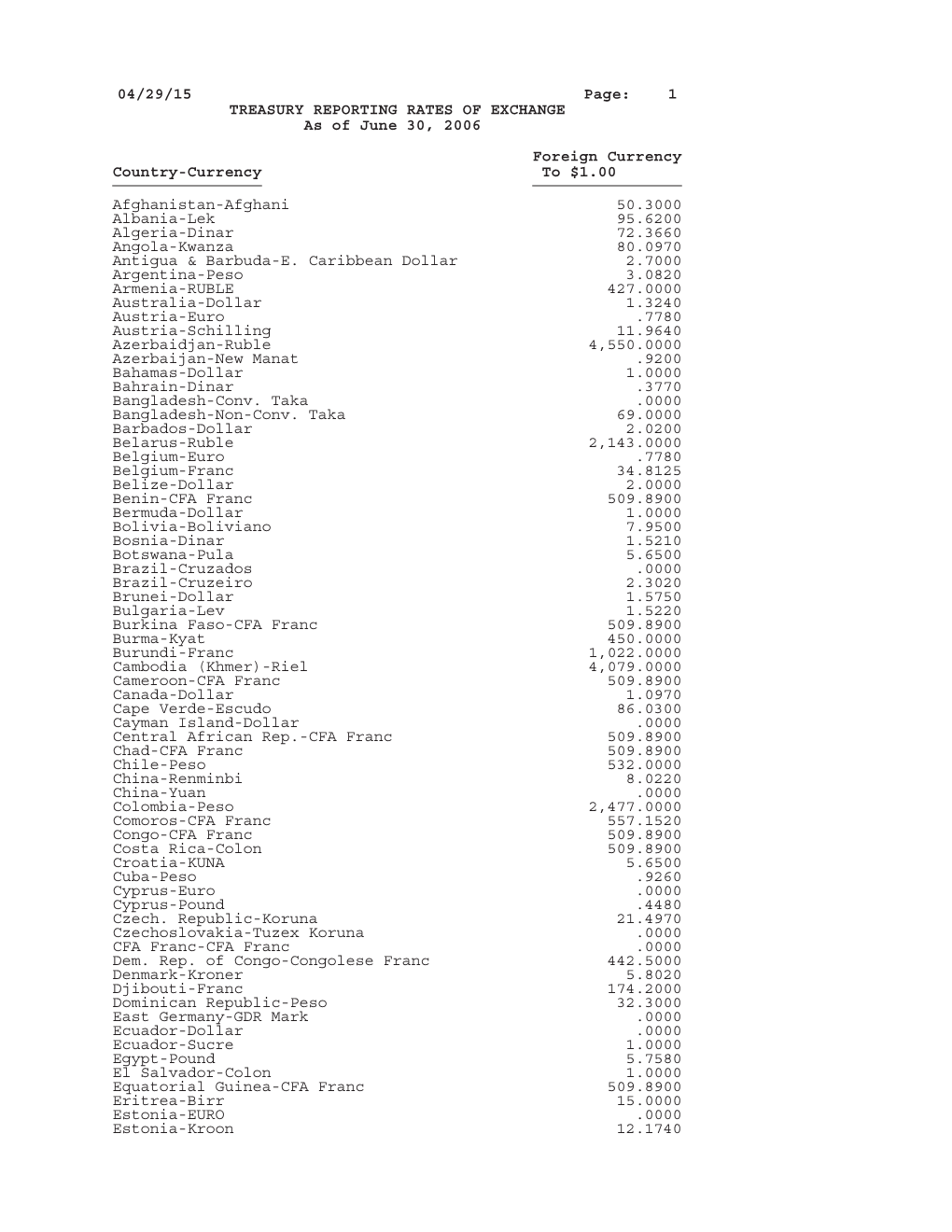

1 TREASURY REPORTING RATES of EXCHANGE As of June 30, 2006 Foreign Currency Country-Currency to $1.00

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Euro: Internationalised at Birth

