ANNUAL REPORT 2000 Financial Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summer 2017 Newsletter from Railfuture Wessex Branch

Summer 2017 Newsletter from Railfuture Wessex Branch Chairman’s Message Well here we go again with another newsletter, the big news being the winning of the South West franchise by First/MTR. To date we do not think the contract between them and Department for Transport has been completed and so we continue just with a watching brief. The Company’s first public offering *Improving South Western Railway looks at first sight to be good, but on closer study it seems to promise little. We will have to do much work to understand where these improvements can be delivered … and how! Passengers will not be interested in a 10% journey time saving if intermediate stops are to be cut. No doubt this will be the subject of a consultation in due course. In the meantime, good luck to Andy Mellors who is the new MD of South Western Railway, previously having been GWR Engineering Director. *read it online here: http://www.firstgroupplc.com/about-firstgroup/uk-rail/improving-south-western-railway.aspx On the West of England Line (Waterloo-Salisbury-Exeter), we can see no benefits from the new franchise: no new trains, and a journey time saving from Salisbury to Waterloo that can only be achieved by cutting out Woking and Clapham Junction stops. Railfuture is set against that and will mobilise passengers and members to say “no” when the consultation appears. Why the DfT specifies such matters which have no passenger benefit, we do not know … but we will work with First/MTR, local MP’s and rail authorities to ensure long term passenger benefits accrue. -

Simply the Best Buses in Britain

Issue 100 | November 2013 Y A R N A N I S V R E E R V S I A N R N Y A onThe newsletter stage of Stagecoach Group CELEBRATING THE 100th EDITION OF STAGECOACH GROUP’S STAFF MAGAZINE Continental Simply the best coaches go further MEGABUS.COM has buses in Britain expanded its network of budget services to Stagecoach earns host of awards at UK Bus event include new European destinations, running STAGECOACH officially runs the best services in Germany buses in Britain. for the first time thanks Stagecoach Manchester won the City Operator of to a new link between the Year Award at the recent 2013 UK Bus Awards, London and Cologne. and was recalled to the winner’s podium when it was In addition, megabus.com named UK Bus Operator of the Year. now also serves Lille, Ghent, Speaking after the ceremony, which brought a Rotterdam and Antwerp for number of awards for Stagecoach teams and individuals, the first time, providing even Stagecoach UK Bus Managing Director Robert more choice for customers Montgomery said: “Once again our companies and travelling to Europe. employees have done us proud. megabus.com has also “We are delighted that their efforts in delivering recently introduced a fleet top-class, good-value bus services have been recognised of 10 left-hand-drive 72-seat with these awards.” The Stagecoach Manchester team receiving the City Van Hool coaches to operate Manchester driver John Ward received the Road Operator award. Pictured, from left, are: Operations Director on its network in Europe. -

Stagecoach Group Plc Response to the Joint Preliminary Consultation on Automated Vehicles

Stagecoach Group plc Response to the Joint Preliminary Consultation on Automated Vehicles Stagecoach Group plc (“Stagecoach Group”) welcomes the consultation by the Scottish and English Law Commissions on Automated Vehicles. Stagecoach Group is actively participating in trialling automated vehicles in both the depot and public transport environments, working with technology developers, vehicle manufacturers, academia and others. We welcome the consultation as another important initiative in this area. The consultation is wide – ranging in scope and some of the questions posed will be better able to be answered as more information and understanding of automated vehicles and their use in different scenarios emerges. Equally, we do not propose to respond to or comment on all questions but we offer views based on our experience to date as one of the UK’s biggest bus and coach operators, with some 8,000 buses and coaches operating in different environments across the UK. We look forward to future initiatives, particularly the planned consultation on automated vehicles in Mobility as a Service and the challenges of achieving “everything somewhere” later this year. Stagecoach Group: • Stagecoach is an international public transport group, with operations in the UK, the United States and Canada. • We are one of the UK's biggest bus and coach operators with over 8,000 buses and coaches on a network stretching from south-west England to the Highlands and Islands of Scotland. Our low-cost coach service, megabus.com, operates a network of inter-city services across the UK. • Stagecoach is a major UK rail operator, with an involvement in operating several franchised rail networks, including the East Midlands Trains network. -

Stagecoach Group out in Front for 10-Year Tram Contract Responsible for Operating Tram Services on the New Lines to Oldham, Rochdale, Droylsden and Chorlton

