Insurance Brochure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Post Event Report

presents 9th Asian Investment Summit Building better portfolios 21-22 May 2014, Ritz-Carlton, Hong Kong Post Event Report 310 delegates representing 190 companies across 18 countries www.AsianInvestmentSummit.com Thank You to our sponsors & partners AIWEEK Marquee Sponsors Co-Sponsors Associate Sponsors Workshop Sponsor Supporting Organisations alternative assets. intelligent data. Tech Handset Provider Education Partner Analytics Partner ® Media Partners Offical Broadcast Partner 1 www.AsianInvestmentSummit.com Delegate Breakdown 310 delegates representing 190 companies across 18 countries Breakdown by Organisation Institutional Investors 46% Haymarket Financial Media delegate attendee data is Asset Managemer 19% independently verified by the BPA Consultant 8% Fund Distributor / Private Wealth Management 5% Media & Publishing 4% Commercial Bank 4% Index / Trading Platform Provider 3% Association 2% Other 9% Breakdown of Institutional Investors Insurance 31% Endowment / Foundation 27% Corporation 13% Pension Fund 13% Family Office 8% Breakdown by Country Sovereign Wealth Fund 6% PE Funds of Funds 1% Mulitlateral Finance Hong Kong 82% Institution 1% ASEAN 10% North Asia 5% Australia 1% Europe 1% North America 1% Breakdown by Job Function Investment 34% Finance / Treasury 20% Marketing and Investor Relations 19% Other 11% CEO / Managing Director 7% Fund Selection / Distribution 7% Strategist / Economist 2% 2 www.AsianInvestmentSummit.com Participating Companies Haymarket Financial Media delegate attendee data is independently verified by the BPA 310 institutonal investors, asset managers, corporates, bankers and advisors attended the Forum. Attending companies included: ACE Life Insurance CFA Institute Board of Governors ACMI China Automation Group Limited Ageas China BOCOM Insurance Co., Ltd. Ageas Hong Kong China Construction Bank Head Office Ageas Insurance Company (Asia) Limited China Life Insurance AIA Chinese YMCA of Hong Kong AIA Group CIC AIA International Limited CIC International (HK) AIA Pension and Trustee Co. -

Allianz Se Allianz Finance Ii B.V. Allianz

2nd Supplement pursuant to Art. 16(1) of Directive 2003/71/EC, as amended (the "Prospectus Directive") and Art. 13 (1) of the Luxembourg Act (the "Luxembourg Act") relating to prospectuses for securities (loi relative aux prospectus pour valeurs mobilières) dated 12 August 2016 (the "Supplement") to the Base Prospectus dated 2 May 2016, as supplemented by the 1st Supplement dated 24 May 2016 (the "Prospectus") with respect to ALLIANZ SE (incorporated as a European Company (Societas Europaea – SE) in Munich, Germany) ALLIANZ FINANCE II B.V. (incorporated with limited liability in Amsterdam, The Netherlands) ALLIANZ FINANCE III B.V. (incorporated with limited liability in Amsterdam, The Netherlands) € 25,000,000,000 Debt Issuance Programme guaranteed by ALLIANZ SE This Supplement has been approved by the Commission de Surveillance du Secteur Financier (the "CSSF") of the Grand Duchy of Luxembourg in its capacity as competent authority (the "Competent Authority") under the Luxembourg Act for the purposes of the Prospectus Directive. The Issuer may request the CSSF in its capacity as competent authority under the Luxemburg Act to provide competent authorities in host Member States within the European Economic Area with a certificate of approval attesting that the Supplement has been drawn up in accordance with the Luxembourg Act which implements the Prospectus Directive into Luxembourg law ("Notification"). Right to withdraw In accordance with Article 13 paragraph 2 of the Luxembourg Act, investors who have already agreed to purchase or subscribe for the securities before the Supplement is published have the right, exercisable within two working days after the publication of this Supplement, to withdraw their acceptances, provided that the new factor arose before the final closing of the offer to the public and the delivery of the securities. -