The euro: internationalised at birth Frank Moss1 I. Introduction The birth of an international currency can be defined as the point in time at which a currency starts meaningfully assuming one of the traditional functions of money outside its country of issue.2 In the case of most currencies, this is not straightforwardly attributable to a specific date. In the case of the euro, matters are different for at least two reasons. First, internationalisation takes on a special meaning to the extent that the euro, being the currency of a group of countries participating in a monetary union is, by definition, being used outside the borders of a single country. Hence, internationalisation of the euro should be understood as non-residents of this entire group of countries becoming more or less regular users of the euro. Second, contrary to other currencies, the launch point of the domestic currency use of the euro (1 January 1999) was also the start date of its international use, taking into account the fact that it had inherited such a role from a number of legacy currencies that were issued by countries participating in Europe’s economic and monetary union (EMU). Taking a somewhat broader perspective concerning the birth period of the euro, this paper looks at evidence of the euro’s international use at around the time of its launch date as well as covering subsequent developments during the first decade of the euro’s existence. It first describes the birth of the euro as an international currency, building on the international role of its predecessor currencies (Section II). -

March 31, 2013 Foreign Currency Country-Currency to $1.00

04/29/15 Page: 1 TREASURY REPORTING RATES OF EXCHANGE As of March 31, 2013 Foreign Currency Country-Currency To $1.00 Afghanistan-Afghani 53.1800 Albania-Lek 109.0700 Algeria-Dinar 78.9000 Angola-Kwanza 95.0000 Antigua & Barbuda-E. Caribbean Dollar 2.7000 Argentina-Peso 5.1200 Armenia-RUBLE 415.0000 Australia-Dollar .9600 Austria-Euro .7800 Austria-Schilling .0000 Azerbaidjan-Ruble .8000 Azerbaijan-New Manat .0000 Bahamas-Dollar 1.0000 Bahrain-Dinar .3800 Bangladesh-Conv. Taka .0000 Bangladesh-Non-Conv. Taka 80.0000 Barbados-Dollar 2.0200 Belarus-Ruble 8,680.0000 Belgium-Euro .7800 Belgium-Franc .0000 Belize-Dollar 2.0000 Benin-CFA Franc 511.6700 Bermuda-Dollar 1.0000 Bolivia-Boliviano 6.9600 Bosnia-Dinar 1.5300 Botswana-Pula 8.2400 Brazil-Cruzados .0000 Brazil-Cruzeiro 2.0200 Brunei-Dollar 1.2400 Bulgaria-Lev 1.5300 Burkina Faso-CFA Franc 511.6700 Burma-Kyat 878.0000 Burundi-Franc 1,650.0000 Cambodia (Khmer)-Riel 4,103.0000 Cameroon-CFA Franc 511.6700 Canada-Dollar 1.0200 Cape Verde-Escudo 84.1800 Cayman Island-Dollar .8200 Central African Rep.-CFA Franc 511.6700 Chad-CFA Franc 511.6700 Chile-Peso 471.5000 China-Renminbi 6.2100 China-Yuan .0000 Colombia-Peso 1,824.0000 Comoros-CFA Franc 361.3500 Congo-CFA Franc 511.6700 Costa Rica-Colon 498.6000 Croatia-KUNA 5.8300 Cuba-Peso 1.0000 Cyprus-Euro .7800 Cyprus-Pound .7890 Czech. Republic-Koruna 19.7000 Czechoslovakia-Tuzex Koruna .0000 CFA Franc-CFA Franc .0000 Dem. Rep. of Congo-Congolese Franc 920.0000 Denmark-Kroner 5.8200 Djibouti-Franc 177.0000 Dominican Republic-Peso 40.8600 East Germany-GDR Mark .0000 Ecuador-Dollar 1.0000 Ecuador-Sucre .0000 Egypt-Pound 6.8000 El Salvador-Colon 1.0000 Equatorial Guinea-CFA Franc 511.6700 Eritrea-Birr 15.0000 Estonia-EURO .7800 Estonia-Kroon 11.6970 04/29/15 Page: 2 TREASURY REPORTING RATES OF EXCHANGE As of March 31, 2013 Foreign Currency Country-Currency To $1.00 Ethiopia-Birr 18.4000 Euro-Euro .7800 European Community-European Comm. -

