Print This Briefing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

World's Largest Container Ship Successfully Passes Through the Suez Canal | Datamarnews

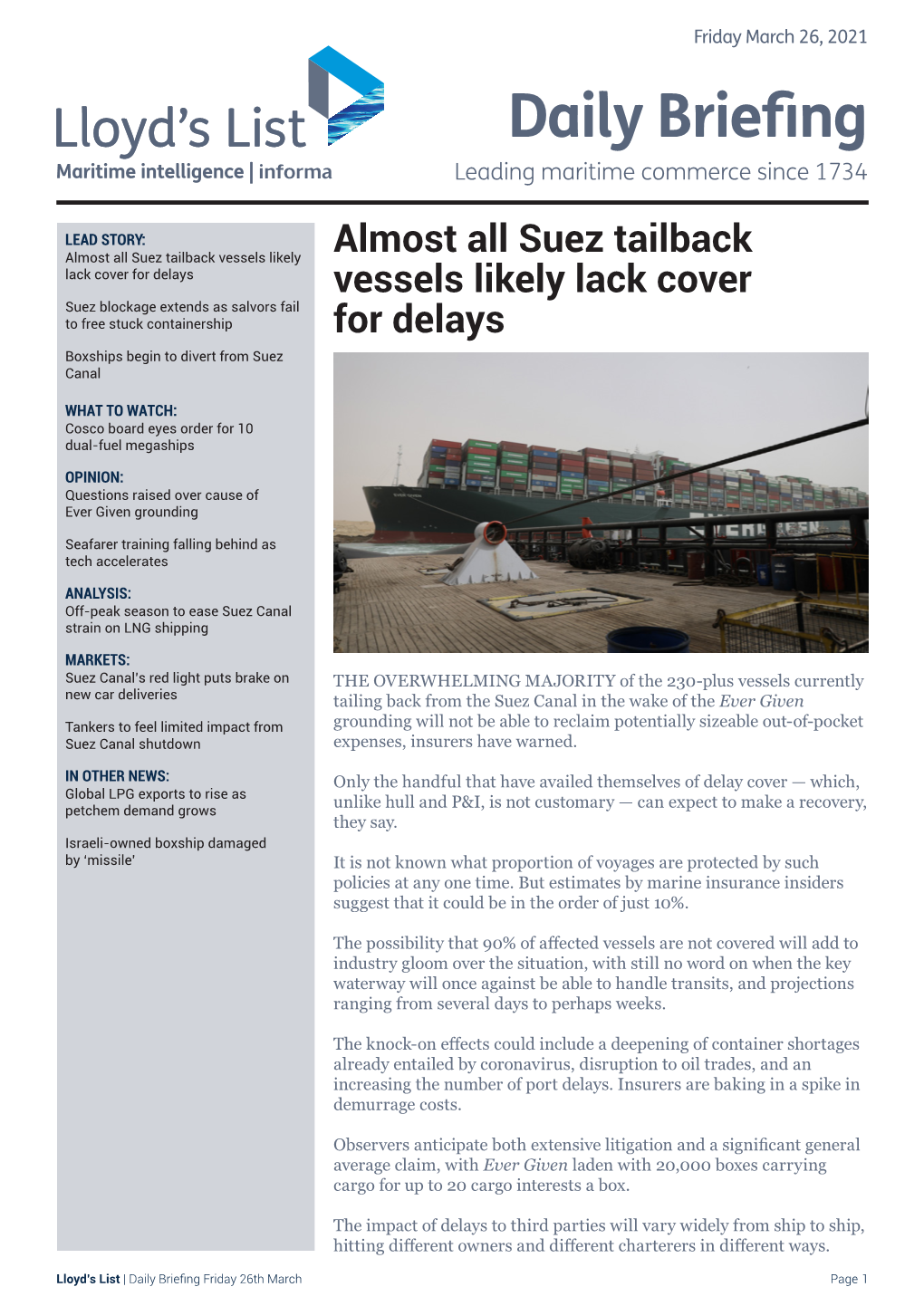

9/3/21, 4:43 PM World's Largest Container Ship Successfully Passes Through the Suez Canal | DatamarNews About Contact Us Media Kit SHIPPING WORLD’S LARGEST CONTAINER SHIP SUCCESSFULLY PASSES THROUGH THE SUEZ CANAL Sep, 02, 2021 Posted by Sylvia Schandert Week 202135 On August 28, the Ever Ace container ship made waves and turned heads with its unusual appearance. This monstrous oating box was built by Samsung Heavy Industries for Evergreen Marine Corporation and has a capacity of 23,992 TEU (twenty-foot equivalent unit), making it the largest such vessel in the world. It is the newest addition to Evergreen’s eet and was delivered by the builder this July. The Ever Ace measures 1,312 ft (400 meters) in length and weighs approximately 235,000 tons. Because of its large size, the Suez Canal Authority (SCA) followed its protocols and offered navigation support during the transit, ensuring a safe passage of the ship. It also welcomed the captain and the crew of the vessel. The SCA later shared the moment on social media. Earlier this month, the Ever Ace set sail from the Port of Taipei in Taiwan, beginning its maiden voyage. Its destination is the Port of Rotterdam in the Netherlands, where the container ship is expected to arrive on September 4. Evergreen Marine Corporation also owns the Ever Given ship, which made the headlines this spring for blocking the Suez Canal and causing a major disruption in global trade. It took six days to reoat it and hundreds of vessels had to wait their turn to pass through the 120-mile (193 km) long canal. -

