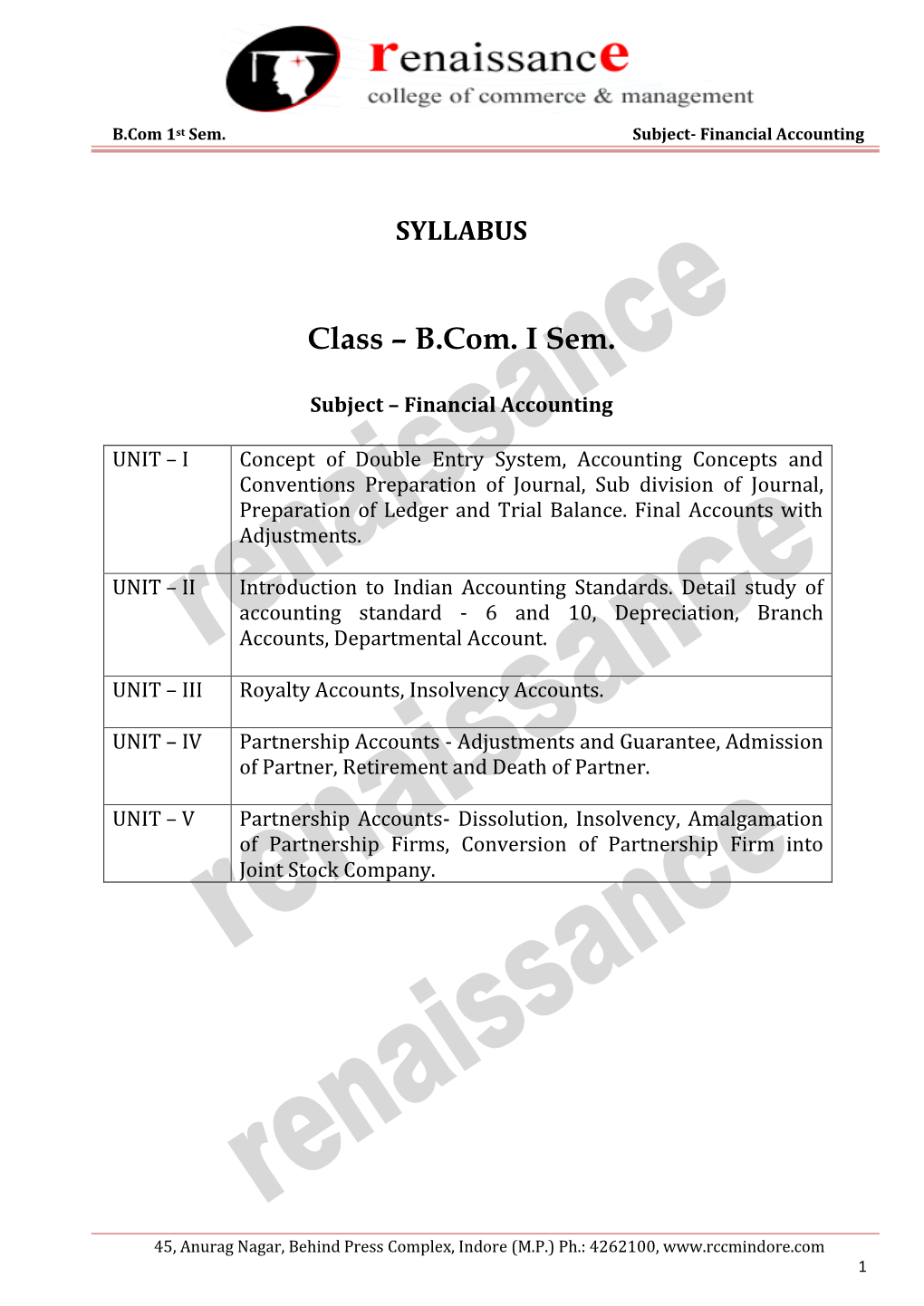

Class – B.Com. I Sem

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Basic Concepts Page 1 PARTNERSHIP ACCOUNTING