The Monetary Legacy of the Soviet Union / Patrick Conway

ESSAYS IN INTERNATIONAL FINANCE ESSAYS IN INTERNATIONAL FINANCE are published by the International Finance Section of the Department of Economics of Princeton University. The Section sponsors this series of publications, but the opinions expressed are those of the authors. The Section welcomes the submission of manuscripts for publication in this and its other series. Please see the Notice to Contributors at the back of this Essay. The author of this Essay, Patrick Conway, is Professor of Economics at the University of North Carolina at Chapel Hill. He has written extensively on the subject of structural adjustment in developing and transitional economies, beginning with Economic Shocks and Structural Adjustment: Turkey after 1973 (1987) and continuing, most recently, with “An Atheoretic Evaluation of Success in Structural Adjustment” (1994a). Professor Conway has considerable experience with the economies of the former Soviet Union and has made research visits to each of the republics discussed in this Essay. PETER B. KENEN, Director International Finance Section INTERNATIONAL FINANCE SECTION EDITORIAL STAFF Peter B. Kenen, Director Margaret B. Riccardi, Editor Lillian Spais, Editorial Aide Lalitha H. Chandra, Subscriptions and Orders Library of Congress Cataloging-in-Publication Data Conway, Patrick J. Currency proliferation: the monetary legacy of the Soviet Union / Patrick Conway. p. cm. — (Essays in international finance, ISSN 0071-142X ; no. 197) Includes bibliographical references. ISBN 0-88165-104-4 (pbk.) : $8.00 1. Currency question—Former Soviet republics. 2. Monetary policy—Former Soviet republics. 3. Finance—Former Soviet republics. I. Title. II. Series. HG136.P7 no. 197 [HG1075] 332′.042 s—dc20 [332.4′947] 95-18713 CIP Copyright © 1995 by International Finance Section, Department of Economics, Princeton University. -

'Foreign Exchange Markets Welcome the Start of the EMS' from Le Monde (14 March 1979)

'Foreign exchange markets welcome the start of the EMS' from Le Monde (14 March 1979) Caption: On 14 March 1979, the day after the implementation of the European Monetary System (EMS), the French daily newspaper Le Monde describes the operation of the EMS and highlights its impact on the European currency exchange market. Source: Le Monde. dir. de publ. Fauvet, Jacques. 14.03.1979, n° 10 612; 36e année. Paris: Le Monde. "Le marché des changes a bien accueilli l'entrée en vigueur du S.M.E.", auteur:Fabra, Paul , p. 37. Copyright: (c) Translation CVCE.EU by UNI.LU All rights of reproduction, of public communication, of adaptation, of distribution or of dissemination via Internet, internal network or any other means are strictly reserved in all countries. Consult the legal notice and the terms and conditions of use regarding this site. URL: http://www.cvce.eu/obj/foreign_exchange_markets_welcome_the_start_of_the_ems _from_le_monde_14_march_1979-en-c5cf1c8f-90b4-4a6e-b8e8-adeb58ce5d64.html Last updated: 05/07/2016 1/3 Foreign exchange markets welcome the start of the EMS With a little more than three months’ delay, the European Monetary System (EMS) came into force on Tuesday 13 March. The only definite decision taken by the European Council, it was announced in an official communiqué published separately at the end of Monday afternoon. In the official text, the European Council stated that ‘all the conditions had now been met for the implementation of the exchange mechanism of the European Monetary System.’ As a result, the eight full members of the exchange rate mechanism, i.e. all the EEC Member States except for the United Kingdom, which signed the agreement but whose currency will continue to float, have released their official exchange rates. -