Malacca-Max the Ul Timate Container Carrier

MALACCA-MAX THE UL TIMATE CONTAINER CARRIER Design innovation in container shipping 2443 625 8 Bibliotheek TU Delft . IIIII I IIII III III II II III 1111 I I11111 C 0003815611 DELFT MARINE TECHNOLOGY SERIES 1 . Analysis of the Containership Charter Market 1983-1992 2 . Innovation in Forest Products Shipping 3. Innovation in Shortsea Shipping: Self-Ioading and Unloading Ship systems 4. Nederlandse Maritieme Sektor: Economische Structuur en Betekenis 5. Innovation in Chemical Shipping: Port and Slops Management 6. Multimodal Shortsea shipping 7. De Toekomst van de Nederlandse Zeevaartsector: Economische Impact Studie (EIS) en Beleidsanalyse 8. Innovatie in de Containerbinnenvaart: Geautomatiseerd Overslagsysteem 9. Analysis of the Panamax bulk Carrier Charter Market 1989-1994: In relation to the Design Characteristics 10. Analysis of the Competitive Position of Short Sea Shipping: Development of Policy Measures 11. Design Innovation in Shipping 12. Shipping 13. Shipping Industry Structure 14. Malacca-max: The Ultimate Container Carrier For more information about these publications, see : http://www-mt.wbmt.tudelft.nl/rederijkunde/index.htm MALACCA-MAX THE ULTIMATE CONTAINER CARRIER Niko Wijnolst Marco Scholtens Frans Waals DELFT UNIVERSITY PRESS 1999 Published and distributed by: Delft University Press P.O. Box 98 2600 MG Delft The Netherlands Tel: +31-15-2783254 Fax: +31-15-2781661 E-mail: [email protected] CIP-DATA KONINKLIJKE BIBLIOTHEEK, Tp1X Niko Wijnolst, Marco Scholtens, Frans Waals Shipping Industry Structure/Wijnolst, N.; Scholtens, M; Waals, F.A .J . Delft: Delft University Press. - 111. Lit. ISBN 90-407-1947-0 NUGI834 Keywords: Container ship, Design innovation, Suez Canal Copyright <tl 1999 by N. Wijnolst, M . -

