“The Everything Store”

Total Page:16

File Type:pdf, Size:1020Kb

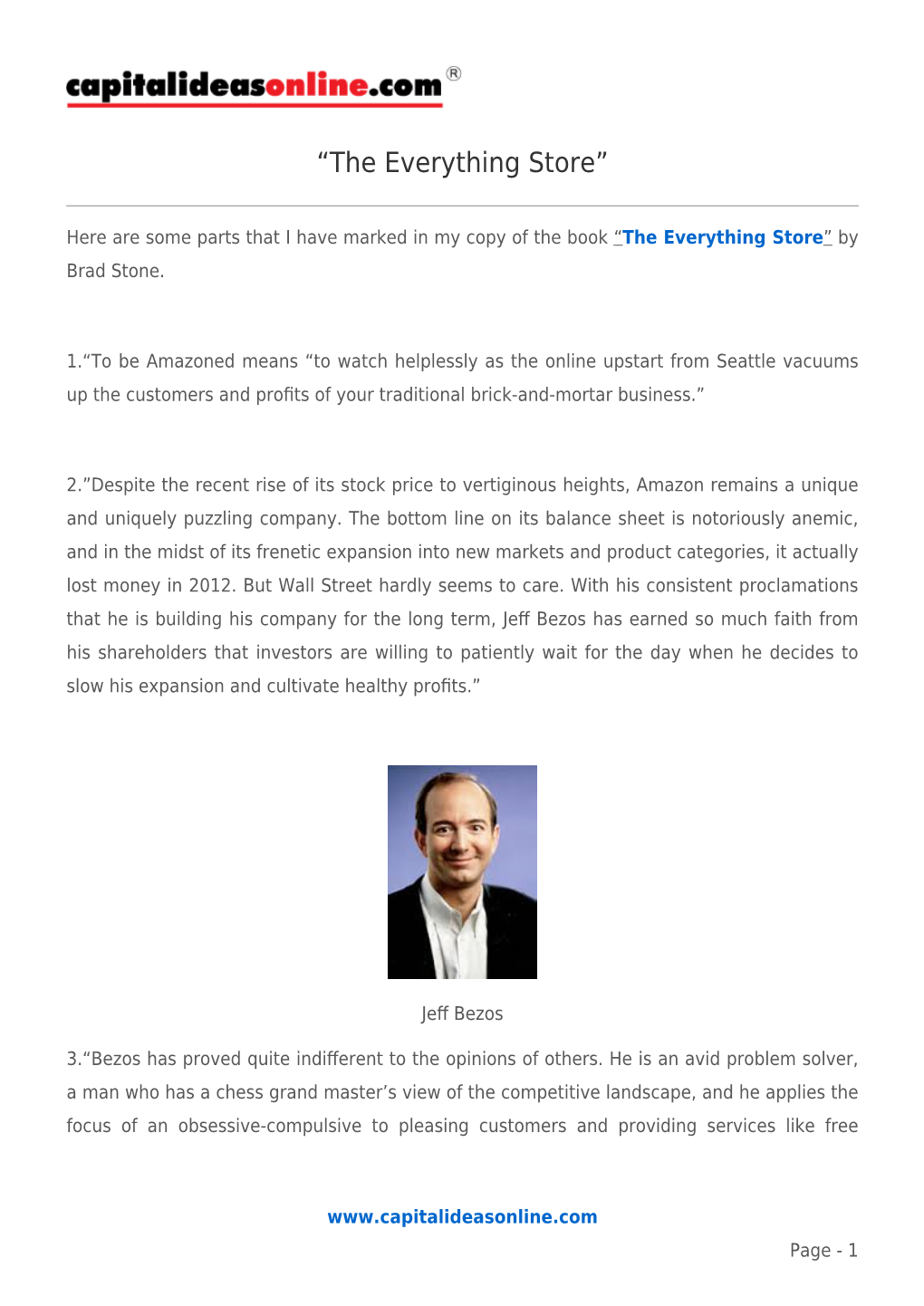

Load more

Recommended publications

-

Is an Immersive and Intense Journey That Digs Deep Into Each of Its Main Characters’ Souls

