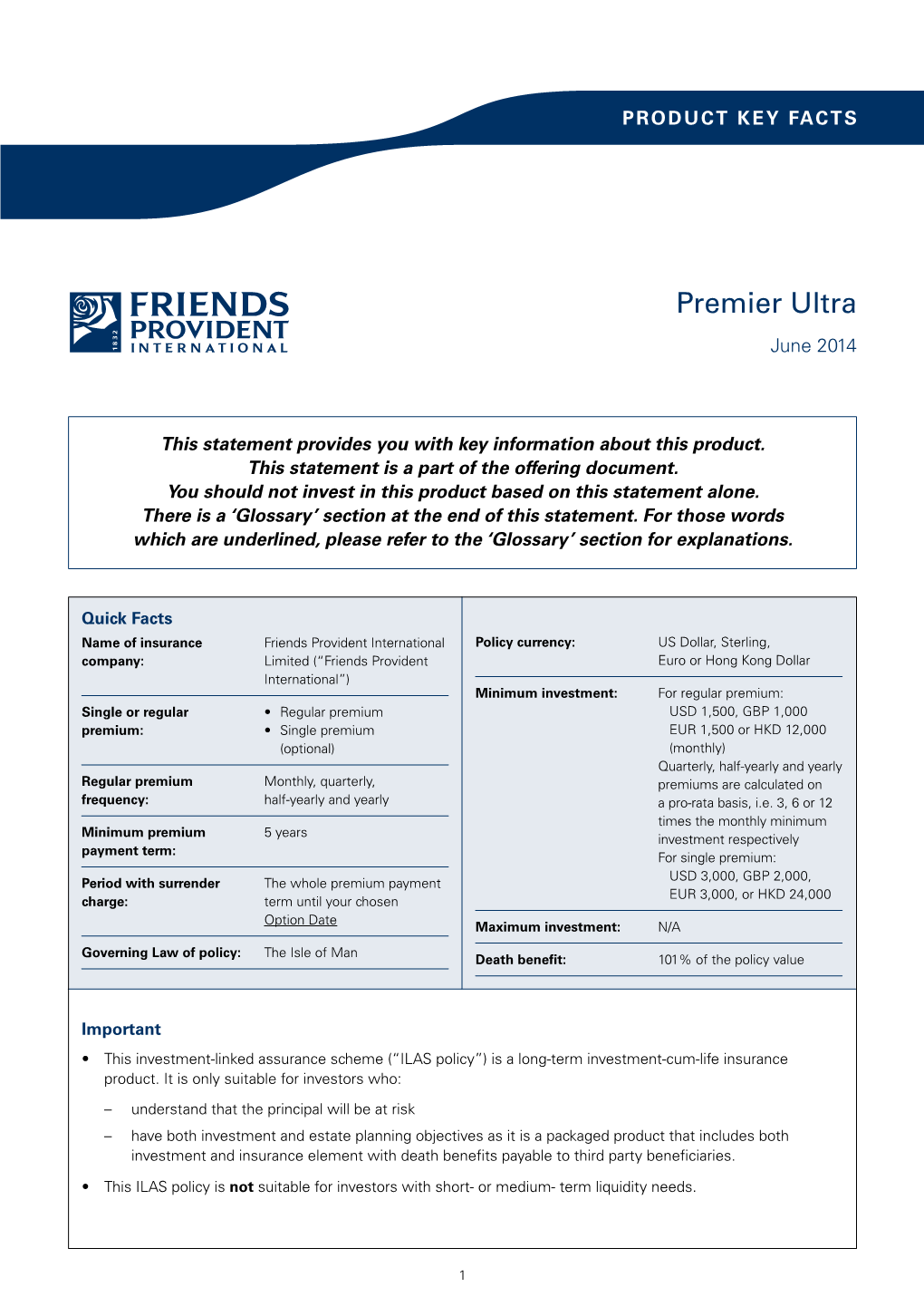

Premier Ultra June 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Assignment of a Life Policy