1 Present Facilities, Equipment and Natural Condition

Chapter 1 Present facilities, equipment and natural condition 1.1 The Canal The Suez Canal is a waterway of 162.25km in length, which bridges the Mediterranean Sea and the Red Sea. North and South Approaches are set at both ends of the Canal. Timsah Lake, the Great Bitter Lake and the Little Bitter Lake are situated along the Canal. Layout of the Canal is shown in Figure 1.1.1. Table 1.1.1 Outline of the Suez Canal Overall length 190.250km From Port Said to Port Tewfic 162.250km From Port Said to Ismailia 78.500km From Ismailia to Port Tewfic 83.750km From the fairway buoy to Port Said lighthouse 19.500km From the waiting area to the southern entrance 15.000km The length of doubled parts 78.000km Width at water level (North/South) 345/280m Width between buoys (North/South) 210/180m Maximum permissible draught for ships 58ft Cross section area (North/South) 4,500/3,900m2 Being increased 4,700/4,000m2 Permissible speed for tankers group 11-15km/hr for other vessels 13-16km/hr Source) SCA Table 1.1.2 Historical Progress of the Suez Canal Item 1869 1956 1962 1980 1994 1996 2000 Overall Length (km) 164 175 175 190.25 190.25 190.25 190.25 Doubled Parts (km) - 29 29 78 78 78 78 Width at 11m depth (m) - 60 90 160 210/180 210/180 210/200 Water Depth (m) 10 14 15.5 19.5 20.5 21 21 Max. Draft of Ship (feet) 22 35 38 53 56 58 58 Cross Section Area (m2) 304 1,100 1,800 3,600 4,300 4,500 4,500 /3,800 /3,900 /4,100 Max. -

The Forgotten Fronts the First World War Battlefield Guide: World War Battlefield First the the Forgotten Fronts Forgotten The

Ed 1 Nov 2016 1 Nov Ed The First World War Battlefield Guide: Volume 2 The Forgotten Fronts The First Battlefield War World Guide: The Forgotten Fronts Creative Media Design ADR005472 Edition 1 November 2016 THE FORGOTTEN FRONTS | i The First World War Battlefield Guide: Volume 2 The British Army Campaign Guide to the Forgotten Fronts of the First World War 1st Edition November 2016 Acknowledgement The publisher wishes to acknowledge the assistance of the following organisations in providing text, images, multimedia links and sketch maps for this volume: Defence Geographic Centre, Imperial War Museum, Army Historical Branch, Air Historical Branch, Army Records Society,National Portrait Gallery, Tank Museum, National Army Museum, Royal Green Jackets Museum,Shepard Trust, Royal Australian Navy, Australian Defence, Royal Artillery Historical Trust, National Archive, Canadian War Museum, National Archives of Canada, The Times, RAF Museum, Wikimedia Commons, USAF, US Library of Congress. The Cover Images Front Cover: (1) Wounded soldier of the 10th Battalion, Black Watch being carried out of a communication trench on the ‘Birdcage’ Line near Salonika, February 1916 © IWM; (2) The advance through Palestine and the Battle of Megiddo: A sergeant directs orders whilst standing on one of the wooden saddles of the Camel Transport Corps © IWM (3) Soldiers of the Royal Army Service Corps outside a Field Ambulance Station. © IWM Inside Front Cover: Helles Memorial, Gallipoli © Barbara Taylor Back Cover: ‘Blood Swept Lands and Seas of Red’ at the Tower of London © Julia Gavin ii | THE FORGOTTEN FRONTS THE FORGOTTEN FRONTS | iii ISBN: 978-1-874346-46-3 First published in November 2016 by Creative Media Designs, Army Headquarters, Andover. -