ADVERTISEMENT IS AN IMMERSIVE AND INTENSE JOURNEY THAT DIGS DEEP INTO EACH OF ITS MAIN CHARACTERS’ SOULS. JANUARY 2, 2020 US $9.99 JAPAN ¥1280 CANADA $11.99 CHINA ¥80 UK £ 8 HONG KONG $95 EUROPE €9 RUSSIA 400 AUSTRALIA $14 INDIA 800 3 GOLDEN GLOBE® NOMINATIONS INCLUDING DRAMA BEST DIRECTOR BEST PICTURE SAM MENDES CRITICS’ CHOICE AWARDS NOMINATIONS INCLUDING 8 BEST DIRECTOR BEST PICTURE SAM MENDES THE BEST OF THE LIKE NO FILM YOU A MASTERWORK OF PICTURE YEAR IS HAVE SEEN. THE FIRST ORDER. YOU COULDN’T LOOK AWAY IF YOU WANTED TO. GOLDEN GLOBES YEARS HER MOMENT FOLLOWING ACCLAIMED ROLES IN ‘BOMBSHELL’ AND ‘ONCE UPON A TIME IN HOLLYWOOD,’ ACTOR-PRODUCER MARGOT ROBBIE STORMS THE NEW YEAR WITH A FLURRY OF CREATIVE ENDEAVORS BY KATE AURTHUR P.5 0 P.50 Hollywood on Her Terms Margot Robbie is charging ahead as both an actor and a producer, carving a path for other women along the way. By KATE AURTHUR P.58 Creative Champion AMC Networks programming chief Sarah Barnett competes with streamers by nurturing creators of new cultural hits. By DANIEL HOLLOWAY P.62 Variety Digital Innovators 2020 Twelve leading minds in tech and entertainment are honored for pushing content boundaries. By TODD SPANGLER and JANKO ROETTGERS HANEL; HAIR: BRYCE SCARLETT/THE WALL GROUP/MOROCCAN OIL; MANICURE: TOM BACHIK; DRESS: CHANEL BACHIK; OIL; MANICURE: TOM GROUP/MOROCCAN WALL SCARLETT/THE HANEL; HAIR: BRYCE VARIETY.COM JANUARY 2, 2020 JANUARY (COVER AND THIS PAGE) PHOTOGRAPHS BY ART STREIBER; WARDROBE: KATE YOUNG/THE WALL GROUP; MAKEUP: PATI DUBROFF/FORWARD ARTISTS/C -

New Architectures for Sustainable Social Networking

Supporting Kalyāṇamittatā Online: New Architectures for Sustainable Social Networking Paul Trafford Oxford, UK [email protected] 1-2 December 2010 3rd World Conference on Buddhism and Science 1 About these slides (version 1.0s for Slideshare) These slides are based on those that I used for a presentation entitled: Supporting Kalyāṇamittatā Online: New Architectures for Sustainable Social Networking given at the 3rd World Conference on Buddhism and Science ( http://www.wcbsthailand.com/ ) held 1-2 December 2010 at the College of Religious Studies, Mahidol University, Thailand. The slides are generally the same, except here I've inserted details of citations. Note also that some words use diacritics and were authored with the Times Ext Roman font. The content is provided under the Creative Commons License 2.0 Attribution 2.0 Generic. - Paul Trafford, Oxford. 1-2 December 2010 3rd World Conference on Buddhism and Science 2 Preface: School Friends "Paul"Paul doesn'tdoesn't havehave manymany friendsfriends butbut hehe hashas goodgood friends.”friends.” Teacher,Teacher, Parents'Parents' Evening,Evening, HagleyHagley FirstFirst SchoolSchool c.1977c.1977 1-2 December 2010 3rd World Conference on Buddhism and Science 3 Photo copyright © Hagley Community Association Overview of Presentation 1. Introduction 2. Approaches in Social Sciences: Well-being 3. Buddhist Architectures for Sustainable Relationships Online 4. Conclusions 1-2 December 2010 3rd World Conference on Buddhism and Science 4 Part 1: Introduction 1-2 December 2010 3rd World -