Assignment form Assignment of a Life Policy To change the legal ownership of a life assurance policy If you make a mistake, please cross it out and correct it, initialling any amendments. Please do not use correction fluid or any other method for deleting incorrect information. To: Friends Provident International Limited (Friends Provident International) I, the undersigned (‘Assignor(s)’), do HEREBY ASSIGN unto the person(s) (‘Assignee(s)’), whose name(s) and address(es) are set out below, or to his/her executors, administrators and assign, as the case may be, the policy(ies) of assurance issued by Friends Provident International, particulars of which are given below and all sums thereby assured or payable thereunder, to hold unto the Assignee(s) absolutely. If the policy has an existing fund adviser, optional management authority, regular withdrawal or beneficiary appointed we will require a new form completing if the agreement is to continue. Current policyholder details (Assignor) Current policyholder 1 (Assignor) Current policyholder 2 (Assignor) Full name of current policyholder(s) Residential address Policy number(s) (all relevant policy numbers must be listed) New/continuing policyholder details (Assignee) New policyholder 1 (Assignee) New policyholder 2 (Assignee) 1 Name of new/continuing policyholder(s) 2 If assigning segments please state the segment numbers 3 Residential address 4 Email address (mandatory) 5 Correspondence address (if different to residential address) Please note that where an existing policyholder is going to remain a policyholder after assignment, their name should be inserted as an assignor and assignee. New/continuing policyholder details (Assignee) (continued) New policyholder 1 (Assignee) New policyholder 2 (Assignee) 6 Contact telephone number 7 Position or occupation (if retired, please state former occupation) In witness whereof I/we have executed this document as a deed this day of year Please note we will be unable to proceed with the assignment if this document is not dated. -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

Friends Provident International Launches Financial Adviser Academy

Friends Provident International launches Financial Adviser Academy Date: As part of a strategic plan to add value for its distribution partners Friends Provident International (FPI) has launched The FPI Financial Adviser Academy. FPI has a long-standing reputation for providing a superior level of support for advisers, and many have benefited from our expertise when structuring their customers’ offshore investments, savings and protection plans to maximum effect. Initially available in the UAE, and aimed at advisers working with expatriate customers, the Academy offers access to a team of specialists who will share their expertise in tax, trust and estate planning, funds and investments and sales training to help advisers to develop financial planning solutions that will lead to the best possible outcomes for their customers. Philip Cernik, Chief Marketing Officer UAE at FPI said: “At FPI we understand the many issues faced by our business partners today. Whether it is recruiting, training and retaining people with the appropriate skills and qualifications, or coming to terms with the complex dimensions of financial planning for internationally mobile customers, they have a tough job. The aim of the Academy is to support our advisers’ professional development by sharing the knowledge of the excellent people we have on the ground in the UAE.” FPI has recruited several top class specialists in the international financial services market. Scott Hood is FPI’s Regional Technical Manager for the Middle East and Africa. He is a Chartered Financial Planner and Fellow of the Personal Financial Society. He holds a law degree and Post Graduate Diploma in Legal Practice and is experienced in both dispensing and auditing UK regulated financial advice. -

Annual Report and Financial Statements

Annual report and financial statements For the year ended 30 September 2019 Friends Provident Charitable Foundation (A company limited by guarantee) Charity No: 1087053 Company No: 4228843 Friendsprovidentfoundation.org FRIENDS PROVIDENT CHARITABLE FOUNDATION REPORT OF THE TRUSTEES - YEAR ENDED 30 SEPTEMBER 2019 I N D E X P A G E _______________________________________________________________________________ REFERENCE AND ADMINISTRATIVE INFORMATION 3-4 CHAIR’S INTRODUCTION 5-6 REPORT OF THE TRUSTEES 7-29 INDEPENDENT AUDITOR’S REPORT 30-33 STATEMENT OF FINANCIAL ACTIVITIES 34 BALANCE SHEET 35 STATEMENT OF CASH FLOWS 36 NOTES TO THE ACCOUNTS 37-48 2 FRIENDS PROVIDENT CHARITABLE FOUNDATION REPORT OF THE TRUSTEES - YEAR ENDED 30 SEPTEMBER 2019 REFERENCE AND ADMINISTRATIVE INFORMATION Charity name: Friends Provident Charitable Foundation Other names by which the charity is known: Friends Provident Foundation Charity number: 1087053 - registered in England & Wales Company number: 04228843 - incorporated in the UK REGISTERED ADDRESS Blake House 18 Blake Street York YO1 8QG BOARD OF TRUSTEES Members: Joycelin Dawes (retired 30 September 2019) Paul Dickinson Joanna Elson (Vice Chair) Patrick Hynes Kathleen Kelly Rob Lake (retired 30 September 2019) Stephen Muers Hetan Shah (Chair) Aphra Sklair KEY MANAGEMENT PERSONNEL Foundation Director: Danielle Walker Palmour Investment Engagement Manager: Colin Baines Grants Manager: Abigail Gibson Finance and Operations Manager: Kate Kendall Communications Manager: Nicola Putnam 3 FRIENDS PROVIDENT CHARITABLE -