Dr. M. D. Chase Long Beach State University Advanced Accounting 1305-87B Partnership Accounting: Basic Concepts Page 1 PARTNERSHIP ACCOUNTING I. Basic Concepts of Partnership Accounting A. What is A Partnership?: An association of two or more persons to carry on as co-owners of a business for a profit; the basic rules of partnerships were defined by Congress: 1. Uniform Partnership Act of 1914 (general partnerships) 2. Uniform Limited Partnership Act of 1916 (limited partnerships) B. Characteristics of a Partnership: 1. Limited Life--dissolved by death, retirement, incapacity, bankruptcy etc 2. Mutual agency--partners are bound by each others’ acts 3. Unlimited Liability of the partners--the partnership is not a legal or taxable entity and therefore all debts and legal matters are the responsibility of the partners. 4. Co-ownership of partnership assets--all assets contributed to the partnership are owned by the individual partners in accordance with the terms of the partnership agreement; or equally if no agreement exists. C. The Partnership Agreement: A contract (oral or written) which can be used to modify the general partnership rules; partnership agreements at a minimum should cover the following: 1. Names or Partners and Partnership; 2. Effective date of the partnership contract and date of termination if applicable; 3. Nature of the business; 4. Place of business operations; 5. Amount of each partners capital and the valuation of each asset contributed and date the valuation was made; 6. Rights and responsibilities of each partner; 7. Dates of partnership accounting period; minimum capital investments for each partner and methods of determining equity balances (average, weighted average, year-end etc.) 8. -

The Federal Definition of Tax Partnership

Brooklyn Law School BrooklynWorks Faculty Scholarship Winter 2006 The edeF ral Definition of Tax Partnership Bradley T. Borden [email protected] Follow this and additional works at: https://brooklynworks.brooklaw.edu/faculty Part of the Other Law Commons, Taxation-Federal Commons, and the Tax Law Commons Recommended Citation 43 Hous. L. Rev. 925 (2006-2007) This Article is brought to you for free and open access by BrooklynWorks. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of BrooklynWorks. ARTICLE THE FEDERAL DEFINITION OF TAX PARTNERSHIP Bradley T. Borden* TABLE OF CONTENTS I. INTRODU CTION ...................................................................... 927 II. THE DEFINITIONS OF MULTIMEMBER TAx ENTITIES ............ 933 A. The EstablishedDefinitions .......................................... 933 B. The Open Definition: Tax Partnership......................... 936 III. HISTORY AND PURPOSE OF PARTNERSHIP TAXATION ............ 941 A. The Effort to Disregard................................................. 941 B. The Imposition of Tax Reporting Requirements ........... 943 C. The Statutory Definition of Tax Partnership............... 946 D. The 1954 Code: An Amalgam of the Entity and Aggregate Theories........................................................ 948 E. The Section 704(b) Allocation Rules and Assignment of Incom e ....................................................................... 951 F. The Anti-Abuse Rules .................................................... 956 * Associate Professor of Law, Washburn University School of Law, Topeka, Kansas; LL.M. and J.D., University of Florida Levin College of Law; M.B.A. and B.B.A., Idaho State University. I thank Steven A. Bank, Stanley L. Blend, Terrence F. Cuff, Steven Dean, Alex Glashausser, Christopher Hanna, Brant J. Hellwig, Dennis R. Honabach, Erik M. Jensen, L. Ali Khan, Martin J. McMahon, Jr., Stephen W. Mazza, William G. Merkel, Robert J. Rhee, William Rich, and Ira B. -