Steve Yegge on Google and Amazon Platforms

I was at Amazon for about six and a half years, and now I've been at Google for that long. One thing that struck me immediately about the two companies -- an impression that has been reinforced almost daily -- is that Amazon does everything wrong, and Google does everything right. Sure, it's a sweeping generalization, but a surprisingly accurate one. It's pretty crazy. There are probably a hundred or even two hundred different ways you can compare the two companies, and Google is superior in all but three of them, if I recall correctly. I actually did a spreadsheet at one point but Legal wouldn't let me show it to anyone, even though recruiting loved it. I mean, just to give you a very brief taste: Amazon's recruiting process is fundamentally flawed by having teams hire for themselves, so their hiring bar is incredibly inconsistent across teams, despite various efforts they've made to level it out. And their operations are a mess; they don't really have SREs and they make engineers pretty much do everything, which leaves almost no time for coding - though again this varies by group, so it's luck of the draw. They don't give a single shit about charity or helping the needy or community contributions or anything like that. Never comes up there, except maybe to laugh about it. Their facilities are dirt-smeared cube farms without a dime spent on decor or common meeting areas. Their pay and benefits suck, although much less so lately due to local competition from Google and Facebook. -

Everything You Need to Know About Internet Marketing

© Tourism Intelligence International www.tourism-intelligence.com Everything You Need to Know About Internet Marketing Market Intelligence Report www.Tourism-Intelligence.com Everything You Need to Know about Internet Marketing 1 www.tourism-intelligence.com © Tourism Intelligence International 2 Everything You Need to Know about Internet Marketing © Tourism Intelligence International www.tourism-intelligence.com Tourism Intelligence International is a leading research and consultancy company with offices in Germany and Trinidad. This report — Everything You Need to Know About Internet Marketing — is another in a series of tourism market analyses. Tourism Intelligence International is the publisher of Tourism Industry Intelligence, a monthly newsletter that provides analyses of and tracks the key trends and developments in the international travel and tourism industry, that is also available in Spanish. Other reports from Tourism Intelligence International include: Travel & Tourism’s Top Ten Emerging Markets €999.00 How Americans will Travel 2015 €1,299.00 How Germans will Travel 2015 €1,299.00 Everything you Need to Know about Internet Marketing €1,299.00 Sustainable Tourism Development – A Practical Guide for €1,299.00 Decision-Makers Successful Hotels and Resorts – Lessons from the Leaders €1,299.00 Successful Tourism Destinations – Lessons from the Leaders €1,299.00 The Impact of the Global Recession on Travel and Tourism €499.00 How the British will Travel 2015 €1,299.00 How the Japanese will Travel 2007 €799.00 Impact of Terrorism on World Tourism €499.00 Old but not Out – How to Win and Woo the Over 50s market €499.00 The ABC’s of Generation X, Y and Z Travellers €999.00 Tourism Intelligence International: German Office Trinidad Office An der Wolfskuhle 48 8 Dove Dr, P.O. -

Online-Buchhandel in Deutschland Die Buchhandelsbranche Vor Der Herausforderung Des Internet

Online-Buchhandel in Deutschland Die Buchhandelsbranche vor der Herausforderung des Internet Ulrich Riehm, Carsten Orwat und Bernd Wingert sind wissenschaftliche Mitarbeiter des Instituts für Technikfolgenabschätzung und Systemanaly- se (ITAS) des Forschungszentrums Karlsruhe. Kontakt: Forschungszentrum Karlsruhe, ITAS, Postfach 3640, 76021 Karlsruhe Tel.: 07247/82-2501, Fax: 07247/82-4806, E-Mail: [email protected] Die Projektseite im Internet lautet: http://www.itas.fzk.de/deu/projekt/pob.htm Die Studie zum Online-Buchhandel in Deutsch- land wurde durchgeführt im Auftrag der Akade- mie für Technikfolgenabschätzung in Baden- Württemberg, Stuttgart. Ulrich Riehm, Carsten Orwat, Bernd Wingert Online-Buchhandel in Deutschland Die Buchhandelsbranche vor der Herausforderung des Internet Forschungszentrum Karlsruhe Technik und Umwelt © Copyright 2001 Ulrich Riehm, Carsten Orwat, Bernd Wingert – Karlsruhe Überarbeitete und erweiterte Fassung des als Ar- beitsbericht Nr. 192 bei der Akademie für Tech- nikfolgenabschätzung in Baden-Württemberg unter gleichem Titel erschienen Berichts. Das Werk einschließlich aller seiner Teile ist ur- heberrechtlich geschützt. Jede Verwertung ist ohne Zustimmung der Autoren unzulässig. Das gilt insbesondere für Vervielfältigungen, Über- setzungen, Mikroverfilmungen, die Einspeiche- rung und Verarbeitung in elektronische Systeme, die körperliche und unkörperliche Wiedergabe am Bildschirm oder auf dem Wege der Daten- fernübertragung. Umschlaggestaltung: Nicole Gross, Forschungs- zentrum Karlsruhe Umschlagfoto: Markus Breig, Forschungs- zentrum Karlsruhe Bezugswege: Die gedruckte Ausgabe kann über jede stationäre wie Internet-Buchhandlung bezogen werden oder auch direkt bei Books on Demand GmbH, Norderstedt (http://www.bod.de). Die elektronischen Ausgaben, vollständig oder kapitelweise, zum Lesen am Bildschirm oder zum Ausdrucken auf dem Bürodrucker, sind erhält- lich über Spezialbuchläden für elektronische Bü- cher und bei allgemeinen Online-Buchläden: http://www.ciando.com, http://www.epodium.de, http://www.dibi.de, http://www.amazon.de. -

