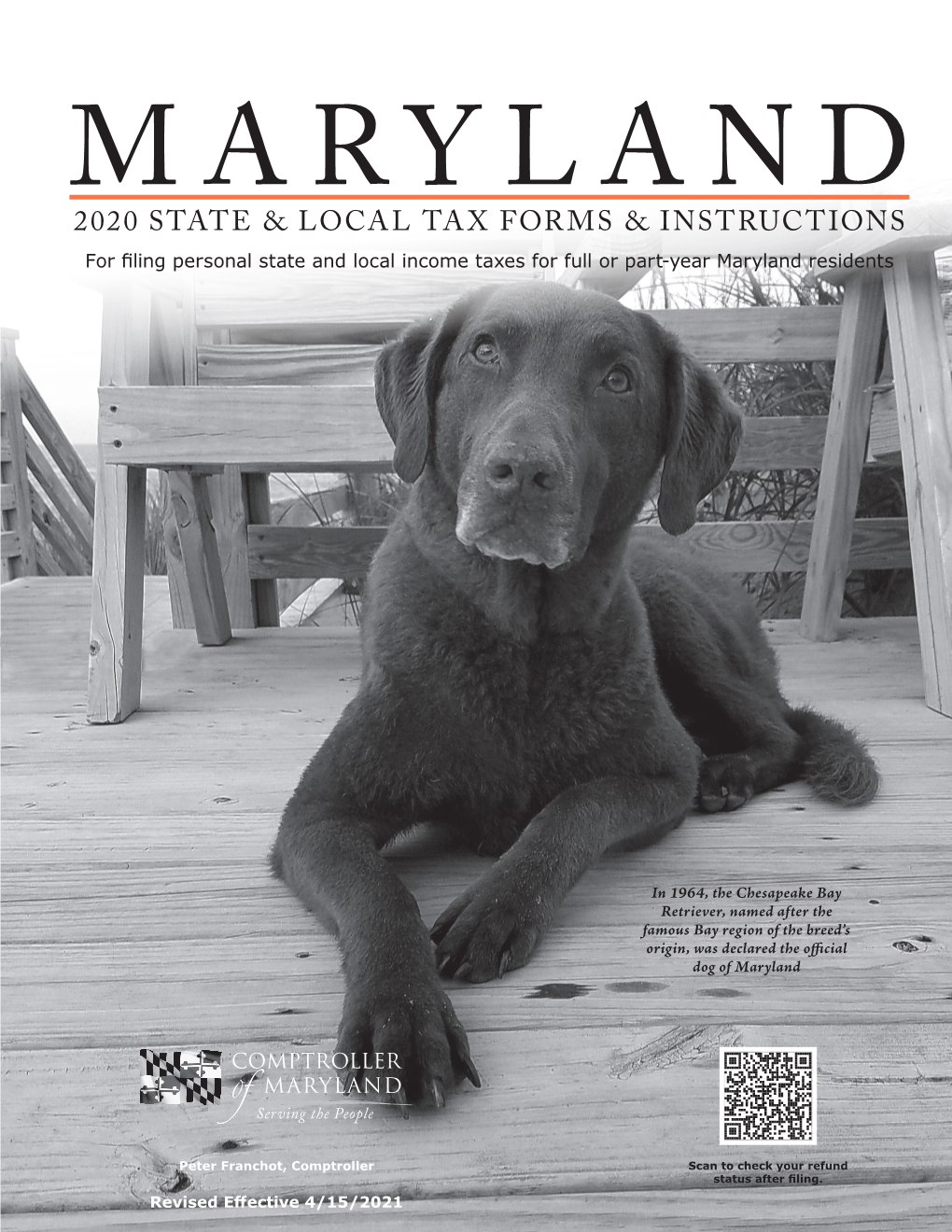

2020 State & Local Tax Forms & Instructions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Budget Battle Ahead Attorney General