Unit 1 and 2 Nature and Formation of a Partnership

Unit 1 and 2 Nature and Formation of a Partnership A partnership is a contract whereby two or more persons bind themselves to contribute money, property or industry into a common fund with the intention of dividing the profit among themselves (Article 1767 of the Civil Code of the Philippines). This joint effort may be supported by a partnership agreement known as the Articles of Co-Partnership, which is an agreement in writing among the partners governing the nature and terms of the partnership contract. A written agreement is required when partnership capital is P 3,000 or more in money or in property. The Article of Co-partnership helps in avoid misunderstanding among the partners. The written agreement among the partners governs the formation, operation and dissolution of the partnership and is required to be registered with SEC. The Article of Co-partnership contains the following information: 1. The name of the partnership; 2. The names, addresses of the partners, classes of partners stating whether the partner is a general or a limited partner; 3. The effective date of the contract; 4. The purpose and principal place of business of the business; 5. The capital of the partnership stating the contributions of each of the partners; 6. The rights and duties of each of the partners; 7. The manner of dividing profit or loss among the partners; 8. The conditions under which the partners may withdraw money or other assets; 9. The manner of keeping the books of accounts; 10. The causes for dissolution and the provision for arbitration in settling disputes. -

APPENDIX B Partnerships Partnerships and Related Forms of Business

Appendix B 11/20/06 10:38 AM Page B-2 APPENDIX Partnerships B artnerships differ in many ways from sole proprietorships and corpo- Prations. Here, we describe their characteristics and those of related forms of business. We also examine management and accounting issues pertaining to the formation, dissolution, and liquidation of partnerships, as well as the division of income among partners. Because of the special characteristics of partnerships, individuals who engage in them should choose as partners people who have high ethical standards. LEARNING OBJECTIVES LO1 Describe the characteristics of partnerships and related forms of business. LO2 Record partners’investments of cash and other assets when a partnership is formed. LO3 Use stated ratios, capital balance ratios, and partners’salaries and interest to compute the income or losses that partners share. LO4 Record a person’s admission to or withdrawal from a partnership. LO5 Compute and record the distribution of assets to partners when they liquidate their partnership. B-2 Appendix B 11/9/06 4:30 PM Page B-3 DECISION POINT A USER’S FOCUS ERNST & YOUNG ● How does a firm as large as Ernst & Young organize to accomplish its objectives? ● How does a partnership account for its partners’ interests? ● What happens when partners enter or withdraw from a partnership? Many people think of partnerships as relatively small businesses, and usually they are right. However, some partnerships—among them law firms, invest- ment companies, real estate companies, and accounting firms—are very large. One example is Ernst & Young, an organization with offices in 140 countries and revenues of almost $17 billion. -

Identifying Partners' Interests in Profits and Capital

March 2007 Identifying Partners’ Interests in Profi ts and Capital: Uncertainties, Opportunities and Traps By Sheldon I. Banoff* The Problem 198 §1.706-1(b)(4) 215 Overview 200 Computation of PIPP—Other Administra- I. Survey of Operative Provisions Involving PIPP tive Guidance 216 and/or PIPC 202 Measuring PIPP: Judicial Guidance 218 II. Partner’s Interest in Partnership Profi ts: Mea- III. Partner’s Interest in Partnership Capital: Mea- surement Issues 230 surement Issues 223 Example 1—Proportionate Ownership of Example 17—Proportionate Ownership of Profi ts and Capital 205 Profi ts and Capital 224 Example 2—Changes in Profi ts and Losses Example 18—Disproportionate Allocation Mandated by Form of Passthrough Entity 205 of Losses 224 Example 3—Disproportionate Profi ts and Example 19—Disproportionate Contribu- Capital Due to Additional Profi ts Interest tions and Distributions 225 for Services 207 Example 20—Code Sec. 704(c) Built-in Example 4—Disproportionate Profi ts and Capital Gain or Loss 225 Due to Service Partner’s Profi ts Interest 208 IV. Practical and Administrative Aspects 226 Example 5—Guaranteed Payments 208 1. When Should PIPP and PIPC Be Measured? 226 Example 6—Code Sec. 707(a) Payments 209 2. What Is the Effect of Valid Retroactive Al- Example 7—Profi ts Interest for Services by locations of Profi ts and Losses in Measuring Partner’s Affi liate 209 PIPP and PIPC Through the Year? 228 Example 8—Differing Profi ts Interests for 3. What Is the Potential Impact of Changes or Shifts Differing Sources of Income 210 in Current and Future Profi ts Interests? 229 Example 9—Disproportionate Capital and Prof- 4. -