Annexure 2 Standard XML Reporting - Instructions and Specifications

Annexure 2 Standard XML Reporting - Instructions and Specifications - Draft - © FIU Deutschland Last Update: 22-Jan-2018 Table of Contents 1. Summary ...................................................................................................................................................... 1 2. Conventions used in this document ....................................................................................................... 2 3. Description of XML Nodes ........................................................................................................................ 2 3.1 Node “report” ......................................................................................................................... 2 3.2 Subnode report_indicators ..................................................................................................... 5 3.3 Node transaction ..................................................................................................................... 6 3.4 Node Activity (New in Schema 4.0) ......................................................................................... 9 3.5 Node t_from_my_client ........................................................................................................ 10 3.6 Node t_from .......................................................................................................................... 11 3.7 Node t_to_my_client ............................................................................................................ 13 3.8 -

A Case Study of a Currency Crisis: the Russian Default of 1998

agents attempting to alter their portfolio by buying A Case Study of a another currency with the currency of country A.2 This might occur because investors fear that the Currency Crisis: The government will finance its high prospective deficit through seigniorage (printing money) or attempt to Russian Default of 1998 reduce its nonindexed debt (debt indexed to neither another currency nor inflation) through devaluation. Abbigail J. Chiodo and Michael T. Owyang A devaluation occurs when there is market pres- sure to increase the exchange rate (as measured by currency crisis can be defined as a specula- domestic currency over foreign currency) because tive attack on a country’s currency that can the country either cannot or will not bear the cost A result in a forced devaluation and possible of supporting its currency. In order to maintain a debt default. One example of a currency crisis lower exchange rate peg, the central bank must buy occurred in Russia in 1998 and led to the devaluation up its currency with foreign reserves. If the central of the ruble and the default on public and private bank’s foreign reserves are depleted, the government debt.1 Currency crises such as Russia’s are often must allow the exchange rate to float up—a devalu- thought to emerge from a variety of economic condi- ation of the currency. This causes domestic goods tions, such as large deficits and low foreign reserves. and services to become cheaper relative to foreign They sometimes appear to be triggered by similar goods and services. The devaluation associated with crises nearby, although the spillover from these con- a successful speculative attack can cause a decrease tagious crises does not infect all neighboring econ- in output, possible inflation, and a disruption in omies—only those vulnerable to a crisis themselves. -

Euro Information in English

European Union: Members: Germany, France, the Netherlands, Luxembourg, Belgium, Spain, Portugal, Greece, Italy, Austria, Finland, Ireland, United Kingdom, Sweden, Denmark, Poland, Hungary, Slovenia, Slovakia, Malta, Cyprus, Estonia, Lithuania, Latvia, the Czech Republic, Romania and Bulgaria. Flag of the European Union: Contrary to popular belief the twelve stars do not represent countries. The number of stars has not and will not change. Twelve represents perfection, with cultural reference to the twelve apostles and tribes. The European Anthem is “Ode to Joy” from Beethovens 9th symphony. There are two common holidays May the 5th commemorates Churchill’s speech about a united Europe and May the 9th commemorates the French statesman, an one of the EU-founders, Robert Schuman. On the map: Economic & Monetary Union: In the fifteen countries that make up the EMU (Economic & Monetary Union) the national currency has been replaced by the euro. Members: Germany, France, the Netherlands, Luxembourg, Belgium, Spain, Portugal, Greece, Italy, Austria, Finland, Ireland, Slovenia, Malta and Cyprus. Euro symbol: Demonstration of correct usage: 1 euro € 1,00 21 eurocents € 0,21 Important facts: - On the EU: The interior borders have seized to exist (in the Schengen countries). The inhabitants have the right of free travel, and may work an settle in any EU-country. - On the EMU: The functions of the National Banks in the euro-zone have been taken over by the European Central Bank in Frankfurt. - Stamps with euro face-value can only be used in the country in which they have been published. - The European mini-states San Marino, Monaco and the Vatican have their own euro-coins, but have no influence on the monetary policy of the ECB. -