A short honeymoon? Facing a vote – or not Familiar challenges await It’s unclear if Crittendon Mansion incoming USM chancellor 8A project needs council OK. 5A Monday, December 22, 2014 Volume 126 | Number 055 TheDailyRecord.com Ciraolo to get post at Justice She’s to be appointed to tax division role BY LAUREN KIRKWOOD [email protected] Caroline Ciraolo, a partner in Rosenberg Martin Greenberg LLP’s tax controversy practice group, will be appointed by the U.S. attorney general in January to a position in the Department of Justice’s Tax Division. Ciraolo will join the department as the tax division’s deputy assistant MAXIMILIAN FRANZ attorney general for policy and plan- ning, and will also serve as the princi- pal deputy assistant attorney general, she said. If President Barack Obama announces a nominee for assistant attorney general of the tax division, Ciraolo will become acting assistant The budget battle ahead attorney general. At Rosenberg Martin, Ciraolo de- fends individuals and businesses in Hogan, legislators face ‘difficult decisions’ with deficits growing federal and state civil tax controver- sies, civil tax litigation and criminal BY BRYAN P. SEARS Hogan, who will LIS S very difficult de- challenges facing the state, tax investigations and prosecutions. [email protected] be sworn into PO U cisions because said he did not wish to scare Although she’ll be on the prosecu- A M public office for N M state govern- residents. tion side of the courtroom soon, her In roughly 30 days, Larry the first time N I ment cannot “What’s good for state ultimate goal as an attorney isn’t that T Hogan will be sworn in to in January, A continue to government is good for Mary- different, she said. -

Comptroller of Maryland

Spring 2016 Peter Franchot, Comptroller www.marylandtaxes.com From the Desk of the Comptroller This year’s tax season with the statutory powers we need was once again highly to keep pace with the fraudsters and successful, and much financial predators that are becoming credit is due to the hard more brazen each day. Unfortunately, work of my staff in the despite the fact that it was passed Comptroller’s Office. almost unanimously by the House of We remain committed Delegates, the Senate failed to adopt to fulfilling our pledge to the taxpayers this important legislation. by fulfilling what I call the “Three R’s— Respect, Responsiveness and Results. Regardless of the legislature’s inaction on this bill, my office will remain As part of our commitment to serving on high alert and continue to take Maryland taxpayers, my office has measures to protect Marylanders’ redoubled our efforts to combat the financial integrity. We will continue rising tide of tax fraud and identity to work with our federal and state theft incidents in our state. This year partners to investigate and prosecute alone, my office has detected and those who seek to defraud our state blocked more than 8,000 fraudulent and its citizens, and keep a watchful returns—exceeding the combined total eye on every tax return that comes to from my first four years in office. our office. This past legislative session, I introduced the Taxpayer Protection Peter Franchot Act of 2016 to better equip my office Comptroller of Maryland Comptroller Stops Radioactive State Tax Returns This Tax Filing Season In an ongoing effort to thwart tax fraudsters and identity thieves, Comptroller Peter Franchot spent this past tax filing season identifying tax preparers filing suspicious returns, working with the Attorney General’s Office to indict nine people accused of tax fraud against vulnerable citizens, alerting taxpayers to various tax fraud phone and email schemes and trying to convince the General Assembly to pass his Taxpayer Protection Act. -

Newsletter 2014 Spring

Access to Independence of Cortland County, Inc. Nothing More, Nothing Less For All People ACCESS NEWS With Disabilities Spring 2014 NUMBER XXXX ATI Recognizes Volunteers ATI Celebrates Founding Day ATI Awarded Grants On April 10, ATI recognized the On May 8, ATI recognized its Over the last several months, contributions of its volunteers by 16th anniversary as a nonprofit cor- ATI has been awarded a number of hosting them to pizza, wings and poration by hosting 50 former and small grants from area foundations salad. ATI also presented special current Board Members to a cele- in support of specific program and awards of appreciation to two indi- bration luncheon. operations initiatives. viduals who went above and be- On May 8, 1998, founding Board On February 19, ATI received yond over the past six months: Sara Members included: Thomas Miller, $2,000 from the Ralph R. Wilkins Askew and Rene Waddy. Lorriane Janke and Christopher Far- Foundation towards the cost of in- Over the past six months, 45 kas. Frances Pizzola was the found- stalling a new network server and individuals have volunteered their ing volunteer Director. At the time productivity software for consumer time at ATI for a total of 1,156 ATI was housed in Room 200 of the and staff computers. hours. Volunteers donated their County Office Building. On March 31, ATI received time in various ways, including: ATI’s roots go back to the 1980’s $2,000 from the Triad Foundation providing clerical support, partici- when it was known as the Cortland to provide support for ATI’s 2014 pating in advocacy efforts, partici- County Accessibility Committee Disability Employment Awareness pating on the Board of Directors, (CCAC). -