AquaBus New alliance Meet the Sightseeing ready to forged for megabus.com tours' bumper set sail rail bid A-Team launch The newspaper of Stagecoach Group Issue 66 Spring 07 By Steven Stewart tagecoach Group has been Sselected as the preferred bidder to operate and maintain the Manchester Metrolink tram Metrolink bid network. The announcement from Greater Manchester Passenger Transport Executive (GMPTE) will see Stagecoach Metrolink taking over the 37km system and the associated infrastructure. The contract will run for 10 years and is expected to begin within the next three months. right on track It will include managing a number of special projects sponsored by GMPTE to improve the trams and infrastructure to benefit passengers. Stagecoach Metrolink will also be Stagecoach Group out in front for 10-year tram contract responsible for operating tram services on the new lines to Oldham, Rochdale, Droylsden and Chorlton. Nearly 20 million passengers travel every year on the network, which generates an annual turnover of around £22million. ”We will build on our operational expertise to deliver a first-class service to passengers in Manchester.” Ian Dobbs Stagecoach already operates Supertram, a 29km tram system in Sheffield, incorpo- rating three routes in the city. Ian Dobbs, Chief Executive of Stagecoach Group’s Rail Division, said: “We are delighted to have been selected as preferred bidder to run Manchester’s Metrolink network, one of the UK’s premier light rail systems. “Stagecoach operates the tram system in Sheffield, where we are now carrying a record 13 million passengers a year, and we will build on our operational expertise to deliver a first-class service to passengers in Growing places: Plans are in place to tempt more people on to the tram in Manchester. -

South Western Franchise Agreement

_____ September 2006 THE SECRETARY OF STATE FOR TRANSPORT and STAGECOACH SOUTH WESTERN TRAINS LIMITED SOUTH WESTERN FRANCHISE AGREEMENT incorporating by reference the National Rail Franchise Terms (Second Edition) CONTENTS CLAUSE PAGE 1. INTERPRETATION AND DEFINITIONS ............................................................................. 4 2. COMMENCEMENT .......................................................................................................... 5 3. TERM 5 4. GENERAL OBLIGATIONS ................................................................................................ 6 5. SPECIFIC OBLIGATIONS ................................................................................................. 6 6. COMMITTED OBLIGATIONS ......................................................................................... 48 7. SUPPLEMENTAL TERMS ............................................................................................... 48 8. RECALIBRATION OF THE BENCHMARKS ...................................................................... 49 9. DOCUMENTS IN THE AGREED TERMS .......................................................................... 49 10. ENTIRE AGREEMENT ................................................................................................... 49 APPENDIX 1 ........................................................................................................................... 52 Secretary of State Risk Assumptions (Clause 5.1(y)) ................................................. 52 APPENDIX -

Key to Maps for Details in Central London See Overleaf

S 1 N B C 712.724 M S 2 O 9 Maldon Manor Station, The Manor Drive, Worcester Park, Dorchester Road, North Cheam, London Road, Windsor Avenue, H A C 242.C1.C2 M H 310.311 W1† 614 S 298 308.312 610 66.103.175 D 9 757 to D NE R R 2 E Cuffley 381 3 R E R A A 8 N LEY 4 1 A 5 .39 FF H U . 364 5.248 . A L N 12 A CU IL D 1 T A E P C1.C3.C4 6 621 N 615 A 3 A 380.880 L 191 W8 W10 247.294.296 O 8 - * Luton Airport E Cranborne Road . L T H 8 Stayton Road, Sutton, Cedar Road, Langley Park Road, Lind Road, Westmead Road, Carshalton, Carshalton Beeches, D R 2 9 O 1 R Breach Barns A R D Colney D * L T N 2 84 N C1 K B81 Y . O 2 648.N15 4 N S3 R 6 TI 242 I 8 E . E 0 84.302 A 365.375.575 S . A 797 D *T C T 2 S S C1 W9 O O L M B 298 B Industrial 3 RD C 382 9 . E N 7 6 G Y R . 8 CH 880 G * S S 1 T I U Street E . R R 242 211.212† 6 4 8 602 A U O R C Belmont, Royal Marsden Hospital, Sutton Hospital (Mon-Sat except evenings). Quality Line M O O O 4 398 H R 169 R T H S Shenleybury B 0 E 242 F . -