Suez-Max Tanker Optimization

Design Analysis of a New Generation of Suezmax Tankers Igor Belamarić,1 Predrag Čudina,2 Kalman Žiha3 A thoroughly investigated design of a new generation of Suezmax tankers incorporating the builder's consideration in the form of a condensed mathematical model is presented. The design model is provided for practical application and for a fast assessment of the conceptual design. The design model is subjected to different methods of design analysis in order determine an adequate design and the appropriate procedure applicable in the design office. In addition, the computational, building and operational uncertainties involved in the design and mathematical model are considered. The uncertainty analysis based on tolerances indicates a wider choice of designs within acceptable limits. INTRODUCTION The enlarged profile of the Suez Canal, along with The design concept of the Suezmax tanker is intensive development of double-hull structures described by a mathematical/numerical model during the past number of years, has had a great following design principles [Watson & Gilfillan impetus on the design of a new generation of 1977, Taggart 1980]; this concept is subjected to an Suezmax tankers. analysis giving a solid basis for design selection and Basic dilemmas in the design of tankers concern the decision-making, [Žanić, Grubišić & Trincas 1992]. longitudinal bulkheads, shape of the midship section, Due to the large number of uncertainties involved cargo loading/unloading equipment, capacity and in the design model, a certain skepticism may arise design of segregated ballast tanks, as well as the among practicing engineers concerning highly arrangement of engine room, and have been sophisticated and accurate numerical procedures. -

Scorpio Tankers Inc. Company Presentation June 2018

Scorpio Tankers Inc. Company Presentation June 2018 1 1 Company Overview Key Facts Fleet Profile Scorpio Tankers Inc. is the world’s largest and Owned TC/BB Chartered-In youngest product tanker company 60 • Pure product tanker play offering all asset classes • 109 owned ECO product tankers on the 50 water with an average age of 2.8 years 8 • 17 time/bareboat charters-in vessels 40 • NYSE-compliant governance and transparency, 2 listed under the ticker “STNG” • Headquartered in Monaco, incorporated in the 30 Marshall Islands and is not subject to US income tax 45 20 38 • Vessels employed in well-established Scorpio 7 pools with a track record of outperforming the market 10 14 • Merged with Navig8 Product Tankers, acquiring 27 12 ECO-spec product tankers 0 Handymax MR LR1 LR2 2 2 Company Profile Shareholders # Holder Ownership 1 Dimensional Fund Advisors 6.6% 2 Wellington Management Company 5.9% 3 Scorpio Services Holding Limited 4.5% 4 Magallanes Value Investor 4.1% 5 Bestinver Gestión 4.0% 6 BlackRock Fund Advisors 3.3% 7 Fidelity Management & Research Company 3.0% 8 Hosking Partners 3.0% 9 BNY Mellon Asset Management 3.0% 10 Monarch Alternative Capital 2.8% Market Cap ($m) Liquidity Per Day ($m pd) $1,500 $12 $10 $1,000 $8 $6 $500 $4 $2 $0 $0 Euronav Frontline Scorpio DHT Gener8 NAT Ardmore Scorpio Frontline Euronav NAT DHT Gener8 Ardmore Tankers Tankers Source: Fearnleys June 8th, 2018 3 3 Product Tankers in the Oil Supply Chain • Crude Tankers provide the marine transportation of the crude oil to the refineries. -

A Short History of the Suez Canal.Pdf

Acknowledgements: Thanks to my son Adam and daughter-in-law Kylie Twomey who encouraged (read constantly hounded) me to write a book that related to a lecture that I had written. I promise that this is the start of a series! Also, to my son Andrew and daughter-in-law Rachel who inspire me to maintain a thirst for greater knowledge. And to my wife Julie who supported me during the long hours of putting this book together, providing suggestions and took responsibility for formatting the pages. And to Colin Patterson at Mumby Media for his valued input in reviewing this document prior to publication. Front cover: Photo courtesy Aashay Baindur/Wikimedia https://commons.wikimedia.org/wiki/File:Capesize_bulk_carrier_at_Suez_Canal_Bridge.JPG Back cover: Photo courtesy Alydox at English Wikipedia https://commons.wikimedia.org/wiki/File:DeLesseps.JPG Table of Contents A Few Interesting Canal Facts.......................................................... 1 The Course of the Suez Canal ........................................................... 2 Regional Geography .......................................................................... 3 Ancient Projects ................................................................................. 6 Early Ambitions ................................................................................. 9 Early Troubles ..................................................................................13 Canal Construction ..........................................................................16 Canal Completed -