LUXEMBOURG Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT LUXEMBOURG Executive Summary Banking Luxembourg’s central bank is the Banque centrale du Luxembourg (BCL). As Luxembourg is a participant in the eurozone, some central bank functions are shared with the other members of the European System of Central Banks (ESCB). Bank supervision is performed by the Financial Sector Supervisory Authority (CSSF). All transactions between residents and non-resident companies must be reported on a monthly basis to the BCL. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Luxembourg. Residents are also permitted to hold fully-convertible domestic currency (EUR) bank accounts outside Luxembourg. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Luxembourg. Of the 151 banks operating in Luxembourg, over 90% are foreign-owned; 106 are incorporated under Luxembourg law, while 45 are branches of foreign banks. Luxembourg’s only significant domestic bank is the state-owned Banque et Caisse d’Epargne de l’Etat. Payments The two main payment systems used in Luxembourg are the pan-European TARGET2 RTGS system and the Euro Banking Association’s pan-European automated clearing house (ACH), STEP2. The most important cashless payment instruments in Luxembourg are credit transfers, both in terms of volume and value. A high proportion of credit transfers are cross-border, reflecting the key role of the financial sector in Luxembourg’s economy. Card payments are also widely used in the retail sector, while direct debit volumes are also growing. Checks are rarely used and volumes continue to diminish. -

Wilfried Loth Building Europe

Wilfried Loth Building Europe Wilfried Loth Building Europe A History of European Unification Translated by Robert F. Hogg An electronic version of this book is freely available, thanks to the support of libra- ries working with Knowledge Unlatched. KU is a collaborative initiative designed to make high quality books Open Access. More information about the initiative can be found at www.knowledgeunlatched.org This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivs 4.0 License. For details go to http://creativecommons.org/licenses/by-nc-nd/4.0/. ISBN 978-3-11-042777-6 e-ISBN (PDF) 978-3-11-042481-2 e-ISBN (EPUB) 978-3-11-042488-1 Library of Congress Cataloging-in-Publication Data A CIP catalog record for this book has been applied for at the Library of Congress. Bibliographic information published by the Deutsche Nationalbibliothek The Deutsche Nationalbibliothek lists this publication in the Deutsche Nationalbibliografie; detailed bibliographic data are available in the Internet at http://dnb.dnb.de. © 2015 Walter de Gruyter GmbH, Berlin/Boston Cover image rights: ©UE/Christian Lambiotte Typesetting: Michael Peschke, Berlin Printing: CPI books GmbH, Leck ♾ Printed on acid free paper Printed in Germany www.degruyter.com Table of Contents Abbreviations vii Prologue: Churchill’s Congress 1 Four Driving Forces 1 The Struggle for the Congress 8 Negotiations and Decisions 13 A Milestone 18 1 Foundation Years, 1948–1957 20 The Struggle over the Council of Europe 20 The Emergence of the Coal and Steel Community -