Double Award Success

Issue 98 | July 2013 onThe newsletter stage of Stagecoach Group Celebrating our champions EMPLOYEES across the Group Eighteen honours were up for grabs Helen Mahy said: “The standard of who have gone the extra mile for – gold, silver and bronze awards in each nominations this year was extremely excellence have been honoured in the category – and more than 160 nominations high and we are delighted to award our 2013 Stagecoach Champions Awards. were received. champions who are an inspiration to us all This year’s accolades were presented The judging panel – consisting of Non- and thoroughly deserve their awards. at the Group’s recent management executive Director Helen Mahy, Stagecoach “Thanks to everyone who took the time to conference, recognising outstanding co-founder and Non-executive Director vote for a colleague. Again this year’s awards employees in the categories of Health, Ann Gloag, and Director of Corporate outlined the quality of our workforce.” Safety, Customer Service, Environment, Communications Steven Stewart – had a Turn to page 3 to find out who won Innovation and Community. tough challenge to select the winners. this year’s awards... Busway gets Double royal seal of award approval HER Majesty The Queen and the Duke of Edinburgh chose to travel in style during a recent visit to success Cambridge as they took a trip on the STAGECOACH Guided Busway. co-founder and The royals were in Cambridge to open the Group Chairman new Birth Centre at The Rosie Hospital, Sir Brian Souter boarding the bus to take them from Cambridge was recognised Station to the Addenbrooke’s campus. -

Scotland/Northern Ireland

Please send your reports, observations, and comments by Mail to: The PSV Circle, Unit 1R, Leroy House, 9 436 Essex Road, LONDON, N1 3QP by FAX to: 0870 051 9442 by email to: [email protected] SCOTLAND & NORTHERN IRELAND NEWS SHEET 850-9-333 NOVEMBER 2010 SCOTLAND MAJOR OPERATORS ARRIVA SCOTLAND WEST Limited (SW) (Arriva) Liveries c9/10: 2003 Arriva - 1417 (P807 DBS), 1441 (P831 KES). Subsequent histories 329 (R129 GNW), 330 (R130 GNW), 342 (R112 GNW), 350 (S350 PGA), 352 (S352 PGA), 353 (S353 PGA): Stafford Bus Centre, Cotes Heath (Q) 7/10 ex Arriva Northumbria (ND) 2661/57/60/2/9/3. 899 (C449 BKM, later LUI 5603): Beaverbus, Wigston (LE) 8/10 ex McDonald, Wigston (LE). BLUEBIRD BUSES Limited (SN) (Stagecoach) Vehicles in from Highland Country (SN) 52238 9/10 52238 M538 RSO Vo B10M-62 YV31M2F16SA042188 Pn 9412VUM2800 C51F 12/94 from Orkney Coaches (SN) 52429 9/10 52429 YSU 882 Vo B10M-62 YV31MA61XVC060874 Pn 9?12VUP8654 C50FT 5/98 (ex NFL 881, R872 RST) from Highland Country (SN) 53113 10/10 53113 SV 09 EGK Vo B12B YV3R8M92X9A134325 Pn 0912.3TMR8374 C49FLT 7/09 Vehicles re-registered 52137 K567 GSA Vo B10M-60 YV31MGC1XPA030781 Pn 9212VCM0824 to FSU 331 10/10 (ex 127 ASV, K567 GSA) 52141 K571 DFS Vo B10M-60 YV31MGC10PA030739 Pn 9212VCM0809 to FSU 797 10/10 54046 SV 08 GXL Vo B12BT YV3R8M9218A128248 Pn 0815TAR7877 to 448 GWL 10/10 Vehicle modifications 9/10: fitted LED destination displays - 22254 (GSU 950, ex V254 ESX), 22272 (X272 MTS) 10/10: fitted LED destination displays - 22802 (V802 DFV). -

Capital Space Ltd Land South of Coldharbour Road, Gravesend

Capital Space Ltd Land South of Coldharbour Road, Gravesend Transport Assessment July 2016 Gravesham Borough Council Contents 1 INTRODUCTION .................................................................................................. 1 2 SITE AND LOCAL AREA ........................................................................................ 2 Site Location ....................................................................................................... 2 Local Road Network ............................................................................................ 2 Public Transport .................................................................................................. 3 3 POLICY ................................................................................................................ 4 National Planning Policy Framework .................................................................. 4 Supplementary Planning Guidance SPG 4 Kent Vehicle Parking Standards (July 2006) ................................................................................................................... 4 Gravesham Local Plan Core Strategy (September 2014) ................................... 5 4 BASELINE CONDITIONS ..................................................................................... 6 Existing Traffic Conditions .................................................................................. 6 5 PROPOSED DEVELOPMENT ................................................................................. 7 Overview -

On Stage, Stagecoach Group, Stagecoach South West Mark Whittle 01392 889747 Operating Companies