The Complete Guide to Social Media from the Social Media Guys

The Complete Guide to Social Media From The Social Media Guys PDF generated using the open source mwlib toolkit. See http://code.pediapress.com/ for more information. PDF generated at: Mon, 08 Nov 2010 19:01:07 UTC Contents Articles Social media 1 Social web 6 Social media measurement 8 Social media marketing 9 Social media optimization 11 Social network service 12 Digg 24 Facebook 33 LinkedIn 48 MySpace 52 Newsvine 70 Reddit 74 StumbleUpon 80 Twitter 84 YouTube 98 XING 112 References Article Sources and Contributors 115 Image Sources, Licenses and Contributors 123 Article Licenses License 125 Social media 1 Social media Social media are media for social interaction, using highly accessible and scalable publishing techniques. Social media uses web-based technologies to turn communication into interactive dialogues. Andreas Kaplan and Michael Haenlein define social media as "a group of Internet-based applications that build on the ideological and technological foundations of Web 2.0, which allows the creation and exchange of user-generated content."[1] Businesses also refer to social media as consumer-generated media (CGM). Social media utilization is believed to be a driving force in defining the current time period as the Attention Age. A common thread running through all definitions of social media is a blending of technology and social interaction for the co-creation of value. Distinction from industrial media People gain information, education, news, etc., by electronic media and print media. Social media are distinct from industrial or traditional media, such as newspapers, television, and film. They are relatively inexpensive and accessible to enable anyone (even private individuals) to publish or access information, compared to industrial media, which generally require significant resources to publish information. -

ENT 202 – Introduction to Entrepreneurial Ventures Is a Semester Course Work of 2 Credit Units

COURSE GUIDE ENT 202 INTRODUCTION TO ENTREPRENEURIAL VENTURES Course Team Dr. Cletus Akenbor – (Course Writer) Department of Business Administration Faculty of Management Sciences Federal University, Otuoke Prof. Bello Sabo - (Course Editor) Department of Business Administration Faculty of Administration Ahmadu Bello University, Zaria Dr. Lawal Kamaldeen A.A (H.O.D) Department of Entrepreneurial Studies Faculty of Management Sciences National Open University of Nigeria Dr. Timothy Ishola (Dean) Faculty of Management Sciences National Open University of Nigeria NATIONAL OPEN UNIVERSITY OF NIGERIA 1 National Open University of Nigeria Headquarters University Village Plot 91 Cadastral Zone Nnamdi Azikiwe Expressway Jabi, Abuja. Lagos Office 14/16 Ahmadu Bello Way Victoria Island, Lagos e-mail: [email protected] URL: www.noun.edu.ng Published by: National Open University of Nigeria ISBN: Printed: 2017 All Rights Reserved 2 COURSE GUIDE TABLE OF CONTENT Introduction Course Content Course Aims Objectives Course Materials Study Units The Modules Assignment Assessment Summary 3 INTRODUCTION ENT 202 – Introduction to Entrepreneurial Ventures is a semester course work of 2 credit units. It is available to all students taking the B.Sc Entrepreneurship programme in the Department of Entrepreneurial Studies, Faculty of Management Sciences. The course consists of 13 units which cover the concept and y of organization success. The course guide tells you what ENT 202 is all about, the materials you will be using and how to make use of them. Other information includes the self assessment and tutor-marked questions. COURSE CONTENT The course content consists of entrepreneurial ventures COURSE AIMS The aim of this course is to expose: - understand the character of ventures - explain the long-term character of venture - explain the short – term character of venture 4.0. -