Disability Rights Movement —The ADA Today

COVER STORY: ADA Today The Disability Rights Movement —The ADA Today Karen Knabel Jackson navigates Washington DC’s Metro. by Katherine Shaw ADA legislation brought f you’re over 30, you probably amazing changes to the landscape—expected, understood, remember a time in the and fostering independence, access not-too-distant past when a nation, but more needs and self-suffi ciency for people curb cut was unusual, there to be done to level the with a wide range of disabilities. were no beeping sounds at playing fi elds for citizens Icrosswalks on busy city street with disabilities. Yet, with all of these advances, corners, no Braille at ATM court decisions and inconsistent machines, no handicapped- policies have eroded the inten- accessible bathroom stalls at the airport, few if tion of the ADA, lessening protections for people any ramps anywhere, and automatic doors were with disabilities. As a result, the ADA Restoration common only in grocery stores. Act of 2007 (H.R. 3195/S. 1881) was introduced last year to restore and clarify the original intent Today, thanks in large part to the Americans with of the legislation. Hearings have been held in both Disabilities Act (ADA), which was signed into law the House and Senate and the bill is expected to in 1990, these things are part of our architectural pass in 2008. 20 Momentum • Fall.2008 Here’s how the ADA works or doesn’t work for some people with MS today. Creating a A no-win situation Pat had a successful career as a nursing home admin- istrator in the Chicago area. -

Visitability: Trends, Approaches, and Outcomes

VISITABILITY: TRENDS, APPROACHES, AND OUTCOMES Katie Spegal, MSG and Phoebe Liebig, Ph.D. [NOTE: Reformatted by HCD] Background The rapid increase of “visitability” legislation in the United States over the past 14 years demonstrates a growing awareness of the need for housing with specific features that allow easy, safe, and convenient access by any individual with a mobility impairment. Access to visitable homes is limited to the main floor or habitable grade level of new single-family homes, duplexes or triplexes. Visitability” focuses on accommodations that a guest would utilize, such as the entrance to a home and a first-floor bathroom and hallways, rather than on features used by residents of the dwelling. Required features in visitability ordinances differ in many ways. However, the most common features designated in visitability ordinances include 1) at least one accessible route into a dwelling; 2) accessible entrance doors; 3) specifications for hallway widths throughout the main floor; and 4) electrical/environmental controls in accessible locations. Also common in visitability laws is the availability of waivers if compliance is not feasible due to topographical factors. Some of the more unusual specifications include a usable first-floor kitchen that is wheelchair-maneuverable; wall reinforcements in first-floor bathrooms provided for the possible installation of grab bars; a no-step entrance into the home; and electrical panels/breaker boxes in accessible locations, either on the first floor or adjacent to the accessible route. (See Appendices A-C.) The first visitability legislation was passed in Florida and is known as ‘The Florida Bathroom Law’ (1989). This law only requires one feature. -

Comptroller of Maryland's - News Releases

Comptroller of Maryland's - News Releases Media Agency Office of the Services Services Comptroller News Releases 2008 Archived Media Releases 2010 News Releases 2009 News Releases Franchot: Crackdown on Tax Scheme Yields $3.5 million for the State 2008 News Releases Annapolis, MD (December 17, 2008) - Comptroller Peter Franchot announced today that a major corporation has paid over $3.5 million to the state as the result of his agency’s aggressive enforcement of Maryland’s tax laws. This is the second check resulting from a 2007 News Releases change – initiated by Franchot – in the way so-called “captive” Real Estate Investment Trusts (REIT) are treated for taxation purposes. Publications Administrative News Comptroller Franchot Claims Another Victory Against Corporate Tax Scofflaws Annapolis, MD (October 27, 2008) - Comptroller Peter Franchot announced today that subsidiaries of the popular retail chain ReveNews newsletter Nordstrom, Inc. were found liable to Maryland for corporate income taxes due from tax years 2002 and 2003. The Maryland Tax Court Booklets & Brochures ordered Nordstrom to pay the state $1,264,864 in back taxes plus interest and ten percent in penalties. This case was the most recent victory for the Comptroller's office in an aggressive effort to crack down on corporations avoiding taxes using Delaware Holding Photo and Video Archive Company tax schemes and other tax avoidance strategies. To date, the Comptroller's office has collected more than $267 million in taxes through Delaware Holding Company cases, and has an -