Belarus Country Report BTI 2016

BTI 2016 | Belarus Country Report Status Index 1-10 4.27 # 99 of 129 Political Transformation 1-10 3.93 # 91 of 129 Economic Transformation 1-10 4.61 # 90 of 129 Management Index 1-10 3.02 # 115 of 129 scale score rank trend This report is part of the Bertelsmann Stiftung’s Transformation Index (BTI) 2016. It covers the period from 1 February 2013 to 31 January 2015. The BTI assesses the transformation toward democracy and a market economy as well as the quality of political management in 129 countries. More on the BTI at http://www.bti-project.org. Please cite as follows: Bertelsmann Stiftung, BTI 2016 — Belarus Country Report. Gütersloh: Bertelsmann Stiftung, 2016. This work is licensed under a Creative Commons Attribution 4.0 International License. BTI 2016 | Belarus 2 Key Indicators Population M 9.5 HDI 0.786 GDP p.c., PPP $ 18184.9 Pop. growth1 % p.a. 0.0 HDI rank of 187 53 Gini Index 26.0 Life expectancy years 72.5 UN Education Index 0.820 Poverty3 % 0.0 Urban population % 76.3 Gender inequality2 0.152 Aid per capita $ 11.1 Sources (as of October 2015): The World Bank, World Development Indicators 2015 | UNDP, Human Development Report 2014. Footnotes: (1) Average annual growth rate. (2) Gender Inequality Index (GII). (3) Percentage of population living on less than $3.10 a day at 2011 international prices. Executive Summary Summer 2014 marked the 20th anniversary of Aliaksandr Lukashenka’s election as the first, and so far only, president of the Republic of Belarus. -

LUXEMBOURG Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT LUXEMBOURG Executive Summary Banking Luxembourg’s central bank is the Banque centrale du Luxembourg (BCL). As Luxembourg is a participant in the eurozone, some central bank functions are shared with the other members of the European System of Central Banks (ESCB). Bank supervision is performed by the Financial Sector Supervisory Authority (CSSF). All transactions between residents and non-resident companies must be reported on a monthly basis to the BCL. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Luxembourg. Residents are also permitted to hold fully-convertible domestic currency (EUR) bank accounts outside Luxembourg. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Luxembourg. Of the 154 banks operating in Luxembourg, over 90% are foreign-owned; 108 are incorporated under Luxembourg law, while 46 are branches of foreign banks. Luxembourg’s only significant domestic bank is the state-owned Banque et Caisse d’Epargne de l’Etat. Payments The two main payment systems used in Luxembourg are the pan-European TARGET2 RTGS system and the Euro Banking Association’s pan-European automated clearing house (ACH), STEP2. The most important cashless payment instruments in Luxembourg are credit transfers, both in terms of volume and value. A high proportion of credit transfers are cross-border, reflecting the key role of the financial sector in Luxembourg’s economy. Card payments are also widely used in the retail sector, while direct debit volumes are also growing. Checks are rarely used and volumes continue to diminish. -

Currencies of the World

The World Trade Press Guide to Currencies of the World Currency, Sub-Currency & Symbol Tables by Country, Currency, ISO Alpha Code, and ISO Numeric Code € € € € ¥ ¥ ¥ ¥ $ $ $ $ £ £ £ £ Professional Industry Report 2 World Trade Press Currencies and Sub-Currencies Guide to Currencies and Sub-Currencies of the World of the World World Trade Press Ta b l e o f C o n t e n t s 800 Lindberg Lane, Suite 190 Petaluma, California 94952 USA Tel: +1 (707) 778-1124 x 3 Introduction . 3 Fax: +1 (707) 778-1329 Currencies of the World www.WorldTradePress.com BY COUNTRY . 4 [email protected] Currencies of the World Copyright Notice BY CURRENCY . 12 World Trade Press Guide to Currencies and Sub-Currencies Currencies of the World of the World © Copyright 2000-2008 by World Trade Press. BY ISO ALPHA CODE . 20 All Rights Reserved. Reproduction or translation of any part of this work without the express written permission of the Currencies of the World copyright holder is unlawful. Requests for permissions and/or BY ISO NUMERIC CODE . 28 translation or electronic rights should be addressed to “Pub- lisher” at the above address. Additional Copyright Notice(s) All illustrations in this guide were custom developed by, and are proprietary to, World Trade Press. World Trade Press Web URLs www.WorldTradePress.com (main Website: world-class books, maps, reports, and e-con- tent for international trade and logistics) www.BestCountryReports.com (world’s most comprehensive downloadable reports on cul- ture, communications, travel, business, trade, marketing,