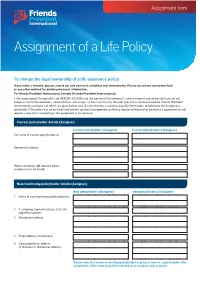

Assignment of a Life Policy

Assignment form Assignment of a Life Policy To change the legal ownership of a life assurance policy If you make a mistake, please cross it out and correct it, initialling any amendments. Please do not use correction fluid or any other method for deleting incorrect information. To: Friends Provident International Limited (Friends Provident International) I, the undersigned (‘Assignor(s)’), do HEREBY ASSIGN unto the person(s) (‘Assignee(s)’), whose name(s) and address(es) are set out below, or to his/her executors, administrators and assign, as the case may be, the policy(ies) of assurance issued by Friends Provident International, particulars of which are given below and all sums thereby assured or payable thereunder, to hold unto the Assignee(s) absolutely. If the policy has an existing fund adviser, optional management authority, regular withdrawal or beneficiary appointed we will require a new form completing if the agreement is to continue. Current policyholder details (Assignor) Current policyholder 1 (Assignor) Current policyholder 2 (Assignor) Full name of current policyholder(s) Residential address Policy number(s) (all relevant policy numbers must be listed) New/continuing policyholder details (Assignee) New policyholder 1 (Assignee) New policyholder 2 (Assignee) 1 Name of new/continuing policyholder(s) 2 If assigning segments please state the segment numbers 3 Residential address 4 Email address (mandatory) 5 Correspondence address (if different to residential address) Please note that where an existing policyholder is going to remain a policyholder after assignment, their name should be inserted as an assignor and assignee. New/continuing policyholder details (Assignee) (continued) New policyholder 1 (Assignee) New policyholder 2 (Assignee) 6 Contact telephone number 7 Position or occupation (if retired, please state former occupation) In witness whereof I/we have executed this document as a deed this day of year Please note we will be unable to proceed with the assignment if this document is not dated. -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

China Insurance Sector

China / Hong Kong Industry Focus China Insurance Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 1 Nov 2017 Multi-year value growth ahead HSI: 28,336 • Strong growth potential back by C-ROSS, favourable policy direction, and structural drivers ANALYST • Favourable asset/liability mismatch position Ken SHIH +852 2820 4920 [email protected] bodes well under a rising rate environment; China lifers’ book value is set to rise Keith TSANG CFA, +852 2971 1935 nd [email protected] • Impact from 2 phase of auto insurance pricing reform expected to be more severe; online insurers considered to be a disruptive force Recommendation & valuation • Initiating coverage on China Insurance sector. Top picks: China Taiping (966 HK), CPIC (2601 HK), and C losing Targe t FY17F Ping An (2318 HK). Top SELLs: PICC P&C (2328 HK), Stock Ticker Rating Price Price PB Yield ROE and China Re (1508 HK) (HKD) (HK D) (X) (%) (% ) Spotlight on value enhancement: We believe China’s low Ping A n - H 2318 H K BUY 68. 1 86. 0 2.4 1.5 17.8 insurance coverage, launch of China Risk-Oriented Solvency C hina Life - H 2628 H K BUY 25. 8 32. 0 1.9 1.8 9.6 System (C-ROSS), and policy guidance will continue to direct China Taiping 966 HK BUY 25.1 38.0 1.4 1.1 8.9 China life insurers to refocus on traditional life products and C hina Pacific - H 2601 HK BUY 37. 7 54. 0 2.0 2.8 11.1 value enhancement. -