Getting You Back on Track Friends Provident International

Getting you back on track Friends Provident International Friends Provident International - where EVERY customer counts 2 Getting you back on track Friends Provident International Dear Policyholder I’m taking this opportunity to write to you as someone who may have been affected in one way or another by the global recession. Our records indicate that you are no longer paying premiums, and I would like to share with you some important information about the impact this could have on your Friends Provident International (FPI) plan. All is not lost. Your FPI plan has a great deal of flexibility, When you first decided to invest in an FPI plan, your and we can help you to rectify your current situation financial adviser will have explained the benefits and resume the premiums to help you meet your financial of investing regularly over the longer term. We know goals. These are the options now available to you: our customers invest for many reasons... • Restart your premiums without repaying the missed – to put money aside for children’s education payments – this will affect the final value of your – to plan for retirement or purchasing a property plan. – to simply have the financial flexibility to pursue • When you took out your plan, you and your financial a life-long ambition. adviser calculated the rate at which you should be Whatever your reason might have been, I’d like to take this saving, and it would seem sensible to aim to restart opportunity to show how we can help to get you back on your savings at that level. -

Corporate Application Form Not for Use in UAE, Do Not Use If You Are Applyinghong Askong a Trustee Or of a Trust

Reserve For use in South Africa and Qatar Corporate Application form Not for use in UAE, Do not use if you are applyingHong asKong a Trustee or of a trust. Please use our Trustee ApplicationSingapore. form instead. Financial adviser and policy details Company name Friends Provident International agency number Contact details for acknowledgement/queries on the application. Contact name Phone number Email address Please contact us to obtain a Policy number (if known) pre-allocated policy number if desired. Please tick to confirm you have included with this application Personal charging structure illustration Copy of certificate of incorporation* Copy of share register* Copy of latest annual report and accounts* Copy of signatory list and signing powers* Evidence of the registered office address (if this is not the address on the application, we require evidence that the address is being used and confirmation of why there is a difference)* Verification of identity and address for any shareholder owning 25% or more of the shares* Copy of director list* Verification of identity and address of an Executive Director* Verification of identity and address of a Non-Executive Director* Source of wealth supporting documentation (where required)* Source of funds – original or certified copy of the payment remittance* *Suitably certified as being a true copy Where a shareholder is a company, trust or nominee, then we are required to look behind this structure to obtain a certified copy of the identification documents relating to the ultimate beneficial owner. Details of information required for source of wealth can be found on pages 12 to 14. -

Application Form Financial Adviser and Policy Details

Reserve Application form Financial adviser and policy details Company name Friends Provident International agency number Contact details for acknowledgement/queries on the application. Contact name Phone number Email address Please contact us to obtain a Policy number (if known) pre-allocated policy number, if desired. Please tick to confirm you have included with this application Personal charging structure illustration Verification of client identity* Verification of client address as utility bill (or suitable alternative)* Source of wealth (including supporting documents, where required)* Method of payment details (if known) *Suitably certified as being a true copy Details of information required for Source of wealth can be found on pages 9 to 12. Please complete all details in Section 1. This form should be read in conjunction with the following documents: • Reserve brochure. • Key Information Document (for all applications submitted after 1 July 2019) • Your personal charging structure illustration. • Reserve Charging Structures document. Specimen policy conditions are available from us on request. Please provide all relevant information and documentation so that we can process your application as soon as possible. If you do not provide all relevant information, it may cause a delay in the processing of your application. Further information may be required during the validation process (i.e. questions arising from the information provided). Please complete this form in English, using block capitals. If you make a mistake, please cross it out and correct it, initialling any amendments. Please do not use correction fluid or any other method for deleting incorrect information. 2 Friends Provident International Reserve Application form Your policy structure Capital Redemption Whole of life Your investment structure Collective Personalised investment structure only available to non-UK residents. -