CCH Expert Treatise Library: Federal Taxation of Partnerships & Partners

CCH Expert Treatise Library: Federal Taxation of Partnerships & Partners, Table of Contents Click to open document in a browser PART 1 CHAPTER ONE-OVERVIEW AND GENERAL CONCEPTS ¶1.01 OVERVIEW —THE PARTNERSHIP'S ROLE IN THE MODERN WORLD ¶1.01[A] Defining "Partnership" for Purposes of this Treatise ¶1.01[B] A Brief (Non-Tax) History of Partnerships ¶1.01[C] The History and Structure of Subchapter K ¶1.02 ENTITY VS. AGGREGATE MODELS ¶1.02[A]Aggregate Model ¶1.02[B] Entity Model ¶1.02[C] Other Provisions ¶1.02[D] Tension and Significance of Distinction Between Aggregate and Entity Models ¶1.03 ROLE OF THE PARTNERSHIP AGREEMENT ¶1.04 TAX PLANNING WITH PARTNERSHIPS ¶1.04[A] Partnership Flexibility ¶1.04[B] Special Allocations ¶1.04[C] Code Section 736 Payments ¶1.04[D] Code Section 743 Basis Adjustments ¶1.05 LIMITS ON TAX PLANNING WITH PARTNERSHIPS ¶1.05[A] Substantial Economic Effect ¶1.05[B] Disguised Sales ¶1.05[C] Mixing Bowl Transactions ¶1.05[D] Family Partnerships ¶1.05[E] Partnership Anti-Abuse Rule ¶1.05[E][1] General Abuse-of-Subchapter-K-Rule ¶1.05[E][2] Abuse-of-Entity-Rule ¶1.05[E][3] Scope of Anti-Abuse Regulations ¶1.05[E][4] Criticisms of the Anti-Abuse Rule ¶1.06 GENERAL COMMENTS REGARDING PARTNERSHIP ACCOUNTING ¶1.06[A] Importance of Partnership Accounting ¶1.06[B] Overview of Partnership Financial Accounting ¶1.06[C] Introduction to Tax Accounting for Partnerships CHAPTER TWO-CHOICE OF ENTITY ¶2.01 OVERVIEW - CHOICE OF ENTITY ¶2.02 QUESTION ONE: CAN I USE A PASSTHROUGH ENTITY? ¶2.02[A] Restrictions on the Use of Partnerships—the -

Limited Partner by This Agreement

LIMITED PARTNERSHIP AGREEMENT OF Q3 I, LP Dated as of November 1, 2018 TABLE OF CONTENTS Page ARTICLE I – FORMATION AND PURPOSE ........................................................................................... 1 ARTICLE II – ADMISSION OF PARTNERS; CAPITALIZATION ......................................................... 2 ARTICLE III – CAPITAL ACCOUNTS; PROFITS AND LOSSES .......................................................... 3 ARTICLE IV – DISTRIBUTIONS OF CASH FLOWS; WITHDRAWALS .............................................. 6 ARTICLE V – POWERS, DUTIES AND RIGHTS OF GENERAL PARTNER ...................................... 10 ARTICLE VI – POWERS, RIGHTS AND OBLIGATIONS OF LIMITED PARTNERS ........................ 15 ARTICLE VII – ACCOUNTING, BOOKS AND RECORDS; REPORTS TO PARTNERS ................... 16 ARTICLE VIII –TRANSFER AND ASSIGNMENT OF PARTNERSHIP INTERESTS ........................ 17 ARTICLE IX – DISSOLUTION OF PARTNERSHIP .............................................................................. 18 ARTICLE X – POWER OF ATTORNEY ................................................................................................. 21 ARTICLE XI – MISCELLANEOUS ......................................................................................................... 21 APPENDIX A – DEFINITIONS ................................................................................................................ 25 -i- This FIRST AMENDED AND RESTATED LIMITED PARTNERSHIP AGREEMENT (the “Agreement”) of Q3 I, LP, a Delaware limited -