Friends Provident International Launches Financial Adviser Academy

Friends Provident International launches Financial Adviser Academy Date: As part of a strategic plan to add value for its distribution partners Friends Provident International (FPI) has launched The FPI Financial Adviser Academy. FPI has a long-standing reputation for providing a superior level of support for advisers, and many have benefited from our expertise when structuring their customers’ offshore investments, savings and protection plans to maximum effect. Initially available in the UAE, and aimed at advisers working with expatriate customers, the Academy offers access to a team of specialists who will share their expertise in tax, trust and estate planning, funds and investments and sales training to help advisers to develop financial planning solutions that will lead to the best possible outcomes for their customers. Philip Cernik, Chief Marketing Officer UAE at FPI said: “At FPI we understand the many issues faced by our business partners today. Whether it is recruiting, training and retaining people with the appropriate skills and qualifications, or coming to terms with the complex dimensions of financial planning for internationally mobile customers, they have a tough job. The aim of the Academy is to support our advisers’ professional development by sharing the knowledge of the excellent people we have on the ground in the UAE.” FPI has recruited several top class specialists in the international financial services market. Scott Hood is FPI’s Regional Technical Manager for the Middle East and Africa. He is a Chartered Financial Planner and Fellow of the Personal Financial Society. He holds a law degree and Post Graduate Diploma in Legal Practice and is experienced in both dispensing and auditing UK regulated financial advice. -

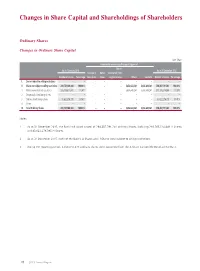

Changes in Share Capital and Shareholdings of Shareholders

Changes in Share Capital and Shareholdings of Shareholders Ordinary Shares Changes in Ordinary Share Capital Unit: Share Increase/decrease during the reporting period Shares As at 1 January 2015 As at 31 December 2015 Issuance of Bonus transferred from Number of shares Percentage new shares shares surplus reserve Others Sub-total Number of shares Percentage I. Shares subject to selling restrictions – – – – – – – – – II. Shares not subject to selling restrictions 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% 1. RMB-denominated ordinary shares 205,108,871,605 71.04% – – – 5,656,643,241 5,656,643,241 210,765,514,846 71.59% 2. Domestically listed foreign shares – – – – – – – – – 3. Overseas listed foreign shares 83,622,276,395 28.96% – – – – – 83,622,276,395 28.41% 4. Others – – – – – – – – – III. Total Ordinary Shares 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% Notes: 1 As at 31 December 2015, the Bank had issued a total of 294,387,791,241 ordinary shares, including 210,765,514,846 A Shares and 83,622,276,395 H Shares. 2 As at 31 December 2015, none of the Bank’s A Shares and H Shares were subject to selling restrictions. 3 During the reporting period, 5,656,643,241 ordinary shares were converted from the A-Share Convertible Bonds of the Bank. 79 2015 Annual Report Changes in Share Capital and Shareholdings of Shareholders Number of Ordinary Shareholders and Shareholdings Number of ordinary shareholders as at 31 December 2015: 963,786 (including 761,073 A-Share Holders and 202,713 H-Share Holders) Number of ordinary shareholders as at the end of the last month before the disclosure of this report: 992,136 (including 789,535 A-Share Holders and 202,601 H-Share Holders) Top ten ordinary shareholders as at 31 December 2015: Unit: Share Number of Changes shares held as Percentage Number of Number of during at the end of of total shares subject shares Type of the reporting the reporting ordinary to selling pledged ordinary No. -