Friends Life 2011

Prospectus dated 18 April 2011 Friends Provident Holdings (UK) plc (incorporated in England and Wales with limited liability with registered number 06986155) £500,000,000 8.25 per cent. Fixed Rate Subordinated Notes due 2022 guaranteed by Friends Provident Life and Pensions Limited (incorporated in England and Wales with limited liability with registered number 04096141) The £500,000,000 8.25 per cent. Fixed Rate Subordinated Notes due 2022 guaranteed by Friends Provident Life and Pensions Limited (the ‘‘Guarantor’’) (the ‘‘Subordinated Notes’’) will be issued by Friends Provident Holdings (UK) plc (the ‘‘Issuer’’) on or about 21 April 2011 (the ‘‘Issue Date’’). Subject to satisfaction of the Issuer Solvency Condition (as defined herein) and to no Regulatory Deficiency Interest Deferral Event (as defined herein) having occurred, payments of interest on the Subordinated Notes will be made annually in arrear on 21 April in each year. The first payment will be made on 21 April 2012. Payments on the Subordinated Notes or under the Guarantee will be made without deduction for or on account of taxes of the United Kingdom to the extent described under ‘‘Terms and Conditions of the Subordinated Notes — 9. Taxation’’. Unless previously redeemed or purchased and cancelled, the Subordinated Notes will mature on 21 April 2022 (the ‘‘Maturity Date’’) and shall, subject to the satisfaction of the Issuer Solvency Condition and to no Regulatory Deficiency Redemption Deferral Event having occurred, be redeemed on the Maturity Date. Prior to any notice of redemption before the Maturity Date or any substitution, variation or purchase of the Subordinated Notes, the Issuer will be required to have complied with regulatory rules on notifications to, or consent from, (in either case, if and to the extent required) the UK Financial Services Authority (the ‘‘FSA’’) and to be in continued compliance with Regulatory Capital Requirements (as defined herein) applicable to it. -

Friends Provident International Limited (FPIL)

IFGL to acquire Friends Provident International Limited (FPIL) International Financial Group Ltd ("IFGL") - previously known as RL360 Group, the owner of the RL360°, RL360° Services and Ardan brands - has today announced it has reached an agreement with the Aviva Group to acquire Friends Provident International Limited ("FPIL"), subject to regulatory approval. FPIL, which employs around 500 staff worldwide and services in the region of 180,000 policies, has its head office in the Isle of Man, where IFGL is also headquartered. FPIL has more than 35 years of international experience providing savings, investment and protection products to customers across the globe, with a particular expertise in Asia and the Middle East. There are no changes to FPIL customers’ policies as a result of today’s announcement. IFGL was formed in October 2013 to support the management led buyout of RL360 Insurance Company Limited (RL360°) from the Royal London Group, with the support of its financial backers Vitruvian Partners. IFGL has a consistent record of growth in recent years having acquired CMI Insurance Company Ltd (now branded RL360° Services) in 2015 and wealth platform Ardan International the following year. The acquisition of FPIL further demonstrates the Group’s strategy to become the pre-eminent institution in the offshore savings market. FPIL has £7.6bn in funds under management and its addition to IFGL will take the Group’s combined assets to £15.9bn and policies to 250,000. David Kneeshaw, IFGL’s Chief Executive, said: “Welcoming FPIL to the IFGL Group’s already impressive stable fits with our stated long-term goal of high-quality acquisitions to complement our existing international business. -

Additional Investment

Additional Investment This form is for use with the following: International Investment Bond International Investment Account International Savings Plan International Investment Plan Guernsey International Pension UltimaBond UltimaSave Flexible Savings Plan Flexible Investment Plan Versatile Investment Plan J22307_XGU02F_HL65001_1017.indd 1 30/08/17 3:12 pm Part 1 – Introduction – It is most important that you read this part before completing the application form. • Please use BLOCK CAPITALS throughout and tick the boxes where appropriate. • If you make a mistake please cross it out, put in the correct word or words and initial next to the correction. • Incorrect or incomplete application forms may delay the processing of this proposal. This may also result in the form being returned for completion. Part 2 – Details of Existing Policy Policyholder name(s) Policy number If you have changed your address since effecting the existing policy please provide the details below. Current residential address (including street name, town and area code if known) Email address Contact telephone number Part 3 – Financial Adviser Details Company name Contact details for acknowledgement/queries on the application. Contact name Telephone number Email address Country where advice given Country where application signed Part 4 – Details of Additional Investment Regular Single Amount of additional investment Minimum contribution Regular Single International Investment Bond n/a GBP 5,000 / USD 7,500 / EUR 7,500 International Investment Account GBP 50pm / GBP -