II B.COM SEMESTER : III SUBJECT : Partnership Accounting UNIT

STUDY MATERIAL COURSE : II B.COM SEMESTER : III SUBJECT : Partnership Accounting UNIT : V SUBJECT CODE: 18BCO31C Syllabus: Amalgamation of firms - Sale to a company Meaning of Amalgamation of firms When two or more business firms are merged to form a new business firm, resulting in closure of the old firms and continuation of the new firm, it is known as amalgamation of firms. In other words, when two or more existing partnership firms amalgamate and in their place, a new partnership firm is formed to take over their businesses, the process is called amalgamation of firms. The firms which are combined together are called "amalgamating firms" and the resulting new firm is called "amalgamated firm" . In short, old firms are amalgamating firms and the new firm is the amalgamated firm. Objectives or benefits of Amalgamation • The strategy of amalgamation of partnership firms is mainly adopted to achieve certain objectives and to reap certain benefits such as • avoidance of unhealthy competition, • Internal and external economies of large scale business, • enlarged marketing network, • efficiency of management personnel, • technology, • tax benefits, • gaining monopoly or dominant position in the market • reducing unnecessary expenses on advertising • achieving mass production at minimum cost, • better utilization of factors of production, and • getting more capital for expansion of the business. Forms of Amalgamation of Firms The amalgamation of firms may take place in any one of the following ways: (a) Merging of two or more sole traders to form a new partnership firm. (b) An existing partnership firm taking over an existing sole trading concern. Merging of two or more existing partnership firms, forming a new partnership firm. -

Case 3:04-Cv-01320-K^Pcument 46-2 Filed 02/11/05 P|Ge 10 of 51

Case 3:04-cv-01320-K^pcument 46-2 Filed 02/11/05 p |g e 10 of 51 PageiD 786 EXHIBIT “A” TO CONFIDENTIAL PRIVATE PLACEMENT MEMORANDUM Agreement o f lim ited Partnership CS 000059 Case 3:04-cv-01320-K^ocument 46-2 Filed 02/11/05 flBge 11 of 51 PagelD 787 SECOND AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP OF INTEGRAL ARBITRAGE, L.P. THE PARTNERSHIP INTERESTS REPRESENTED BY THIS AGREEMENT OF LIMITED PARTNERSHIP HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933 OR UNDER ANY OTHER APPLICABLE SECURITIES LAWS. SUCH INTERESTS MAY NOT BE SOLD, ASSIGNED, PLEDGED OR OTHERWISE DISPOSED OF AT ANY TIME WITHOUT EFFECTIVE REGISTRATION UNDER SUCH ACT AND LAWS OR EXEMPTION THEREFROM, AND COMPLIANCE WITH THE OTHER SUBSTANTIAL RESTRICTIONS ON TRANSFERABILITY SET FORTH HEREIN. CS 000060 Case 3:04-cv-01320-K^ocument 46-2 Filed 02/11/05 ABge 12 of 51 PageiD 788 TABLE OF CONTENTS Page ARTICLE ONE.............................................................................................................................. 1 Definitions............................................................................................................................ 1 ARTICLE TWO..............................................................................................................................4 General............................................................................................................................... 4 Section 201. Formation and Term........................................................................... -

Real Estate Accounting and Taxation Real Estate Accounting and Taxation

Sneak Preview Real Estate Accounting & Taxation By John F. Mahoney, CPA Included in this preview: • Copyright Page • Table of Contents • Excerpt of Chapter 1 For additional information on adopting this book for your class, please contact us at 800.200.3908 x71 or via e-mail at [email protected] Real Estate Accounting and Taxation Real Estate Accounting and Taxation by John F. Mahoney, CPA Copyright © 2008 by John F. Mahoney. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, without permission in writing from the publisher. University Readers is NOT affiliated or endorsed by any university or institution. First published in the United States of America in 2008 by University Readers Cover design by Monica Hui Hekman 12 11 10 09 08 1 2 3 4 5 Printed in the United States of America ISBN: 978-1-934269-26-8 (paper) Contents Chapter One: Choosing Type of Entity 3 Chapter Two: Key Principles of Real Estate Investing 15 Chapter Three: Basis 19 Chapter Four: Limitations on Loss Deductions 25 Chapter Five: Like-Kind Tax-Free Exchanges 31 Chapter Six: Accounting 37 Partnership Accounting Example 45 REIT Accounting Example 53 Chapter Seven: Utilizing Ratio Analysis for Decision Making 69 Chapter Eight: Utilizing Models for Decision Making 79 Chapter Nine: Long-term Construction Contracts 89 Chapter Ten: Synthetic Leases 93 Chapter One Choosing Type of Entity Choosing Type of Entity here are various forms of ownership that an individual or organization can choose to hold property in. The following is a brief summary of Tsome of them: SOLE PROPRIETORSHIP: One individual owns the business. -