Scalability Rules: Principles for Scaling Web Sites

Praise for the First Edition of Scalability Rules “Once again, Abbott and Fisher provide a book that I’ll be giving to our engineers. It’s an essential read for anyone dealing with scaling an online business.” —Chris Lalonde, GM of Data Stores, Rackspace “Abbott and Fisher again tackle the difficult problem of scalability in their unique and practical manner. Distilling the challenges of operating a fast-growing presence on the Internet into 50 easy-to-understand rules, the authors provide a modern cookbook of scalability recipes that guide the reader through the difficulties of fast growth.” —Geoffrey Weber, VP, Internet Operations, Shutterfly “Abbott and Fisher have distilled years of wisdom into a set of cogent principles to avoid many nonobvious mistakes.” —Jonathan Heiliger, VP, Technical Operations, Facebook “In The Art of Scalability, the AKF team taught us that scale is not just a technology challenge. Scale is obtained only through a combination of people, process, and tech- nology. With Scalability Rules, Martin Abbott and Michael Fisher fill our scalability toolbox with easily implemented and time-tested rules that once applied will enable massive scale.” —Jerome Labat, VP, Product Development IT, Intuit “When I joined Etsy, I partnered with Mike and Marty to hit the ground running in my new role, and it was one of the best investments of time I have made in my career. The indispensable advice from my experience working with Mike and Marty is fully captured here in this book. Whether you’re taking on a role as a technology leader in a new company or you simply want to make great technology decisions, Scalability Rules will be the go-to resource on your bookshelf.” —Chad Dickerson, CTO, Etsy “Scalability Rules provides an essential set of practical tools and concepts anyone can use when designing, upgrading, or inheriting a technology platform. -

AMAZON.COM, INC. (Exact Name of Registrant As Specified in Its Charter) Delaware 91-1646860 (State Or Other Jurisdiction (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2004 or ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File No. 000-22513 AMAZON.COM, INC. (Exact name of registrant as specified in its charter) Delaware 91-1646860 (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) 1200 12th Avenue South, Suite 1200, Seattle, Washington 98144-2734 (206) 266-1000 (Address and telephone number, including area code, of registrant’s principal executive offices) Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $.01 per share Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes È No ‘ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Music's On-Line Future Shapes up by Juliana Koranteng Line Music Market

ave semen JANUARY 22, 2000 Music Volume 17, Issue 4 Media. £3.95 W-411` talk -C41:30 rya dio M&M chart toppers this week Music's on-line future shapes up by Juliana Koranteng line music market. Also, the deal could untoward about one of the world's Eurochart Hot 100 Singles catapult Warner Music Group (WMG), media groups merging with the world's EIFFEL 65 LONDON - Last week's unexpectedTime Warner's music division, intomost successful on-line group," notes Move You Body takeover of Time Warner by on-linefrontrunner positioninthedigital New York -based Aram Sinnreich, ana- (Bliss Co.) giant America Online (AOL) not only delivery race among the five majors. lyst at Jupiter Communications. "It will European Top 100 Albums confirms the much predicted conver- The AOL/Time Warner merger help speed the adoption of on-line music immediatelyovershadowedother by consumers." Sinnreich adds that "It CELINE DION gence of old and new media, but also acknowledges the Internet as the importantdownloadable could even make or break a All The Way..A Decade of Song biggest influence on the future music deals announced band, which has not been (Epic/Columbia) growth of global music sales. A M ER ICA shortly beforehand byTI\IF. ARNFR done so far on the Internet. European Radio Top 50 According to analysts, Universal Music But AOL has the ability to CELINE DION shareholderandregulatory Group(UMG) andSony do so. As a well-known global brand, AOL's ambitions will be far-reaching. That's The Way It'Is approval of AOL/Time Warn- Music Entertainment (SME). -