Presentation Slides for Visitability: Building Today's Housing For

Visitability – Building Today's Housing for Tomorrow February 23rd, 2021 Disclaimer • This presentation is for the City of Austin’s Visitability Ordinance No. 20140130-021 which only applies to certain private residential projects. • An accessible house presumes that a person with a disability will live in the unit, while a visitable house provides the ability to visit it and is more adaptable for future need. • The Americans with Disability Act (ADA), which only applies to commercial, public and governmental buildings, is not covered in this presentation. Outline • The City of Austin’s history/background of accessible code requirements. • Components of the 2014 ordinance - interior requirements - exterior requirements - waiving out of the exterior requirements - submittal requirements History/Background • There have been provisions for providing some type of accessibility inside the new construction of a single family dwelling or duplex residence since the early 1980’s. • The requirements were limited to providing a 30” clear opening and 2x6 min lateral wall reinforcement @ 34” from and parallel to the interior floor finish. • As we are living longer, there was a growing need to expand upon the existing regulations allowing for better access into & around a home so that more people can age-in place. Components to the ordinance There are (7) sections which are as follows: – R320.1 Applicability (eff. February 10st, 2014) – R320.2 Compliance req’d at plan review – R320.3 Visitable bathrooms – R320.4 Visitable light switches, receptacles and environmental controls – R320.5 Visitability bathroom route – R320.6 Visitable dwelling entrance – R320.7 Exterior visitable route (eff. July 1st, 2015) R320.1 Applicability. -

Winter 2017 Peter Franchot, Comptroller

Winter 2017 Peter Franchot, Comptroller www.marylandtaxes.com From the Desk of the Comptroller This year’s tax season fraud, we need additional resources is off to a great start. to keep pace with the increasingly Once again, my agency sophisticated fraud schemes that is firmly committed to continue to emerge. delivering the highest That’s why this legislative session, I level of service to will be urging legislators to pass my Maryland taxpayers. agency’s Taxpayer Protection Act, As part of our focus on providing which would grant my office the first-class service, we continue to be statutory powers we need to more aggressive in our efforts to combat tax effectively protect Marylanders from fraud and identity theft in Maryland. fraudsters and financial criminals. Earlier this month, we suspended I’m grateful to Governor Hogan processing electronic returns from for including this bill in his 20 tax preparation services and our administration’s legislative package nationally recognized state-of-the-art and it is my hope that the General fraud detection systems keep a watchful Assembly passes this bill with broad eye for potential fraudulent returns. We bipartisan support. also joined with the Attorney General’s Office to bring indictments in four tax fraud schemes. While I am proud of my agency’s Peter Franchot national leadership in fighting tax Comptroller of Maryland 2017 Tax Filing Season Under Way Maryland began processing personal income tax returns for Tax Year 2016 on January 23, 2017, the same day the Internal Revenue Service (IRS) began accepting returns. In an ongoing effort to combat tax fraud, the agency did not immediately process a state tax return if W-2 information was not on file. -

Visitability

VISITABILITY: ENSURING HOMES ARE ACCESSIBLE FOR PERSONS WITH DISABILITIES FACT SHEET # 11 Published by the Fair Housing Center of Central Indiana “Visitability” is an architectural concept that means that new a lack of accessible homes, primarily single-family houses, are built to have some features in a home basic accessible features which allow the resident’s family prevents anyone members or friends who have mobility impairments to with a disability “visit” the home. Visitability also accommodates residents from being able to who don’t have disabilities at purchase but who age while visit them. For still in the same home or who unexpectedly obtain a mobil- example, a child ity impairment. Having basic “visitable” features allows the who uses a wheel- home to be accessible to both young and aged residents. chair would not be able to attend a The Fair Housing Center of Central Indiana (FHCCI) defines friend’s birthday A visitable home featuring a zero-step entrance. minimum visitability requirements as: party in a home where the doorways are too narrow to fit Providing at least one zero-step entrance (which does his wheelchair, or a grandparent with a mobility impairment not have to be the front entrance); would not be able to visit her children or grandchildren if All main floor doors - including bathrooms - have at their home has steps leading up to the front door. This ef- least 32 inches of clear passage space and hallways have fectively segregates families and communities into “disabled” at least 36 inches of width; and “nondisabled,” running contrary to the nation’s efforts to enforce and further fair housing. -