(AGCS) Safety & Shipping Review 2021

ALLIANZ GLOBAL CORPORATE & SPECIALTY Safety and Shipping Review 2021 An annual review of trends and developments in shipping losses and safety SAFETY AND SHIPPING REVIEW 2021 About AGCS Allianz Global Corporate & Specialty (AGCS) is a leading global corporate insurance carrier and a key business unit of Allianz Group. We provide risk consultancy, Property‑Casualty insurance solutions and alternative risk transfer for a wide spectrum of commercial, corporate and specialty risks across 10 dedicated lines of business. Our customers are as diverse as business can be, ranging from Fortune Global 500 companies to small businesses, and private individuals. Among them are not only the world’s largest consumer brands, tech companies and the global aviation and shipping industry, but also satellite operators or Hollywood film productions. They all look to AGCS for smart answers to their largest and most complex risks in a dynamic, multinational business environment and trust us to deliver an outstanding claims experience. Worldwide, AGCS operates with its own teams in 31 countries and through the Allianz Group network and partners in over 200 countries and territories, employing around 4,400 people. As one of the largest Property‑ Casualty units of Allianz Group, we are backed by strong and stable financial ratings. In 2020, AGCS generated a total of €9.3 billion gross premium globally. www.agcs.allianz.com 2 PAGE 4 Executive summary PAGE 10 Losses in focus: 2011 to 2020 Trends PAGE 18 1. The Covid factors PAGE 28 2. Larger vessels PAGE 38 3. Supply chains and ports PAGE 42 4. Security and sanctions PAGE 48 5. -

Weekly Market Report

GLENPOINTE CENTRE WEST, FIRST FLOOR, 500 FRANK W. BURR BOULEVARD TEANECK, NJ 07666 (201) 907-0009 September 24th 2021 / Week 38 THE VIEW FROM THE BRIDGE The Capesize chartering market is still moving up and leading the way for increased dry cargo rates across all segments. The Baltic Exchange Capesize 5TC opened the week at $53,240/day and closed out the week up $8,069 settling today at $61,309/day. The Fronthaul C9 to the Far East reached $81,775/day! Kamsarmaxes are also obtaining excellent numbers, reports of an 81,000 DWT unit obtaining $36,500/day for a trip via east coast South America with delivery in Singapore. Coal voyages from Indonesia and Australia to India are seeing $38,250/day levels and an 81,000 DWT vessel achieved $34,000/day for 4-6 months T/C. A 63,000 DWT Ultramax open Southeast Asia fixed 5-7 months in the low $40,000/day levels while a 56,000 DWT supramax fixed a trip from Turkey to West Africa at $52,000/day. An Ultramax fixed from the US Gulf to the far east in the low $50,000/day. The Handysize index BHSI rose all week and finished at a new yearly high of 1925 points. A 37,000 DWT handy fixed a trip from East coast South America with alumina to Norway for $37,000/day plus a 28,000 DWT handy fixed from Santos to Morocco with sugar at $34,000/day. A 35,000 DWT handy was fixed from Morocco to Bangladesh at $45,250/day and in the Mediterranean a 37,000 DWT handy booked a trip from Turkey to the US Gulf with an intended cargo of steels at $41,000/day. -

Tanker Orders Turn to Bulkers

4 TradeWinds 19 October 2007 www.tradewinds.no www.tradewinds.no 19 October 2007 TradeWinds 5 DRY BULK DRY BULK More older Dollar signs tankers set for Capesize market hopping Tanker Trond Lillestolen Oslo sizes from NS Lemos of Greece start to erase and says one of the ships, the conversion The period-charter market for 164,000-dwt Thalassini Kyra capesizes was busy this week (built 2002), has been fixed to old stigmas Trond Lillestolen and Hans Henrik Thaulow with a large number of long-term Coros for 59 to 61 months at Oslo and Shanghai deals being done. $74,750 per day. Gillian Whittaker and Trond Lillestolen Quite a few five-year deals Hebei Ocean Shipping (Hosco) Athens and Oslo The rush to secure dry-bulk ton- orders have been tied up. One of the has fixed out two capesizes long nage is seeing more owners look- most remarkable was Singapore- term. The 172,000-dwt Hebei The hot dry-bulk market is ing to convert old tankers. based Chinese company Pacific Loyalty (built 1987) went to Old- closing the price gap for ships BW Group is converting two King taking the 171,000-dwt endorff Carriers for one year at built in former eastern-bloc more ships, while conversion Anangel Glory (built 1999) from $155,000 per day and Hanjin countries. specialist Hosco is acquiring the middle of 2008 at a full Shipping has taken the 149,000- Efnav of Greece is set to log a even more tankers and Neu $80,000 per day. The vessel is on dwt Hebei Forest (built 1989) for massive profit on a sale of a Seeschiffahrt is being linked to a turn to charter from China’s Glory two years at $107,000 per day. -