Going topless Reaching a in New new level York of control The newspaper of Stagecoach Group Issue 54 Spring 2004 Stagecoach joins Danes in bid for rail franchise tagecoach Group has linked up with Danish State SRailways (DSB) to bid for a major UK rail franchise. Carry on The Group has taken a 29.9% majority of passenger rail services in stake in South Eastern Railways Ltd, a Denmark and has further franchise company set up by DSB, to bid for operations in other Scandinavian the new Integrated Kent franchise in countries. logging on south-east England. It is an independent Public Three other companies – GNER, Corporation, owned by the Danish Carry on megabus.com! First Group and a consortium of Go- Government, and is managed by a That was the message Ahead and Keolis, of France – have Board of Directors and an Executive from bubbly actress been shortlisted for the seven to 10- Committee, who are responsible for Barbara Windsor when year franchise. the day-to-day business. she helped launch Integrated Kent, which will be let Executive Vice President and CFO Britain’s first low-cost from early 2005, of DSB, Søren internet bus service. will include routes Eriksen said: And, with tickets on the national rail ‘Both Stagecoach “Stagecoach has available from just £1 network throug- extensive through megabus.com, the hout Kent, parts of and DSB share a experience with initiative is catching the Sussex and South- train operations in public’s imagination for East London. It will commitment to the UK and DSB is catching a bus. -

Stagecoach Group Plc – Preliminary Results for the Year Ended 30 April 2007

10 Dunkeld Road T +44 (0) 1738 442111 Perth F +44 (0) 1738 643648 PH1 5TW Scotland stagecoachgroup.com 27 June 2007 Stagecoach Group plc – Preliminary results for the year ended 30 April 2007 Business highlights • Delivering excellent performance and value to shareholders o Continued growth in earnings per share+ - up 10.4% o Underlying revenue growth in all core divisions o Around £700m in value returned to shareholders in May/June 2007 o Dividend increased by 10.8% • Partnerships and innovation driving growth at UK Bus o Continued organic passenger growth – like-for-like volumes up 6.6% o Strong revenue growth– like-for-like revenue up 10.3% o Like-for-like operating profit up 26.9% o Strong marketing, competitive fares strategy and concessionary travel schemes underpin growth o Named UK Bus Operator of the Year • Excellent performance in UK Rail o Strong start to new South Western rail franchise o Revenue up 12.8% o Contract wins: East Midlands; Manchester Metrolink • Strong growth in North America o Operating margin up from 7.1% to 7.9%, excluding Megabus o Continued strong revenue growth in both scheduled services and leisure markets – constant currency like-for-like revenue up 9.1% o Expansion of budget inter-city coach service, megabus.com, in United States • Growth at Virgin Rail Group o Continued revenue growth on West Coast and CrossCountry franchises o Winning market share from airlines o Good prospects for re-negotiated West Coast franchise • Stagecoach Group Board appointment o Appointment of Garry Watts as non-executive -

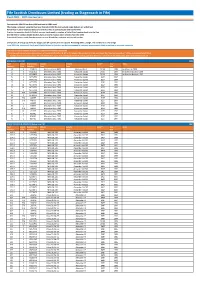

Historic Fleetlists.Xlsx

Fife Scottish Omnibuses Limited (trading as Stagecoach in Fife) Fleet 2001… 40th Anniversary Fleet strength 294 (25 less than 1996 and back to 1991 level) After being a constant since the fleet was formed in 1961 the last Leyland single deckers are withdrawn 30 low floor 'Loliner' branded buses are now in service at Cowdenbeath and Dunfermline A return to operating Scottish Citylink services has brought a number of toilet fitted coaches back into the fleet Over 50 former London double deckers have arrived to replace older vehicles from the 1970s Stagecoach Express coach fleet has grown to over 40 vehicles, including articulated coaches Livery notes; A new group livery for Stagecoach UK operations is introduced. Retaining white, orange, red and blue in a new design From 2000 Fife, Stagecoach Perth and Bluebird Buses in Aberdeen are being managed by common management albeit remaining as separate companies * LF next to a fleet number indicates it is low floor/wheelchair accessible ** Seating code shows a bus, dual purpose or coach (starts with a B, DP or C) followed by number of seats and then F (for front entranced) a 't' at the end means toilet fitted *** Double decker seating is shown 'H' followed by the upper deck seating/lower deck seating and then the door code (F for front entranced). Open top vehicles start 'O' MINIBUSES (Total 20) 2001 Fleet Depot Registration Chassis Vehicle Seats** Year Notes Number* Alloc Number Type Type New 16 K F234NLS Mercedes Benz 609D Mercedes Benz DP18F 1988 ex Alisons in 2000 17 K M317RSO Mercedes Benz