Chapter 15 Partnerships

Chapter 15 Partnerships Most family forest land traditionally has been operated as Partnership Mechanics sole proprietorships or in joint fee ownership. Increasingly, however, nonindustrial forest landowners are turning to Partnership accounting procedures define partnership partnerships, limited liability companies (LLCs), and interests in terms of capital, profits, and losses. A corporations as the entities of choice. This particularly is partner’s capital interest is measured by his (her) capital true if two or more persons are involved in the ownership account, which reflects that person’s economic stake in and management. The trend has been accelerated in part due the partnership at any given time. Initial contributions are to the increasing financial value associated with managed recorded, and are increased to reflect income and decreased forest land and the desire to use prudent business and tax to reflect losses and distributions. practices. In many families, there also is a special interest in using partnerships, LLCs, and corporations for estate Partnership Units planning purposes. Family partnerships sometimes use partnership units to A key factor in selecting a form of organization is whether reflect ownership interests. These are similar to shares of it is intended that the family forest operation will continue stock and may be represented by paper certificates as is beyond the lives of the current owner(s). If this is not the stock. The use of units rather than percentage adjustments case, sole proprietorship may be the best vehicle. But if it on the partnership books makes gifts and sales of partnership is expected that the forest as an entity will continue into the interests to family members easier to accomplish. -

Partnerships

PARTNERSHIPS A PAPER PRESENTED AT THE 2004 CICA SYMPOSIUM Ottawa , Ontario October 4 - 6, 2004 MAURICE ARSENAULT ROBERT G. KREKLEWETZ [email protected] [email protected] RAYMOND CHABOT GRANT THORNTON MILLAR KREKLEWETZ LLP Membre du réseau Grant Thornton International Tax & Trade Lawyers Tour de la Banque Nationale BCE Place – Bay Wellington Tower 600, rue de La Gauchetière Quest 28th Floor, P.O. Box 745 Bureau 1900 181 Bay Street Montréal (Québec) Toronto, Ontario H3B 4L8 M5J 2T3 Telephone: (514) 878 - 2691 Telephone: (416) 864 – 6200 Facsimile: (514) 878 - 2127 Facsimile: (416) 864 – 6201 www.rcgt.com www.taxandtradelaw.com NOTE TO READER This paper has been formatted to be printed or photocopied in a double-sided format. Accordingly certain spacer pages (like this one) may appear at appropriate junctures. PROFESSIONAL PROFILE ROBERT G. KREKLEWETZ – LL.B, M.B.A. MILLAR KREKLEWETZ LLP is a boutique tax law firm specializing in Commodity Tax and Customs & Trade matters including Tax & Trade Litigation. Specialized Commodity Tax – Millar Kreklewetz LLP’s Commodity Tax practice encompasses all Practice Canadian indirect taxes, and includes all matters relating to Canada's Goods and Services Area Tax (GST) and Harmo nized Sales Tax (HST), and all matters relating to Canada's various provincial sales taxes – like the Ontario, Manitoba and Saskatchewan retail sales taxes (RST), the British Columbia social services tax (SST), and the Quebec sales tax (QST). Our Commodit y Tax practice also encompasses a variety of other indirect taxes, like the Employer Health Tax (EHT), and a range of excise taxes applying to goods like tobacco, alcohol, jewellery, gasoline and other motive fuels.