Annual Report and Financial Statements

Annual report and financial statements For the year ended 30 September 2019 Friends Provident Charitable Foundation (A company limited by guarantee) Charity No: 1087053 Company No: 4228843 Friendsprovidentfoundation.org FRIENDS PROVIDENT CHARITABLE FOUNDATION REPORT OF THE TRUSTEES - YEAR ENDED 30 SEPTEMBER 2019 I N D E X P A G E _______________________________________________________________________________ REFERENCE AND ADMINISTRATIVE INFORMATION 3-4 CHAIR’S INTRODUCTION 5-6 REPORT OF THE TRUSTEES 7-29 INDEPENDENT AUDITOR’S REPORT 30-33 STATEMENT OF FINANCIAL ACTIVITIES 34 BALANCE SHEET 35 STATEMENT OF CASH FLOWS 36 NOTES TO THE ACCOUNTS 37-48 2 FRIENDS PROVIDENT CHARITABLE FOUNDATION REPORT OF THE TRUSTEES - YEAR ENDED 30 SEPTEMBER 2019 REFERENCE AND ADMINISTRATIVE INFORMATION Charity name: Friends Provident Charitable Foundation Other names by which the charity is known: Friends Provident Foundation Charity number: 1087053 - registered in England & Wales Company number: 04228843 - incorporated in the UK REGISTERED ADDRESS Blake House 18 Blake Street York YO1 8QG BOARD OF TRUSTEES Members: Joycelin Dawes (retired 30 September 2019) Paul Dickinson Joanna Elson (Vice Chair) Patrick Hynes Kathleen Kelly Rob Lake (retired 30 September 2019) Stephen Muers Hetan Shah (Chair) Aphra Sklair KEY MANAGEMENT PERSONNEL Foundation Director: Danielle Walker Palmour Investment Engagement Manager: Colin Baines Grants Manager: Abigail Gibson Finance and Operations Manager: Kate Kendall Communications Manager: Nicola Putnam 3 FRIENDS PROVIDENT CHARITABLE -

Asian Insurance Industry 2019 Gearing up for Regulatory Complexities

Asian Insurance Industry 2019 Gearing Up for Regulatory Complexities OVERVIEW & METHODOLOGY This report, in its sixth iteration, analyzes Asia’s life insurance industry through the PRODUCT DETAILS asset management lens. It provides both qualitative and quantitative information, including life insurance assets and premiums, asset allocations, investment practices, Included with Purchase and outsourcing to affiliated and third-party asset managers. The report discusses y Digital copy and hardcopy in color both institutional (general account) and retail (separate account or investment-linked y Online access to five related reports product) segments, and covers China, Taiwan, Hong Kong, Korea, Singapore, Thailand, y Unlimited online firm-wide access Indonesia, and Malaysia. y Exhibits in Excel The report also details key factors that influence insurers’ investments, such as y Key findings regulations, asset-liability management, products, distribution landscapes, and other y Analyst support key developments. Besides covering three region-wide themes—retirement products, y Interactive Report Dashboards insurers’ alternative investments, and outsourcing—the report provides in-depth analysis of Asia ex-Japan’s insurance markets, capturing trends in both chart and Interactive Report Dashboards text forms. Experience Cerulli’s digital analytics platform and explore interactive data from this report USE THIS REPORT TO 1. Asian Insurance Investment Landscape: Analyze five years of historical data that y Review the opportunities for asset managers -

Getting You Back on Track Friends Provident International

Getting you back on track Friends Provident International Friends Provident International - where EVERY customer counts 2 Getting you back on track Friends Provident International Dear Policyholder I’m taking this opportunity to write to you as someone who may have been affected in one way or another by the global recession. Our records indicate that you are no longer paying premiums, and I would like to share with you some important information about the impact this could have on your Friends Provident International (FPI) plan. All is not lost. Your FPI plan has a great deal of flexibility, When you first decided to invest in an FPI plan, your and we can help you to rectify your current situation financial adviser will have explained the benefits and resume the premiums to help you meet your financial of investing regularly over the longer term. We know goals. These are the options now available to you: our customers invest for many reasons... • Restart your premiums without repaying the missed – to put money aside for children’s education payments – this will affect the final value of your – to plan for retirement or purchasing a property plan. – to simply have the financial flexibility to pursue • When you took out your plan, you and your financial a life-long ambition. adviser calculated the rate at which you should be Whatever your reason might have been, I’d like to take this saving, and it would seem sensible to aim to restart opportunity to show how we can help to get you back on your savings at that level. -