Adding Value to Global Logistics: the Expansion of the Suez Canal

EuDA 2018 Annual Conference Th 15/11/2018, Brussels European Dredgers adding Value to Society Worldwide Adding Value to Global Logistics: the Expansion of the Suez Canal Paris SANSOGLOU Secretary General European Dredging Association Presentation’s Objectives Demonstrate: cthe importance of the Suez Canal in Global Logistics cthe importance of the New Suez Canal Project cDredging is a problem-solving and solution-oriented sector ! Provide food for thought on the role of dredging and its contribution to global logistics infrastructures. Slide 2 Suez Canal Expansion Slide 3 Suez Canal Historical overview 1798: Napoleon Bonaparte discovers ancient waterway passage. North – South canal deemed impossible to an alleged water level difference (10m) 1854: Ferdinand de Lesseps obtains a concession to construct a canal open to ships of all nations 1859: Construction begins on the shore of future Port Said 1869: Opening of Canal under French control 1875: British buy minority shareholding in the canal for just under ₤4.0 million 1882: Britain invades Egypt and seizes control of the canal 1956: Nasser, second president of Egypt, nationalises the canal 1967 - 75: Suez canal is closed due to Arab-Israeli war 2014: President el-Sisi launches New Suez Canal project Slide 4 First Canal Project 1859-1869 § Designed for steam powered vessels (only 5% of traffic at that time) § Considered “crazy and utopic” by the British § 70.000.000 m3 – 10 years § Methodology: - Started with forced laborers, shovels and camels - Shifted to steam powered dredgers, introduction -

Surface Microplankton Composition at a Hyper Saline Oligotrophic Environment of Bitter Lake on the Suez Canal, Egypt

www.trjfas.org ISSN 1303-2712 Turkish Journal of Fisheries and Aquatic Sciences 14: 439-448 (2014) DOI: 10.4194/1303-2712-v14_2_14 Surface Microplankton Composition at a Hyper Saline Oligotrophic Environment of Bitter Lake on the Suez Canal, Egypt Hamed A El-Serehy1,2,*, Fahad A Al-Misned1, Hesham M Shafik3, Khaled A Al-Rasheid1, Magdy M Bahgat3 1 King Saud University, College of Science, Department of Zoology, B.O. Box 2455-Riyadh 11451, Saudi Arabia. 2 Port Said University, Faculty of Science, Department of Marine Science, Port Said, Egypt. 3 Port Said University, Faculty of Science, Department of Botany and Microbiology, Port Said, Egypt. * Corresponding Author: Tel.: +966.11 4675753; Fax: +966.11 4678514; Received 28 June 2013 E-mail: [email protected] Accepted 22 April 2014 Abstract The Bitter Lake is the central and most important water body of the Suez Canal as it contains 85% of the water of the canal system. This study reports the microplankton found occurring in the surface water of the Bitter Lake at monthly intervals from November 2008 until November 2009. A total of 130 taxa were identified, among which 67 taxa were of Bacillariophyceae, 15 Dinophyceae, 11 Chlorophyceae, 11 Cyanophyceae, 1 Euglenophyceae, 18 Tintinnidae, 4 Foraminiferidae, as well as 3 of Rotifera. Species diversity, numerical abundances and dynamics were analyzed for each taxon at three sites inside the Bitter Lake. At each of these sites Bacillariophyceae were predominant in the standing crop forming -1 67.2% of the total microplankton community with an average of 11,594 ind. L .