Friends Life Fpg Limited

FRIENDS LIFE FPG LIMITED COMPANY INCORPORATED IN ENGLAND AND WALES REGISTRATION NUMBER 06861305 ANNUAL REPORT AND FINANCIAL STATEMENTS For the year ended 31 December 2019 Registration Number: 06861305 FRIENDS LIFE FPG LIMITED CONTENTS PAGES Company Information 2 Strategic Report 3 Report of the Directors 7 Independent Auditors’ Report 9 Profit and Loss Account 12 Balance Sheet 13 Statement of Changes in Equity 14 Notes to the Financial Statements 15 1 Registration Number: 06861305 FRIENDS LIFE FPG LIMITED COMPANY INFORMATION BOARD OF DIRECTORS C. Binmore R. J. Priestley COMPANY SECRETARY Aviva Company Secretarial Services Limited St Helen’s 1 Undershaft London EC3P 3DQ REGISTERED OFFICE Pixham End Dorking Surrey RH4 1QA INDEPENDENT AUDITORS PricewaterhouseCoopers LLP Chartered Accountants and Statutory Auditors 7 More London Riverside London SE1 2RT 2 Registration Number: 06861305 FRIENDS LIFE FPG LIMITED STRATEGIC REPORT The directors present their Strategic Report on Friends Life FPG Limited (the Company) for the year ended 31 December 2019. PRINCIPAL ACTIVITY The Company, a private company limited by shares, is a wholly owned subsidiary of Aviva Life Holdings UK Limited (UKLH) and is part of the Aviva plc Group (the Group). The Company has one direct subsidiary, Friends Life FPL Limited (FPL), and acts as an intermediate holding company for ex-Friends life subsidiaries acquired by the Aviva Group in 2015. The results of these subsidiary undertakings have not been consolidated in these financial statements as they have been included in the consolidated financial statements of Aviva plc. RESULTS AND BUSINESS REVIEW 2019 2018 £000 £000 Income from shares in group undertakings 12,726 99,680 Realised losses on investments (1) (101,883) Other interest receivable and similar income 9 6 Total equity 6,111 7,363 Income from shares in group undertakings reflects dividends received from FPL, the Company’s only directly held subsidiary. -

FOI3002 Information Provided

Firm Ref Firm Name 100013 Skipton Financial Services Ltd 100014 Leek United Building Society 100015 Saffron Building Society 100017 SBCA 100129 Allotts 100163 Alexander Ash & Co Ltd 100266 Bevan & Buckland 100556 Oury Clark 100732 Alliotts 100747 Heywood Shepherd 100799 Forrester Boyd 100813 Gibbons 100820 Gilberts 100825 Greaves West & Ayre 100883 Friend-James 101012 Neville A. Joseph 101022 Howard Worth 101092 Javed & Co 101112 Lamont Pridmore 101117 Winningtons 101133 Gross Klein (incorporating Gross Klein Wood and Gross Klein & Partners) 101142 Larking Gowen 101163 Latif & Company 101180 Keymer Haslam & Co 101321 J.H. Greenwood & Company 101330 John Kerr 101494 Lovewell Blake 101501 McCabe Ford Williams 101566 Hamilton Brading 101579 Robinson and Co 101608 Pentins 101609 Peters, Elworthy & Moore 101633 Palmer, Riley & Co 101739 Nicholsons 101840 Price Mann & Co 101886 Leftley, Rowe & Company 102046 Mitchell Charlesworth 102167 Playfoot & Company 102245 Stephenson & Co 102323 Volans, Leach & Schofield 102395 Whitakers 102411 Shelvoke, Pickering, Janney & Co 102529 Trudgeon Halling 102531 Uppal & Warr 102557 Shah Dodhia & Co 102577 Wildin & Co 102581 Gerald Thomas & Co 102677 Arthur E Walker & Co 102722 BSG Valentine 102781 Pierce 102903 Winburn Glass Norfolk 102983 Mark J Rees 103410 Sedley Richard Laurence Voulters 103440 Leonard Gold 103630 Tyas & Company 103677 Daly, Hoggett & Co 103876 Sandison Easson & Co 104021 Sampson West 104101 Geo Little Sebire & Co 104219 M. Emanuel 104354 Potter Baker 104433 Millener Davies 104538 Bird Simpson & Co 104673 Thomson Cooper 104732 Gilmour Hamilton & Co 104752 James S Lessells 104753 Walker, Dunnett & Co 104766 James Hair & Co 104875 Ipswich Building Society 104877 West Bromwich Building Society 104917 Armstrong Watson 104961 Morris Owen 104965 Mercer & Hole 104982 Strover, Leader & Co 105125 Hicks and Company 105181 Malthouse & Company Wealth Management 105402 H.B.