Allianz Se Allianz Finance Ii B.V

3rd Supplement pursuant to Art. 16(1) of Directive 2003/71/EC, as amended (the "Prospectus Directive") and Art. 13 (1) of the Luxembourg Act (the "Luxembourg Act") relating to prospectuses for securities (loi relative aux prospectus pour valeurs mobilières) dated 25 November 2016 (the "Supplement") to the Base Prospectus dated 2 May 2016, as supplemented by the 1st Supplement dated 24 May 2016 and the 2nd Supplement dated 12 August 2016 (the "Prospectus") with respect to ALLIANZ SE (incorporated as a European Company (Societas Europaea – SE) in Munich, Germany) ALLIANZ FINANCE II B.V. (incorporated with limited liability in Amsterdam, The Netherlands) ALLIANZ FINANCE III B.V. (incorporated with limited liability in Amsterdam, The Netherlands) € 25,000,000,000 Debt Issuance Programme guaranteed by ALLIANZ SE This Supplement has been approved by the Commission de Surveillance du Secteur Financier (the "CSSF") of the Grand Duchy of Luxembourg in its capacity as competent authority (the "Competent Authority") under the Luxembourg Act for the purposes of the Prospectus Directive. The Issuer may request the CSSF in its capacity as competent authority under the Luxemburg Act to provide competent authorities in host Member States within the European Economic Area with a certificate of approval attesting that the Supplement has been drawn up in accordance with the Luxembourg Act which implements the Prospectus Directive into Luxembourg law ("Notification"). Right to withdraw In accordance with Article 13 paragraph 2 of the Luxembourg Act, investors who have already agreed to purchase or subscribe for the securities before the Supplement is published have the right, exercisable within two working days after the publication of this Supplement, to withdraw their acceptances, provided that the new factor arose before the final closing of the offer to the public and the delivery of the securities. -

© 2020 Thomson Reuters. No Claim to Original U.S. Government Works. 1 AB STABLE VIII LLC, Plaintiff/Counterclaim-Defendant, V...., Not Reported in Atl

AB STABLE VIII LLC, Plaintiff/Counterclaim-Defendant, v...., Not Reported in Atl.... 2020 WL 7024929 Only the Westlaw citation is currently available. MEMORANDUM OPINION UNPUBLISHED OPINION. CHECK *1 AB Stable VIII LLC (“Seller”) is an indirect subsidiary COURT RULES BEFORE CITING. of Dajia Insurance Group, Ltd. (“Dajia”), a corporation organized under the law of the People's Republic of China. Court of Chancery of Delaware. Dajia is the successor to Anbang Insurance Group., Ltd. (“Anbang”), which was also a corporation organized under AB STABLE VIII LLC, Plaintiff/ the law of the People's Republic of China. For simplicity, Counterclaim-Defendant, and because Anbang was the pertinent entity for much of v. the relevant period, this decision refers to both companies as MAPS HOTELS AND RESORTS ONE LLC, “Anbang.” MIRAE ASSET CAPITAL CO., LTD., MIRAE ASSET DAEWOO CO., LTD., MIRAE ASSET Through Seller, Anbang owns all of the member interests in GLOBAL INVESTMENTS, CO., LTD., and Strategic Hotels & Resorts LLC (“Strategic,” “SHR,” or the MIRAE ASSET LIFE INSURANCE CO., “Company”), a Delaware limited liability company. Strategic in turn owns all of the member interests in fifteen limited LTD., Defendants/Counterclaim-Plaintiffs. liability companies, each of which owns a luxury hotel. C.A. No. 2020-0310-JTL | Under a Sale and Purchase Agreement dated September 10, Date Submitted: October 28, 2020 2019 (the “Sale Agreement” or “SA”), Seller agreed to sell | all of the member interests in Strategic to MAPS Hotel and Date Decided: November 30, 2020 Resorts One LLC (“Buyer”) for a total purchase price of $5.8 billion (the “Transaction”).