VISITABILITY Prepared by the Housing Committee for Unit Discussion

LWVCA STUDY PAGES - APRIL 2013 VISITABILITY Prepared by the Housing Committee for Unit Discussion The League of Women Voters of the United States Position: “Support policies to provide a decent home and a suitable living environment for every American family.” Objectives: Awareness of the idea of visitability Understanding of the benefits for people with and without disabilities Advantages to society of building with visitability Outline advocacy opportunities for the future Definition: Visitability is a movement to change home construction practices so that virtually all new homes — not merely those custom-built for occupants who currently have disabilities — offer a few specific features making the home easier for mobility-impaired people to live in and visit. This requires a few essential features in every new home: --At least one zero-step entrance approached by an accessible route on a firm surface no steeper than 1:12, proceeding from a driveway or public sidewalk --Wide passage doors (minimum 32” opening) --At least a half bath/powder room on the main floor Rationale: Visitability increases sustainability by allowing individuals to age in place. It helps people to remain living in the community as opposed to nursing homes. It allows seniors and others with mobility limitations to lead more socially active lives by offering them the possibility of visiting their friends and family. It adds ease and convenience for all. As our population lives longer, and the “silver tsunami” of baby boomers hit old age, the need for more accessible housing is rising, and the lack thereof is a large source of unacceptable and unnecessary fiscal waste for society. -

Testimonies from the Visitability Survey

Visitability Interview Responses In its report, Increasing Home Access: Designing for Visitability, AARP published a compendium of interviews with individuals about national visitability initiatives http://assets.aarp.org/rgcenter/il/2008 14 access.pdf. In that spirit, The Montana Housing Task Force (MHTF) and the Montana Disability and Health Program (MTDH) have been collecting online testimonies about individual and community level activities related to visitability. A visitable home welcomes all visitors including those with physical disabilities. Design features make it easy to get into and move around the home. A visitable home has one zero-step entrance (front, side or rear), doors with 32 to 36 inches of clear passage space, and one bathroom on the main floor with maneuver space for a wheelchair. These testimonies have been used as public comment before the Montana Board of Housing (August 2010) and in visitability presentations throughout Montana. The survey is available at http://www.surveygizmo.com/s/453201/visitability The testimonies below have been edited to add missing words and correct spelling and punctuation. Testimonies Testimony 1 I first heard the term “visitability” when … a friend shared the Summit's newsletter with me. My role in visitability is as a consumer. My daughter uses a wheelchair and now that she is getting older, we have had to install a ramp and take out the front steps in order to get her safely out the front door to the sidewalk. Now we are looking at having our doors widened and a bathroom remodeled that will work better for her. A friend of mine built a 'visitable' house for their son in a wheelchair, and the ease of getting the wheelchair around is so great! Ease of getting out of doors to the bathroom to his room, etc. -

Maryland Revenue Structure

LEGISLATIVE HANDBOOK SERIES VOLUME III MARYLAND’S REVENUE STRUCTURE • Maryland’s Revenue Structure Legislative Handbook Series Volume III 2018 For further information concerning this document contact: Library and Information Services Office of Policy Analysis Department of Legislative Services 90 State Circle Annapolis, Maryland 21401 Baltimore Area: 410-946-5400 • Washington Area: 301-970-5400 Other Areas: 1-800-492-7122, Extension 5400 TTY: 410-946-5401 • 301-970-5401 Maryland Relay Service: 1-800-735-2258 E-mail: [email protected] Home Page: http://mgaleg.maryland.gov The Department of Legislative Services does not discriminate on the basis of age, ancestry, color, creed, marital status, national origin, race, religion, gender, gender identity, sexual orientation, or disability in the admission or access to its programs, services, or activities. The Department's Information Officer has been designated to coordinate compliance with the nondiscrimination requirements contained in Section 35.107 of the Department of Justice Regulations. Requests for assistance should be directed to the Information Officer at the telephone numbers shown above. ii Foreword The consequences of State tax law affect a myriad of transactions ranging from typical consumer purchases to the financing of multimillion dollar bond issuances. Because legislators will be facing many important tax decisions, this handbook has been prepared to summarize the major features of Maryland’s revenue structure. Sections are devoted to key aspects of State imposed taxes. In addition, descriptions of nontax-related sources are included to provide background and insight into the funds that compose over half of the total revenues collected by the State.