Minden Eladó

Brad Stone Minden eladó Jeff Bezos és az Amazon kora A fordítás alapja: Brad Stone: Everything Store – Jeff Bezos and the Age of Amazon. This edition published by arrangement with Little, Brown, and Company, New York, USA. All rights reserved. © Brad Stone, 2013 Fordította © Dufka Hajnalka, 2014 Szerkesztette: Csizner Ildikó Borítóterv: Megyeri Gabriella HVG Könyvek Kiadóvezető: Budaházy Árpád Felelős szerkesztő: Koncz Gábor ISBN 978-963-304-197-0 Minden jog fenntartva. Jelen könyvet vagy annak részleteit tilos reprodukálni, adatrendszerben tárolni, bármely formában vagy eszközzel – elektronikus, fényképészeti úton vagy más módon – a kiadó engedélye nélkül közölni. Kiadja a HVG Kiadó Zrt., Budapest, 2016 Felelős kiadó: Szauer Péter www.hvgkonyvek.hu Nyomdai előkészítés: Sörfőző Zsuzsa Nyomás: Gyomai Kner Nyomda Zrt. Felelős vezető: Fazekas Péter Isabella és Calista Stone-nak „Amikor az ember nyolcvanévesen egy nyugodt pillanatban vissza- gondol az életére, és legszemélyesebb krónikáját próbálja felidézni, a legtömörebb és legérvényesebb összegzést addigi döntéseinek egymás- utánja adja. Végső soron a döntéseink határoznak meg minket.” Jeff Bezos beszéde a Princetoni Egyetem diplomaosztó ünnepségén, 2010. május 30. Tartalom Elõszó 11 I. rész: HIT 1. fejezet: Kvantok háza 25 2. fejezet: Bezos könyve 38 3. fejezet: Lázálmok 74 4. fejezet: Milliravi 111 II. rész: OLVASMÁNYÉLMÉNYEK 5. fejezet: Rakétasrác 151 6. fejezet: Káoszelmélet 172 7. fejezet: Nem kereskedelmi – tech-no-ló-gi-a-i cég! 206 8. fejezet: Fiona 238 III. rész: HITTÉRÍTÕ VAGY ZSOLDOS? 9. fejezet: Felemelkedés 275 10. fejezet: Praktikus eszmények 301 11. fejezet: A kérdõjel birodalma 336 Utószó 357 Köszönetnyilvánítás 371 Függelék: Jeff Bezos olvasmánylistája 375 Jegyzetek 379 Név- és tárgymutató 388 Elõszó Az 1970-es évek elején egy ambiciózus reklámigazgató, Julie Ray egy nem mindennapi közoktatási program megszállottja lett, amely a Texas állambeli Houstonban működött, és a tehetséges gyermekeket karolta fel. -

How Innovation Works a Bright Future Not All Innovation Is Speeding up the Innovation Famine China’S Innovation Engine Regaining Momentum

Dedication For Felicity Bryan Contents Cover Title Page Dedication Introduction: The Infinite Improbability Drive 1. Energy Of heat, work and light What Watt wrought Thomas Edison and the invention business The ubiquitous turbine Nuclear power and the phenomenon of disinnovation Shale gas surprise The reign of fire 2. Public health Lady Mary’s dangerous obsession Pasteur’s chickens The chlorine gamble that paid off How Pearl and Grace never put a foot wrong Fleming’s luck The pursuit of polio Mud huts and malaria Tobacco and harm reduction 3. Transport The locomotive and its line Turning the screw Internal combustion’s comeback The tragedy and triumph of diesel The Wright stuff International rivalry and the jet engine Innovation in safety and cost 4. Food The tasty tuber How fertilizer fed the world Dwarfing genes from Japan Insect nemesis Gene editing gets crisper Land sparing versus land sharing 5. Low-technology innovation When numbers were new The water trap Crinkly tin conquers the Empire The container that changed trade Was wheeled baggage late? Novelty at the table The rise of the sharing economy 6. Communication and computing The first death of distance The miracle of wireless Who invented the computer? The ever-shrinking transistor The surprise of search engines and social media Machines that learn 7. Prehistoric innovation The first farmers The invention of the dog The (Stone Age) great leap forward The feast made possible by fire The ultimate innovation: life itself 8. Innovation’s essentials Innovation is gradual Innovation is different from invention Innovation is often serendipitous Innovation is recombinant Innovation involves trial and error Innovation is a team sport Innovation is inexorable Innovation’s hype cycle Innovation prefers fragmented governance Innovation increasingly means using fewer resources rather than more 9.